Downwards movement unfolded exactly as expected.

Summary: The main and alternate wave counts today are judged to have a close to even probability. Classic technical analysis today favours the alternate and more downwards movement. A new low below 1,310.84 would indicate the alternate is correct, so expect price to continue lower to a target at 1,279. A new high above 1,341.45 would indicate the main wave count is correct, so expect upwards movement to continue with strengthening momentum and volume to a target at 1,582.

New updates to this analysis are in bold.

Last weekly charts, and a more bearish weekly alternate, are here.

Grand SuperCycle analysis is here.

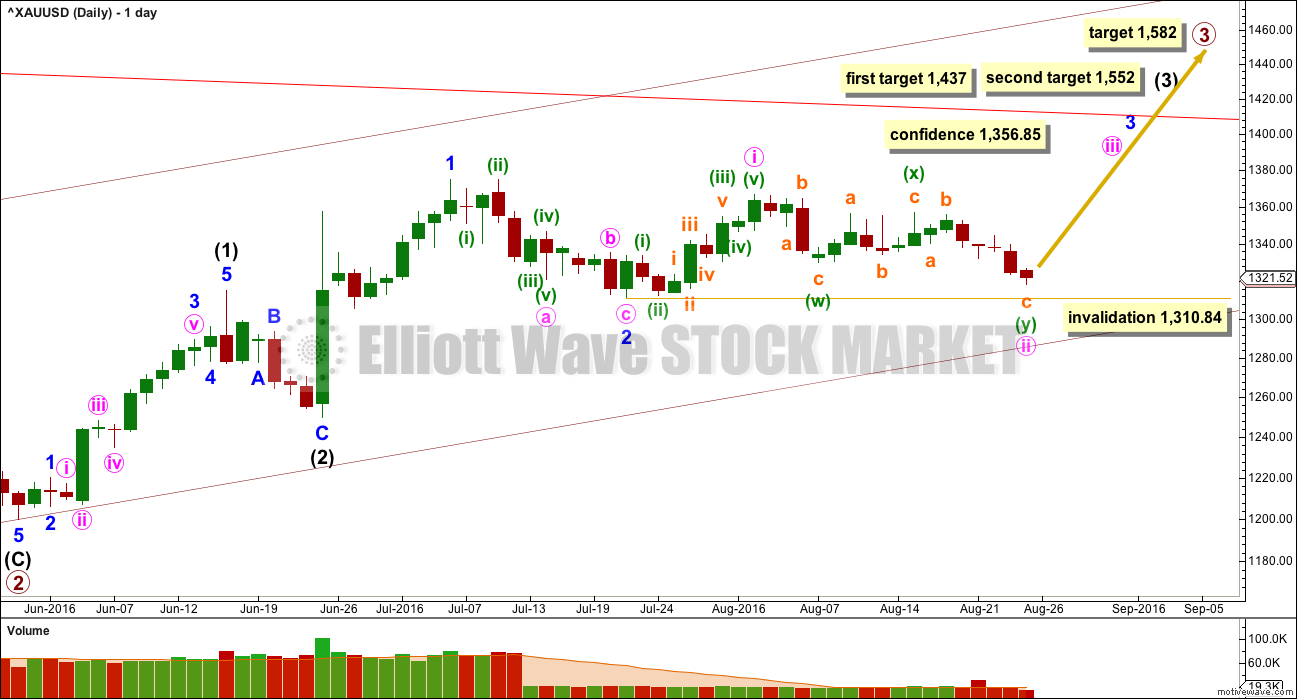

DAILY ELLIOTT WAVE COUNT

Primary wave 2 is a complete expanded flat correction. Price from the low labelled primary wave 2 has now moved too far upwards to be reasonably considered a continuation of primary wave 2. Primary wave 3 is very likely to have begun and would reach 1.618 the length of primary wave 1 at 1,582.

Primary wave 3 may only subdivide as an impulse.

So far intermediate waves (1) and (2) may be complete within primary wave 3. The middle of primary wave 3 may have begun and may also only subdivide as an impulse.

Within intermediate wave (3), the end of minor wave 1 is moved up to the last high. This fits on the hourly chart although it looks odd here on the daily chart. There was a small fourth wave correction up at the end of minor wave 1 and it subdivides on the hourly chart as an impulse. Minor wave 2 may be a complete zigzag, also subdividing as a zigzag on the hourly chart. If minor wave 2 is over, it would be 0.50 the depth of minor wave 1.

Minute wave ii is incomplete. It may be subdividing either as a double combination or double zigzag. Within the second structure in the double, labelled minuette wave (y), the structure is incomplete.

Minute wave ii may not move beyond the start of minute wave i below 1,310.84. This is the final risk to any long positions entered here or which members may still be holding. At this stage, I have chosen to close long positions, taking a little profit. I will wait for minute wave ii to be over before entering again.

At 1,437 intermediate wave (3) would reach 1.618 the length of intermediate wave (1). If price keeps going upwards through this first target, or if it gets there and the structure is incomplete, then the next target would be at 1,552 where intermediate wave (3) would reach 2.618 the length of intermediate wave (1).

