Upwards movement was expected. The target remains the same.

Summary: I expect upwards movement for this week. In the short term look out for a quick sharp second wave correction, after which upwards momentum should increase. I expect a green candlestick for tomorrow’s session. Upwards movement may end at the end of this week, or more likely now continue into next week. Upwards movement should reach at least to 1,262.94.

Click on charts to enlarge

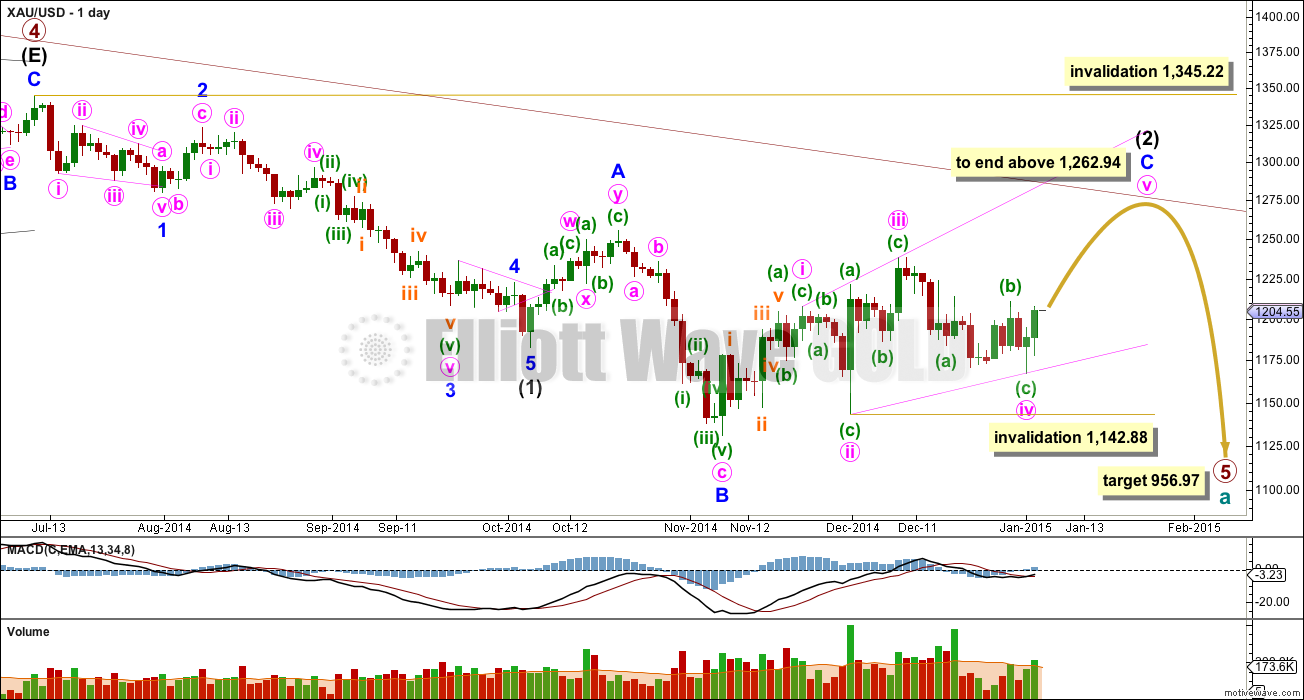

Primary wave 4 is complete and primary wave 5 is unfolding. Primary wave 5 may only subdivide as an impulse or an ending diagonal. So far it looks most likely to be an impulse.

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. I am confident this movement is one complete impulse.

Intermediate wave (2) is an incomplete expanded flat correction. Within it minor wave A is a double zigzag. The downwards wave labelled minor wave B has a corrective count of seven and subdivides perfectly as a zigzag. Minor wave B is a 172% correction of minor wave A. This is longer than the maximum common length for a B wave within a flat correction at 138%, but within the allowable range of twice the length of minor wave A. Minor wave C may not exhibit a Fibonacci ratio to minor wave A. Minor wave C is extremely likely to move at least slightly above the end of minor wave A at 1,255.40 to avoid a truncation and a very rare running flat correction. It may end when price touches the upper edge of the maroon channel, copied over here from the weekly chart. To see how to draw this channel click here.

