Movement below 1,170.83 was not expected and the Elliott wave count was invalidated. The bigger picture and the mid term outlook remain the same.

Summary: The fourth wave of the ending diagonal continued lower and is now even more likely to be complete. A final fifth wave up should unfold to 1,262.94 or above. It may last one week if intermediate wave (2) completes in a Fibonacci 13 weeks, but it looks like it may need a little longer.

Click on charts to enlarge

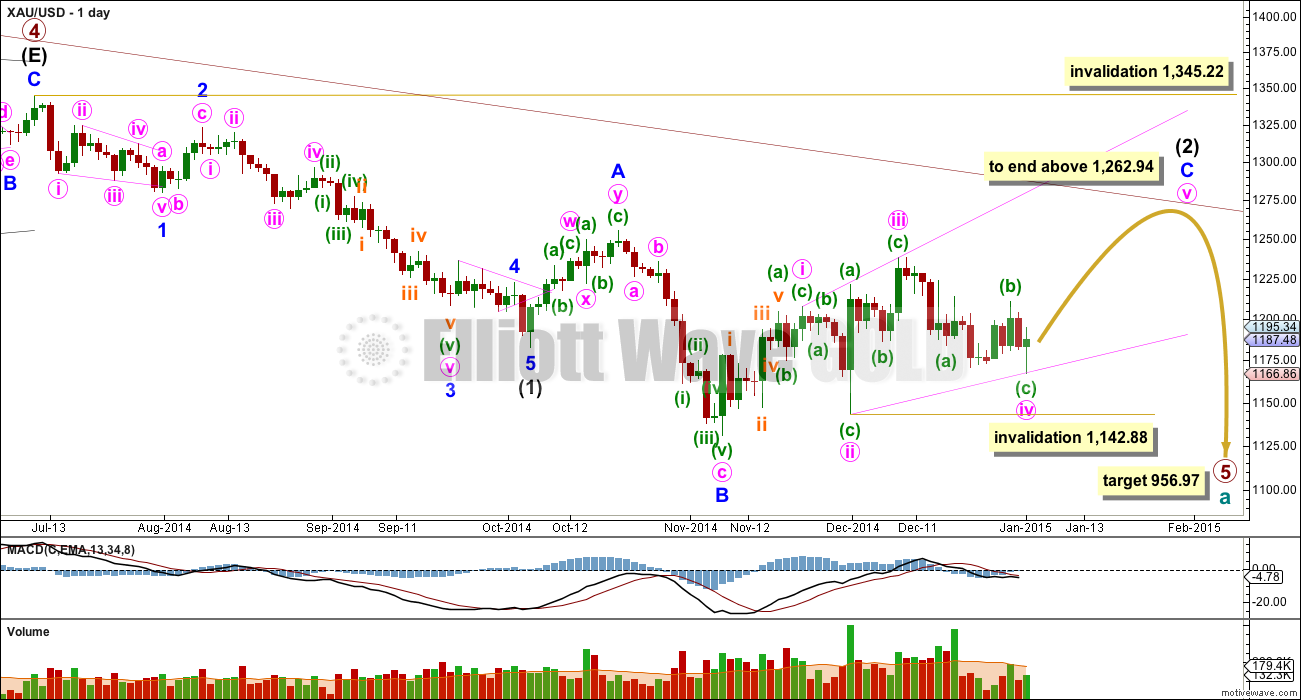

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A. Minor wave C is extremely likely to move at least slightly above the end of minor wave A at 1,255.40 to avoid a truncation and a very rare running flat correction. It may end when price touches the upper edge of the maroon channel, copied over here from the weekly chart. To see how to draw this channel click here.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, click here.

Intermediate wave (1) lasted a Fibonacci 13 weeks. If intermediate wave (2) exhibits a Fibonacci duration it may be 13 weeks to be even with intermediate wave (1). Intermediate wave (2) is ending its twelfth week. If it continues for one more week it may have an even duration with intermediate wave (1). This may be possible, or it may need a little longer.

So far within minor wave C the highest volume is on three up days. This supports the idea that at this stage the trend remains up. Even for the last nine trading days the highest volume is in two up days.