A new high above 1,356.85 would invalidate the alternate wave count below and provide price confirmation of this main wave count.

Primary wave 1 lasted 14 weeks and primary wave 2 lasted 12 weeks. Primary wave 3 should be longer in both price and time as it should be extended. It may be about a Fibonacci 34 weeks. So far it has lasted eleven.

At this stage, the duration of minute wave ii is now giving this wave count an odd look in terms of proportion. Minute wave ii has lasted 17 days, minor wave 2 lasted 11 days, and intermediate wave (2) lasted 6 days. Each lower degree second wave is taking longer in time where normally they should be more brief. For this reason, at this stage, the alternate has a better look at the daily chart level today.

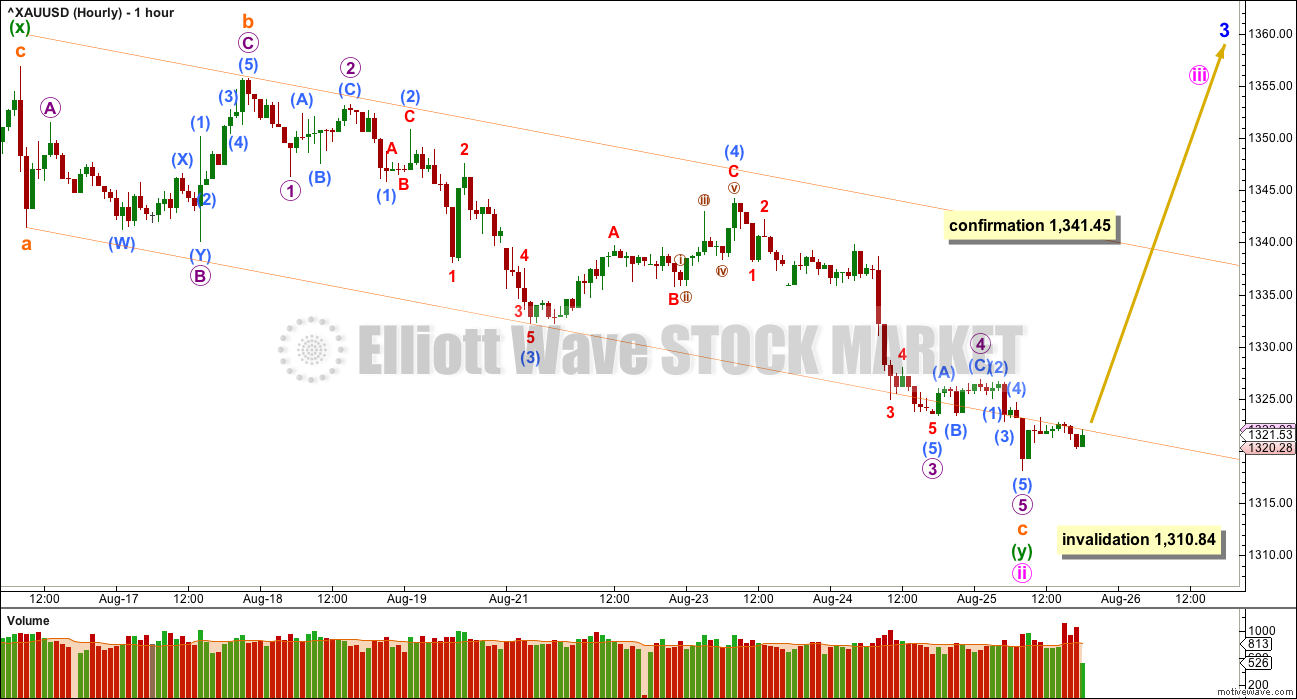

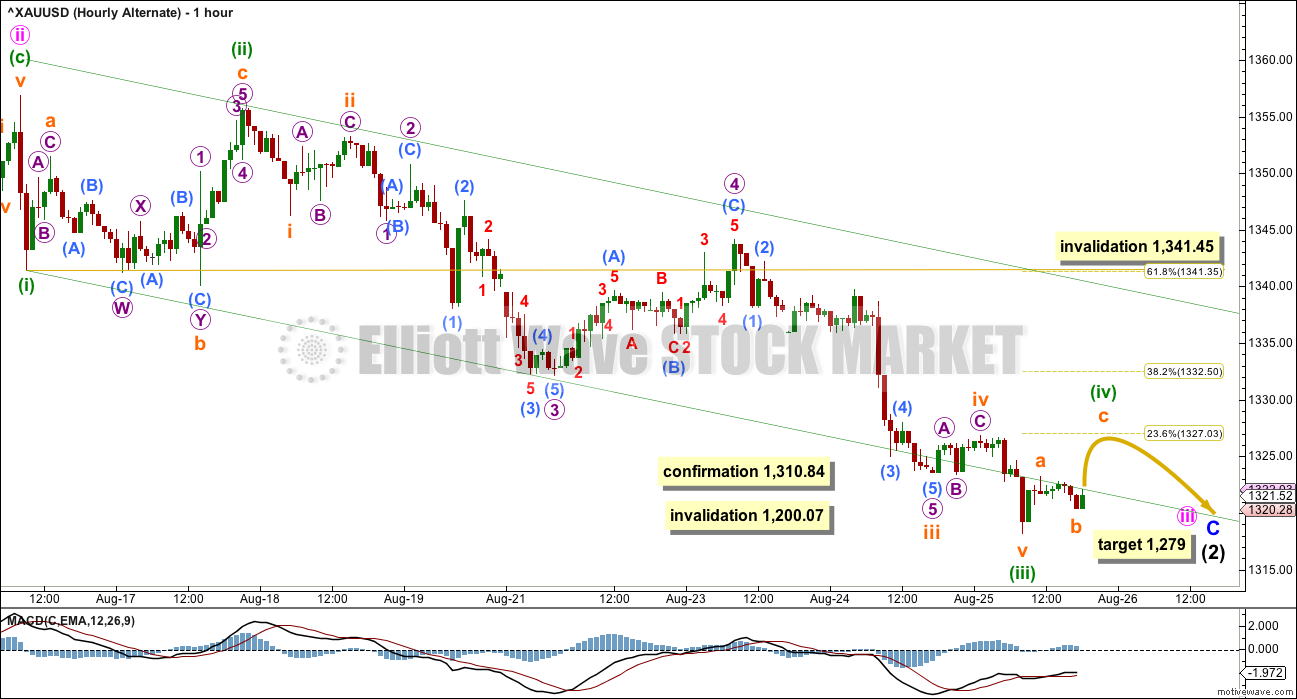

HOURLY ELLIOTT WAVE COUNT

Minute wave ii fits as either a double combination or a double zigzag. The first structure in the double (seen on the daily chart) fits as a zigzag labelled minuette wave (w). The double is joined by a three in the opposite direction labelled minuette wave (x), which fits perfectly as a zigzag.

