Upwards movement today has support from volume. This fits the main Elliott wave count.

Summary: The target is now 1,411. Triple bullish divergence between price and Stochastics suggest a low may be in place here or very soon.

If price does move lower, then it should find very strong support at the lower black (2)-(4) trend line on the weekly and daily charts. Support from volume and a bullish signal from On Balance Volume reduce the probability of this alternate scenario today.

Price is finding strong resistance at 1,310 – 1,300. If this can be overcome, then a trend may be able to build strength.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

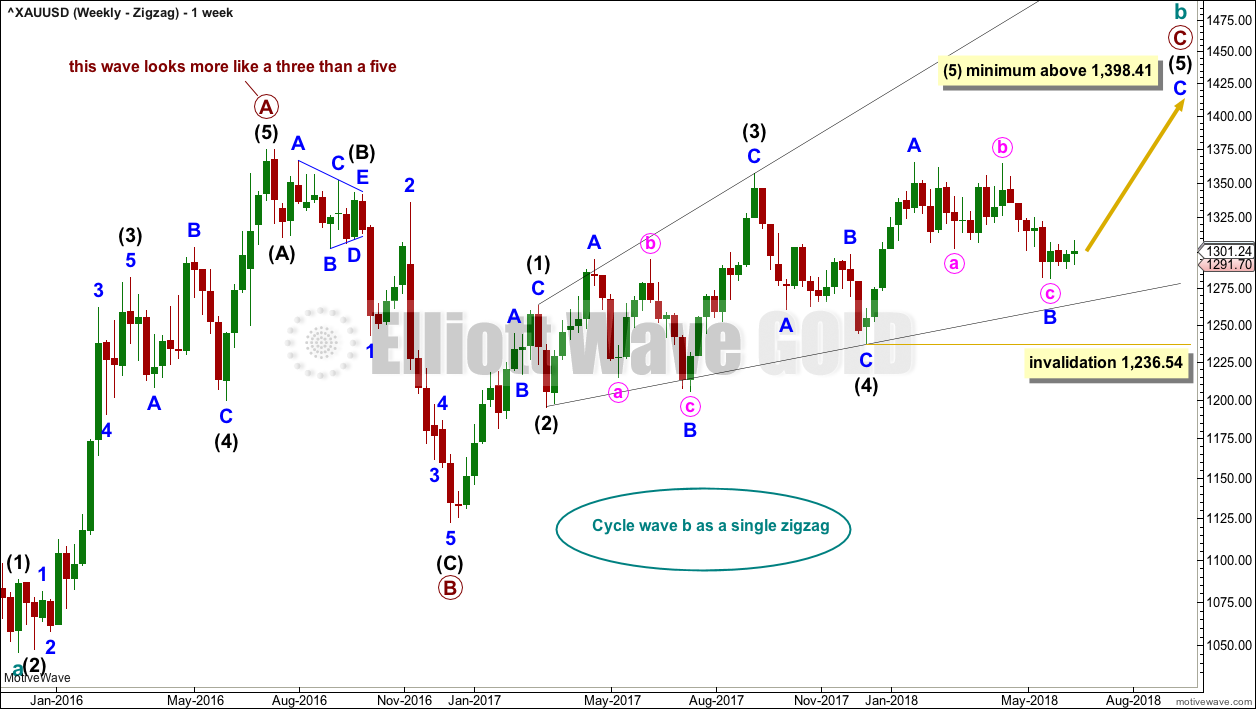

BULLISH ELLIOTT WAVE COUNT

FIRST WEEKLY CHART

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five wave structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54. However, if it were now to turn out to be relatively deep, it should not get too close to this invalidation point as the lower (2)-(4) trend line should provide strong support. Diagonals normally adhere very well to their trend lines.

Within the diagonal of primary wave C, each sub-wave is extending in price and so may also do so in time. Within each zigzag, minor wave B may exhibit alternation in structure and may show an increased duration.

Within intermediate wave (1), minor wave B was a triangle lasting 11 days. Within intermediate wave (3), minor wave B was a regular flat lasting 60 days. Intermediate wave (5) is expected to be longer in price than intermediate wave (3), and it may also be longer in duration, and so minor wave B within it may also be longer in duration. If minor wave B is over, it would have lasted 82 days.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

