A small red candlestick for an inside day is completing. Overall, this fits the Elliott wave count.

Summary: The middle of intermediate wave (3) has most likely begun. A breach of the green channel on the hourly chart would add confidence to the wave count. I will have full confidence that minor wave 3 has begun with a new low below 1,189.64. The target for minor wave 3 to end is at 1,055. In the short term I expect to see a small correction complete up to 1,214 finding strong resistance at the upper edge of the blue channel on the daily and hourly charts.

Click on charts to enlarge.

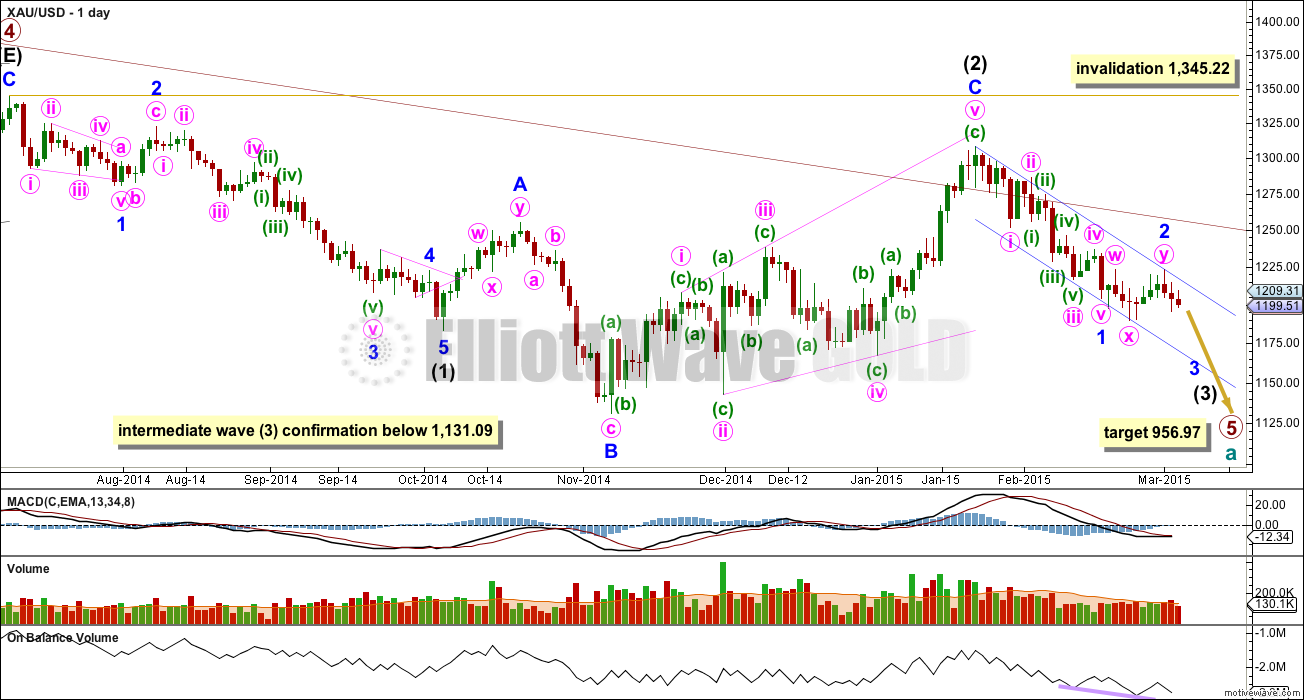

Main Daily Wave Count

This main wave count sees Gold as still within a primary degree downwards trend, and within primary wave 5 intermediate wave (3) has begun. At 956.97 primary wave 5 would reach equality in length with primary wave 1. For Silver and GDX this idea, that the primary trend is down, is the only remaining wave count. This main wave count has a higher probability than the alternate below.

The maroon channel about cycle wave a from the weekly chart is now breached by a few daily candlesticks and one weekly candlestick. If cycle wave a is incomplete this channel should not be breached. The breach of this channel is a warning this wave count may be wrong, and so I will still retain the alternate.

