I had expected a little more upwards movement to complete a first wave, and thereafter a second wave to begin downwards. The first wave was actually complete at last analysis, and this red candlestick on the daily chart is the second wave which follows it.

Summary: A third wave is underway. The target is 1,262. The trend is upwards, and corrections are downwards.

Click on charts to enlarge

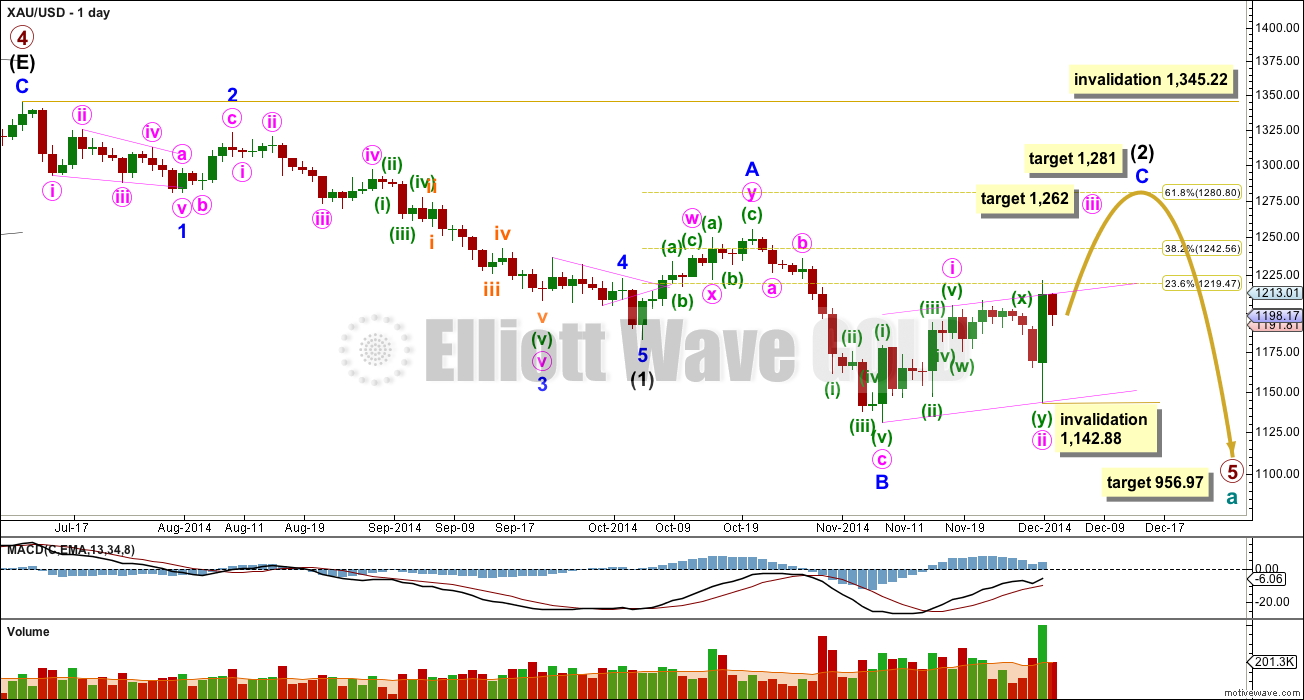

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of less than twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A, and I think the target for it to end would best be calculated at minute degree. At this stage I would expect intermediate wave (2) to end close to the 0.618 Fibonacci ratio of intermediate wave (1) just below 1,281.

Intermediate wave (1) lasted a Fibonacci 13 weeks. If intermediate wave (2) exhibits a Fibonacci duration it may be 13 weeks to be even with intermediate wave (1). Intermediate wave (2) has just begun its eighth week.

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit as either a complete impulse nor an ending diagonal.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, go here.

*Note: I am aware (thank you to members) that other Elliott wave analysts are calling now for the end of primary wave 5 at the low at 1,131. I am struggling to see how this downwards movement fits as a five wave impulse: I would label the second wave within it (labelled minor wave 2) intermediate wave (1), and the fourth wave intermediate wave (4) (labelled as a double zigzag for minor wave A). Thus a complete impulse down would have a second wave as a single zigzag and a fourth wave as a double zigzag, which would have inadequate alternation. Finally, the final fifth wave down would be where I have minor wave B within intermediate wave (2). This downwards wave has a cursory count of seven, and I do not think it subdivides as well as an impulse as it does as a zigzag. If any members come across a wave count showing possible subdivisions of a complete primary wave 5 I would be very curious to see it.

