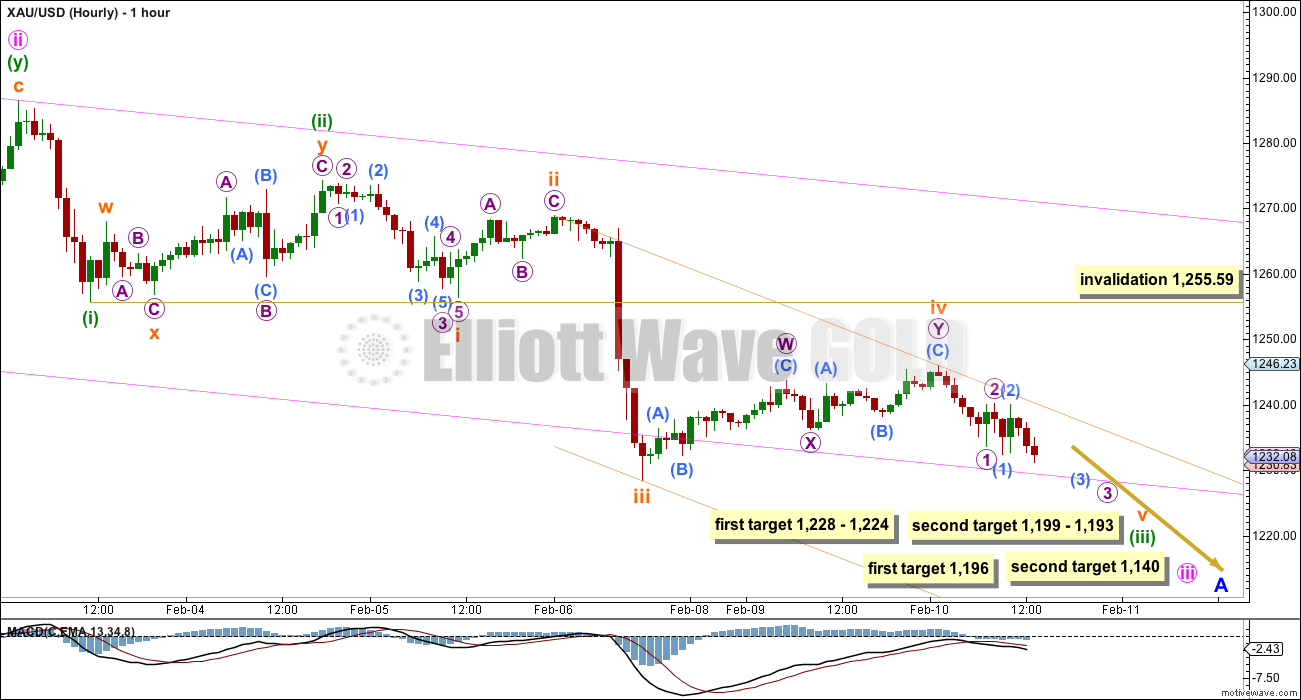

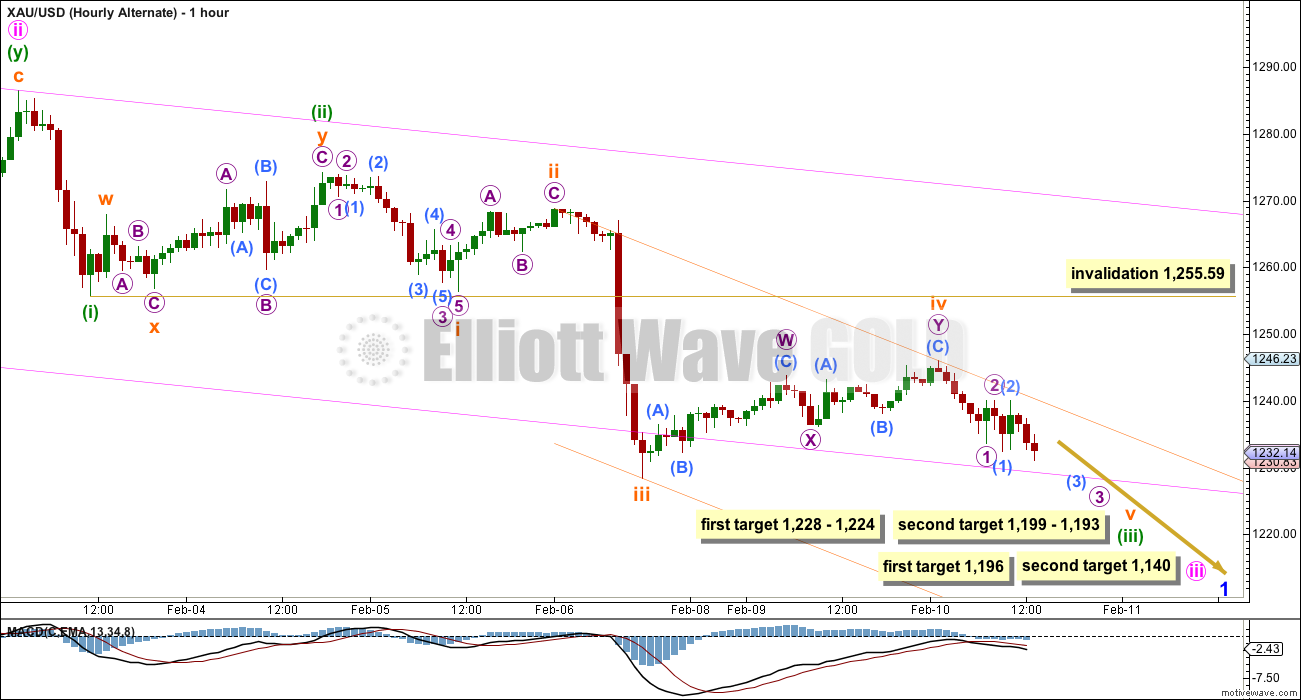

The fourth wave correction drifted slightly higher and was followed by downwards movement, exactly as expected.

Summary: Once the lower pink trend line is breached I expect downwards momentum to increase. The short term targets are either 1,228 – 1,224 or 1,199 – 1,193. I favour the lower target zone at this point. The trend at intermediate, minor, and minute degrees is all down.

Click on charts to enlarge.

