A green candlestick was expected for Thursday which is exactly what we have. The Elliott wave count remains the same. Now there is more structure to analysis within this current wave I can give you a clearer picture of what to expect next.

Summary: I expect a continuation of overall sideways movement for another four to seven days most likely. This second wave correction looks like it will be very shallow, and it may include a new low within it.

Click on charts to enlarge.

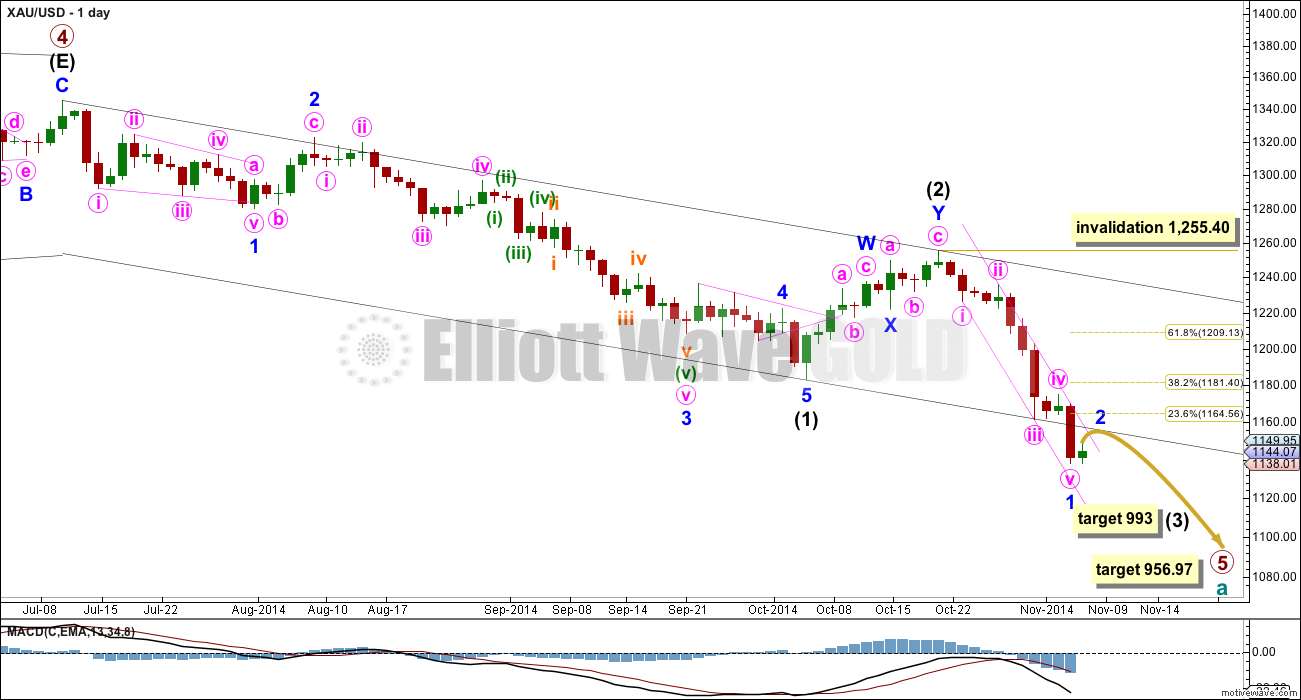

Main Wave Count

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. Intermediate wave (2) is a relatively shallow 45% double zigzag correction.

Intermediate wave (3) may only subdivide as an impulse, and at 993 it would reach 1.618 the length of intermediate wave (1).

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (3) must move far enough below the end of intermediate wave (1) to allow room for upwards movement for intermediate wave (4) which may not move into intermediate wave (1) price territory. Although a five wave structure downwards can now be seen complete within intermediate wave (3) it has not moved low enough. Only minor wave 1 within it is complete.

Minor wave 2 may not move beyond the start of minor wave 1 above 1,255.40.

Because this is a second wave correction within a third wave one degree higher it may be more quick and shallow than second waves normally are. At this stage it looks like it may only reach up to about the 0.236 Fibonacci ratio most likely about 1,164.56. It may find resistance at the lower edge of the base channel which previously provided support. It may last a Fiboancci 5 or 8 days in total.

The black channel is a base channel about intermediate waves (1) and (2): draw the first trend line from the start of intermediate wave (1) to the end of intermediate wave (2), then place a parallel copy on the end of intermediate wave (1). Intermediate wave (3) has breached the lower edge of the base channel which is expected.

Draw a channel about minor wave 1 on the daily chart and copy it over to the hourly chart. Draw the first trend line from the lows labelled minute waves i to iii, then place a parallel copy on the high labelled minute wave ii.

