I have the same two Elliott wave counts for GDX. I still favour neither.

Click charts to enlarge.

GDX does not appear to have sufficient volume for Elliott wave analysis of this market to be reliable. It exhibits truncations readily, and often its threes look like fives while its fives look like threes. I will let my Gold analysis lead GDX, and I will not let GDX determine my Gold analysis for this reason.

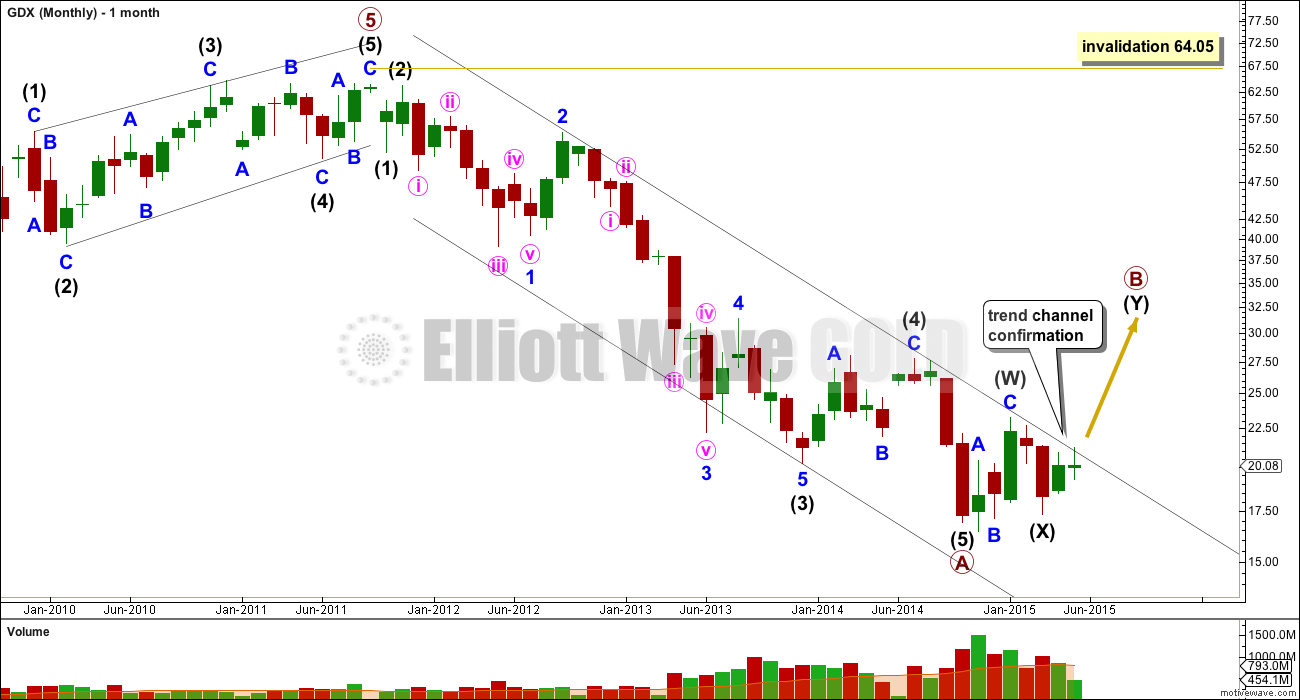

Bull Wave Count

The bull wave count expects that a five wave impulse is complete for primary wave A down. Within it, the extended wave is intermediate wave (3). There is no Fibonacci ratio between intermediate waves (3) and (1), and intermediate wave (5) is 0.98 short of equality in length with intermediate wave (1). (This chart is on a semi log scale).

The channel drawn about primary wave A down is a best fit. The upper edge is still providing resistance. For the bear count (or any variation of it) to be discarded this trend line must be breached. That would provide trend channel confirmation that primary wave A is over and the next wave of primary wave B would then be underway.

Because primary wave A subdivides as a five, primary wave B may not move beyond its start above 64.05.

Primary wave B must subdivide as a corrective structure.

