Sideways movement is exactly what was expected, and it’s not done yet.

Summary: The trend at minor degree is up. The sideways correction is incomplete, and should end within the next 24 hours. The invalidation point remains at 1,142.88. The target for minute wave iii remains at 1,262.

Click on charts to enlarge

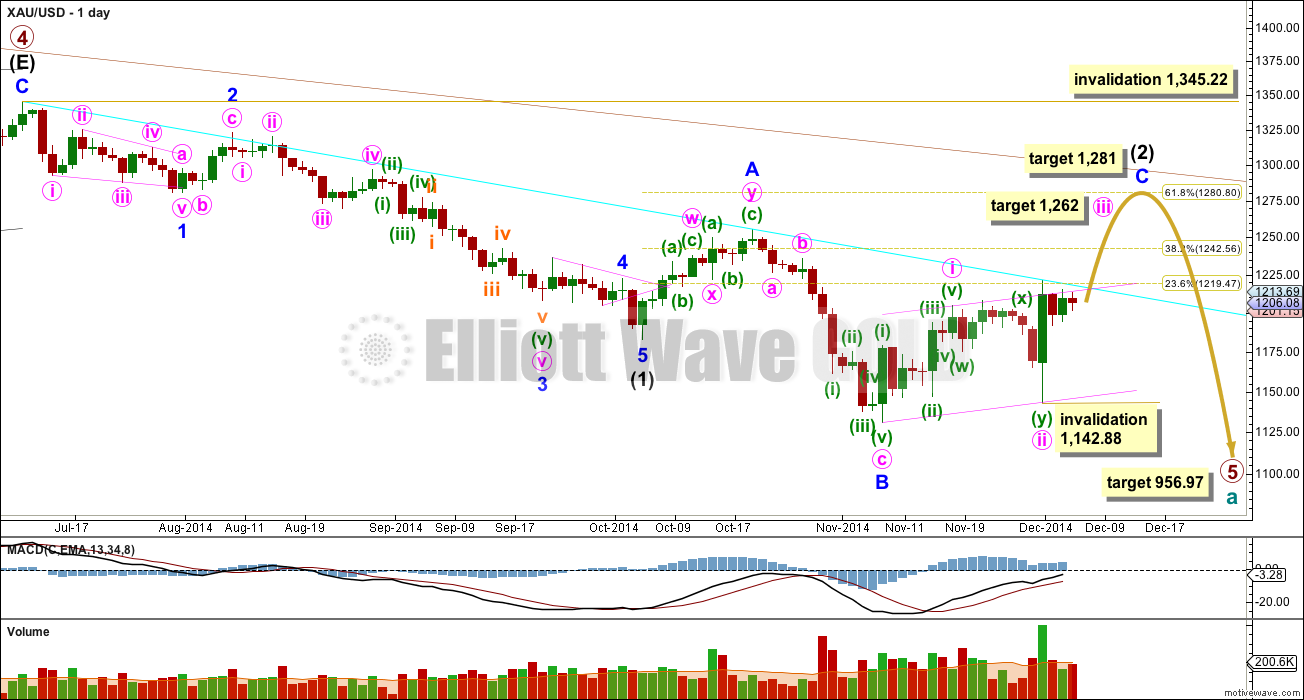

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of less than twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A, and I think the target for it to end would best be calculated at minute degree. At this stage I would expect intermediate wave (2) to end close to the 0.618 Fibonacci ratio of intermediate wave (1) just below 1,281.

Intermediate wave (1) lasted a Fibonacci 13 weeks. If intermediate wave (2) exhibits a Fibonacci duration it may be 13 weeks to be even with intermediate wave (1). Intermediate wave (2) is ending its eighth week.

The upper maroon trend line is the upper edge of the Elliott channel drawn about this impulse on the weekly chart, and copied over here to the daily chart. See the most recent Gold Historic Analysis to see how this trend line is drawn on the weekly chart. If minor wave C lasts long enough it should find extremely strong resistance at that trend line, I would not expect that trend line to be broken while primary wave 5 is incomplete.

The aqua blue trend line is a simple TA trend line which is showing where price is currently finding resistance. The power of the middle of the upcoming third wave should break above this trend line.

The target for primary wave 5 at this stage remains the same. At 956.97 it would reach equality in length with primary wave 1. However, if this target is wrong it may be too low. When intermediate waves (1) through to (4) within it are complete I will calculate the target at intermediate degree and if it changes it may move upwards. This is because waves following triangles tend to be more brief and weak than otherwise expected. A perfect example is on this chart: minor wave 5 to end intermediate wave (1) was particularly short and brief after the triangle of minor wave 4.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit as either a complete impulse nor an ending diagonal.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, go here.

*Note: I am aware (thank you to members) that other Elliott wave analysts are calling now for the end of primary wave 5 at the low at 1,131. I am struggling to see how this downwards movement fits as a five wave impulse: I would label the second wave within it (labelled minor wave 2) intermediate wave (1), and the fourth wave intermediate wave (4) (labelled as a double zigzag for minor wave A). Thus a complete impulse down would have a second wave as a single zigzag and a fourth wave as a double zigzag, which would have inadequate alternation. Finally, the final fifth wave down would be where I have minor wave B within intermediate wave (2). This downwards wave has a cursory count of seven, and I do not think it subdivides as well as an impulse as it does as a zigzag. If any members come across a wave count showing possible subdivisions of a complete primary wave 5 I would be very curious to see it.

