Upwards movement to a short term target for Friday was expected. The target at 1,164 – 1,168 was met and slightly exceeded by 0.41.

I have a new wave count. Volume analysis favours it, and some problems with the prior Elliott wave count are resolved.

Summary: Short term some downwards movement is expected from here. The new wave count expects it to be very choppy and overlapping for a minor degree fourth wave correction which may not move below 1,119.23. The old wave count, which is now an alternate, would be confirmed if price breaks below this point. At that stage, a third wave down would be confirmed. Now, while price remains above 1,119.23, we may be in a bull market to continue for a further 10 weeks up to 1,400.

To see weekly charts and analysis click here.

Changes to last analysis are bold.

MAIN ELLIOTT WAVE COUNT

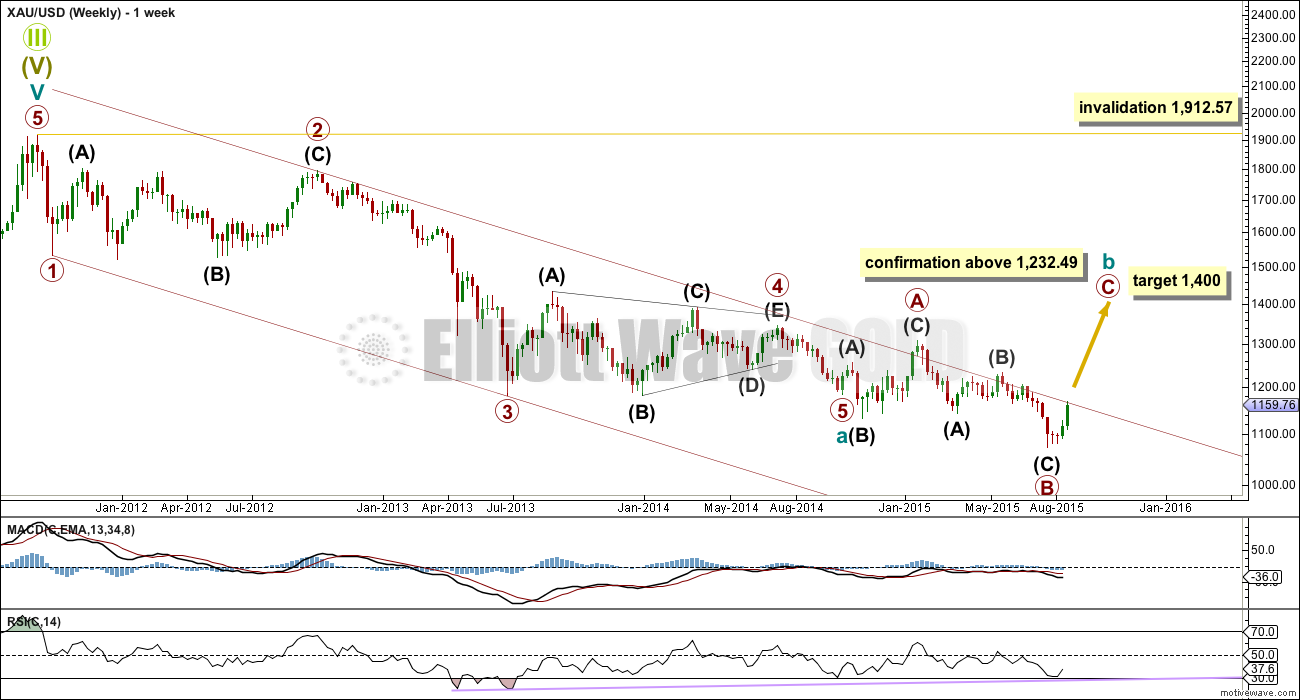

The bigger picture at super cycle degree is still bearish. A large zigzag is unfolding downwards. Along the way down, within the zigzag, cycle wave b must unfold as a corrective structure. This wave count now sees cycle wave b ending with primary wave C up. Cycle wave b is seen as a big expanded flat correction.

This wave count resolves a few problems I had with the prior main wave count, and is better supported by regular technical analysis at this stage. For these reasons, it must be my main wave count.

Ratios within cycle wave a are: primary wave 3 is 12.54 short of 1.618 the length of primary wave 1 and primary wave 5 is 13.85 longer than 0.382 the length of primary wave 1. There is perfect alternation between the deep flat of primary wave 2 and the shallow triangle of primary wave 4. Primary waves 2 and 4 are both very close to a Fibonacci 55 week duration, giving this part of the wave count the right look.

Cycle wave b is an expanded flat. Within cycle wave b, primary wave A also subdivides as an expanded flat. Primary wave B is 1.89 times the length of primary wave A, longer than the common length up to 1.38 but within the allowable convention of up to twice the length of primary wave A. This deep B wave is the only part of this wave count which is not absolutely typical. It breaks no Elliott wave rule; I have seen plenty of expanded flats with B waves this deep or even deeper, but it is not the most common look. It still looks reasonable.

At 1,400 primary wave C would reach 2.618 the length of primary wave A.

The alternate would be invalidated with a new high above *edit: 1,232.49, which would provide full confidence in this wave count.

Because cycle wave a is a five wave structure, cycle wave b may not move beyond its start above 1,912.57.

RSI shows some long held bullish divergence going back to April 2013. This strongly supports this wave count.

Cycle degree waves should take one to several years to unfold. At its end, cycle wave b would probably have lasted just over one year; cycle wave b may complete in a total Fibonacci 55 weeks. Thus far cycle wave b has just ended its 45th week, so it may now be expected to continue for a further ten weeks, give or take up to three either side of this expectation.

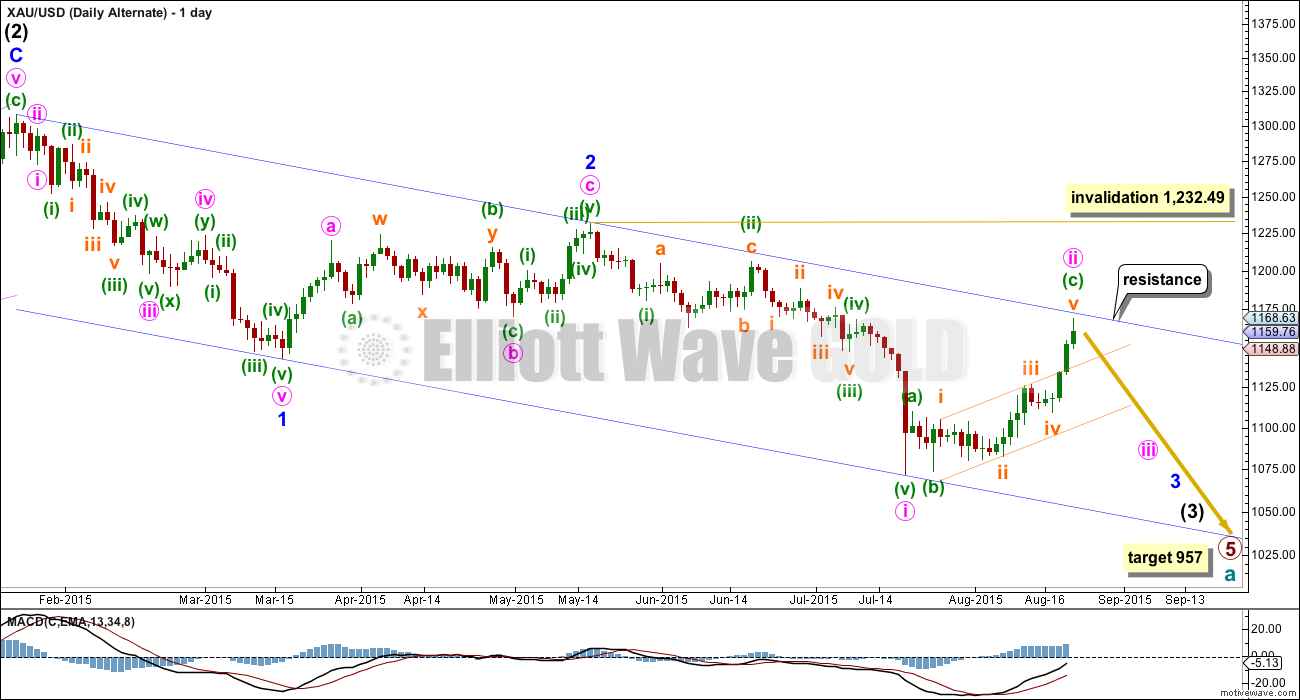

The daily chart focusses on all of primary wave B.

