A small green candlestick on the daily chart, and a slight increase in upwards momentum on the hourly chart, fits the main Elliott wave count well.

Summary: It is still most likely that the minor degree trend is now upwards. The target for the next wave up is at 1,278 – 1,281, which may be met in a Fibonacci 8 or 13 days total. I have a little more confidence in the main wave count today.

Click on charts to enlarge.

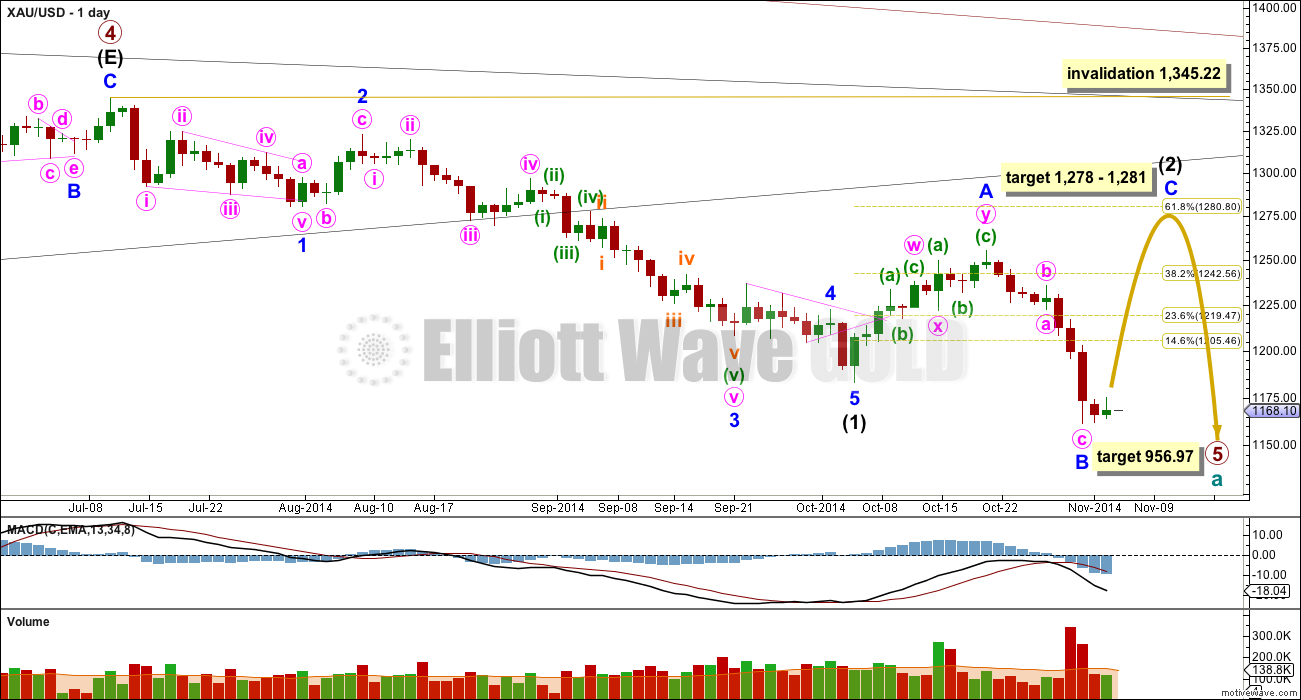

Main Wave Count

On the weekly chart extend the triangle trend lines of primary wave 4 outwards. The point in time at which they cross over may be the point in time at which primary wave 5 ends. This does not always work, but it works often enough to look out for. It is a rough guideline only and not definitive. A trend line placed from the end of primary wave 4 to the target of primary wave 5 at this point in time shows primary wave 5 would take a total 26 weeks to reach that point, and that is what I will expect. Primary wave 5 is now in its 17th week.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 3 is $12.54 short of 1.618 the length of primary wave 1, and equality between primary waves 5 and 1 would give a perfect Elliott relationship for this downwards movement.

However, when triangles take their time and move close to the apex of the triangle, as primary wave 4 has, the movement following the triangle is often shorter and weaker than expected, and this is my main reason for presenting the alternate wave count to you. If the target at 956.97 is wrong it may be too low. When intermediate waves (1) through to (4) within primary wave 5 are complete I will recalculate the target at intermediate degree because this would have a higher accuracy, and the target may move higher. I cannot do that yet; I can only calculate it at primary degree.

