Downwards movement continues for both Gold and GDX as last analysis expected.

A new target is calculated for Gold. Targets for GDX remain the same.

Summary: With support from volume, GDX has effected a downwards breakout from a very long held consolidation (beginning December 2016). The long term target is at 16.02.

A short term target for GDX is now at 19.12.

The target for Gold is now at 1,166. If price keeps falling through this target, then a classic analysis target is at 1,157. At about one of these targets a bounce is expected for a multi week throwback or consolidation.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts and several weekly alternates is here, video is here.

Weekly charts were last all reviewed here, with video here.

MAIN ELLIOTT WAVE COUNT

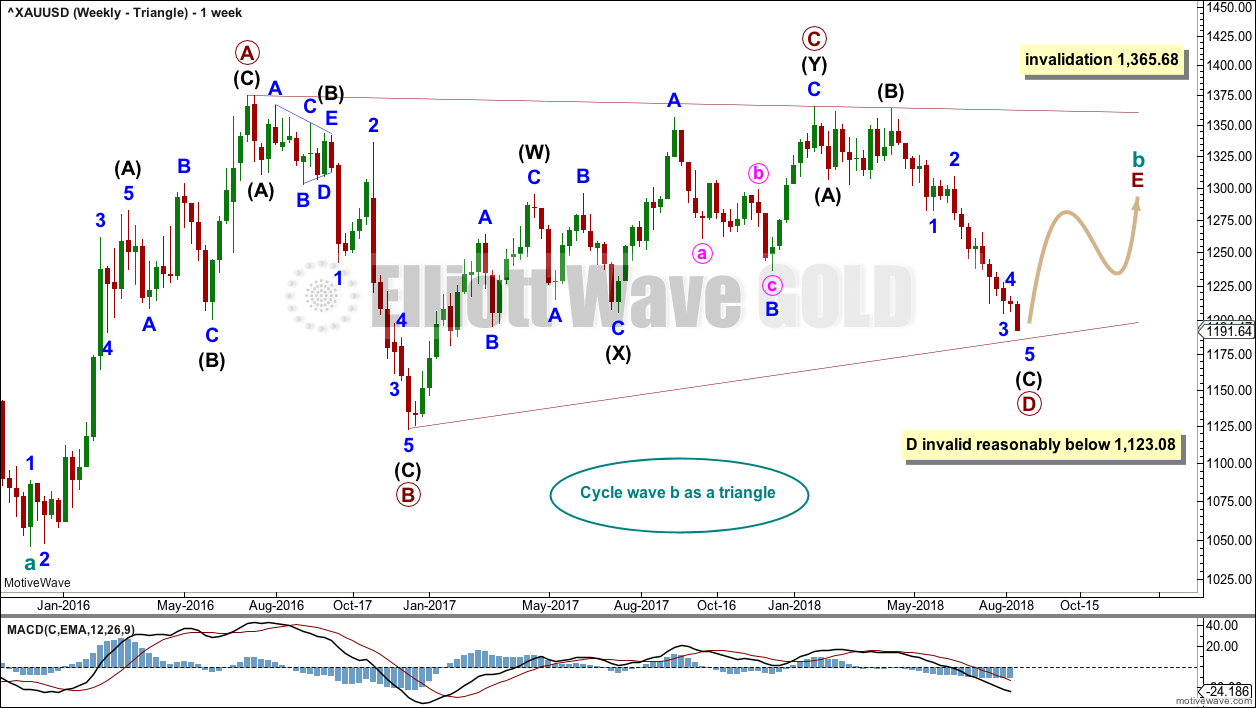

WEEKLY CHART – TRIANGLE

There are four remaining weekly wave counts at this time for cycle wave b: a triangle, flat, combination or double zigzag. Only one weekly chart shall be published Monday to Thursday and all four weekly charts will be reviewed at the end of the week after the close of Friday’s session.

While the direction does not diverge for these four weekly wave counts, only one weekly wave count shall be published on a daily basis, so that the analysis is manageable for me to publish and for members to digest. Note: This does not mean that the remaining three counts may not be correct.

The triangle so far has the best fit and look.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

DAILY CHART – TRIANGLE

Primary wave D may now be close to completion with minor wave 5 completing.

Minor wave 5 has not found support at the lower edge of the blue Elliott channel; it has now slightly overshot the channel. Fifth waves for commodities do sometimes exhibit strength and do sometimes overshoot channels.

If price turns up and breaks above the upper edge of this channel, then that shall be a very strong indication that the downwards wave of intermediate wave (C) should be over and a new upwards wave should have begun.

