The main Elliott wave count expected a fourth wave correction to unfold downwards / sideways. This is what happened, although it is more time consuming than expected.

Summary: The main hourly wave count has a higher probability than the alternate hourly wave count. The target for minor wave 3 to end remains at 1,303. In the short term I expect upwards movement to 1,212. That would complete a five up on the hourly chart, so should be followed by a three down.

Click on charts to enlarge.

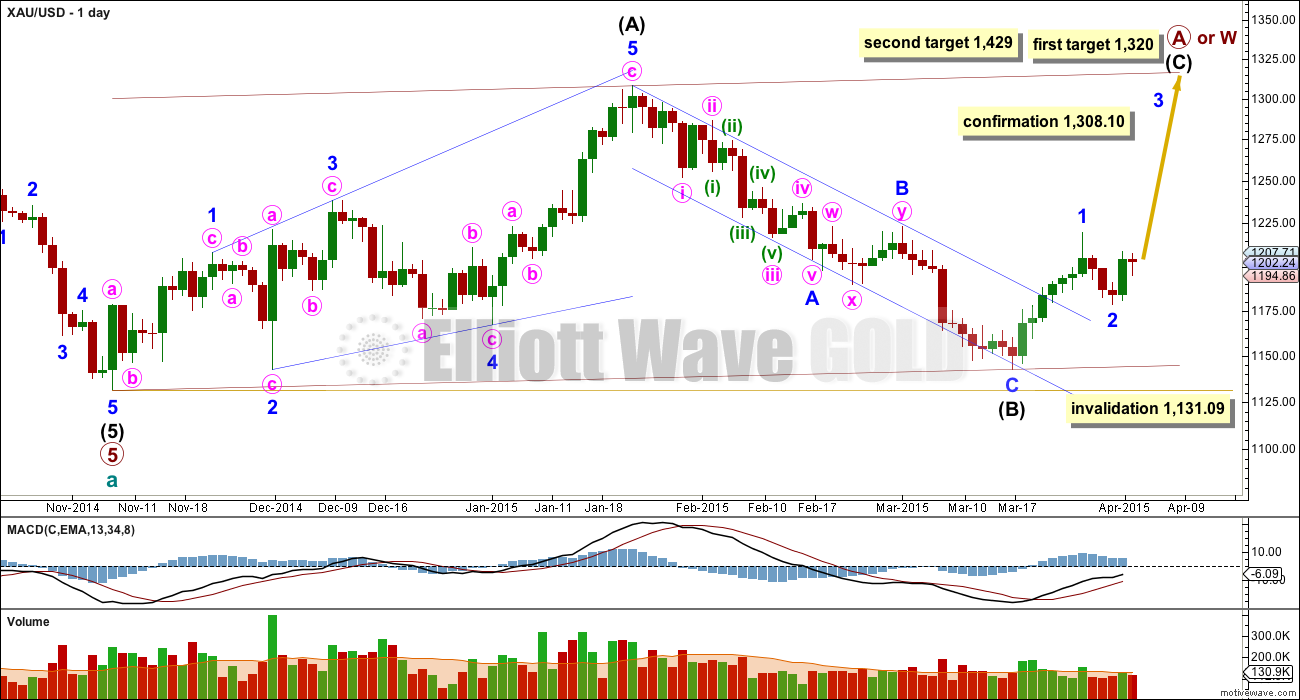

Main Daily Wave Count

There are more than thirteen possible corrective structures that cycle wave b may take. At this stage it is unclear what degree to label this big movement. Primary wave A (or W) is an incomplete zigzag.

Cycle wave b may be a flat correction where primary wave A is a zigzag. Cycle wave b may be a triangle where primary wave A is a zigzag. Cycle wave b may be a combination where primary wave W is a zigzag. Cycle wave b may be a double zigzag with the first in the double, primary wave W, incomplete.

When the big zigzag now labelled primary wave A is complete it is also possible that cycle wave b could be over there with the degree of labelling within it moved up one degree.

When intermediate wave (C) is a complete five wave structure then alternate wave counts will be required to manage the various possibilities of cycle wave b continuing.

A new high above 1,308.10 would invalidate the alternate and confirm this main wave count at primary and cycle degree.

The upwards wave labelled intermediate wave (A) fits only as a five wave structure, a leading expanding diagonal. Within a leading diagonal the first, third and fifth waves are most commonly zigzags, and the fourth wave should overlap first wave price territory.

Because intermediate wave (A) subdivides as a five, intermediate wave (B) may not move beyond its start below 1,131.09.

At 1,320 intermediate wave (C) would reach equality in length with intermediate wave (A). If price keeps rising through this first target, or if when it gets there the structure is incomplete, then I would use the second target. At 1,429 intermediate wave (C) would reach 1.618 the length of intermediate wave (A).

Because intermediate wave (A) is a diagonal then it is highly likely intermediate wave (C) will be an impulse in order to exhibit alternation. Intermediate wave (C) may end about the upper edge of the channel drawn about primary wave A.

This wave count sill has problems of structure within primary wave 5 of cycle wave a:

– within primary wave 5 intermediate wave (2) is a running flat with its C wave looking like a three and not a five.

– within intermediate wave (5) the count is seven which is corrective; either minor wave 3 or 5 will look like a three wave structure on the daily chart where they should be fives.

It is for these reasons that I will retain the alternate until price confirms finally which wave count is correct and which is invalidated.

Wednesday’s candlestick completed a bullish engulfing pattern. This is the strongest bullish candlestick pattern and supports the main hourly wave count.

Volume for downwards movement of minor wave 2 is lower than the prior upwards movement of minor wave 1. Importantly, Wednesday’s session sees volume increase beyond that seen for the prior three downwards days, which supports the main hourly wave count.