Intermediate wave (2) is an incomplete expanded flat correction. Expanded flats are the most common type of flat. Minor wave B is a 130% correction of minor wave A, nicely within the normal range of 100% to 138%. At 1,278 minor wave C would reach 1.618 the length of minor wave A. At 1,281 intermediate wave (2) would reach the 0.618 Fibonacci ratio of intermediate wave (1). This gives a small $3 target zone with a high probability.

I would expect minor wave C to last about a Fibonacci 8 or 13 days, with 13 more likely. It may only subdivide as an impulse or ending diagonal, and an impulse is much more likely.

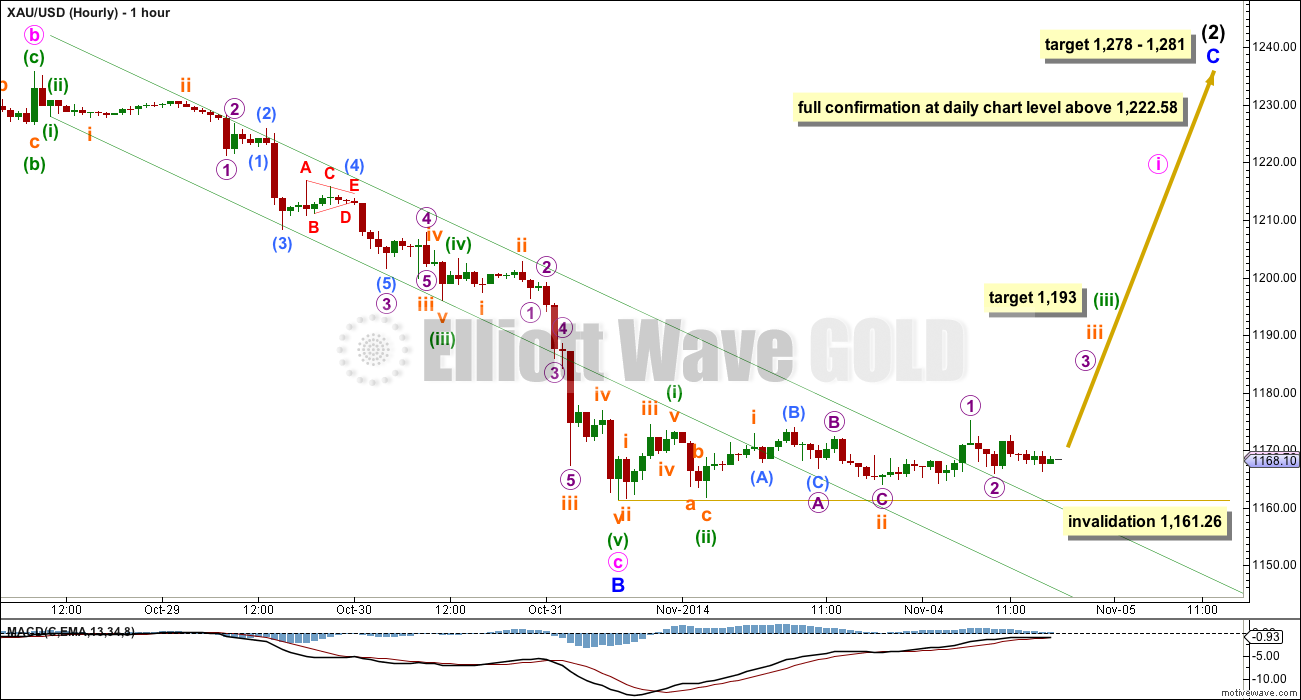

Main Hourly Wave Count

The channels about downwards movement on yesterday’s hourly charts have both been breached by upwards and sideways movement. MACD is showing a small increase in upwards momentum. It’s not completely convincing, but this does indicate that this main hourly wave count is more likely to be correct.

I am leaving the invalidation point at the start of minor wave C. No second wave correction may move beyond its start below 1,161.26.

I have checked the subdivisions of all three first waves on the five minute chart, they may all be seen as five wave structures.

This main wave count now expects to see a strong increase in upwards momentum. At 1,193 minuette wave (iii) would reach 2.618 the length of minuette wave (i).

Movement above 1,222.58 would invalidate both daily alternate wave counts and so provide full and final confidence in this main wave count.

Alternate Hourly Wave Count

This alternate idea has substantially reduced in probability because there is such a gross disproportion between the one hour duration of minuette wave (ii) and the 33 hour duration of minuette wave (iv). This wave count does not have the right look.

If the main wave count is invalidated with movement below 1,161.26 in the next one to few days either of these three alternate ideas may be correct, and this alternate hourly wave count would still have a low probability.

Redraw the channel now that minuette wave (iv) may be over using Elliott’s second technique: the first line from the ends of minuette waves (ii) to (iv) then a copy on the end of minuette wave (iii).

