The fourth wave was expected to show on the daily chart, but it does not. Upwards movement now touches the large maroon channel on the weekly chart.

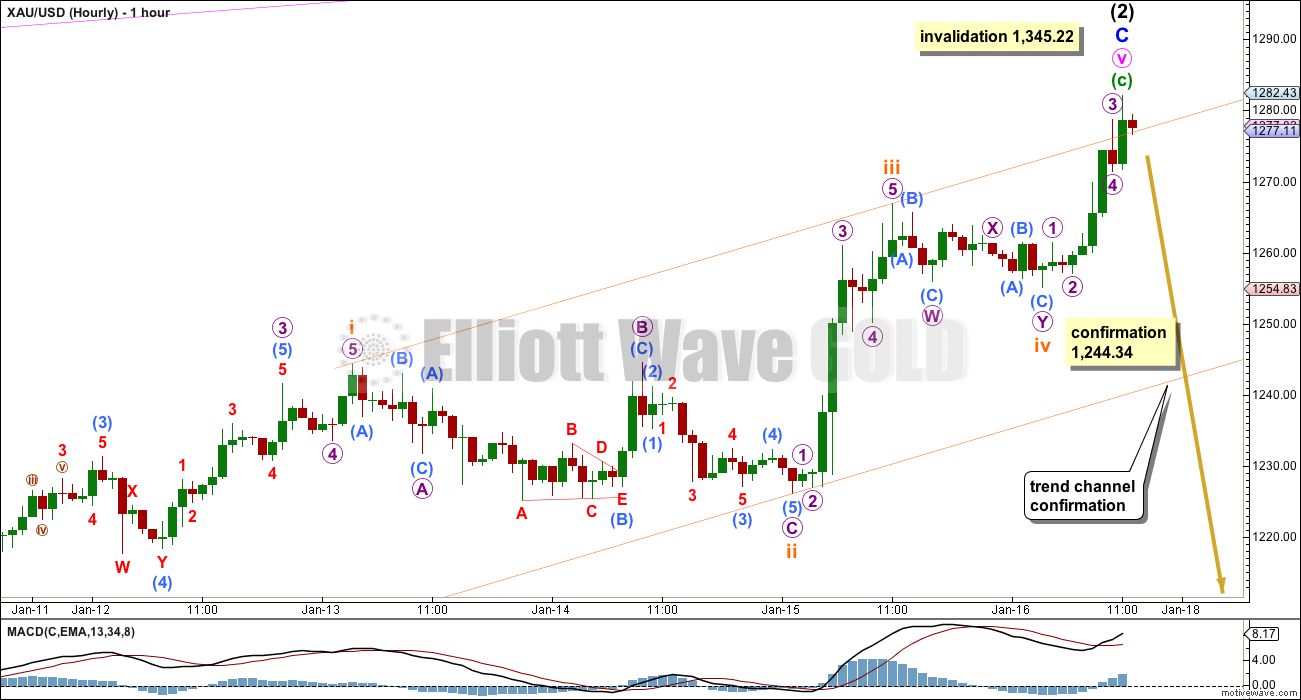

Summary: I am expecting a trend change either now or very soon. First confirmation would come with a new low below 1,244.34 and a clear breach of the orange channel on the hourly chart. Stronger confirmation would come with a clear breach of the green channel on the daily chart. This is a big trend change and patience is essential.

Click on charts to enlarge.