Draw the maroon trend line on a weekly chart on a semi-log scale, and copy it over to a daily chart also on a semi-log scale (see this analysis for a weekly chart).

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1.

Intermediate wave (2) is an expanded flat correction. Minor wave C is a complete expanding ending diagonal. Within an ending diagonal all the sub waves must subdivide as zigzags. The fourth wave should overlap first wave price territory. Expanded flats are very common structures and ending diagonals are more common than leading diagonals.

This wave count has more common structures than the alternate wave count, and it has a better fit.

A new low below 1,131.09 would confirm that intermediate wave (3) down is underway.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. If this invalidation point is passed this wave count would be fully invalidated.

Within intermediate wave (3) minor wave 1 is a completed impulse lasting 18 days. Minor wave 2 is a completed double flat correction which lasted 9 days, exactly half the duration of minor wave 1. Because this is a second wave correction within a third wave one degree higher I would expect it to be more shallow than normal.

Looking at the duration of minor degree waves within intermediate wave (1): minor wave 1 lasted 18 days, minor wave 2 lasted 5 days, minor wave 3 lasted 31 days, minor wave 4 lasted 8 days, and minor wave 5 lasted 2 days. Corrections do tend to be more brief than an actionary wave of the same degree, so for minor wave 2 within intermediate wave (3) to be over in 9 days looks perfectly normal. I would expect minor wave 3 to most likely last a total Fibonacci 34 sessions. It is just completing its second session.

Draw a base channel about minor waves 1 and 2. Minor wave 3 should have the power to break through support at the lower edge. Along the way down upwards corrections should find resistance at the upper edge. Copy this channel over to hourly charts.

Since the top labelled intermediate wave (2) volume is still strongest on down days. Volume for 2nd March, a down day, was the highest since 5th February, also a down day.

On Balance Volume agrees that the trend is down. There is no divergence.