At 1,155 minuette wave (v) would reach 2.618 the length of minuette wave (i). Minor wave B would be just slightly longer than the maximum common length of 138% the length of minor wave A at 1,156.

Alternate Daily Wave Count I

It is possible that the double zigzag is a completion of intermediate wave (2), but this idea has a very low probability.

This would see intermediate wave (2) only 45% of intermediate wave (1), but more importantly it would have lasted only 11 days in comparison to the 62 days for intermediate wave (1). This is too brief to give the wave count the “right look” on the daily chart.

So far intermediate wave (3) is incomplete (and the degree of labeling within it may yet be moved down one degree). So far only a 1-2-3 down is complete. A following fourth wave may not move into first wave price territory above 1,222.58.

At 993 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Alternate Daily Wave Count II

It is possible that primary wave 5 is nearing its end, but this idea has a rather low probability.

This wave count moves the degree of labeling within primary wave 5 all up one degree.

The biggest problem with this wave count is the lack of alternation between intermediate waves (2) and (4): intermediate wave (2) is a deep 65% single zigzag lasting a Fibonacci 5 days and intermediate wave (4) is a somewhat deep 52% double zigzag lasting 11 days. Single and double zigzags are different structures, but they are very similar and belong to the same family. It is not common to see one in a second wave position and the other in a corresponding fourth wave position, especially when both are close to similar depth.

There is no Fibonacci ratio between intermediate waves (3) and (1) so this wave count would expect to see a Fibonacci ratio between intermediate wave (5) and either of (1) or (3). If intermediate wave (5) were to reach equality in length with intermediate wave (1) it would be truncated. At 1,116 intermediate wave (5) would reach equality in length with intermediate wave (3). At 1,101 minor wave 5 would reach equality in length with minor wave 5. This gives a rather wide $15 target zone which may be narrowed once it can be calculated at a third wave degree.

Within intermediate wave (5) minor wave 4 may not move into minor wave 1 price territory above 1,222.58.

This analysis is published about 05:07 p.m. EST.

I use Gold to determine probability for GDX, not the other way around.

GDX does not have the same level of volume as Gold, and so its structures don’t have as typical a look. Also, I can’t look at any time frame below daily for GDX so I can’t check the subdivisions of its waves.

Thanks for your response. After Gold’s breach of 1,161 during Wednesday’s trading session and the alternate wave count becoming the new main wave count for Gold with a target of 993 for intermediate wave 3 within primary wave 5, does this now change the wave count and/or targets for GDX from the current $16.26 to a new much lower amount or do you think the GDX could move in opposite direction of Gold? Seems like a new wave count and/or targets for GDX could increase in probability as Gold looks to move much lower at this point. If so, would you be able to update the GDX today with a new main wave count and possibly an alternate wave count, if available? Also, what do you think the GDX minor wave 2 targets would be given Gold’s recent activity and new main wave count. Thanks and much appreciated.

I will be updating GDX today.

I looked at it yesterday, but the data I can import did not show enough movement at that stage. I wanted to have that next daily candlestick for analysis.

Lara, which of the daily alternate wave counts do you prefer at this time? A quick response would be much appreciated. Thanks.

The first. And I’m moving the degree of labelling within the third wave down one degree.

Lara, thanks for the analysis. I was wondering if GDX had an increased probability for downward movement to $16.26, as published in your most recent GDX analysis this weekend, do you ever compare the chart and use to assess “probability” for main wave and alternate wave counts when analyzing Gold? Usually, GDX follows Gold. Seems like if we thought GDX was still heading downward, then Gold would as well. Wouldn’t this give rise to the alternate wave counts substantially increasing in probability that as listed in your analysis? What are your thoughts? Thanks for your time.

Hi Lara, can you please update oil as it’s completely collapsed and exceeded your targets from 2 weeks ago?

OK.

Hi Lara, regarding the Alternate Daily Wave Count II What if (1) was a short 3-day impulse instead of an LD and (2) was an expanded flat? That would make (2) and (4) different structures and increase the probability of the count. Would also mean that it is very little left of 5 of (5). Thanks.

If true… Vlad’s expanded flat idea would be a total of 18 days and .618 of 18 is 11days for wave 4. POG just invalidated main so this looks like the count to use.

the problem with that idea is (2) would not be an expanded flat, it would be a very rare running flat (A would reach up to 1,324.73 and C would only end at 1,322.83). this substantially reduces the probability of that idea.

also, you then have to see C as a five. it has a really strong look as a three on the daily chart.

it would be so much better to go with the much less rare leading diagonal