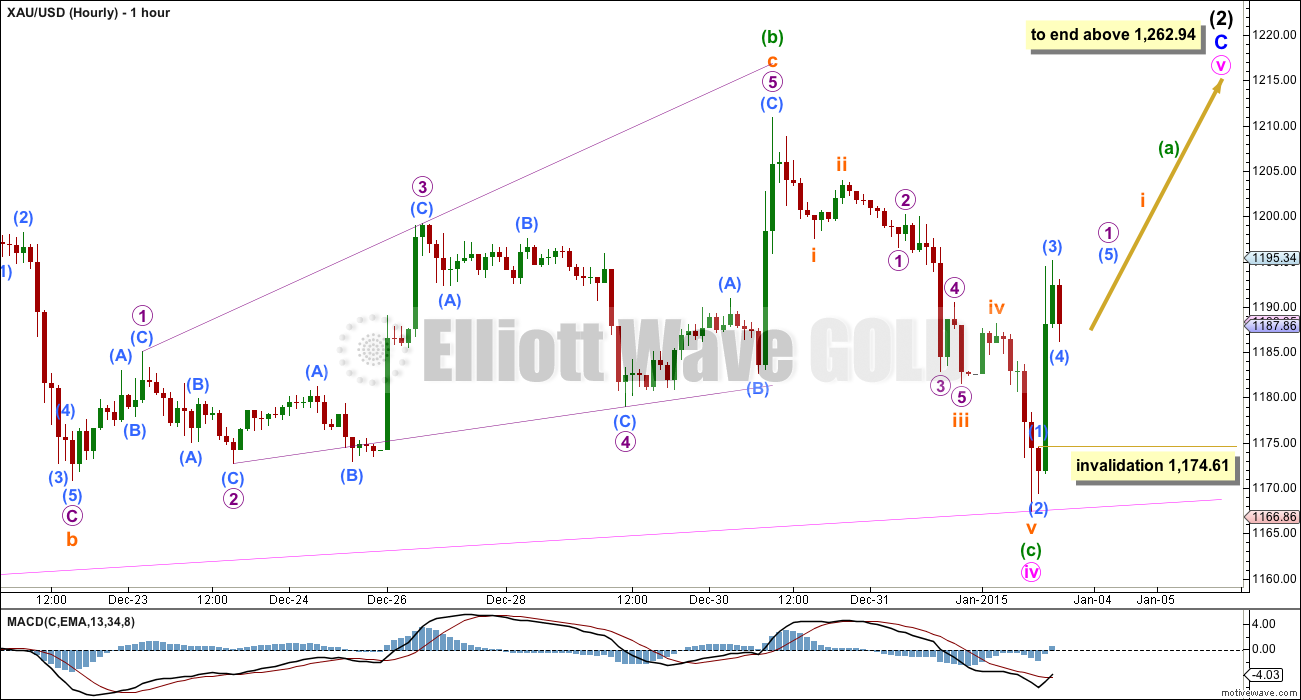

Minor wave C may be either an impulse or an ending diagonal. At this stage an impulse looks very unlikely because there is too much overlapping. An ending diagonal looks more likely, and it may be now just beginning the final fifth wave. The downwards spike which invalidated the last labelling of this structure looks like a continuation of minute wave iv. If minute wave iv continues yet further it may not move beyond the end of minute wave ii below 1,142.88.

Within an ending diagonal all the sub waves must subdivide as zigzags. With downwards movement in the first trading day of 2015 minute wave iv now subdivides as a single zigzag rather than a double.

This diagonal would be expanding: minute wave iii is longer than minute wave i, and minute wave iv is longer than minute wave ii. The trend lines are now clearly diverging. Minute wave v should be longer than equality with minute wave iii which would be achieved at 1,262.94. This would also see minor wave C end above the end of minor wave A at 1,255.40 avoiding a truncation and a very rare running flat.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit well as either a complete impulse nor an ending diagonal. If it is seen as a complete impulse there would be inadequate alternation between the single zigzag of the second wave and the double zigzag of the fourth wave correction, and there would be no Fibonacci ratios between the first, third and fifth waves within it.

I have considered the possibility that minor wave C ended at the high labelled minute wave iii at 1,238.38. If it did, it would have to be an ending diagonal which does not fit because the third and fifth waves within it do not subdivide as zigzags and instead subdivide as impulses. For this reason I do not think minor wave C is over yet and should continue higher.

Downwards movement to 1,167.44, which invalidated the last wave count, completed a clear five wave impulse. This should be the end of minute wave iv as a single zigzag.

Within minute wave iv minuette wave (b) subdivides as a running flat correction, with its C wave truncated by 3.12. I have checked the subdivisions carefully within minuette wave (b) and they fit perfectly.

Within minute wave iv there is no Fibonacci ratio between minuette waves (a) and (c).

The next upwards movement has begun as an impulse, but is incomplete. Within it sub micro wave (4) may not move into sub micro wave (1) price territory below 1,174.61. When a final upwards wave which may be sub micro wave (5) completes an impulse for micro wave 1 then the invalidation point must move down to the start of micro wave 1 at 1,167.44.

Along the way up I would expect downwards corrections to find strong support, and not breach the lower pink ii-iv trend line of the diagonal. Diagonals should conform very well to their trend lines, and is rare for them to not do so.

Despite the invalidation of the last wave count, I am still confident that overall upwards movement is not over and minor wave C is incomplete. The diagonal of minor wave C now has a better more typical look on the daily chart, now that its fourth wave is clearly bigger than its second wave.

This analysis is published about 1:31 p.m. EST.

ABC target for gold is 1206. If it makes it.

Deep correction Tuesday, expect it to be quick, use it as an opportunity, invalidation point 1,167.44. See Lara’s 2 comments below. Report will be later in 3 hours.

Does anyone have a guess as from now until close at 4 pm EST, which wave and dollar amount the low for today will be before close as I’m looking to buy into GDX again?