Primary wave B subdivides perfectly as a zigzag. Draw a channel about it using Elliott’s technique for a correction. When this blue channel is breached, then that shall provide trend channel confirmation that primary wave B is over and primary wave C upwards has begun. The channel may provide resistance before that happens. After the channel is breached, then a throwback to test it for support may also be expected as very likely.

Primary wave C must subdivide as a five wave structure, either an impulse or an ending diagonal. An impulse is more likely. When the first wave up is complete, then we shall know which structure primary wave C is unfolding as because an impulse requires a five up and an ending diagonal requires a zigzag up for intermediate wave (1).

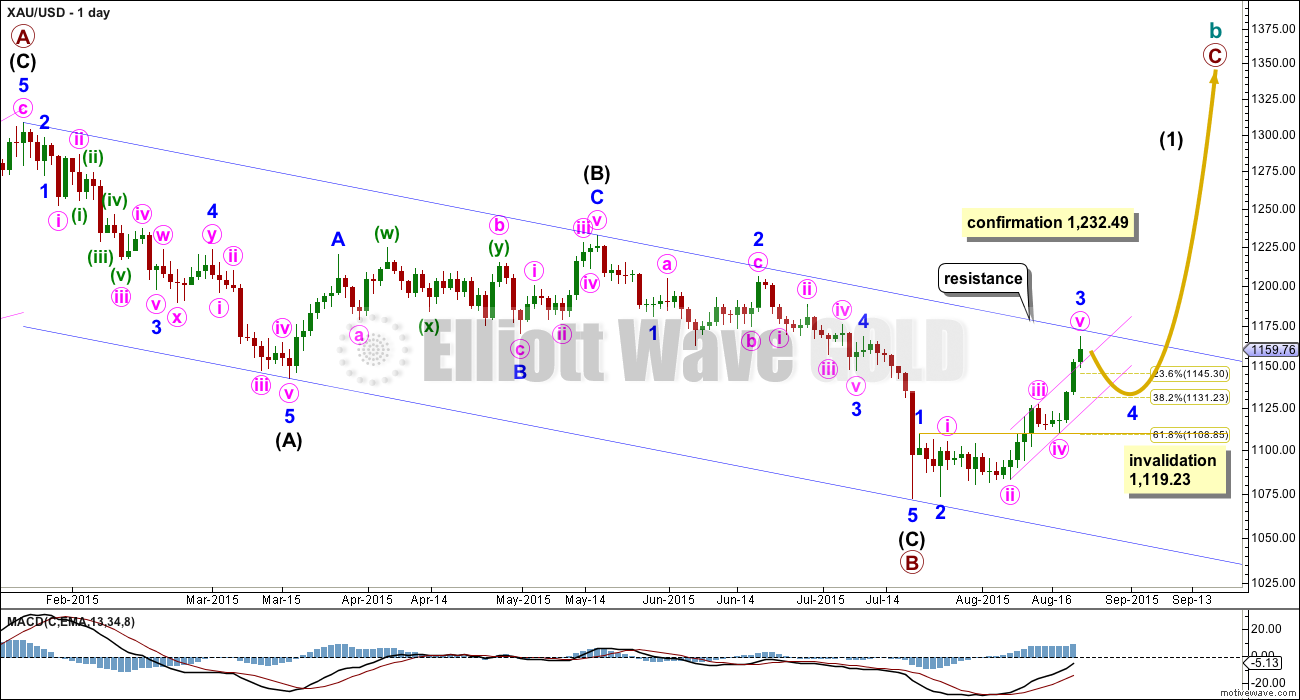

Within intermediate wave (1), minor wave 4 may not move into minor wave 1 price territory below 1,119.23 (the high of minor wave 1 is taken from the hourly chart).

If primary wave C is to be an ending diagonal, then this upwards movement looks too short to be intermediate wave (1) in its entirety; it would be only minor wave A, which must be a five wave structure. The invalidation point for both ideas, at this stage, should be at the same place at 1,119.23.

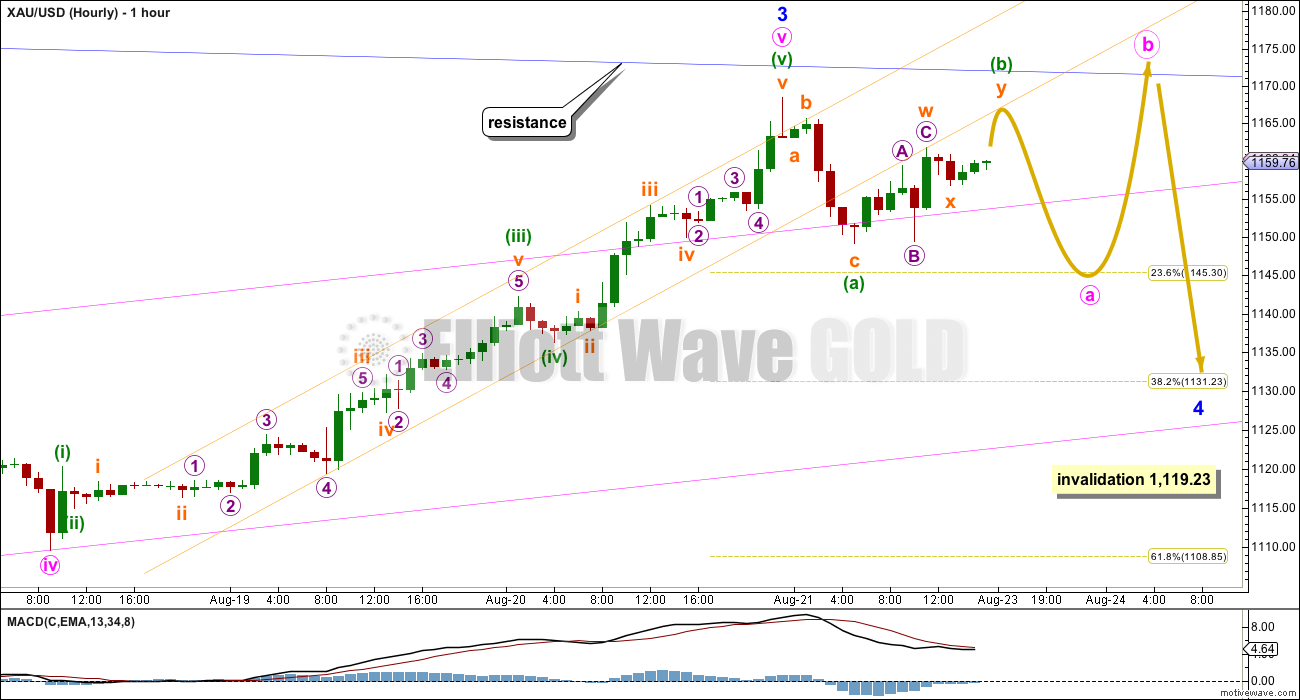

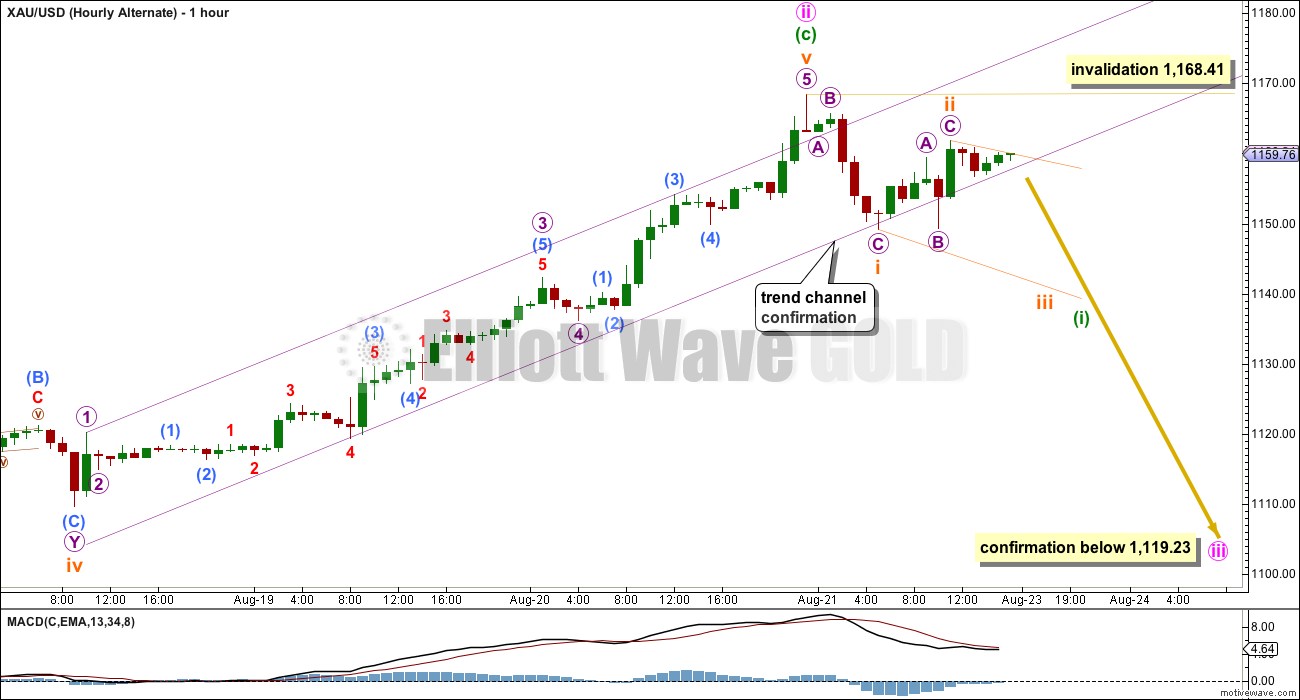

Price is finding resistance at the upper edge of the blue channel copied over here from the daily chart. This may be where minor wave 3 ends and minor wave 4 begins.

