The small triangle completed, as expected, and was followed by more upwards movement as expected. I can now calculate a final target for you.

Summary: The trend remains up at minor, intermediate, primary and cycle degrees for the main wave count. The target for upwards movement to end is at 1,204, and should be met within a few hours. Thereafter, how low the next wave down goes will indicate which wave count, main or alternate, is more likely. The main wave count expects a deep second wave correction which may not move below 1,142.82. The alternate expects a third wave down which must move below 1,142.82.

Click on charts to enlarge.

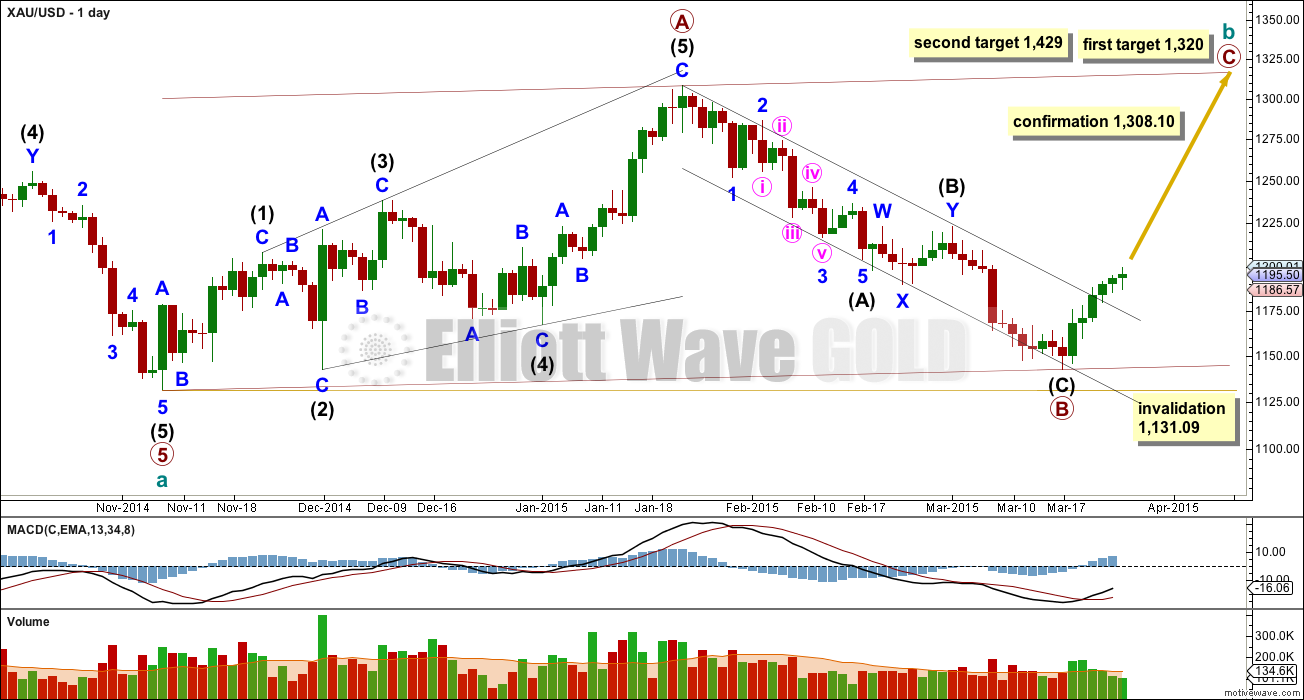

Main Daily Wave Count

There are more than thirteen possible corrective structures that cycle wave b may take. At this stage it is unclear what degree to label this big movement. I will leave labelling as is at primary degree, but it is equally possible that this degree may be moved down one level and primary wave A is an incomplete zigzag.

