Upwards movement has continued as last analysis expected.

Summary: After a new high, which may be only slight, look out for a pullback. Price may find resistance about 1,365 and react there to swing down to support about 1,310 – 1,305.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

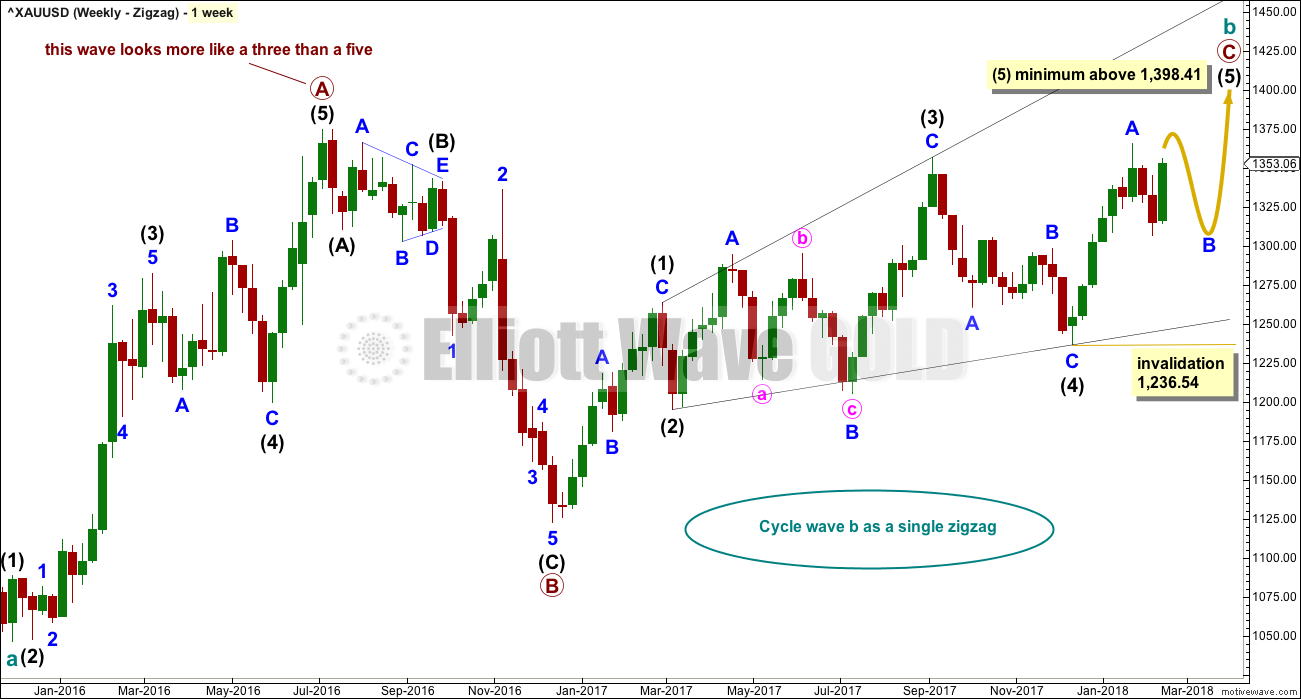

BULLISH ELLIOTT WAVE COUNT

FIRST WEEKLY CHART

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five wave structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54.

Within intermediate wave (1), the correction labelled minor wave B was over within one week. Within intermediate wave (2), the correction labelled minor wave B was too quick to be seen on the weekly chart. Within intermediate wave (3), the correction labelled minor wave B was over in 12 weeks, one short of a Fibonacci 13. Within intermediate wave (4), the correction labelled minor wave B was over in a Fibonacci 8 weeks. As each actionary wave is extending in time as well as price, the correction of minor wave B within intermediate wave (5) may be longer than that within intermediate wave (3). At this early stage, a Fibonacci 13 or possibly even 21 weeks may be expected. This expectation is a rough guideline; flexibility is essential when B waves unfold.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