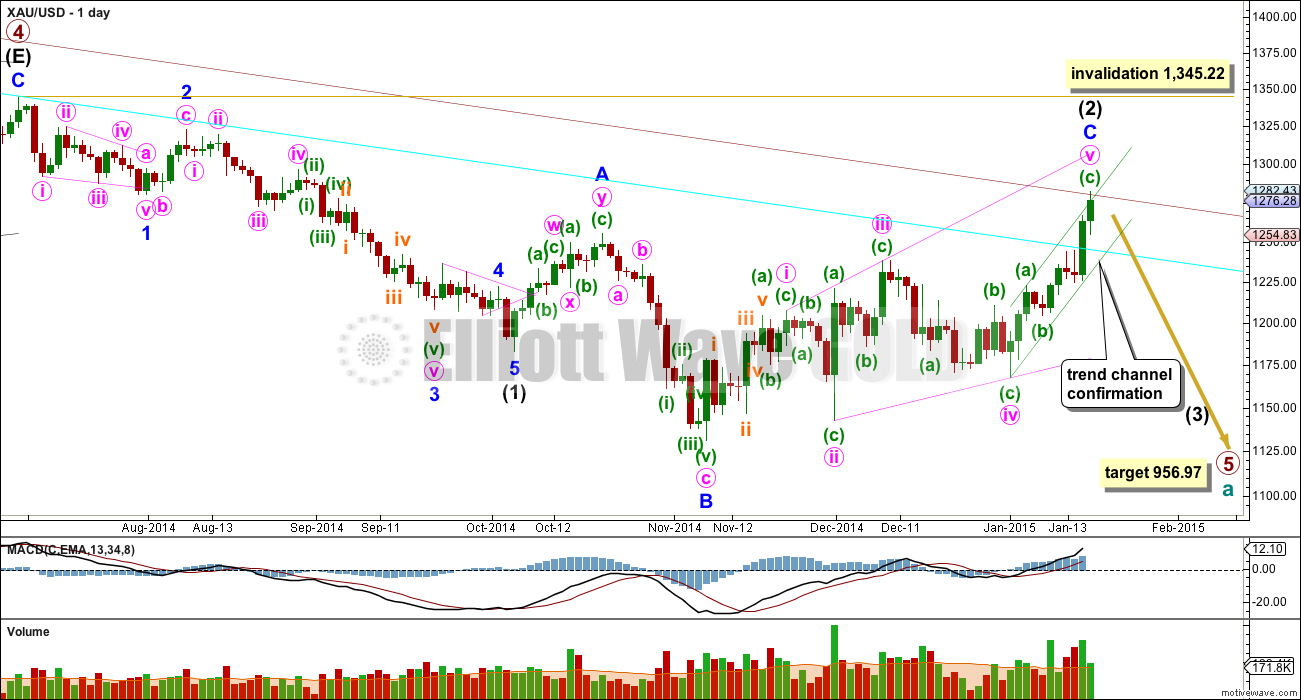

So far since the all time high at 1,921.15, in September, 2011, Gold is moving lower in five waves. The final fifth wave down is underway.

Primary wave 3 is $12.54 short of 1.618 the length of primary wave 1. At 956.97 primary wave 5 would reach equality in length with primary wave 1. This is the most likely relationship between first and fifth waves, so this target has the highest probability.

Primary wave 2 was a deep 68% rare running flat correction. Primary wave 4 shows alternation in depth and structure with a shallow 27% regular contracting triangle.

With weekly and daily charts on a semi-log scale, draw a trend channel about this downwards impulse on the weekly chart and copy it over to the daily chart: draw the first trend line from the lows of primary waves 1 to 3, then place a parallel copy on the high of primary wave 2. I would expect downwards movement for primary wave 5 to find support, and maybe end, at the lower trend line. Alternatively, we may see a strong fifth wave typical of commodities and the lower trend line could be breached by strong downwards movement.

Primary wave 1 lasted 3 weeks, primary wave 2 lasted 53 weeks (two short of a Fibonacci 55), primary wave 3 lasted 37 weeks (three longer than a Fibonacci 34) and primary wave 4 lasted 54 weeks (one short of a Fibonacci 55). So far primary wave 5 has lasted 27 weeks. At this stage it may end with a total Fibonacci 55 weeks (give or take one to two weeks either side of this).

While primary wave 5 is underway the upper edge of the maroon channel should not be breached.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit well as either a complete impulse nor an ending diagonal.

If it is seen as a complete impulse there would be inadequate alternation between the single zigzag of the second wave and the double zigzag of the fourth wave correction, and there would be no Fibonacci ratios between the first, third and fifth waves within it which would be highly unusual for Gold. If the upper edge of the maroon channel is breached by one full daily candlestick above it and not touching it then I would publish a wave count which sees primary wave 5 over. I consider this to have a very low probability, and I will only seriously consider it if it begins to show itself to be true.