Cycle wave b may be a single zigzag as labelled, but may also be a double zigzag with the first zigzag unfolding as labelled. It may be a triangle with only primary wave A zigzag incomplete, or a double combination within a zigzag for primary wave W incomplete. It may be a flat correction with primary wave A as an unfolding zigzag. All these structures are equally likely. Of all Elliott waves, B waves exhibit the greatest variety in form and structure and are the hardest to label correctly as they unfold.

When the big zigzag labelled primary waves A-B-C is complete I will have alternate wave counts to manage the various possibilities for cycle wave b. When the big zigzag is complete that does not mean that cycle wave b must be complete, and only means that if cycle wave b is a single zigzag it would be complete there. All other possibilities will remain open.

A new high above 1,308.10 would invalidate the alternate and confirm this main wave count at primary and cycle degree.

The upwards wave labelled primary wave A fits only as a five wave structure, a leading expanding diagonal. Within a leading diagonal the first, third and fifth waves are most commonly zigzags, and the fourth wave should overlap first wave price territory. I have tried to see this movement as a three; if it is a three then wave A would end at the high labelled intermediate wave (3) within primary wave A. That would see wave A a leading contracting diagonal, but within it the third wave would be longer than the first. This violates the rule for wave lengths of contracting diagonals so that idea is not a viable wave count. This leads me to the conclusion that primary wave A is a five wave structure and cannot be seen as a three.

Because primary wave A subdivides as a five, primary wave B may not move beyond its start below 1,131.09.

At 1,320 primary wave C would reach equality in length with primary wave A. This would complete a 5-3-5 zigzag trending upwards. At that stage alternate wave counts would be required to manage the various possibilities for cycle wave b.

At 1,429 primary wave C would reach 1.618 the length of primary wave A.

Because primary wave A is a diagonal then it is highly likely primary wave C will be an impulse in order to exhibit alternation. Primary wave C may end about the upper edge of the channel drawn about cycle wave b.

This wave count sill has problems of structure within primary wave 5 of cycle wave a:

– within primary wave 5 intermediate wave (2) is a running flat with its C wave looking like a three and not a five.

– within intermediate wave (5) the count is seven which is corrective; either minor wave 3 or 5 will look like a three wave structure on the daily chart where they should be fives.

It is for these reasons that I will retain the alternate until price confirms finally which wave count is correct and which is invalidated.