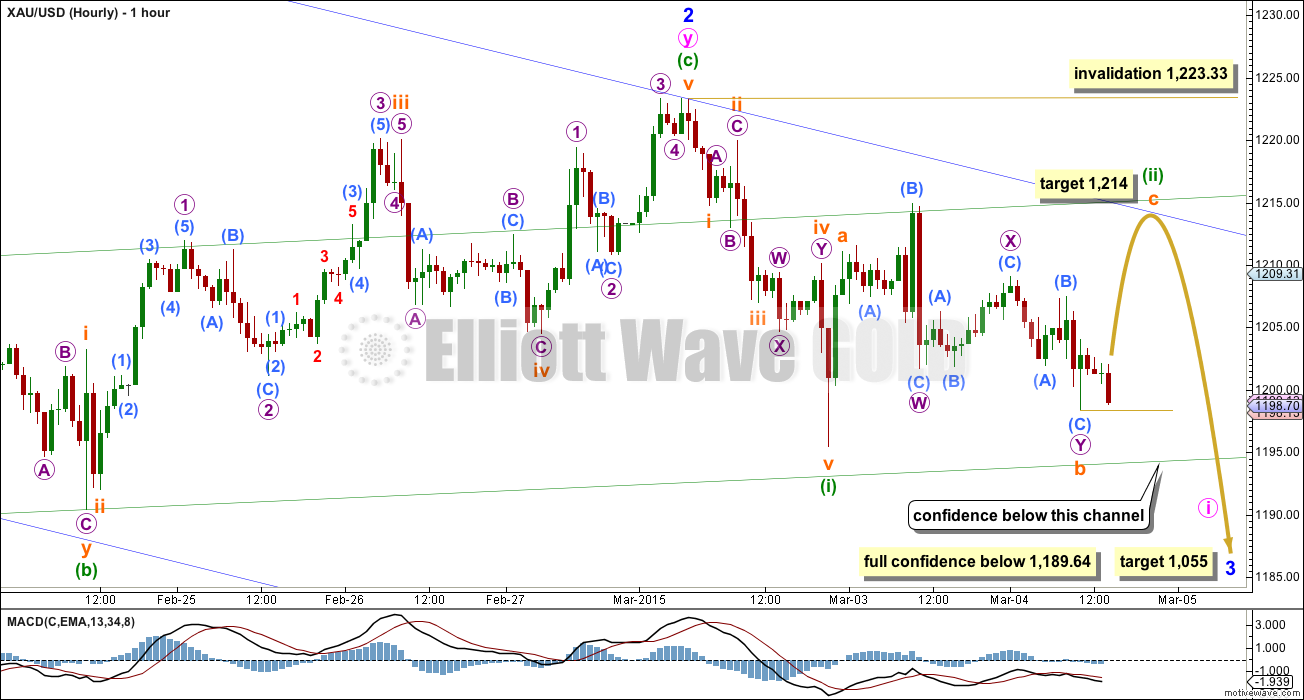

Main Hourly Wave Count

Because the last downwards movement labelled subminuette wave b subdivides as a three wave structure I expect minuette wave (ii) is an incomplete zigzag. Within it subminuette wave b subdivides as a complete double combination: flat – X – zigzag.

At 1,214 subminuette wave c would reach equality in length with subminuette wave a and would find resistance at the upper edge of the blue channel.

Alternatively, in the short term (before subminuette wave c upwards can be seen as complete) a new low below the start of subminuette wave c at 1,198.39 would indicate that the alternate wave count below may be correct.

I will have confidence in this main wave count with a clear breach of the green channel on the hourly chart. To see how to draw this channel see yesterday’s hourly chart here.

Thereafter, a new low below 1,189.64 would provide full and final confidence that the minor degree trend is down. At that stage I would have full confidence in calling for a strong increase in downwards momentum.

Minor wave 3 may last a Fibonacci 34 days in total.

Minuette wave (ii) may not move beyond the start of minuette wave (i) above 1,223.33.