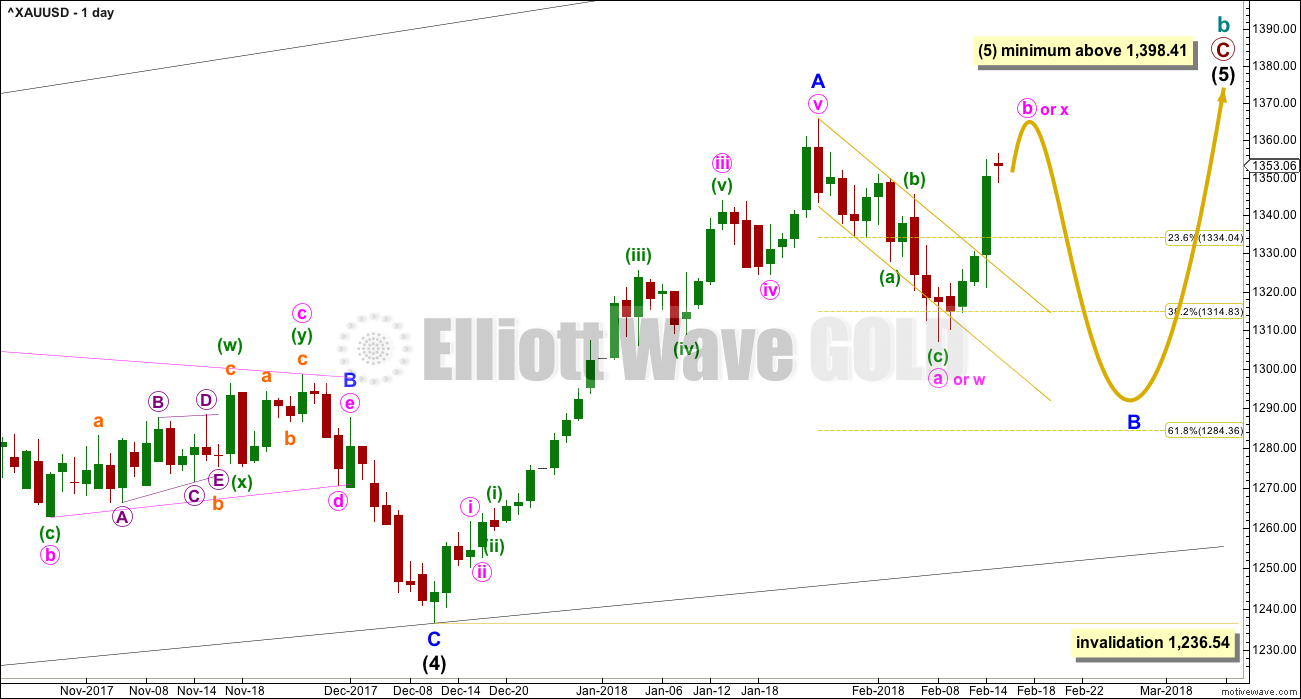

FIRST DAILY CHART

Within the ending diagonal, intermediate wave (5) must sub-divide as a zigzag.

Minor wave B may be a reasonably time consuming consolidation or a quicker sharper pullback within the upwards trend, and it may end about either of the 0.382 or 0.618 Fibonacci ratios (neither may be favoured).

There are more than 23 possible structures that minor wave B may take, and it is impossible until close to or at the end to have confidence which structure has unfolded. When B waves unfold, it is essential that analysis is flexible. B waves are analogous to either range bound consolidations or sharp corrections. As minor wave B unfolds, the labelling on the hourly chart for its sub-waves will change and alternates will be required from time to time.

The yellow arrow outlines the possible pathway for a flat or combination. These corrections are analogous to sideways range bound consolidations. Within both a flat and consolidation, minute wave b or x may make a new high above the start of minute wave a or w at 1,365.68.

Minor wave B may still be a triangle or zigzag. All possibilities must still be considered.

Minor wave B may not move beyond the start of minor wave A below 1,236.54.