I hope Lara will update before close so position can be taken for the next wave up. If this wave down completes the wave(2) than next is up wave.

Not too much help???

If I understand your question correctly, the low for todays session (5th Jan, 2015) is and will be 1,178.09.

I would not expect a new low before closing.

But I am expecting a second wave correction should begin tomorrow, and the invalidation point is at 1,167.44 for that.

Hi Lara,

Why do you expect a second wave for tomorrow?

I count micro wave 1 from 1167 to 1198, micro 2 to 1186 and now in the middle of micro wave 3. Do you agree?

Sorry but in this moment I cannot post a chart.

Hi Lara,

Crude oil is going south nicely, is there any correction to expect soon?

Could you please update the chart?

Thank you very much

Ursula

Lara , what about the possibility that we are forming a triangle ? i.e. Minor A and Minor B are as you say in your chart . But Minor C is at Minute iii and Minor D completed or is yet to complete ? (Or maybe C is not finished but won’t go above A . ) Why or why not , thanks . I am not a good counter so maybe I don’t know what I am talking about . Also , regarding this current count of expanding diagonal , doesn’t elliott say that these are rare and often the 5th wave of ending diagonal is an overshoot of the upper trendline ? That would take us too far above important levels maybe ?

That would fit for that piece of movement, but the problem is it does not fit in the bigger picture.

Minor wave C may only be a five wave structure. A triangle within a five may not be the sole corrective structure in a second wave position. I can see a possible triangle, but it would be in the second wave position. Which is invalid.

Expanding diagonals aren’t rare, they’re just less common than contracting types. I’ve seen a fair few over the years. The final wave of expanding diagonals usually falls short of the 1-3 trend line. It is contracting diagonals where the final fifth wave slightly overshoots the 1-3 trend line. As it did for minor wave 1 on the daily chart, top left hand corner.

OK , to make sure we are talking about the same thing … When you say “second wave position” are you talking about intermediate wave (2) ?

I am referring to a symmetrical triangle starting from Minor wave A . A and B are as you have it and C ends where you currently label Minute iii . Then D just ended and we are now in E . In this case C doesn’t have to be 5 waves correct ?

Thanks .

Its both actually.

Minor C must be a five, so a smaller triangle within it would be in its second wave position and that would be invalid.

But your second comment outlines your idea better. You are seeing a big triangle for intermediate wave (2). Again, a triangle can’t be the sole corrective structure for a second wave so that’s invalid.

Which, as you point out, you now know.

On Jan 4th at 18:00 hour EST wave (4) is complete at 1178.08.

Await what London brings on????

you mean wave (2)….already had a five wave impulse for wave (1)…SHOULD finally be in third wave targeting $1221ish at a min and possibly $1250ish if Lara’s count is correct.

I am not sure what I meant. But it appears complete wave circle 1 and (5). Now in wave circle 2 down, Then wave circle 3 up.

Is that correct???

papudi

I agree at 18:28 OR 6:28 EST sub micro wave (4) may have completed at 1178.08. Next may be happening now is final upwards wave which may be sub micro wave

(5) completes an impulse for micro wave 1 circle to about the 1,195 area, then down in micro wave 2 circle, where the

invalidation point must move down to the start of micro wave 1 at 1,167.44. Then up to finish wave i, then down in wave ii…

At 5:57 EST gold is doing what u describe. Completed wave (i) and is in wave (2) and invalidation has moved down to 1167 per Lara.

once wave(3) completes the wave (3) impulse will unfold as I see it??????

After (2) it only goes up to i which looks like at 1202 on the charts, then down again in ii then up in iii, iv, v to (a)

I see a first wave up almost complete. It has an extended fifth wave within it, which is now just slightly over equal in length with its third wave.

I would expect the development of a second wave correction pretty soon to begin, invalidation point at 1,167.44. I would not expect this second wave to show up on the daily chart as a red candlestick or doji, but it is possible it might. Just less likely.

I expect another green candlestick for tomorrows session.

I won’t be able to get the analysis out before market close today, sorry guys, hence the detailed comment here. I have to go right now and will be back in about 3 hours.

So… look out for a deep correction, expect it to be quick, use it as an opportunity, invalidation point 1,167.44 and the trend remains UP.

Good luck everyone!

Thanks Lara! on the hourly is 4 now complete at $1182.14?

I’ve found it difficult to identify the end of a wave 4 because what starts out looking like a zigzag can morph into an expanded flat which can then morph into some type of triangle and take forever to complete. if someone knows how to identify what it will be early in the process, I’d love to hear it. In the present case (submicro wave (4) color aqua), we know that wave (2) was deep and quick and the rule of alternation says wave (4) should be shallow and long. My guess is the uncertainty will last until London is open on Monday.

There is absolutely no way to tell at the beginning of a correction what structure will unfold. You’ve pinpointed one of the most difficult aspects of EW right there.

Alternation can tell us what structure, or group of structures, is most likely, and what depth is most likely.

Alternation is a guideline only, not a rule, and it should be applied with flexibility.