Upwards movement has breached the invalidation point on the hourly chart. The short term structure of the last four sessions is reanalysed.

Summary: Overall, still expect a downwards swing from here to support. Use the wide channel on the hourly chart for confidence that a high is in place. The target is at 1,306. Do not expect this swing to move in a straight line. There may be one more bounce on the way down, which may last one to a few days. Use the channel on the hourly chart to indicate where bounces may find resistance.

Always responsibly manage your risk. Always trade with stops to protect your account. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

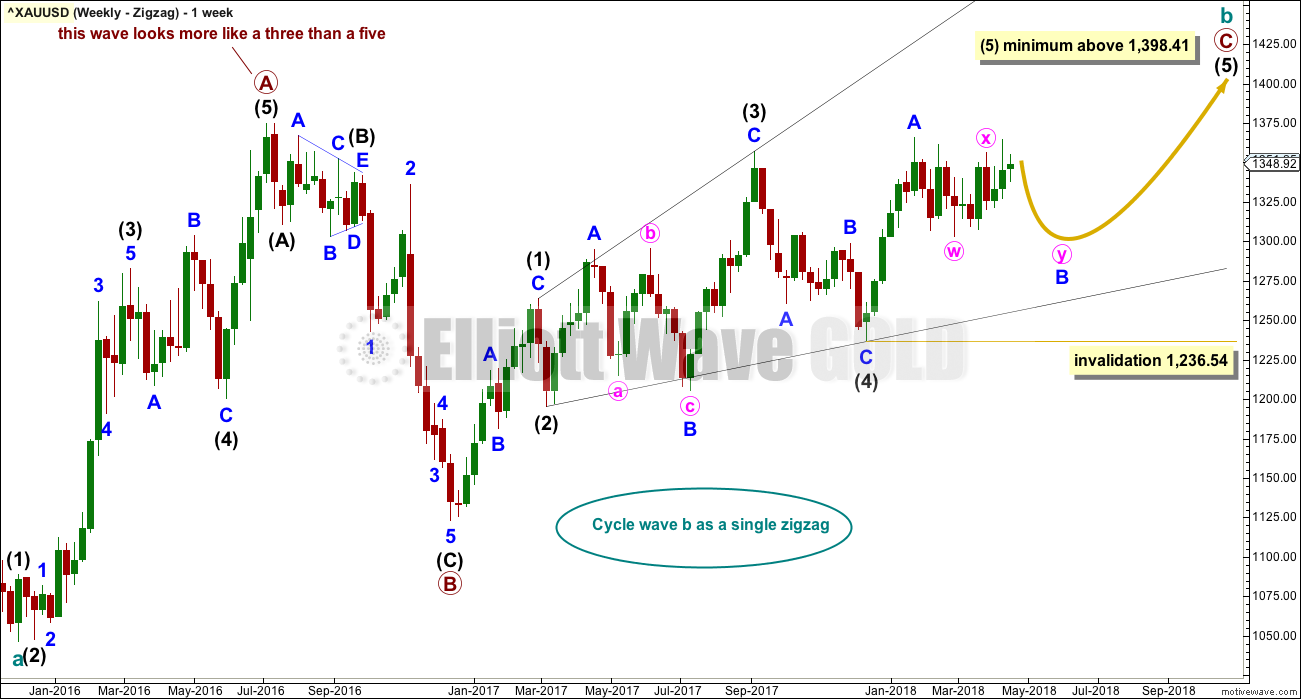

BULLISH ELLIOTT WAVE COUNT

FIRST WEEKLY CHART

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five wave structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54. However, if it were now to turn out to be relatively deep, it should not get too close to this invalidation point as the lower (2)-(4) trend line should provide strong support. Diagonals normally adhere very well to their trend lines.

Within the diagonal of primary wave C, each sub-wave is extending in price and so may also do so in time. Within each zigzag, minor wave B may exhibit alternation in structure and may show an increased duration.

Within intermediate wave (1), minor wave B was a triangle lasting 11 days. Within intermediate wave (3), minor wave B was a regular flat lasting 60 days. Within intermediate wave (5), minor wave B may last as long as 40 to 60 days. So far it has lasted 59 days (refer to daily chart) and the structure is incomplete.

