Upwards movement was expected. Price has moved mostly sideways, with a very slight new high.

Downwards movement for Friday’s session remains well above the Elliott wave invalidation point and well above the prior day’s low.

Summary: Look for price to continue now in an upwards swing to end above 1,361.46. The target is at 1,375.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

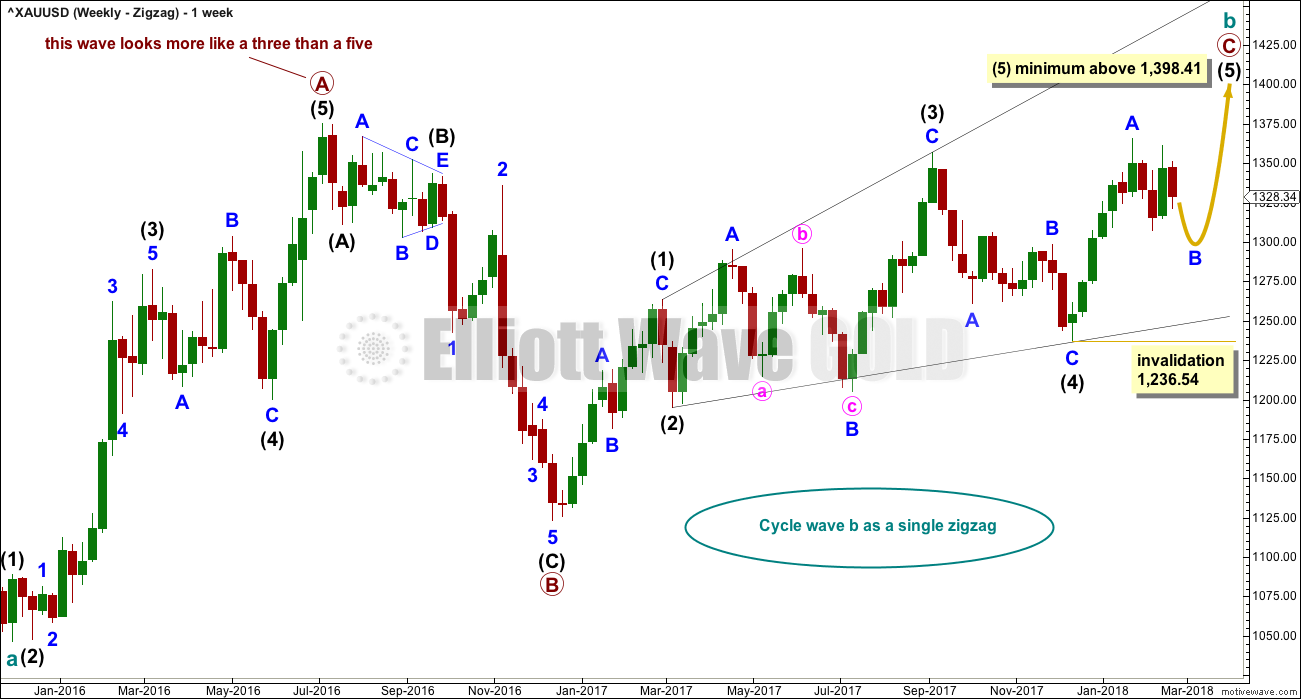

BULLISH ELLIOTT WAVE COUNT

FIRST WEEKLY CHART

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five wave structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54.

Within intermediate wave (1), the correction labelled minor wave B was over within one week. Within intermediate wave (2), the correction labelled minor wave B was too quick to be seen on the weekly chart. Within intermediate wave (3), the correction labelled minor wave B was over in 12 weeks, one short of a Fibonacci 13. Within intermediate wave (4), the correction labelled minor wave B was over in a Fibonacci 8 weeks. As each actionary wave is extending in time as well as price, the correction of minor wave B within intermediate wave (5) may be longer than that within intermediate wave (3). At this early stage, a Fibonacci 13 or possibly even 21 weeks may be expected. This expectation is a rough guideline; flexibility is essential when B waves unfold.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