The second structure in this double may now be complete. It will subdivide as a zigzag and looks best as a zigzag. Minuette wave (y) has moved comfortably beyond the end of minuette wave (w) deepening the correction and achieving the purpose of a second zigzag in a double.

It is possible that labelling within subminuette wave c is wrong because it may still be yet to complete with another low. A breach of the invalidation point by any amount at any time frame would fully invalidate this wave count and confirm the alternate.

A new high above 1,341.45 is required for confidence in this wave count. At that stage, a third wave up at four degrees should be expected to be in the very early stages.

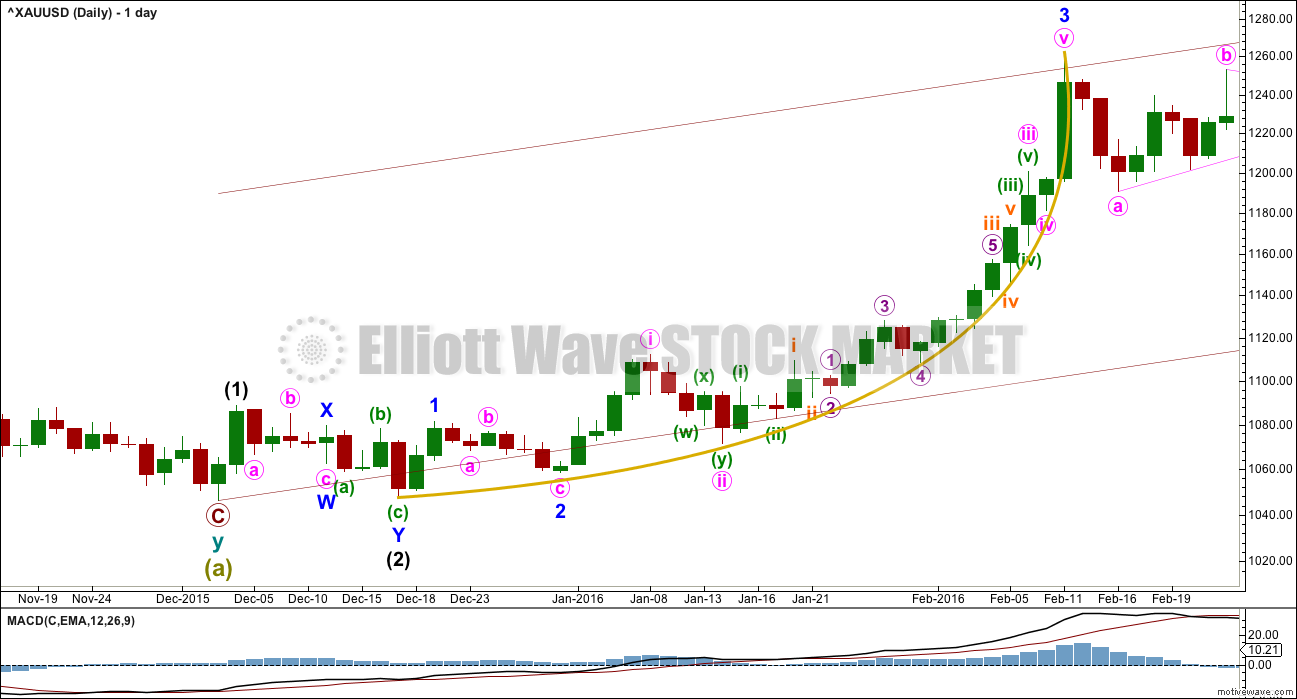

THIRD WAVE EXAMPLE – DAILY CHART

In discussing the curved look to Gold’s impulses, particularly for its third waves, here is an example.