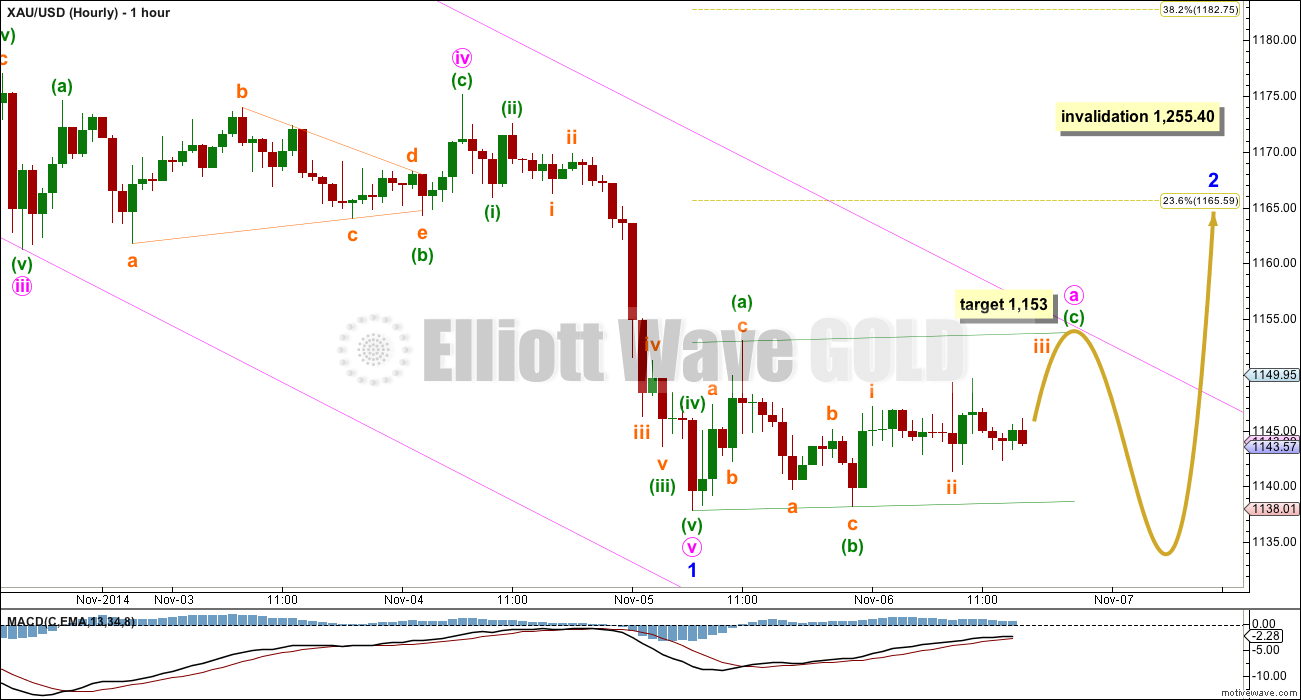

I will focus today and for the next few days on the structure of minor wave 2.

So far it is subdividing as a series of three wave structures. This may indicate either a flat correction, a combination or a double flat unfolding. A flat correction would be labeled minute waves a-b-c, a combination or double flat would be labeled minute waves w-x-y. All of these structures are sideways movements (an expanded flat is slightly different though in that its range increases or expands at the end). All of these structures may include a new low below the start of minute wave a (or w) at 1,137.85.

Within minute wave a minuette wave (a) is a zigzag. Minuette wave (b) is a 98% correction of minuette wave (a) and is also a zigzag. Minute wave a (or w) is unfolding as a regular flat correction. At 1,153 minuette wave (c) would reach equality in length with minuette wave (a). Minuette wave (c) may end at the upper edge of the green channel drawn about minute wave a, and it may also find resistance at the upper edge of the pink channel drawn about minor wave 1.

Minor wave 2 should breach the upper pink trend line because it should break out of the channel containing minor wave 1. Before it does that it may find resistance at the upper pink trend line.

When minute wave a (or w) is a complete three wave structure then minute wave b (or x) should move lower as a three wave structure. Minute wave b (or x) may make a new low below the start of minute wave a at 1,137.85 and in fact is reasonably likely to do so. The most common type of flat is an expanded flat where minute wave b would be a 105% correction or greater of minute wave a.

If a new low is seen as part of this second wave correction then the alternate below may be discarded.