Intermediate wave (2) is now a complete expanded flat correction. Minor wave C is longer than 1.618 the length of minor wave A, and there is no Fibonacci ratio between them. Minor wave C is now a complete expanding ending diagonal.

Within an ending diagonal all the sub waves must subdivide as zigzags. The fourth wave should overlap first wave price territory. The rule for the end of a fourth wave of a diagonal is it may not move beyond the end of the second wave.

Within the final zigzag up of minute wave v minuette wave (c) does not look like a clear five wave structure on the daily chart, and looks like a three. However, on the hourly chart minuette wave (c) looks like a clear five wave structure, and the final fifth wave is showing divergence with the third wave in momentum. Gold almost always exhibits textbook perfect Elliott wave structures. This is not the same as always. Because there is slight doubt in this case given the look on the daily chart I would advise caution and patience. This is a big trend change.

The structure is complete at all wave degrees and I am now awaiting confirmation of a trend change before I have any confidence in it.

Within minute wave v there is no Fibonacci ratio between minuette waves (a) and (c).

Ratios within minuette wave (c) are: subminuette wave iii is 1.07 longer than equality with subminuette wave i, and subminuette wave v is 1.86 longer than 0.618 the length of subminuette wave iii. Subminuette wave v shows weaker momentum than subminuette wave iii. This looks like a typical and complete impulse. Subminuette wave v slightly overshoots the channel, and this may be where upwards movement ends.

A new low below 1,244.34 would provide some price confirmation of a trend change; at that stage downwards movement could not be a fourth wave correction within minute wave c. A clear breach of the orange channel on this hourly chart would provide trend channel confirmation that minute wave c should be over.

One cause for concern I have regarding this wave count today is what is happening with Silver. I am struggling to see a complete corrective structure upwards for Silver, and I keep concluding that Silver needs to move higher no matter how I label the correction. When I am satisfied that I have a reasonable looking wave count for Silver I will publish it. Given this concern, it is possible that Gold too could move higher and / or sideways before the final high is reached and a trend change is seen.

I will keep a very close eye on Gold, Silver and GDX over the next few days as I expect a trend change for all three markets. For all three I expect a third wave down to begin now or very soon.

This analysis is published about 2:49 p.m. EST.

Gold’s fundamental view from chart only.

Some times in late 2011 and 2012 Swiss decided to peg Franc to Euro that ended the gold bull trend.

After 4 year experiment again Swiss last week removed the peg from Euro.

Has the gold trend changed now back??????? I am not currency expert. Just saying what I see on charts.

Lara,

On the attached chart from around mid July to early August 2014, minute 2 (your count), appears to be labeled as a flat or expanded flat. This appears possible when minute 1 is not labeled as a leading diagonal as it is on your analysis. Would the subdivisions support a flat here? If so, could that “solve” your concern for alternation between waves 2 & 4 and significantly improve the probability that primary 5 is over?

Lara,

This is the long term chart from the same EW analyst as above. He shows the move down from 2011 as a complete corrective structure as opposed to an impulse. This would mean that we could be set for a major move up. What do you think of this viewpoint?

Many thanks.

its possible, and I notice he’s avoided a running flat for primary wave 2 by seeing the B wave as a triangle. I’ll take a closer look at that piece, thats interesting.

Hi Bob, I think Lara does not like this solution because minute wave 2 is not a flat but is a very rare running flat ( wave c do not goes up the start of wave a ).

the second wave is a running flat, which would be okay right before a strong third wave if the subdivisions fit perfectly.

they don’t. the C wave looks like a three wave movement not a five on the daily chart, unless you see it with a truncated fifth wave (taking in the next piece of movement) but that gets really problematic.

it does resolve the problem of a lack of Fibonacci ratios though; the third wave is now close to 2.618 the length of the first wave.

it also resolves the problem of a lack of alternation between the second and fourth waves.

so its certainly worth a closer look. I’ve charted it and I’ll take a closer look at the subdivisions, particularly that running flat as thats the key.

the final fifth wave down doesn’t look like a five though, it still has a corrective wave count.

