Upwards movement was expected after last analysis. An inside day completed. The low so far remains in place.

Summary: It still looks like a low is in place. Price closed within support and Stochastics is oversold and exhibits bullish divergence. Expect an upwards swing at least, and likely an upwards breakout from the consolidation that Gold has been in since January.

Risk remains at 1,236.54 while the channel on the hourly chart has not yet been breached by upwards movement.

The target is now at 1,431.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

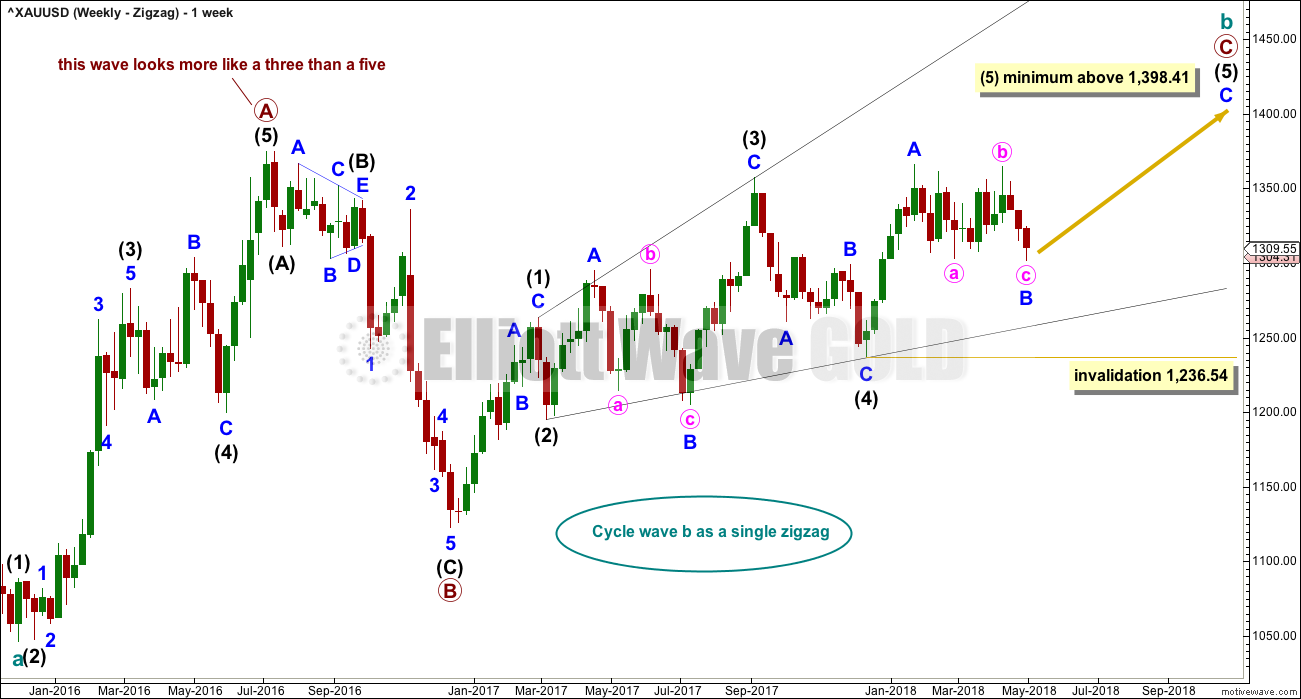

BULLISH ELLIOTT WAVE COUNT

FIRST WEEKLY CHART

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five wave structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54. However, if it were now to turn out to be relatively deep, it should not get too close to this invalidation point as the lower (2)-(4) trend line should provide strong support. Diagonals normally adhere very well to their trend lines.

Within the diagonal of primary wave C, each sub-wave is extending in price and so may also do so in time. Within each zigzag, minor wave B may exhibit alternation in structure and may show an increased duration.