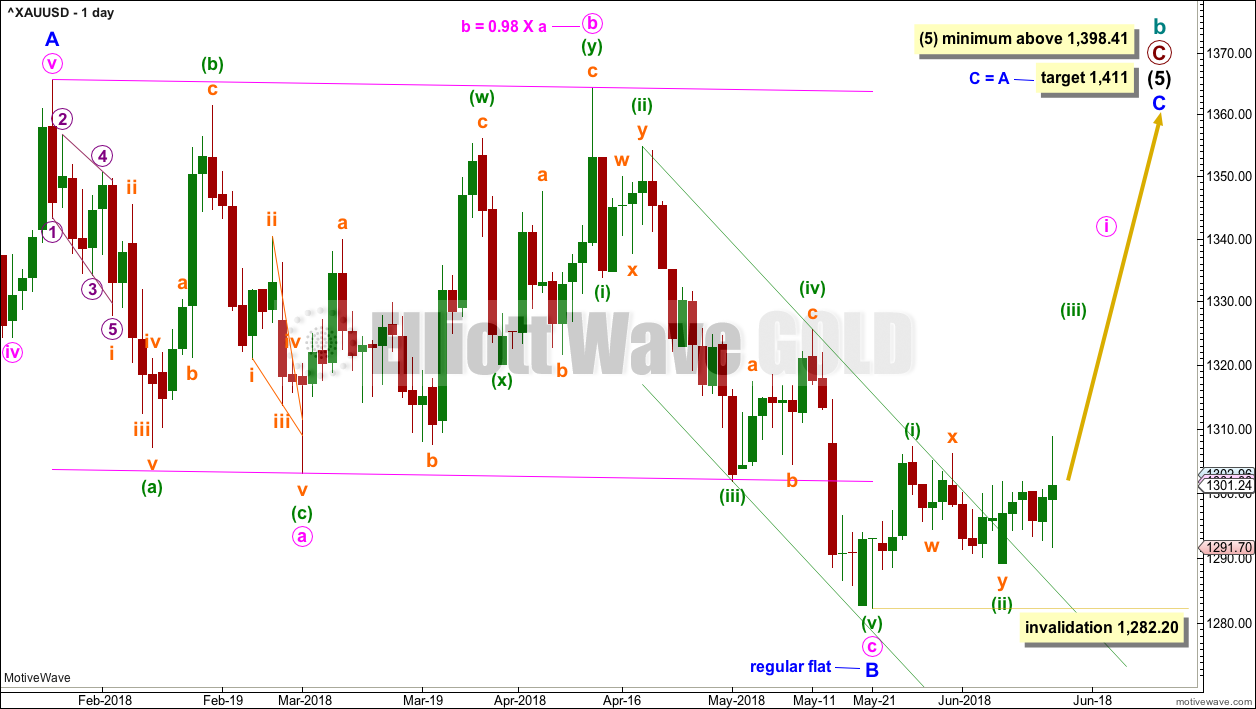

FIRST DAILY CHART

Minor wave B may be a complete regular flat correction. Minute wave c has overshot the lower trend line. Although this is not the most common look for a regular flat, it does sometimes happen. Minute wave c now looks like an obvious five wave structure at the daily chart level.

There is now one full daily candlestick above and not touching the upper edge of the channel which contains minute wave c. This indicates that the downwards wave labelled minute wave c may be over and a new wave upwards may have begun. Within minute wave c, minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,282.20. The channel breach may give some confidence now in this wave count.

What would add substantial confidence to this wave count now would be a close back above resistance at 1,300 – 1,310 on an upwards day with support from volume. Price closed at 1,308.30, with support from volume, and this adds reasonable confidence to this wave count today. If tomorrow can close above 1,310, further confidence would be had.

The target for minor wave C is calculated using the most common Fibonacci ratio to minor wave A. This would see intermediate wave (5) reach beyond its minimum required length. All Elliott wave rules would be met.

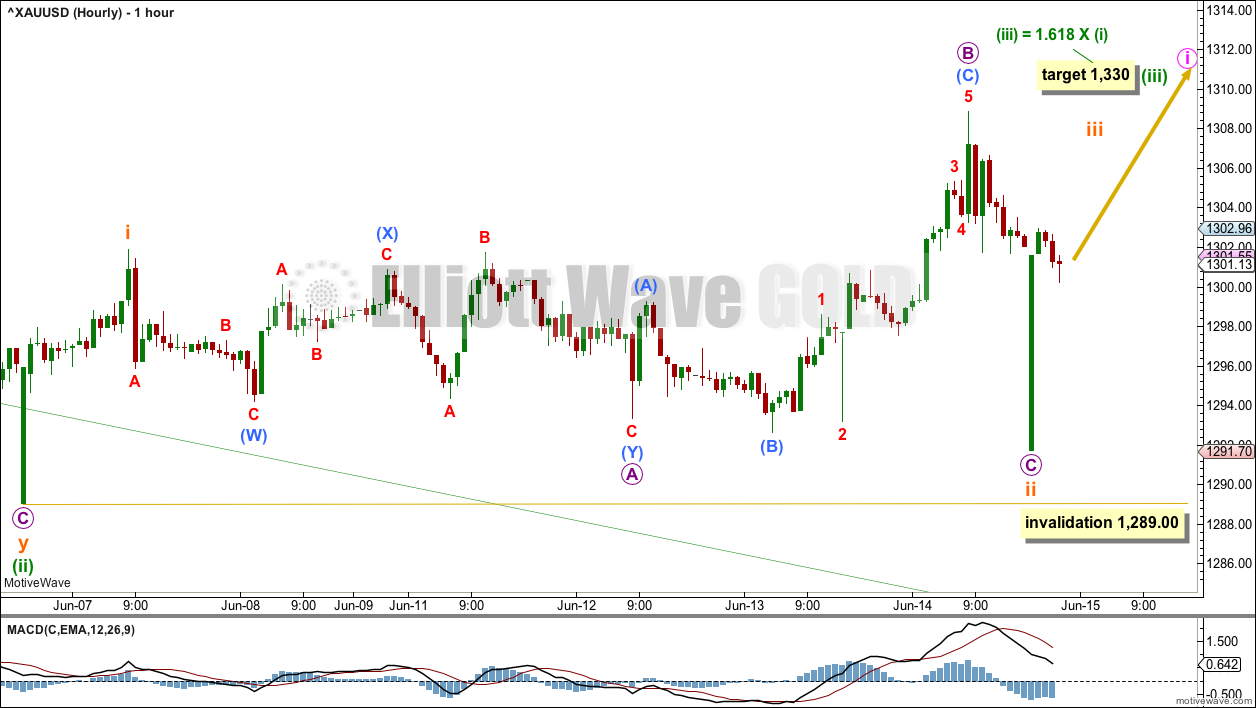

HOURLY CHART

Another spike down at the end of the session must, for this data, be a continuation of subminuette wave ii. Subminuette wave ii now fits as an expanded flat correction.

The target for minuette wave (iii) remains the same; it expects the most common Fibonacci ratio to minuette wave (i).

There are now again two first and second waves complete for this wave count. This wave count still expects a further increase in upwards momentum.

If subminuette wave ii continues lower, then it may not move beyond the start of subminuette wave i below 1,289.00.