Can you enlarge these charts . I can’t see the labeling at all .

I can only point you to the original post. He also has thoughts on SPX.

http://www.gold-eagle.com/article/gold-us-stocks-c-wave-thunder

At 5:45EST gold has backed of the high and is down by 3.95 at 1275.

Gold still looking bullish. What won’t go down, will go up.

Regardless, I hope Lara posts the alt count today. Is it possible the rise from $1131 was a leading expanding diagonal…

Minor 1 = $1131-$1239

Minor 2 = $1239-$1167

Minor 3 = underway targeting $1340ish

Perhaps so and then:

M4 = $1340 – $1280

M5 = $1280 – $1430ish

??

something like that, but target for M5 would be too high using conventional fib wave analysis. I’m fairly confident the expanding diagonal is correct…just could be leading instead of ending

1430 is lateral chart resistance, also 38.2% retracement of the whole move 1920-1130, and most importantly was a lucky pt for me on the way down, haha

yes of course, and it that maroon channel is breached clearly that is exactly how I’d see it. I would expect the final fifth wave to now be closer to completion though, and it should fall short of the i-iii trend line.

Lara, thank you for the silver insight. Indeed the silver trend seems incomplete yet.

Silver has pushed above several Res lines and broken above its neckline on an i-HnS just like gold did earlier last week. Above lies the 200 DMA and a TL extension, both near 18.5 (which might mark Silver’s turn), then next significant target/res >20.

One should not see silver rise and gold fall if the PM market has turned bearish. Because in a bearish PM market, silver performs worse than gold (except for smaller time units).

Does anyone know whether, at major turns, silver always turns before gold? Empirically that seems so. Remember 2011 & others

this question keeps coming up; does silver turn before gold or vice versa?

the last low for these markets saw gold turn before silver in November last year.

I simply don’t have time to find it right now, but if you look back over the historic analysis category I looked at these two side by side, there’s a chart where I noted the turning points and dates.

Here is my monthly chart for Gold which shows the dates of turning points for both Gold and Silver.

Yes, Silver often turns before Gold. But not always. The last low saw Gold turn on 7th November, 2014 while Silver found its low later on 1st December, 2014.

If indeed this pans out as irregular ABC flat with expanding ending diagonal in C, this would be an example where EW gives you completely different perspective from classic technical analysis. While this looks like a breakout on the charts, EW indicates pending sharp reversal from this point. It looks too ambiguous to me at this point to pick a side.

Good point. Do chart patterns really work well anymore?

My TL analysis also shows ambiguity. The main downward channel on high time units stands as strong Res while TL’s on short time units are supportive. I respect the former until broken, beyond just a throw over.

Folks, mine is a very tongue in cheek view: For Monday, with its current bullish posture, at this stage with 1179-76 holding, gold price looks all set to pop through 1281-82 for 1288-89 with downside risk 1272-68…. The retracement level 1292 may not be able to curtail the upside. On a weekly basis, both Gold and Silver appear to indicate to initiate longs; hard to indentify a Sell signal yet other than an expected price drop due to overbought stochastic which is not likely to seek a break below 1245. Let’s see how this pans out and wait for Lara’s insight. Good luck!

Syed

My experience tells me that after three white (Green) candles and a large last candle a possibility of next action is a reversal candle: dark cloud/bearish engulfing/inverted hammer/harami/doji. 80% probability.

@papudi / @Chapstick_jr: Thank you both for your valued feedback/input. So far Gold price appears to have made base camp / a bit of a floor at 1255. Given its current bullish posture indicative for continuation to further new highs, I would now expect gold price to start to test the retracement zone 1292-1328. Of course these things have a way of changing on the spin of a coin lol. With gold price above the upper band and both the

hourly and daily RSI tagging 70+ a price drop is inevitable…. Unless something changes, my sentiment for now is to initiate longs on the drop/s. It would take more than just a break below 1245 with 1233 curtailing. I was and am still looking for a reversal to kick in. There do not appear any signs of that just yet. As Lara has pointed out, caution and patience is required. This is a big trend change.