Within intermediate wave (1), minor wave B was a triangle lasting 11 days. Within intermediate wave (3), minor wave B was a regular flat lasting 60 days. Intermediate wave (5) is expected to be longer in price than intermediate wave (3), and so it may also be longer in duration. If it is over at the last low, it would have lasted 68 days.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

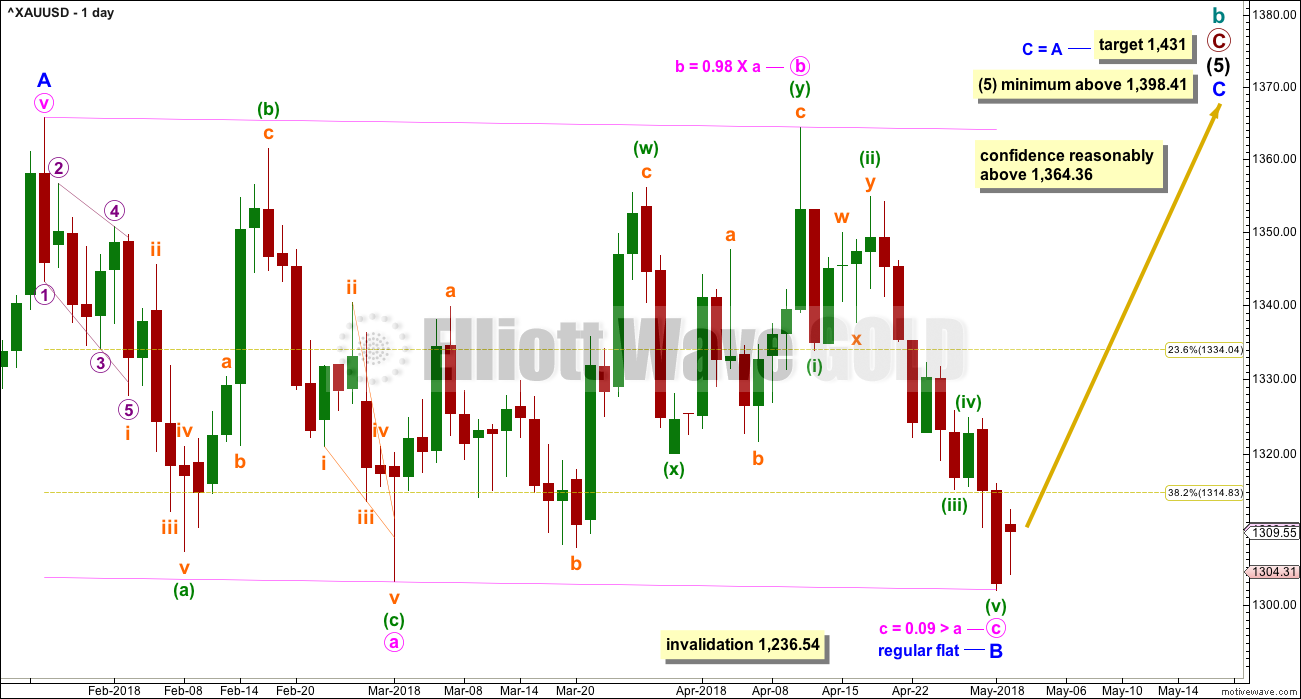

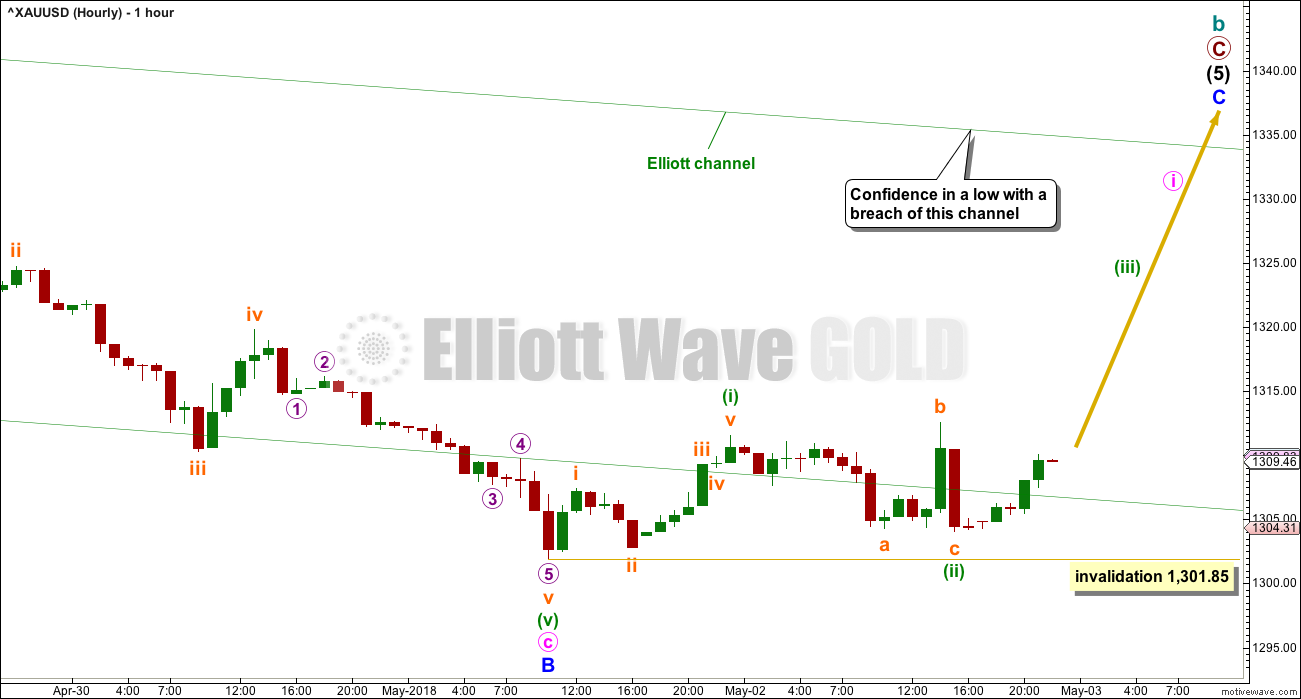

FIRST DAILY CHART

Minor wave B may be a complete single regular flat correction. Within the flat, minute wave a is a three, a single zigzag, and minute wave b is a three, a double zigzag, and minute wave c is a five that has moved price slightly below the end of minute wave a. There is a very close Fibonacci ratio of equality between minute waves a and c.

Regular flats normally fit very well into parallel channels. Minute wave c has found support almost exactly at the lower edge of this channel. This gives the flat correction the right look.

FIRST HOURLY CHART

Minor wave B may be complete. The structure of minute wave c is now a completed five wave impulse.

The Elliott channel is drawn in this way: first trend line is drawn from the ends of minuette waves (i) to (iii), then a parallel copy is placed upon the end of minuette wave (ii). These waves can be seen on the daily chart.

Gold, typical of commodities, often exhibits swift strong fifth waves. Their strength can often overshoot Elliott channels. This one looks typical.

If price breaks above the upper edge of the Elliott channel, that should provide substantial confidence that a low is in place.

At this stage, a first wave up and a second wave down may be complete within a new trend. These are labelled minuette wave (i) and minuette wave (ii), respectively.