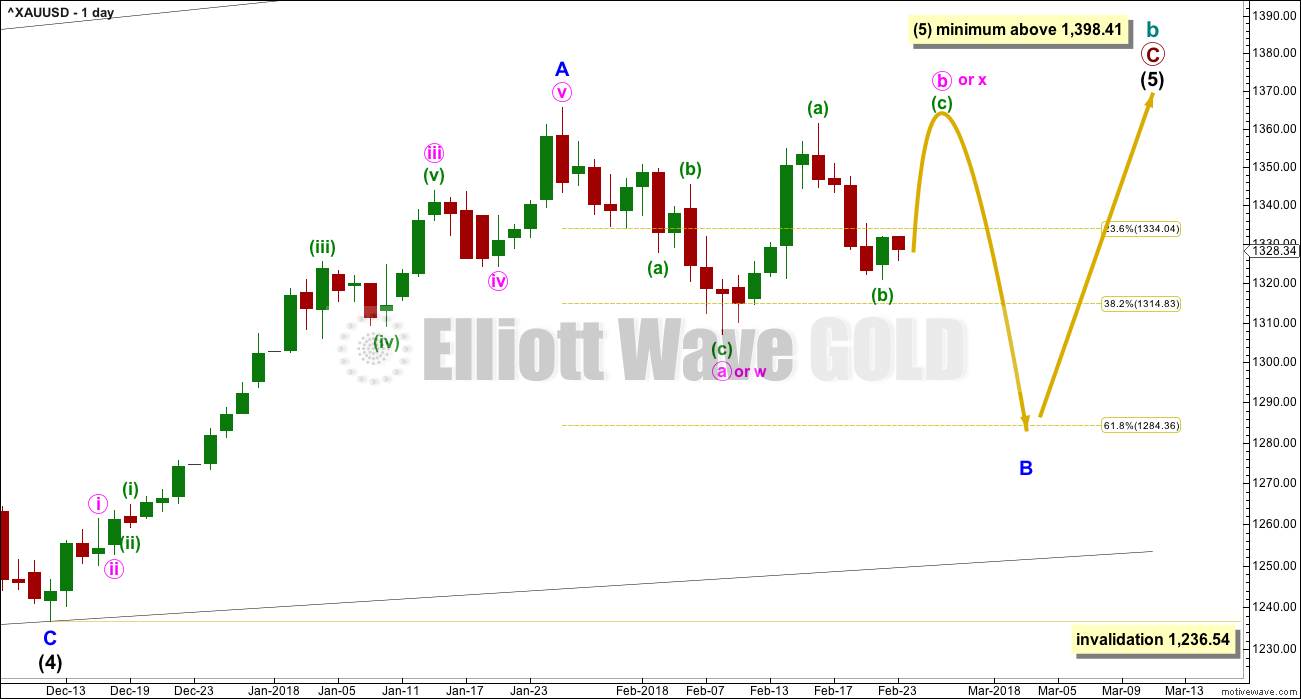

FIRST DAILY CHART

Within the ending diagonal, intermediate wave (5) must sub-divide as a zigzag.

Minor wave B may be a reasonably time consuming consolidation or a quicker sharper pullback within the upwards trend, and it may end about either of the 0.382 or 0.618 Fibonacci ratios (neither may be favoured). At this stage, it looks more likely that minor wave B may be a more time consuming sideways consolidation. Although it is possible that minor wave B could have been over at the low on the 8th of February as a quick shallow pullback, which is considered in the second alternate hourly chart.

There are more than 23 possible structures that minor wave B may take, and it is impossible until close to or at the end to have confidence which structure has unfolded. When B waves unfold, it is essential that analysis is flexible. B waves are analogous to either range bound consolidations or sharp corrections. As minor wave B unfolds, the labelling on the hourly chart for its sub-waves will change and alternates will be required.

The yellow arrows outline the possible pathway for an expanded flat for minor wave B. Members are strongly advised that this pathway is only one possible pathway of many. It is chosen to illustrate one of the most common structures for a B wave. This pathway may change as minor wave B continues further. If it does, then the labelling on hourly charts will change.

Minor wave B may still be a triangle or zigzag. All possibilities must still be considered.

Minor wave B may not move beyond the start of minor wave A below 1,236.54.