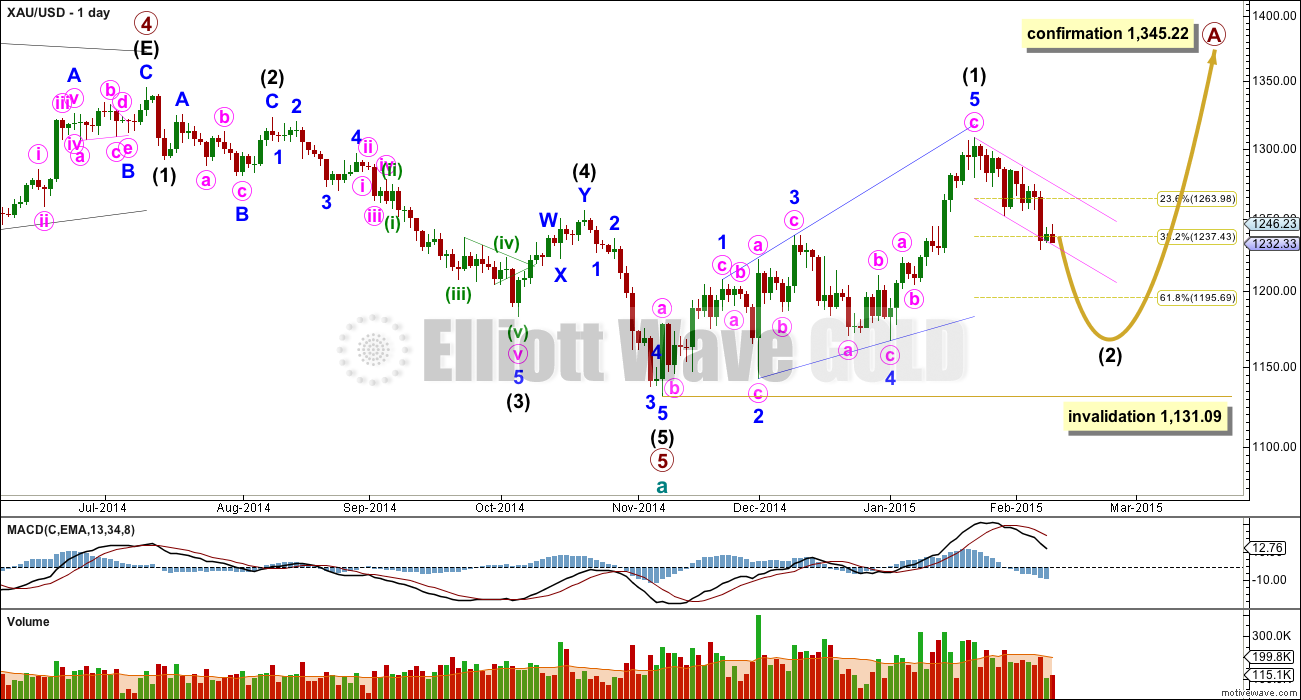

Main Daily Wave Count

At this stage I judge this main wave count to have an even probability with the alternate below. I will let the structure of downwards movement, and momentum, tell us which wave count is correct over the next few weeks. At this stage they both expect more downwards movement so there is no divergence in the expected direction.

This wave count sees a five wave impulse down for cycle wave a complete, and primary wave 5 within it a completed five wave impulse. The new upwards trend at cycle degree should last one to several years and must begin on the daily chart with a clear five up.

The first five up may be a complete leading expanding diagonal. Within leading diagonals the second and fourth waves must subdivide as zigzags. The first, third and fifth waves are most commonly zigzags but they may also be impulses. This wave count sees minor waves 1, 3 and 5 as zigzags.

Leading diagonals are almost always followed by deep second wave corrections, sometimes deeper than the 0.618 Fibonacci ratio. This wave count expects a big deep correction downwards, and it should subdivide as a clear three on the daily chart (the alternate below expects a five down).

My biggest problem with this wave count, and the reason I will retain the alternate, is the structure of intermediate wave (2) within primary wave 5. This is a rare running flat but the subdivisions don’t fit well. Minor wave C should be a five wave structure, but it looks like a clear three on the daily chart. If you’re going to label a running flat then it’s vital the subdivisions fit perfectly and this one does not. This problem is very significant and this is why I judge the two wave counts to be about even in probability.

Intermediate wave (5) looks like a zigzag rather than an impulse, and has a corrective wave count. This is also a problem I have with this wave count.

Intermediate wave (2) is most likely to subdivide as a zigzag, which subdivides 5-3-5 at minor degree. When this 5-3-5 is complete then how high the following movement goes will tell us which wave count is correct.

Intermediate wave (2) of this new cycle degree trend may not move beyond the start of intermediate wave (1) below 1,131.09.

From January 23rd onwards, since the expected trend change, volume is highest on down days. This supports the idea that we may have seen a trend change and the trend is now down. Volume for Silver is even clearer, with a big spike on the down day there for 29th January.