Within primary wave 1, the third wave of minor wave 3 had a strong curved look to it. The impulse begins more slowly and has deep and relatively time consuming second wave corrections: Minor wave 2 was 0.68 of minor wave 1, minute wave ii was 0.76 of minute wave i, minuette wave (ii) was 0.56 of minuette wave (i), and subminuette wave ii was 0.64 of subminuette wave i.

The curved look comes from the disproportion between second and fourth wave corrections within the impulse. Here, minute wave ii lasted 4 days and shows clearly on the daily chart yet minute wave iv was over within one day and does not show up with any red candlesticks or doji on the daily chart.

Momentum builds towards the middle of the impulse, continuing to build further during the fifth wave and ending in a blowoff top. This is typical of Gold and all commodities.

This tendency to blowoff tops and curved impulses is particularly prevalent for Gold’s third waves.

Notice also how this third wave began with a series of overlapping first and second waves. When third waves extend, which is very common, this is very often how they begin. When that happens, they convince us the market will not move strongly and the wave count must be wrong, and they do that right before the trend moves clearly with increasing momentum and volume.

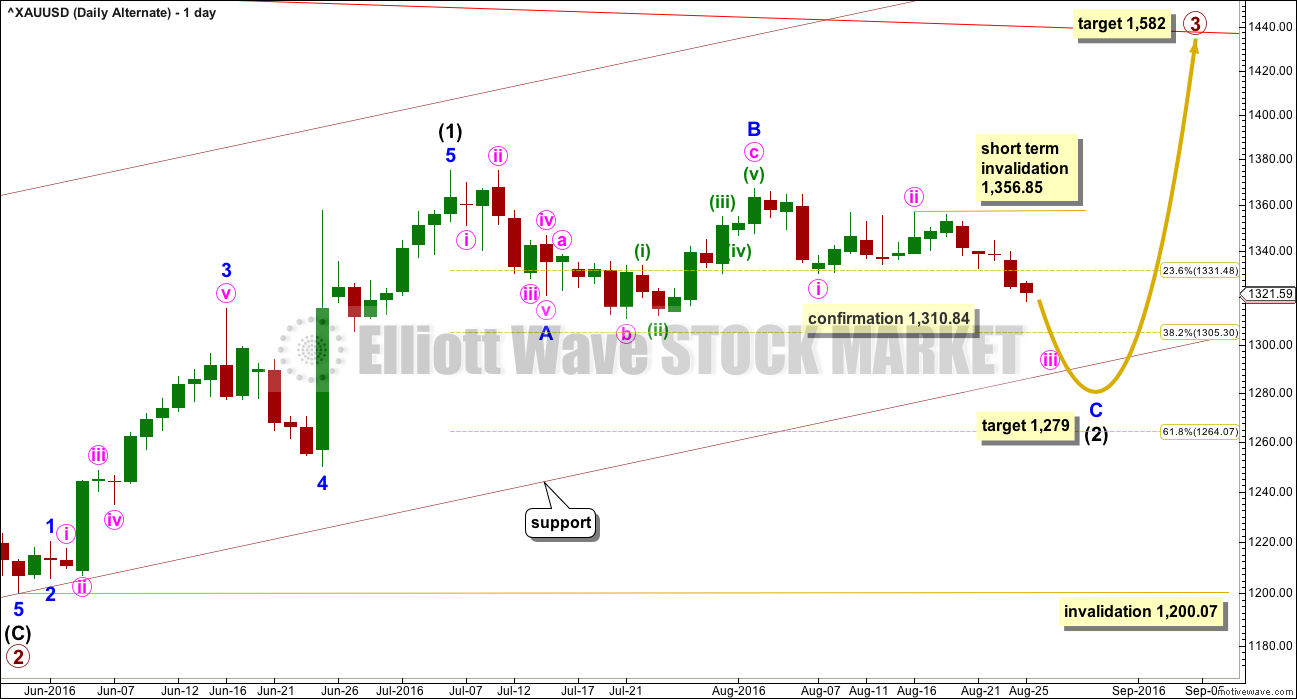

ALTERNATE DAILY ELLIOTT WAVE COUNT

This wave count is identical to the main wave count up to the end of primary wave 2. Thereafter, what if only intermediate wave (1) ended at the last high?

This movement will fit as a five wave impulse, although it does not have a very good look on the daily chart. This reduces the probability of this wave count.

If intermediate wave (1) was over at the last high, then it may have lasted 27 days. So far intermediate wave (2) may have taken 36 days and would still be incomplete.

Within minute wave iii, no second wave correction may move beyond the start of its first wave above 1,356.85.

At 1,279 minor wave C would reach 1.618 the length of minor wave A. Price may end downwards movement when it finds support at the lower edge of the maroon base channel drawn about primary waves 1 and 2.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,200.07.