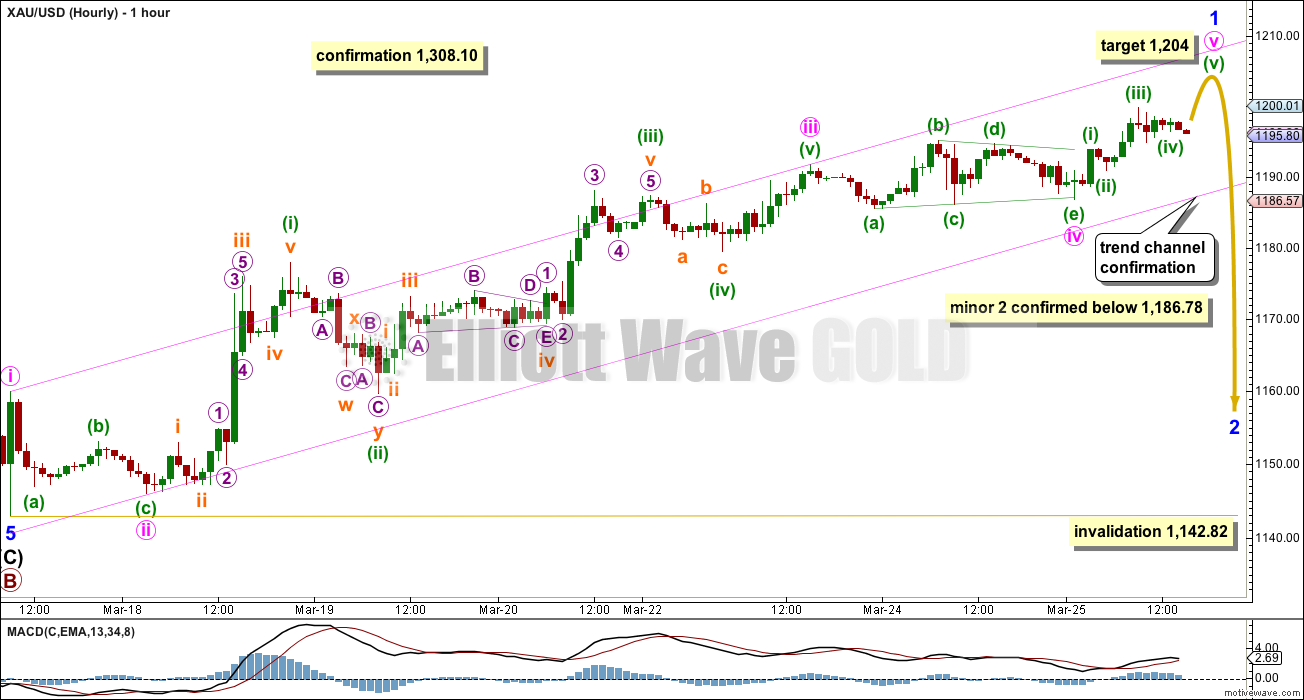

Minor wave 1 is extremely close to completion. The triangle for minute wave iv continued mostly as expected, with minuette wave (e) slightly overshooting the (a)-(c) trend line which is the second common place for E waves to end.

There is perfect alternation between the deep zigzag of minute wave ii and the shallow triangle of minute wave iv. Strongest momentum is within minute wave iii, although it is the first wave within it which was strongest, not its third or fifth waves.

Minute wave v is close to completion, with minuette wave (iv) possibly unfolding as a small triangle or flat correction. At 1,204 minute wave v would reach equality in length with minute wave i. If this target is wrong it may be too high. Fifth waves following triangles in fourth wave positions are often more short and brief than expected, and sometimes they surprise us in how short they are.

Price remains nicely within the Elliott channel for this impulse. Draw the channel from the highs labelled minute waves i to iii, then place a parallel copy on the low labelled minute wave ii. When this channel is breached by downwards movement that shall provide trend channel confirmation that minor wave 1 is over and minor wave 2 downwards is underway. A breach is a full hourly candlestick below the lower pink trend line and not touching it, preferable with clear downwards not sideways movement.

A new low below 1,186.78 would provide price confirmation that minor wave 1 is over and minor wave 2 has begun. That is the end of minute wave iv and the start of minute wave v within minor wave 1. When price moves beyond the start of minute wave v it may not be a second wave correction within minute wave v, and minute wave v cannot be extending and must be over. If the labelling of minute wave iv triangle is correct then this price point will accurately indicate a trend change.

When the channel breach and / or 1,186.78 indicates a high is in place then draw a Fibonacci retracement along the length of minor wave 1. Minor wave 2 is most likely to reach down to the 0.618 Fibonacci ratio of minor wave 1. Minor wave 2 may not move beyond the start of minor wave 1 below 1,142.82. Minor wave 2 may last three or five days.