To see a prior example of an expanded flat correction for Gold on the daily chart, and an explanation of this structure, click here.

Intermediate wave (1) lasted a Fibonacci 13 weeks. If intermediate wave (2) exhibits a Fibonacci duration it may be 13 weeks to be even with intermediate wave (1). Intermediate wave (2) is beginning its 13th week. It is just possible it could end at the end of this week, but it now looks like it may need longer than this. It may end next week.

So far within minor wave C the highest volume is on three up days. This supports the idea that at this stage the trend remains up. Even for the last nine trading days the highest volume is in three up days.

Minor wave C may be either an impulse or an ending diagonal. At this stage an impulse looks very unlikely because there is too much overlapping. An ending diagonal looks more likely, and it may be now just beginning the final fifth wave. The diagonal is expanding and the trend lines clearly diverge. Expect the final fifth wave of expanding diagonals to fall short of the i-iii trend line. Minute wave v should be longer than equality with minute wave iii which would be achieved at 1,262.94. This would also see minor wave C end above the end of minor wave A at 1,255.40 avoiding a truncation and a very rare running flat.

Within an ending diagonal all the sub waves must subdivide as zigzags. The fourth wave should overlap first wave price territory. The rule for the end of a fourth wave of a diagonal is it may not move beyond the end of the second wave at 1,142.88.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. I have confidence this price point will not be passed because the structure of primary wave 5 is incomplete because downwards movement from the end of the triangle of primary wave 4 does not fit well as either a complete impulse nor an ending diagonal. If it is seen as a complete impulse there would be inadequate alternation between the single zigzag of the second wave and the double zigzag of the fourth wave correction, and there would be no Fibonacci ratios between the first, third and fifth waves within it.

I have considered the possibility that minor wave C ended at the high labelled minute wave iii at 1,238.38. If it did, it would have to be an ending diagonal which does not fit because the third and fifth waves within it do not subdivide as zigzags and instead subdivide as impulses. For this reason I do not think minor wave C is over yet and should continue higher.