Subminuette wave iv is now over as a double zigzag. There is some alternation between subminuette waves ii and iv: subminuette wave ii is a deep 70% single zigzag and subminuette wave iv is a shallow 44% double zigzag.

At 1,228 subminuette wave v would reach equality in length with subminuette wave i, and at 1,224 minuette wave (iii) would reach 1.618 the length of minuette wave (i). This gives a first target zone of $4. However, if my analysis of the structure of subminuette wave v so far as just now moving into the middle is correct then this target would be too close. The structure of subminuette wave v looks like it will need more room to unfold, and must be a five wave structure.

At 1,199 subminuette wave v would reach 2.618 the length of subminuette wave i, and at 1,193 minuette wave (iii) would reach 2.618 the length of minuette wave (i). This gives a lower $6 target zone which may have a better probability. This lower target zone may see subminuette wave v as a strong fifth wave, typical of commodities. Once price manages to break through support offered by the lower edge of the pink base channel then downwards movement may increase in momentum.

While subminuette wave v is underway no second wave correction within it may move beyond its start above 1,246.02.

When subminuette wave v completes minuette wave (iii) then the following correction for minuette wave (iv) may not move back into minuette wave (i) price territory above 1,255.59.

Minuette wave (ii) was a deep zigzag so I would expect minuette wave (iv) to be a shallow sideways correction given the guideline of alternation.

The target for minuette wave (iii) to end may be met within 24 to 48 hours. If subminuette wave v is a longer fifth wave it may be also be longer in duration.

Mid term targets for minute wave iii remain the same and are still at least one week away, probably longer. At 1,196 minute wave iii would reach 1.618 the length of minute wave i, at 1,140 minute wave iii would reach 2.618 the length of minute wave i.

Draw a channel using Elliott’s second technique about this third wave down: draw the first trend line from the ends of subminuette waves ii to iv, then place a parallel copy on the end of subminuette wave iii. Subminuette wave v may end either about the lower trend line, or if it is a particularly strong fifth wave it may breach this lower trend line. Along the way down upwards corrections should find resistance at the upper edge of this trend channel.

