A breach of the channel on the daily and hourly Elliott wave charts indicates the alternate daily chart is more likely.

Summary: A consolidation looks likely to have begun, and it may be as time consuming as a Fibonacci 13 or even 21 weeks. It is also possible it may be a quicker sharper pullback. When it is complete, the upwards trend may resume.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

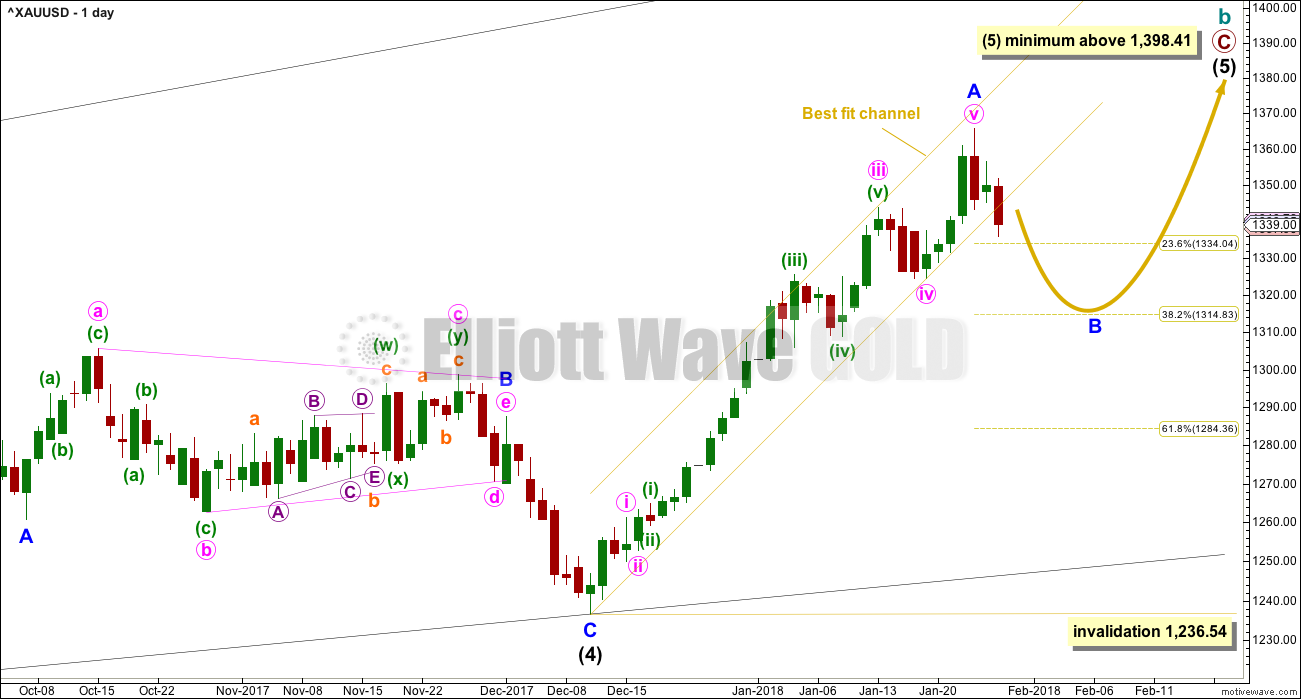

BULLISH ELLIOTT WAVE COUNT

FIRST WEEKLY CHART

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54.

Within intermediate wave (1), the correction labelled minor wave B was over within one week. Within intermediate wave (2), the correction labelled minor wave B was too quick to be seen on the weekly chart. Within intermediate wave (3), the correction labelled minor wave B was over in 12 weeks, one short of a Fibonacci 13. Within intermediate wave (4), the correction labelled minor wave B was over in a Fibonacci 8 weeks. As each actionary wave is extending in time as well as price, the correction of minor wave B within intermediate wave (5) may be longer than that within intermediate wave (3). At this early stage, a Fibonacci 13 or possibly even 21 weeks may be expected. This expectation is a rough guideline; flexibility is essential when B waves unfold.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

FIRST DAILY CHART

Within the ending diagonal, intermediate wave (5) must sub-divide as a zigzag.

