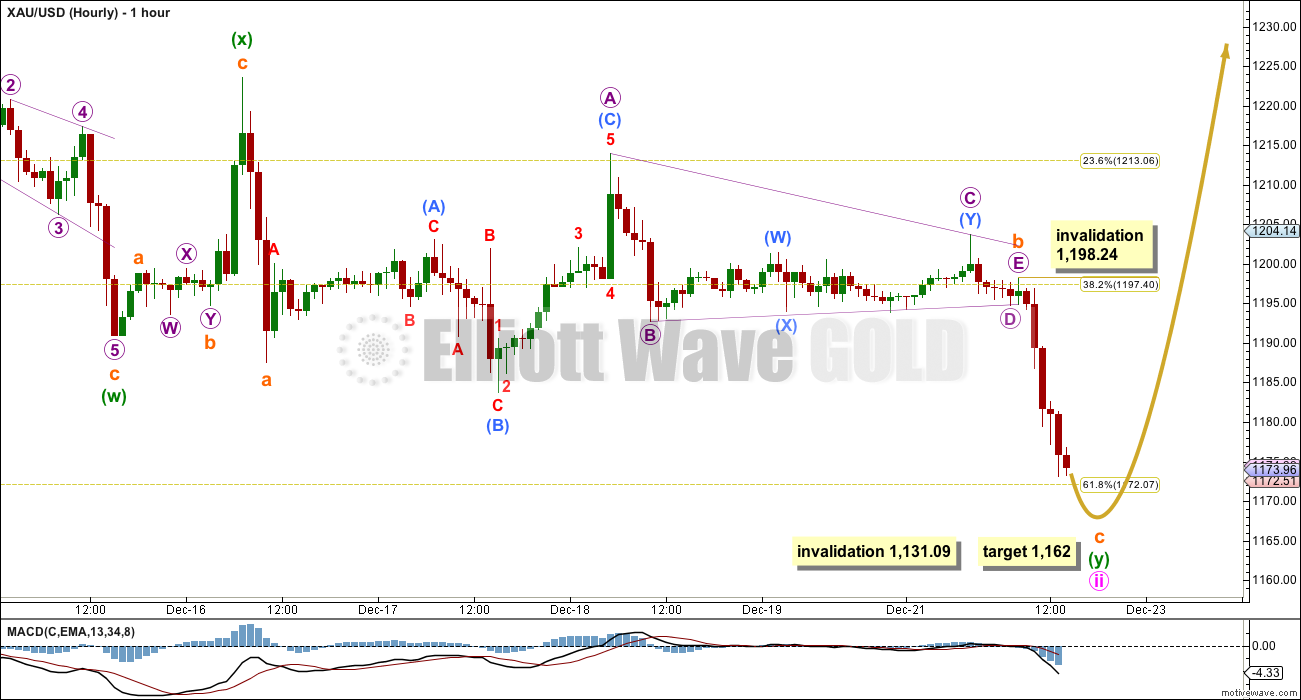

As expected price broke out of the sideways range with a downwards thrust. The target can now be calculated.

Summary: Downwards movement should be close to completion. The target is at 1,162. Thereafter, the next move for Gold should be a strong third wave up, which will be confirmed as underway when we see a new high above 1,198.24.

Click on charts to enlarge

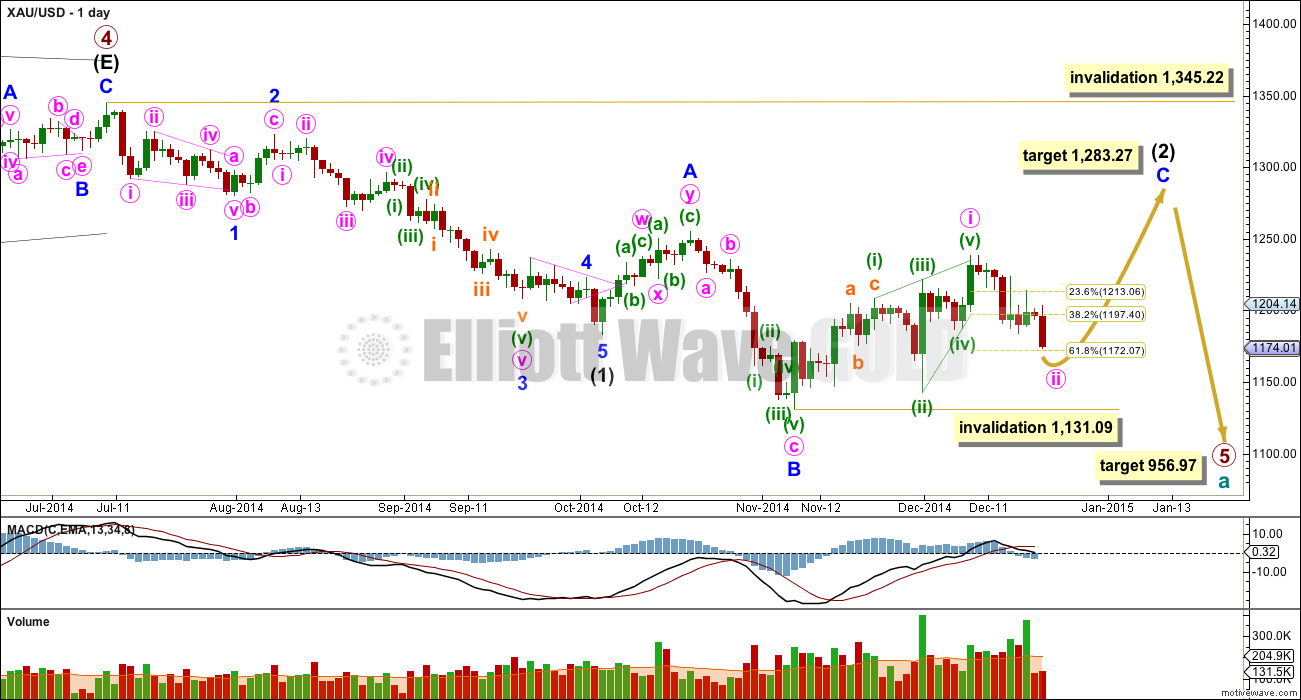

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A, and I think the target for it to end would best be calculated at minute degree. At this stage I would expect intermediate wave (2) to end close to the 0.618 Fibonacci ratio of intermediate wave (1) at 1,283.27.