At this stage, minor wave B may now be a double flat or triangle. These two ideas are separated out in daily charts below.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

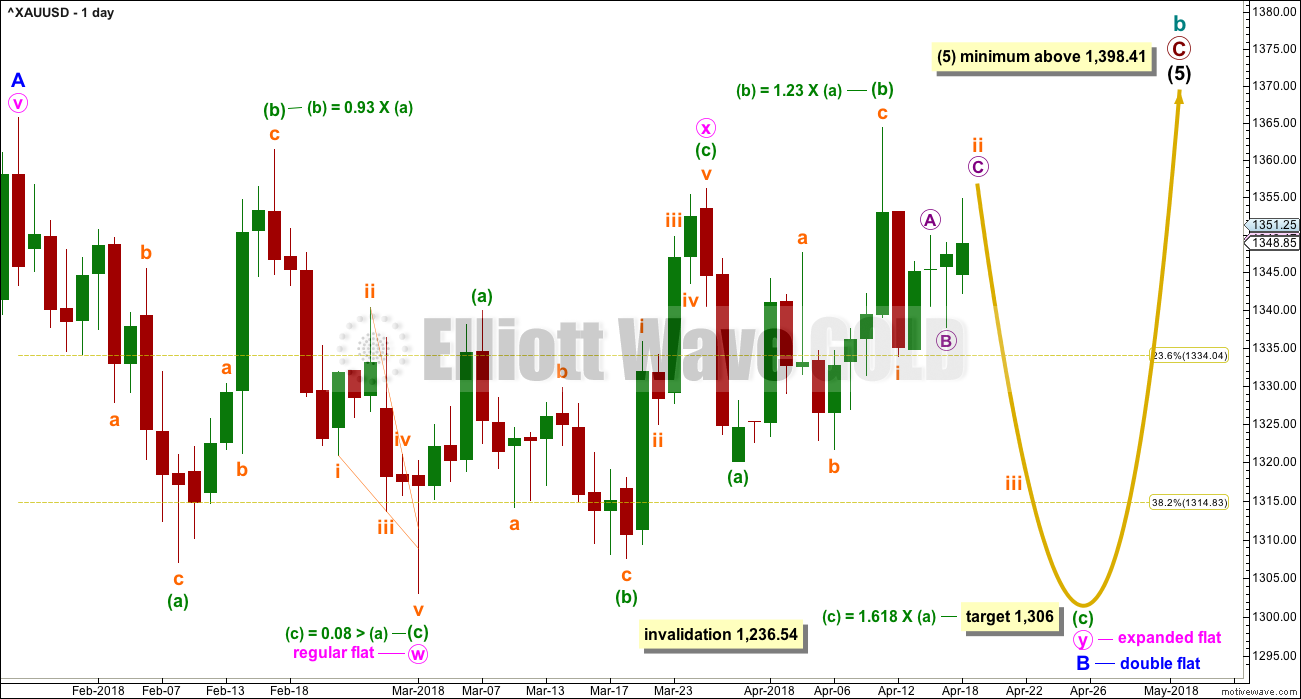

FIRST DAILY CHART – DOUBLE FLAT

A new high above 1,356.12 indicates minute wave y be an expanded flat correction. This indicates minor wave B may be a relatively rare double flat correction.

Within this possible double flat, the first flat labelled minute wave w is a regular flat. The second flat labeled minute wave y may be an expanded flat, providing alternation with the first.

Within the expanded flat of minute wave y, minuette wave (b) is within the common range of from 1 to 1.38 times the length of minuette wave (a). The most common Fibonacci ratio for minuette wave (c) is used to calculate a target for it to end.

The target would see minute wave y end close to the same level as minute wave w; the double flat would have a sideways look and achieve its purpose of taking up time and moving sideways. This target is also within a strong area of support.

Minuette wave (c) should subdivide as a five wave structure. It may not move in a straight line, so do not expect it to. Within minuette wave (c), there may be expected to be two bounces for a second and fourth wave. The first bounce for subminuette wave ii now shows up as two green daily candlesticks.

Minuette wave (c) would be extremely likely to move at least slightly below the end of minuette wave (a) at 1,320 to avoid a truncation and a very rare running flat.

HOURLY CHART – DOUBLE FLAT

The whipsaw which saw a new high in this last session may be subminuette wave ii continuing higher as a double zigzag. The best fit channel contains almost all upwards movement. When this channel is breached by downwards movement, it should provide substantial confidence that a high is in place.

The second zigzag in the double labelled micro wave Y may be incomplete, and within it sub-micro wave (C) may be an incomplete impulse. Minuscule wave 4 fits only as a zigzag on the five minute chart, indicating that upwards movement is reasonably likely to be incomplete. Minuscule wave 4 may not move into minuscule wave 1 price territory below 1,346.37. A new low below this point could not be a fourth wave within an ongoing impulse, so at that stage the impulse should be over.

Sub-micro wave (C) may require only a final fifth wave up to complete the structure. Thereafter, price may turn strongly lower.

The target remains the same.

Subminuette wave ii may not move beyond the start of subminuette wave i above 1,364.36.