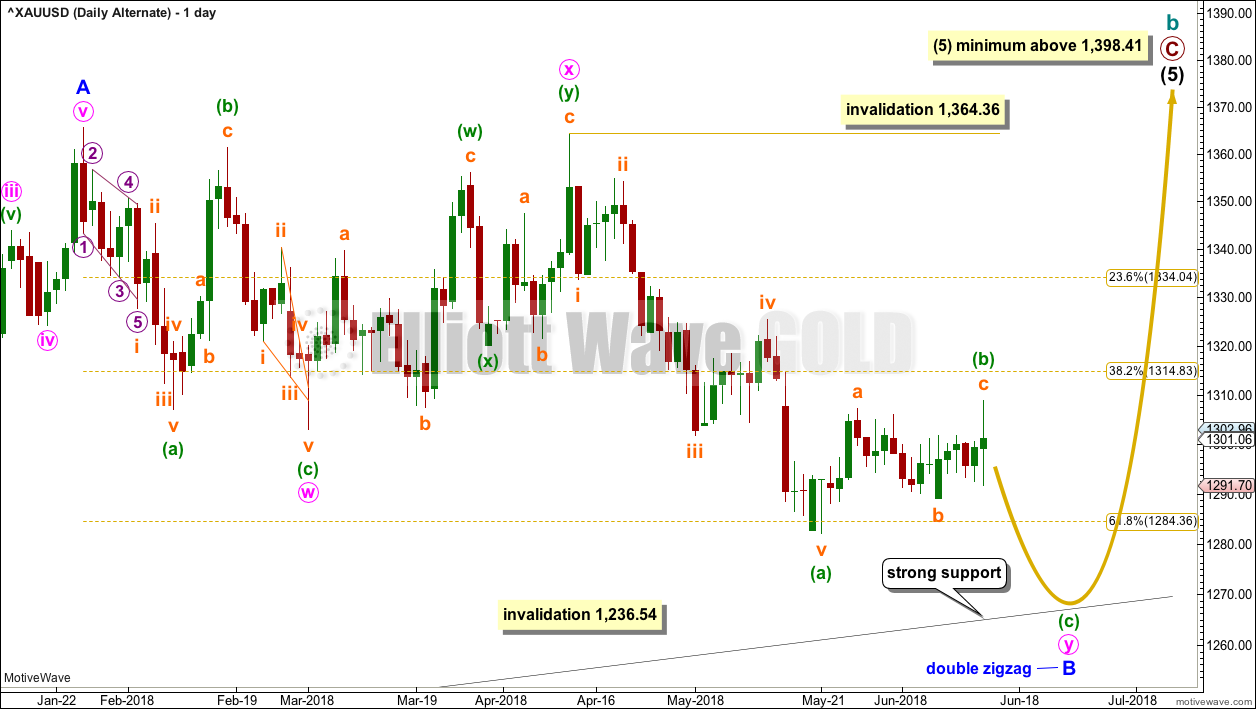

ALTERNATE FIRST DAILY CHART

Minor wave B may be a double zigzag, which may be close to completion.

The first zigzag in the double is labelled minute wave w. The double is joined by a three in the opposite direction, a double zigzag labelled minute wave x. The second zigzag in the double is labelled minute wave y, and it is deepening the correction, which is the purpose of second zigzags.

Minute wave y may end at support at the lower black (2)-(4) trend line, which is copied over here from the weekly chart. This is the lower diagonal trend line.

Minuette wave (b) within minute wave y no longer fits the rules for an Elliott wave triangle. Minuette wave (b) may be complete today as a zigzag.

Subminuette wave c has moved slightly above the end of subminuette wave a at 1,307.34, avoiding a truncation. This wave count may now expect a sharp downwards move to end about the lower (2)-(4) trend line, which is copied over from the weekly chart. Both weekly and daily charts are on semi-log scales.

The problem with this wave count is the depth of minute wave x. X waves within double zigzags are almost always brief and shallow, particularly shallow. This is because multiple zigzags should have a strong slope against the prior trend, and to achieve a strong slope their X waves should be shallow. When their X waves are deep and time consuming, as this one is, they lend more of a sideways look to the structure.