Minor wave 3 is 4.42 short of 2.618 the length of minor wave 1.

Within minor wave 3, there are no adequate Fibonacci ratios between minute waves i, iii and v.

There are 23 possible corrective structures that minor wave 4 may unfold as. Although I am labelling minor wave 4 as a possible expanded flat correction, it does not have to unfold like this. Minor wave 4 may be a triangle, combination or multiple flat correction to exhibit structural alternation with the double zigzag of minor wave 2.

Minor wave 2 was very deep at 0.97 of minor wave 1. Minor wave 4 should be shallow, reaching down to either the 0.236 or 0.382 Fibonacci ratios. Minor wave 2 lasted a Fibonacci three days. Minor wave 4 may be 1.618 or 2.618 the duration lasting a Fibonacci 5 or 8 days in total.

Minor wave 4 is likely to be very choppy and overlapping; it may move sideways or have a slight downwards slope. While minor wave 4 unfolds, the wave count within it will change as its structure becomes clearer. Analysis of minor wave 4 should focus on seeing when it is over. There may be a breach of the pink channel copied over from the daily chart.

If minor wave 4 is an expanded flat or running triangle, then it may include a new high above 1,168.41. If it does that, then the alternate below would further reduce in probability.

The best fit channel about this last fifth wave up, here labelled minute wave v, is breached and now provides resistance. There is more than one way to draw a best fit channel, and the hourly charts show two possibilities. Here, use the lower orange line for resistance.

ALTERNATE ELLIOTT WAVE COUNT

This was yesterday’s new main wave count, but today this count is relegated to an alternate.

This wave count is now an alternate, because it has the following problems which the new wave count resolves neatly:

1. Intermediate wave (2) is much bigger in size than an intermediate correction within Gold’s impulses normally are.

2. The maroon channel has been breached on the daily chart twice. This is an early indication that cycle wave a may be over.

3. Minor wave 2 is much longer in duration than a minor degree correction within Gold’s impulses normally are.

4. Volume no longer supports this wave count.

5. Gold often exhibits very short fifth waves to follow its fourth wave triangles.

A new low below 1,119.23 in the short term would confirm this wave count. Full and final confirmation would come with a new low below 1,072.09.

If primary wave 5 reaches equality with primary wave 1, then it would end at 957.

This wave count now sees a series of three overlapping first and second waves: intermediate waves (1) and (2), minor waves 1 and 2, and now minute waves i and ii.

The blue channel is drawn in the same way on both wave counts. The upper edge will be critical. Both wave counts expect some downwards movement from here to bounce down from resistance about the upper blue trend line. Here the blue channel is a base channel drawn about minor waves 1 and 2. A lower degree second wave correction for minute wave ii should not breach a base channel drawn about a first and second wave one or more degrees higher. If this blue line is breached by one full daily candlestick above it and not touching it, then this alternate wave count will substantially reduce in probability.

Minute wave ii may not move beyond the start of minute wave i above 1,232.49.

Today, at the hourly chart level, this alternate wave count has another problem. Downwards movement during Friday’s session looks best as a three wave structure. While it may be a zigzag within a leading diagonal for a first wave down, leading diagonals are not nearly as common as impulses for first waves.

This sideways movement for Friday looks too big to be a micro degree correction within subminuette wave v.

So far the channel drawn here about subminuette wave v is providing support. When it is breached on Monday, then it would provide trend channel confirmation that minute wave ii should be over. This channel drawn here as a best fit about subminuette wave v is more conservative than the best fit channel drawn on the main hourly chart. For confirmation of a minute degree trend change the channel should be as conservative as possible.

Further confirmation is absolutely required for confidence in this wave count. A clear five down on the hourly chart followed by a new low below 1,119.23 is required.

Only when this wave count is confirmed would I calculate a target for minute wave iii. Minute wave iii would be expected to show a strong increase in downwards momentum.

Subminuette wave ii may not move beyond the start of submineutte wave i above 1,168.41. A new high above this point would indicate that minute wave ii may be continuing higher, but it should still find resistance at the blue channel on the daily chart. If that channel is breached, then the probability of this alternate would be substantially reduced.

TECHNICAL ANALYSIS

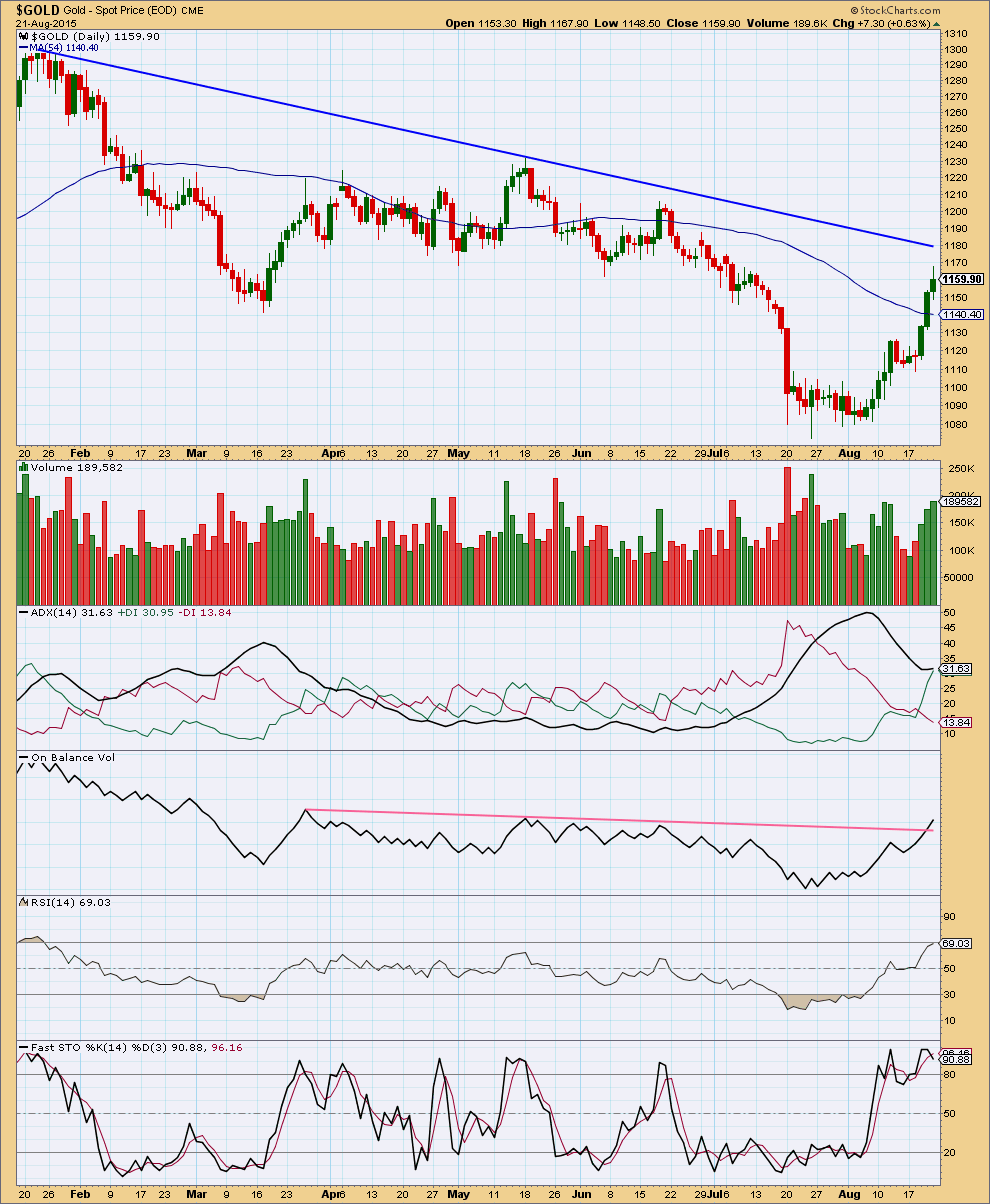

Click chart to enlarge. Chart courtesy of StockCharts.com.