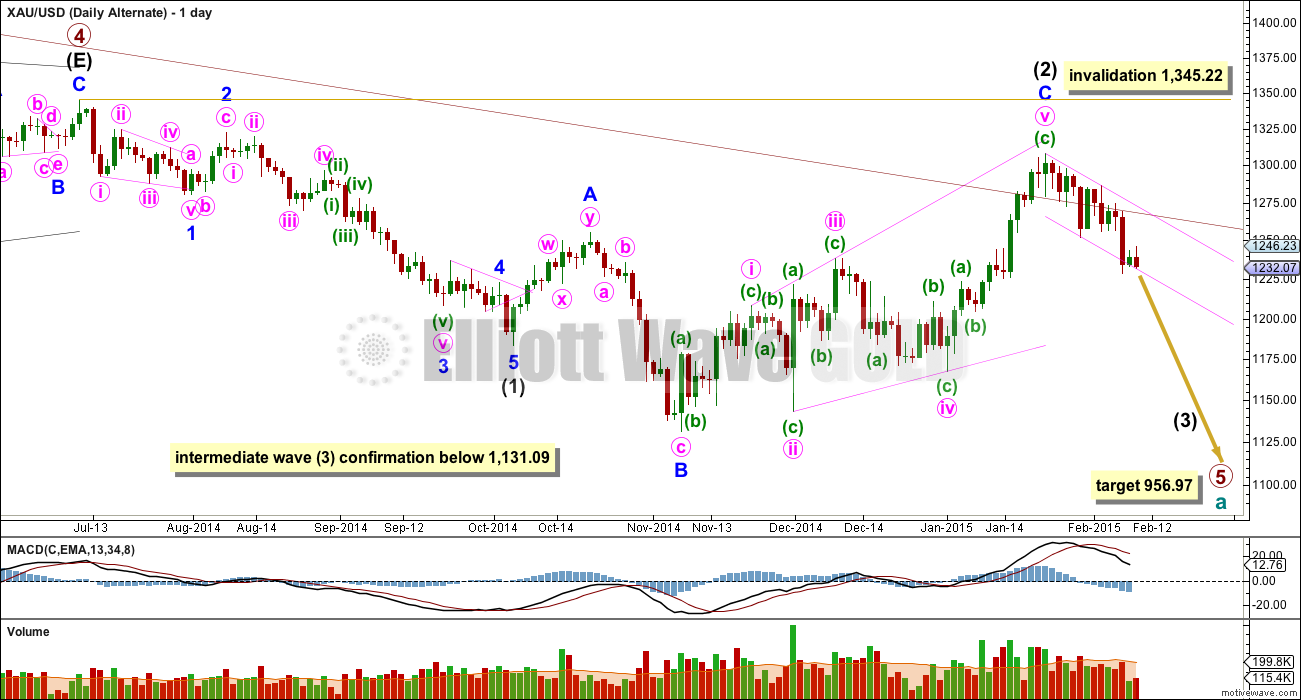

Alternate Daily Wave Count

The maroon channel about cycle wave a from the weekly chart is now breached by a few daily candlesticks, and is now also breached on the weekly chart by one weekly candlestick. If cycle wave a is incomplete this channel should not be breached. For this reason and this reason only this wave count, despite having the best fit in terms of subdivisions, only has an even probability with the main wave count. It will prove itself if we see a clear five down with increasing momentum on the daily chart.

Draw the maroon trend line on a weekly chart on a semi-log scale, and copy it over to a daily chart also on a semi-log scale (see this analysis for a weekly chart).

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1.

Intermediate wave (2) is now a complete expanded flat correction. Minor wave C is a complete expanding ending diagonal. Expanded flats are very common structures.

This wave count has more common structures than the main wave count, and it has a better fit.

For this alternate wave count the diagonal is an ending diagonal for minor wave C. Within an ending diagonal all the sub waves must subdivide as zigzags. The fourth wave should overlap first wave price territory. The rule for the end of a fourth wave of a diagonal is it may not move beyond the end of the second wave.

Although Gold almost always adheres perfectly to trend channels, almost always is not the same as always. This wave count is still possible. The trend channel breach is a strong warning that this wave count may be wrong and we need to heed that warning with caution at this stage.