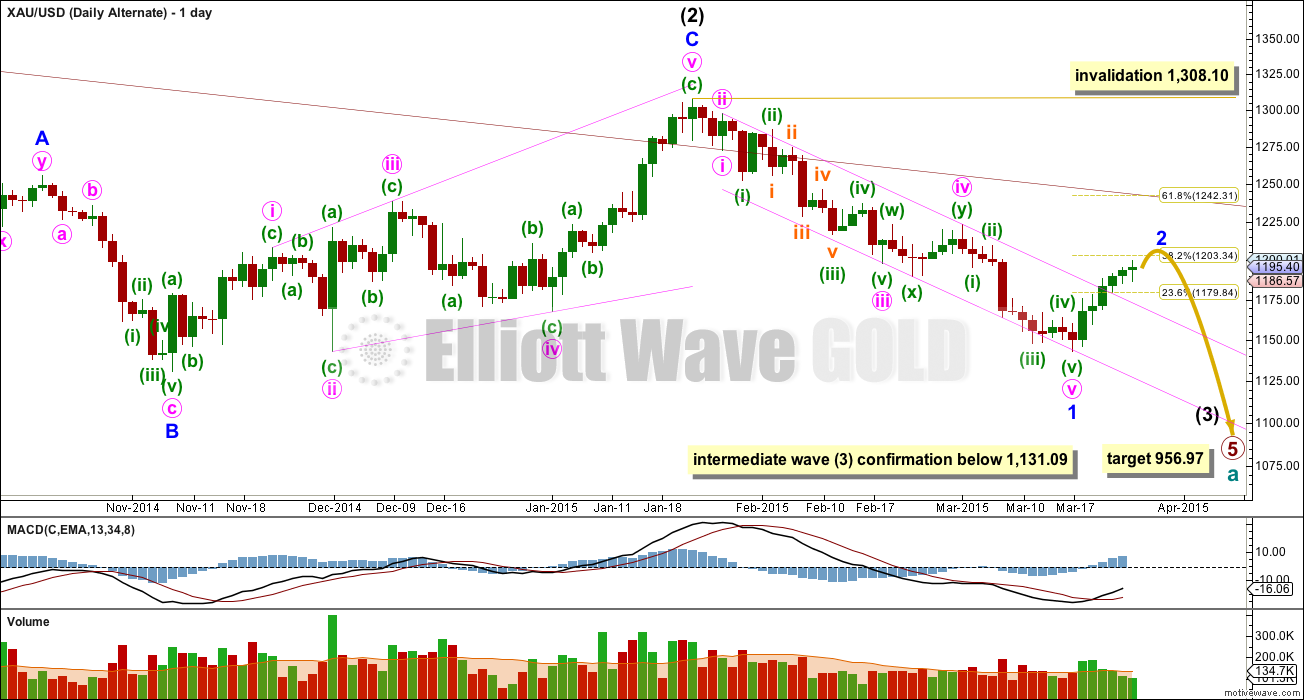

Alternate Daily Wave Count

This alternate wave count sees Gold as still within a primary degree downwards trend, and within primary wave 5 intermediate wave (3) has begun.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 5 may last a total Fibonacci 55 weeks. So far it is now in its 36th week.

The maroon channel about cycle wave a from the weekly chart is now breached by a few daily candlesticks and one weekly candlestick. If cycle wave a is incomplete this channel should not be breached. The breach of this channel is a warning this wave count may be wrong.

This wave count still has a better fit in terms of better Fibonacci ratios, better subdivisions and more common structures within primary wave 5, in comparison to the main wave count above.

Within intermediate wave (3) minor wave 1 is a long extension. Within minor wave 1 minute waves iv and ii are grossly disproportionate, with minute wave iv more than 13 times the duration of minute wave i. This also reduces the probability of this wave count.

A new low below 1,131.09 would confirm that intermediate wave (3) down is underway.

Minor wave 2 may not move beyond the start of minor wave 1 above 1,308.10. It may end about the 0.382 Fibonacci ratio. Because this is a second wave within a third wave one degree higher it should be expected to be more brief and shallow than a second wave correction normally is.