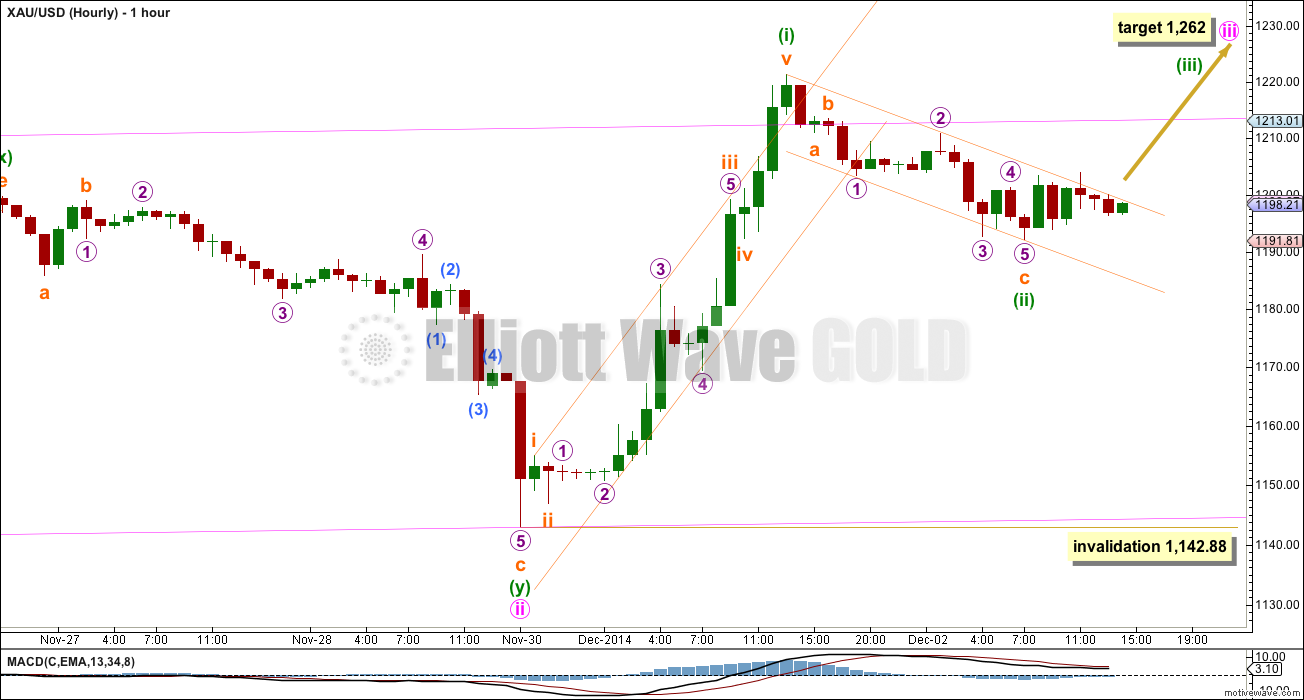

Downwards movement since last analysis has lasted too long and taken price too far out of the small orange channel to be a correction within minuette wave (i). This must be minuette wave (ii), and it is showing up on the daily chart as it was expected to do.

Ratios within minuette wave (i) are: subminuette wave iii is 1.12 longer than 4.236 the length of subminuette wave i, and subminuette wave v is 2.64 short of 2.618 the length of subminuette wave i.

Ratios within subminuette wave iii are: micro wave 3 has no Fiboancci ratio to micro wave 1, and micro wave 5 is 2.48 longer than 4.236 the length of micro wave 1.

The structure within minuette wave (ii) can be seen as a complete zigzag. There is no Fibonacci ratio between subminuette waves a and c. Within subminuette wave c micro waves 2 and 4 have good alternation.

Minuette wave (ii) may be over here, or this may only be subminuette wave a of a larger flat correction for minuette wave (ii). Although this second wave correction is so far relatively shallow at only 0.373 of minuette wave (i), I would expect this second wave correction to be shallow as it is within a larger third wave. However, it may continue further to be a little more time consuming. Minute wave ii lasted 9 days, so minuette wave (ii) may last a Fibonacci 3 or maybe even 5 days. So far it has lasted only one day. If it continues further then it may not move beyond the start of minuette wave (i) below 1,142.88.

I would judge it to be about 50% likely that minuette wave (ii) is over.

I have drawn a best fit channel about minuette wave (ii). Unfortunately, a breach to the upside of this channel is not confirmation that minuette wave (ii) is over. It may be a B wave of a continuing correction. Only a clear five up would confirm an end to this correction and the beginning of minuette wave (iii) upwards.

If we see a clear five up and an increase in momentum then I would expect the middle of this third wave is unfolding. Expect any surprises to be to the upside.

The next movement for Gold should be upwards with a strong increase in momentum. The target for minute wave iii remains the same at 1,262 where it would reach 1.618 the length of minute wave i.

This analysis is published about 03:00 p.m. EST.

Miners have huge overhead resistance to overcome. The why ratio of miners to gold is down despite gold had best day Monday.

Gold needs to overcome and close above 1213. Before one can count on the target????

From an Elliott wave perspective GDX and Gold are separate markets. They have their own wave counts. They do not have to follow each other nor move in tandem.

I know this is an extremely unpopular view, but that’s EW.

So I do not see any resistance in GDX as necessary to be overcome before Gold can move higher.

Deep thoughts by Jaf LOL:

If green (iii) = green (i), POG will reach $1270. That will overshoot pink target of $1262.

Hmmm….

This thought came to me also. Gold always overshoots or undershoots. So it is possible 1271

I don’t think minuette wave (ii) (green) is actually over.

So I don’t think we can start to calculate a target of minuette wave (iii) yet…. because we don’t know where it starts.

Thanks for clarifying that green (ii) is not complete. That means Gold still may move below the wave green (ii).

This helps.

Hi Lara,the upward movement from 1191,94 not seems impulsive and the prices have breach the trendline draw from the start of minuette wave (i) to the low at 1191,94……so we could suppose that minuette wave (ii) is not end and the upward movement could be subminuette wave b within minuette wave (ii) and the minimum target it is 90% of subminuette wave a ( 1218,00 ), unless that minuette wave (ii) is a double correction ( wxy ). Is it correct ?

Thanks

Yes. That is what I expect.

I don’t think minuette wave (ii) is over.

I am on board with EW waves for Gold. BUT Dollar is strong and Euro is weak. On the back of these currencies trend how Gold is supposed to go higher in impulse wave up to 1260??????

If gold does go higher while dollar goes up than it will break the orthodox inverse relation w/dollar. That will be huge and noticeable to trading community.

papudi

The “orthodox inverse relation w/dollar” is not consistent, not fundamental as it doesn’t always happen. Gold often moves in same direction and opposite direction of gold.

Sorry for the typo, Gold often moves in the same direction and opposite direction of the US dollar.

Thanks Sir Richard.