A new low below 1,131.09 would confirm that a third wave down is underway.

At 956.97 primary wave 5 would reach equality in length with primary wave 1.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. If this invalidation point is passed this wave count would be fully invalidated.

The short term structure, targets and invalidation points are still the same for both wave counts at this stage. They probably won’t diverge for a few weeks.

This analysis is published about 02:20 p.m. EST.

Feb 11 report out

It seems like Gartley is developing… for this to confirm now gold has to correct 0.382 on daily chart…..

started from 1167……..high 1307…. retraced 0.618 ….now if it retraces 0.382 t0 1253 then it can be confirmed. after retracing 0.382 to 1253 it can move to 1.27 at 1145.

With labeling XABCD

Waseem, which is easiest and most accurate, Gartley or Elliott ?

I belong to Pakistan. Here i don’t find anyone who can teach me Elliott wave so i tried to learn harmoic patterns.

Both are accurate in their own way..

The target in both are almost same Lara’s target is 1140 and if this pattern is correct than 1145….

Thanks

I believe it is now 5th sub-micro wave within micro 3rd of 5th subminuette. It shall end shortly and 4th wave should unfold. It shall not move above 1230. Looking forward to see Lara’s work.

X waves must be corrective structures, so they would be labeled A-B-C most commonly (or A-B-C-D-E if a triangle, or rarely W-X-Y if a combination).

X waves would never be labeled 1-2-3-4-5.

The structure you have labeled would be a diagonal, the convention for diagonals is to put the diagonal trend lines on it to identify it as a diagonal.

If you don’t have a copy of EW Principle by Frost and Prechter (10th edition) then do get one. Read the rules and guidelines in it repeatedly, read them once a day. You’ll soon learn they by heart. That’s necessary.

hi lara thanks for above explanation, this work very well cause of live trade and it’s great learning in compare to theory of deffrant EW books, as i read and follow “Five wave to financial freedom” by ramki

Gold just made a new low at 1:27 pm. Not sure if gold will bounce or drop.

Anyone know of any Elliott Wave software that does a fairly accurate EW count that I could use during the day between Lara’s daily analysis.?

the best would be motive wave and no, it does most definitely not do an accurate EW count.

the lower target is my only target now for this fifth wave down…. I’m working on it now, it may change. should be published shortly.

I would look to short any rise above 1225 at 1233-38 with 1242 limiting; upside risk 1256… lets see how this closes today.

Syed, would this upside risk (1256) not be considered at higher degree? Lara had mentioned no 2nd wave correction within subminuette v should move beyond 1246. Waseem’s chart shows 1235 as a resistance level which I am looking at closely.

Hi Pjay. Gold price never did get to 1240 today. Going forward, I would expect gold price upside to remain curtailed within 1232-38… One has to be aware of the upside risk 1242/56/83; not to suggest that gold price is going there!…. For now gold price is adequately under 50dma (1229) which is bearish and gold price may not be able to rise above here; gold price is also under the lower band, so I would be cautious initiating sells under the band.

Hi Syed, thank you. I see my error.

I believe you are discussing minuette wave (iv).

Lara mentioned Feb 5th it may last at least two days. She may clarify that tonight.

“When subminuette wave v completes minuette wave

(iii) then the following correction for minuette wave (iv) may not move back above 1,255.59.”

I would like to buy GDX for minuette (iv) then go DUST.

This third wave down today (labelled purple on Lara’s charts) had wave 1 ended at 1230.89. Thus, wave 4 should not move above 1230.89 into wave 1 price territory. Please correct me if I am wrong.

1221 Pattern completed…..

Bearish Gartley.

🙂

can you pls post the diagram showing this move completing here?

Thank you very much Waseem, that was a great chart you had out here the other day. Congratulations! Goes without saying Lara’s work is exceptional…. 🙂

No… There is no doubt that Lara is exceptional.

But the 5th wave is still incomplete, need one more move down

Where do you expect that wave to end?

I am expecting a correction

1st sub-wave stopped at 0.382, the 3d at 0.618 so if I understand rules right the 5th wave should be an extended one to 1.382 and stopped around 1192-1193

yes, of course there will be a correction around 6-8h before this move down

and what is your expectation for correction level?

it does look like even 3d sub-wave is not finished so probably it is early to talk about any correction

Looking for clarity on exact count so as to trade the rest of the move down to (iii) then exit for minuette wave (iv) which Lara said in Feb 5th analysis would show up on the daily chart and last at least two days.