Lara, I’m all for technical analysis and a big fan of EW but fundamentals are looking quite scary for our shorts.

We have the following SERIOUS NEWS to consider:

– The Swiss Surprise before the ECB meeting.

– The ECB meeting and quantitative easing.

– Greek presidential election and possible default on their debt.

All of this news disseminates fiat credibility and that’s very scary when investors panic and seek safe havens.

I understand you only do TA but under the circumstances one has to recognize the elephant in the room.

…Would really appreciate your thoughts on this serious matter.

Quite scary? I completely disagree since we know exactly when to bail on the short…full daily candlestick above trendline. I believe we will get a pull back to $1260ish so it reflects on daily chart. It will be the fifth wave that determines everything IMO. Maybe we touch $1290 first and then pullback to $1260. Either way, I think we’ll have a chance to exit shorts with minimal damage.

Lara, J., Matt, and Chapstick,

We seem to be putting a lot of emphasis/dependence on the maroon channel.

I’d like to point out that other respectable EWavers are displaying charts for Gold, GDX and GDXJ with breached channels.

Many gold stocks have more than surpassed this channel already.

And while I’m respective of Lara and others, I have to be honest with myself and recognize that it’s impossible to have “the” right weekly channel.

The slightest change in degree over a long period of time can create disputable results.

J.- as far as your comments that fundamentals/news don’t really matter…

Consider a possible “knee jerk reaction” – this could completely throw us over Lara’s maroon channel within seconds.

Here’s an example.

Sept. 18 2013.

The Federal Reserve announced they would not reduce their $85 billion monthly asset purchase program. The unexpected announcement bolstered gold $70 within

minutes. Now ask yourself..

What will the chart look like when the maroon channel is breached $70 within a blink. Even non EWavers will recognize this as significant. Will it change our Elliot wave count? ..You betchya. I wouldn’t discount this news as unimportant.. We have a 50/50 chance… hopeful we are on the right side.

Good luck,

Jaf

I’m putting a lot of emphasis on it because I think it’s the most accurately drawn. We are back inside the hourly channel and have touched the maroon channel for today anyway. It certainly looks like we could be in subminuette iv now which I suggested 2 days ago.

However, I’m not panicing and will simply adjust as is required with EW analysis. At this stage it certainly looks like Lara’s count IS NOT GOING TO HOLD, but I think a pullback to $1260ish is coming. My biggest concern has always been the length of the B wave, but I completely understand why Lara labeled it that way. It does look like a 3 and not a 5. Let’s get through the events of this week before coming to a final conclusion

Jaf I understand what you’re saying as I used to be under that belief before, too. Certainly the news can make an immediate price impact, but how long does that impact last?

Using your own example, the impact of that Fed announcement was merely counter-trend and subsequently erased by the (down) trend already established in the bigger channel.

This is a time when the masses may be fooled. Most have been perplexed by the fact that gold has been going up for several months now, despite dollar strength, tanking oil prices, etc. However, it wasn’t all that long ago that gold was at 1130. There are many more reasons for gold to go down than up in the coming weeks, if you ask me. Nonetheless, this is an Elliott Wave forum, so you can research more for yourself online. Yes, it’s going to be a bumpy ride over the next two weeks (this week ECB, next week FOMC). Position yourself accordingly, or step aside temporarily.

EW is mutually exclusive to fundamental analysis. They are opposite.

When the majority of traders / analysts / market pundits insist Gold must go up, that is exactly when it can turn down.

From an EW perspective it is social mood which moves the market, market movement is a direct expression of social mood. It is social mood which makes the news, not the news which moves markets.

I know this is currently a very unpopular viewpoint, it is opposite to current thinking on markets and how they behave. But if I’m do do EW properly this is the viewpoint I must work from.

So in regards to any announcements from ECB or the Greek elections, it is social mood which will determine what these announcements / election results will be.

The market does tend to anticipate news prior to announcements anyway.

So we shall see. I understand your concern, but it is not a viewpoint that I share, coming from a very different perspective as I do.