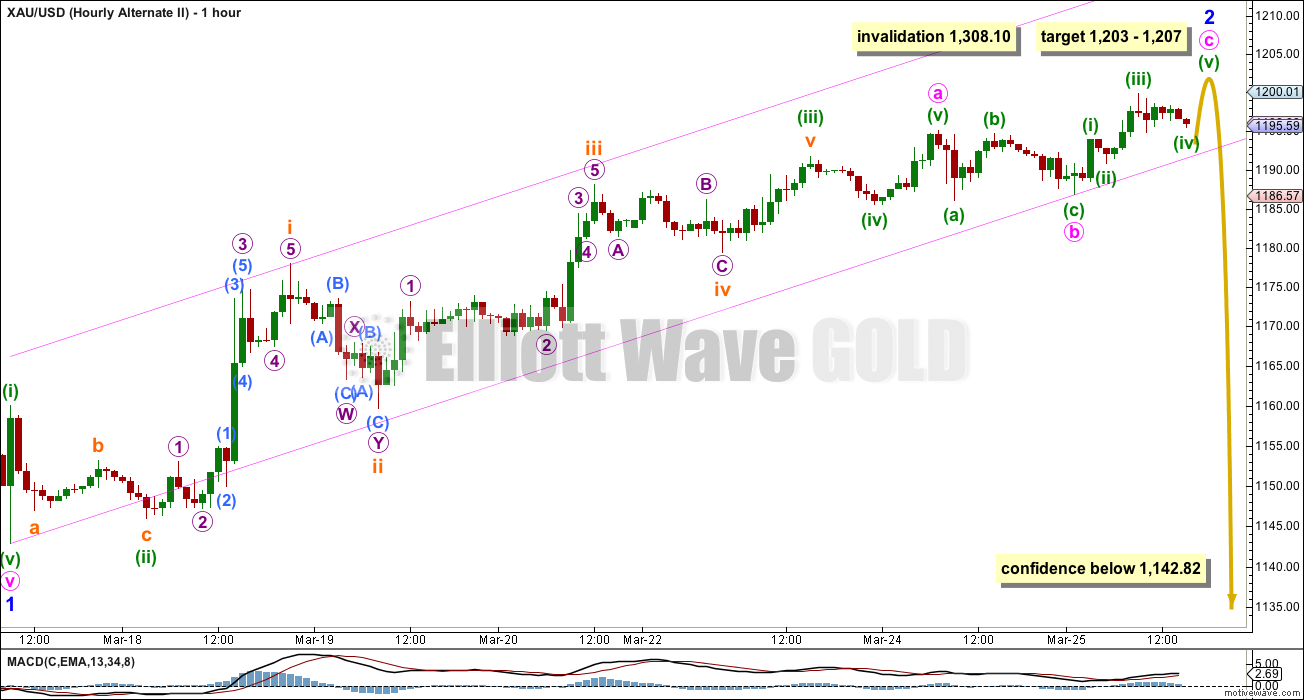

I have changed the labelling of minor wave 2 from a double to a single zigzag. The final fifth wave ending diagonal (for subminuette wave v) of yesterday’s hourly alternate wave count does not fit within the diagonal trend lines, and does not have the right look at all. I do not think an ending diagonal is unfolding in this fifth wave position.

At 1,207 minute wave c would reach 0.382 the length of minute wave a. At 1,203 minor wave 2 would end at the 0.382 Fibonacci ratio of minor wave 1.

Once the final fifth wave upwards is complete, thereafter a new low below 1,142.82 would add some confidence to this wave count. Minor wave 3 must move beyond the end of minor wave 1 below 1,142.82 to meet a core Elliott wave rule. Because this should be a third wave within a third wave it should be strong and swift, and should have a new low below 1,142.82 quickly.

This wave count would still require a new low below 1,131.09 for full confidence in the downwards trend at primary degree.

At the hourly chart level the decrease in momentum would be expected. This hourly wave count fits with MACD.

This analysis is published about 04:24 p.m. EST.

papudi, here is the source of the Gold chart you posted two days ago. It has the trader’s explanation for it and several other gold charts. Worth the look.

http://traderdan.com/?p=3337

I have to admit, this morning when I looked at Gold I was like – what the hell happened….later I added to JDST today around 9.55. Nice move in the miners.

The good thing so far – gold price is being held under 100dma (1206-07), that’s BEARISH! A break below 1196/94 ought to seek 1189/88-85…Good luck!

GDX and GDXJ are dropping fast…silver is looking like it’s about to drop…could get exciting soon…but we need to break below 1200 in gold, then I think pandemonium will accelerate.

