Yesterday’s signal from On Balance Volume that caused concern for the main Elliott wave count is now negated. The main Elliott wave count has support from classic technical analysis.

Summary: The target is now 1,411. Triple bullish divergence between price and Stochastics, and now a cluster of long lower candlestick wicks, suggest a low may be in place here or very soon.

Yesterday’s bearish signal from On Balance Volume is now negated as it returns back above that support line. At the time of publication of this analysis the trend channel on the daily and hourly charts is being finally breached, so some confidence that a low is in place may now be had.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

BULLISH ELLIOTT WAVE COUNT

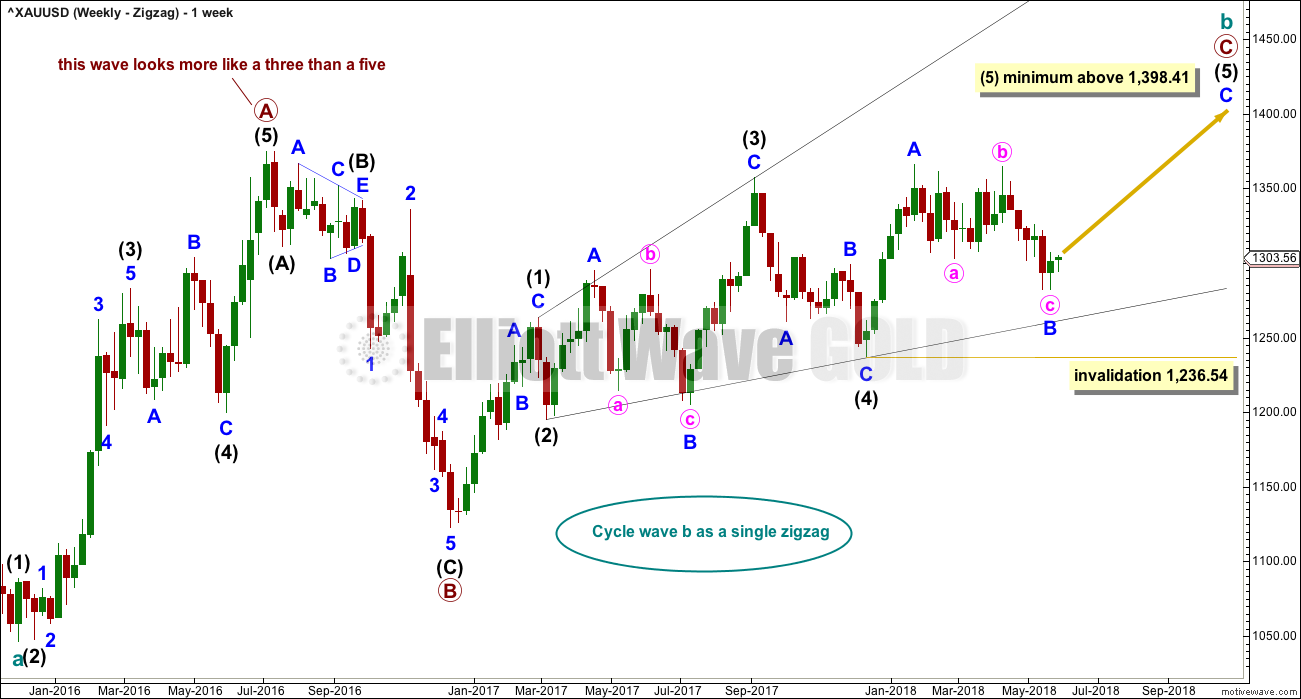

FIRST WEEKLY CHART

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five wave structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54. However, if it were now to turn out to be relatively deep, it should not get too close to this invalidation point as the lower (2)-(4) trend line should provide strong support. Diagonals normally adhere very well to their trend lines.

Within the diagonal of primary wave C, each sub-wave is extending in price and so may also do so in time. Within each zigzag, minor wave B may exhibit alternation in structure and may show an increased duration.

Within intermediate wave (1), minor wave B was a triangle lasting 11 days. Within intermediate wave (3), minor wave B was a regular flat lasting 60 days. Intermediate wave (5) is expected to be longer in price than intermediate wave (3), and it may also be longer in duration, and so minor wave B within it may also be longer in duration. If minor wave B is over, it would have lasted 82 days.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