I’m guessing that (3) was at 10:35 am 1,221.37.

Still to come up to (4), down to 3 circle, up to 4 circle,

down to (iii) 1,199 – 1,193. Which may or may not be reached today.

1224 in play.

I raised a debate to consider using a global gold index

instead of one that contains silver because they clearly differ from one

another. This was met by a typical rhetoric response

which I totally expected from this board.

Now I realize that many of you trade DUST and that’s all you have on

your mind when Lara posts a GDX chart.

But this site is worldwide. It

doesn’t revolve around American DUST.

There’s Asian trades, European traders, Canadian traders… Not everyone plays DUST.

When I look at a gold stock Chart I’m looking for

confirmation of the main gold count, I’m not thinking DUST. I want to know that both charts are in somewhat

of an agreement. Clearly, $GDM and

$sptgd are telling a different story, so the question is which one is

right? My argument is that $GDM contains

proponents of silver giving credence to the global gold index.

This question should have raised a meaningful debate, but the

level of discussion on this board is nonesensical; it does nothing for the

professionalism of this service. We have people that don’t care anything about anything as long as they can be tipped off on their next DUST play. In fact, if they could, they would have Lara do EW on Direxion ETF’s… Some are even asking Lara to tell them when

to buy and sell and that is usually followed with some sort of brown-nosing comments.

As embarrassing as the discussion is I would lobby Lara to

raise her rates, weed out the highschool/college immaturity and bring in some real traders. This site should charge a minimum of $200usd/mth. Good traders will pay $5000/yr for good information with a MEANIGFUL network.

Why concern yourself with other members’ trading strategies and/or portfolio size? NUGT and DUST are merely leveraged and reasonably liquid swing trade instruments off the GDX ETF. If they do not interest you, by all means ignore the comments. If no one is interested in your proposed debate, well, that’s what makes a market, isn’t it?

You are right, members on this site really are global. Its not even dominated by the USA actually.

I will raise rates when I complete my CMT, but not to $200 p.a. because too few people would be prepared to pay it. I do not think that would be a good business decision.

I would appreciate it greatly if you modified the tone of your comments to be more respectful. Its perfectly fine to disagree with others here, but if you aren’t saying it in a neutral or positive way then perhaps don’t say it.

Thank you.

Great, jack’em up,

don’t be shy.

and yes, no worries…

I agree. Worth it. There are few that are worth it like this one. I know some that are so bad charges 1500/yr. Total zero. That is institutional pay those.

What $200 per annum? Per Current special rate that is ??? Who will not pay???? One can get that from one gold futures option trade .

U can charge double.!!!!!!

Thanks Lara from your service I do not fear gold any more: what will happen next day : loosing sleep.

Jaf

Thanks for your efforts for a better or perhaps secondary gold standard for Lara to chart for us as separate from the miners etf GDX. It is a valuable idea to pursue.

waverider

The EW basic rules are:

WAVE 2 CANNOT MOVE BELOW THE START OF WAVE 1.

WAVE 4 CANNOT MOVE INTO THE PRICE TERRITORY OF (OVERLAP) WAVE 1.

WAVE 3 IS ALWAYS THE BIGGEST/STRONGEST WAVE.

Per Frost & Prechter, the rule for wave 3 is it is never the shortest. That does not mean it has to be the biggest.

And another picky detail is taht your rules apply to impulses and not diagonals. We have been seeing a lot of diagonals recently.

Have you bought the book yet?

Correction that ended @1238,5 is too deep to be micro 4 or submicro 4. It is IMO micro 2 or submicro 2. So the notation slightly changes. It may be an early sign that subminuette V will pass 1228-1224 zone and end below 1200.

Can some one EW expert update Lara’a hour chart in the same counts sequence as she left last? No new idea only along her continuous count PLS.

Also yes u may add new yr count with chart.

Thanks.

Gold doesn’t feel like a (3) of 3 of iii. It also looks to have breached the upper yellow channel line in Lara’s hourly. Gold pitchfork TL analysis shows gold at a make-or-break level, at the intersection of 2 lower and middle PF lines. Monitor that for a cue. And monitor the technical cue from Silver, too. Good luck!

After 3 days of sideways consolidation around that point, gold finally capitulates in the direction called for by Lara. Respect!

On reflection, it’s time I dropped out of the GDM vs GDX debate. Good luck to all.

