An Elliott wave version of “where’s Waldo” might be a fun exercise (for the geeks amongst us).

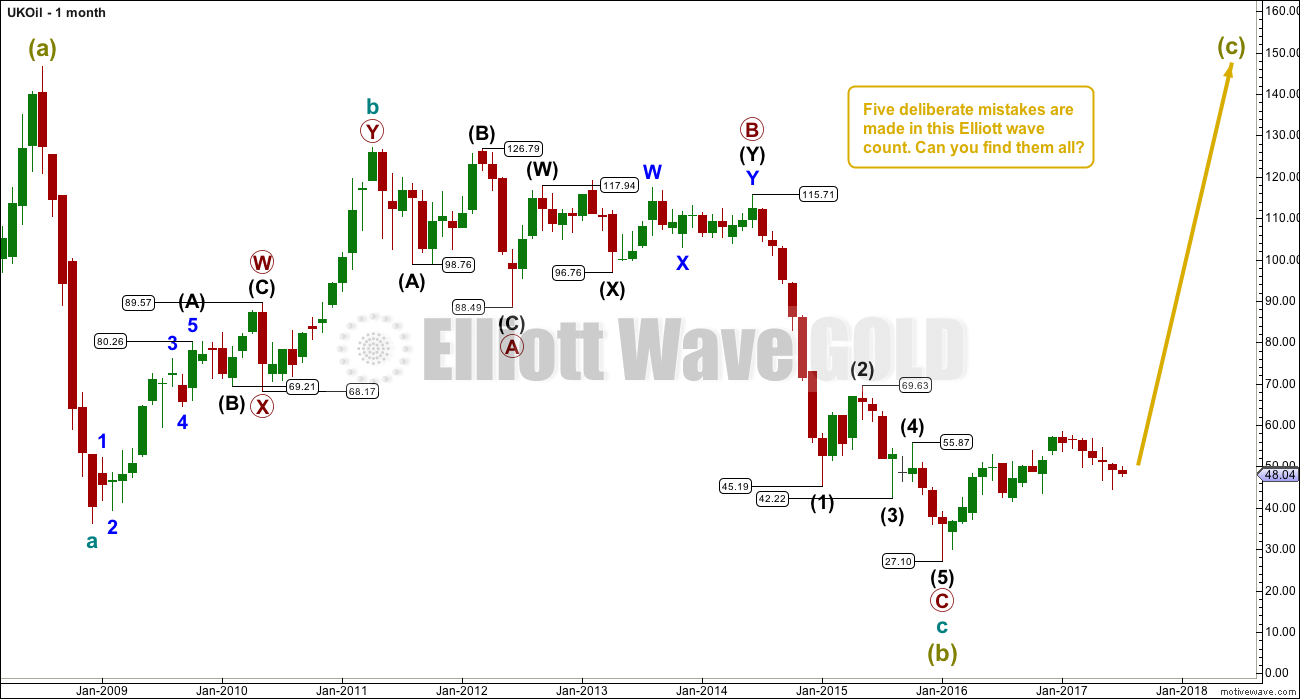

Test your knowledge of Elliott wave rules. Review this chart and find five deliberate mistakes:

The mistakes are all fairly obvious. Two of them break core rules, one is a very common mistake, and another mistake is something that MotiveWave allows (but it should not).

Play in comments below.

Published @ 05:38 p.m. EST.

And finally, this is why it is so important to know what you’re doing and to follow EW rules and guidelines.

When we do that with this market we come up with a very different conclusion about what should happen next. And that is the point of EW; what is price most likely to do next?

If our wave count is wrong, our conclusion is wrong.

This is a valid wave count, and this is the conclusion that I draw for this market.

Where I have that series of overlapping first and second waves at the start of cycle wave c, it does look kinda like a triangle. But if you try and put a triangle in there the rest of it doesn’t work, and the triangle trend lines look wrong. This is what I mean.

triangle trend lines almost never contract that quickly, and the breakout normally comes before the triangle trend lines touch

Okay folks, here’s your answer.

I enjoyed this, even though only two people interacted with it, I think I’ll do it again. Maybe the exercise will grow on us and maybe members and readers will find it helpful to learn how to do Elliott wave. Or at least, how to spot useless Elliott wave 🙂

The two breaking core rules are 4 overlapping into 1, and 3 the shortest. Dreamer and Verne both got the first, Dreamer got the second. That’s why I had the price points provided, so you could check wave lengths.

The multiples within multiples again both Dreamer and Verne got, and this is the most common mistake I see in EW work online.

The cycle c subdividing as A-B-C and not 1-2-3-4-5 no one got, and this is the mistake that Motive Wave will let you do.

And finally,

no one*Edit: only Dreamer got the B is < 0.9 X A, and A is a three so the structure should be a flat.Lara, if you look at the bottom balloon comment on my annotated chart below, I think I correctly indicated that Primary wave B was less than 90%….

Oops! Sorry Dreamer. So you did. I stand corrected.

Believe it or not, I looked at that C wave down and completely fooled myself when I looked for the five waves down and confused myself by not paying attention to the degree of cycle instead of primary! Good one.

It also for some strange reason took me awhile to figure out that the numbers on the waves actually corresponded directly to the chart scale…duh!

You would think as many charts that I have looked at over the years… 🙂

Isn’t it funny how our minds tend to make things more complicated than the are?! Looking forward to the next one. 🙂

After tomorrows session I’ll put up an answers chart.

These are my ideas

Very nice Dreamer. You’ve got three out of five of the rule violations and a few nice points in guidelines.

So far between you and Verne you’ve got three out of five rule violations.

There are two more. One is a core rule (hint: I’ve provided price points so you can determine if the rule is violated).

The last one is the one that Motive Wave will let you get away with.

2. A fourth wave in wave one territory.

Where is everybody? 🙂

Yep. That’s one of the core rules.

I think everybody’s sleeping?

I see a few.

1. Multiple in a multiple.

Yep. You’ve found the most common mistake.