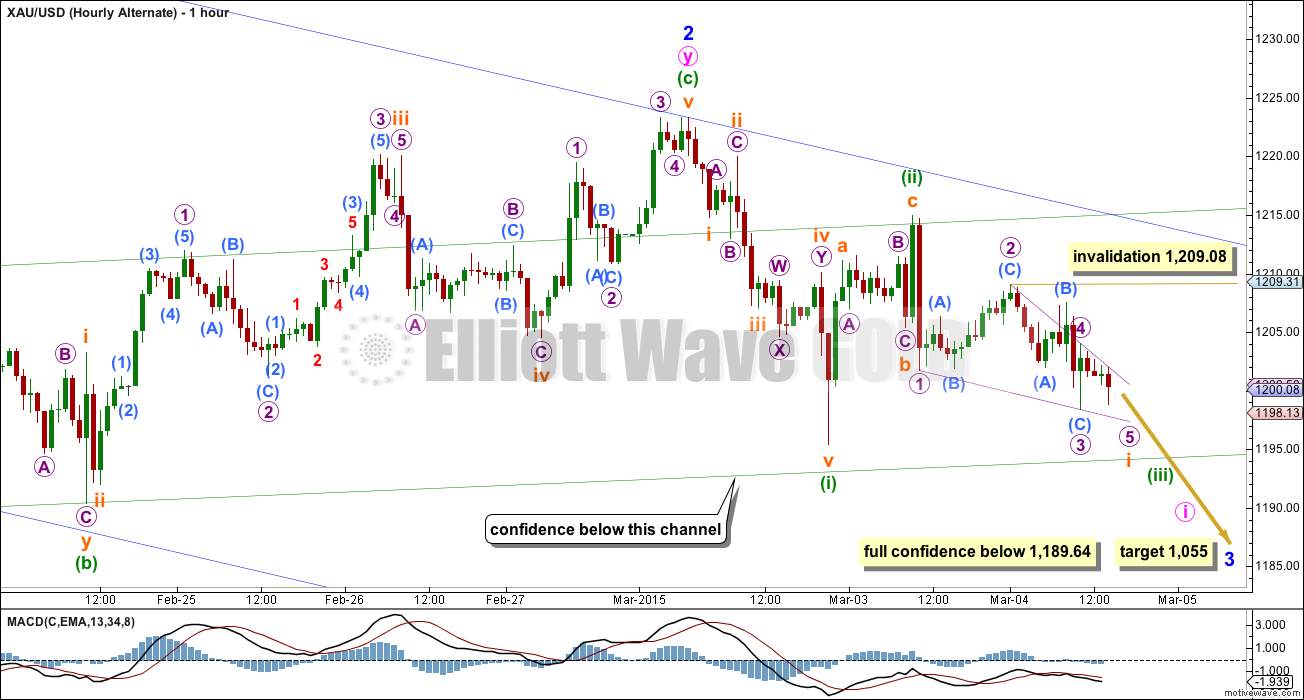

Alternate Hourly Wave Count

It is possible that minuette wave (ii) is over and minuette wave (iii) downwards has begun with a leading contracting diagonal.

Leading diagonals may not have truncated fifth waves so this wave count requires a new low below 1,198.39 in the short term.

This wave count has a lower probability than the first hourly chart because the diagonal is not adhering well to its trend lines. For Gold, its diagonals almost always adhere very strongly to its trend lines.

Within the diagonal micro wave 4 may not move beyond the end of micro wave 2 above 1,209.08.

If this wave count is correct then when the diagonal is complete I would expect a deep second wave correction to follow. The invalidation point must be moved up to the start of the diagonal for subminuette wave i at 1,214.94. I would expect a deep second wave correction to find resistance at the upper blue trend line.

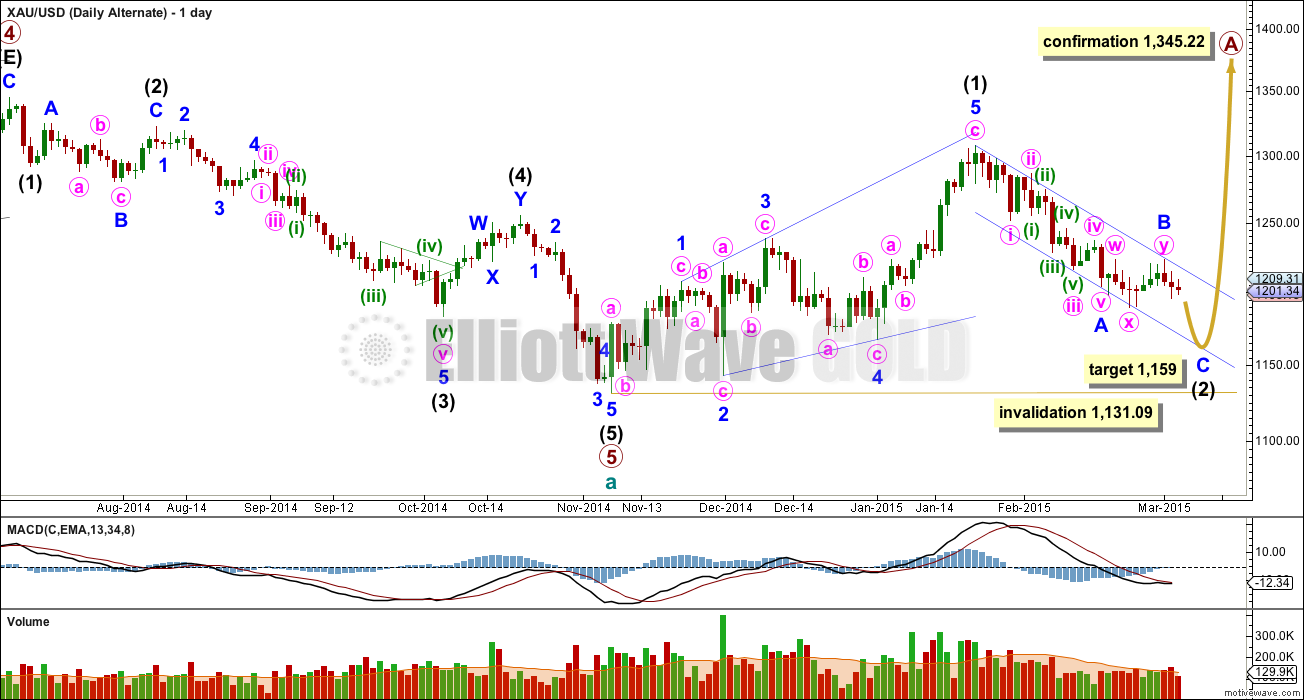

Alternate Daily Wave Count

At this stage I judge this alternate wave count to have a lower probability. The structure of downwards movement, and momentum, will determine which wave count is correct over the next few weeks. At this stage they both expect more downwards movement so there is no divergence in the expected direction.