Minor wave 4 looks like a complete triangle. Gold often exhibits surprisingly short fifth waves out of its fourth wave triangles. If the new target calculated is wrong, it may be too low; if my expectations for minor wave 5 to now continue for another one to few days is wrong, it may be that it ends more quickly.

Minor wave 4 may not move into minor wave 1 price territory above 1,282.20.

HOURLY CHART

Minor wave 5 is unfolding as an impulse, and within it minute waves i and ii now look complete.

Minute wave iii may now be unfolding lower; it may exhibit some increase in momentum.

Minute wave i at its end broke below the lower edge of the blue Elliott channel, which is copied over from the daily chart. After this trend line was breached, minute wave ii has effected a typical throwback to resistance.

A base channel is added to this hourly chart. Along the way down, bounces may find resistance at the upper edge of the channel. Minute wave iii may have the power to break below the lower edge of the channel.

TECHNICAL ANALYSIS

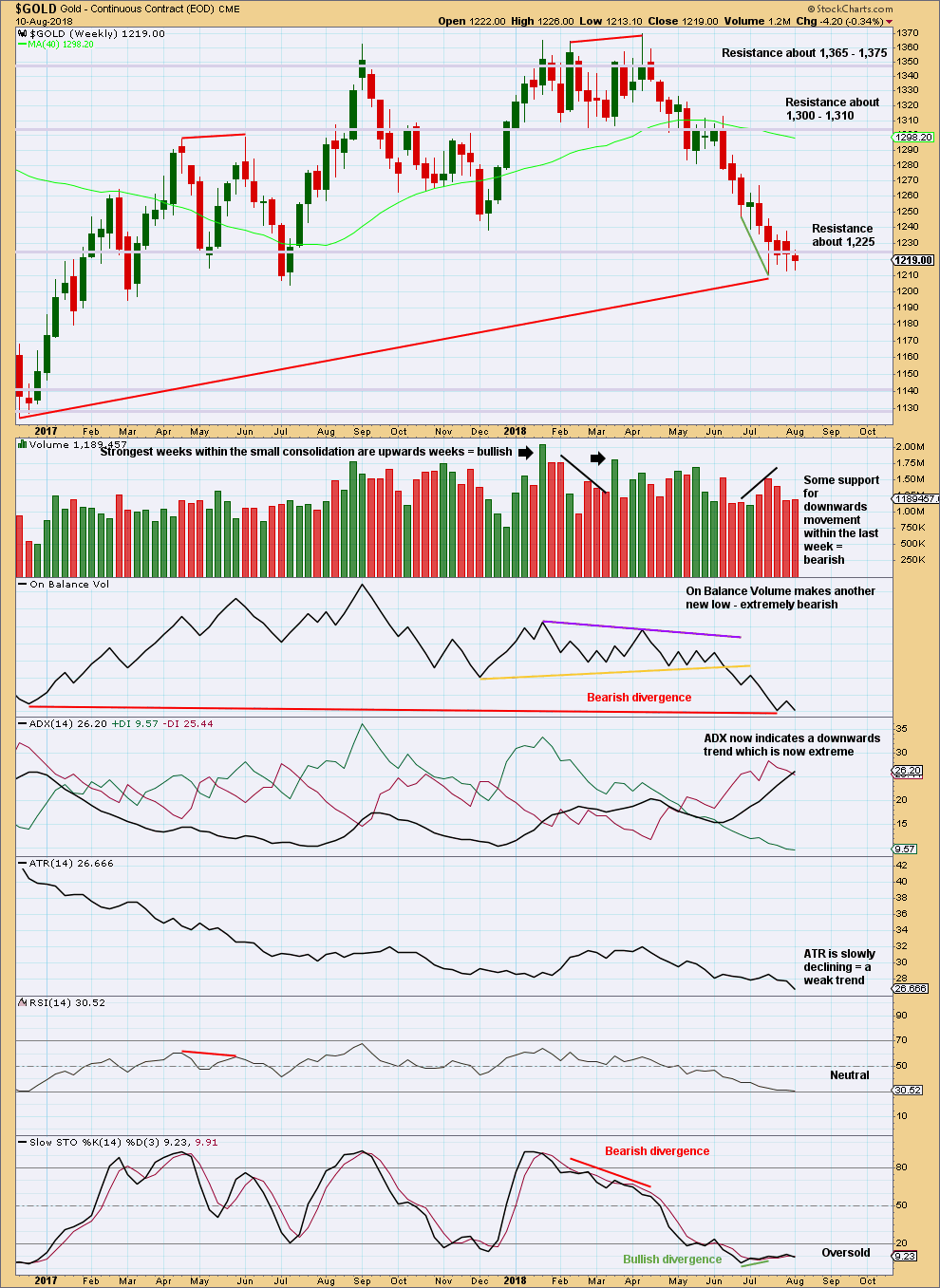

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The long term picture for this chart is bearish due to the long term bearish divergence between price and On Balance Volume.