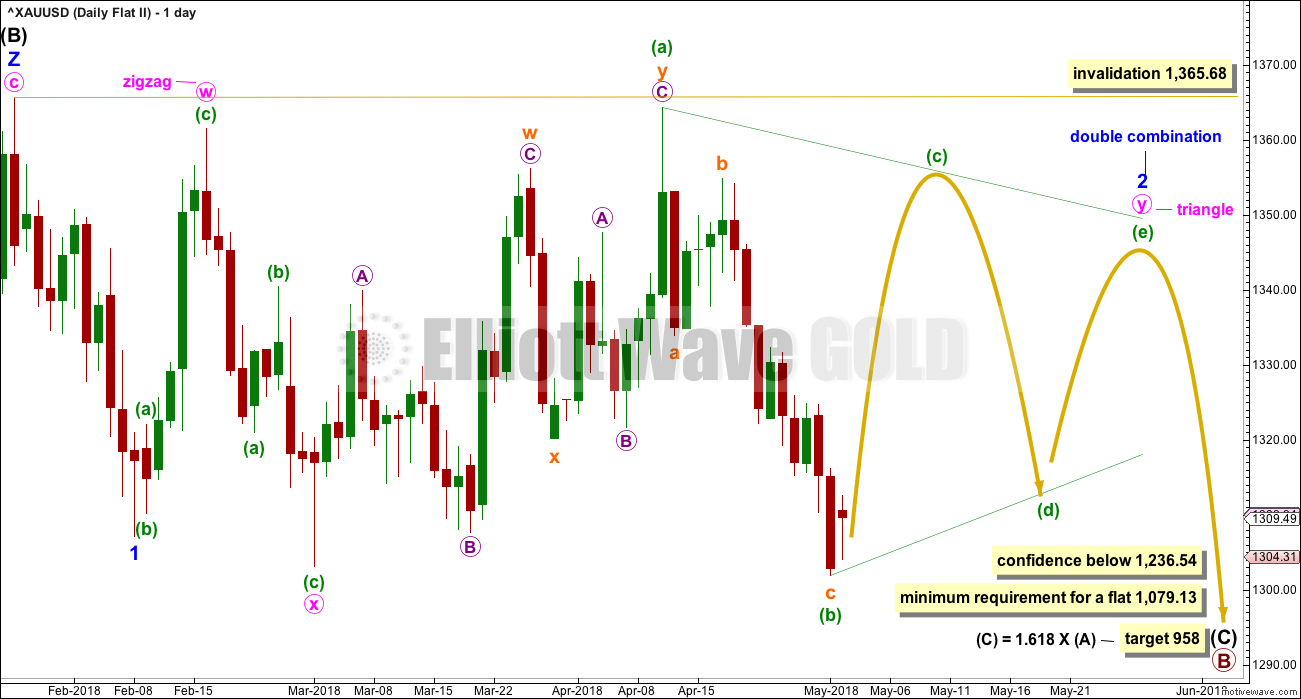

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction.

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

Primary wave B may be subdividing as a regular flat correction, and within it both intermediate waves (A) and (B) subdivide as three wave structures. Intermediate wave (B) fits as a triple zigzag.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

FIFTH DAILY CHART

Minor wave 1 may have been a relatively brief impulse over at the low of the 8th of February. Thereafter, minor wave 2 may be an incomplete double combination.

The first structure in the double may be a zigzag labelled minute wave w. The double may be joined by a three in the opposite direction, a zigzag labelled minute wave x. The second structure in the double may be an incomplete running triangle labelled minute wave y. This structure may yet take some weeks to complete. In my experience a double combination with a triangle for minute wave y is not very common. This reduces the probability of this wave count, but it remains valid.

This wave count is a good solution for this bearish wave count. All subdivisions fit and there are no rare structures so far within intermediate wave (C).