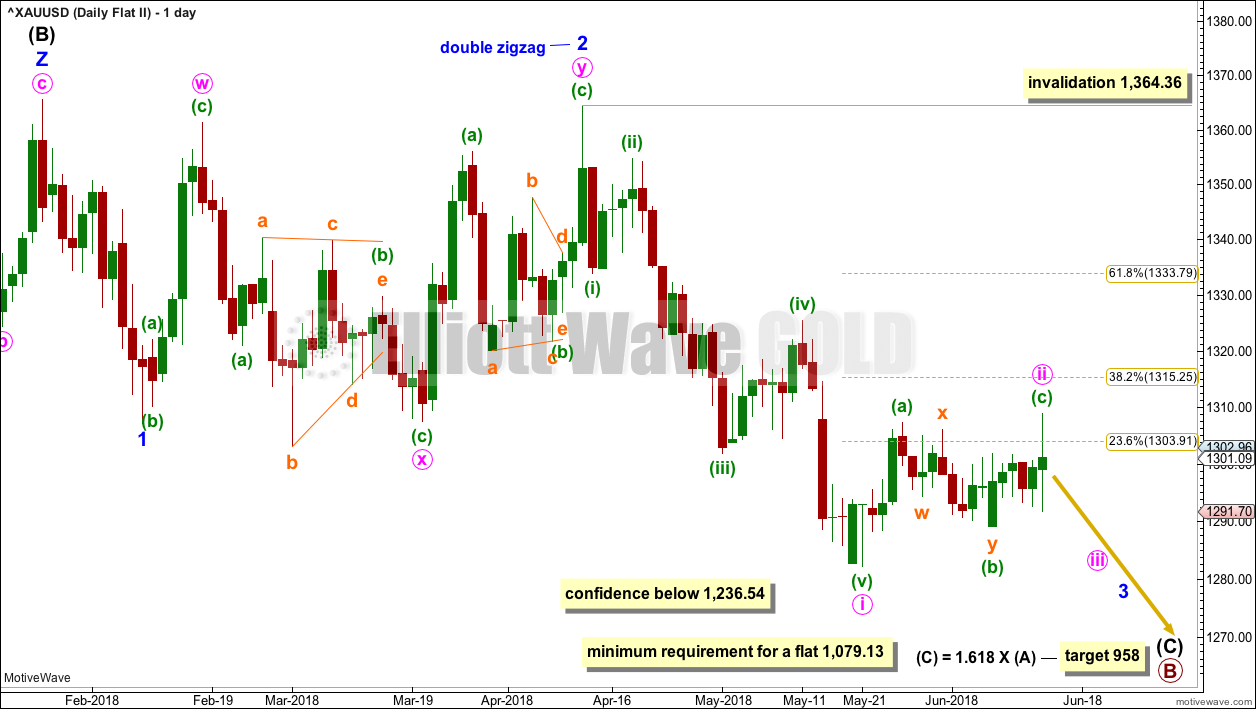

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction.

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

Primary wave B may be subdividing as a regular flat correction, and within it both intermediate waves (A) and (B) subdivide as three wave structures. Intermediate wave (B) fits as a triple zigzag.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

FIFTH DAILY CHART

Minor wave 1 may have been a relatively brief impulse over at the low of the 8th of February.

Minor wave 2 may be over at the last high as a double zigzag. All subdivisions fit and all Elliott wave rules are met. The second zigzag in the double does deepen the correction, which is its purpose, although it is not by very much.

It is possible that a third wave, minor wave 3, began at the last high labelled minor wave 2. Minor wave 3 may only subdivide as an impulse.

Within minor wave 3, minute wave i may be over at the last low. Minute wave ii may be a multi day bounce or sideways movement that may end about the 0.382 or 0.618 Fibonacci ratios, but the pull of the middle of a third wave down may now force it to be more shallow than second wave corrections usually are; the 0.382 Fibonacci ratio may be slightly favoured.

Minute wave ii may not move beyond the start of minute wave i above 1,364.36.

TECHNICAL ANALYSIS

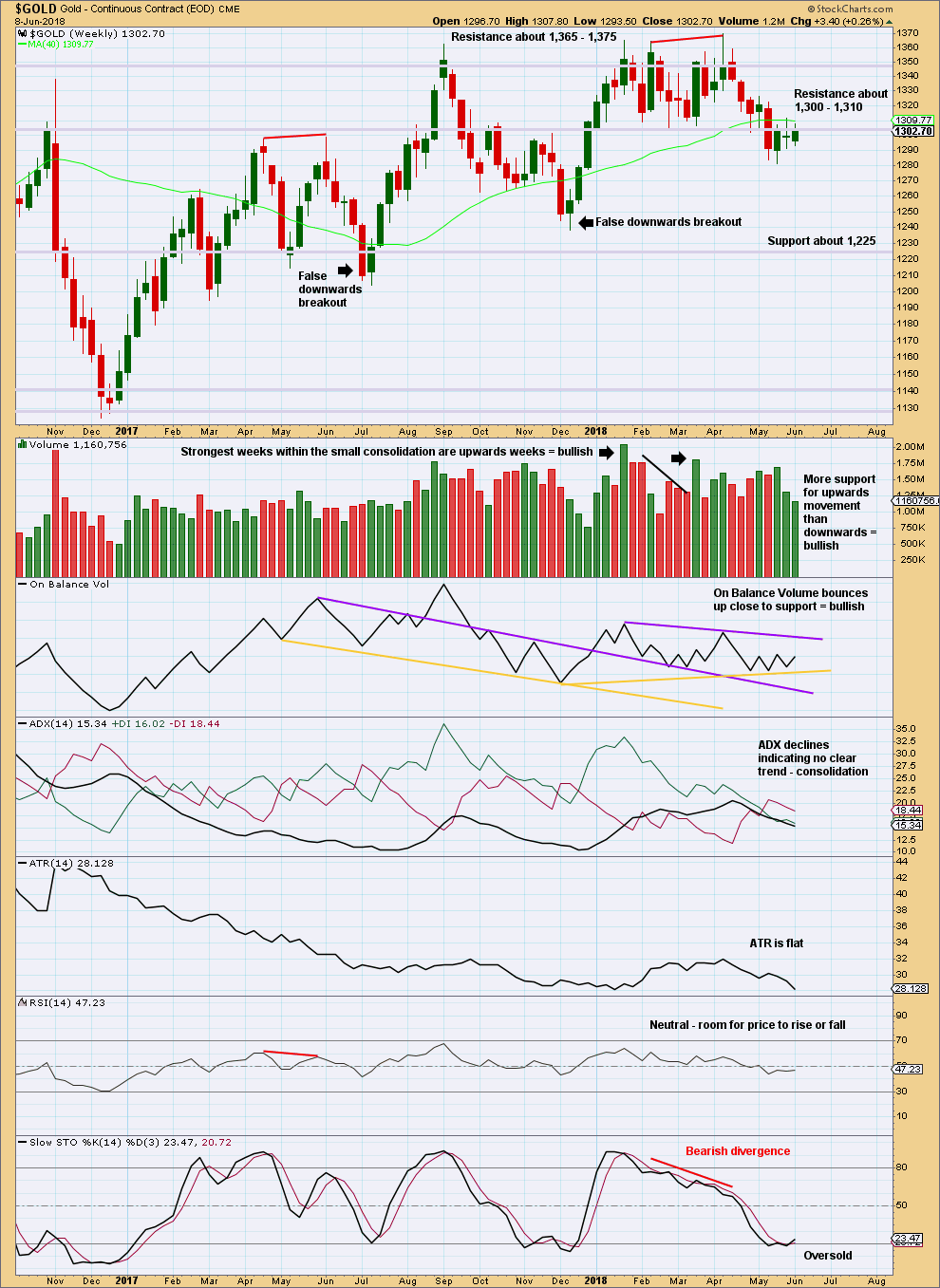

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price remains close to the resistance zone about 1,300 to 1,310. What looked like a possible downwards breakout now looks false. There are two recent examples on this chart, and this may be a third. In all three cases the consolidation prior to the possible downwards breakout had the strongest week as an upwards week, which was the clue that the downwards breakout may turn out to be false.