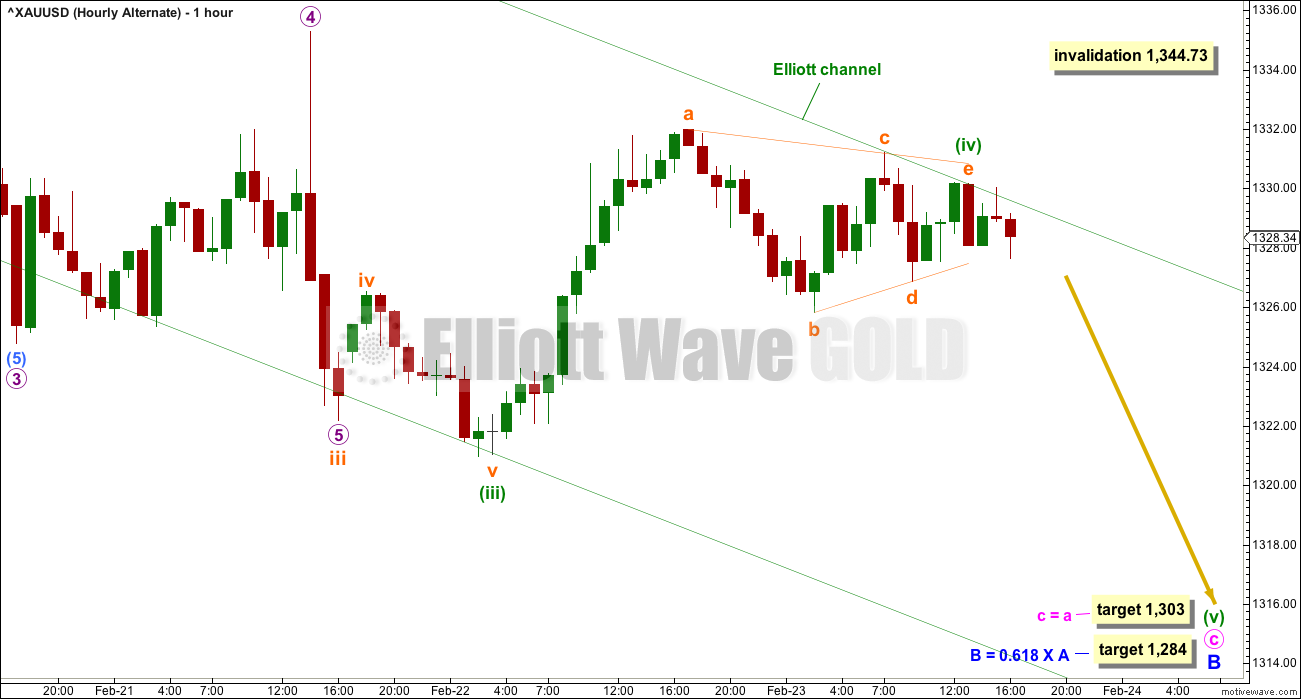

HOURLY CHART

The consolidation for minor wave B continues. It may still be any one of a flat, combination, triangle or double zigzag. This first hourly chart looks at the possibility that minor wave B may be a flat, triangle or combination.

Within minor wave B, minute wave b may be incomplete. It may be unfolding as a zigzag.

Within the zigzag of minute wave b, minuette waves (a) and now also (b) may be complete. Minuette wave (c) would be very likely to make at least a slight new high above the end of minuette wave (a) at 1,361.46 to avoid a truncation. A target is calculated for minute wave b to end, which expects minuette wave (c) to exhibit the most common Fibonacci ratio to minuette wave (a), that of equality in length.

A new high above 1,335.28 would still add some further confidence that a low is in place for the short term, even though this is no longer the invalidation point on the alternate hourly chart below.

Minuette wave (c) must subdivide as a five wave structure, either an impulse or an ending diagonal. So far subminuette wave i may be complete. Subminuette wave ii may be an incomplete zigzag and may move a little lower when markets open on Monday, but it may not move beyond the start of subminuette wave i below 1,320.96.

ALTERNATE HOURLY CHART

This alternate looks at the possibility that minor wave B is continuing as a zigzag.

Within the zigzag, minute wave a may be over as per the labelling on the daily chart. Minute wave b may have been over at the last high.

Minute wave c may now be underway. It would be extremely likely to move at least slightly below the end of minute wave a at 1,307.09 to avoid a truncation. The targets would see it achieve this.

Minuette wave (iv) is labelled as a triangle. This is valid, but within the triangle subminuette wave b is more shallow than is normal for a triangle sub-wave. This labelling does not have the right look.