Downwards movement during Monday’s session has clearly broken below the yellow best fit channel; the channel is strongly breached on the hourly chart. This indicates that the upwards wave labelled minor wave A should now be over and the next wave labelled minor wave B may now have begun.

Minor wave B may be a reasonably time consuming consolidation or a quicker sharper pullback within the upwards trend, and it may end about either of the 0.382 or 0.618 Fibonacci ratios (neither may be favoured).

There are more than 23 possible structures that minor wave B may take, and it is impossible until close to or at the end to have confidence which possibility has unfolded. When B waves unfold, it is essential that analysis is flexible. B waves are analogous to either range bound consolidations or sharp corrections. As minor wave B unfolds, the labelling on the hourly chart for its sub-waves will change and alternates will be required from time to time.

Minor wave B may not move beyond the start of minor wave A below 1,236.54.

HOURLY CHART

At this stage, minor wave B may beginning with a double zigzag unfolding lower. This may be minute wave a, or it may also be only minuette wave (a) if the degree is moved down one.

So far the pink best fit channel mostly contains downwards movement. If it is breached by upwards movement (not sideways), then the double zigzag may be complete and the next wave up may have begun.

If this analysis is correct in identifying a double zigzag unfolding lower, then minor wave B may be a choppy time consuming consolidation to last several weeks. It may be a flat or triangle, and these tend to be time consuming structures.

Within the second zigzag in the double, subminuette wave c has passed equality and 1.618 the length of subminuette wave a. The next Fibonacci ratio in the sequence is used to calculate a target for it to end.

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction, and within it intermediate wave (B) may be a complete triple zigzag. This would indicate a regular flat as intermediate wave (B) is less than 1.05 the length of intermediate wave (A).