Weekly Chart: This week has ended with slightly lower volume. A small decline in volume for another upwards week indicates at least a near term correction; the rise in price was not fully supported by volume this week.

On Balance Volume has has plenty of room to move higher. When it touches the purple trend line, then that may provide resistance for a larger multi-week downwards movement.

RSI is within normal. There is plenty of room for price to rise or fall.

Click chart to enlarge. Chart courtesy of StockCharts.com.

Daily Chart: Volume for Friday shows a third upwards day on rising volume. Friday’s volume is higher than 11th August. This rise in price is now supported by volume.

ADX has finally turned up: above 30 and pointing upwards. The +DX line is above the -DX line indicating a new upwards trend. ADX does tend to be a lagging indicator, but when it shows a trend we must take notice. This supports the main wave count.

On Balance Volume did not find resistance at its pink trend line, which was broken through. This is further bullish indication today which supports the main wave count.

RSI is close to overbought. There is still room for price to rise.

While price made new highs for Friday Stochastics turned lower. Near term Stochastics is expecting a correction against the trend indicated by ADX to resolve its overbought condition. The divergence between price and Stochastics for Friday is near term bearish. This supports the main wave count, which expects a correction agains the trend to unfold from here.

Friday’s candlestick has a longer upper wick than lower, indicating the bulls may be at least temporarily exhausted. Bulls did not manage to keep price close to Friday’s highs; the bears managed to push it lower than the bulls could hold it.

This regular technical analysis overall supports the new main wave count, and plays a large reason for my change of wave counts today.

Finally, an additional note to answer the question I am sure will be asked (and has in fact been asked once already): What could I have done differently to come up with this new wave count sooner?

Firstly, it must be admitted that although I expected this upwards movement was a correction, I have for the last three days correctly predicted direction and provided targets each day which were met. That’s not perfect by any means, but direction is important. We have not had confirmation upwards movement is over for the alternate wave count.

Up to 11th August volume data from FXCM clearly showed the strongest day in the sideways chop was a downwards day (look at the TA chart at the bottom of that analysis). I rely on volume data heavily to indicate the direction of a breakout, but data changed on 12th August, so I learned that FXCM volume data is unreliable, so have changed to using StockCharts data. That data change was a major change from bearish to bullish.

So what could have been done differently? I needed to be more flexible with where cycle wave a may have ended, remembering that cycle wave b should be choppy and overlapping and may include a new low below the end of cycle wave a. I needed to take more time to find an alternate at the weekly chart level once the maroon trend line was breached. I have learned from this exercise that trend channels should be given more weight plus volume data must be reliable.

If I’m right, then we still have reasonably early indication of a new upwards trend. My job now will be to find when corrections within the trend are over to pick the next strong impulsive movement.

This analysis is published about 07:17 p.m. EST.

August 24th update done at 9:03 pm

Lara, pretty tall red volume bar on gold today. Looking forward to your update, I wouldn’t expect a red bar like that in a correction of a bull trend.

Go bears! Ha-ha

Bears fan? or looking for a decline?

Decline.

So here’s an interesting possibility….hedge funds are extremely short gold on the COT, so with margin calls and the limited daily margin decision earlier today, a margin call for someone short would cause a buy to cover…..I will be interested to see what happens in the next few days. If this is the case, gold may have been artificially held up today with all of the forced covering, and that might explain all of the volume. Big guys could have been taking the other side of all of those buy-to-cover purchases and shorting the dickens out of gold.

We shall see.

Today saw a lot of margin calls in stocks, so there was likely increased liquidation on both the bull and bear sides to cover other bets. That might explain why gold went up and down all day, but never made it that far. Long wick on each side of the candle.

I think gold will lose when stocks continue their dead cat bounce.

Also, GDX looked like a series of 1-2’s today leading to the first of a few 3’s down.

I’m noticing that too.

It has to be considered in conjunction with the prior three upwards days on rising volume. If this is a bear market rally it shouldn’t have a volume profile with increasing volume as price moves up. It should be the opposite.

So overall the volume profile is confusing. Today’s volume spike says a downwards breakout should be expected. But the prior three up days say it’s a new upwards trend.

Conflicting information which may be resolved when we have a bit more information.

Bear market looms as S&P 500 snaps 5th-longest correction-free streak – Aug 24, 2015 4:47 p.m. ET

http://www.marketwatch.com/story/bear-market-looms-as-sp-500-snaps-5th-longest-correction-free-streak-2015-08-24?mod=MW_story_top_stories

The average overall decline after the end of the 4 longer correction-free streaks was 31%. The S&P 500 index’s fifth-longest correction-free streak (36 months) just ended.

The S&P 500 SPX, -3.94% tumbled 3.9% on Monday, to close 11% below its May 21 record close of 2,130.82

And if history is any guide, that means there is a good chance that a 20% bear-market selloff is coming.

Just a thought on the bear count…

Could today’s high be the end of a small five to end a 5 up? After reading parts of Frost and Prechter again over the weekend, I learned that diagonals are most common in the 5th wave position following a huge prior wave. In this case, we really did have a 3rd wave that went ‘too fast, too far.’ If the subwaves are threes – which I can’t quite tell – it would fit the bill perfectly. Diagonals in ending positions are, more less, exhaustion formations.

Not positive on the EW side, but that is one screaming bearish candle on GLD today. Higher volume than on the July drops.

Interesting. Is that for contracting or expanding diagonals? If it were one, i think it would have to be expanding.

Still, hard to see it other than as a 3. And to the naked eye, it looks like it could be the b wave of an expanded flat that would be a fourth or second wave. But it’s far from obvious.

Against my better judgment i kept my short position which is back in the money to see what tomorrow will bring.

I believe contracting because participation diminishes. I too am still holding on to my short positions and waiting for tomorrow.

Phrase ‘too far, too fast’ was used incorrectly here. Should be applied to reason for truncations.

My personal approach to this market will be this:

The blue trend line on the daily chart is holding. It looks like we have a correction unfolding sideways. It will probably take a few days.

When price breaks above that blue trend line I’ll look at structure carefully of the upwards movement that manages to do that. If it looks like a clear five I’ll expect the next impulse up may be beginning. It may be a fifth wave which for Gold may be swift and extended, a great trading opportunity.

I’ll then wait for a throwback to the blue trend line. When price touches it I’ll look for an entry point for a long position and put my stop a little below the trend line (they sometimes are overshot).

I’d like to ride the next wave up now that my equity is released from my NZDUSD trade and my Oil trade is nicely positive and my stop can be moved down to protect profits.

Can we get down to 1131 still ?

Certainly. This fourth wave is not done I expect, it should take longer than one day. The final C wave (or Y wave) may get down to 1,131. That would see the fourth wave end about the 0.382 ratio which would be a reasonable expectation.

It doesn’t have to do that, but it is entirely possible that it should.

There are 23 possible structures this fourth wave may unfold as. At this stage we can only eliminate three, the zigzag family. All others are possible. So I cannot tell you exactly where it will end, my goal will be to tell you when it is over and what to look for to see confirmation it’s over.

How the market carnage is deepening, in four charts – Aug 24, 2015 9:30 a.m. ET

http://www.marketwatch.com/story/how-the-market-carnage-is-deepening-in-four-charts-2015-08-24

Lara, I’m hoping you can send us a quick excerpt on which count we’re in — minuette iii or minor 4– before taking the time to scroll through all your comments. There are a lot. 🙂

It’s choppy and overlapping. There’s no five down. It looks corrective.

I’m not going to rule out the bull wave count until it’s either invalidated by price OR the blue channel is clearly breached.

Both wave counts remain viable.

Thank U!!!!

HUI miners index and US dollar chart today

https://www.dropbox.com/s/7az25t0iw7o4mf3/HUI.png?dl=0

Tham your target high of $25.00 for DUST at gold low of 1,13X has already been exceeded as day high so far is $25.90 at 3:06 pm up from day low of 20.60 at 10:20 am.

An amazing run of 26 % from the DUST low to high.

GDX down $1 or 6.7% since Friday close.