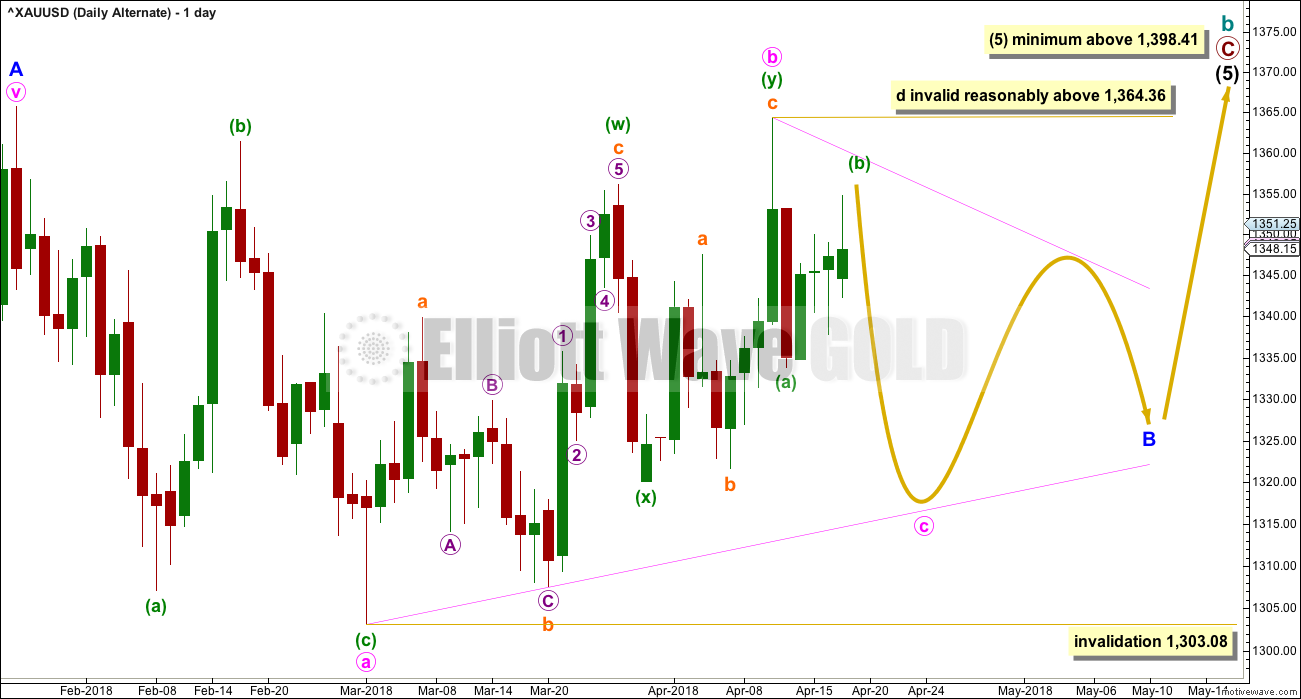

SECOND DAILY CHART – TRIANGLE

This daily chart is identical to the first daily chart up to the high labelled minor wave A. Thereafter, it looks at a different structure for minor wave B.

A triangle for minor wave B may still be valid. Within a triangle, four of the five sub-waves must sub-divide as zigzags and one sub-wave usually subdivides as a double zigzag; the double zigzag is most commonly wave C of the triangle, but it may be any sub-wave. Here, it may have been minute wave b.

All remaining triangles must be simple A-B-C structures, most likely zigzags.

Within minute wave c, the current bounce of minuette wave (b) may not move beyond the start of minuette wave (a) above 1,364.36.

Minute wave c may not move beyond the end of minute wave a below 1,303.08 for both a contracting or barrier triangle. Thereafter, minute wave d may not move above the end of minute wave b at 1,364.36 for a contracting triangle. For a barrier triangle, minute wave d may end about the same level as minute wave b in order for the b-d trend line to look essentially flat.

A final small zigzag downwards for minute wave e would most likely fall short of the a-c trend line.

This wave count still allows for choppy overlapping movement in an ever decreasing range for several weeks. Minor wave B may be as long lasting as a Fibonacci 21 weeks if it is a triangle, as triangles do tend to be very long lasting structures.

This wave count now expects a zigzag may be unfolding lower for minute wave c. At this stage, the subdivisions at the hourly chart level do not diverge from the main wave count; both counts expect to see 5-3-5 unfold lower. This count expects a zigzag and the main count expects a 1-2-3 of an impulse. At the point the two counts diverge in terms of structure at the hourly chart level, then separate hourly charts will be published for them.