Short term bullishness may have now been resolved by some sideways movement.

For this market, when a strong trend is unfolding, ADX may reach very extreme and may continue as such for several weeks.

Low and declining ATR looks normal for a B wave, particularly a triangle.

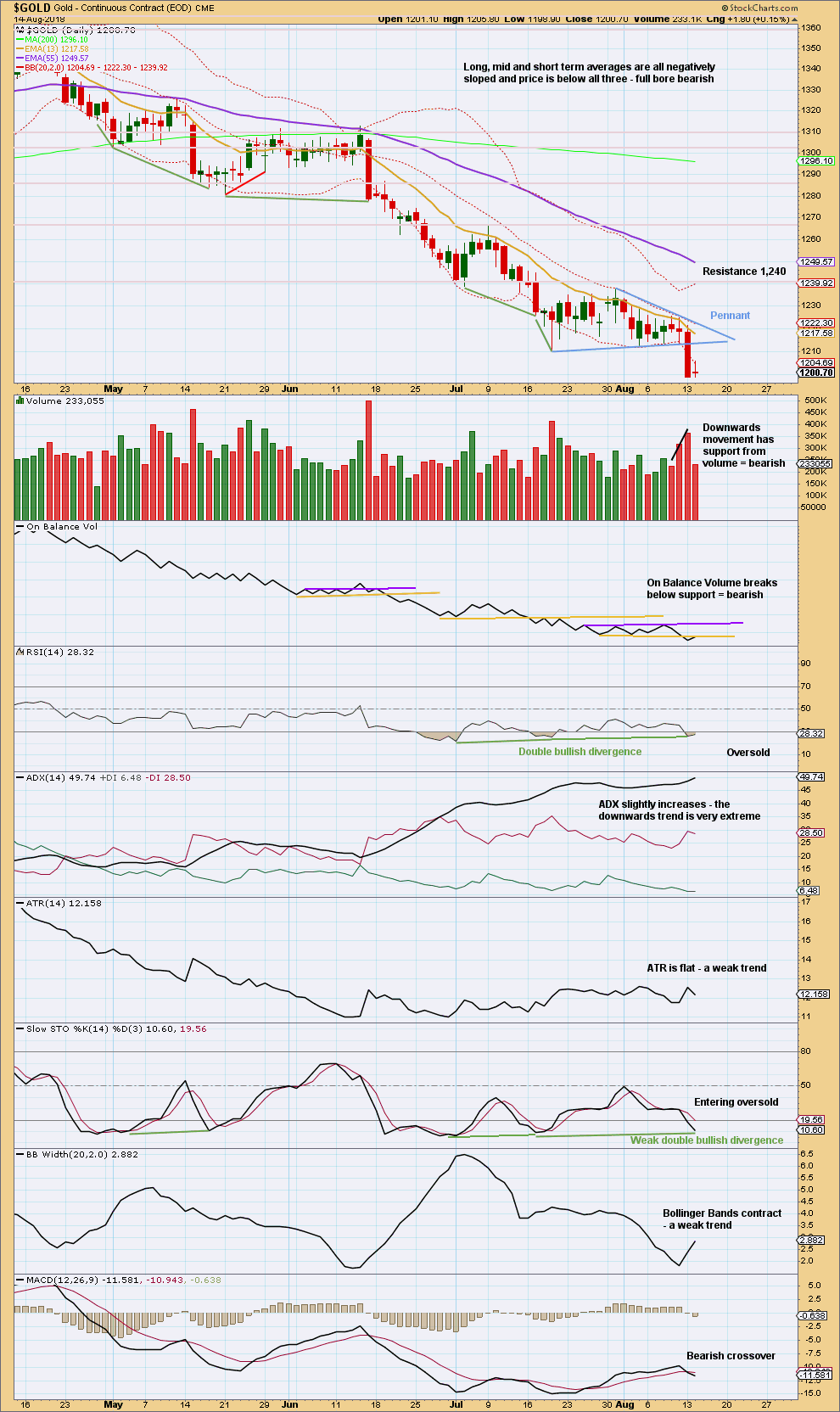

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Yesterday saw a downwards breakout below the Pennant pattern that has support from volume. The target using the length of the flagpole which precedes the Pennant is 1,157. This is still lower than the Elliott wave target, so use this classic target if price keeps on falling through the Elliott wave target.