This wave count sees a five wave impulse down for cycle wave a complete, and primary wave 5 within it a completed five wave impulse. The new upwards trend at cycle degree should last one to several years and must begin on the daily chart with a clear five up.

The first five up may be a complete leading expanding diagonal. Within leading diagonals the second and fourth waves must subdivide as zigzags. The first, third and fifth waves are most commonly zigzags but they may also be impulses. This wave count sees minor waves 1, 3 and 5 as zigzags.

Leading diagonals are almost always followed by deep second wave corrections, sometimes deeper than the 0.618 Fibonacci ratio. It is possible now to see intermediate wave (2) as a deep 0.67 single zigzag. If it is over it may have lasted just a little under half the duration of intermediate wave (1).

My biggest problem with this wave count is the structure of intermediate wave (2) within primary wave 5. This is a rare running flat but the subdivisions don’t fit well. Minor wave C should be a five wave structure, but it looks like a clear three on the daily chart. If you’re going to label a running flat then it’s vital the subdivisions fit perfectly and this one does not. This problem is very significant.

Within intermediate wave (5) minor wave 3 looks like a three on the daily chart, where it should be a five. This movement may also be labelled with minor wave 3 ending higher and minor wave 5 looking like a three. Either way, one of the actionary waves within this downwards movement will look like a three and not a five which does not have the “right look” at the daily chart level.

Intermediate wave (2) may be an incomplete zigzag, which subdivides 5-3-5. The subdivisions within intermediate wave (2) for this alternate are exactly the same as for this movement on the main wave count which sees a first, second and now third wave unfolding subdividing 5-3-5.

For this alternate wave count minor wave C down must subdivide as a five wave structure. The hourly chart would see the subdivisions exactly the same as the main wave count above, so to keep the number of charts at a minimum I will publish only one. For this alternate at 1,159 minor wave C would reach 0.618 the length of minor wave A.

For this alternate the channel is drawn in the same way, but here it is correctly termed a corrective channel. Minor wave C should find support and end at the lower edge of this channel. The main wave count expects the power of a third wave to break below support at that trend line. How price behaves when it gets to the lower trend line will provide an indication of which wave count is more likely at the daily chart level.

Intermediate wave (2) of this new cycle degree trend may not move beyond the start of intermediate wave (1) below 1,131.09.

This analysis is published about 03:28 p.m. EST.

GOLD Elliott Wave Technical Analysis – 5th March, 2015 is out now!!!

holding at 1201…Any opinions….down or back up? Ty

If you can withstand the possibility of gold still moving to 1209-1213 area, then just stay put and wait. I think gold may break to new lows after the jobs report tomorrow. That will be at 8:30 am EST on Friday.

I guess I’ll keep my DUST….Ty Matt

Down. I think the correction is done as a double zigzag and a third wave down is beginning. Especially as we have a new low below 1,197.92

Ty Lara…

Lara, gold just dropped about $12 in 2 hours.

Does gold have to retract up first? Such as .618?

Or is gold almost ready to breach the green channel around the 1,194 area, where you would have confidence that the minor degree trend is down, once we get at least one hourly candlestick below it and not touching it?

I see you just commented below,

“The risk is that is just wave A of a flat, and the correction could continue higher to touch the blue line. The invalidation point must remain at 1,214.94.”

I’m adjusting my initial idea of this movement, I’m seeing a third wave of a third wave down beginning. The invalidation point I’m moving down to 1,209.53.