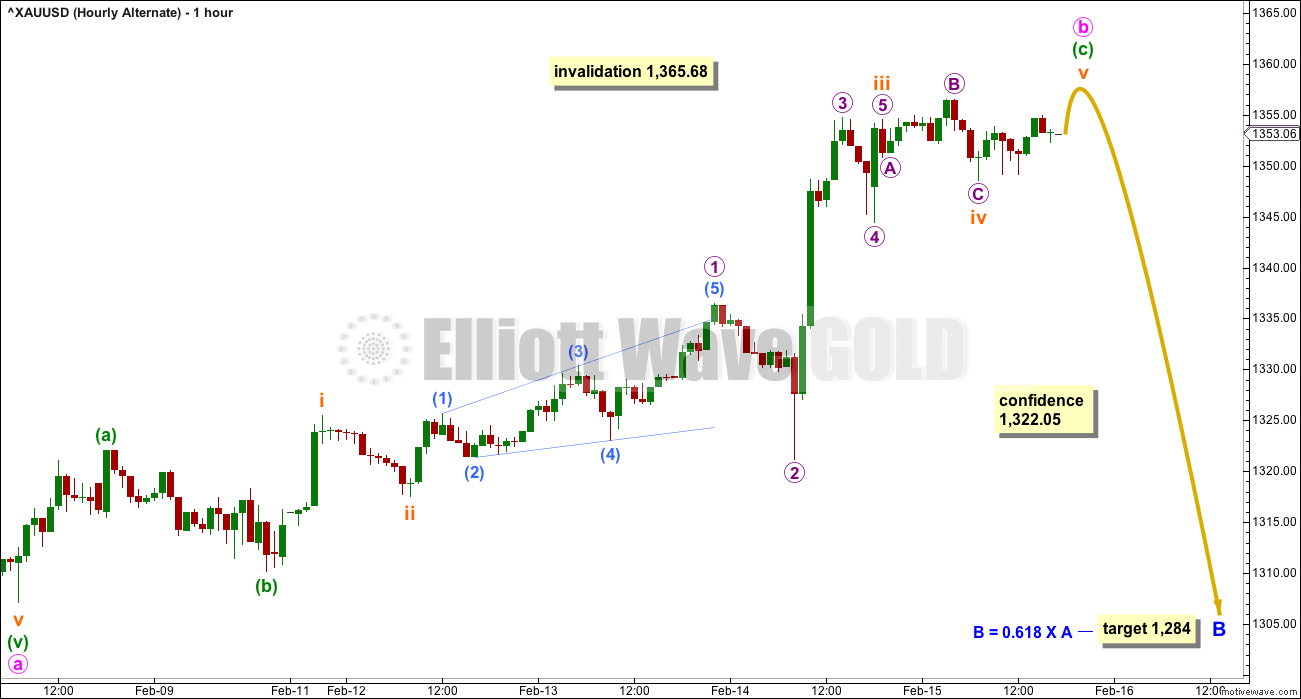

HOURLY CHART

This first hourly chart considers the possibility that minor wave B may be continuing as a flat, triangle or combination.

If minor wave B is a flat correction, then within it minute wave a must be seen as a three wave structure and minute wave b must retrace a minimum 0.9 length of minute wave a and must also subdivide as a three wave structure. It looks like at this stage it may be a zigzag, but it may still be any one of several structures. The most common type of flat is an expanded flat correction where minute wave b would move above the start of minute wave a at 1,365.68.

If minor wave B is a triangle, then minute wave b within it must subdivide as a three wave structure and would most likely be a zigzag. There is no minimum requirement for minute wave b within a triangle. The most common type of triangle is a regular contracting triangle where minute wave b would end below the end of minute wave a. A running triangle is less common but not a rare structure, and within it minute wave b would end above the start of minute wave a.

If minor wave B is a combination, then the first structure in a double may be a zigzag labelled minute wave w. The double would be joined by a three in the opposite direction labelled minute wave x, which would most likely be a zigzag but may be any corrective structure. Minute wave x may make a new high above the start of minute wave w.

Minute wave b must subdivide as a corrective structure. At this stage, it looks like it may be unfolding as a single zigzag. A five up may be completing for minuette wave (a). Within minuette wave (a), if subminuette wave iv continues sideways or lower, it may not move into subminuette wave i price territory below 1,322.05. However, it would be very likely to remain contained within the orange Elliott channel. If this channel is breached by downwards movement prior to a new high, then expect that minuette wave (a) is over and minuette wave (b) has begun.

When minuette wave (b) unfolds, it may last about two to several days and may not move beyond the start of minuette wave (a) below 1,307.09 (if the analysis of minuette wave (a) as a five wave structure is correct).

If minute wave b is unfolding as a zigzag, then it will not move in a straight line, despite the arrow on this chart. That is not how B waves unfold. Within it a smaller consolidation or pullback is expected for minuette wave (b).