The strongest week during the last few weeks remains an upwards week. The short term volume profile remains overall bullish despite weak volume for this last week.

The bullish signal from On Balance Volume supports the main Elliott wave count.

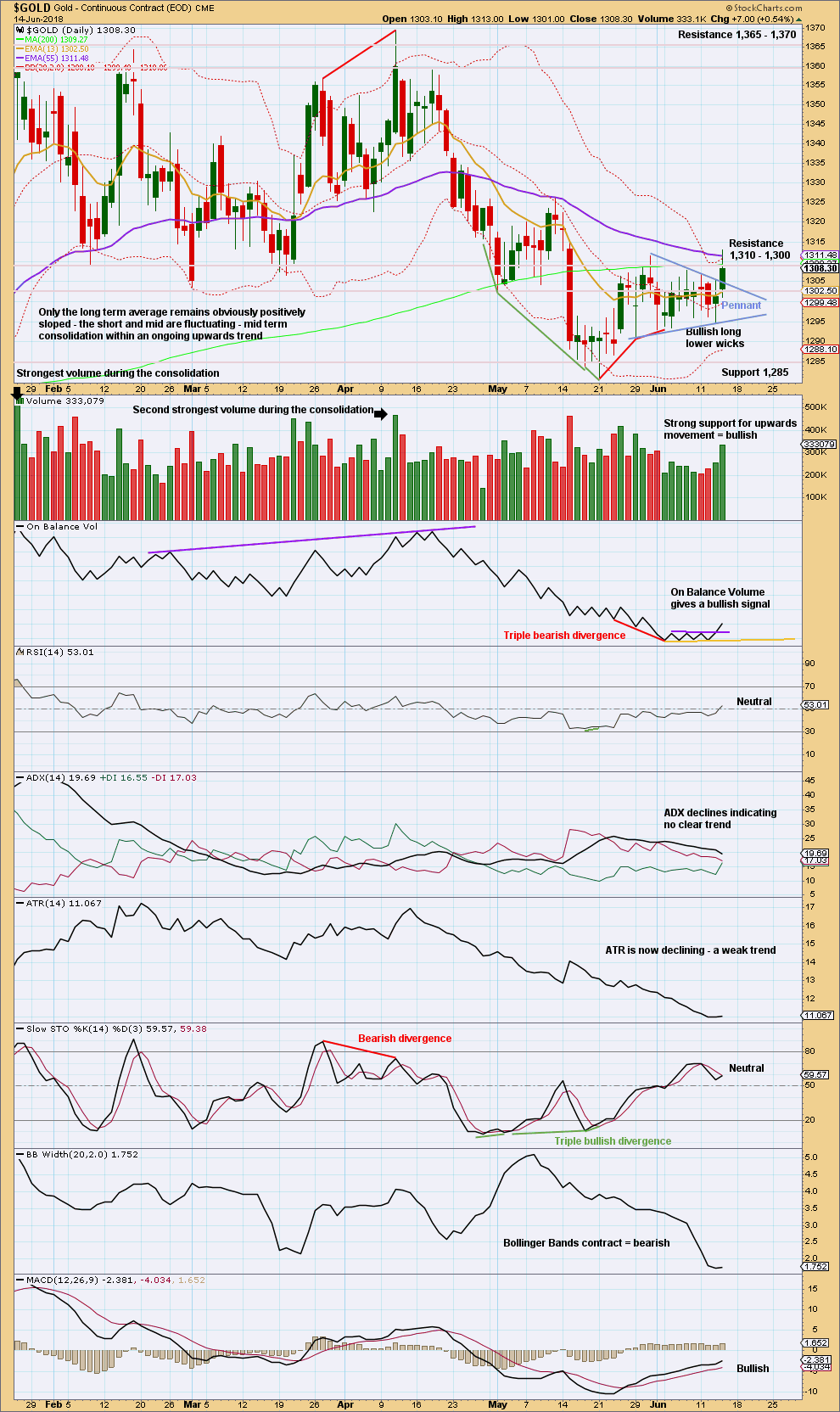

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the last low now 18 days ago, it is an upwards day which has strongest volume. This suggests there is more support now for upwards movement. This support today is strong. Price has closed back up within the resistance zone and On Balance Volume gives a bullish signal. Overall, this chart today is looking more bullish. A close fully above resistance, which has its upper edge at 1,310, would add further confidence that a low is probably in place.

It looks like the downwards breakout may have been false, but before that can properly be concluded price needs to close back above 1,310. It has not done that yet.

Let us look back at major lows from November 2015 and see how price behaved in the days immediately after.

A major low was found on the 3rd of December, 2015. The following day for the 4th of December saw a strong Bullish Engulfing reversal pattern with support from volume, and it came with strong double bullish divergence between price and both of RSI and Stochastics. That low in hindsight looks fairly strong.

Another reasonable low was found on the 31st of May, 2016. There was no reasonable bullish divergence at the low between price and either of RSI or Stochastics. At the low, the candlestick had a bullish long lower wick (although with a reasonable upper wick, it is not properly a Hammer reversal pattern). The two days following the low for the 1st and 2nd of June were inconclusive; both closed red and could at the time have been considered a potential bear flag pattern developing; both had a balance of volume downwards but showed strongly declining volume. Not until the third day, with a very strong upwards day with support from volume to complete a very strong Bullish Engulfing reversal pattern, was a low set in place.