Primary wave 2 lasted 56 days (one more than a Fibonacci 55). So far intermediate wave (2) is more brief in duration. It has lasted 36 days and may be just a few days away from completion. At this stage, this wave count has better proportions than the main wave count.

ALTERNATE HOURLY ELLIOTT WAVE COUNT

Within minuette wave (iii), the structure looks to be incomplete. This part of downwards movement is essentially seen in the same way for both wave counts, only the degree of labelling differs. Both see an impulse unfolding lower.

Minor wave C must subdivide as a five wave structure. This alternate wave count would be confirmed with a new low below 1,310.84.

Minor wave C still needs more downwards movement. Along the way down two more fourth wave corrections should complete and be followed by fifth waves downwards towards the target.

Minuette wave (iv) is most likely to be a zigzag to exhibit alternation with the expanded flat of minuette wave (ii). It is most likely to be shallow also, to exhibit alternation, and so the 0.236 and 0.382 Fibonacci ratios are reasonable targets. Minuette wave (iv) may not move into minuette wave (i) price territory above 1,341.45.

If price moves below 1,310.84, then expect more downwards movement for a deeper pullback to end about 1,279. Look also for price to find support at the maroon channel on the daily chart. The target at 1,279 may be a little too low; the maroon trend line may stop price before it reaches the target.

TECHNICAL ANALYSIS

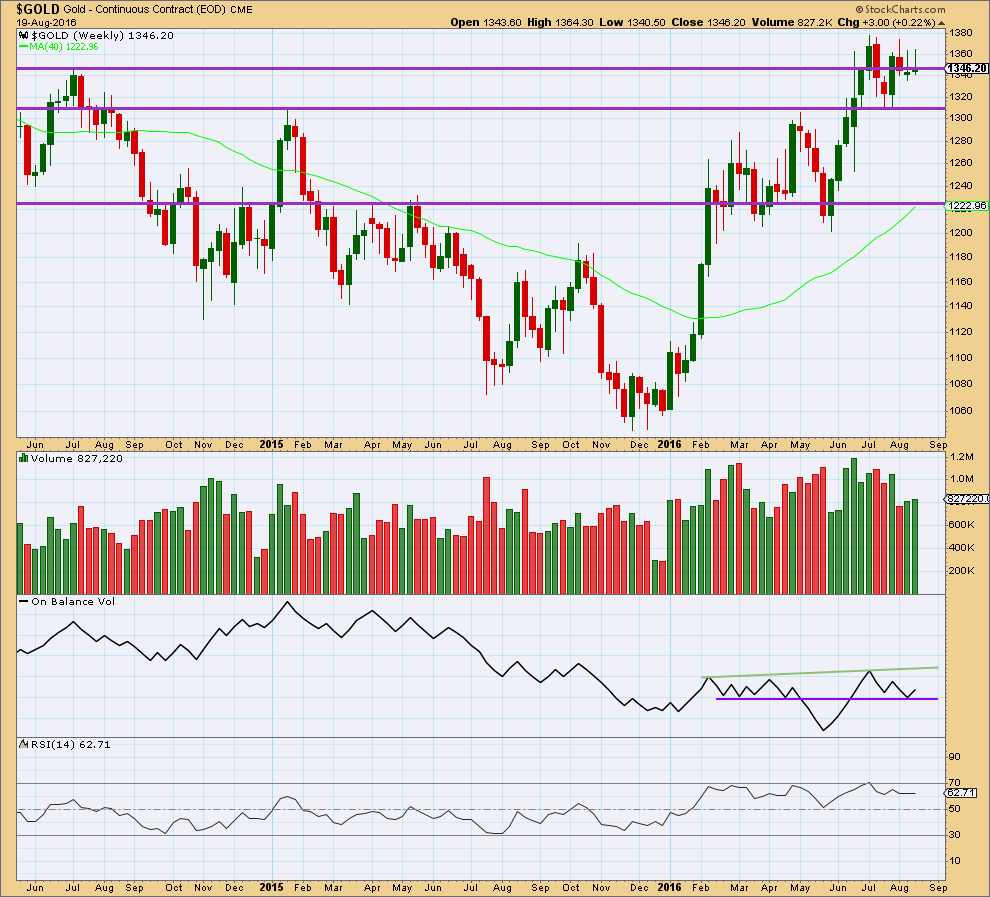

WEEKLY CHART

Two green weekly candlesticks in a row come now with a small rise in volume. Volume for both weeks is stronger than the prior downwards week. Short term, at the weekly chart level, the volume profile looks bullish.

Last week completes a weekly candlestick with a higher high and a higher low than the week before. Overall, price has moved upwards last week.

It is concerning for the main wave count that both of these last two weeks have long upper wicks on the candlesticks. These wicks are bearish and indicate caution. For this reason please manage risk carefully. The alternate wave count is possible and illustrates the risk currently to long positions.

On Balance Volume last week has moved up from the lower purple trend line. This is a reasonable bullish signal week.

RSI is still not extreme. There is room for price to rise.