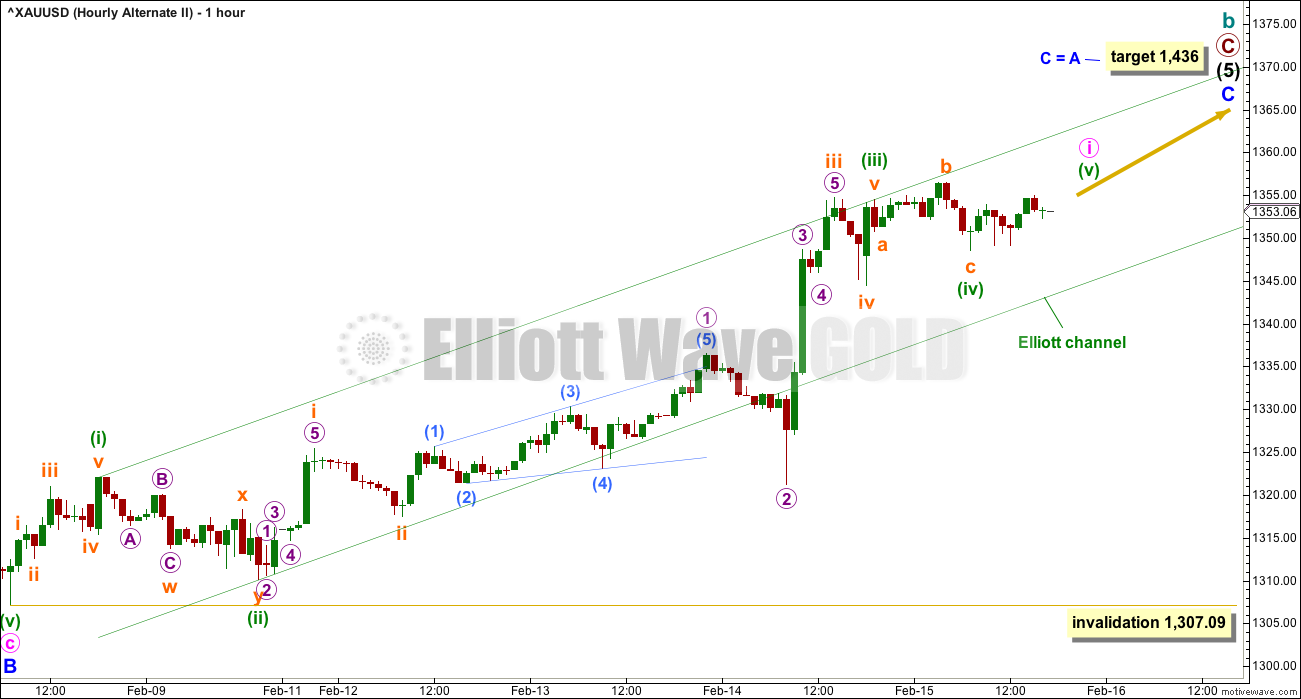

ALTERNATE HOURLY CHART

It is still possible that minor wave B is unfolding as a relatively quick sharp zigzag. It is still possible that the last wave down labelled minute wave a was a five wave impulse.

If minute wave a was a five, then minute wave b may not move beyond its start above 1,365.68.

Minute wave b could be complete with just one more slight high above today’s high.

Minute wave c may take price down to the 0.618 Fibonacci ratio of minor wave A about 1,284.

SECOND ALTERNATE HOURLY CHART

This second alternate has the lowest probability of all three hourly charts today.

This wave count is the same as the first hourly wave count, with the exception of the degree of labelling. If the degree of labelling within the possible zigzag downwards is moved up one, then minor wave B may be complete already. It would be relatively shallow and brief though, which is the main reason for low probability.

Minor wave C now shows some strength: volume strongly supports upwards movement. However, for reasonable confidence, this wave count would still require a classic upwards breakout above resistance about 1,375 on a day with support from volume.

So far a five up may be almost complete. When minute wave i can be seen as a complete five wave impulse, then the following correction for minute wave ii may not move beyond its start below 1,307.09.

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction, and within it intermediate wave (B) may be a complete triple zigzag. This would indicate a regular flat as intermediate wave (B) is less than 1.05 the length of intermediate wave (A).