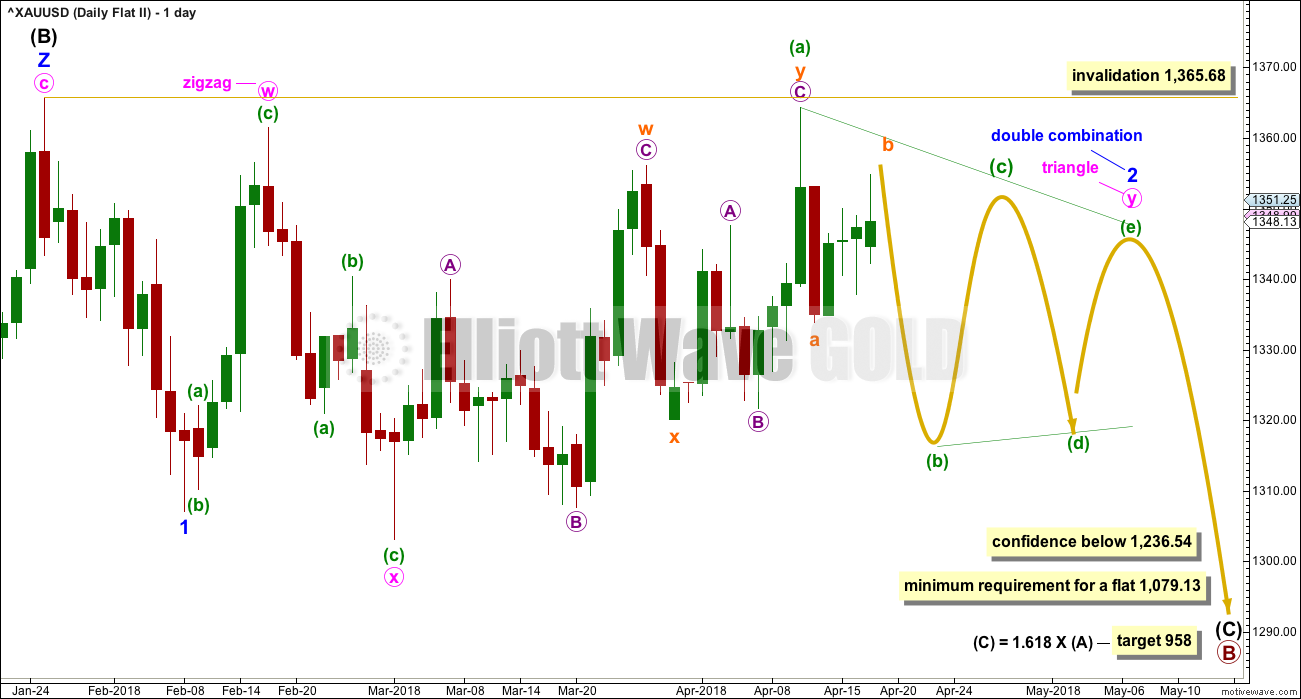

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction, and within it intermediate wave (B) may be a complete triple zigzag. This would indicate a regular flat as intermediate wave (B) is less than 1.05 the length of intermediate wave (A).

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

FIFTH DAILY CHART

Minor wave 1 may have been a relatively brief impulse over at the low of the 8th of February. Thereafter, minor wave 2 may be an incomplete double combination.

The first structure in the double may be a zigzag labelled minute wave w. The double may be joined by a three in the opposite direction, a zigzag labelled minute wave x. The second structure in the double may be an incomplete triangle labelled minute wave y. This structure may yet take some weeks to complete. In my experience a double combination with a triangle for minute wave y is not very common. This reduces the probability of this wave count, but it remains valid.

This wave count is a good solution for this bearish wave count. All subdivisions fit and there are no rare structures so far within intermediate wave (C).