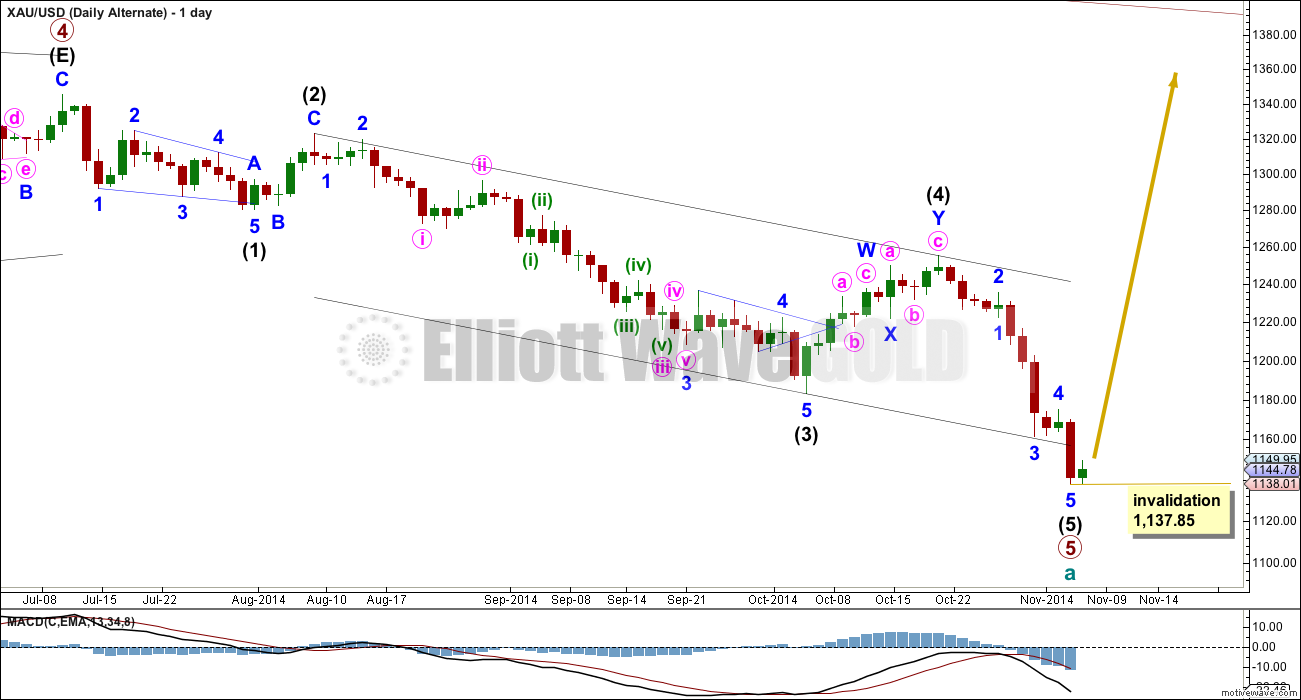

Alternate Daily Wave Count

It is possible that primary wave 5 is now over, but this idea has a rather low probability.

For this idea today I am labelling primary wave 5 as complete because the structure within intermediate wave (5) is such a perfect complete impulse and it slightly overshoots the channel drawn about primary wave 5 using Elliott’s second technique. However, with this idea there are no Fibonacci ratios between intermediate waves (1), (3) and (5). This is highly unusual for Gold and further reduces the probability of this wave count.

The biggest problem with this wave count is still the lack of alternation between intermediate waves (2) and (4): intermediate wave (2) is a deep 65% single zigzag lasting a Fibonacci 5 days and intermediate wave (4) is a somewhat deep 52% double zigzag lasting 11 days. Single and double zigzags are different structures, but they are very similar and belong to the same family. It is not common to see one in a second wave position and the other in a corresponding fourth wave position, especially when both are close to similar depth.

If primary wave 5 is over then there has just been a trend change at cycle degree. Within the new upwards trend no second wave correction may move beyond the start of its first wave at 1,137.85.

This analysis is published about 04:12 p.m. EST.

bring on the alternate daily! weeeee

Lara, it looks to me like Minor 1 ended a few hrs ago at $1131 with a quick burst down out of a triangle and then $25 reversal as of now. Can you see if this wave count fits? Minor 2 underway now through next week

No, it does not fit for the whole structure for minor wave 1.

Minor wave 1 must be a five wave structure. If we see a triangle in that position as you suggest (which does fit on the hourly chart) then how does minor wave 1 work? It has a count of 7 on the daily chart. That is corrective not impulsive.

I will take some time (when I do GDX tomorrow) to have a closer look at this idea, because it has some merit for sure, but my initial response is it does not look like a good fit.

Lara, with the invalidation point passed on the alternate, could the wave count still be possible with an extended 5th wave?

I guess it could be….

this upwards movement could be a second wave correction within intermediate wave (5)….

but its so unlikely. and it expects pretty much the same movement next, and the invalidation point is the same as the main wave count as well.

I want to discard that alternate now. I judge the probability to be too low now for publication.

u r a good analyst but coulnt find ur post helpful frm few months