TECHNICAL ANALYSIS

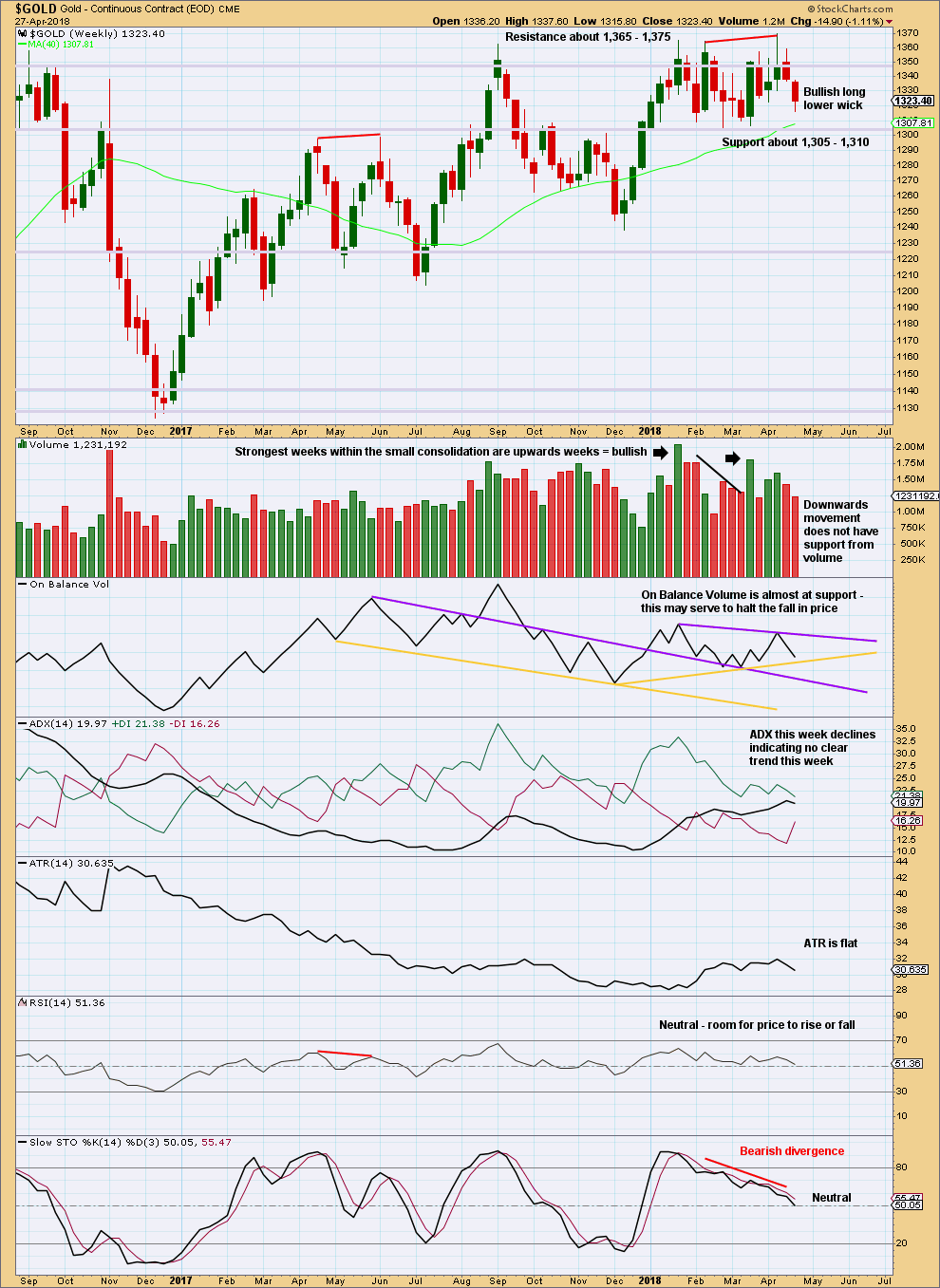

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold is within a small consolidation with resistance about 1,365 to (final) 1,375 and strong support about 1,310 to 1,305. Volume suggests an upwards breakout is more likely than downwards.

The long lower wick on the last weekly candlestick suggests a bounce for next week, as does support for On Balance Volume.