A major low was found on the 15th of December, 2016. At the low, the candlestick had a somewhat bullish long lower wick; volume for the last downwards day supported the fall in price; and, there was clear and strong bullish divergence between price and RSI and Stochastics. The next two days closed green but did not have support from volume. The following two days closed red and did have support from volume. At that stage, four days out from a major low, the short term volume profile was bearish and it looked like a bear flag pattern may be developing. It was not until seven days after the low on the 27th of December that a reasonable bullish day unfolded, and even then it did not have good support from volume. This low did not look clear.

The next low to study occurred on the 10th of March, 2017. That day was inconclusive, closing green, but the balance of volume was downwards and volume supported that downwards movement. At the low, there was no reasonable bullish divergence between price and either of RSI or Stochastics. It was not until three days after the low on the 15th of March that price bounced strongly to complete a strong Bullish Engulfing reversal pattern, which had good support from volume.

The next low to study occurred on the 9th of May, 2017. On that day RSI reached oversold, but there was no divergence between it and price nor price and Stochastics. Right up until six days after the low the short term volume profile could have been judged to be bearish; rising price did not have support from volume. It was clear a low was in place on the 17th of May as a very strong Bullish Engulfing reversal pattern unfolded with strong support from volume. The small bounce up until that date could have been judged to be a bounce within an ongoing downwards trend.

The next low to study occurred on the 10th of July, 2017. There was no divergence at the low between price and RSI, but there was strong clear bullish divergence between price and Stochastics. There were two candlesticks with bullish long lower wicks at the low, but volume remained lighter than the prior downwards day of the 9th of July. This looks like a selling climax in hindsight, but at the time it could have been judged to support downwards movement. Right up until the 14th of July, five days after the low, it could have been considered a bear flag pattern unfolding. On the 14th of July a strong Bullish Engulfing pattern unfolded with some support from volume.

The last low to study is a very important one on the 12th of December, 2017. This occurred after a downwards breakout below support, which was previously at 1,262. That downwards breakout was short lived; price remained below support for two weeks, and found a low only five days after the breakout. At the low, there was no bullish divergence between price and either of RSI or Stochastics. The first upwards day on the 13th of December had a wide range but a very small real body. It did have good support from volume, but volume remained lighter than most prior downwards days. After that low, price moved steadily higher for weeks, initially on light and declining volume. That low in hindsight was very difficult to pick.

Some conclusions may be drawn in relation to the current situation. The first and strongest conclusion is that lows for Gold (at least for the last two years and five months) are not always very clear at the time. Price can be weak in days immediately following lows; it can remain weak for about five to seven days following lows. Lows do not always come with divergence between price and RSI nor even price and Stochastics, but when they do that offers a clue.

Although the last few days have seen unexpected downwards movement, some suspicion may be had that this is a downwards breakout. ADX at this time indicates a downward trend is in place, but this is a lagging indicator. Look out for at least a short term bounce here, and do not be surprised if it begins to show some strength towards the end of this week. If it remains persistently weak, then short positions may be taken for a downwards trend (the new labelling for the fifth wave count could be correct). If it shows strength, that would support the first wave count; the downwards breakout may have been yet another false breakout.

The last low 18 days ago has triple bullish divergence with price. Considering volume was bullish during the last consolidation, and Gold has a recent history of false downwards breakouts following that set up, the last low may be the end of a false downwards breakout.