Minor wave 1 lasted seven days (no Fibonacci number) and minor wave 2 is now most likely over lasting a Fibonacci three days. If minor wave 3 exhibits a Fibonacci duration it may last thirteen days, which would see it end in eleven more sessions (depends on how long the corrections within it last).

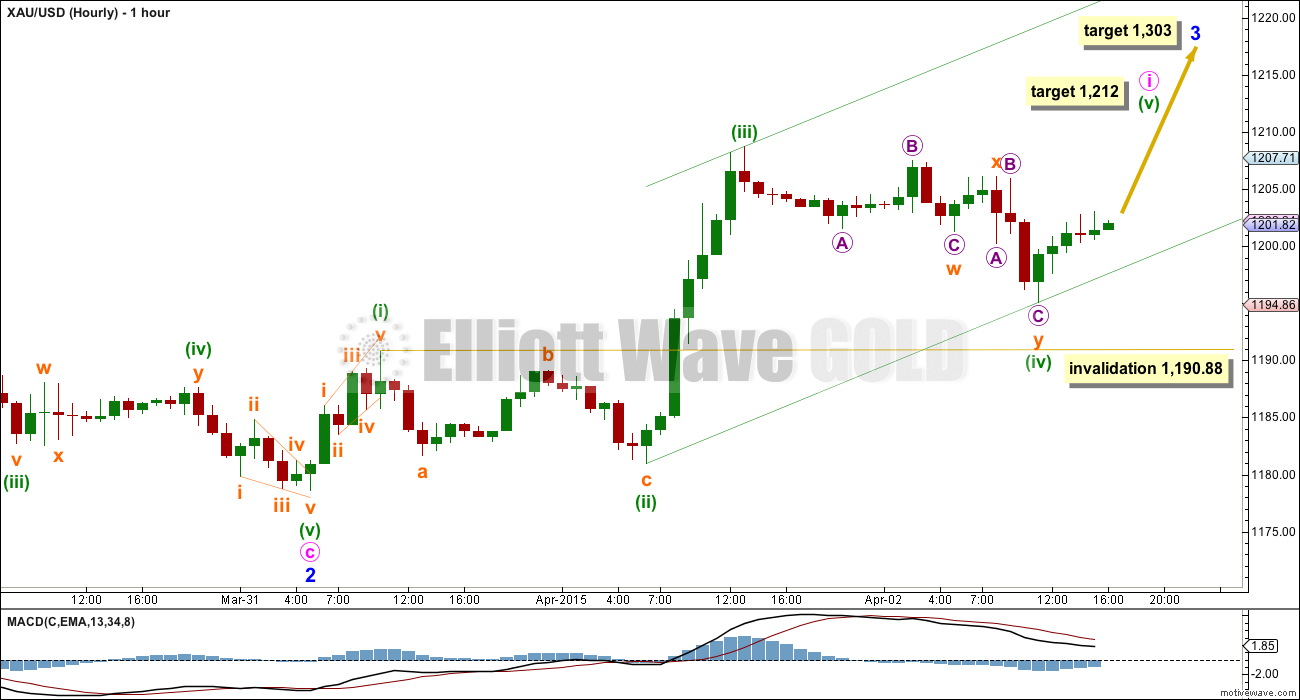

Main Hourly Wave Count

Minuette wave (iv) is a complete three wave structure showing some alternation with minuette wave (ii): minuette wave (ii) was a deep 0.8 single zigzag and minuette wave (iv) is a more shallow 0.49 double zigzag.

There is no Fibonacci ratio between minuette waves (i) and (iii), making it more likely that minuette wave (v) will exhibit a Fibonacci ratio to either of minuette waves (i) or (iii). Equality with minuette wave (i) would see minuette wave (v) truncated, so the next likely ratio would be 0.618 the length of minuette wave (iii) at 1,212.

Keep in mind that Gold sometimes exhibits particularly strong swift fifth waves typical of commodities. If this happens the target may be more likely equality with minuette wave (iii) at 1,223.

When minute wave i is complete then the invalidation point must move down to the beginning of minute wave i at 1,178.59, and a deep second wave correction would be expected to last about two or three days.

The mid term target for minor wave 3 remains the same at 1,303. Along the way up to that target two corrections, minute waves ii and iv, should show up on the daily chart so that minor wave 3 is a clear five wave impulse at the daily chart level.

Minute wave (iv) breached the channel which was drawn using Elliott’s first technique, so redraw the channel now using the second technique. Draw the first trend line from the ends of minuette waves (ii) to (iv), then place a parallel copy on the end of minuette wave (iii). Minuette wave (v) may end midway within the channel, or it may end at the upper edge.

Minuette wave (iv) may not move into minuette wave (i) price territory below 1,190.88.