TECHNICAL ANALYSIS

WEEKLY CHART

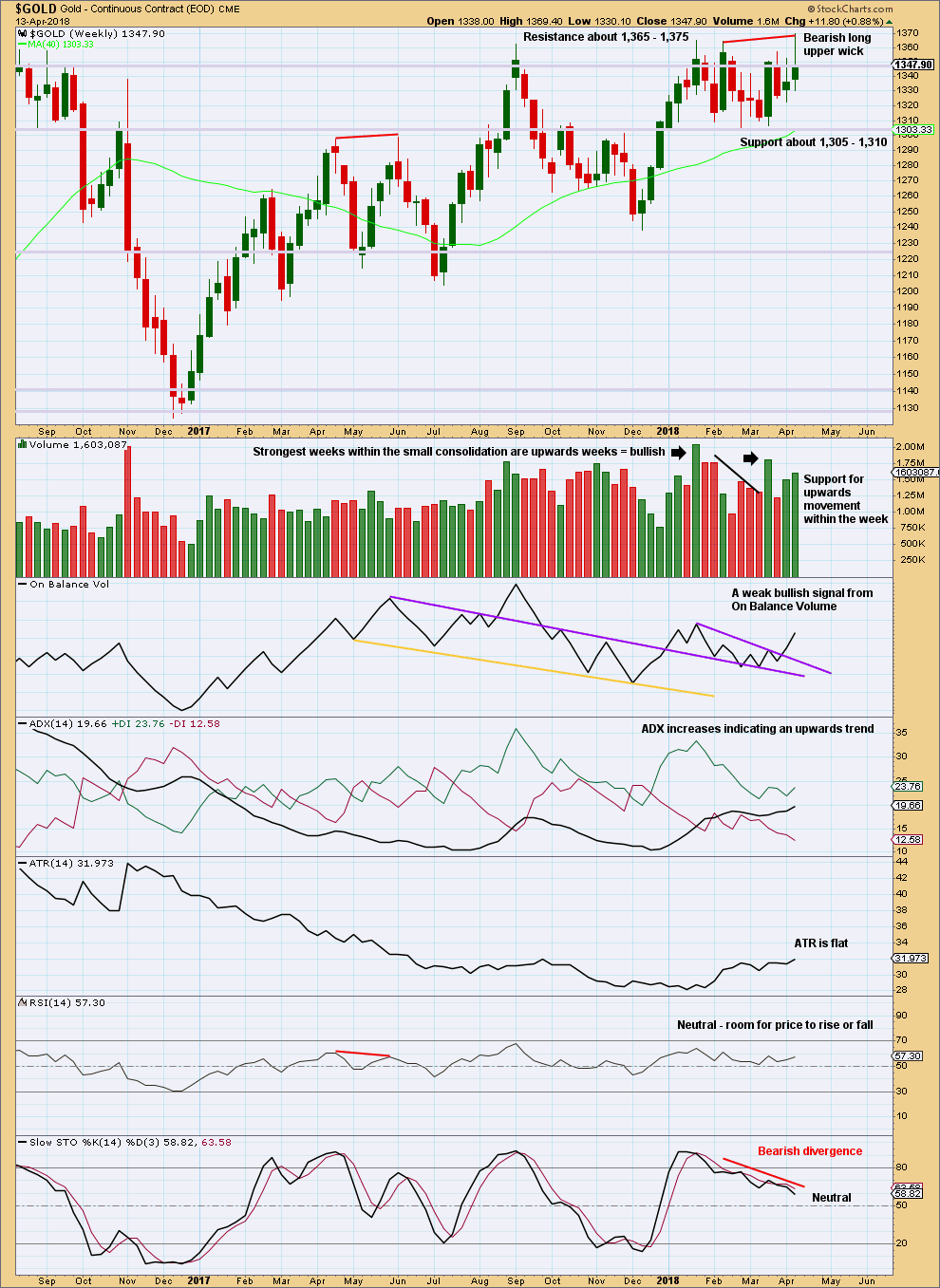

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold is within a small consolidation with resistance about 1,365 to (final) 1,375 and strong support about 1,310 to 1,305. Volume suggests an upwards breakout is more likely than downwards.

The bullish signal last week from On Balance Volume is weak because the purple line, which has been breached, has a reasonable slope and was only tested twice prior.

Reasonable weight should be given to the long upper wick on the last weekly candlestick; it is reasonably bearish. With price at resistance at the high of this candlestick, and Stochastics exhibiting bearish divergence, it seems reasonable to expect a downwards swing to support this week.