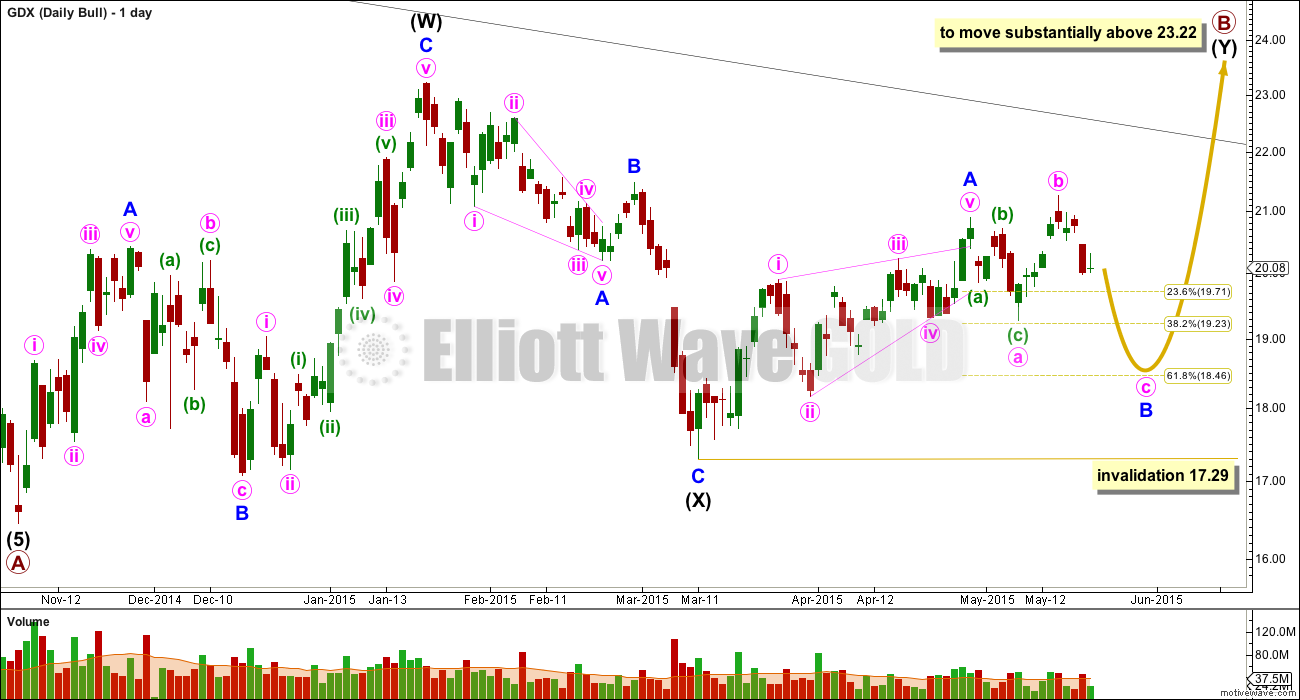

This daily chart shows all of primary wave B so far.

The wave down labelled intermediate wave (X) is 88% of the prior upwards wave of intermediate wave (W). A flat correction can be ruled out for primary wave B, at this stage, because this is less than 90%.

Primary wave B may be unfolding as a double zigzag. The first zigzag in the double labelled intermediate wave (W) is complete. The double is joined by a three in the opposite direction, a zigzag labelled intermediate wave (X) which is also now complete. The second zigzag in the double is underway labelled intermediate wave (Y).

The purpose of the second zigzag in a double (and the third in a rare triple) is to deepen the correction when the first (and second) zigzag does not move price deep enough. To achieve this purpose the second (and third) zigzag moves substantially beyond the end of the first (and second). Intermediate wave (Y) may be expected to move substantially above the end of intermediate wave (W) at 23.22.

Within intermediate wave (Y) minor wave A is a complete leading contracting diagonal. Minor wave B is most likely an incomplete expanded flat. I am not labelling minor wave B over at the low of minute wave a, that looks to be too brief.

Minor wave B may end closer to the 0.618 Fibonacci ratio of minor wave A about 18.46.

Thereafter, a five wave structure up (very likely to be an impulse) for minor wave C may be very long.