Hourly alternate (bearish) wave count was clearly invalidated with movement above 1,168.41 at 9:31 am.

Gold pattern since Friday close has clearly been following the patterns in Lara’s hourly wave (bullish) count. Yes bullish even though gold has been going down. Gold bullish has to drop to maybe 1,131 before heading up towards $1,300+ area.

Daily alternate is still valid although not the preferred count.

The bear count for the bigger picture is still valid. But the probability is reducing.

little boom to the downside here on gold.

Lara

Your ALERNATIVE wave count is where we are going – its SPOT ON –

The possibility for an approximate $100 DROP in gold is looking extremely strong –

Could be quite an adventure

Regards

Laurence

it sure would be nice, but I show the hourly invalidated early this a.m. @ 1169.86. Think there is a small revision to this chart retaining its overall structure/direction?

edit: guess thats possible… because daily is still good

Could have still been part of the wave ii correction to a slightly new high.

great. I hope this was all a bull trap (sorry bulls). Risk on ward and upward.

Thanks Laurence for the reminder. Was stuck on the main.

Been seeing a lot of experienced traders doing well in today’s volatility– congrats!

I’m just looking forward to Lara’s analysis today of where gold is today–the subminuette within minute of minor 4 (with targets of course). Can hardly wait.

Could be a big reversal candle on GLD Daily today.

Wild day…Nasdaq futures moved nearly 400 points (10%!) off of their lows…everything is a 3x ETF today, and 3x ETFs are 9x ETFs with this volatility.

Bonds are turning red, yields moving up. Risk on?

Tham you mention we are still in Minor 3. Why is gold following Lara’s hourly bullish chart patterns since Friday close and thus indicates gold still in Minor wave 4?

Hourly bullish chart – targets 1,167 then 1,145 then 1,170 then 1,131 then up much higher. Gold has sort of been following that since Friday close.

Richard. My mind was fogged up with the new high particularly as it jumped onto the screen when pmbull suddenly came out of coma. But no excuses. Guess I still have a long way to go to rein in my emotions. Meditation perhaps?

Now it is crystal clear as I explained below with the expanded flat. It might take a few days though to complete. But I guess I am still sitting this one out. DUST is still quite erratic at the moment. Maybe it is torn between its need to depict the gold market and of being a stock. Something like being pulled by two opposing forces. S&P ETFs and oil were the stars of the day. Made a respectable profit from those two. Now everything seems to have simmered down, exhausted from the wild gyrations. I am tempted now to call it a night.

Wave count anyone?

Gold hit Lara’s target of 1,170 on bullish hourly chart.

Is the next movement today down deep as chart shows 1,131 for minor wave 4.

DUST averaging up since 10:20 am low of $20.60, now at $23.20 (Direction change every 5-10 minutes during ascent.)

I’m assuming that GDX is being dumped as DUST moving up even as gold moving up.

I think a 3 wave down on Friday formed an A wave and now a B wave up may be complete at today’s high. If correct, gold would be in the infancy stages of a C wave down to take it to 1140 or below. This is just my best guess.

I am not really comfortable in the current gold environment and am just using ups and downs to unwind my positions. I’ll jump back in when I get more clarity.

I agree in wave c down and towards next maybe 1,131?

Sounds reasonable. C waves can be longer with 5 waves, so this may take a couple days.

Just a reminder, Lara wrote that this minor 4 could take 5 to 8 days…if its a minor 4.

Gold made a new high at 1170.17.

I take it back. You all are right after all. There were 3 waves up, not 5, in Minor 3 which means we are now still in Minor 3. Now, it seems that the fifth wave has only made 3 subwaves. If so, then there should be another new high before a correction occurs (if the market is bull). Alternatively, it would be a plunge if bears regain their supremacy. I have been staying on the sidelines in the gold market since Friday. There are too many twists and turns to my liking. Every analysis I make seems to be wrong. I concede that he who guesses better is the winner.

The move up since Friday looks corrective. Seems like we need to move below Friday’s low before we can move to a new high.

I believe so

That is correct theoretically. But a new high? I am bamboozled by that. One possibility I can think of is that Minor 3 is not complete yet. Another one is that Minor 4 is an expanded flat, and the down move will be very deep.

I’m going with an expanded flat.

Yes. It looks like it now. A deep correction towards 113x for completion of Minor 4.

Technically it may be a regular flat because (b) is 109% of (a).

An expanded flat has (b) minimum 110% of (a).

A regular flat has (c) = (a) most commonly.

But this is probably only minute a (or w) within minor wave 4.

Choppy, overlapping, sideways for a few days.

Quite honestly, none of this makes any sense to me. All I know is what I see immediately right in front of me, namely that gold is correcting in some fashion. The expanded flat looks best.

That said, I do see the move up from the July low as a clear 5. There’s a conflict there – I know. My objective now is just to unwind positions until I get a handle on what this is.

Matt. I think it is a wise move. It is better to be safe. As I said, I got out last Friday and have been on the sidelines ever since. The path now is clear, gold going down to 113x. But ETFs are still behaving quite unpredictably. I have calculated that DUST would rise to around 25, but now I am not too sure.

A deep correction towards 113x for completion of Minor 4.

Yes, that is what Lara’s hourly bullish chart looks like for a lower target of 1,13X before climb towards a bullish trend. DUST $25 sounds interesting.

I agree with Dreamer, down first, then up.

3 reasons stocks are tanking – Aug 24, 2015 10:33 a.m. ET

http://www.marketwatch.com/story/3-reasons-stocks-are-tanking-2015-08-24

My take on Elliott Wave (shared on Aug. 16), was that: “A break below 2,052 may indicate a wave 3 lower for the S&P.”

This decline may turn into a 5-wave move (according to EWT) similar to the 2011 correction.

Financial websites may be overloaded today and slow due to a sort of Tsunami in almost all markets.

Huge delays accessing http://www.pmbull.com but now up

TOS website is taking 2 minutes to refresh when I change time frames and usually instantly as I have fastest internet.

gold is wild and GDX wild and DUST super wild today up and down a lot every 5 minutes like a rodeo.

It’s a field day for scalpers. Fortune favors the brave. Some will most probably make more money in one morning than in one month. On the flip side, deep losses would also occur. It’s a zero sum game.

Guys/ladies. Is pmbull working? Mine is dead. Portending pmbear?

Mine is still auto-updating. I have seen times in the recent past where auto-updating continues to work on one machine but reloading the site on another machine fails. i use the non-flash option.

http://www.pmbull.com was not accessing from 9:30 until last few minutes and now up 10:05 am EST

That is precisely my case. That’s why I said the bears were flexing their muscles. They can’t bear to lose the stranglehold they have been enjoying for the past four years. LOL.

TVIX opened up 74%, I wonder if Tham was in?

Immediately cashed out. SPX is now undergoing the dead cat bounce. There will be another large opportunity. Just patiently waiting …

Tham, will you ride the bounce up or catch the top and ride it down?

No, I was out at the open. I always trade with the trend. I’m waiting for the bounce to complete before entering again. This dead cat seems to be filled with helium. SPX was down nearly 100 points, and then rose 60 points. Currently at an inflection point — 61.8% retrace.

Tham, thanks, was just wondering if a skilled trader trader went against the trend. Filed your answer under My Education.

To CFE,ECBOT,GLOBEX,NYBOT,NYMEX,NYSELIFFE traders:

Mon Aug 24 08:40:32 2015 EST

In light of the notable volatility in global markets, we are temporarily suspending intra-day margin release. Please monitor your accounts accordingly to ensure margin compliance. Any account not in margin compliance will, as always, become subject to IB-initiated liquidation.

Just got the same message. It’s not just a bloodbath in world stock markets, but the dollar now too has broken multi-month support.

A small triangle is forming in 1h.

support around 1150-1153 Resistance 1164-1165

Most probable break will be to upside.

Target 1177-1180

IMHO the bears are in it as long as 1172-73 is not taken out and would need a break below 1152-51-46; on the upside Gold price is having difficulty reaching above 100dma 1166…. Topping cant be far off~!

Lara,

Great call on oil.

Thank you.

And the S&P500.

My last video expected “explosive” downwards movement. And it happened. I think that may be one of the best calls of my analysis career to date.

EW expert Gary Wagner is bullish Gold and Bonds – bearish stocks and oil August 21

Reeling, Tripping, Stumbling, Falling and Looming

August 21, 2015 – 4:54pm

http://thegoldforecast.com/video/reeling-tripping-stumbling-falling-and-looming

Includes a video.

It would be interesting if Gold price can be held under 1165-68 for a take out of 1150 to test check a possible break below 1144-43 to go for the root 1121-20…. Wishful thinking as yet I guess with Gold price bouncing back up from 1152 lol….