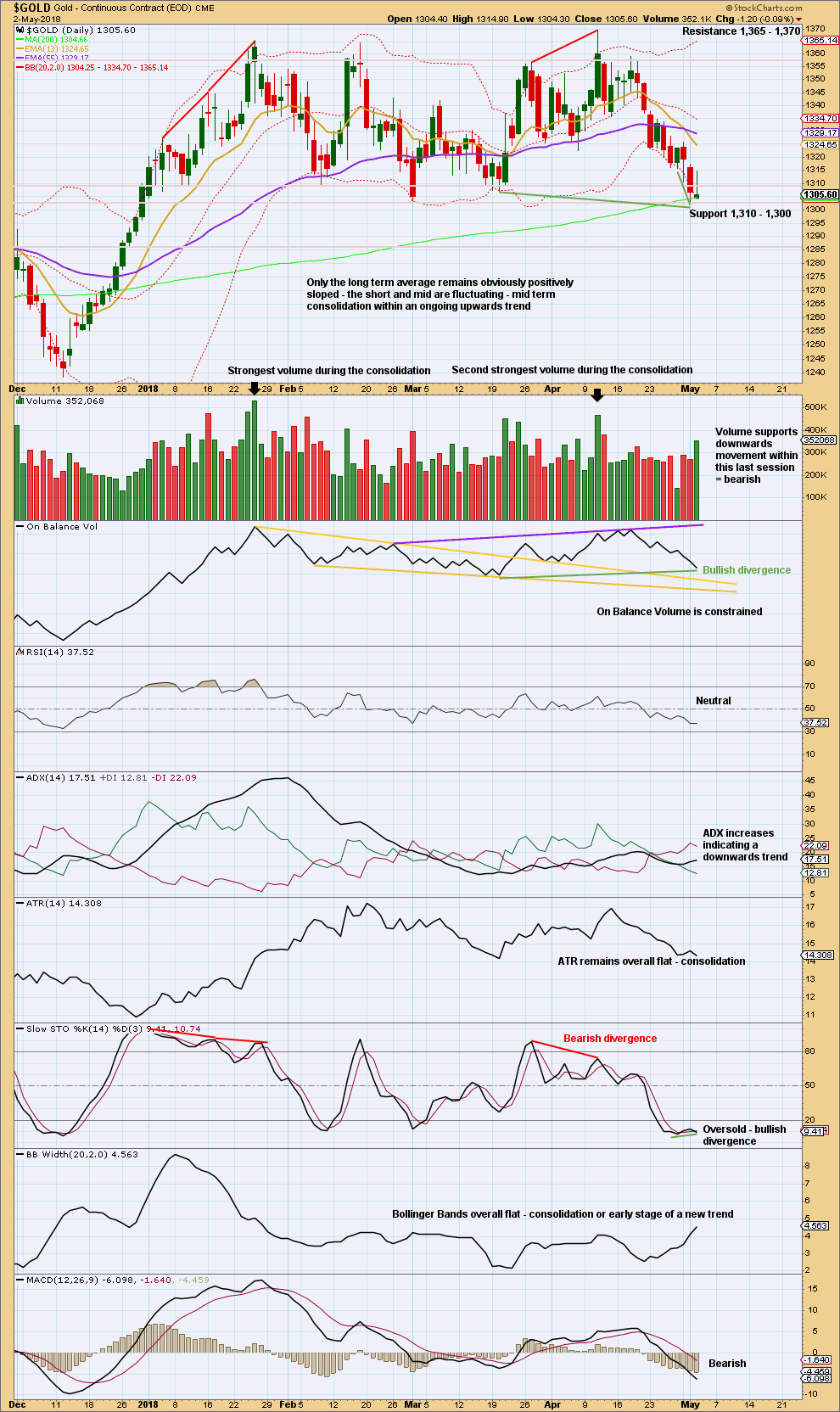

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold is within a smaller consolidation that began back on about the 3rd of January. This consolidation is delineated by resistance about 1,360 to 1,365 and support about 1,310 to 1,300 (the support zone is very slightly widened today). It is the upwards days of the 15th of January and the 11th of April that have strongest volume. This strongly suggests an upwards breakout may be more likely than downwards.

Price was at resistance and exhibited divergence with Stochastics at the last high. Price has slightly found support and closed within the strong support zone yesterday. Bullish divergence with Stochastics while it is oversold is now clearer. With two long lower wicks and support about the 200 day moving average, it looks like Gold has found a low. The inside day of the last session does not change this view.

There is some small cause for concern today with strong volume supporting downwards movement within the last session; the short term volume profile is bearish, so the support zone may be tested one more time before a low is in place.

It is noted that although price has made a new low below the prior low of the 20th of March, On Balance Volume has not. This divergence is bullish and supports the main Elliott wave count.