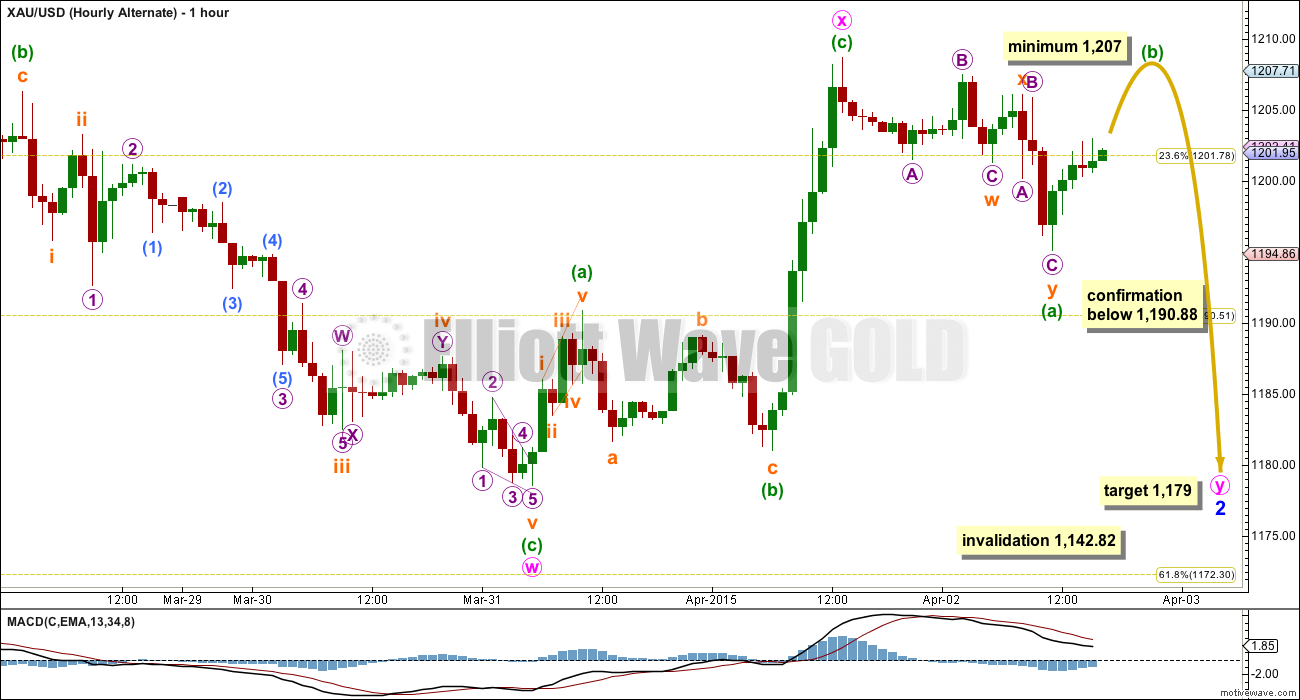

Alternate Hourly Wave Count

It is still possible that minor wave 2 may continue sideways as a double combination, but this wave count is not supported by volume or momentum. It is my judgement that this alternate wave count has a very low probability, so I would only use it if the main hourly wave count is invalidated with a new low below 1,190.88. I publish it only as a “what if”, to consider all possibilities.

Double combinations are sideways movements. Their purpose is to take up time. To achieve this purpose a double combination normally has a deep X wave which is most often a zigzag. Within a double combination the X wave may make a new price extreme beyond the start of the first structure in the combination. The second structure in a double combination normally ends close to the same level as the first.

If minor wave 2 continues it may last a Fibonacci eight days in total.

The second structure for minute wave y may be either a flat or a triangle. At this stage a flat correction looks more likely. Within that flat correction minuette wave (b) must retrace a minimum 90% of minuette wave (a) and so must move up to 1,207. Minuette wave (b) may make a new price extreme beyond the start of minuette wave (a) above 1,208.72, as there is no upper invalidation point for this alternate wave count.

The structure of the next wave up will tell us finally which wave count, main or alternate hourly, is correct. If the next wave up subdivides as a three it may be a b wave. It if subdivides as a five this alternate will be discarded.

Minute wave y is most likely to end about the same level as minute wave w at 1,179 to achieve the purpose of a sideways correction.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,142.82.

If price moves below 1,190.88 in the trading session the main hourly wave count would be invalidated and this alternate would be confirmed.

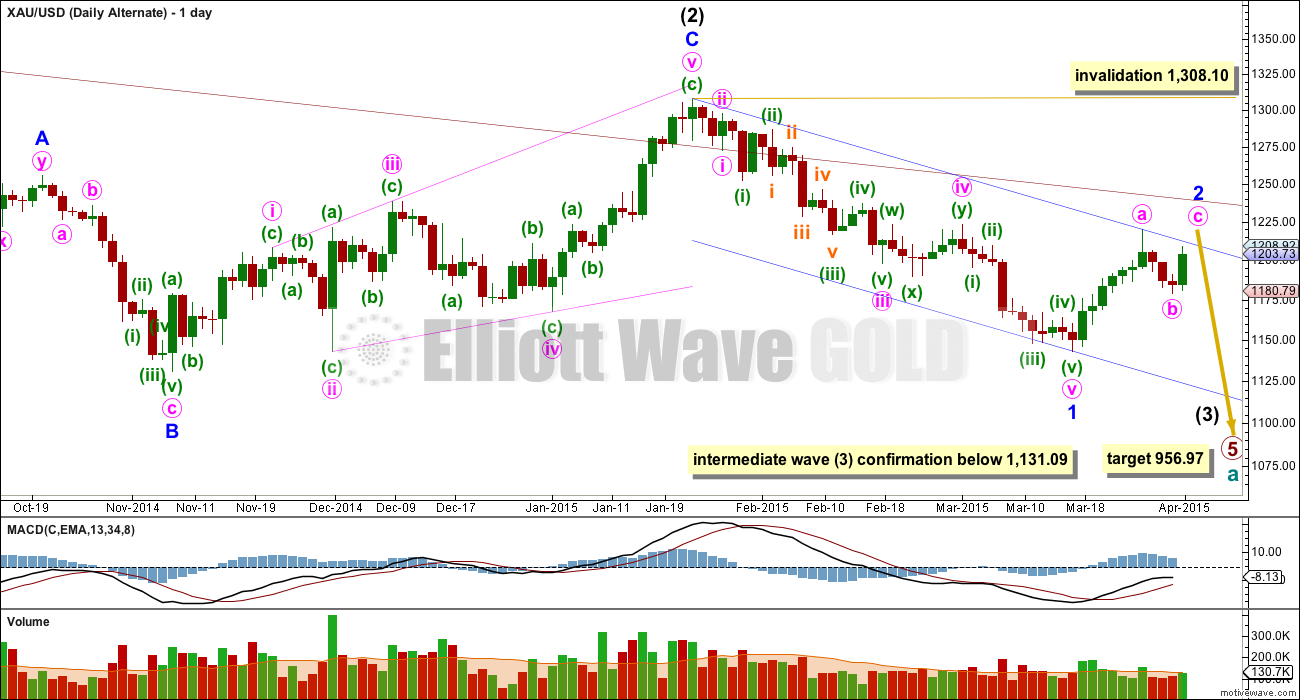

Alternate Daily Wave Count

This alternate wave count sees Gold as still within a primary degree downwards trend, and within primary wave 5 intermediate wave (3) has begun.