Since gold high 1,219.80 high at 4:09 am

then down to low of 1,202.50 at 9:07 am

then up t0 1,207.13 at 10:25 am

now new low of 1,202.09 at 2:02 pm

I believe a new low is sign of more down to go today?

Lara are you in here at this time? Can you confirm the recent downward movement is a trend change?

Yes I’m here. No I can’t.

We need a channel breach and / or a new low below 1,186.78.

At this stage a new low below 1,194.64 would add some confidence to a trend change.

The long upper wick on the daily candlestick looks like the bulls are losing the fight, they can’t keep the highs up there.

are we in a 4th wave still?

I’m counting a complete minor wave 1. I’m working on the wave counts with a high in place, but the risk will exist that I’m wrong until we have confirmation.

I think the final fifth wave ended with a small blow off, typical of commodities. Volume is slightly up too for the day.

I hadn’t expected to see that after a fourth wave triangle.

Thanks for the real-time insight Lara. It also seems that the mining stocks sure were signaling a downturn ahead of the metals as they became extremely weak before the metal did. I look forward to your commentary in a few hrs. Your efforts are greatly appreciated!

Thank you so much for your prompt input. I seem to have good eyes– just can’t assimilate it yet to splain it 🙂 You on the other hand have the fluent gift — So you know, you never did get back to me on if you made out ok with cyclone Pam buzing around. I hope there was no damage – only bigger WAVES :):)

a thing of beauty! 🙂

oh yes, you can say that again!!!

7 days in a row of upward movement, with decreasing volume each day, and a blowoff top. Seems like a strong argument for downward movement.

If DUST moves above today’s highs, we could see a nice saucer base breakout to the upside.

15 min chart for dust shows dust in a 3rd wave up, target 16.50, don’t quote me on this one

Lara

Help, any idea of next target by the close? and for Friday open?

Would gold bounce up or continue back down?

I’m expecting a trend change has just occurred, but this is unconfirmed. We need that channel on the hourly chart to be breached and a new low below 1,186.78 before you may have confidence in this trend change.

The target for minor wave 2 is 1,172. It may be met in two or three days.

Check out http://www.pmbull.com at 15, 10, 5, 3, 3 , 2 , 1 minute time frames.

http://www.pmbull.com/gold-price/

Gold been forming a wedge since 4:09 am when the gap was $19.

Now the gap is down to only $1

Which way will gold break out of the wedge, up or hopefully down?

Falling wedges usually are bullish and resolve to the upside.

Was hoping to see a break below 1202 to target 1196/94; that hasn’t happened yet, sigh…. A break above 1207 would look to seek 1213-18…

A new low below 1,186.78 would provide price confirmation

that minor wave 1 is over and minor wave 2 has begun. This price point indicates

a trend change. When the channel breach and / or 1,186.78 indicates a high is

in place then draw a Fibonacci retracement along the length of minor wave 1.

Minor wave 2 is most likely to reach down to the 0.618 Fibonacci ratio of minor

wave 1. Minor wave 2 may not move beyond the start of minor wave 1 below

1,142.82. Minor wave 2 may last three or five days.

TKL

Lara did provide price breach for top 1186,

My estimates are well within those constraints. The drop below 1186 only confirms that minor 1 has completed. Lara’s minor 2 ends at 0.616 retrace which is precisely what I use. I took the measurement at the presumed 1224 top for minor 1 as I replied to Richard about an hour ago.

It is still possible to have gold rise to 1224???

If it is going to be a 5th wave, price has to be higher than 1219.80, today’s high which I reckon is wave 3. The current sleepy movement is wave 4. Once wave 4 ends, I expect a nice rally towards 1222 / 1224. That value is based on 1.618 of wave 1 of my modified minute 5 count.

But, if price now drops below 1194.57, it invalidates my count, and minor 2 has been underway since 1219.80.

I guess we need patience to wait this out.

Urrrgh…..

Precisely my sentiments. I doubt if this gets resolved today due to the slowed pace of things. Going to sleep soon.

Tham

Your guidance and sharing is appreciated.