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

TECHNICAL ANALYSIS

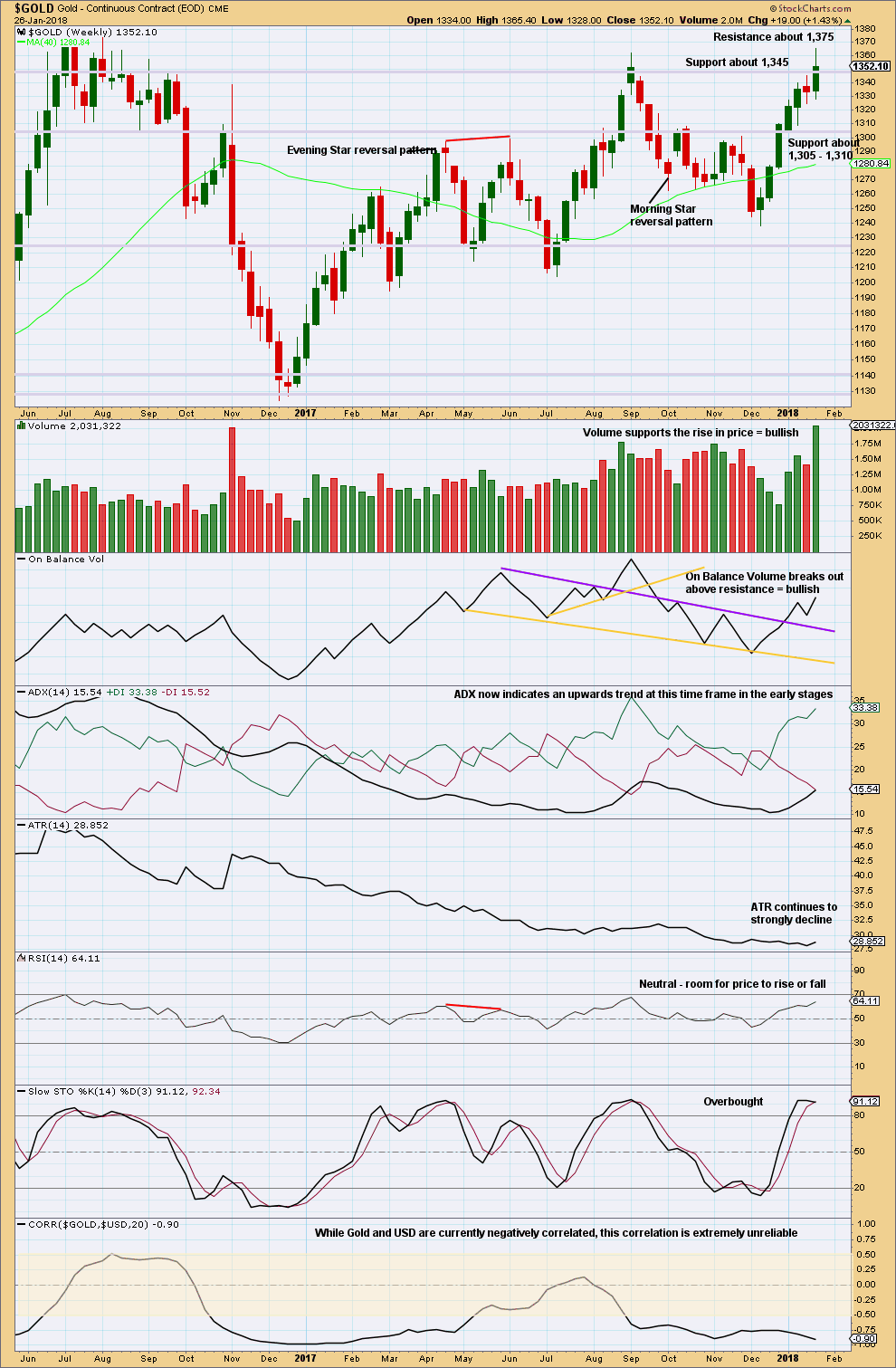

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Prior resistance about 1,345 may now be support. This upwards trend may still be in the relatively early stages.

Markets do not move in straight lines when markets trend; there are corrections and consolidations within the trend.

On Balance Volume, ADX and RSI all indicate more upwards movement is possible and looks likely.

The negative correlation between Gold and the USD was very weak for about four months as recently as early May 2017 to late August 2017. While these two markets are currently strongly negatively correlated, they may not be so in the near future. The correlation may disappear at any time. Looking at the correlation co-efficient on the monthly chart shows periods of up to a year where these two markets are not correlated, usually when Gold is consolidating.

Currently, Gold is still within a huge consolidation range delineated by resistance about 1,375 and support about 1,195 to 1,235. With price now closing in on a resistance zone and Stochastics overbought, a downwards swing or pullback is possible soon. If price can break above resistanace at 1,375, and if it does so with support from volume, then a classic upwards breakout would be indicated.

Within this large consolidation, it is now this completed upwards week that has strongest volume. This suggests an upwards breakout from the huge consolidation is now more likely than downwards.