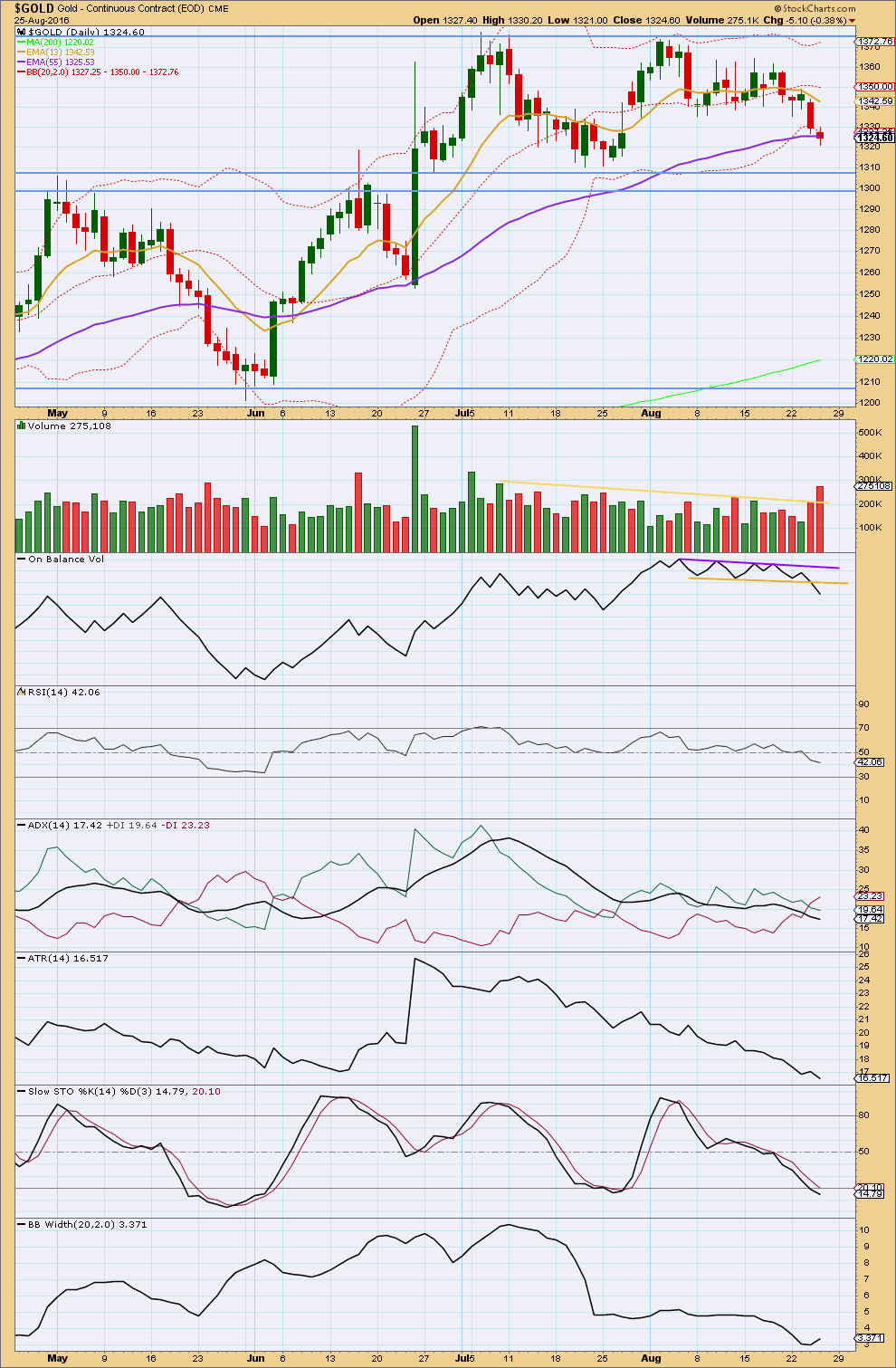

DAILY CHART

This analysis today is very bearish. On Balance Volume has broken below the yellow support line indicating a downwards breakout from price is likely to follow. Two days in a row of downwards movement with strong and increasing volume is bearish, so the fall in price has support from volume. This looks likely to continue until price finds some support.

The next support line for price is about 1,305 – 1,310.

RSI is not yet extreme. There is room for price to rise or fall. There is no divergence between price and RSI today to indicate weakness in price.

ADX has indicated a trend change as the -DX line crossed above the +DX line. If the black ADX line turns up now, it would indicate a downwards trend.

However, ATR continues to decline. This small downwards move may be a counter trend movement. This supports the alternate wave count.

Stochastics is now just entering oversold. It may move further into extreme territory before downwards movement ends, but it is warning the end may be close.

Bollinger Bands have today widened slightly. A trend may be ready to return. Price is at the lower Bollinger Band, but price can remain at the edge of Bollinger Bands for a few days when it trends.

This analysis is published @ 07:49 p.m. EST.

Lara, what if?

I’ve been staring at what seems to be a symmetrical triangle developing. According to “thepatternsite”, they have a 54% chance of breaking upward. That doesn’t provide much help as there’s close to an equal chance of it breaking downward.