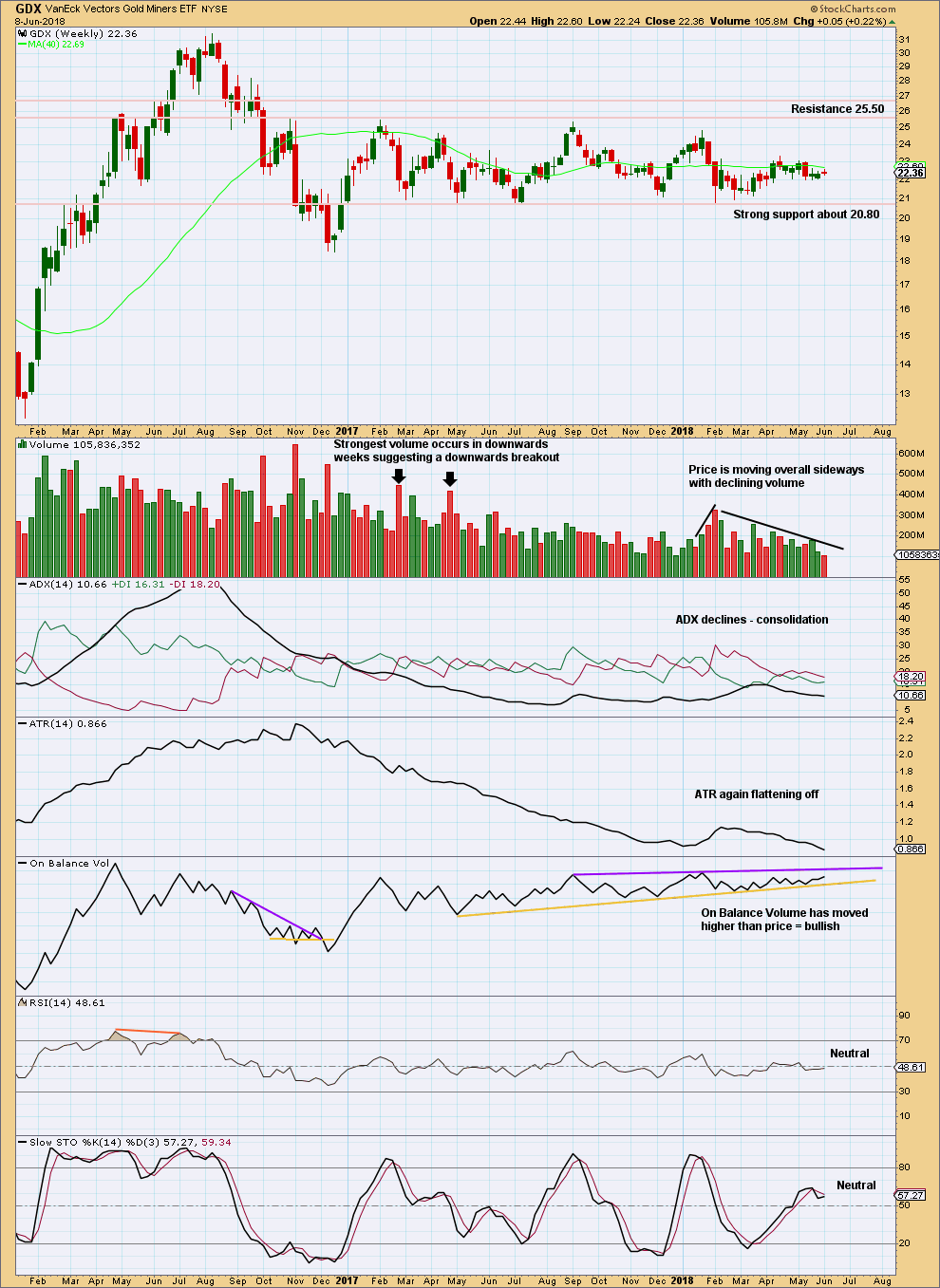

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

Overall, a slow upwards swing may be underway. Do not expect it to move in a straight line; it may have downwards weeks within it.

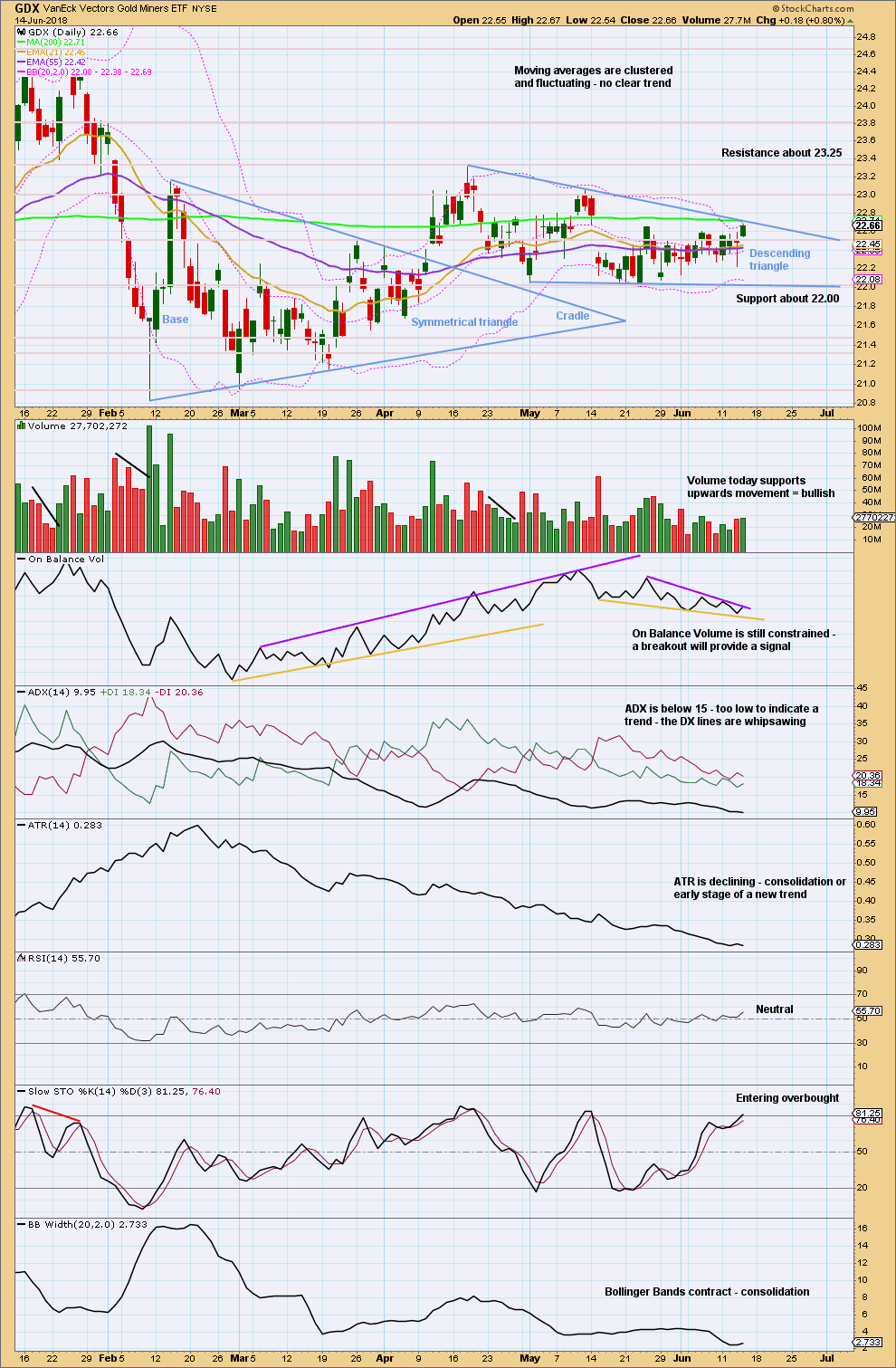

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support here about 22.00 has been tested now five times in recent weeks and has held. The more often a price point is tested for resistance or support and holds, the stronger the technical significance at that point.