It will be interesting to see how gold/silver hold up with the SM carnage tonight.

S&P futures down 40 point tonight due to global meltdown. The fear trade like gold should be higher tomorrow. Taking my profits on goldminers tomorrow…Selling into the fear. Happy trading.

Certainly the situation is unclear at the moment. This chart from Thirdeyeopentrades suggests a large bullish falling wedge. According to thepatternsite, these break upwards 68% of the time. An upwards break would support Lara’s new bull count. Also note the RSI and MACD divergence.

USD weekly chart looks bearish down to the proposed trend line, which also supports a bull move for gold over the next several weeks. Then a reversal back up and a break of the upper trend line would support the final big move down in Gold

Here’s another USD chart, this one is monthly. Overall it looks very bullish, since the break upwards from the bullish falling wedge, but it also could align well with the weekly chart above in that it looks like another back test of the wedge breakout could occur at around 92. When the USD hits around 92, that’s when gold will likely start dropping again as the USD moves up.

Rambus full post on currencies and world stock markets:

http://rambus1.com/?p=43150

That’s it for the Bounce in Gold, Silver and Miners – 4 charts – 08/23/2015 – GUNNER24

http://www.gunner24.com/newsletter/nl-082315/

Hello Lara!

Which broker have you taken chart? it look difference from my chart!

Thank you very much!

I’m using FXCM data for my Motive Wave work. And I’m back again to using FXCM as my broker.

For the regular technical analysis charts at the end of the analysis I’m using StockCharts.com

Gold and COT data

Upward /sideways zz action should increase shorts. Line up with Lara’s EW and trade gold accordingly.

The chart shows visually the up/down with COT commercial positions fluctuation.

IMHO barring the numerous various possible wave counts, Gold price is the one calling the shots lol… Gold price did get thrown back down about $20 from around 100dma / down trending resistance at $1170-71 but has menacingly crept back up, is currently bottomy at $1150-$1140 with strong support at $1149 and weak resistance at $1161-64…. On weekly out look basis Gold price is looking to rally (short term up move), the shorts may want to consider liquidating and take to the sidelines…. On the upside it would be interesting to see Gold price reaction at 20week moving average $1174-75, at 200dma $1188-89 and at $1191-92 (50% retrace of H $1308 / L $1073) where is also 50dma on weekly basis…. Gold price has closed above its pivot currently hovering at or around above the upper band with daily RSI tagging 70…. Don’t know how long Gold price can sustain this level and gives me a sense that Gold price ought to be topping soon to fall off the cliff… StochRSI on 8hrly/daily is highly overbought, likely to be more overbought but pretty close to topping…. It would be interesting to see if downward corrections can get Gold price below 50dma with a rising 10dma below there to likely curtail…. I guess as long as Gold price remains above 20dma, Buying on the dips would probably be the way to go…. A break above $1197 would likely open up upside risk $1209-11 through to $1256…. Got to watch how this pans out.//// 5dma is about primed to cross above 50dma which should be bullish….

Lara,

Does it matter that primary 5 is truncated, or at best ends at the same level as primary 3? I know that you often emphasize that 5th waves after triangles can be surprisingly short, but this seems off.

The expanded flat within the expanded flat seems odd to me as well. It struck me right away when I read your analysis. Edward brought it up below and I saw your reply. However, I am not certain if that works. It just seems like gold has made too many drops below primary 5.

I’ll keep an open mind to all of this. In the meantime, I have been re-reading Frost and Prechter to look for more answers.

The best alternative I have at this time is an expanding diagonal for primary 5 down. My thought was that primary 3 was ‘too big, too far.’ However, I am not sure if a diagonal can come after a triangle, especially one that lasted a whole year!

What you have as primary 5, I have marked as intermediate 1 within primary 5. Intermediate 2 is an expanded flat. Intermediate 3 was a big three wave structure that ended at the July low. Intermediate 4 would be in progress now, with wave A perhaps complete.

You do great work. Even though I am a little at odds with your current publication, you can count on me to stay.

Primary 5 is truncated by 2.66. It’s a truncation yes, but it’s pretty small. That may actually be the biggest problem with that new wave count.

Primary 5 just does not work as an ending diagonal. I’ve most certainly looked at that idea in depth. The problem is the wave up I have labelled intermediate (C) within primary A; it would need to be a zigzag for it to be the second wave within a diagonal, and as I’ve outlined it just won’t work at the daily chart level or any other level.

Intermediate (2) as you propose within an ending diagonal may not be an expanded flat. A second wave within an ending diagonal may only be a zigzag.

The bear wave count is still viable. It sees intermediate (2) as an expanded flat. But within an impulse for primary 5. Because a diagonal just does not work.

Thanks for clarifying.

That a primary degree 5th wave is truncated and overshot MULTIPLE times still makes no sense to me.

I’ll just tread lightly until we get more clarification.

One thing that I am really looking at these days, especially since this last analysis, is the scale of this current bear market relative to the prior multiyear bull.

The last bull market (5 waves up) is widely recognized as being about 12 years in duration. Gold has now corrected approx. 4 years. If it’s five waves up and three down, this correction should last about 3/5 of 12 years or 7.2 years. That would place gold right about in a corrective C wave where you suggest.

That’s what expanded flats do. They make new price extremes in the trend direction. So do running triangles.

That it comes after a small truncation really isn’t material. What is material to the truncation is did it come after a very strong move that could be described as “too far too fast”. I think the end of primary 3 could be described as that.

Hello Matt, I’ve been paying particular attention to your comments for some time. I am more or less in agreement with your assessment. Intermediate 4 bull trap. And the illegal expanded flat in wave 2 is still the prettiest solution to my eyes.

Lara is providing ew analysis based on the best numbers she can get, none of which come with a measure of their accuracy or precision and seem to change from from day to day now. But what other choice does she have. She has to play by the rules. Heroic is how I describe her efforts to myself. I’ve never paid anyone for their opinion before, but I pay Lara now.

My *mood* is the mood you’d expect from a frustrated trader stuck in a primary ending diagonal. Some of the instruments I trade are marked up as expanding and some are contracting, but I have them all in the final wipe out of a dying bear, still trying to bite my head off, now with a cycle wave whipsaw, not a young bull teasing me to take a quick ride to easy street.

I think market mood trumps the numbers. Your thoughts?

o7

It’s always easier to swim with the current than against it. Since gold has moved up so powerfully, I want to reevaluate. While I definitely still think this is nothing more than a correction within a bear market, it is not totally clear to me how high it will go.

I am going to exit and reposition myself when I get more clarity. That may be very soon, but I would rather be safe than sorry right now.

Bollinger bands have been overshot and RSI is getting closer to oversold. This can go on for a little longer, but not much. An answer should come next week.

Wise words

GDX analysis will be published today.

It has a bull and a bear count.

The bull has three different structures of it’s primary wave B. And please note: these three ideas work in exactly the same way for Gold there for cycle wave b.

The analysis here for Gold has only one possible structure for cycle wave b, that of an expanded flat.

But there are 23 possible structures for a B wave. Here we can eliminate a zigzag or zigzag multiple. That leaves 20 possible structures if you include all the possible combinations and different types of triangles.

From Monday onwards I’ll publish three different ideas for cycle wave b at the weekly chart level: an expanded flat (which is the one published here), a running triangle and a combination. Short – mid term they’d all expect upwards movement.

Papudi – your concerns regarding the Oil / Gold ratio may be ameliorated by the huge triangle idea for cycle wave b.

Correction,

I can’t reply to my triangle comment (won’t let me)

I realize the error in the degree of labeling for this idea.

Should be intermediate instead of primary and if so the triangle would be too small but nonetheless my point is to eliminate numerous possibilities through sound technical and fundamental analysis

Forum does not allow reply to MTLSD August 22, 2015 at 5:01 pm so I copy it here:

“This would all essentially push the ~$900 gold into April 2016.”

I like Martin Armstrong cycle theory as 2nd opinion for big picture gold—as of several months ago Armstrong projected gold in the 900s, probably by late 2015, but secondary timeline of April 2016.

Yes, Martin has a nice long article out from today/yesterday discussing in more detail the capital flows and possibilities. I think his gold targets are reflected in the two wave counts we have right now.

Given how few shorts the swaps are taking on, I can see the specs getting squeezed like the new wave count suggests.

Look at July to November 2008, this was the last primary degree C wave we have had, but it is in the opposite direction to the current wave above. I’ve been looking at it inverted to help me visualize the possible movements and timing. It fits very well with the 10 weeks remaining that Lara discusses above.