So, is there any way that it could be an EW triangle? I have not scrubbed the details, but am showing this daily look as an example. Could you make the details work?

If so, this may offer another option. A short break upwards from the triangle could then get “stopped” by the Magee bear market trend line for another bigger correction. This may line up better with GDX.

Thoughts?

I’d look for Gold price to probe below 1320 spot for bottoming and rally to likely get curtailed under 1330-35 spot. Expect 38.2% retrace of H 1375 / L 1205 at 1310 to hold. Lets see how this plays out.

Hi Syed,

It’s good to hear from you, I had feared you had left us. I miss your “JUST A VIEW”

Well this is confusing 🙁

BarChart XAUUSD data shows a red daily candlestick with lighter volume.

StockCharts $GOLD data shows a green daily candlestick with a big volume spike.

On balance, both these signals are bullish. I’ll give a bit more weight to the volume data coming from StockCharts, but as members know sometimes this can change retrospectively.

I think i can help. I think that Stockcharts data is taken at 4 pm or market close. There is 1 more hours trading on Comex thus the discrepancy. I too have found the volume to be higher on a chart taken just after close on occasions than at some point later with Stockcharts. So there varying candlestick charts dependant on the time at which the charting program delineates the close of each days trading and volume discrepancies so this is not helpful at all for your analysis.

I use finviz.com to check the hourly chart and it shows an increase in volume for today http://finviz.com/futures_charts.ashx?t=GC&p=d1 as well

What is also annoying is Stockcharts have recently changed from spot to continuous contract price.

Okay, this is the correct data feed to follow along daily with Lara’s validation and invalidation points. You can click on the chart to enlarge.

http://www.barchart.com/quotes/forex/%5EXAUUSD

Please disregard the one I posted below

Yes, that is the one. Thanks again Dreamer 🙂

I’ll add a link to this data feed in the FAQ actually. I think that may be helpful 🙂

Gold, GDX, and NUGT all had higher lows and highs today.

Yesterday was the low for the month for all 3 as per pmbull.com and TOS

Lara,

I just saw your comments to James.

Is the answer to my Ques. #3 for Barchart.com- Volume that you use their XAUUSD chart for end of day volume, because Futures contract charts are too leveraged?

For XAUUSD I’m really more interested in price.

It is price that may have extremes in futures markets that aren’t seen in cash markets. It is price that determines EW invalidation / confirmation / confidence points.

For volume I’m watching both, and I’ve noticed that for both sometimes the data changes retrospectively (days later). I’ll give more weight to StockCharts volume data though.

Hi Lara,

I’d like to confirm the following. Please correct me if I have the wrong idea on any point below:

1. I should use the XAUUSD chart for Primary confirmation of your Invalidation, Confirmation and Confidence Levels because XAUUSD is the ‘instrument’ you have chosen to use for EW TA of gold?

2. Some of us traders may wish to use Gold Futures ‘Spot’/Cash price for a comparison of price movement to confirm that your count may/may not be playing out on Gold ‘Spot’/Cash chart at same time. The better way to do this would be to look at Barchart.com GCY00 chart [ as Dreamer so kindly mentions below ] for price?

a. GCY00 would be most appropriate futures chart to compare your XAUUSD

charting to for confirmation purposes? OR, should I be using current Front

month futures contract (currently Oct.)?

3. About Volume, I understand that you look at both Stockcharts.com and Barchart.com for your nightly volume.

a. Are you taking the volume from ‘Gold Continuous chart’, $GOLD @

Stockcharts.com?

b. ……and from ‘Front Month’, currenlty GCV16 (October) @ Barchart.com?

Thank you for clarifying…perhaps your answers may help more than just myself.

Have a good weekend!

1. Yes.

2. GCY00 is COMEX futures, and yes, that would be the most appropriate comparison to the cash price for XAU/USD

3. I’m comparing volume from StockCharts $GOLD Continuous Contract and BarChart XAU/USD. Sometimes there are differences, in those cases I will give a little more weight to StockCharts $GOLD.

Both wave counts are still valid. It looks like we will not get clarity before the market closes at the end of this week.

I’m working on alternate ideas today at the weekly chart level. Should have something to post in todays analysis.

After thoroughly analysing GDX yesterday and seeing how bearish it is, I need to see if there is a good wave count for Gold which is also very bearish.

Lara, which gold feed do you use?

I’m using the forex gold feed from BarChart. It’s an amalgamation of feeds from several exchanges. At least, that’s what they tell me.

I can’t use COMEX, it’s futures not cash. For EW analysis I need cash data with volume.

BarChart’s feed is the closest approximation to the cash market that I can find.

I need to update my FAQ for this too.

Well, I could use futures data. But the extreme leverage means EW rules don’t always work. So that would be a very difficult exercise indeed.

I think analysing cash data is hard enough 🙂

Chart by RTV looks good if we can hold here

And HUI

Good charts, thanks for sharing them!

At this point gold and NUGT are both below Thursday’s close and no bullish wave count confirmations, so for now things are still in limbo.