At 956.97 primary wave 5 would reach equality in length with primary wave 1. Primary wave 5 may last a total Fibonacci 55 weeks. So far it is now in its 37th week.

The maroon channel about cycle wave a from the weekly chart is now breached by a few daily candlesticks and one weekly candlestick. If cycle wave a is incomplete this channel should not be breached. The breach of this channel was the first warning this wave count may be wrong.

This wave count still has a better fit in terms of better Fibonacci ratios, better subdivisions and more common structures within primary wave 5, in comparison to the main wave count above.

Within intermediate wave (3) minor wave 1 is a long extension. Within minor wave 1 minute waves iv and ii are grossly disproportionate, with minute wave iv more than 13 times the duration of minute wave i. This also reduces the probability of this wave count.

Although the invalidation point is at 1,308.10, this alternate wave count should be discarded long before that price point is reached. If the maroon channel is breached again by one full daily candlestick above it and not touching it then I would discard this alternate wave count.

A new low below 1,131.09 would confirm that intermediate wave (3) down is underway.

I will allow for the possibility that minor wave 2 may be completing as a big zigzag, but the duration is longer than minor degree corrections normally are so the probability of this idea is very low. The probability of this alternate wave count has further reduced today.

This wave count now needs to prove itself. It needs to show strong downwards movement with an increase in momentum and an increase in volume. A new high above 1,219.99 would further reduce the probability of this alternate at this stage, I may discard it at that point.

This alternate wave count remains technically possible.

This analysis is published about 05:26 p.m. EST.

Did gold just complete a 5 down from high of the day of 1,224.31 at 11:12 am EST down to 1,214.37 at 3:30 pm? Now we may get a short bounce?

Agreed. There was a 5 wave down for minuette a of minute ii. Minute ii is a 3-wave ABC correction. Since the first wave down divides into 5 subwaves, minute ii is likely to be 5-3-5 zigzag.

Going forward, the most likely targets are 1220.51 for minuette b (0.618 retrace of a), and 1206.78 for minuette c, and hence minute ii (1.382 retrace of a). I have bought DUST at the beginning of minute ii at 14.55, and will look to add some more at the rebound high of 1220.51.

Lara

Has minute i ended?

Any idea of the lower retrace target for minute ii?

Since it may be a 3 wave down, any idea the upper bounce high before heading for the bottom of minute ii?

Is it still estimated at 2 to 3 days to end minute ii?

I’m not Lara of course but I may add longs at 1202 SL=1175. The entry is ~50% retracement of minute 1, the opening of the gap-up and just above 1200 psych support. There is also a gann turn window midweek. Over the years I’ve seen how these partial global holidays often turn into inflection points in the fx & pm market. The next turn up will be minute 3 of minor 3 and s/b strong. Perhaps the gap I mentioned at 1286 will fill sometime thereafter.

Thanks for the opinion and info.

Remember than Wednesday 2 pm FED FOMC minutes are being released this week.

Yes. There’s also the greek repayment (or default) on Apr 9. You might find this wkly calendar handy for tracking event risk:

http://www.dailyfx.com/calendar

I think minute wave i has ended yes.

I’m expecting about 1-3 days of downwards movement for minute wave ii to about 1,207 (more likely) or 1,196 (less likely) for minute wave ii correction.

Lara, is your expectation based on the assumption that second wave of the third wave one degree higher is likely to retrace max. 61.8% of the 1st? Because normally it should be deep and scary?

This is a second wave within a third wave one degree higher, so the third wave exerts a “pull” on the second wave. So in this case the second wave would be more likely to be more shallow than usual.

Second waves most commonly are deep, the 0.618 Fibonacci ratio is a common target for them. But in this case I’d go with the 0.382 Fibonacci ratio. The 0.618 Fibonacci ratio is still entirely possible, and just a little less likely in this case.

Does that all make sense?

Surely it does. Thx

Time to buy DUST???

Yes I bought DUST after Lara comment below and before close. Now I may hold to about lower gold target 1,207 or sell at a high Tuesday.

Remember FED FOMC Wednesday 2 pm minutes released. That is a guessing game to watch closely as gold can move fast then.

Actually, my comment comes with the caveat that the end of minute wave i is unconfirmed. We need to see a channel breach on the hourly chart before we can have confidence that it is over. Price is really close to the lower edge of the channel now, the channel breach should come within the next 24 hours (sooner rather than later within that 24 hours)

Took a DUST position at $14.66. I will post chart shortly.

Here’s what I’m looking at:

Nice trade and entry!

Thanks! I had the price level right but certainly got very lucky on the timing. 5 minutes after I entered the trade it really took off and I’m up 50 cents already.

Dust made the Buying on Weakness list and GLD is on the Selling on Strength list (neither is very high on the lists but they are both on it).

It’s after 2pm eastern and GDX has only traded 16M shares. Seems pretty soft for such a huge gap up. As it is near resistance and could produce an island spinning top candle, I’m inclined to fade the move and treat this as a data point moving towards Lara’s call for swift corrective wave shortly.