Fundamentals don’t really matter. You speak of QE… But consider that after QE1, gold eventually doubled. Yet after QE3, gold eventually lost $600. How to explain that difference? You can see different psychological reactions to the same fundamental event at different times. Besides, there are dozens of fundamentals in-play and nothing can track nor assess the price impact of all them.

GDX pullback expected

No signs of a reversal but there is a potential game changing event in gold next week on Thurs when ECB is expected to announce something major (QE?). If Lara’s count is correct, QE announcement should overwhelm and gold should plummet. My preferred scenario would be for gold to pullback early next week (subminuette iv) and make an initial jump after announcement. Initial reactions are usually the wrong reaction. I believe it’s very important not to have one full daily candlestick above maroon trendline

I give little weight to fundamental events. That said, if ECB announces QE, that might could calm nervousness about EU debt deflation (like Draghi’s “whatever it takes” speech in 2012), which would depress gold. Or the ECB QE announcement might disappoint markets somehow (eg., too little, poorly structured) and thus stoke nervousness over EU, which would support gold. That said, there are dozens of other fundamentals also in play and its impossible to figure them all out. So IMHO trading on fundamentals is a fool’s errand.

Be careful before jumping long. Wait for action on Monday and afternoon Lara’s report.

Than there is a luck factor if you do it.

I sold my JNUG and started a position in JDST on Friday. The only thing that had me question this is that these recent waves are all taking longer than anticipated until Thursday/Friday. Like Lara said, the turn takes patience, so I will look to be adding to JDST/DUST next week.

Wish I could figure out how to change my profile name…

Click on your profile name, then click on profile picture. Edit settings as desired in Disqus.

Lara- From a weekly wave count on a chart posted by Bob B below can your wave int (2) B be labeled as wave (5) {A} as in the chart below?

From EW novice!!Still learning.

Yes it could, but Lara’s keen eye for the details in the subdivisions alert her that it has a low probability. Even low probability wave counts are correct at times. A confirmed break of the maroon trend line would likely see Lara show that count as an alternate and with more up, a main count. Lara is very good at adapting the wave count when price action no longer supports her preferred wave count. Listen to about the 5:00 min mark in the video and near the end of the video when Lara talks about the price action that would cause her to accept that Primary 5 could be over.

Thanks Bob! You’ve answered the question perfectly 🙂

Hi. I am a new member and have been reading the members

comments with keen interest. Lara’s EW analysis is quite fantastic and has

helped me a lot. There probably could be no better! Just my view: With a close above 1280, gold price remains bullish suggesting continuation to further new highs with no signs of reversal yet. It appears that Gold price trend has changed direction for up, initially seeking 1292-1310 range and it is probably still not too late to initiate longs though gold price appears to be looking to top….

We all know that the price of gold will have the final say. We also know that we are at a critical point for the current count, even though the official invalidation is at 1345. Many analysts are getting very bullish. One example from Daneric is attached. On the other hand, COT data shows Commercial traders (the big money) getting increasingly short. Also, next Thurs, the ECB is expected to announce a bond buying program, which will likely weaken the euro and strengthen the usd.

My vote is still with Lara’s count.

If ECB does that then it will be very bearish for gold. Recently YEN did the same so for awhile gold went down with yen. IMO

Only Lara can find wrong with this projection to wave {B}. Why This wave has high overshoot? Does it meet FIB rule of EW?

Upto wave (4) this wave count matches with Lara’s count.on weekly just published.

Why wave {A} is not wave b? Only Lara or other members EW can explain for our benefit.

At 1130 this wave count is (5). Lara has time after time said this is not wave (5).

If the maroon channel on the weekly and daily charts is breached then this would be my alternate count. If further upwards movement happened then it may change to a main count. Price will tell us.

Are you asking why (A) is not labelled (B)? It makes no sense. B follows A. Also, this downwards move subdivides as a five wave impulse, not a three. B waves must be “threes”.

This count is technically possible, but for reasons I’ve explained it has a very low probability. I will only publish it if it shows itself to be true / more likely.

My concern right now is gold showed no signs of a reversal and closed strong. This still looks like subminuette iii IMO. We could see a $20+ ($1258-$1262 is first area of support) correction for subminuette iv which would show on the daily chart. However, that would force subminuette v to be a truncation due to maroon trendline or have an extremely long top wick which is possible. No matter the case, I think a pullback is in store at the very least.