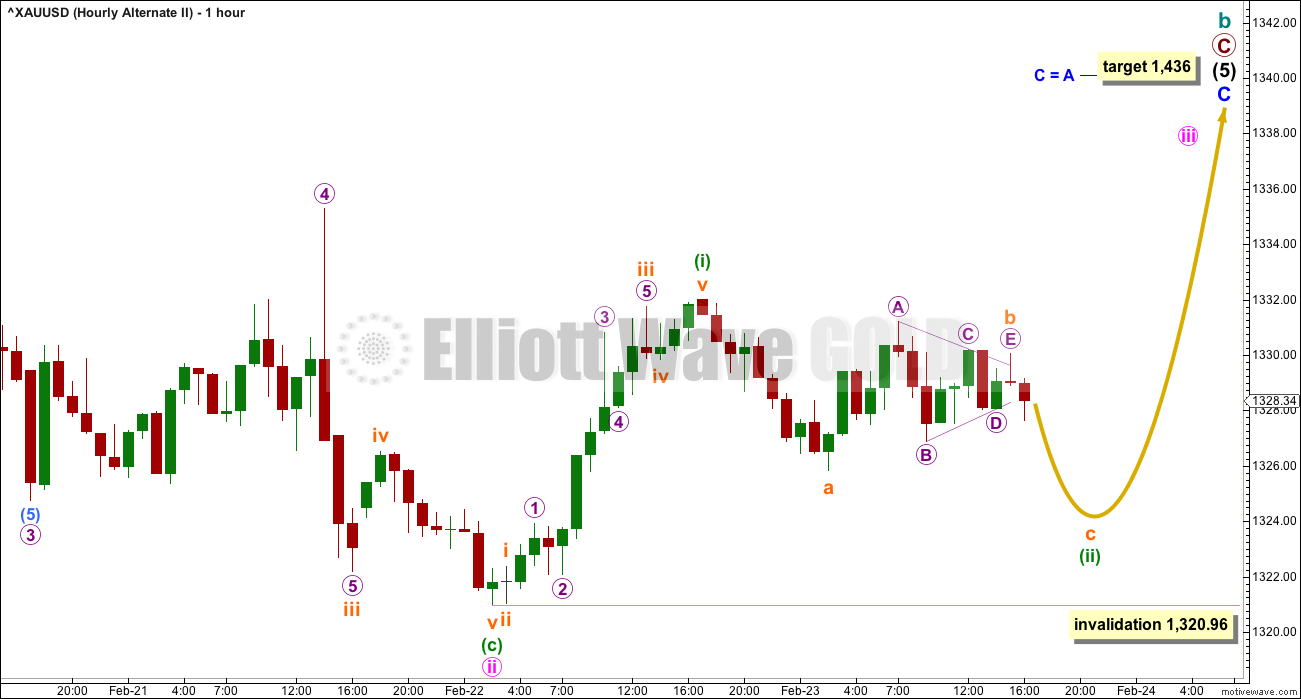

SECOND ALTERNATE HOURLY CHART

If minor wave B is complete on the 8th of February, then minor wave C must have begun there. Minor wave C may only be an impulse or an ending diagonal.

Minor wave C should be assumed to be an impulse until overlapping indicates an ending diagonal.

Within the impulse, minute waves i and now ii may be complete. Within minute wave iii, minuette wave (i) may be complete. Minuette wave (ii) may move a little lower on Monday. Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,320.96.

So far this week volume does not support any upward movement in price. This does not look like the start of a third wave up. Third waves should exhibit strength.

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction, and within it intermediate wave (B) may be a complete triple zigzag. This would indicate a regular flat as intermediate wave (B) is less than 1.05 the length of intermediate wave (A).