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

TECHNICAL ANALYSIS

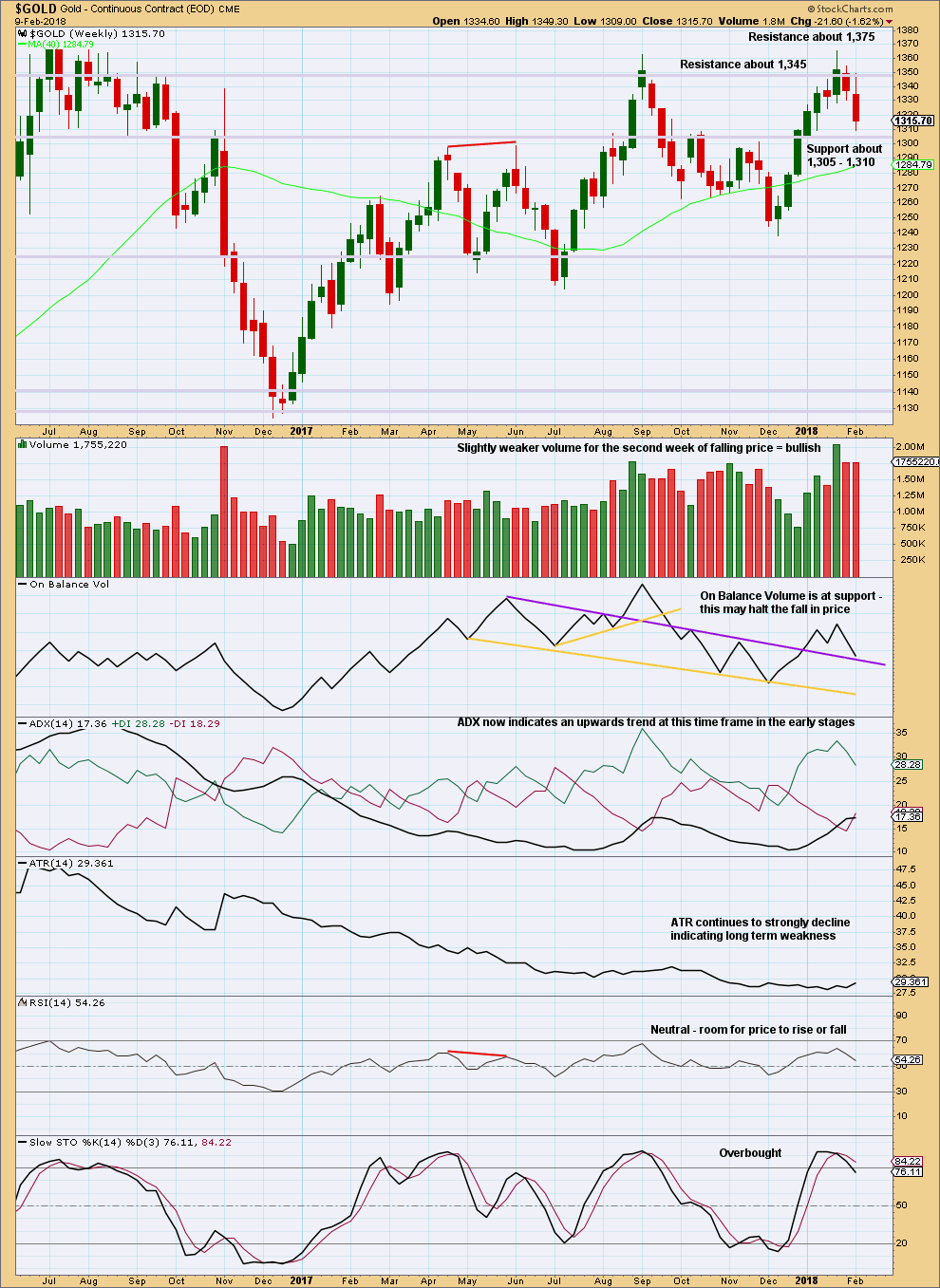

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support for price about 1,310 – 1,305 and support for On Balance Volume may halt the fall in price here.

However, RSI and Stochastics indicate there is plenty of room for price to fall further. If support about 1,310 – 1,305 gives way, then next support is about 1,225.

A breakout above 1,375 on a day with strong volume would have to occur for the bullish case to have strong confidence.