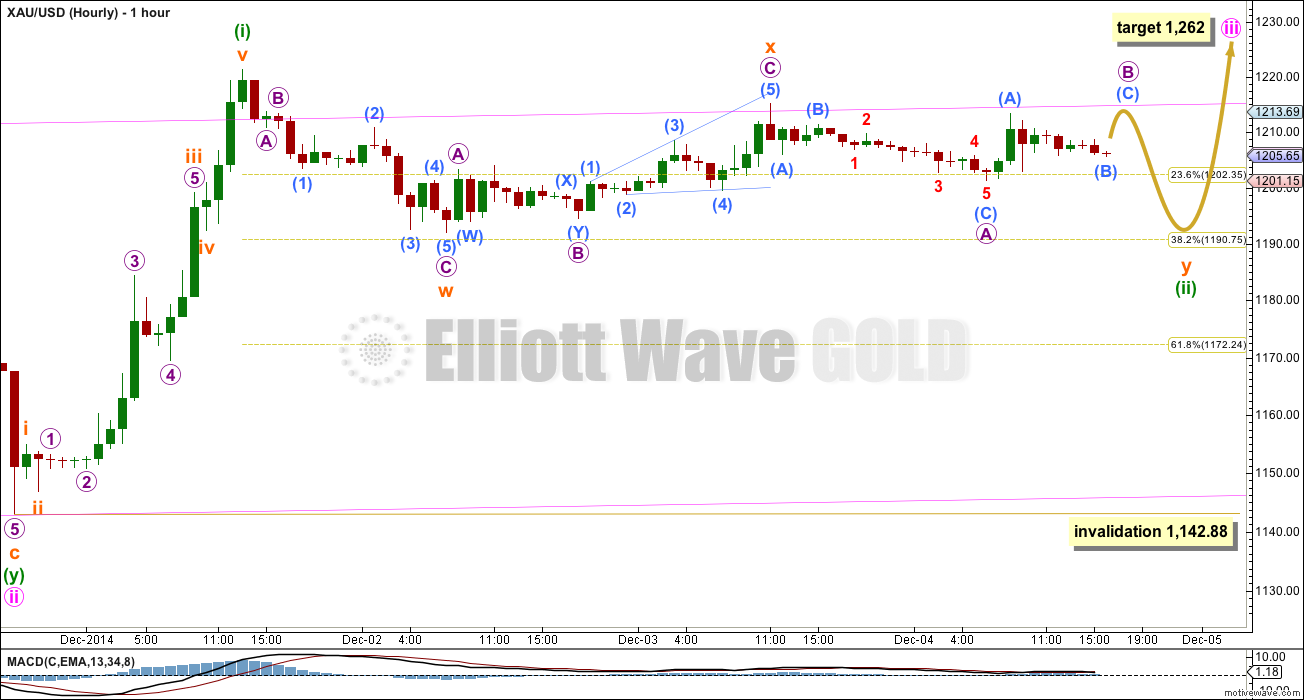

I had expected minuette wave (ii) to be over by now, but it continues sideways. The structure is still incomplete, and may not manage to complete in a Fibonacci three days to not exhibit a Fibonacci duration.

At this stage it looks like minuette wave (ii) is unfolding as a double combination. The purpose of double combinations is the same as that for triangles, which is to take up time and move price sideways.

The first structure in the double is a zigzag labelled subminuette wave w. The double is joined by a three in the opposite direction, a zigzag labelled subminuette wave x. This cannot be a B wave within a flat correction for minuette wave (ii) because subminuette wave x is less than 90% the length of subminuette wave w (the minimum requirement for a B wave within a flat is 90%).

The second structure in the double is a flat correction or triangle labelled subminuette wave y. I am labelling it as an incomplete flat, but it may also be an incomplete triangle. Both would expect more sideways movement.

The second structure in the double normally ends close to the same level as the first structure because the purpose of double combinations is to move price sideways. I would expect minuette wave (ii) to end about the 0.382 Fibonacci ratio at 1,191, which is just below the end of subminuette wave w at 1,192. Along the way there micro wave B may find resistance at the upper edge of the pink base channel about minute waves i and ii.

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,142.88.

When minuette wave (ii) is finally done then the next movement for Gold should be a strong upwards wave, as a third wave for minuette wave (iii) unfolds within the third wave of minute wave iii. Momentum should increase strongly.

I still cannot calculate a target for minuette wave (iii) because I don’t know where it begins. Because minuette wave (ii) is so shallow (and only if it continues to be shallow) I would expect minuette wave (iii) to maybe only reach equality in length with minuette wave (i) and so be about 78.46 in length. It may be over quickly, within one day.

This analysis is published about 04:43 p.m. EST.

Anyone notice the “fat finger” trade on GDX within the last 5 minutes of trading on Dec 3? GDX moved down over 10% and came all the way back up. Seems like the “only” purpose of this trade was to complete the minuette ABC correction of minute wave B so that GDX could then move up with gold. Amazing! Anyone else have a logical explanation for this? Gold didn’t spike at all.

Yes, I don’t know how to interpret these situations as they do happen from time to time. Are they part of a true wave or just a hiccup to be ignored?

Some may not show on all data feeds.

It showed on many data feed. These may be HFT boyz for quick mopup.

Last two days of sideways move in gold miners for no reason fluctuated more than should have.

Lara, Thanks for adding the maroon trend line. Looks like gold has enough room to hit your target for Intermediate 2.

Yeah, and it may time perfectly too for intermediate wave (2) to last a Fibonacci duration.