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

TECHNICAL ANALYSIS

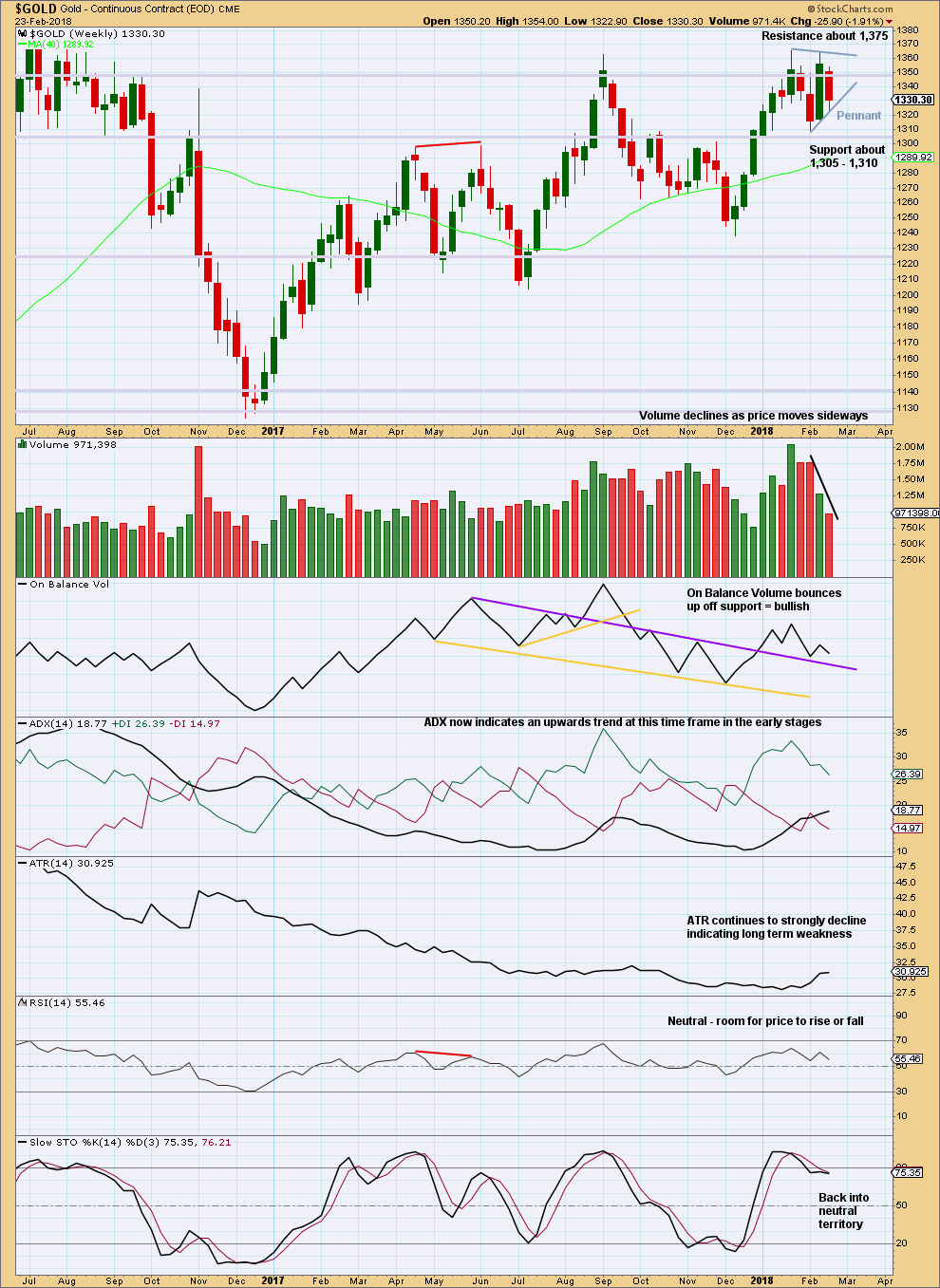

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

At the weekly time frame, ADX now indicates an upwards trend but price is still range bound with resistance about 1,375 and support finally about 1,225.

Strongest weekly volume of recent weeks is an upwards week, which is bullish. The last signal from On Balance Volume is bullish. This supports the main daily Elliott wave count.

A pennant pattern may be forming. If this is a pennant, already 4 weeks in duration, then it should conclude very soon. If it continues, then it would be a triangle which may be either a reversal or continuation pattern.