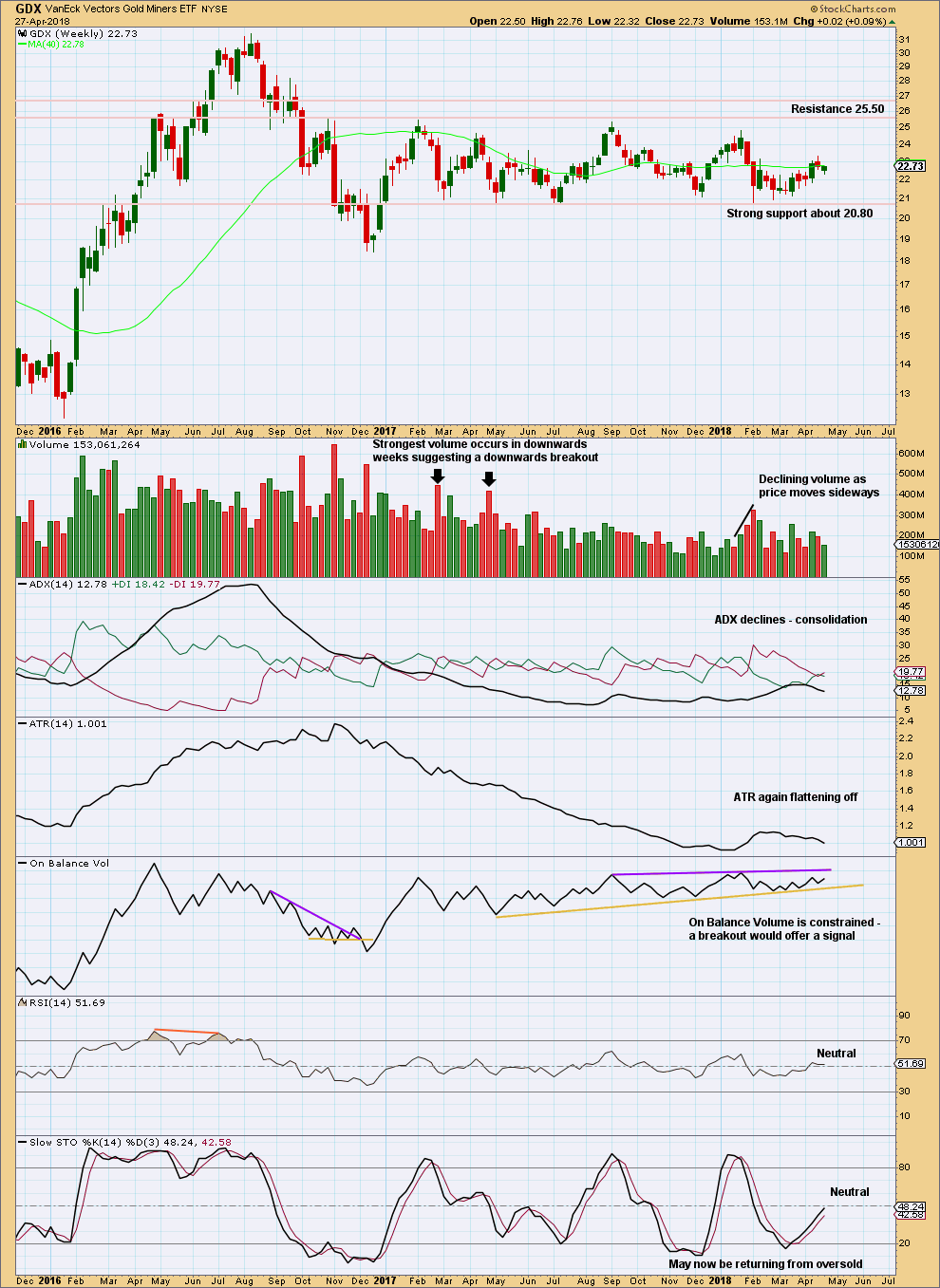

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

Overall, a slow upwards swing may be underway. Do not expect it to move in a straight line; it may have downwards weeks within it.