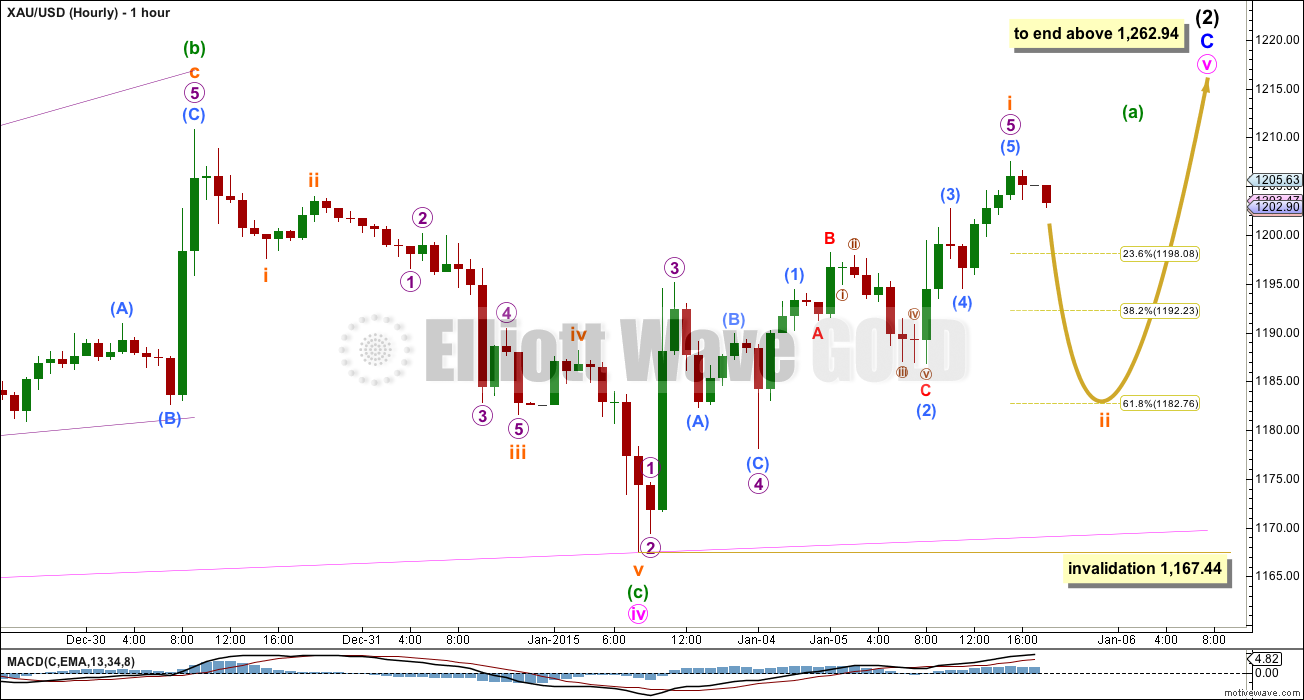

Minute wave v upwards must subdivide as a zigzag, and within it minuette wave (a) must subdivide as a five wave structure.

There is now what looks like a completed five wave impulse upwards, with an extended fifth wave. Ratios within subminuette wave i are: there is no Fibonacci ratio between micro waves 3 and 1, and micro wave 5 is just 0.91 short of 4.236 the length of micro wave 1.

Ratios within the extended wave of micro wave 5 are: sub micro wave (3) is 0.51 short of equality with sub micro wave (1), and sub micro wave (5) has no Fibonacci ratio to either of sub micro waves (1) or (3).

Because there are three red candlesticks after the end of micro wave 5, I would expect it is very likely to be over here. Subminuette wave ii may end at either the 0.382 or 0.618 Fibonacci ratios of subminuette wave i, with the 0.618 Fibonacci ratio slightly preferred. It may be quick and may not show up on the daily chart as a red candlestick or doji, but this is not certain. It is possible that it could be time consuming enough to show on the daily chart, but this is less likely. I expect it to be over within a few hours. The next movement for Gold when it is done should be a third wave up which should show an increase in upwards momentum.

Subminuette wave ii may not move beyond the start of subminuette wave i below 1,167.44.

This analysis is published about 6:40 p.m. EST.

Lara, would be great to see a silver and gdx chart.

Yeah, I know. And US Oil too.

I am certainly intending to find the time… today or tomorrow. Probably charts only.

Chart only is good. Visual comparison of gold, silver and gdx is what I like. Vote the charts. If all point in the same direction I am happy. I leave intricacies of EW to experts. I am a KISS guy (keep it simple stupid) !

Would someone please comment when they think the gold low for this session is!

I sold GDX Friday when both charts were invalidated and haven’t bought back in yet and am looking for an intra-day low. Gold doesn’t seem to be agreeing with the forecast. Is it possible that subminuette wave ii ended at 1201.75 at 19:24 Monday?

What would be the wave count of the high of the day so far at 1214.42 at 4:15 am? Could that be the top of subminuette wave iii? Is (a) a 3 wave count? If we are in (b) how low can it go this session?

When I wanted GDX to be strong it invalidates and I sell. Then when I want GDX to be weak, it decides to go keep going up each session? I should of bought at 18.76 Monday.

You’re not the only one that got stopped out…

I think this error is going to hurt many of us.

Lara, any ideas?

Jaf, Lara lives in New Zealand and may be sleeping. I think she may respond about 2 pm.

Yes, this is a draw back indeed..

My strategy was to go long during this correction up ( which I don’t particularly like to do since I usually play in the direction of the larger trend/rule). But my concern is over primary 5. I know that Lara has a very good argument for further down movement, and I agree with her wholeheartedly particularly when I look at the monthly chart. But it’s the other analysts’ that I worry about. What if there sloppy predictions influence the masses? For this reason it was important that I go long into this correction…. Is hate to lose out on a primary trend change, it would be disastrous.

Which wave just peaked at 11:56 am at 1,223.19?

I doubt that this gold activity this week would change a primary wave 5 outcome.

I have heard from some of the top gold traders in the world and they all very bearish on gold.

It hasn’t done what would look like a second wave correction yet, so I’d expect this upwards movement is still subminuette wave i. Which is incomplete.

The trend is up. Corrections are down.

The trend at minor degree is up at this stage. So I would expect if one were trading this one would go long.

The trend is up. And will be for the rest of this week and into next week probably.

I have to go out again now, but I’ll be back to give you analysis hopefully just before markets close, or close to that time.