Sold another 1/3 of JNUG at 22.00 limit. Waiting for a pullback.

Nice trade. I’m still looking for GDX to make one more push higher close to $20.

Still holding the other third. I’ll probably keep it since it is inline with the bigger trend. I’m not going to try to play the pullback against the trend, I cost myself quite a bit in feb/Mar attempting to do this well and have decided It’s not for me right now.

Good trading all!

You just answered the question I was going to ask you (eg: dust/jdst against the trend). Thanks for sharing! And congrats on great trades!

Thanks! I had a fabulous January, 105% return, but I gave half of that back in February and March trying to trade both sides, and decided I’d rather just trade the trend. It was taking too much precision to try to trade the corrections for my liking.

I assume you mean the swing trend which has been up since mid March? The trend has been down since the 3rd week in January and certainly remains down year over year since gold was at $1,900 highs. I trade the swing trends myself as well. I was just curious how you were defining “trend”.

Exactly. The one that hurt the most was I was expecting a new low below 1130 and was positioned for that when gold and miners shot up and switched trend.

Tell me about it! 🙂 At that time DUST wiped out all my previous month’s gains.

Gold still looks strong just set new high 1224.17 at 11:00 and US Dollar set new low then.

Gold just hit high of today of 1,223.51 at 10:30 am EST on pmbull.com

Would that be the official end of minute i?

That also looks to be the low of the day for the US dollar index $DXY today at .9635

Looks like the first 2 waves of the ii minuette are over. New low below 1216 should confirm. Nice to have day off and watch it closely from home.

GLD still has a gap right above to $118 to fill and I still think GDX hits $20 before the upmove is done. Sitting on my hands for now.

Sold 1/3 of my JNUG at 21.65 on the open.

If GDX runs up to ~$20 today, that could be a good spot to get into DUST for the corrective wave down. That would be an ideal risk/reward entry according to my chart attached. You can see my rationale annotated.

Mark F–great charts.

Thanks Davey, I like aiming for a convergence between Lara’s analysis and mine. When they come together I feel the odds are high for success. I suspect there may not be a good swing entry available until the end of the day.

This does not look too good for the shorts with 1215 holding; a break above 1223-25 will likely seek 1233+ very quickly and looks imminent…. downside requires a break below 1215, 1208 with 1202-01 holding….

TKL

Lara: “When minute wave i is complete then a quite deep 3 wave, minute wave ii down about two or three days.”

Do you know how deep the wave ii will be?

So this week up to Thursday expect gold to retreat. Then up in wave iii..

Hi papudi.

It appears that gold has completed minute 1 at 1223.48. I reckon minute 2 would end either at 0.382 or 0.618 retracement, i.e. 1206 or 1196 respectively. There is strong support near 1200 today so I don’t expect minute 2 to complete today, but maybe in two or three days (Fed minutes).

There is a good chance that minute 2 will drop in 3 waves divided 5-3-5. We are currently in the a wave.

2nd waves usually retraces at least 61,8% of the 1st… 61,8% (1196) corresponds to the bottom of the 4th wave of the lesser degree. 76,4% (1190) corresponds nicely to the top of the 1st wave of the lesser degree.

I rest my case. Lara has agreed with me that the 38.2% retrace is more likely (at 1207) rather than the 61.8% (at 1196).

May I jump in… I’ll say inbetween, perhaps about 50%. IMO T.A is a guide, not gospel.

And I like to use a combination.

That is true, TA is a guide, but most of the time quite a reliable one. I like to have something to work with and use the most likely ratios until proven wrong. It is much better than having to guess and staying glued to the computer monitor. That would be rather stressful.

Especially after 4 am? ….. lol

Yes, and because the next move up will be potentially be stronger and longer, I will be conservative in placing my long entries by specifying higher bids that my target low, so I dont miss getting filled long.

Good luck.

Agreed totally. After minute ii comes the strong minute iii. It would be the time to go long. As Richard said, it would probably come at the FOMC minutes release, or as you said, the possible Greek default (although I personally feel that a compromise solution will somehow be forged. I doubt if the eurozone would let Greece go to Russia for funding. It would have been too disastrous for them).

Yes it’d be disastrous on both sides and thus unlikely, however the takeaway is that there is a risk, however small, of a multi-sigma event, so one must be aware and manage their risk just in case of a surprise blow-out, especially if you’re leveraged. Speaking of which, IMO you’re a great candidate to move up to trading gold CFD’s or other futures. You can get as much leverage as you want and 24-hr trading execution. It’s a good match only for technical traders like you, just sayin.

I expect the big Greek repayments will be done, and this will be an inflection point that sets EURUSD for a run up. Trendlines and EW appear to align same way, and also, look at the historical extreme positioning in COT (something has gotta give):

http://www.dailyfx.com/forex/technical/article/cot/2015/04/06/COT-Records-in-Euro-Commercial-Longs-and-Speculative-Shorts.html

Thanks for the suggestion. I have been seriously day trading only about three months back. I still have a lot to learn. Once I am confident of getting the price movement and timing right, I may consider more leveraged trades. These work both ways, and losses can be phenomenal. Accuracy is important in getting those trades right.

Right. I began trading 8 years ago at age 19.

I began on the largest gold/fx trading forum and heard of lara there 2-3 yrs ago. You find your own style and system over time. This is me and my profile/picture when I began 🙂

http://www.dailyfx.com/forex_forum/members/25909-skibunny/

Do you trade SGD or have you a technical opinion of SGD and/ or MYR?