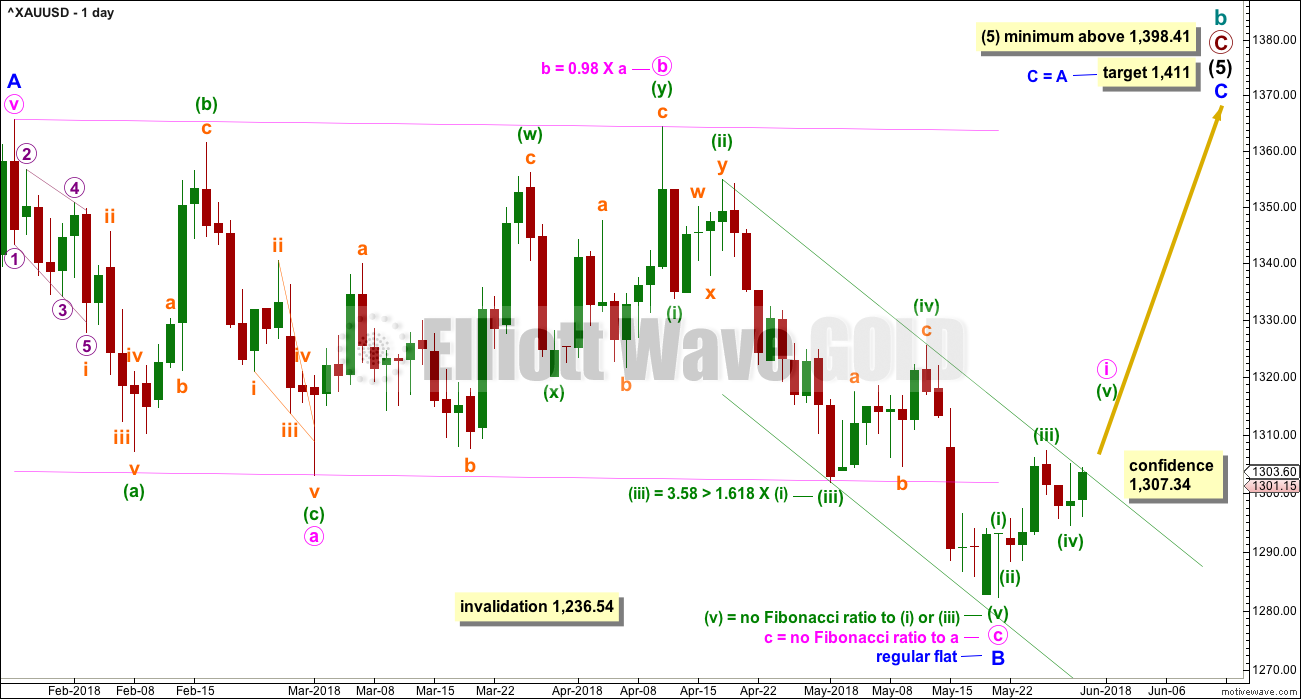

FIRST DAILY CHART

Minor wave B may be a complete regular flat correction. Minute wave c has overshot the lower trend line. Although this is not the most common look for a regular flat, it does sometimes happen. Minute wave c now looks like an obvious five wave structure at the daily chart level.

The bottom line for this wave count is it now requires a breach of the green Elliott channel about minute wave c for confidence that a low is now in place. That looks like at this stage it may be beginning at the hourly chart level. If a full daily candlestick prints above the line and closes not touching the line, then reasonable confidence may be had in this wave count. At that stage, the invalidation point would be moved up to the end of minor wave B at 1,282.20.

The target for minor wave C is calculated using the most common Fibonacci ratio to minor wave A. This would see intermediate wave (5) reach beyond its minimum required length. All Elliott wave rules would be met.