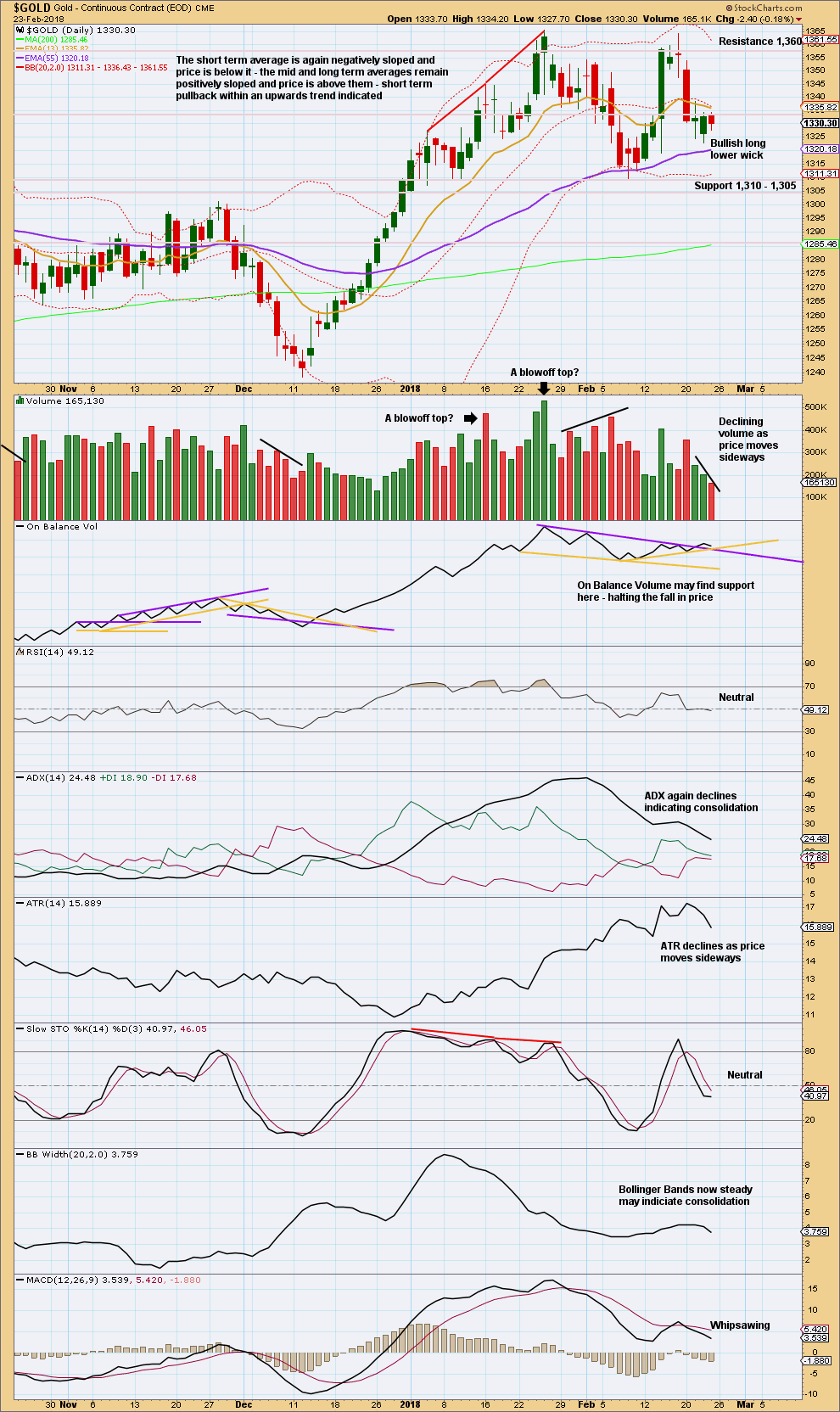

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support on On Balance Volume may halt the fall in price here.