There will be corrections along the way down, there always are. But downwards momentum should increase. Analysis out now in a few minutes. Off to record a video now.

I am going to go out on a limb here and say that upward movement was, in fact, a corrective 3 wave structure and could well be over.

Sorry for my jumpy remarks today – am just anxious for that last opportunity to set up short positions. Please disregard this and see what I wrote to Tham below.

It looks over to me.

If it was a 4th wave, would be problem as just dropped to 1,201.90 and went below 1,204.93 at 8:31 am.

The Upper blue trend line is sloped downward, and the alternate doesn’t have a target of 1,214 it has an invalidation of 1,214.94 and the trend line is lower today and ‘may’ of been hit at high this morning at $1,209.55 at 10:40 am.

Lara mentioned for alternate hourly, “I would expect a deep second wave correction to find resistance at the upper blue trend line.”

Did someone plot the blue line to confirm exact hit as not able to calculate myself. I might be 1 or 2 dollars off.

Upward movement should be a 3 up. While a 3 up can be seen on the hourly chart, there were no red candlesticks to show the 2nd wave of that 3 up. We do have a couple solid red candlesticks now though. This makes me think that gold is only now completing that 2nd wave of 3 up. All in all, I guess it is just a question of getting a slightly better short position before gold falls off a cliff.

I’m seeing a small red doji for an X wave. It subdivides okay as a double zigzag. It’s just over the 0.618 Fibonacci ratio, so I think its very likely done. It found resistance just below that blue trend line, didn’t touch it.

The risk is that is just wave A of a flat, and the correction could continue higher to touch the blue line. The invalidation point must remain at 1,214.94.

and…. that was wrong. It wasn’t a diagonal, the wave lengths don’t work.

analysis out in a few minutes.

If this is a 5 wave up, then this current 4th wave (assuming that I am seeing this correctly) cannot move below 1204.95 (or whatever you see as the high at 8:30 am EST). If gold falls under this level, look out below!

Is this movement up supposed to be 5 wave or 3 wave formation? If 5 wave, then gold may be in a 4th wave.

I sold my GDX already because hourly alternate confirmed below 1,198.39 and now gold just invalidated hourly alternate by going above 1,209.08 at 10:36 am to 1,209.53. Now both hourly charts are invalidated.

You and I have different interpretations of what Lara wrote. I think the 1209.08 limit applied while the diagonal was in process. The low below 1198.39 marked the end of the diagonal and “the invalidation point…moved up to…1214.94”

You are correct so hourly alternate is still valid, my apologizes.

“Within the diagonal micro wave 4 may not move beyond the end of micro wave 2 above 1,209.08.

If this wave count is correct then when the diagonal is complete I would expect a deep second wave correction to follow. The invalidation point must be moved up to the start of the diagonal for subminuette wave i at 1,214.94. I would expect a deep second wave correction to find resistance at the upper blue trend line.”

So alt hour wave count is validated and is Prime hour count.

“Leading diagonals may not have truncated fifth waves so this ALTERNATE Hourly wave count requires a new low below 1,198.39 in the short term.”

pmbull.com says we broke below 1198.38 around 5:20 this morning. And the alternate hourly now allows a movement up to 1214

LR said. “Alternatively, in the short term (before subminuette wave c upwards can be seen as complete) a new low below the start of subminuette wave c at 1,198.39 would indicate that the alternate wave count below may be correct.”

I guess that means gold won’t be heading up to $1,214 and time to sell my GDX and buy DUST?

From what I can see at this point in time, gold price did make a new low below 1198.39 around 5:15 am ET. That would have completed micro 5 and hence subminuette 1 in the alternate hourly chart. We are now in a three wave up in subminuette 2 before heading downwards. If this is a simple 3-wave affair, sm 2 could end around 1208 (1.0 third wave retrace) or 1210 (at 1.328). If it is a double zigzag, it would end around 1214. There could be other structures. I just checked out those that could fit 1214. Lara mentioned there are 13 possibilities. I wouldn’t waste time going through the whole lot. My engineering background has taught me that a ball park figure is good enough, because we are dealing with probabilities, not absolutes.