Gold may ‘free fall’ if it hits $1,150: Expert Jacob Pramuk Monday, 9 Feb 2015

If Gold breaks below $1,150 then free fall down to $1,000.

http://www.cnbc.com/id/102409906

Very amateur as one of the biggest rules of EW is wave 4 can’t overlap into wave 1. Yet you guys continue to post useless charts.

Seems like the experienced investors who post comments would help others a lot more by offering sincere advise as opposed to snarky comments calling others “amateur”, “you guys”, “amateur speculator”, etc.

Why not make the comments section a “safe haven”, where all can offer their ideas and opinions without fear of ridicule?

We can all learn from others no matter their level of experience.

I agree Bob. Remember Lara asked us to use the test. “Would you say that to your grandmother?”

Jack Chen- Gold on sell signal. Plain Simple analysis.

http://www.321gold.com/editorials/chan/chan020915.html

As noted in previous analysis, gold continues to make lower highs and this time is no different. Until this trend is reversed, gold is in a bear market and rallies to the 200ema should be sold.

A bear market rally has completed, short sellers should sell into any bounces.

papudi, Great article.

Next we have ETF’s xgd vs gdx: Again you can clearly see the contrast between the two charts, The difference in this comparison is that they are both marketable securities and secondhand information based on their pure form/parent indices.

Here’s a comparison of $sptgd to $gdm

$sptgd (pure global gold index) is the parent of etf xgd.to while $gdm index (gold&silver) is the parent to etf gdx.

Notice how clean $sptgd is in relation to pog while $gdm truncates into what looks like a wave 4.

These are the parent indices in their original form.

Next I will compare both ETFs

Jaf,

As noted below neither GDM (GDX) nor SPTGD (XGD) have ever been a “pure” gold index–that is not possible as mines extract a combination of metals and precious metals. Of course their charts will be different as they own different set of miner stock (though there is overlap), one is canadian currency, one is us dollars, they have different management structures, fees and computer based buy /sell algorithms used to keep them aligned with their parent index. GDX has 3X proxies (NUGT, DUST) which allow significant leverage. I would be happy to trade XGD 3X proxies if they are available on NYSE–does XGD have 3X proxies available to trade?

The SPTGD (XGD) Index

The S&P/TSX Global Gold Index (SPTGD) consists of 64 modified market capitalization-weighted companies (78% large-cap; 19% medium-cap) involved in precious metals (primarily gold) mining. The 3 largest cap companies dominate the index with 42% by weight. A proxy for the index is the XGD which trades in Canadian dollars on the Toronto Stock Exchange. As such, the XGD has a currency bias which is explained below.

The GDM (GDX) Index

The NYSE Arca Gold Miners Index (GDM), as represented by the GDX etf (see here for details), is a modified market capitalization weighted index of 30 companies (72% large cap; 22% medium cap) involved primarily in the mining of gold and silver. The 3 largest cap companies again dominate the index (at 30% by index weight) but to a much lesser extent than in the HUI (41%), the XAU (51%) or the XGD (42%). As such, the GDM/GDX has a medium-cap bias.

$sptgd does look cleaner than gdx. I do think that would be easier for me to do EW analysis on.

I get my data for gdx from yahoo finance. I looked up $sptgd and can’t find it there. If yahoo finance have this data and you could provide the symbol they’re using I’ll take a look and do an EW analysis on it for you. If it is as I suspect easier to analyse (greater volume would do that) then I can produce charts about once a week for you.

^SPTTGD on yahoo finance

Thank you Alex. That was what I needed.

I’m on another road trip this weekend, so if I don’t get to it today it will be early next week.

What about TSE:TTGD on google finance . I see historical data there . I am not sure if it is same thing or not but it is called the same : “S&P/TSX Global Gold Index”

P.S. If it is too hard to download , let me know format needed and I can email it to you .

Great, give it a try.. Tell us what you think. I believe it will benefit everyone in the long run.

I think Alex found the ticker..

To continue with the GDX debate….

GDX is an ETF, it is not an index.

…. It can reverse split.

GDX contains silver and it is not a true representation of gold stocks which is probably why we are having difficulty comparing it to our gold count

GDX is regurgitated information and you can see that in many sloppy truncations. (It’s not the real thing as one member puts it)

GDx is a marketable product that makes for a great Bloomberg discussion, but it’s a business and a rather good one (as someone pointed out volume)

GDX is not market specific to what we are trying to accomplish.