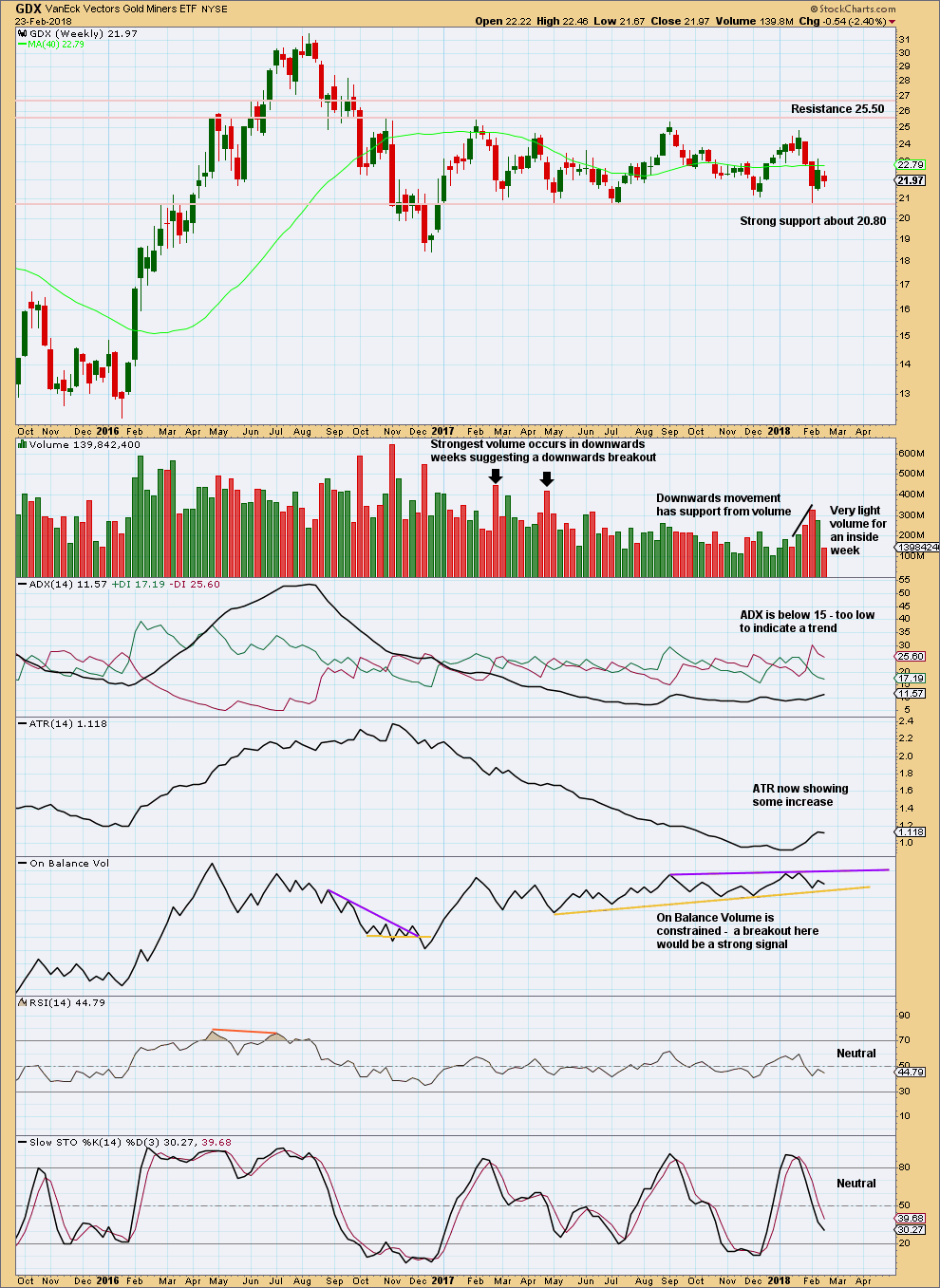

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested about seven times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

On Balance Volume should be watched closely. A breakout there may signal the breakout direction for price.