Tham, how confident are you that this is a 4th wave?

I’ll say about 60%. I have reservations otherwise because if 1219.80 is the end of minor 1, that final fifth wave would have had too much momentum. You see, even Lara predicted only 1204. (Also, I’m too lazy to go into lower degrees like Lara does, which would more accurately pinpoint the wave count).

LOL.

Good night!!! We will hold the gold fort here and soon Lara will be here.

GG is the biggest component of the GDX and its chart looks miserable. Another bearish backtest off the 20ema and you can see I’ve been following the fractal similarities since the beginning of the month.

So is gold going down like Lara said or has that changed?

What are people buying DUST or GDX/NUGT?

Jdst

All in JDST. Crazy risky.

Maybe not! I’m not all in yet, but definitely thinking XAU/USD has topped. Any chartists out there thinking same?

The unexpected rise past 1204 has changed the landscape somewhat. Whether Lara’s count is still intact, or as I modified it, I think it calls for one more wave up to somewhere between 1222 and 1224. We are still currently stuck in the 4th wave. I’ll wait for that before loading up on DUST / JDST. The drop should target at least 1179-1181.

Thanks Tham.

Definitely liking DUST/JDST 4-hr & daily chart. True Strengh Indexx likes uptrend = gold downtrend. Can hardly wait for Lara’s end-of day analysis later. 🙂

Alternatively, if the current drop falls below 1200, then the chances of the top increases. It will definitely have ended on a drop below 1194.57.

Tham, your drop to 1,179 – 1181 is that today or after one more wave up t0 1222 – 1224?

I did a quick .618 retrace of today top 1219.80 at 4:09 am from yesterday low 1186.70 at 1:36 am and come out to 1,199.34.

Any ideas on today’s retrace might it be 1199.34 or Tham’s 1179 – 1181 or something else?

I am working from Minor 1 rise = 1142.88 to 1224 thereabouts. 0.618 drop will yield around 1174. However, most of the time, price doesn’t reach to the level we anticipate, so I used the nearest resistance/support, just to give a margin of error.

I personally think DUST was a steal sub $15 this am. Also bonds continue to get crushed today and $USD is going positive.

bought some DUST at 14.92

Just noticed a possible bearish back test of the broken broadening wedge on GLD. Just another piece of TA to consider……

Mark F , thanks for your timely and helpful chart.

Ditto Richard’s comment

Odd….even with gold up $10 right now from yesterday’s US trading session, GDX is only trading at 19.76 in pre-market. The disconnect between the miners and metals are getting even more amplified right now.

A comment from GANN cycle analyst:

GOLD “inverted” on the 24 Mar turn date and continued higher in a similar fashion to the way it resisted turn dates on the way down from the 22 Jan HIGH

My next turn date is the 27 Mar

then 01 Apr which I expect to be a HIGH

then 06 Apr which I expect to be a LOW (based on 72 month time count from 2009 LOW)

then 14 Apr LOW

Historical counts and triangulation are still playing havoc with GOLD so early April will provide no respite.

Whose gann work is that? Thing I like about it is the fact that TIME is more important than price. A weakness of EW is that it does not adequately deal with “time”.

I think he’s on-track. Today’s turn is minor turn window (down). Thus like THK wrote below, there should be a final wave up again, above 1219.6 and an opportunity to short.

LARA: Great call on oil. Oil is up and is in wave iv. Thanks.

Yeah, that was pretty awesome. Thanks!

Gold hit 1219. Testing high of Dec 1 1221 with low volume. It already tested low of Dec 1 with low volume at 1141.6. Dec 1 gold range was from 1141 to 1221 in one day. It took now 8 days too cover the whole range.

This should capped the advance at the apex of the triangle gold broke down from.

Does any one know how deep or target for corrective wave 2 in hour chart is?

JUST A VIEW: After the drop from 1219/20 high, with 1191/89 holding, gold price appears to be heading to crash and burn basing off 1210/08 (could likely drop to 1201) to possibly target 1225-35 price zone subject to rise above 1216/17…. Ouch!