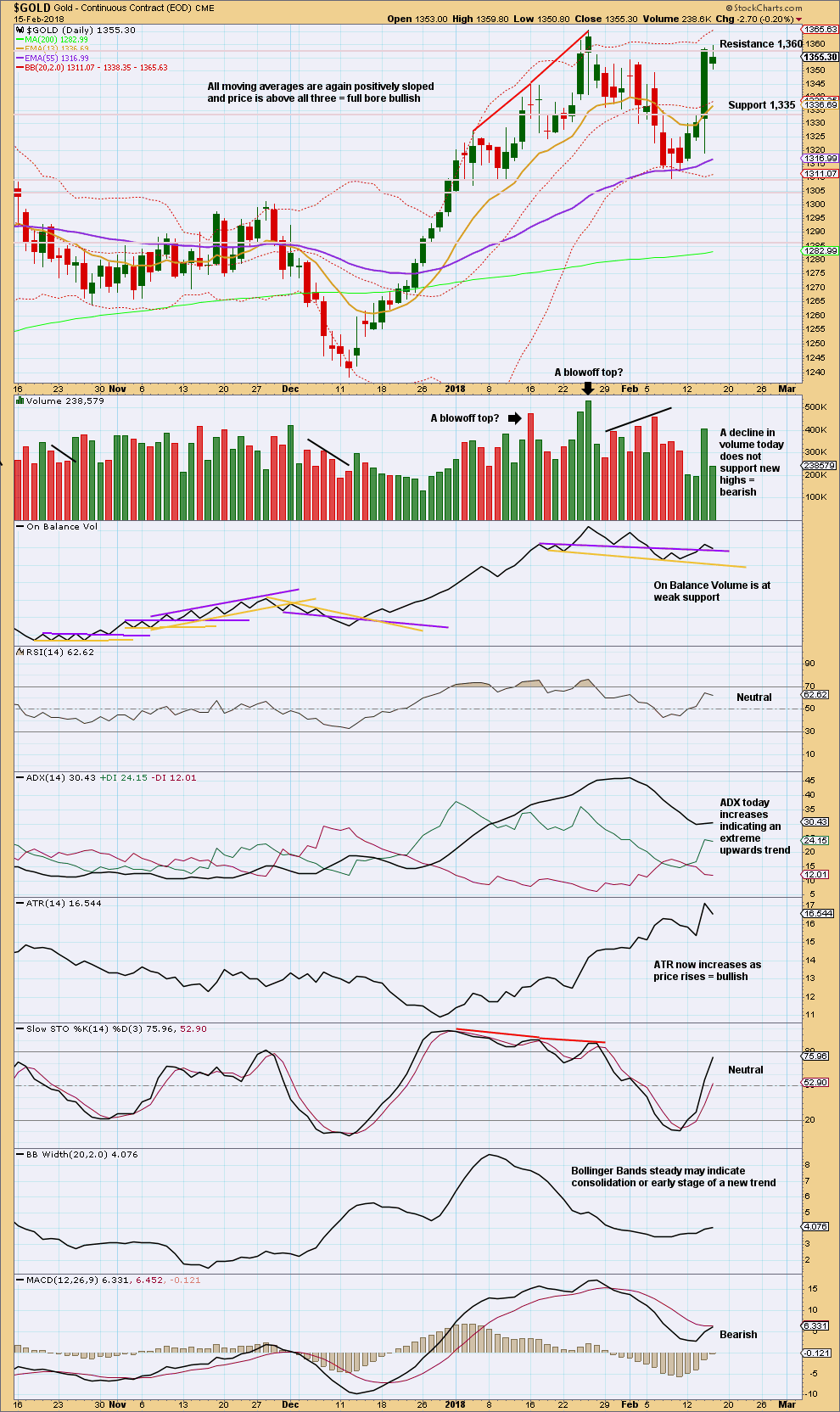

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is finding strong resistance about 1,360 – 1,365. Stochastics is nearing overbought. There is a little room for price to move higher. Thereafter expect a downwards swing.

This upwards trend is again extreme.

If On Balance Volume breaks below support, then the purple line would be so weakened it should be redrawn.