A descending triangle may be completing. A break above resistance or below support would signal an end to the triangle and a possible new trend. Watch On Balance Volume carefully for a signal.

During the descending triangle, it is a downwards day that has strongest volume. This suggests a downwards breakout may be more likely than upwards. A measured rule target would be about 20.74.

Published @ 11:27 p.m. EST.

Gold sure likes to mess with us. False break up to void the triangle, now a false break down before a strong move up??

Market is always a good teacher !

A comment from a member over on Elliott Wave Stock Market today prompts me to issue a notice here too.

I am extremely serious about risk management. My risk management advice is simple and clear. Do not trade without stops. No exceptions, ever. That is the most important rule. Second rule, risk only 1-5% of equity on any one trade.

I have from time to time had to switch analysis from bull to bear or vice versa when price invalidates a main wave count and an alternate turns out to be correct. The nature of probability means that this will happen sometimes, it is inevitable. The nice thing about Elliott wave is we can have a price point which exactly tells us when a count is invalidated. Currently that price point is 1,236.54. Below this the main count is invalid.

Occasionally when that happens a member is positioned for the main count, and has come into comments acknowledging they do not have a stop and now have a losing position. They then want the membership and me to help them get out of their losing position, and when they have big losses they blame me for it.

Do not be that person.

Any member found to be trading without stops may have their membership cancelled and may be blacklisted, to never return. I am that serious about this.

Anyone risking their entire equity by trading without stops cannot blame me if they lose their entire equity, because they would have failed to follow my most basic advice.

Hi Lara,

Sorry to hear bad things from losers. Few new traders doesnot know how to trade and manage their losses, where emotions rules when trade goes against them. They don’t even consider alternatives at all. I been doing EW since 2013. I subscribed you to see similar analysis and detailed robotic count :).

Since your confidence on bullish positions increases I see bearish divergence and “lack of bullish momentum” signaling a LOW on gold with a target of 1274. I better analysis bear trade setup on gold. It’s simply because when I trade gold it’s in bear trend.

I always refer your daily chart and where those market glitches appears, example yesterday your daily candle opens at 1293. Those are early signals which is not there in reality. You care those hidden germs because you marked those lows as C wave down.

I have seen that you have simply relay on software a lot where marking wave B in wrong side. Wave B will the most annoying wave in the elliotwave history. No matter which time frame you choose, B is the most arrogant time consuming zigzag which you can easily identify. End of B will an explosion 🙂 I try to identify this wave especially characteristic of it. for example 1285 to 1309 took more than 15 days which is not normal. Here is where I identified B wave character. End of B an explosion (as two c waves [minor and major] which we got after FOMC

Let me share the chart I follow

https://www.tradingview.com/x/3iX1UzVY/

and my all time favorite of flipped chart.

https://www.tradingview.com/x/tnDNkOrt/

As per rule Wave B should be retrace minimum 30% or extend 120%. Simply follow the rule by measuring time. In this case We met only one scenario (120%) If retrace does not match over time then consider double zigzag or triple zigzag. This was the hard lesson I learnt from the market.

Relax..! don’t think too much about those new traders those who care about money. They simply does not know the hard work behind each analysis. If you are under pressure we never get “cool & guru” analysis.

Enjoy your weekend 🙂

Thanks very much for the comment.

I am having a lovely weekend. Yesterday I did my volunteer work, re-setting trap lines in a conservation estate to protect Kiwi. Exhausting and satisfying. My lungs are full of clean fresh air, and my brain is ready today to analyse some markets.

Not sure where you got the rule re B waves should retrace minimum 30% or extend 120% though… I’ve not come across that one before.

Blue bible – Page 89 (Elliot Wave Principle)

In last 18 years I have seen this happens time after time to investors who refuse to take responsibility of their decision. They turn the blame to market letter author.

Yep. And it’ll probably keep on happening. I can live with that, because I can’t change peoples behaviour.

And so it turns out the alternate wave count was correct. Minor B has continued lower.

If this new low has strong divergence with Stochastics and / or RSI then that would point to a low finally being in place.

If there is no divergence then there may be more downwards movement next week.

The lower (2)-(4) trend line is close by. This candlestick is developing a bullish long lower wick.

Alternate count it is!

GDX refusing to go below 22 for now, and GDXJ staying above 32.50…

Good signs given this very sharp fall in both gold and silver. Let’s see if we get a recovery here…

I think we get one more leg down on Monday for Gold.

Targets for GDX (below 22.01) and GDXJ (below 32.28)

Let’s bet a dollar Dreamer! 🙂

I bet the low is in… meaning this new wave down is a second wave correction of sorts, maybe minute ii of primary 1 of a beginning C wave…

I know your position, one more low before the take off.

Of course this could all unravel and crash to pieces like the 5th daily chart and we’d both be wrong… but I’d b more wrong than you in that scenario. Lol

Deal?

🤣🙃😂. Anything can happen as the market often proves us wrong. That said, the patterns I see for the miners suggest that they need to make lows slightly below the #’s above to complete 2nd wave corrections . Let’s see what happens.

The USD spiked higher yesterday after the ECB decision. A new high has now been made, changing the count and opening up the possibility that Cycle II may move higher yet.

If it does move any higher, it may put pressure on Gold. That said, as Brandon noted in yesterday’s comments, gold held up well yesterday.

https://www.tradingview.com/x/wiaLuUlj/

3 phantom spikes down in the last month is worrisome. Still possible for price to follow these last 2 down…. hmmmnn….

Yeah those phantom bars throw a kink in everything and seem to come true way more than not I’m long but expect 1275 -1280 is possible

They do indeed.

Volume is still favouring upwards days. I expect we may see strong bullish divergence with this new low and Stochastics. If we see it with RSI as well, that would be very bullish.