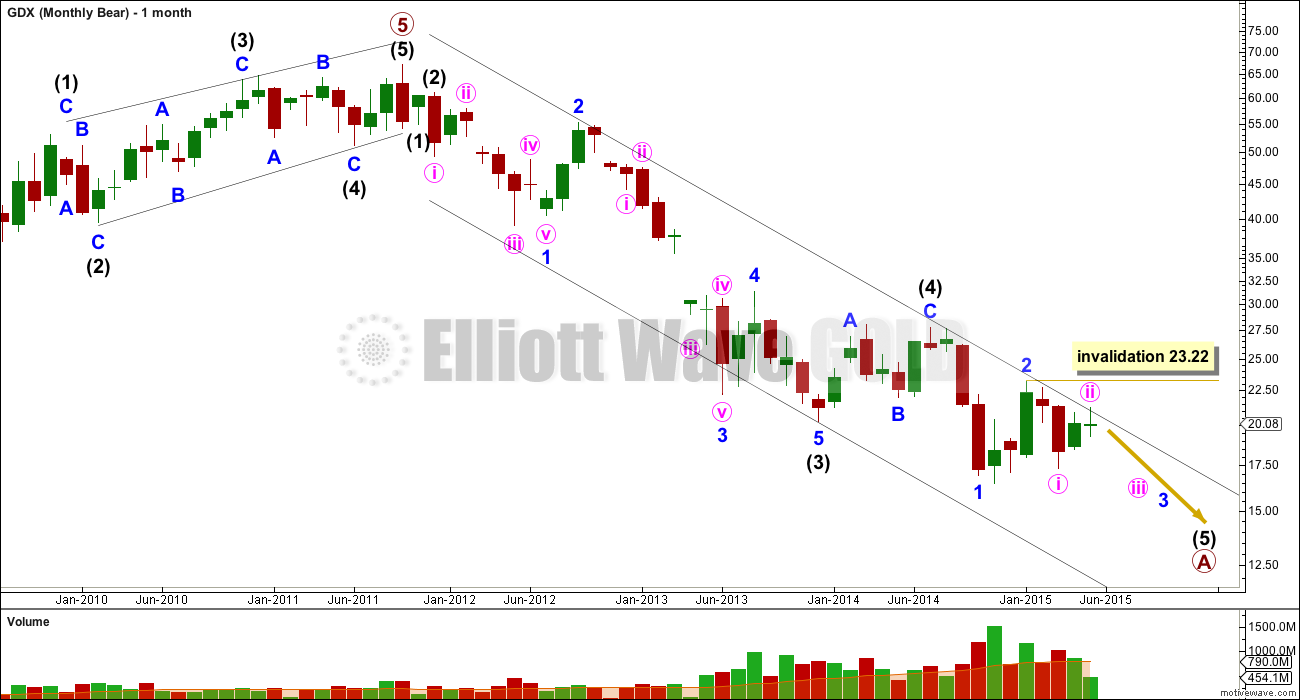

Bear Wave Count

While price continues to find strong resistance at the upper black trend line of this channel this bear wave count must be considered alongside the bull wave count for GDX.

Minute wave ii may not move beyond the start of minute wave i above 23.22.

Minute wave ii is now very likely complete. It is shorter in duration than minor wave 2 one degree higher.

A new low below 17.29 would at this stage invalidate the bull wave count and provide confirmation for this bear wave count.

This bear wave count expects a third wave down to begin to gather momentum.

Lara,

Could minute c/minor b be complete at this point based on the wave count you see? I’m looking at the bull daily, we seemed to have found support and bounced at 38.2 fib.

I guess I didn’t mean “weight”, instead I felt that you should have strongly favored the bearish scenario because of the obvious resistance. I was disappointed that nothing in the EW world seemed to give high odds on shorting or selling long term resistance. Instead it left everyone expected 1240+ minimum and more likely 1300. It also appears to me this year that the GDX has been a leading indicator for gold. Gold moved up to 1230+ only after the GDX began outperforming gold…and while GDX hit resistance at 21+, those couple of days were followed by GDX grossly underperforming gold which was one of the clues that resistance was clearly in control and now gold has followed the GDX down. Whether the GDX has sufficient volume to apply EW or not, it seems that the price action alone in the GDX should be a piece of data to be strongly considered when favoring which gold wave counts are most likely in play.

I also think you should reconsider your conclusion last week that May 19th’s very strong downward movement on big volume was corrective against an upward primary trend. The GDX charts unraveled at that point and they really were informative towards gold’s direction. Just my 2 cents.

Just based on my own TA, I cant imagine not giving weight to the bearish wave count because the bullish wave count assumes that a downtrend channel dating back to 2011 will get broken. Perhaps concepts of resistance and support don’t have a place in EW…again, I really don’t know EW rules or probabilities.

And that’s exactly why I publish the bear wave count, to give it weight.

I agree. For a bullish scenario to be preferred for GDX that trend line providing resistance must be broken. While price remains below that line the bear count must be considered as entirely viable.

For GDX it is that trend line which differentiates the two wave counts.

Support and resistance are important and have a place in EW, EW uses trend channels, drawn as early as possible during a movement.