If this board wants to progress and develop as a group, we need to be more selective and specific with our data.

Now I’m not saying that we completely eliminate GDX but rather recognize it for what it is.

There are better options out there…

Hi Jaf, interesting points and I must admit I have missed what looks like an interesting discussion. Many use DUST?NUGT which tracks GDX, I certainly do.

Jaf, you are a sophisticated trader, I am just keeping it simple.

So I don’t care if gdx is an etf or index or contains silver or has sloppy truncations or is a business or is not a reflection of pog.

All I care is that my best profits are swing trading dust and nugt always keeping primary trend in mind.

When asked which charts I prefer I say: gold, silver and gdx. I would ask for dust and nugt charts but that’s probably not realistic given Lara’s time constraints so I just do a simple 3X on gdx for my dust and nugt data.

As to the future…well Laura doing very well without my help! I do believe consumer interest continues to grow in products like gdx, nugt, dust.

Davey, if you want to make an argument for yourself to remain an amateur speculator you’ve done a great job. But there are some people on this board who would like to get past that status. Now, I don’t have to post this information, in fact it’s a complete waste of my time. I noticed there is a lot of immaturity on this board and that’s going to hurt because it turns people like myself away from contributing.

Jaf, simple does not equal speculator, I always strive for simple, and yes I am and will remain an amateur as I do not sell trading advice.

Jaf, You’ve done a good job of pointing out the differences between some indexes and etf’s, and you’ve stated that there are better options, but I’m not clear on what those better options are?

For those of us trading the 3x etf’s, (NUGT, DUST, JNUG, JDST) are you suggesting that we should trade something different?

Or are you suggesting that there are better options to help us trade those better, like use $GDM instead of GDX?

For those of you playing dust $gdm is your goto index in its purest form.

For those trading Canadian leveraged ETFs ( such as horizon beta pro) and all “gold stocks in general” should base their analysis on $sptgd (s&p/tsx global gold fund index)

If $sptgd is unavailable, xgd.to is The ETF equivalent (second hand info) brought to you by ishares company.

For Lara’s main gold (Xau) count, $sptgd would be ideal for proper bullion to gold stock comparison.

OK, $GDM is the purist index to use for GDX, NUGT, & DUST, but is the difference significant enough to improve trading results?

There may be some daily fluctuations, but looks like GDX tracks $GDM very good over the 5yr term.

What am I missing here? GDX still seems to be a good choice for Lara to provide EW for us.

Thanks for your ideas and input.

Bob B, I believe you asked the correct question.

Are there 3X proxies of GDM available to trade?

We are already trading them:

GDM (index) = GDX (ETF)

Then of course, NUGT & DUST are 3x versions of GDX.

There is no direct 3x version of GDM.

So far in this discussion, I just don’t see any significant reason why we need to switch from GDX to GDM or another index or ETF to get a better look at EW for the miners. Maybe Jaf or someone else can provide a clear reason.

Lara, can you explain the character of the iv subminuette wave? I tried to count it and I had problem with the wave X from your chart. I see there 5-wave structure. So can it be that X is 5, whereas W and Y are 3-waves? I always have problem with estimation how far the correction can reach and how to count wave within it.

I also see it as a 5 wave structure on the 5 minute chart.

See image below

It turned out to be a triangle. I’m working on it now.

Lara, great hourly chart. Thanks for posting early.

Lara–can you give any timelines (trade days or weeks) to achieve various targets?

Of course timelines are generic not specific in EW but your experience and approximate timelines is always appreciated.

The target for minuette wave (iii) to end may be met within 24 to 48 hours. If subminuette wave v is a longer fifth wave it may be also be longer in duration.

Richard – I would be astounded in the fifth wave stops ceases at 1228-1224 as this is only $5-$10 away. Is that your impression?

She comments about 1228-1224 However, if my analysis of the structure of subminuette wave v so far as just now moving into the middle is correct then this target would be too close. The structure of subminuette wave v looks like it will need more room to unfold, and must be a five wave structure.

1,199 – 1,193. I favour the lower target zone at this point.

I thought I did?

Will keep this in mind today.

Appreciated Lara – Keen to see the strength of the 5th wave and hoping for a move below 1200.

doesn’t always happen that way…. its a bit of a coin toss, 50/50

it turns out the fourth wave was a triangle and so the fifth wave to follow is now more likely to be weak