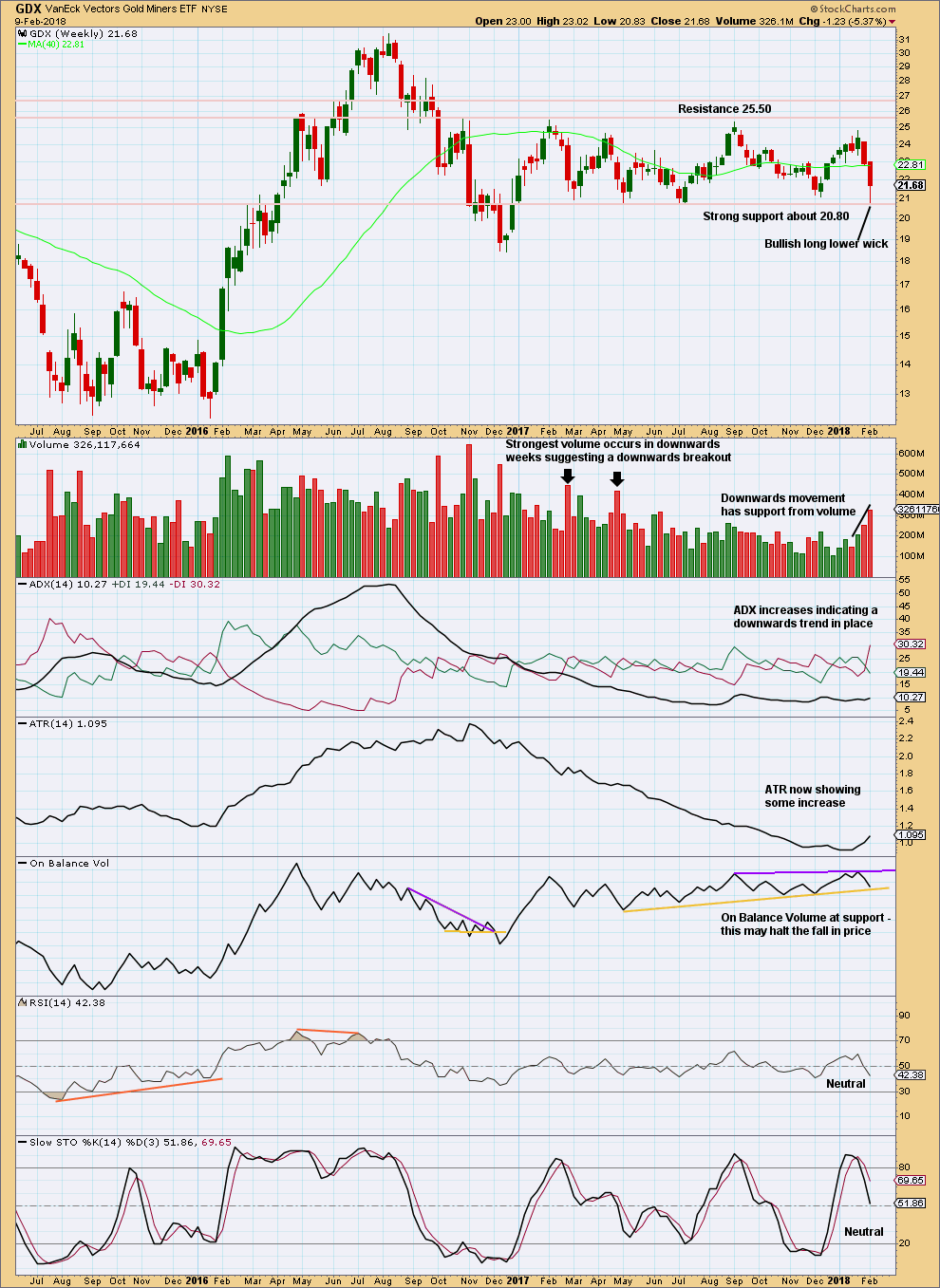

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested at least five times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

The long lower wick this week is fairly bullish. Look for an upwards swing now to resistance.