I will be moving out of my DUST in the coming days as this 4 unfolds, I like the new wave count, it fits with other analysis I use. I have been trying to figure out how we would drop another $200 with where all of my analysis was, and I put too much emphasis on the EW count in front of me, and not enough on my own. When the two don’t agree, I need to be watching. With the new wave count, the two are lining up.

Lara, regarding your new count.

Minor 1 (right after primary B) does NOT fit as a five wave structure. It’s a 3.

I zoomed in on a five min chart and the best fit is a wxy combo. If it’s a five wave structure, I certainly don’t see it.

But if it’s a 3, then that implies a leading diagonal, and this is meaningful because that means blue 4 would have to retrace into price 1 territory (1108.85).

And if I am right, which I believe I am, we could see gdx over-react to the downside as it is sold-off along with everything else on the tumbling broader markets. I wouldn’t be surprised if it makes a new low. I would suggest taking a closer look at gdx and some of the larger gold companies for some insight.

That would also mean intermediate 2 would be a very deep correction probably dropping from ~1240 back down to 1090 area, with the drop starting probably right at the Sept. FOMC meeting on 9/17 and lasting a few weeks, then a huge run into the end of the year maybe to the 1400 target. Then cycle c starts and makes new lows.

Intermediate two would be deep… True.

The idea of having an overlapping (squashed) impulse fits with the fact that gold is being pulled from the downside as part of the larger trend

This would all essentially push the ~$900 gold into April 2016.

Right, and what if cycle degree “b” is a triangle in its entirety ? We would have A and B of the triangle complete while moving into primary C right now. C waves are often complicated structures and a leading diagonal would fit well into the wedge. The Feds are split 50/50 on whether to raise interest rates . This uncertainty may reflect in the form of a (volatile) triangle moving sideways. Many possibilities to consider.. But perhaps we can narrow down possible structures by comparing them to current events/fundamental and careful TA. We are in a wave B within a wave 4 -nasty nasty nasty…

And you’re quite right on another point. I also need to consider cycle b as a huge triangle.

I don’t think it’s a combination though, because their X waves aren’t usually that deep. It could be an unusual combination.

B waves are awful. So many structural possibilities.

My work yesterday was my first outline of the new idea. It will need alternates to run alongside, and I’ll begin to publish what I think are the most likely on Monday. Overall they’d all expect the same direction, up.

If cycle b becomes a triangle, at least it will give us some easy stops to use on trades.

It will fit as a five. There’s a gross disproportion between a second wave zigzag and a fourth wave triangle. But this is at the five minute chart level so it’s not a huge problem. No rules are violated.

I do certainly need to consider a leading diagonal though because you’re right, minor wave 1 does fit best as a zigzag.

I’ll add that idea as a new alternate next analysis.

Here is where I find Ewave bothersome. If an analyst is looking at a daily chart and is faced with a problem where he needs a five-wave count the search could go something like this:

“Need a five wave count”.

Let’s check daily chart…

Nope ! No 5 waves there.

Let’s check the hourly count…

Darn ! No 5 waves there.

Let’s check the 30 minute chart….

Rats ! No 5 wave here either.

Let’s check the five minute chart….

A-ha!! If I place 1,2,3 here and s-t-r-e-t-c-h “4” down yonder I can make it fit..

Well, this is where I start losing confidence in Ewave because 2&4 are grossly disproportioned, but yet, we can exempt the “right look” because we’re at a smaller scale.

This leaves the Ewave open to endless interpretation.

On your previous main count (alternate now)

You had this movement labeled green “A” as part of an ABC/335 structure and we ran with that idea for a long time. But now…. “A”/”3” has become a 5 because we failed to look at it under a 5 minute chart. So which is it Lara? How can I find confidence in Ewave when we flop around like this? I love your work but this is nuts…

And yet, you will make this idea an alternate? I don’t get it… Sorry….

Sometimes a wave is very clearly a three or a five. For example, intermediate (C) within primary A on the weekly chart. That movement on the daily chart will not subdivide as a three. It must be a five.

Sometimes it is ambiguous.

And if you’re looking for technical analysis of any type with zero ambiguity then you’ll not find it.

Fair statement.

But you see my point, right?

In any case good luck with this next leg It won’t be easy..

Regards

Oh yes, of course, I most certainly do see your point.

And that is one of the most difficult aspects of Elliott wave.

Sometimes threes look like fives and vice versa. Sometimes a wave can subdivide either way. Sometimes it doesn’t.

That along with what degree to label a movement (particularly at the start) is the biggest difficulty with EW. It’s infuriating, and I wish it wasn’t so. But it is what it is.

At the weekly chart level Gold almost always has waves which look almost textbook perfect and have the “right look”. So here’s another point to consider: at the weekly chart level that’s why I have not published an alternate idea which sees the big move down as anything other than 1-2-3-4-5 with primary 1-2-3-and 4 labelled as I have (since the triangle was complete). Because it’s obviously a five.

The new wave count sees the movement which I found so hard to analyse from March to May this year as a B wave (minor), within a B wave (intermediate), within a B wave (primary)within a B wave (cycle). And that right there fits perfectly, it was a nightmare because it was a B wave at four big wave degrees. B waves are the worst. That’s a bad as it’s going to get for years.

John, hindsight is 20/20. Forecasting gold isn’t 20/20.

That is why Lara gets a clearer understanding at a later point.

That is the way life works. So no need to blame EW or Lara.

That’s okay Richard, I don’t see him blaming me I just see he’s frustrated with EW. And TBH so am I. It is remarkably difficult. I share his frustration.

Exactly as I suspected…Daneric’s count with a different degree of labeling. Lara, I’m not annoyed at all with your change of stance since the facts warrant it. Since EW is more of an art than science, have you ever considered having a bull & bear count at all times? Maybe you update the one that supports your TA daily as usual and then update the other one weekly until it looks wrong. However once it looks wrong, you would have to find a new bull or bear that looks right. You kind of do this already on EWSM. It may help with all the rig-a-ma-ro you get receive from members.

I did for a long time have a bullish and bearish wave count and only stopped publishing the bull when price eliminated it.

I was also aware of Danerics count because a member posted it here, or a link to it anyway, and I did look at it. At the time I eliminated it because he’s seeing that wave up which I have labelled intermediate (C) of primary (A) on my weekly chart as a three. As I’ve previously explained it does not fit as a three. So I eliminated the idea on that basis.

What I should have done at that time, and hindsight is 20/20, was consider alternate ways to see his idea.

New bull market in Gold!!!! Think again. In commodities ratios of commodities tell the clues which TA will not.

Two ratios are pertaining to this site: Silver to gold and gold to oil.

Silver to gold ratio (SGR) is not showing the coming bull trend to 1400.

Looking at the SGR shows us that nothing has changed for the dynamic that drives a bear market in the PM shares. In a bull market silver out paces gold. In this rally of the past 3 weeks silver’s advance has not sustained itself relative to gold. That’s our big clue.

Below is the chart of SGR weekly it show how SGR was rocketing to high during 2011 uptrend. Even in 1980 high SGR topped highest. Ever since SGR has never reached that level.

Gold to oil:

This ratio has been in the range over 70 years between 26 and 6 and avg being 15.

If gold headed to 1400 and oil headed to 20 in next six months per EW projection the ratio will be at 70.

In history of these markets it has never happen.

Look at the $Gold:GDX ratio on a weekly level, it may rolling over, consistent with rises in gold/miners that lasts for a few months.

Papurdi excellent point that gold wont go to 1400 and oil to $22 in 6 months.

They tend to go in the same direction.

Well Lara, what a week it has been. You’ve certainly given us a lot to think about over the weekend! Once again, you’ve given us a look into your analytical mind. You knew something wasn’t quite right and you went back to the drawing board last night and you had an ah-ha moment with the new ending point for cycle wave a, which allowed all the pieces of the puzzle to neatly fall into place. That darn short 5th wave after the triangle did it again!

You fear that some members may be “annoyed an will leave”. Maybe so, but the smart ones will stay because they won’t find a more dedicated, detailed oriented, or better EW analyst anywhere. There’s plenty of money to be made by bull or bear as long as we get the direction right. I’m actually getting excited about the probability of two primary degree impulses in a row! Thanks for getting us back on the right path.

P.S. Would appreciate a new GDX count with bull targets when you get a chance, but maybe it’s best to wait for gold to show it’s hand with the trend line break first.

Here’s the new COT report. Commercials added to short positions.

COT Commercial short increase is not significant. Will have to wait for next week data. Increase needs to between 30k to 50k over two weeks.

Next week will be a tell all report.