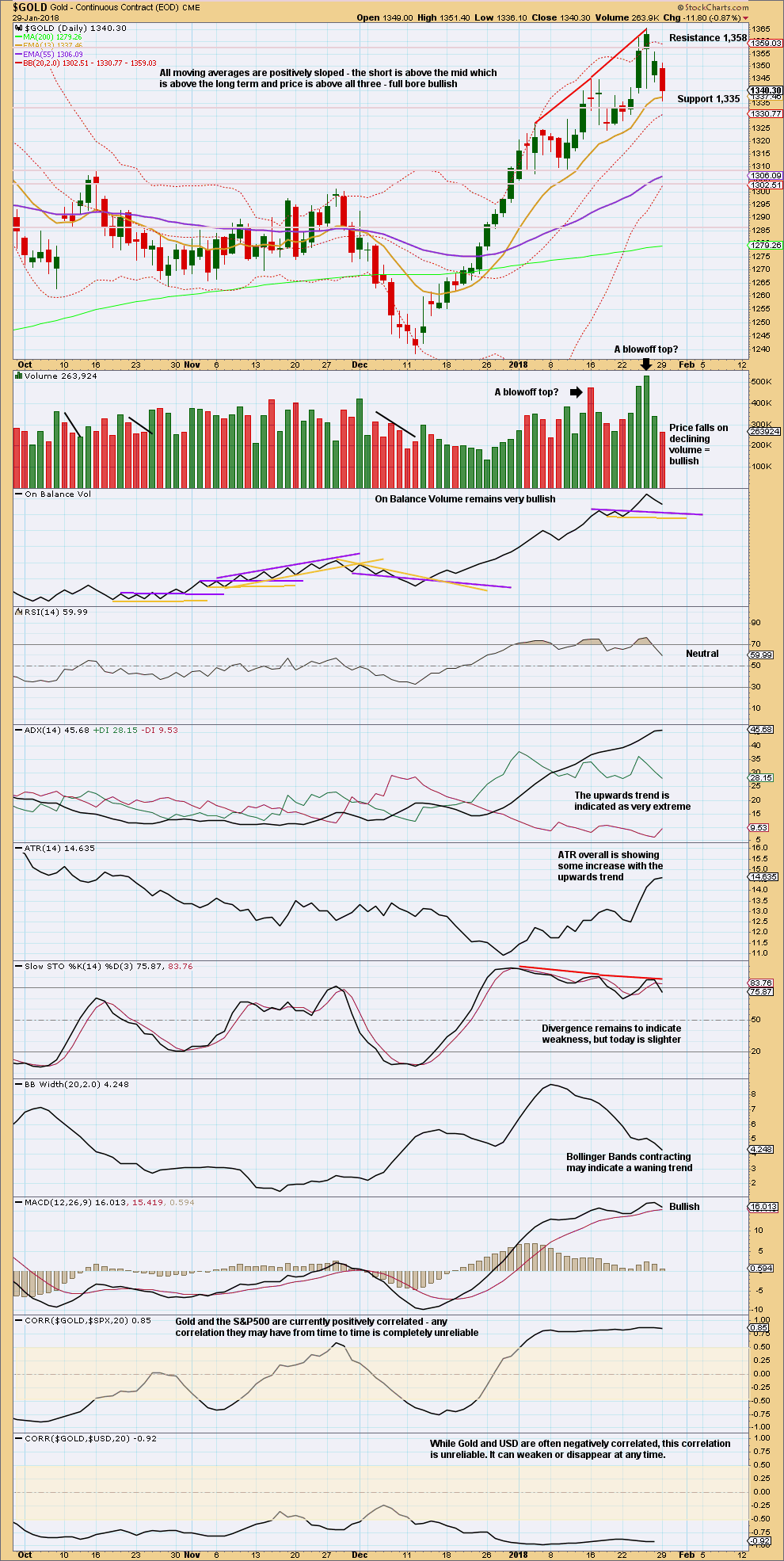

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price may be finding some support here about the short term Fibonacci 13 day moving average. The slightly longer lower wick on today’s candlestick is slightly bullish for the short term. The volume profile is bullish.

So far this downwards movement looks like the start of a pullback or consolidation within the upwards trend. This may relive extreme overbought conditions and then allow for the upwards trend to continue.

Support below 1,335 is next at the zone of 1,310 to 1,305.