I was thinking that 1,342.28 on pmbull.com would get gold above Lara’s 1341.45 bullish data feed confirmation point but it appears not yet?

Perhaps a miracle before the close would clarity the direction otherwise the weekend and next week would be a guessing game and risk for any holdings?

Perhaps our EW Surfing Queen Lara may add some clarity before the close?

🙂 Sorry Richard, price is still within the two points we need it to break out of to give us clarity.

The spike up ended just below the invalidation point on the alternate, so minuette (iv) ended there, that wave count is still valid.

With no new low the main wave count is also valid.

http://www.barchart.com/headlines/story/611541/elliott-wave-analysis-gold-in-final-stages-of-a-correction

8/24 article – This guy had same invalidation 1,310 and expected bullish.

With wide range candles and likely high volume today, we need to see gold and miners close positive today to support the bullish case.

I agree that the close price is more important esp. for swimg trading as it filters all noises. 🙂

Dollor is strengthening that hurts both equity and gold…

Yes since gold high at 10:17 am the US Dollar is moving up as gold moves down or vice versa.

http://www.investing.com/quotes/us-dollar-index-streaming-chart

The market may be revising their sentiments about Janet Yellen comments.

Is she making more comments?

NUGT Possible wave count

Bottom Thursday 9:35 am $20.57,

which was the low since June 23rd.

top 1st wave Thursday 11:15 am 23.48

bottom 2nd wave Thursday 3:06 pm 21.40

top 3rd wave Friday 8:45 am 23.90

bottom 4th 10:02 am 21.00

top 5th day high 10:17 am $24.87

Now maybe in a 2nd wave retrace down to a possible .618 retrace target at $22.21?

Any other counts or targets for NUGT

What gold feed does Lara use?

Barchart gold cash

Looks like the Hourly bull count is not confirmed yet?

Yep. That’s the one. Thanks Dreamer

Sorry, no. that’s not the one.

that’s the COMEX data that I recently had problems with.

It says “cash” there, but they tell me it’s futures.

I’m using BarChart XAU/USD

From another TA perspective….

So the primary count is in play, and the 3rd wave of the 3rd wave has begun?

That is not confirmed yet.

Gold dropped to 1,319.57 at 10:01 am then hit high of 1,342.28 at 10:17 am for hourly bullish wave count confirmation above 1,341.45 and an invalidation of the hourly bearish alternate.

Do we have confirmation on Lara’s gold data feed also?

Not yet on her data feed as far as I can tell.

We’ll have to see where gold and GDX are before, during and after 10:00 am EST Yellen speech.

Thanks Lara for the timely GDX update. Now I know it’s also very bearish from the EW perspective.

Lara thanks for your efforts..

Its frustating time for us especially for you. But the way you handle is an another thing to learn from you..tc..

James, I agree as I’ve learnt from Lara about being professional and proper manners and handling stress, etc. much of which is lacking at many other websites or forums.

That’s very kind, thank you.

Good manners are free and make social situations so much easier for everyone. I’m very keen on it in this forum because it makes everyone feel comfortable.

When you know you’re not going to get a negative backlash then you’re more likely to share your ideas.

This membership is large, and there are some very experienced people here. Some of them are kind enough to share their knowledge and experience, so that we are all richer in knowledge and $$

Yaa lara thats why i said its much more to learn from you..can you change my name to jimmy as james are two on this board

I’ve just finished GDX analysis, Cesar will proof and publish shortly.

It’s very bearish indeed. Particularly the TA portion. It looks like GDX is in a clear downwards trend at this time.

Lara would agree about the GDX downtrend, however I found that GDX was much stronger than gold the first half of today although it only closed up 1.26% and had heard that miners often move up first from a bottom before gold maybe by a day, so that had me thinking that Friday gold might bottom and maybe bounce?

I just quickly reviewed the new GDX Analysis, very in depth.

I’m not even holding any miners and I’m really shocked.

If I was holding miners I would start praying.

The bearish count below $26.17 is very scary.

What is the price point on silver where it too will become a sell..?

Below 17.849.

I don’t have a bearish wave count for Silver. Below this point both bullish wave counts would be invalid, so something else must be happening.

At this stage I have not been able to see a bearish wave count for Silver.

Lara, just looking to confirm the 2 bullish counts confidence and confirmation points.

The main daily chart has ‘confidence’ besides 1,356.85 and the written analysis mentions 1,356.85 as price ‘confirmation’ of this main wave count.

The hourly chart has ‘confirmation’ besides 1,341.45 and the written analysis mentions 1,341.45 as ‘confidence’ in this wave count.

Thank you Lara.

Sorry Richard, that is rather confusing isn’t it.

I would consider the main wave count confirmed with a new high above 1,341.45, and further confidence in it and especially in a third wave up may be had above 1,356.85.

The alternate would be confirmed below 1,310.84 at which point the main would be invalid and discarded.

Just my 2 cents. Looking at 5 min chart since low, wave pattern looks more corrective with first 2 waves done, latter looks like contracting triangle B wave with MACD hovering near zero. Now breaking out upwards likely to complete C wave. This would favor alternate count and would look to hedge long positions in am with some DUST.