Thank you Lara. Will study this in depth but looks like we’re on a better path now. Certainly, data is critical. For example, stockcharts data not only has different volume, but price as well – this new wave may be a second wave rather than a fourth wave according to stockcharts. It’s a frustrating thing and I’m a bit uneasy on how to reconcile that. On stockcharts, without looking at ratios it can be seen as a pretty clear 5 wave up from the bottom to me. I had mentioned the data differences before. Something to think about and not sure there’s a right answer

I know, it’s an issue.

Different data feeds will have different price points. Gold Spot should be a global market, but different data feeds will have portions from different parts of the globe… at least, that’s how I think it works, if anyone else here more experienced and knowledgeable than I knows differently please add your comment.

For the Elliott wave count as long as I consistently use the same price data every day the wave count will be good.

I cannot use data from StockCharts in Motive Wave. They’re not a data source.

I will only use StockCharts for regular TA, not EW. And yes, I notice the difference in price.

Lara: Stockchart data feed is from http://www.interactivedata.com.

I wrote this before in my post.

You may get a direct feed from them.

At the bottom of the home page Stockchart lists the name of data feed.

Looks like they have more than one data source. It also says that commodity data is from:

http://www.pinnacledata.com

I can’t use interactive data in Motive Wave.

That’s the problem. The limitations of data feeds for Motive Wave, particularly if you’re on a Mac. As I am.

Hi Lara, what an effort today’s analysis must have been. Thanks for looking at Primary 1 again, I threw away my lying data and checked GLD at an hourly level. The leading diagonal is indeed invalidated by a truncated fifth at two decimal points of precision. My Primary 1 concurs with yours now. I’ll have to adjust my projected fib time ratios.

The principle (not rule) of alternation as I learned it says something like self similarity shows up across wave degrees but not degrees that are adjacent to each other.

Your new main has a Cycle degree (b) expanded flat with a Primary (a) expanded flat leading it, i.e. self similar and adjacent.

Any thoughts?

Alternation is expected between waves of the same degree which move in the same direction.

So you should see alternation between second and fourth wave corrections within an impulse.

*edit: you may also see alternation between a first wave which may be short, and a third wave which may be extended.

Sometimes too you see alternation between A and C waves of a correction, for example, if A is a diagonal then expect C to be an impulse.

Within a flat correction you would not expect to see alternation between the A and B waves.

As long as the A and B waves meet the rules for a flat correction it’s okay.

I’ve seen plenty of flats where A is a flat itself. As long as the A wave is a “three” (but can’t be a triangle) the rule is met.

Yes that’s they way I understand it also. Alternation every other wave but not with the next wave. There are probably higher relationships, maybe in a 9 wave triangle you’d see alternation at a fifth position away.

I was referring to self similarity across wave degrees. I might have it backwards but somewhere along they way I learned to look for the same wave pattern 2 degrees away from where I found the original. The count seems especially pretty if you find something like the common expanded flat at say a minor degree and then zoom out and find it again at the primary skipping over the intermediate. Wish I could remember where I read that. Anyway it’s not a rule so its not mandatory behaviour.

An example

and an expectation (but thats not by any means a prediction)

Thank you Lara,

I appreciate your care and attention to detail, and also your willingness to change your analysis when the facts dictate it.

I came here a couple weeks ago after about two and a half years as a happy subscriber to your EWSM analysis. Excellent work on both these challenging markets!

Unfortunately, unlike Alan, I pretty much ignored the S&P yesterday and today. I perhaps need to be a bit more nimble to keep an eye on both S&P and Gold.

Thanks Curtis.

I fear my switch today will mean a lot of people are annoyed and will leave.

That’s okay. There’s nothing I can do about that now except to learn from what went wrong and not make the same mistakes again (I’m sure I’ll make entirely new ones!).

There’s absolutely no way I’ll always be right.

Sorry you missed out on that big move which happened for the S&P as I’d expected. We waited a long time for that. I did get some… negative correspondence on my stance before it showed up too. That’s what usually happens, I’m somewhat used to it now 🙂

For the S&P it’s quite exiting at the moment. It’s not over yet either. The structure is incomplete. I’m expecting a Dead Cat Bounce (love that term!) next week….

And I took a look in my local “news” and only found a mention buried in the business section for that pretty big move by the US markets.

Hi Lara. That is the reason why I don’t look at the news when I trade. Also, the self-professed gurus that appear in the financial news interviews. I strongly suspect that they have a hidden agenda. Powers that be may be adamant that the stock market must be propped up, and would only concede if there is glaring evidence to the contrary. Hence you see only a small mention in the local newspapers. They are perma-bulls either aligning themselves to the populist view or are beholden.

So-called financial gurus that appear on TV may be “bought” over by the entities with clout to further their cause. A simple case in point is that you may have noticed that almost none of them report on non-glamorous stocks, but always on Apple and other bellwethers. Even financial commentators have been known to dish out advice but have never traded a single day in their lives.

So it makes me wonder why all these have a loyal following.

Lara;

Your new wave count make more sense to me if I compare your analysis on S&P which is bearish now to Gold. But, I’m just wondering , when you are doing the analysis from the longer time frame , did you correlate Gold with S&P and Gold with currency ( especially NZD) ?

Lara, have you considered the entrepreneurial possibilities of catering to people who only want to hear what they want to hear? A new EW site titled “EW Solutions You Prefer” which conducts a daily online poll and subsequently you provide a bull or bear EW analysis based on poll results? Heck, some people will gladly pay extra to hear what they want to hear.

Obviously the above is a (weak) joke. Seriously, I hope you will just continue to to give us quality, unbiased EW analysis.

My mind has been blown, I’m not in Kansas anymore. I’ve entered the Land of the Wizard of Oz or should I say the Wizard of EW. Where the path is paved in 24 kt Gold and around every corner is an adventure where perils may lie, yet I travel in peace, joy and prosperity as I know that if I get led astray, Lady Lara is only a few hours away from getting me back on the path to the Pot of Gold under the Rainbow. My days trading gold are filled with daily adventure. Life is good.

LOL. Yes, a pot of Gold.

I’ve closed my NZDUSD trade and opened US Oil which is now nicely positive and so I’ve moved my stop to just below my entry.

My equity is now freed up for the next trade, and I’m happy to hold two positions. I think I’ll be trading this one up with you all.

As I say in the video, I’ll wait for a breach of the blue channel and a throwback. Then I’ll look for my entry point.

The stock markets are moving very strongly lower. At least I picked one huge move right this week!

Lara, are you long oil now? I thought in your last EW analysis on August 16th you said that you were expecting $32.7 unless if downtrend-line doesn’t hold.

No, I’m short. Because the trend is down, and price remains within the channel. So yes, I’m still expecting price to keep falling towards the target.

Richard. Follow the yellow brick road.

I did, and I was the only one to call an end to the rise at 1168.40. There was a clear-cut 5 waves up, don’t know why everybody saw 3. That was when I exited my DUST for a tidy profit but I missed the crazy surge after that. Most likely, some entity is driving up prices for their own exit before the steel door slammed shut on the greedy ones. In a way I am thankful for not being sucked into that whirlpool. After that, my fears have been confirmed when Lara came up with a bullish scenario which she deems more likely. Now I’ve got to rework my DUST for a bullish count.

PS. Sorry guys / ladies that I did not stop to explain how I saw the 5 waves. Now Lara had done the job beautifully. I was busy scalping S&P’s drop and oil’s bounce at the same time. I concentrated on those two for the rest of the day as I have already closed my gold positions. Shorting S&P had been a field day, an infrequent opportunity.

Nice one there Alan, S&P has moved strongly lower.

And I expect it’s not done.

I won’t trade that particular market though, especially in a bear market. It moves so fast and it’s so volatile, the bounces can take you out quickly. I’ll stay away from it and wait until the bear market bottoms when I plan to use Elliott wave and the in-depth information in Magee to pick some cheap stocks to buy.

Interesting… that’s the the main reason I’ve shifted my trading interest from S&P 500 to Gold and miners ETFs. S&P can be so dangerously choppy, while Gold and miners seem to move bigger but slower.

After the bear market bottoms out, and (hopefully) interest rates have normalized somewhat, I hope to pick up some good dividend-paying stocks. Until then, careful, prudent trading in Gold and miners ETFs seems best.

When trading volatile markets, you need to scalp and not hold. Quick in and quick out. And set very tight stops. Be disciplined. I know it requires intense concentration but the rewards are worth it. It is not often that such an opportunity presents itself, so make the most of it while you can. TVIX and UVXY each rose by more than 30% in one single day. The gains are magnified when you scalp.

Tham I think we were looking for 5 waves down from the high not up to the high?