1209 closed at SL… seems that it goes to 1243. IMHO alternate wave count is in play, just with higher target for 2nd wave.

Are you suggesting gold will rally up to .618 at 1,242.31 instead of heading down now?

This is my understanding. .318 clearly breached but both counts still valid.

The 50% retracement is ~1225. In my years of experience, gold has magic numbers of 20, 80 and 00. Thus I shorted some lots just under 1220 with SL=1226. I am also looking to accumulate longs at 1180-81 (an “80” number, the old low and 50% retracment pt of 1143-1220) and 1172 (61.8 retacement). So I could hold both for awhile, essentially hedged, until the bigger picture clears up.

J.

Great trade short at 1220. Now it is going to 1202.

pupudi gold dropped to 1,202.50 at 9:07 am.

Where may gold go to from here?

Anyone next target?

Do we retrace back up .618 of this morning’s drop or continue down to 1,174 today?

As I mentioned, 1202.50 may be the end of the 4th wave, and a final 5th wave up to 1222/1224 would complete minor 1.

I think Gold should go down first. But the dollar index keeps going down too. I don’t make any trades yet.

Ben Lockhart

, Contributor

Comments (838)| + Follow| Send Message

Author’s reply » Apparently it’s to do with air strikes in Yemen, but I prefer to think of it as ‘because that’s where the target zone is’.. 😉 Looks like we are about to find out which count is in play – 1225 is your bull/bear line.. Short from it with a stop at 1230, but if we break through look to buy instead (wait for a pullback first).

26 Mar, 04:40 AM

Gold just hit 1,219.80 high at 4:09 am Safe haven demand for gold up.

Gold crosses above 1,200 as Saudi Arabia and it’s allies start bombing Yemen. Oil prices surge as Saudi strikes in Yemen trigger supply worries.

http://www.marketwatch.com/story/oil-prices-surge-as-saudi-strikes-in-yemen-trigger-supply-worries-2015-03-26

Rate hike might be delayed until 2016, warns leading Fed official Chris Evans, – a member of the committee that decides policy – told a London audience.

US Dollar drops .5 % in 90 minutes.

I wonder if this larger than expected rally might change Lara’s wave count?

Lara doesn’t have any upper invalidation point until 1,308.10.

Looking to buy DUST as cheap as possible before or at open as long as this won’t effect EW count with gold decreasing.

3:18 am gold hit target 1204.04, then still going above target.

Great now hover there at that price until I can buy DUST at the open.

Perhaps I should buy it in pre-market? I wIll sleep on it!

short @ 1201. Looks like final If the count is correct

Great call Lara on further upwards movement tonight…looks like your 1204 target is in the cards.

As another layer of correlating evidence, I think bond yields may have hit an inflection point today and I can see them heading higher from here as shown on my chart. Rising yields will obviously present headwinds for gold trying to push ahead.http://scharts.co/1HImpcD

I’ve got some JDST started, I’ll be adding more tomorrow as I watch the target zones.

Lara, I would enjoy being a part of the big drop associated with your alternate count. However, just in case gold only moves down some – like maybe to the 1160s – and then bounces up again, for one final leg up, would you keep the alternate? Would the structure still be ok? I completely agree that minor 2 would have to stay below the maroon trendline to remain valid. Thanks.

I’m really struggling to see how I could keep the alternate wave count alive if it doesn’t start to move strongly lower once minor 2 is over. I would not like to see minor 2 continuing further sideways, minor degree corrections normally last about 5 or 7 days, to see it continue well past that duration would not look right.

I think the alternate wave count has to prove itself next week or it’s dead.

After gold’s significant movement over the last few hours, there may no longer be a need for a bounce to new highs or sideways movement. In my mind, this movement cleared the way for the alternate to stand as is.

Yes, that looks correct. Minor 2 has lasted 7 days. It should be over there.

The alternate now absolutely requires strong downwards movement to begin now.