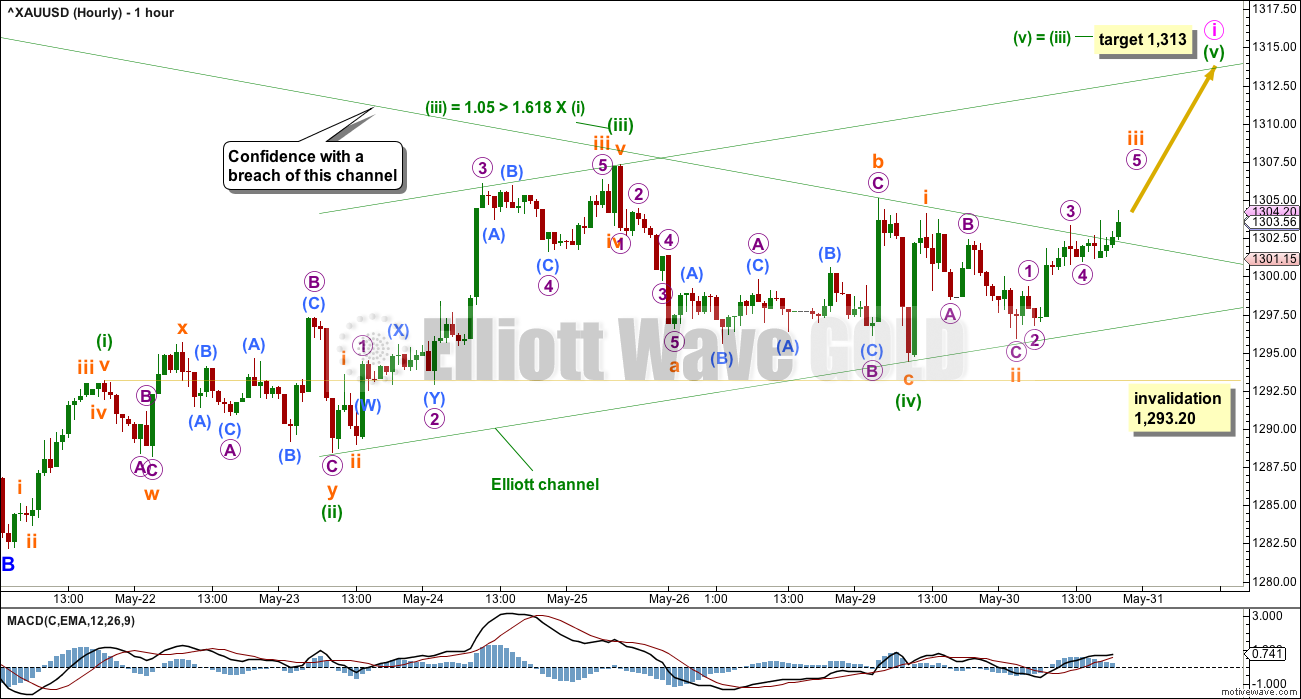

HOURLY CHART

Minor wave C must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common, and that is what will be expected.

Minute wave i may be incomplete. There is perfect alternation between the combination of minuette wave (ii) and a zigzag for minuette wave (iv). A target is calculated for minuette wave (v) to complete minute wave i.

Minuette wave (iv) may not move into minuette wave (i) price territory below 1,293.20.

When minute wave i has breached resistance at the upper edge of the downwards sloping channel, which is copied over from the daily chart, then the upper edge of that channel may provide support.

At the time of publication of this analysis there is now one full hourly candlestick above and just not touching the upper edge of the downwards sloping channel, which is copied over from the daily chart. If price now moves further up and away from this channel, then further confidence may be had in this main hourly chart.

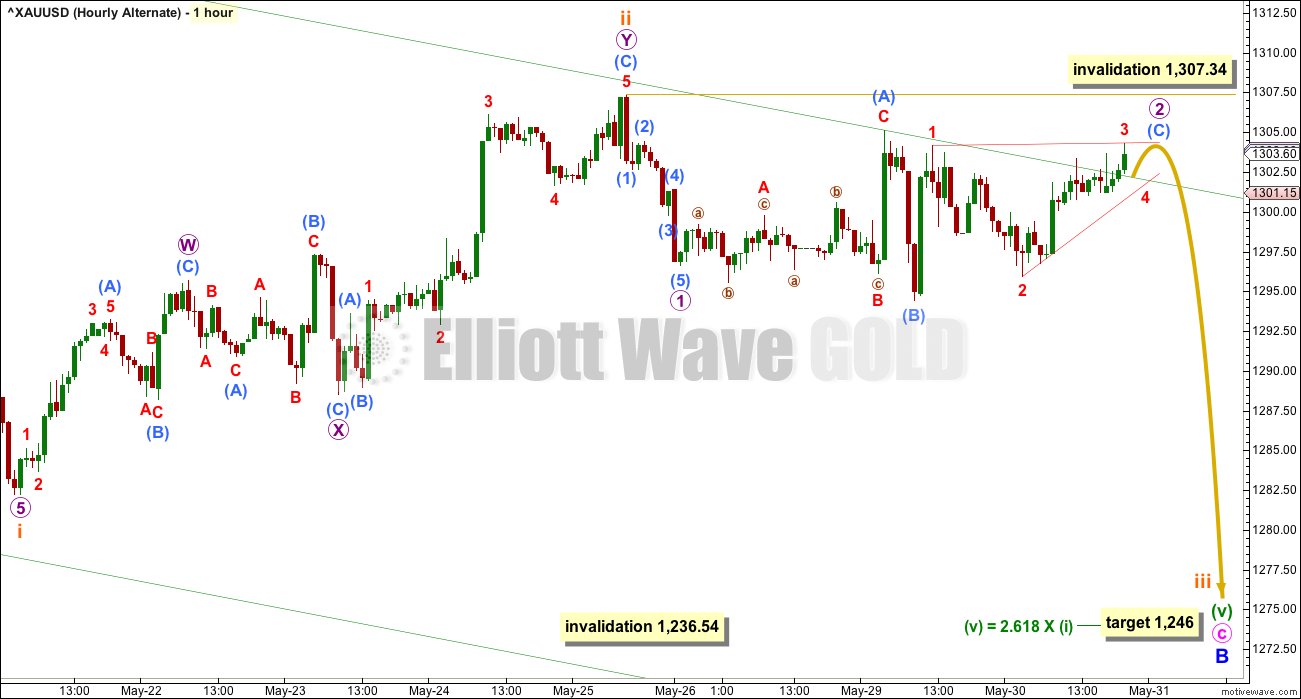

ALTERNATE HOURLY CHART

This alternate wave count sees minuette wave (v) within minute wave c extending. The last low may have been only subminuette wave i.

Subminuette wave ii may be a complete double zigzag.