Chapstick

Thanks for sharing yr idea. Look forward to yr posts daily.

Even though gold closed strong why u think gold will drop on Monday?

Has wave v ever truncated like u suggest?

I am not EWaver.

Just learning. AND looking for this int (2) to be over soon.

U have strong faith in maroon TL.

Chapstick

Recently I posted another EW analysis of gold from Ron Rosen. His analysis is based on longer term chart of gold.

If you can shed some light on his super cycle wave count I will appreciate. Does he have any merit?

http://www.321gold.com/editorials/rosen/rosen011215.pdf

Papudi: What is Rosen’s track record? Here’s what he said about gold in July 2013, has it actually happened?

Rosen: “It will outperform it to such an extent that it will almost be beyond belief. We are looking at a massive move in front of us that will top sometime in 2014. At that point there will be a correction. Then, a massive blowoff will take us probably into early 2016″.

Track record of Rosen very wrong to laughable. I have been reading his EW for many years none none came true.

He has a first wave which looks like a clear three wave structure on a weekly chart.

I’ve looked at that bit pretty carefully on a daily chart. It is possible that it was a leading diagonal, and a long time ago I did have such a wave count, but a more careful look at this piece of movement saw me conclude that the first wave ended earlier.

Thanks Lara! Is there a way to turn off some of these posters? Its takes a day to wade through irrelevant comments, theres a couple that write 50+ coments/day between themselves that no one reads. Some post every single trade they’ve ever made last year on here.

lol , I am with you . Lot of the posts are just irritating . I only just follow Lara’s answers and that’s it .

I think its awesome that members are talking to each other real time while they’re trading, and this is becoming a little community.

We have some VERY experienced members here, some CMTs, some fund managers, and some professional traders. They have a wealth of hard won knowledge to share.

I have to go through them all too, and look for comments that begin with “Lara” as something I have to respond to.

Skim read. It’s different for all; some want the community, others just want the info from the experienced members.

Well said. I for look for trading info from experienced and witty traders. It is helpful for me and I assume it is for others also.

I like Richards comments and it showed me how to synchronize my trades with daily reports. Sometimes gold does not perform as expected but neverthless as long as one does not do 3xetf it is manageable.

Thanks Lara.

Ok Lara, have a great time.

Good luck getting ‘The Brass Ring’.

Say hello to Frodo Baggins and J. R. R. Tolkien. for me.

Monday US holiday, NYSE is closed.

https://www.nyse.com/markets/hours-calendars

Looking for Gold to drop into a deep sink hole over the long weekend.

I bought and kept a small position in DUST.

Will buy more DUST as we get more EW confirmation of a trend change down.

Didn’t see Frodo, but I did see a fair few Ocrs. Forgot my sword though.

Saw fiords, waterfalls, rainforest… I’m all like “oh, another waterfall” now. Ho hum. Spoilt by the best pristine World Heritage site in the world.

NYSE hours are irrelevant to gold & silver. These are globally-traded global commodities, not US stocks.

Gold & silver trade all around the world on Monday, even in US except for Monday afternoon’s Globex electronic futures session, which is typically a light session anyway.

The big gold/bullion exchanges in London and Asia, which are key market players, trade regular hours on Monday.

Because you like ETF and can trade in Canada on Monday, I should also point out that you ETF owners can buy and sell funds or stocks that are cross-listed in US and Canada.

For eg., can trade CEF.A in canada and CEF in US.

Or PHY.U on tsx, then later PHYS on nyse.

PHS.U in canada, then PSLV in US.

GG and MUX in US; then G and MUX in canada.

Etc.

Its also a cheap way to convert between usd and cad

Note to all members: I will have a very limited internet connection over the weekend while I’m in Fiordland. I’ll probably only be able to answer questions on Tuesday my time (late Monday NY time).

I’m off to see fiords and amazing scenery, aka Lord of the Rings stuff!

Thanks Lara

Thank you Lara, for the early analysis…