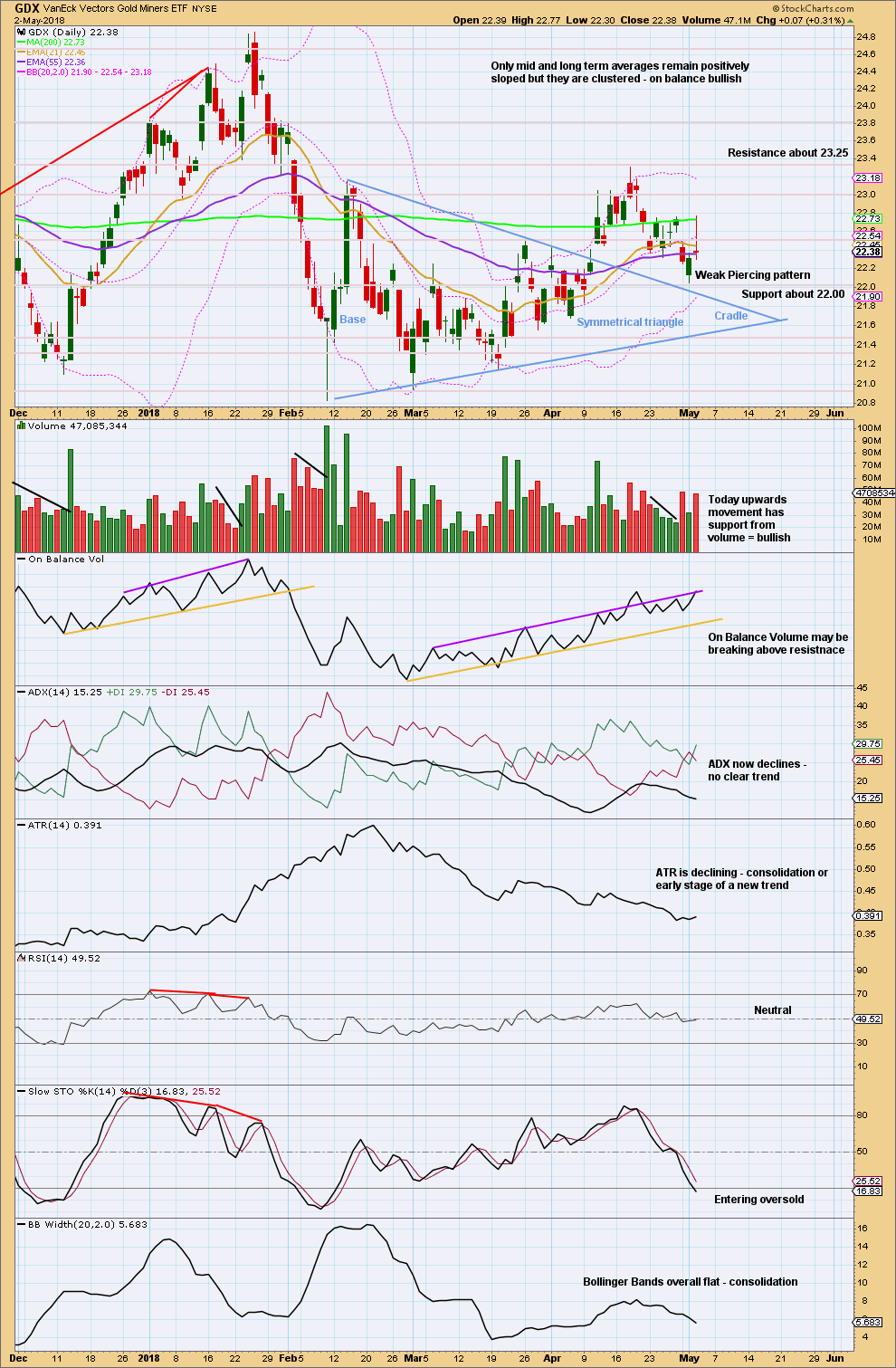

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On trading triangles from Dhalquist and Kirkpatrick, page 319:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout. These patterns seem to work better with small-cap stocks in a rising market.

Although triangles are plentiful, their patterns suffer from many false and premature breakouts. This requires that a very strict breakout rule be used, either a wide filter or a number of closes outside the breakout zone. It also requires a close protective stop at the breakout level in case the breakout is false. Once these defensive levels have been exceeded, and price is on its way, the trader can relax for a little while because the failure rate after a legitimate breakout is relatively low. Trailing stops should then be placed at each preceding minor reversal.

…. in symmetrical triangles, the best performance comes from late breakouts in the 73% – 75% distance.

Volume on the breakout seems more desirable in symmetrical triangles.”

In this case, the breakout has come 61% of the triangle length from base to cradle. Volume towards the end of the triangle declined. The breakout is accompanied by a gap and has good support from volume.

Pullbacks occur 59% of the time for symmetrical triangles.

It looks like the pullback may be over. Price found support.

If tomorrow moves price higher, then On Balance Volume would give a clear bullish signal.

Published @ 10:57 p.m. EST.

updated hourly chart:

well well well… the S&P is behaving erratically this morning, with wild whipsaws

but so far so good for Gold. working out a five up…

Lara / All,

Here’s an updated Daily chart for the Junior Miners. I feel pretty confident that I found my very 1st RARE extended triangle!!! Looks just like the one Lara has in her oil count.

Coming out of the triangle there is either an expanded leading diagonal forming or there’s a 1-2, 1-2 which would line up perfectly with the 1-2, 1-2 count for GDX.

Anyway, looking for this to quickly develop into a strong move up! All aboard…

https://www.tradingview.com/x/krEK3waA/

very nice Dreamer!

interesting how the ends of the E wave triangle all fall short of the larger triangle triangle trend lines… just like the one in Oil!

the geek in me is very satisfied by this wave count. this is good!