Within subminuette wave iii, no second wave correction may move beyond its start above 1,307.34.

The target for minuette wave (v) allows for enough room below for the structure to complete.

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction.

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

Primary wave B may be subdividing as a regular flat correction, and within it both intermediate waves (A) and (B) subdivide as three wave structures. Intermediate wave (B) fits as a triple zigzag.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

FIFTH DAILY CHART

Minor wave 1 may have been a relatively brief impulse over at the low of the 8th of February.

Minor wave 2 may be over at the last high as a double zigzag. All subdivisions fit and all Elliott wave rules are met. The second zigzag in the double does deepen the correction, which is its purpose, although it is not by very much.

It is possible that a third wave, minor wave 3, began at the last high labelled minor wave 2. Minor wave 3 may only subdivide as an impulse.

Within minor wave 3, minute wave i may be over at the last low. Minute wave ii may be a multi day bounce or sideways movement that may end about the 0.382 or 0.618 Fibonacci ratios, but the pull of the middle of a third wave down may now force it to be more shallow than second wave corrections usually are; the 0.382 Fibonacci ratio may be slightly favoured.

Minute wave ii may not move beyond the start of minute wave i above 1,364.36.

TECHNICAL ANALYSIS

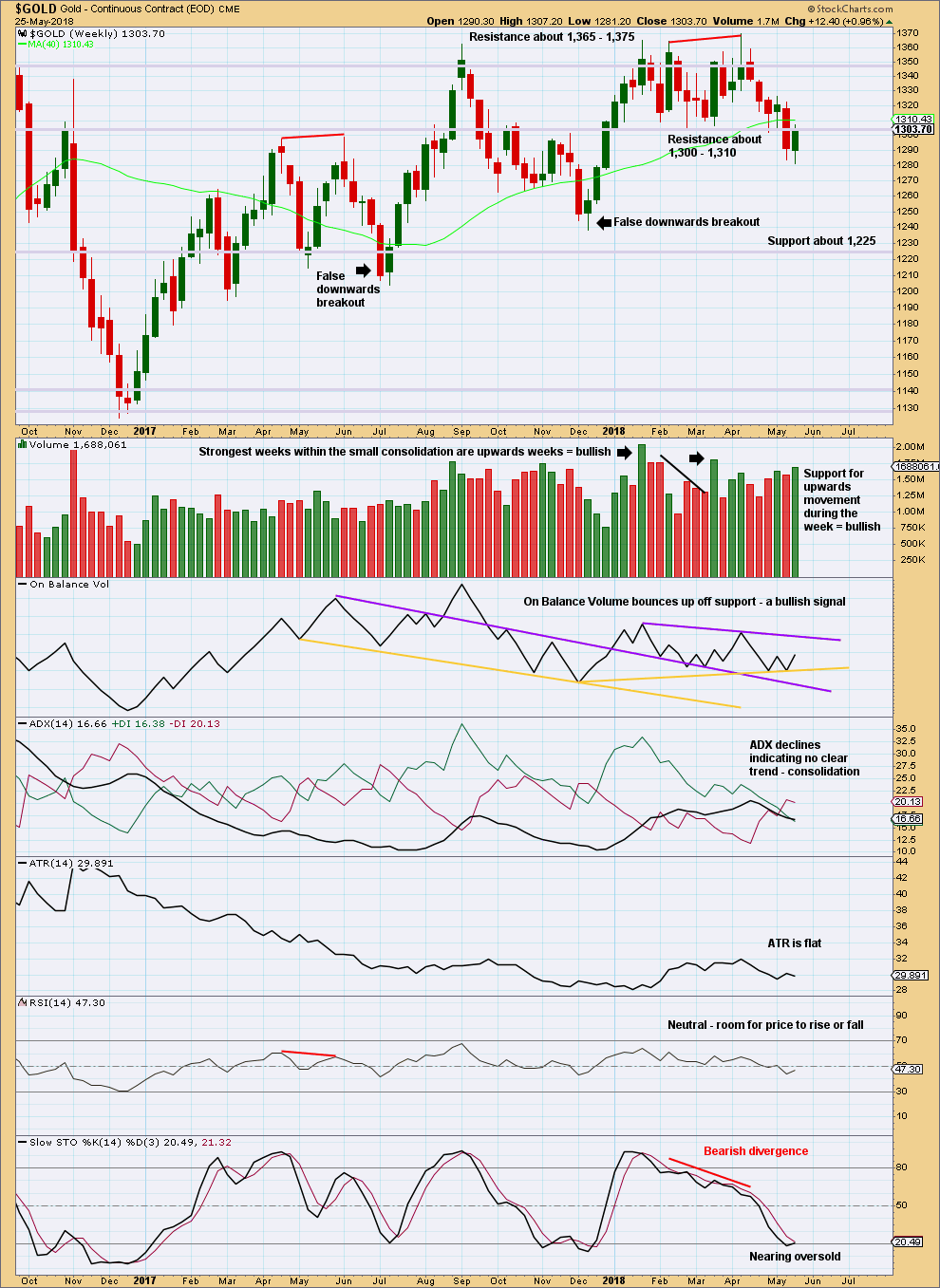

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is back within the resistance zone about 1,300 to 1,310. What looked like a possible downwards breakout now looks false. There are two recent examples on this chart, and this may be a third. In all three cases the consolidation prior to the possible downwards breakout had the strongest week as an upwards week, which was the clue that the downwards breakout may turn out to be false.