Thank you

I think the low is in Richard. I think the high is in too actually.

GDX = big pain or big gain!

GDX most always tracks gold over time but may start or stop 2-3 days before or after gold and move 2-3 times higher or lower than gold.

Indeed, GDX and Gold are not correlated especially in the shorter timeframes.

They do not exhibit the same technical indications or wave counts.

Richard, if you are playing GDX in an effort to get more a more leveraged play on gold than a gold ETF (even a 2X or 3X gold etf), it would be better to instead use a futures trading platform and do real gold trading on it, with as much or little leverage as you want.

Lara mentioned FXCM before and that is an excellent platform available almost everywhere. You get high liquidity, razor thin commissions compared to securties exchanges, precision pricing, 24-hour trading, a lot of tools not available trading ETFs, and as much or as little margin as you want. Plus you trade in terms of the price of gold instead of the price of an ETF.

J. your point is well taken. I am going to look at FXCM you recommended.

Don’t know what country you are in but different rules depending on country and type account. In USA it is my experience many IRAs (retirement accounts) do not allow options trading thus an ETF like GDX or 3X ETF like NUGT or DUST is best (maybe only) way to gain leverage

I am not US. But the negative with trading in retirement accounts is that in most countries your gains are fully taxed upon withdrawal.

Because capital gains are taxed at a lower rate outside a retirement account (and not taxed at all in many Asian countries), then from a tax perspective it is often better to incur capital gains outside a retirement account.

Why did you exit when the intermediate trend was strongly higher? I do not intend to be critical, just helpful lesson, as I have learned in the past from the same. This is a good lesson and example of why short-term “scalp” trading is so difficult and frustrating and stressful, at least for me, and why I prefer medium and longer-term positions. As I’ve posted before, there is more “noise” in short-term and although some folks thrive on scalps, it’s a different animal. IMO it’s less difficult and stressful to go with a longer-term and let it ride, of course employing good stop loss and risk management.

I already lots of GDX and then last Friday morning gold brought through both hourly and daily invalidation and many posters here were concerned that gold could continue even lower so I sold Friday morning. Which turned out to be terrible as was at day low of 18.07 and then waited for Lara update which I believed advised of a correction which I waited for Monday and then waited for another correction expected today to buy and deep correction didn’t happen. Was looking to buy on a dip as with sideways gold since November low some movement were very deep in the choppy waves and going down for days is something I experienced and wanted to avoid.

Yeah I know, it’s difficult. There is never any certainty in these uncertain markets.

Oh well, there is always another good trade setup later. At least you didn’t lose a lot of money; I know from experience what that’s like… some people call that “tuition”, haha.

When I sold Friday morning the short term trend was down and broke through all invalidations and I fear another $40 drop so exited and waited for dip to buy and hasn’t happened yet.

I understand and empathise. To avoid that gut wrenching, I tend to not even check or look at prices too frequently. Instead, before entering a trade, I set an entry target, an exit target and stop-loss based on TA (not just EW). The reward (target) must be a multiple of the risk (stop loss); the more the better. Then I let what happens, happen.

This way, you can be wrong more often than you are right, but still be ahead overall. And you avoid stress and second guessing yourself in real time.

Often the trade goes bad and I lose. But sometimes the trade goes the right way for a lengthy move and I let it run, checking it just periodically and occasionally adjusting the stop or target, taking partial profits after big moves and letting the rest of the move run “on the house”. Good risk management is key I think.

At least that’s how I roll. As I said, I’ve seen others thrive on scalps… it’s not for me tho.

Best wishes for the future.

Gdx appears to be launching into the middle of a third wave which would suggest that we have 3 or 4 embedded 1,2’s. May explain why wave three doesn’t fit as pointed out.

The hourly count seems wrong because the Submicro wave 3 of the Micro 5 becomes the shortest.

For me it is more like Subminuette wave 3 is unfolding

It will be appreciated if you post a chart of correct hourly wave count for members to see.

Thanks.

Lara is expecting swift down and than up.

What is your assessment?

I don’t have a correct count. just pointed out that according the EW rules the 3d wave cannot be the shortest so as price went up extending this labeled “5” wave the Submicro 3d wave has become the shortest which is wrong by the rules

It is just my opinion based more on intuition that Subminuette wave 3 is unfolding.