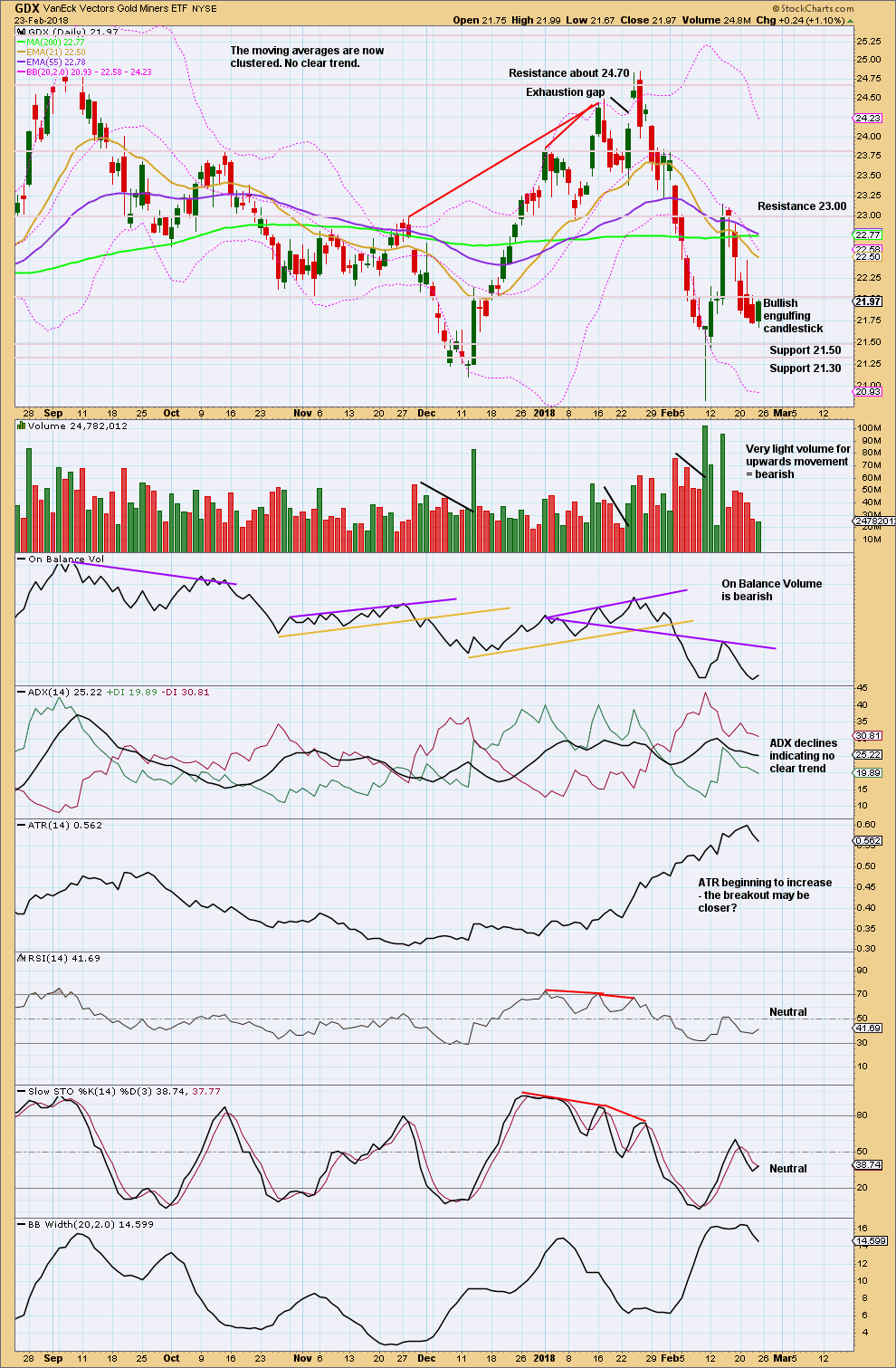

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The bullish candlestick for Friday lacks support from volume, which is concerning for bulls.

If price has not yet found a low, then look for support at 21.50. If price can break through resistance here, then next resistance is at 23.00.

Published @ 10:37 p.m. EST on 24th February, 2018.

Hourly chart updated:

The pullback today is overlapping into subminuette i price territory, so it can’t be subminuette iv.

Subminuette ii must have been over more quickly. It did look more like a five than a three. But it must have been a three. It will fit as a zigzag on the five minute chart.

Gold may be winding up for a strong push higher.

Seems to fit

Brandon, this count has some rule violations. Can you spot them?

I’ll answer for your Brandon. Hope that’s okay.

1. In the first chart, within the ending diagonal of (C) to end Y of IV, the third wave is too long. The diagonal is contracting, and the third wave needs to be shorter than the first. But it’s longer. Violating the rules regarding wave lengths for contracting diagonals.

2. In the second chart, the structure of (1) is very problematic. It is very hard indeed to see that wave up as a five. The labels aren’t there, so I can’t see how you did that. An illustration would be necessary for that movement IMO.

3. In the second chart, iii of 1 is the shortest actionary wave within that impulse upwards.

Thanks Lara wasn’t my chart just wanted an opinion on it

No worries.

Its a good idea to know the EW rules by heart so that you can spot work which violates the rules.

Anything calling itself EW that violates EW rules is worse than a waste of your time, it can put you on the wrong side of the market.

Carter Worth seems to be a pretty good TA analyst

https://www.cnbc.com/2018/02/24/three-charts-that-show-gold-is-going-to-1400.html

I think Lara’s main count has a good probability at this point. Sideways and down movement into the March 21st Fed meeting when rates are expected to increase seems to make sense. Gold has been finding bottoms near Fed increase dates.

Amazing volume of work Lara ( I’m still going through it). Hope you feel better soon 🤒

All good now thanks Dreamer. It was just a weird allergic reaction to something I ate. Strangely, I’m allergic to buckwheat. And pineapple.

Hi Lara,

just wondering if we get an update on Oil as well?

Thanks Ursula

Done now. My apologies Ursula for the delay. I was ill today… you can hear it in my voice on the Gold video.