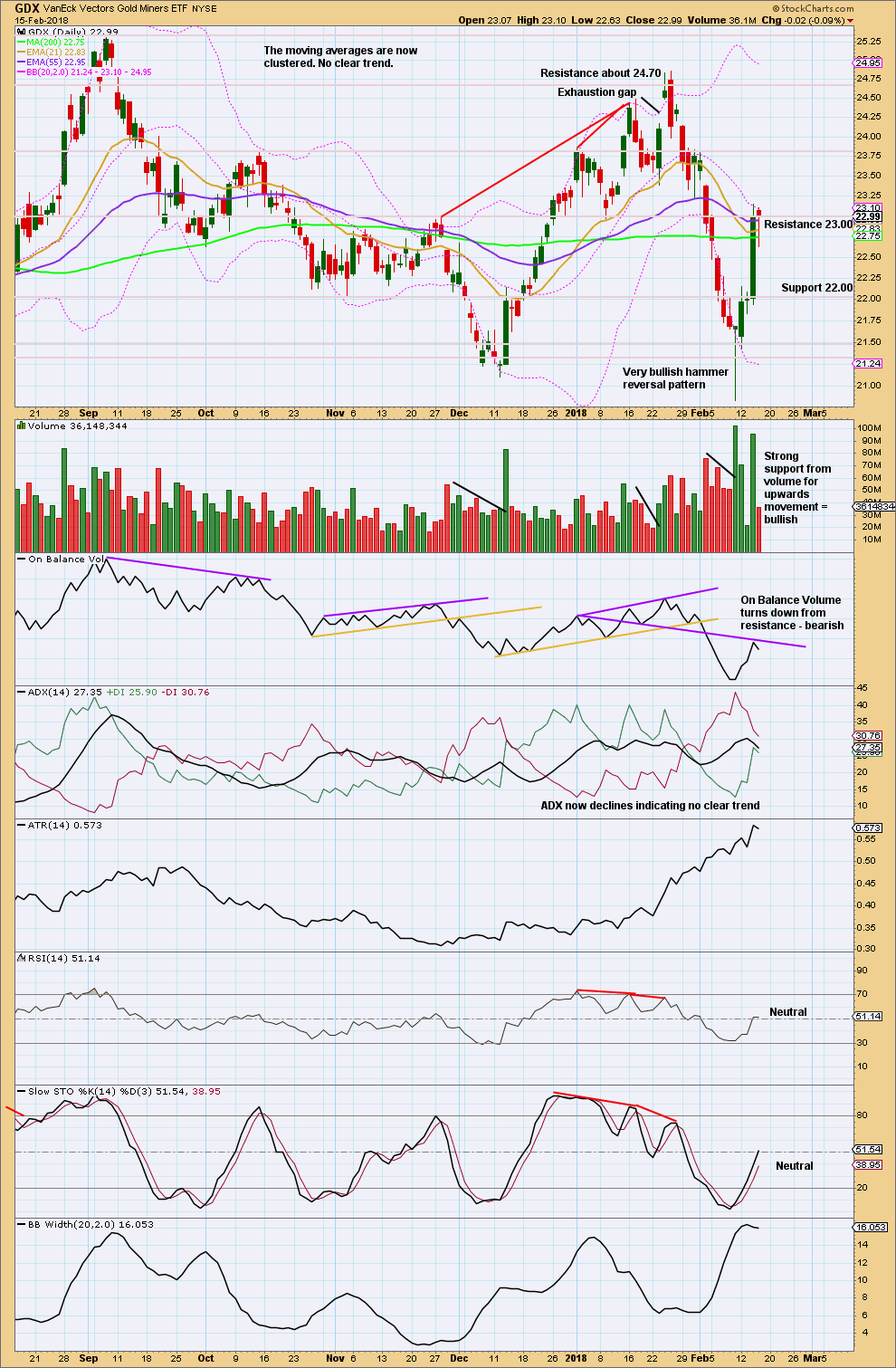

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Next resistance above 23.00 is about 23.75.

Published @ 06:26 p.m. EST.

Imo the down swing should be about completing really and time to go long expecting 1342-41 to hold; SL 1334-33….lets see.

First hourly chart updated:

Now for minuette b down as part of a zigzag up for minute b.

Minute b has now met the minimum requirement of 0.9 times the length of minute a, so minor B may now be a flat correction. These are very common structures, so this would be the preferred option.

Second hourly chart updated:

A zigzag up may be complete. This may be minute b in its entirety.

Minute c may now move down to the target for minor B.

Minor B may still be a zigzag.

And from a classic TA perspective:

Within the consolidation price has now turned down from resistance. Look for a swing down now to support.

Lara: Since weekly count is published for main / alt counts may I request you to provide a link for corresponding monthly wave count for both weekly counts everyday?

I do. It’s the last historic analysis which is linked to at the top each day.

Lara: What comes after int wave 5?

How deep the correction is going to be for gold??

Cycle c down should make a new low below cycle a at 1,046.27 to avoid a truncation. It would likely move substantially below that point.

I can’t calculate a target for cycle c until I know where cycle b ends and cycle c begins.

Lara, have you heard the concept of a “Rogue Wave”? I found this interesting

https://www.mcoscillator.com/learning_center/weekly_chart/stock_market_in_a_rogue_wave/

I have heard of them. It’s why I’d be very nervous to get in a small boat and cross an ocean. That and shipping containers.

An interesting idea when applied to financial markets. It does seem to be how commodities behave. Strong spikes up at the end of a trend, followed by a sheer drop.

And I see it’s an article by Tom McClellan. A most excellent and reliable source IMHO

Excellent read! Thanks Dreamer!

Exited my long miners just in time yesterday. Looks like the dollar bottomed. Island reversal in Euro, inverse in UUP…

Glad you liked 😊

I agree

I took a quick gander around the web recently and it is truly shocking what passes for EW analysis these days, especially in the PM arena. It seems as if anyone that can put labels on a chart can get published. I wonder if we sometimes take Lara’s analysis for granted! 🙂