Intermediate wave (1) lasted a Fibonacci 13 weeks. If intermediate wave (2) exhibits a Fibonacci duration it may be 13 weeks to be even with intermediate wave (1). Intermediate wave (2) is now in its tenth week.

So far within minor wave C the highest volume is on three up days. This supports the idea that at this stage the trend remains up.

See the most recent Historic Analysis to see the long term channel about this whole downwards movement. The channel does not copy over to the daily chart when I put the daily chart on an arithmetic scale, so this channel must be drawn on a weekly chart on a semi log scale. The upper edge of that channel may be where intermediate wave (2) finally ends. I would not expect the upper edge of this channel to be breached.

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Within minor wave C minute wave i subdivides perfectly as a leading contracting diagonal. When leading diagonals unfold in first wave positions they are normally followed by very deep second wave corrections. There is a nice example here on the daily chart: at the top left of the chart minor wave 1 was a leading contracting diagonal and it was followed by a deep 65% zigzag for minor wave 2. I will expect minute wave ii to be deep, at least to the 0.618 Fibonacci ratio at 1,172. When it is over then a third wave up should begin.

I do not think that minor wave C is complete at the high of 1,238 as an ending contracting diagonal for three reasons:

1. Intermediate wave (2) would be a very rare running flat correction.

2. Minor wave C would be substantially truncated, by $17.

3. This structure does not subdivide well as an ending diagonal because the third and fifth waves do not fit well as zigzags. Within an ending diagonal all the sub waves must be zigzags.

Minute wave ii may not move beyond the start of minute wave i below 1,138.19.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit well as either a complete impulse nor an ending diagonal.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, go here.

I do not want to publish a wave count which sees primary wave 5 complete at the low of 1,131.09. This downwards movement does not fit well at all as a complete five wave impulse. There would be inadequate alternation between the single zigzag of the second wave and the double zigzag of the fourth wave correction, and there would be no Fibonacci ratios between the first, third and fifth waves within it.

This main wave count was correct. Subminuette wave b continued sideways as a contracting triangle. The breakout was downwards for subminuette wave c.

On the five minute chart at the time of this analysis being prepared it looks like only the final fifth wave down needs to complete the impulse for subminuette wave c. At 1,162 subminuette wave c would reach equality in length with subminuette wave a. This target would see minute wave ii a very deep correction, which should be expected for a second wave following a leading diagonal in a first wave position. It would also see minuette wave (y) of this double zigzag deepen the correction beyond that of minuette wave (w), which is the purpose of a second zigzag in a double zigzag.

This target should be met within a very few hours. I would not expect to see a green candlestick on the hourly chart within subminuette wave c. The early second wave corrections within it do not show up on the hourly chart so the ending fourth wave corrections should not show on the hourly chart.

Minute wave ii may not move beyond the start of minute wave i below 1,131.09 (*Note: This invalidation point was wrong on the last daily and hourly charts).

Within subminuette wave c no second wave correction may move beyond the start of its first wave above 1,198.24. Eventually, when we see a new high above this point, upwards movement may not be a second wave correction within subminuette wave c, and at that stage subminuette wave c must be over. That would mean that minute wave ii in its entirety must be over and a third wave up would then be expected to have just begun.

I will initially expect minute wave iii to be equal in length with minute wave i at about 107 because this fits nicely with the end target for minor wave C at 1,283. The following fourth wave correction for minute wave iv may be shallow, because minute wave ii is deep.

This analysis is published about 3:12 p.m. EST.

Hi Lara,

congratulation on the Crude Oil call. Target reached. In correction now, could you update your chart please? Thank you very much.

Merry Christmas

Ursula

Thanks.

I want to wait for that channel on the daily chart to be breached before I have any confidence that intermediate wave (3) is over though.

I don’t know that I’ll have time tomorrow to update the chart. Its Christmas eve and I have a lot of prep to do.

Hi Lara Finally gold made the move.

In video you stated that once a green candle shows up in hourly chart that would indicate the Wave c and wave ii is over. Plus of course the price needs to move above 1198.24.

If wave ii is over before NY market opens how wave iii upward will unfold?

You also said that wave iii will begin Tuesday session in afternoon.

Miners were down today and they may still move down or has more room to go down in few days.

Wave iii will have to be an impulse. It must move above the end of wave i. It may either be equal in length with minute wave i, or quite likely it may not exhibit a Fibonacci ratio to minute wave i.

Thanks for your reply. I am sorry I was not able to compose my question properly.

Last night I was concern that wave iii will begin sharply up.

Now gold is still around 1178 and going down is comfort for shorts. Today is the day one should remove shorts.

Thanks for your great EW analysis. I am amaze at your knowledge of all the rules of EW and proper application to gold and oil.

Merry Christmas!!!