Sorry. Almost went back to bed. I don’t trade forex as it is too volatile. From what I know, the Singapore government had wanted a slightly weaker SGD, and hence USD appreciated quite a fair bit in the last one to two months against SGD. I would think there will not be much change going forward as the government is quite happy with the current exchange rate. Technically, the Malaysian ringgit has a loose peg to the USD. But in the past half a year or so, it went down quite significantly. Malaysia is an oil producing country and its fortunes are largely tied up with oil. Singapore is more fortunate in that it does the processing of oil and not the production. Hence it is not greatly affected by the drop in the oil price. The strength of SGD is kept within quite strict bands by the Central Bank.

Minute i actually ended at 1224.31.

Can any one tell if the maroon trend line has broken?

Lara: ” A new high above 1,219.99 would further reduce the probability of this alternate at this stage, I may discard it at that point.”

Can I start ringing the bell for a major trend change in PM sector!!!!! Gold traded above 1223.

Lara, meant to compliment your timing of your EWG picture change… and the pic too. Its fabulous! It says Get ready, surfs up (and avoid the rocks- ha ha). 🙂

LOL. That was a wave from ex tropical cyclone Pam. It passed by NZ sending us the biggest swells I’ve ever seen on our Pacific coast. Plenty of locals surfed that day, 7-8ft on the sets. I’m not keen on big waves, but my husband surfed the next day when it was a little smaller but real clean. There’s a pic of him now on our “about” page.

< !

The gap up has masked a good part of the minuette 5 wave. Judging by the momentum at the Asian open, I surmise that the recent high of 1218.84 at 8 pm ET may be only the third wave of subminuette 3. Minuette 5 ought to close nearer to 1230, according to Lara.

Minuette wave (v) to more likely end at 1,212. Keep in mind that Gold sometimes exhibits particularly strong

swift fifth waves typical of commodities. If this happens the target may be too

low and may be more likely to end at 1,223. When minute wave i is

complete then a quite deep 3 wave, minute wave ii down about two or three days.

Minuette 3 probably ended at 1218.83, and after a small correction to 1215.77, is now embarking on minuette 5.

I don’t see a reason to change the notation one down. According to Lara it is likely that minuette 5 ended at 1223. New high above 1219 further confirmed the main wave count.

1223.48 may be all of subminuette 5 of minuette 5. It is also possible to be only the third wave wthin subminuette 5. The ensuing movement after 1223.48 looks like a wave 4 type. If price rises higher than 1223.48, then the second option is correct. If it does not, then minuette 5 has ended. I can’t really tell at this stage.

I prefer to keep it simple and not overanalyze.

Price rose to 1223.51 and so ends minuette 5, and hence minute 1.

Gold hit a hit of 1217.40 at 6:00 pm EST Sunday as per TOS

Does it look like a short on the opening? There should be a wave down after this blow off??????

What will the target of sm wave ii?

I will make my decision when I see how the GDX chart responds to the gold price in the opening hour of US markets.

i just cleared my long at 1218, I suspect that gap is gonna get filled in the next day or so if not will look for some kinda pull back to get long again

Great trade Kudos!!!!

Mondays action and Lara report may lead us to another long trade???

thx buddy….yes i would like to get back in and leave for a bit …looking foward to what Lara has to say…

Long holders,

what is your strategy? I plan to close my longs and wait for the 2nd wave/ see what structure will it have and seek to enter the market lower. If the price breaks above 1212 with decent momentum, I will use tight trailing SL to decide when to close the position.

I hope for the short sqeeze up to 1220s.

I really want to see how it reacts to the crappy jobs number we had Friday, hoping for a nice gap at open!

Cyclist Bensimon predicts….

google him….

I got this from another poster at a different website about Bensimon…

Well Bensimon is looking for $1070 gold & $13.60 silver to be targeted over the next 3 or so weeks.

If so, then it could spell the end to the bear market, however would have to see how they behave at those levels. This bear market still could carry on for another year, but would have to see what’s going on at those targets…..

We have cyclists and surfers for market analysis!!!!!!!

http://www.pmbull.com on 10 minute time frame shows Friday at 5:00 pm gold opened at 1,202.64 and closed at 1,210.17 up .63%

Glad I bought my GDX at the close Friday. Hopefully gold stays high until I can sell GDX Monday and buy DUST as Lara forecast minute wave i tops at 1,212 then drops in minute wave ii.

U.S. jobs growth in March slumps to 15-month low – The disappointing report makes it more likely the Federal Reserve will to wait until the end of summer before raising a key interest rate for the first time since 2006. Apr 3, 2015 10:53 a.m. ET.

http://www.marketwatch.com/story/us-jobs-growth-in-march-slumps-to-15-month-low-2015-04-03

Richard

What is the target for wave ii down??

So if gold target is reached 1212 on Friday Monday should not be a gap up day rather a day of consolidation and volatile move.

Am I correct?

Are you speaking about daily alternate?

If so it has such low probability Lara didn’t give chart or target.

Alternate hourly target is 1179

Main hourly minute i target is 1212 and if rally is strong then 1223 then lower target not know until know where minute i ends.

I expect most feeds will show gold open Monday with a gap-up from $1202. Gaps almost always fill eventually. Comex gold must still fill a gap-down at 1286 from January and a gap-up at 1151 in March.

1286 and 1151 are not close so Lara would give another daily update before either of those could happen. Then you would get her feedback.

Richard, interesting to see that bullion site’s price, thanks.

But I can’t find their data feed source. Do you know?

Their price looks bogus judging from their chart (below).

Chart shouldn’t stop at 17:00 on April 2 and do nothing for 24 hours, then suddenly spike & stop like it does. Instead, the chart should show price continuing thru the Asian session until Asian exchanges closed at 04:00 EST Apr 3

PS. i’m betting the fed won’t hike at all in 2015… and you?

Remember that Friday US closed but not futures. pmbull may look unusual however pm bull doesn’t do bogus, not a usual day and may be due to futures end of day update at 5 pm, just guessing.