Volume is bullish, and there is a bullish signal from On Balance Volume. This supports the main Elliott wave count.

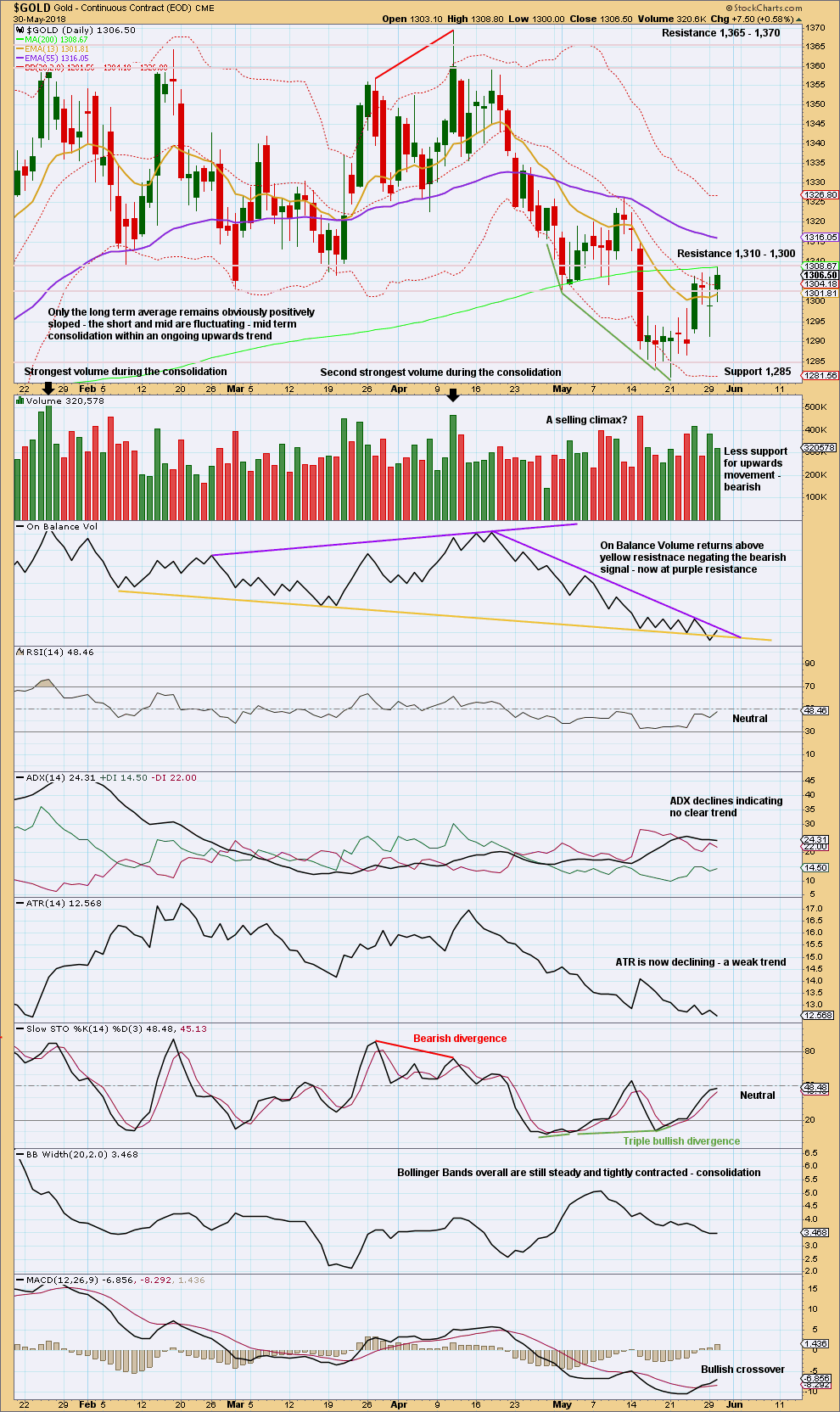

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Yesterday’s bearish signal from On Balance Volume, with a break below the yellow support line, is now negated as On Balance Volume returns back above that line. The purple resistance line is weak because it has a reasonable slope that has only been tested about three times before. A break above this purple line would be a weak bullish signal.

There is strong resistance here about 1,300 to 1,310. If price can break back above this zone, then it may be able to build upwards momentum and strength.

It looks like the downwards breakout may have been false, but before that can properly be concluded price needs to close back above 1,310. It has not done that yet.