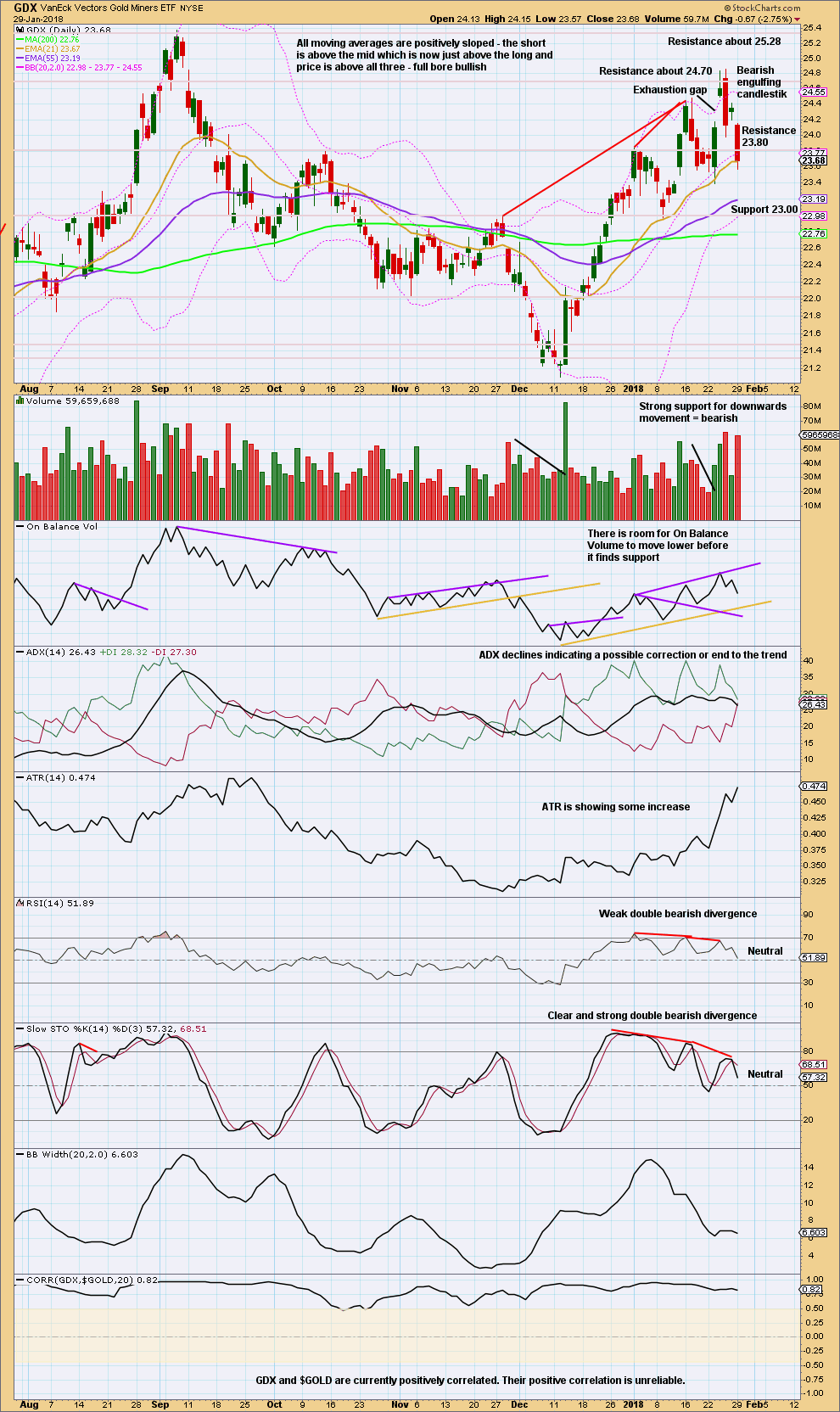

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX looks more bearish than Gold today. A pullback or consolidation within the upwards trend today looks most likely.

Published @ 06:23 p.m. EST.

Updated hourly chart:

That target was fairly good. Price moved a little lower, falling 1.53 short of the target before turning.

The channel is working okay ATM too. After a breach to the upside, the downwards movement today looks like it may be bouncing up off the upper edge of the channel.

The minimum requirement for a flat correction only needs to be met if minor wave B is a flat. Minor wave B could also be a triangle which does not have a minimum length for minute wave b.

this is moving in perfect tune with the US Dollar by the way!

well, they do currently have a strong negative correlation 🙂