A new high occurred at 1209.54. As the upswing took just a little more than four hours, I do not think it is all of subminuette 2. That would only be the first sub-wave. I am waiting for the next two waves to develop, targeting 1214, before going into DUST.

Upper blue trend line ‘may’ of been hit at high this morning at $1,209.55 at 10:40 am.

Lara mentioned for alternate hourly, “I would expect a deep second wave correction to find resistance at the upper blue trend line.”

Omigosh. I missed that. I would go into DUST at the first opportunity. Thanks for your help.

Good point. You may be on to something concerning the duration of this 3 wave up. It shows up very well on a 5 min chart, but less so on an hourly chart. It probably should be much longer to be in proportion to the 1st wave down. A high should occur within 12-20 hours from now.

Was that all you guys selling NUGT?

Did subminuette wave c complete at 1205-1206 (dependent on which feed ) or still waiting for the up move towards 1214 area?

European Stocks Seen Opening Mixed; All Eyes On ECB Meeting

3/5/2015 2:05 AM ET

Stock futures point to a mixed open on Thursday ahead of a key European Central Bank meeting later in the day at which the central bank will provide more details on its quantitative-easing program it announced in January. The euro languishes at an 11-year low against the dollar as investors wait for QE details.

Investors also look forward to Friday’s U.S. jobs data for further confirmation that the world’s largest economy is recovering enough to justify a rate hike. In prepared remarks to the Senate Banking Committee last week, Federal Reserve Chair Janet Yellen said that it was “unlikely” that economic conditions would warrant an interest rate increase for “at least the next couple of meetings”.

Traders eye FRIDAY reports on weekly jobless claims, labor productivity and factory orders later in the day in the run-up to the release of the U.S. Non-Farm jobs report, which includes data on both public and private sector jobs. Economists expect the Labor Department’s report to show an increase of about 230,000 jobs in February, down from 257,000 in the previous month.

As usual, the strong downwards movement should begin after NFP release on Fri 3/6. I like the idea of a correction towards $1214 tomorrow.

TKL

About timing of wave c of minor wave 3 may be 12 to 24 hours.

But Lara mentioned timing of minor wave 3 above: “Minor wave 3 may last a Fibonacci 34 days in total.”

This is going to long drawn out fast and furious down wave to 1035.???

Hi Papudi, I’m sorry if I had not been clear. The approximate timing refers to subminuette c of minuette 2, the orange coloured one that Lara, in her main hourly wave count, predicted. Chapstick_jr has a similar view to the timing when he said that the downwards movement (subminuette 3) ought to begin after NFP release on Friday. That would take just more than 24 hours.

We still have another three minuette waves to complete minute 1, then another four minute waves to give minor 3, so the Fibonacci 34 days is a very good estimate.

Lara thanks for the written and video brief notice of a correction back up to $1,214. I had already sold my DUST today so I did buy GDX at the close and almost the day low.

Richard, I am curious. I enjoy following your comments and notice you trade DUST and GDX but don’t appear to use NUGT. Am I not correct? Is there a reason for using DUST but not NUGT?

I am also hesitant to trade NUGT. The one occasion I did, NUGT did not follow its script. Gold price rose, but NUGT went the opposite direction the next day. I lost a tiny amount by exiting the trade on the next rise. My best guess is that on a downtrend, NUGT decays very much faster, to the extent that overnight holdings are extremely dangerous to the pocket. If I must, it can only be day-traded but it is difficult to do so here in Singapore which is a 12 hours time difference from ET.

davey thanks and you are correct. The reason I don’t trade NUGT is because of the volatility lately is still high, when I get the chance to trade a 1X ETF like GDX I do so and when I have no choice I pick DUST over JDST as may be a little less volatile. I have been burnt too many times holding 3 X ETFs overnight in the choppy waves so I use GDX a safer choice.