Let us look back at major lows from November 2015 and see how price behaved in the days immediately after.

A major low was found on the 3rd of December, 2015. The following day for the 4th of December saw a strong Bullish Engulfing reversal pattern with support from volume, and it came with strong double bullish divergence between price and both of RSI and Stochastics. That low in hindsight looks fairly strong.

Another reasonable low was found on the 31st of May, 2016. There was no reasonable bullish divergence at the low between price and either of RSI or Stochastics. At the low, the candlestick had a bullish long lower wick (although with a reasonable upper wick, it is not properly a Hammer reversal pattern). The two days following the low for the 1st and 2nd of June were inconclusive; both closed red and could at the time have been considered a potential bear flag pattern developing; both had a balance of volume downwards but showed strongly declining volume. Not until the third day, with a very strong upwards day with support from volume to complete a very strong Bullish Engulfing reversal pattern, was a low set in place.

A major low was found on the 15th of December, 2016. At the low, the candlestick had a somewhat bullish long lower wick; volume for the last downwards day supported the fall in price; and, there was clear and strong bullish divergence between price and RSI and Stochastics. The next two days closed green but did not have support from volume. The following two days closed red and did have support from volume. At that stage, four days out from a major low, the short term volume profile was bearish and it looked like a bear flag pattern may be developing. It was not until seven days after the low on the 27th of December that a reasonable bullish day unfolded, and even then it did not have good support from volume. This low did not look clear.

The next low to study occurred on the 10th of March, 2017. That day was inconclusive, closing green, but the balance of volume was downwards and volume supported that downwards movement. At the low, there was no reasonable bullish divergence between price and either of RSI or Stochastics. It was not until three days after the low on the 15th of March that price bounced strongly to complete a strong Bullish Engulfing reversal pattern, which had good support from volume.

The next low to study occurred on the 9th of May, 2017. On that day RSI reached oversold, but there was no divergence between it and price nor price and Stochastics. Right up until six days after the low the short term volume profile could have been judged to be bearish; rising price did not have support from volume. It was clear a low was in place on the 17th of May as a very strong Bullish Engulfing reversal pattern unfolded with strong support from volume. The small bounce up until that date could have been judged to be a bounce within an ongoing downwards trend.

The next low to study occurred on the 10th of July, 2017. There was no divergence at the low between price and RSI, but there was strong clear bullish divergence between price and Stochastics. There were two candlesticks with bullish long lower wicks at the low, but volume remained lighter than the prior downwards day of the 9th of July. This looks like a selling climax in hindsight, but at the time it could have been judged to support downwards movement. Right up until the 14th of July, five days after the low, it could have been considered a bear flag pattern unfolding. On the 14th of July a strong Bullish Engulfing pattern unfolded with some support from volume.

The last low to study is a very important one on the 12th of December, 2017. This occurred after a downwards breakout below support, which was previously at 1,262. That downwards breakout was short lived; price remained below support for two weeks, and found a low only five days after the breakout. At the low, there was no bullish divergence between price and either of RSI or Stochastics. The first upwards day on the 13th of December had a wide range but a very small real body. It did have good support from volume, but volume remained lighter than most prior downwards days. After that low, price moved steadily higher for weeks, initially on light and declining volume. That low in hindsight was very difficult to pick.

Some conclusions may be drawn in relation to the current situation. The first and strongest conclusion is that lows for Gold (at least for the last two years and five months) are not always very clear at the time. Price can be weak in days immediately following lows; it can remain weak for about five to seven days following lows. Lows do not always come with divergence between price and RSI nor even price and Stochastics, but when they do that offers a clue.

Although the last few days have seen unexpected downwards movement, some suspicion may be had that this is a downwards breakout. ADX at this time indicates a downward trend is in place, but this is a lagging indicator. Look out for at least a short term bounce here, and do not be surprised if it begins to show some strength towards the end of this week. If it remains persistently weak, then short positions may be taken for a downwards trend (the new labelling for the fifth wave count could be correct). If it shows strength, that would support the first wave count; the downwards breakout may have been yet another false breakout.

The current low now has triple bullish divergence with price, and there is now a cluster of long lower candlestick wicks. Considering volume was bullish during the last consolidation, and Gold has a recent history of false downwards breakouts following that set up, the strong bounce at the end of this week was expected as likely (which has support from volume).