DAILY CHART

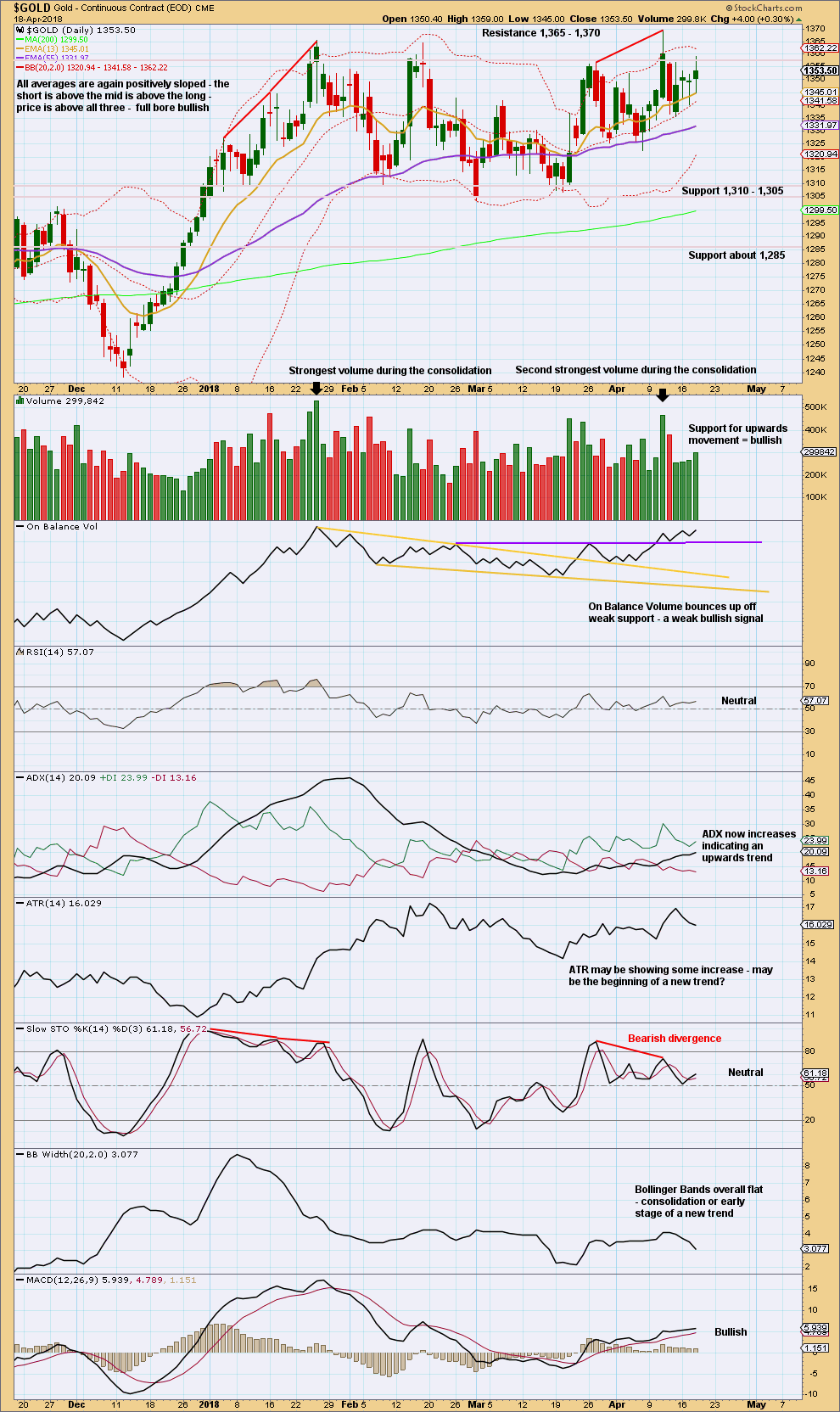

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold is within a smaller consolidation that began back on about the 3rd of January. This consolidation is delineated by resistance about 1,360 to 1,365 and support about 1,310 to 1,305. It is the upwards days of the 15th of January and the 11th of April that have strongest volume. This strongly suggests an upwards breakout may be more likely than downwards.

Price was at resistance and exhibited divergence with Stochastics at the last high. It still looks reasonable to expect a downwards swing overall to continue here until price finds support and Stochastics reaches oversold. Do not expect this swing to move in a straight line because that is not how price moves within a consolidation.

Volume is bullish today, suggesting this small upwards bounce may not be over yet.