Based on terrible US jobs report gold would of went up. We know from other news sources around the world Asia that gold went up Friday.

I see that most bullion sites didn’t update their gold & silver prices since Thursday, so coin & bar stackers have had a good chance this wkend to buy at thursdays lower price:)

Those of you wanting gold price, Shanghai (largest gold exchange in world) and Tokyo were open Friday, closing shortly before NFP due to time zones. Daily prices and live feed available. http://www.sge.com.cn/

Lara based on price and volume, I think Friday clarifies the count by confirming the move up as impulsive in 5 waves, and counts as day #3 in minor 3.

Here is daily close prices (in english):

http://www.en.sge.com.cn/datas/sgeprice-daily/524907.shtml

This is priced in yuan per gram. They convert weight & currency here:

http://www.en.sge.com.cn/investor/gold-converter/#

So 99.95 pure gold closed $1213.76 and nearest futures closed $1216.80

That’s physical gold and futures, not comex futures as many here trade.

Physical is slightly more but consistent.

I think we ALL (including me) expect for gold-related shares to break above resistance on Monday. I always get worried when the move seems so obvious and one corner of the room gets overcrowded. So in case gold and the GDX gets a milder pop than expected on Monday, I throw out the attached chart for consideration. A set up for a mild dip in DUST as a long opportunity (betting on a down move in the GDX). Part of good trading discipline means to trade what happens and not what you think is supposed to happen when the market doesn’t behave as expected. It’s good to have more than one plan in case the market throws you a curveball.

I’m personally not a fan of charting the 3x ETFs because of the decay. My alternative is to chart $one:gdx to get the inverse trend. On a 60 minute time frame it may not matter too much.

Nice alternative to pay attention too. Maybe that blue trendline gets crushed, but backtested in the second wave correction.

I agree….and give more weight to the GDX chart. Your backtest scenario is one I’ve thought about too. Monday will be very interesting for sure.

NFP /Gold market unique day!!

We all can speculate: will gold go higher or lower on Monday. This is the first time NFP is out on Friday and US market was closed. This may have saved the gold from COMEX’s violent reaction.

Sunday night US time and Monday Asian market opens during those trading hours most of the reaction will be known by the time London/US market COMEX opens at 6:00 to 8:15AM.

It will be an interesting data point which market has more pull on gold.

You are right it’s uncommon but actually the NFP has been released about a dozen times before on a holiday. When the first friday of a month is a holiday (except new year).

The conspiracy crowd shows a pattern that NFP is always bad when released on a holiday, and the next one is good.

Gold intermediate cycle high and low.

Post dated March 1 2015:

“Intermediate Cycles (IC) for Gold last about 6 months (22-26 months low to low on average).

Intermediate Cycles have approx 4 shorter Trading Cycles within them

but the lowest low is always at the end of the Intermediate Cycle after

which there is almost always a nice pop to start the next IC (the IC low

recharges investor sentiment for the next cycle).

The current IC started the week of Nov 10, 2014 and appears to have

topped in week 11 and is now still in decline at week 17 but chopping

sideways. The week of April 6 for an IC Low is a possibility that we

are looking at closely as a number of analysts have identified this as a

likely “turn date” (stay tuned as this is not finalized yet). In the meantime, here is a chart of the past 5 Intermediate Cycles going back to June/July 2013. You can very clearly see the IC Lows about every 6 months. The last IC is still underway and predicting a date for the IC low is underway.”

Combining Lara’s main wave count with my non-Elliott charts, this is how I see GDX possibly playing out over the next 2 weeks. http://scharts.co/1xIwFOE

Mark F

I am missing something. When I click the link I see a chart of past performance. Is there some way I can see a 2 week projection?

You don’t see a chart that looks like this using the link above? Let me know.

Insert the image like this makes it so everyone can see it. When you paste the link, I think someone has to be a stock charts member to see what your annotated.

Edit: And….nice chart.

Ahhhh….didn’t realize that. I will post images for now on instead of links. Thanks!

My pleasure, I appreciate your contributions.

I expect gold to open with Gap to the up..

Agreed. Lara’s analysis helped keep me on the right side of the gold trade over this weekend and is much appreciated! For me it was a coin flip so I gave the edge to Lara and moved into cash and out of my DUST. Thanks Lara!

I added to my longs at the close yesterday. USD down 1.00 right now. Commodities should have a good week next week. Have a great weekend all.

Sounds like you are well positioned. I’m flat on gold right now and will see if a good long entry presents itself Monday but I’m long UWTI as of the close yesterday and I’m hoping for a good move up Monday.

NFP 126K jobs only.

Any idea on effect on gold of this news up/down ?????

Up for Gold as signs of weak US jobs is sign of weak economy which would delay FED increasing interest rates which is good for gold.

davey

GANN cycle analyst is an independent and pos’s his thoughts on a forum time to time. I do not think his work is accessible.

However when he posts these i will post here as well.

Thanks for the interest.

Papudi–thanks for reply. Would you post link or address to the forum? I am interested to review all types of market cycle theories.

I will be watching April 6, 9, 14 for low, high, low as Gann analyst predicted.

I know Gann. I think the cycle is inverted from that analyst’s view, ie., should be high-low-high instead.

It aligns perfectly with fundamental catalysts such as the NFP today and Greece repayment on the 9th, with lots of Greece-risk that week. The market is very complacent about Greece, it might be shocked.

These highs and lows can be just local maximums and minimums in the coming uptrend.

I agree, the 6th could be a ‘low’ but still have an up day, it’s just lower than the high on the 9th. That’s been my experience with these, a low doesn’t mean it’s actual lower than current or past price, and vice versa for high.