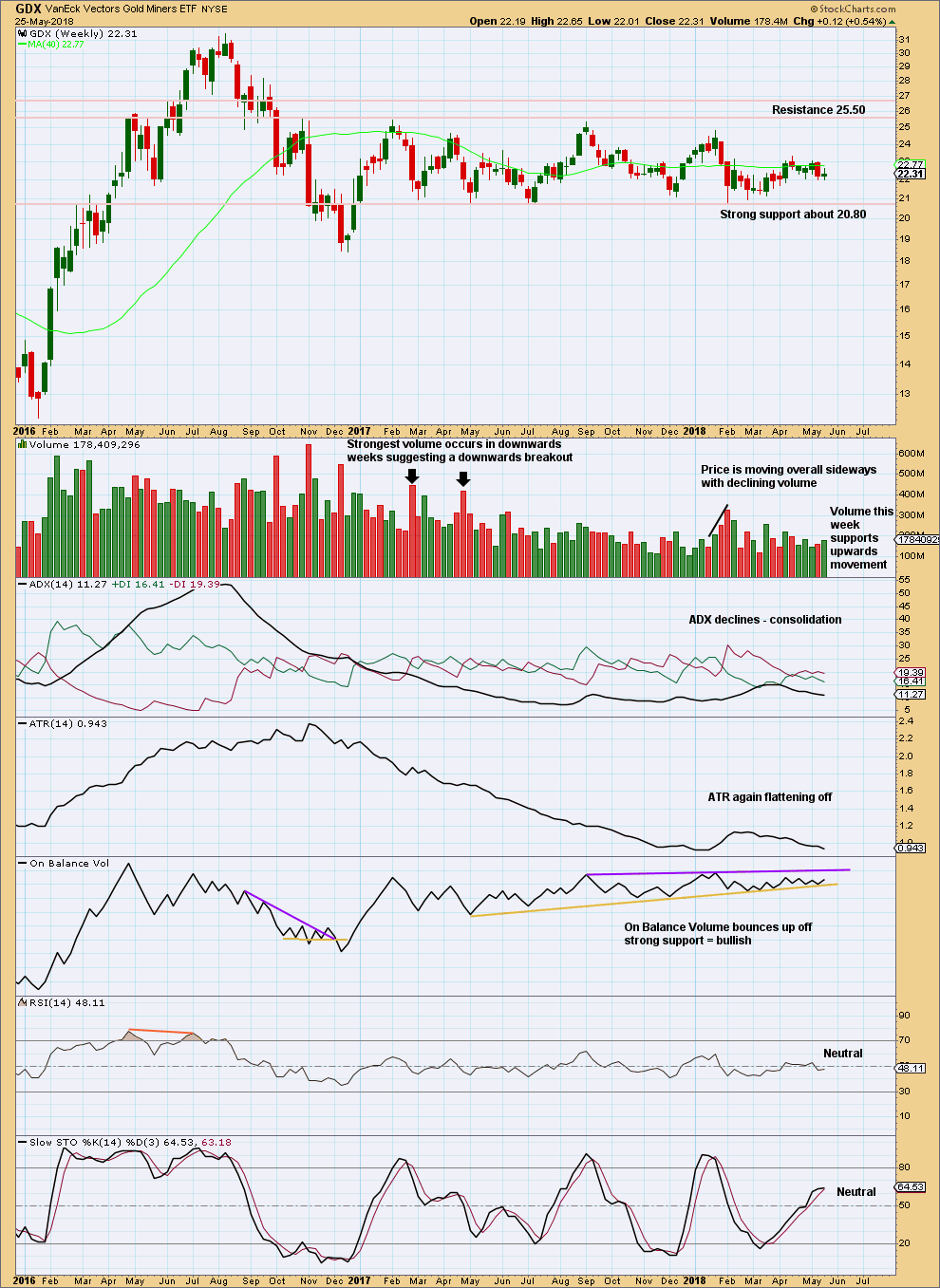

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

Overall, a slow upwards swing may be underway. Do not expect it to move in a straight line; it may have downwards weeks within it.

With a bullish signal from On Balance Volume and bullish volume for the last week, expect a green candlestick this week.