Me too. I had reckoned that minuette 2 was a simple 3-wave affair, as in my post, but realised that my “c” wave was rather drawn out and did not reach back to 2014 (the correction was a flat) but instead declined, so I managed to see the complex nature of the correction. Lara’s timely report confirmed that and I sold off all my DUST for a reasonable 5% profit. The decision was confirmed by volume. One hour before the close, price was still rising but DUST fell disproportionately. Now waiting for price to go back up to complete minuette 2 before loading the truck up. The drop would be a pretty good one, being the third of a third wave. Minuette 2 should take a day or two to complete its move.

Thanks KWL for clarifying. By Friday buy DUST/JDST for long hold. Hope Gold drops from here like oil did.

Papudi, I would exercise some caution here and not go for the long haul so soon. (I have found it most profitable to be aggressive only during third waves when you can buy and go for a holiday if you wish, but other waves have pitfalls to manage and circumvent). Lara’s alternative scenario, although of lower probability, can also happen. For my next trade, I would buy DUST/JDST and ride it on the way down only to 1160. I would then exit as both scenarios call for a rise. The main count sees a small correction but the alternative is staring at a trend reversal. The safest way to play that, covering both cases, is to long GDX for a small amount, then exit if the main wave count is true but load up more if the alternate count proves to be correct.

Absolutely right TKL! For long life in the markets, always plan for the unexpected.

I agree with being cautious.

Also Lara has mentioned that on the way down that there will be two up corrections that will appear on the daily chart. I intend on trading GDX during those two.

There could be more if minuette waves show up on the daily chart. Look at how minor wave 3 on the daily chart within intermediate wave (1) unfolds. I’m expecting something like that.

NUGT is getting a little more bullish….I don’t see a timeframe for hitting 1214…. Maybe I’m just missing it…any feedback is welcome…ty

Hi Scott. My two responses above could be of some help in answering your question. The rise for wave c of minuette 2 should take about 24 hours give or take 50% I reckon. Wave a took about 12 hours and wave b took about 24. Wave c is usually more drawn out. But, this correction is a flat, so it could take less time, possibly anywhere between 12 to 24. I am not good in time estimation so the above is only my gut feel. Anybody else can help out in this?

NUGT’s behaviour is, in my (bad) experience, not following its script well during a downtrend. I have come to realise that these ETFs/ETNs are followers, and not predictors, of prices. Sometimes, they do not follow well.

You could trade DGLD which tracks gold instead of Nugt or Dust which tracks miners. When the trend is flat, the miner ETFs are tough, but they work in multiples of gold as trends really get going one way or another.

Long JNUG right now, will probably close it tomorrow.

I have traded non-miners like USLV, DSLV, AGC for quite a while before. I now go for the miners as they move much better now than a few months back. (There is a simple calculation that indicates whether phyical metal ETFs or miners may perform better in a trading day). They suffer from very low volumes and so (a) they quite often take a very long time to buy or sell, so much so that the trade may sometimes not be fulfilled, and (b) the bid/ask spread is quite large. As a consequence, you make much less than the leverage implies. I had traded silver most of the time as gold ETFs like DGLD performed much worse. The volumes have been so much smaller except in the rare occasions when the impulses are high. If you must, the only safe plays are SLV and GLD with their significantly larger volumes but they are not lucrative as there is no leverage.

Thank you, you have verbalized something I have also recognize but not as

yet documented. I keep a journal of my trades and mistakes. The thing I find of

value in DUST and NUGT is I can sell or buy “in seconds” 3 hours after market

closes and buy or sell 3 hours in pre market. I’ve also noted that when 3xETFs

have six figure trades in the after market a trend change is in the wind

Hi Ram. I agree with your observations about the after-hours trades. I do believe that people who trade DUST and NUGT are seasoned traders or have powerful computer algorithms to help them trade. Novices do not normally attempt leveraged trades as they get burnt easily. To be able to trade after-hours commands a premium from brokerage firms hence volume is usually low. But when there is higher volume, it means that traders smell something is amiss and place their bets accordingly. Also there is the possibility that one or more big players try to influence the market. When the market reopens, there would be a knee jerk reaction as price has changed quite a bit.

I think DGLD has very low volume so may a problem with liquidity and may be more spread between bid and ask.

I haven’t used it, just do your due diligence.