GDX WEEKLY CHART

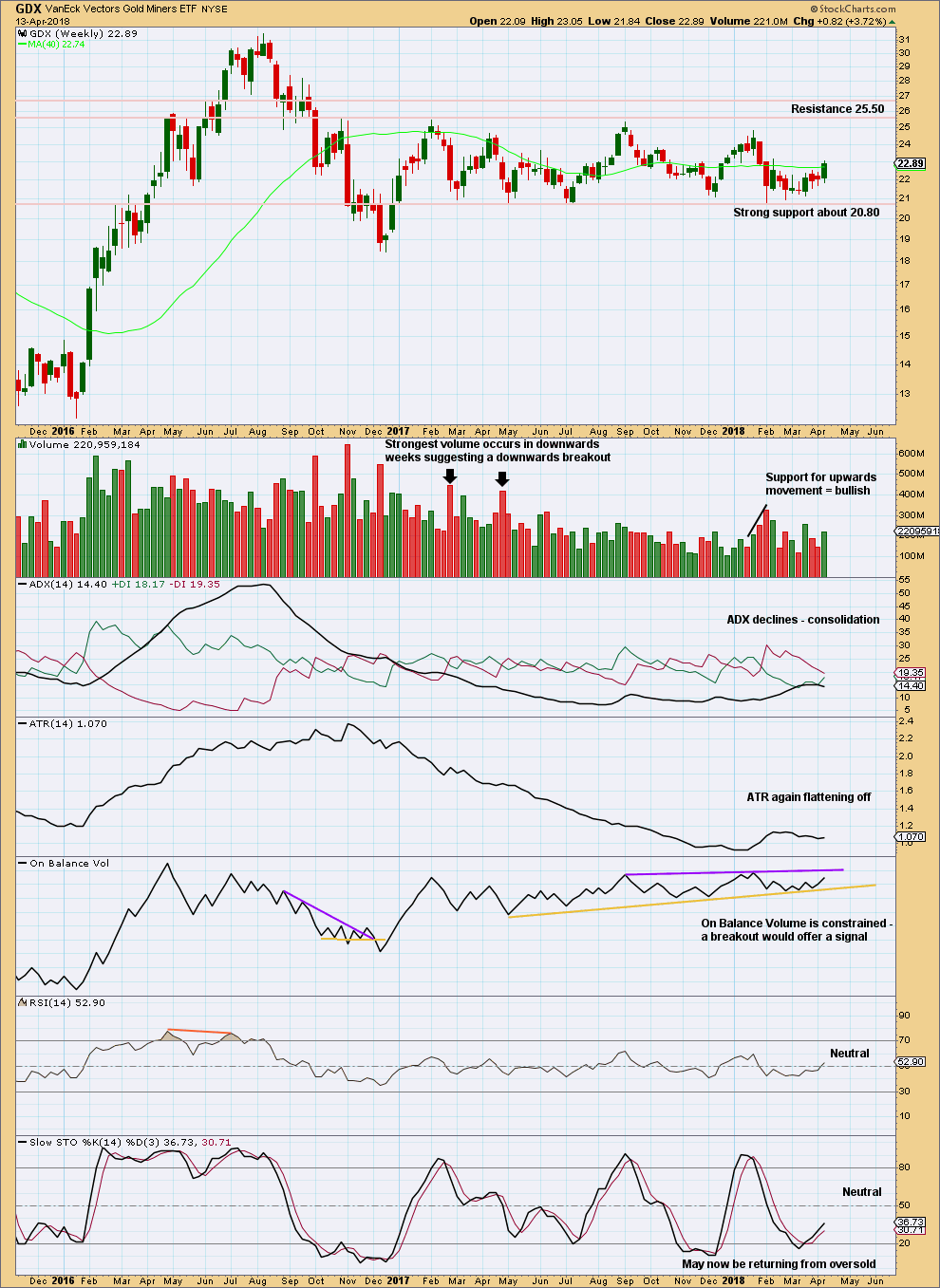

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

The last week is a strong green candlestick with support from volume. There is some distance to go before On Balance Volume finds resistance. It looks like an upwards swing may be underway for GDX to resistance. Do not expect it to move in a straight line.