Hello & Happy Holidays everyone!…. JUST A VIEW: There really does not appear to be much downside for the shorts with gold price finding support at 1199-97/96…. Immediate resistance comes in at 1203 with 1207 on the outside…. Gold price is bullish; short term trend is up. However, momentum and ROC seem to have slowed down suggesting for a short term decline / downturn is expecting for a break below 1197/96 (5dma) to likely go no deeper than 1192/91; a break below here in an unlikely event would probably seek 1185/84…. On the flip side, gold price is looking to top and should encounter resistance at 100dma (1208-09), 20weekMA (1209-10), a resistance cluster at 1210-11 and the upper band 1215-16; a break above 1216-17 could trigger a rally on to 1220-23 (50% retracement of H 1308 / L 1142)…. With ADX weak for the downside (unless it turns around), Gold price remains bottomy, CCI is long. With an inside day on Thursday, a range break can be expected; I wonder which way the pendulum will swing! Preference for now is to stay long on the drop/s and look to short once gold price tops.

Hi Lara – Happy Holidays!

I’ve a suggestion regarding the display of counts. I’m sure you will agree that Elliott Wave forecasting has the capacity to forecast and predict the movements for several decades and that is how Elliott predicted the 1940s fall too

If that is the case then I’m sure with your expertise and your effort of detailing the wave count you should also put forward predictions that are very likely and having more chance of occurring.

If you provide alternate counts and just discuss each of these wave unfolding then it sometimes confuses and will make users believe that the news drives the wave pattern however you know that it is the other way around. Wave movement unfolds the news that is likely to come

Another suggestion that I would like to give is. Let us say we have a news coming up on Fri or during the weekend, you may want to consider that and say how the wave has unfolded and how the market will react to this news basis the wave movements

I’m not sure how much of what I said is actually in sync. with your thought process however I felt like providing these thoughts to you for your improvement of service provided

Hi. I thought that Lara has provided forward predictions already in all her posts, for example 1320 / 1429 for the main count, and 956.97 for the alternate daily.

I can’t help but try to explain the natural course of events from the standpoint of being a science / engineering person. Our training has been quite rooted in Chaos Theory. To quote one of its proponents Edward Lorentz, “the present predicts the future, but the approximate present does not approximately determine the future”. Elliott Wave analysis is non-linear, and so an accurate extrapolation of the present into the future is not possible, only probabilistic. That is only possible under classical Newtonian physics which is linear, and is observable in normal everyday events of a large-scale nature. You may probably have heard of the Butterfly Effect, the most well-known explanation of Chaos Theory and which is popularised in sci-fi movies. In short, what it says is that a small change can cascade events. And so, multiple outcomes are possible. It depends on how people as a whole (and EW Theory is based on social mood) perceive and act upon the change. Often, these events can accelerate the change, such as pivoting news like Fed meetings or minutes. So, the end points can be predicted (as Chaos Theory is deterministic in nature), but which end point is most likely will depend on people’s perception, and is at best probabilistic.

I feel that it is sufficient to point out the various possible outcomes, but to expect an accurate prediction of the immediate future is quite a difficult task. The best that any forecast can do is to take each outcome individually and interpolate between the present and the end point. With the passing of each event, the near-term effects follow a quite predictable path, until the next event comes along. A good example is the weather forecast, which is accurate only for the very short-term. But this enables us to day-trade.

Have you looked at the “Gold Historical” section? Occasionally Lara will post a weekly, monthly, or annual count, like this one:

http://elliottwavegold.com/2014/06/gold-elliott-wave-technical-analysis-grand-supercycle-7th-june-2014/

Also, Lara has stated in the past that she pays little attention to the news, so doubtful that she would incorporate that into her analysis.

The count for the weekly chart in that section differs from the main count in the current postings.

Thank you for your thoughts. I’ll take it into consideration. As Bob says below I do have a long term wave count.

Lara, can you please post weekly charts on more regular basis, once in a month would be great. I think even with minimum comments it will be very useful. Thanks!

I agree it’d be useful if they were current.

Need to look at longer TF then drill down.

Lara the weekly chart in the historical section looks outdated and is now the alt. Some of us missed when you changed the weekly.

I wonder whether the monthly might change too. Can cycle-b be so short in time compared to cycle-a?

Last but not least, thanks to Lara for reading and responding to questions,as many market sites don’t provide that personal touch or high level of service.

Thank you Lara, appreciate it!

Just to articulate my thoughts a little better. Let us say you give 3 alternate counts. You can have a probability section at the top which says

1. option 1 – 80% probability

2. Option 2 – 60% probability, with price not falling below x level

3. Option 3 – 35% probability

This way the reader gets an understanding on applying the concepts to the trading world

I understand that barely you go through news flows. I read it in your FAQs too, however from a wave count teaching perspective you can show viewers/members as to how this perspective is already baked into the wave count and what should be the probable outcome of the news flow. let us say. the wave count is into a contracting d wave during the news flow period. Any news flow can only make the d wave go to e and not have a great fall or an upmove drastically as the general crowd will always speculate

This will give more evidence to viewers that market psychology was well predicted much in advance even before events could occur

Bob & Tham…thank you for pitching in your thoughts too and clarifying some portion of it

Tham – I specifically like the way you’ve put your thoughts in detail. I agree with you, that we should not look for the accuracy in prediction however what I’m stating is to look for a high probable trade. So just call it out somewhere in the chart with all those nearest probability levels

is gold closed till monday???

I think so. FXCM data ends at 5pm NY time. NYSE is closed for Good Friday and it looks like Gold won’t trade again until Monday.

thx Lara have a good holiday

Yes. The other world markets that trade outside the US time zome, that is the Australian, Hong Kong and the British markets are closed. Only some local markets like China are still open, but they do not affect the price.