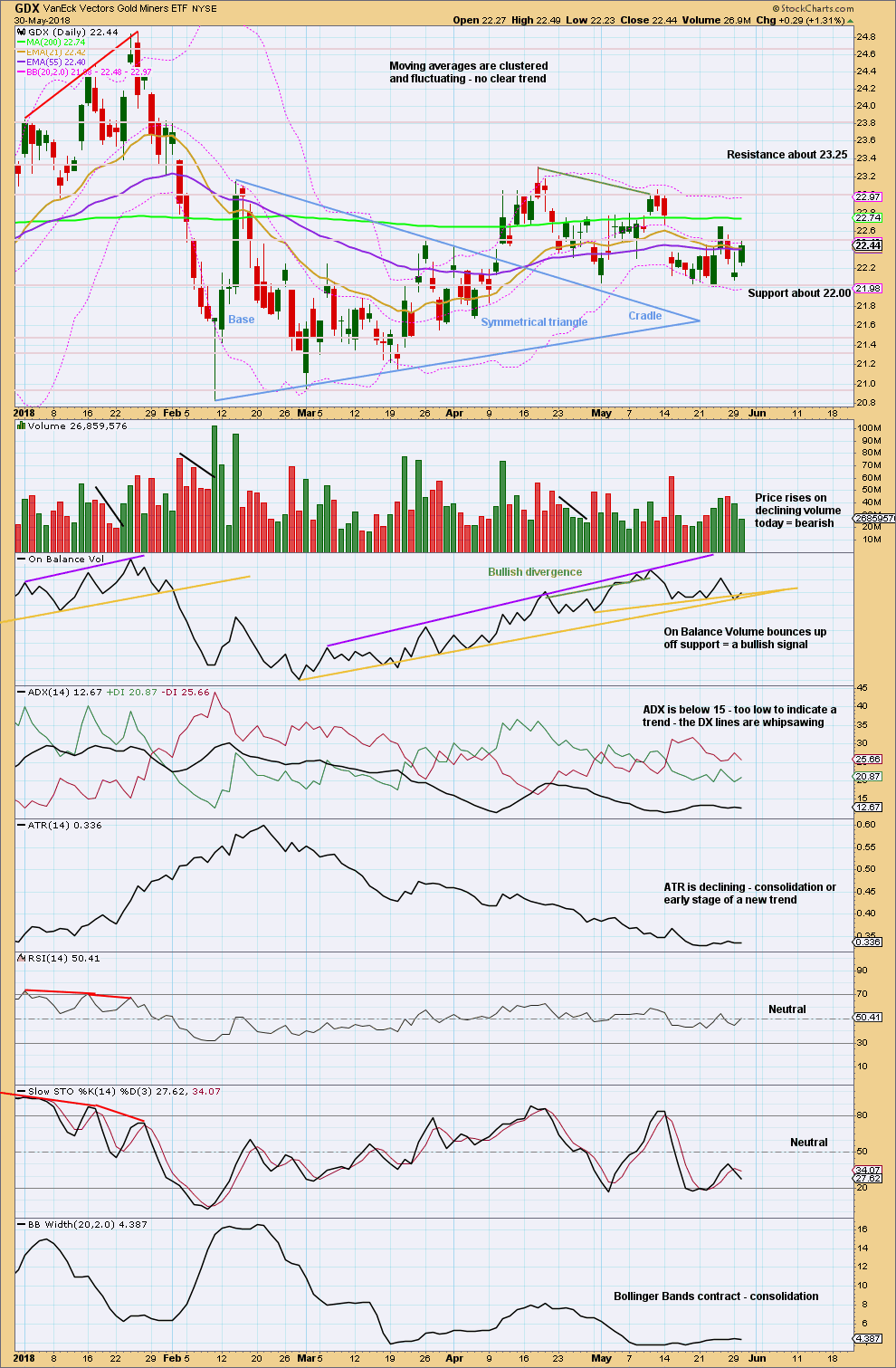

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On trading triangles from Dhalquist and Kirkpatrick, page 319:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout. These patterns seem to work better with small-cap stocks in a rising market.

Although triangles are plentiful, their patterns suffer from many false and premature breakouts. This requires that a very strict breakout rule be used, either a wide filter or a number of closes outside the breakout zone. It also requires a close protective stop at the breakout level in case the breakout is false. Once these defensive levels have been exceeded, and price is on its way, the trader can relax for a little while because the failure rate after a legitimate breakout is relatively low. Trailing stops should then be placed at each preceding minor reversal.

…. in symmetrical triangles, the best performance comes from late breakouts in the 73% – 75% distance.

Volume on the breakout seems more desirable in symmetrical triangles.”

In this case, the breakout has come 61% of the triangle length from base to cradle. Volume towards the end of the triangle declined. The breakout is accompanied by a gap and has good support from volume.

Pullbacks occur 59% of the time for symmetrical triangles.

More weight is given today from the bullish signal from On Balance Volume than to a bearish short term volume profile.

Bullish divergence between price and On Balance Volume at the last highs still remains valid, and it still supports the idea of new highs from price to follow through.

Published @ 10:11 p.m. EST.

Updated hourly chart:

maybe an ending diagonal for the fifth wave?

the channel was breached, and this current hour is now almost fully below it.

that trend line is not being perfectly respected.

Brandon / Lara,

Another thing you’ll notice with TradingView, Investing.com, or PMBull data is that Minuette wave 4 overlaps into Minuette 1 wave territory. That means the count can’t be the same as Lara’s with BarChart. The count could be a Leading Expanding Diagonal [shown} or a 1-2, 1-2. Since I chart with TradingView all the time, I often notice differences like this as compared to Lara’s data. The counts may need to be slightly different, but the overall direction and turning points are very close.

If the TradingView count is a Leading Diagonal, a deep retrace into the low 1,290’s may offer another buying opportunity.

https://www.tradingview.com/x/QSyHZ223/

Thanks dreamer we are now back inside the downtrend channel looks like we are going down from here but who knows been very difficult trading lately

Yeah, with slightly different data the wave counts can be slightly different.

All this overlapping certainly does suggest a diagonal.

Lara my spot gold chart looks different and does not have any closes over trend line only long wicks over I wonder how our feeds can be so different on spot gold on a consistent basis

Because Gold is a truly global market.

There will always be differences from one data supplier to another, one broker to another, for this market. Because none of them amalgamate every single data point for Gold, they all choose only a few. So they’re different.