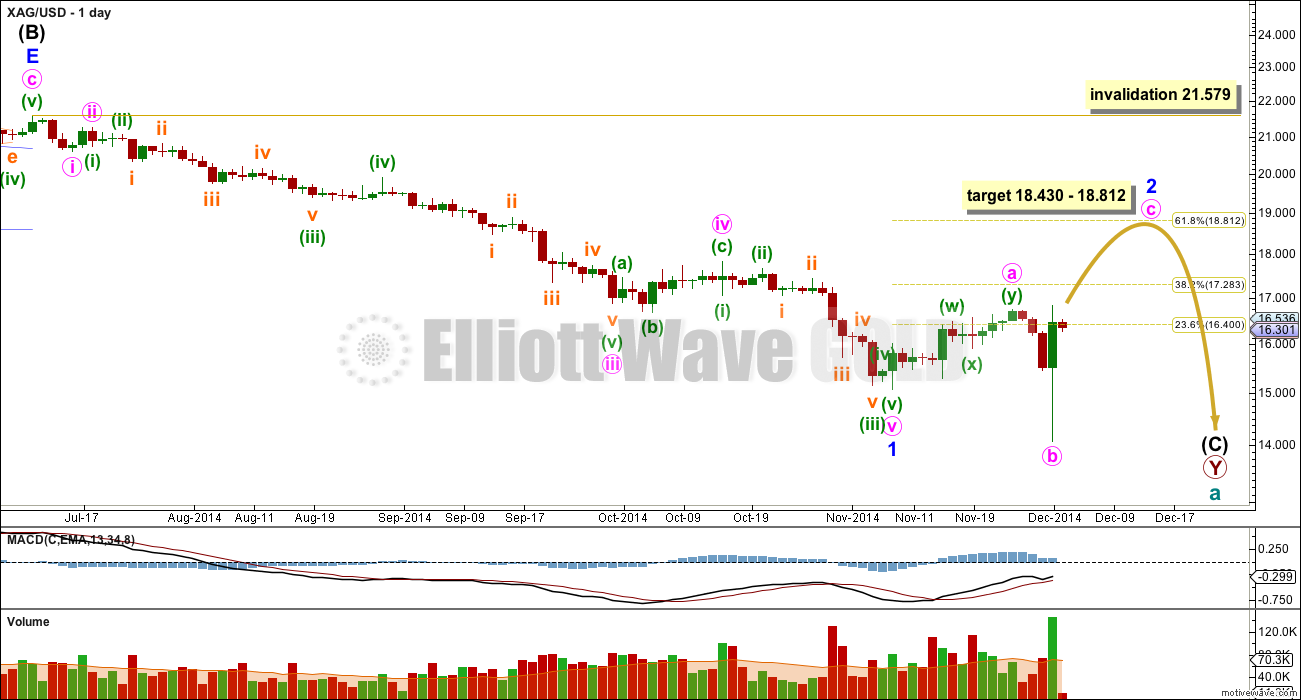

Downwards movement invalidated both daily Elliott wave counts, published two days ago. This Elliott wave count is updated and still expects upwards movement.

Click on chart to enlarge.

At 18.430 minute wave iii would reach 2.618 the length of minute wave i. This is close to the 0.618 Fibonacci ratio of minor wave 1 at 18.812. The target may be about two weeks away.

Hi Lara,

I observed that the ratio 0.50 (or 50%) never appears in your analyses. Am I correct this ratio is not applicable to Elliot waves?

Well spotted. Yes, you are correct, although it is a useful ratio it is not mathematically a Fibonacci ratio. So I removed it from my Fibonacci retracement. I like accuracy.

Here is an explanation: http://elliottwavestockmarket.com/2011/08/18/fibonacci-ratios/

I am clear now. Thanks, Lara.

Lara, you mention that the target 18.430-18.812 at 2 may be about two weeks away. However with gold you mentioned that intermediate wave (2) may last another 5 weeks. I would think these two points in time would be the same number of weeks since from them they both descend down to the final low. “If intermediate wave (2) exhibits a Fibonacci duration it may be 13 weeks to be even with intermediate wave (1). Intermediate wave (2) has just begun its eighth week.”(Gold)

I’m sorry Richard, I’ve not given enough thought to that time expectation for Silver.

I have given it more attention for Gold though.

And you’re right, I’d expect them to top about the same time (although Silver does tend to lead Gold: see this: http://elliottwavegold.com/2013/08/gold-elliott-wave-technical-analysis-29th-august-2013/)

So I really should be expecting Silver to continue upwards for about 5, not 2 weeks.

Lara, thanks for clarifying 5 weeks to high for Silver before it heads for the bottom. It is helpful.