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

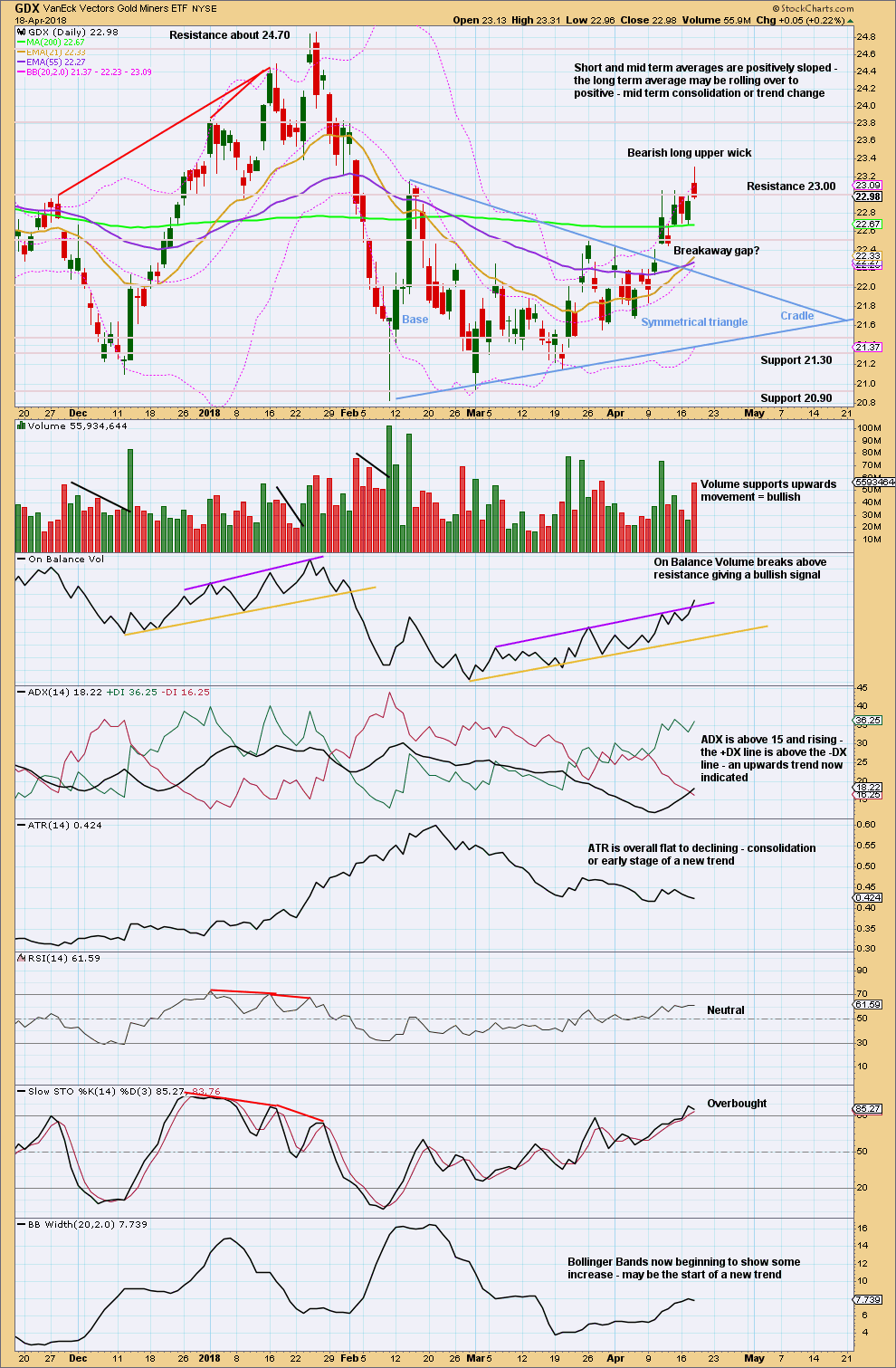

On trading triangles from Dhalquist and Kirkpatrick, page 319:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout. These patterns seem to work better with small-cap stocks in a rising market.

Although triangles are plentiful, their patterns suffer from many false and premature breakouts. This requires that a very strict breakout rule be used, either a wide filter or a number of closes outside the breakout zone. It also requires a close protective stop at the breakout level in case the breakout is false. Once these defensive levels have been exceeded, and price is on its way, the trader can relax for a little while because the failure rate after a legitimate breakout is relatively low. Trailing stops should then be placed at each preceding minor reversal.

…. in symmetrical triangles, the best performance comes from late breakouts in the 73% – 75% distance.

Volume on the breakout seems more desirable in symmetrical triangles.”

In this case, the breakout has come 61% of the triangle length from base to cradle. Volume towards the end of the triangle declined. The breakout is accompanied by a gap and has good support from volume.

Pullbacks occur 59% of the time for symmetrical triangles.

Any long positions entered on a pullback may use the breakaway gap as a place for stops just below 22.41. If that gap is closed, then it may be an exhaustion gap and the breakout may have failed. The gap remains open at this time. If this is correctly labelled as a breakaway gap, then price should bounce up from here. If it is closed, then next support may be about the upper trend line of the triangle.

A profit target is calculated by adding the triangle width to the breakout point. This gives a target at 24.61.

The bullish signal today from On Balance Volume offers some support to the idea that GDX may continue higher towards the target here.

Published @ 10:52 p.m. EST.

I enjoy reading all these comments. I’d have paid the extra $20 if I’d have known a lot of the comments were going to happen on the weekly that I can’t see. Sent me into an ever loving loop until I figured out that included the s&p. Absolutely fascinating there’s no love for silver in here. Thanks again for those that chime in. I love entertaining all views of thought, especially on this subject.

Yea, when Gold and the miners made their huge move up in 2016, there were days with more than 100 comments. Much more fun then…

Updated hourly chart:

I still want to see that channel breached before I would have enough confidence that subminuette ii is over. While price remains above the lower edge I’m leaving the invalidation point at the start of subminuette wave i. That is the risk at this time

I think the bottom is in if silver keep outperforming gold, and GDXJ performs better than GDX. Dollar needs to depreciate.

Zoomed-in look at the current movement for GDX

https://www.tradingview.com/x/Y1XLx7Oh/

From an Elliott Wave perspective, there has been a lot of overlapping which now looks like a leading contracting diagonal. I think the diagonal is complete now with a DEEP retrace starting. I think the Feb 09 low (20.84) and the March 01 low (20.94) will HOLD.

This count, if correct, matches up great with Lara’s main Gold count. I expect a GREAT buying opportunity within the next couple of weeks. A very strong move up will likely commence once Gold and GDX bottoms.

https://www.tradingview.com/x/shS2EMNB/

Looks like a good wave count. Thank you very much for sharing Dreamer!

So I’ve been debating whether the miners have bottomed yet or not. I think the answer is YES.

Since the Feb 09, 2018 spike low in GDX, GDX has outperformed Gold. See the ratio chart below

while that is true at this time, it does not necessarily mean that GDX must continue outperforming Gold. that relationship could change at any time.

is miniscule 5 on the main hourly truncated?

it looks like it’s over now Nick, and yes, it looks truncated. or my count of subminuette ii was wrong