Thanks Lara. Geeks are cool people!

Interesting article from a Stockcharts Decision Point blog suggesting correlation between gold and dollar very strong:

“So far Gold is holding support along the 2018 lows and the 200-EMA. I don’t think that will hold. Note that the correlation between the Dollar and Gold is at -0.96. This is a near perfect negative correlation which suggest if the Dollar is going to rally, then Gold is going to tank. I don’t see anything bullish here, so look for support to be broken very soon.”

Yep, just the facts from their tool. I disagree with the writers conclusions regarding the direction of GOLD and USD.

I was just issued a recommendation to short gold futures due to embedded slo stochastic’s. Said it’s going sub $1300. Hmmm. Once again, that’s short term trading. But I see no charts here that say that’s even possible except the daily flat ii. That doesn’t fit the timeline or narrative of given parameters of “trade recommendation”. I am not trading futures at this time but do dabble in etf’s and stocks. Thoughts?

Slo stochastic embedding (I heard it first from Ira Epstein) is not a good tool. The stock market was embedded for a while and look what happened there. It’s embedded until you have a big move which un-imbeds it. Lol

yes, that correlation does exist at this time, and it is strong

but past behaviour absolutely proves that the correlation may not persist, it is unreliable

and so… it may break down at any day, and we have no way of predicting when that could be… it could be tomorrow or next month.

there at least two unacknowledged assumptions in the short quote you published Nick. I don’t like unacknowledged assumptions, and so I would like to break this down if I may.

1. As I said prior, the negative correlation exists but just because it exists now does not mean that it must continue. In fact, the only thing we can be sure of here is that it will break down at some time in the future.

2. “the Dollar is going to rally” …. why? no explanation is given for this statement

I actually find this kind of analysis rather frustrating. It also ends with an overly confident statement. No “may have” or “could be”. Just “look for support to be broken soon”.

I know sometimes I too can get a bit over confident, and Mr Market usually whips that out of me.