Support below is now close by, about 1,195 and then 1,125.

This trend is still very extreme. Bullish divergence today between price and Stochastics is weakened, but remains between price and RSI.

Gold can sustain an extreme trend for a reasonable period of time. Look now for a clear bullish candlestick reversal pattern to indicate it could be over.

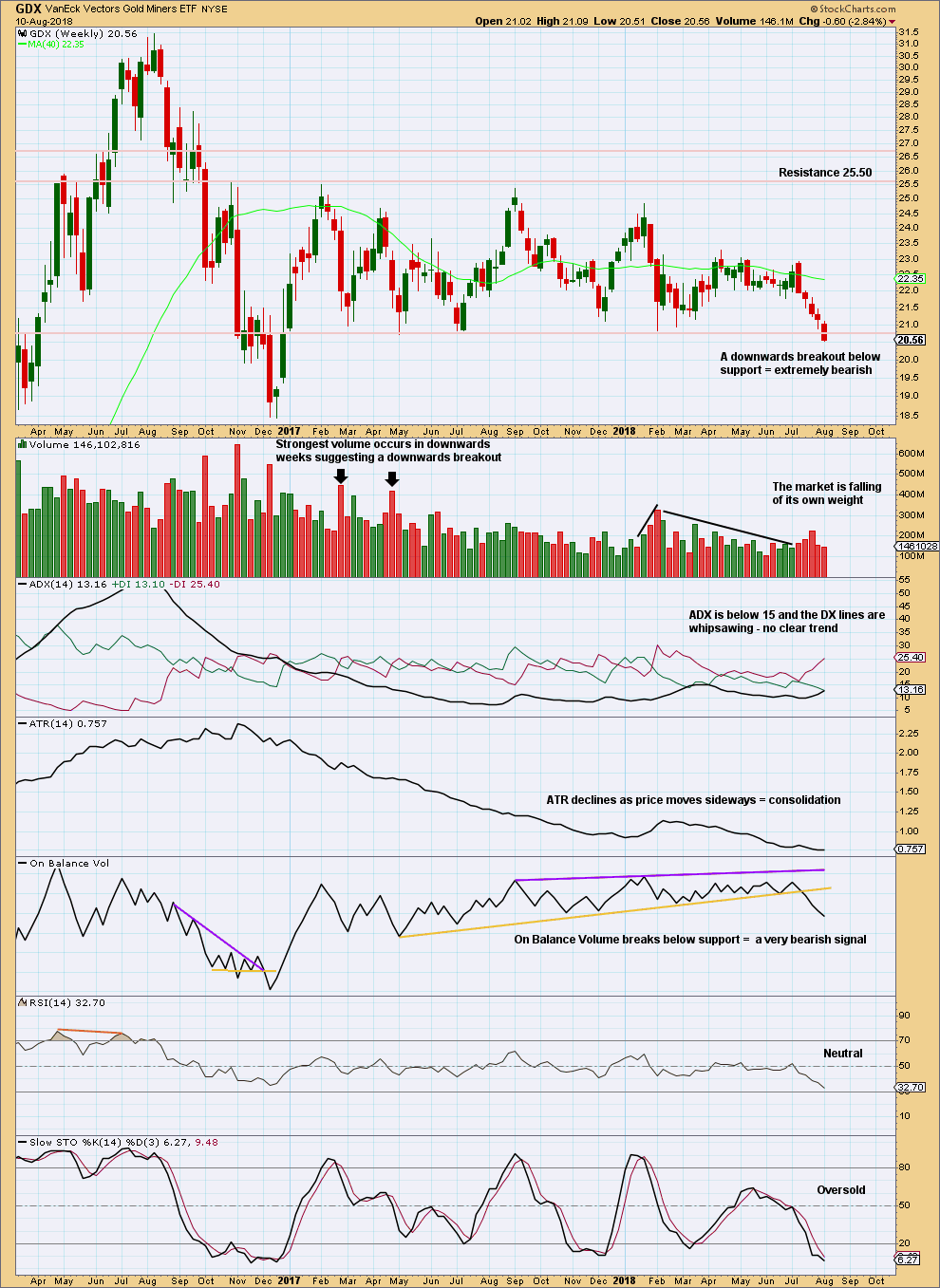

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has been range bounce since January 2017. This is a very long sideways consolidation. The longer it continues, the more sustained the eventual breakout will be. Volume suggests the breakout may more likely be downwards.

Price last week closed below support, which was about 20.80. The close this week is the lowest price point for about a year and a half, which is extremely significant. A very long term downwards trend now looks very likely for GDX.

The long term target for the trend is at 16.02.

Next support is about 18.40.

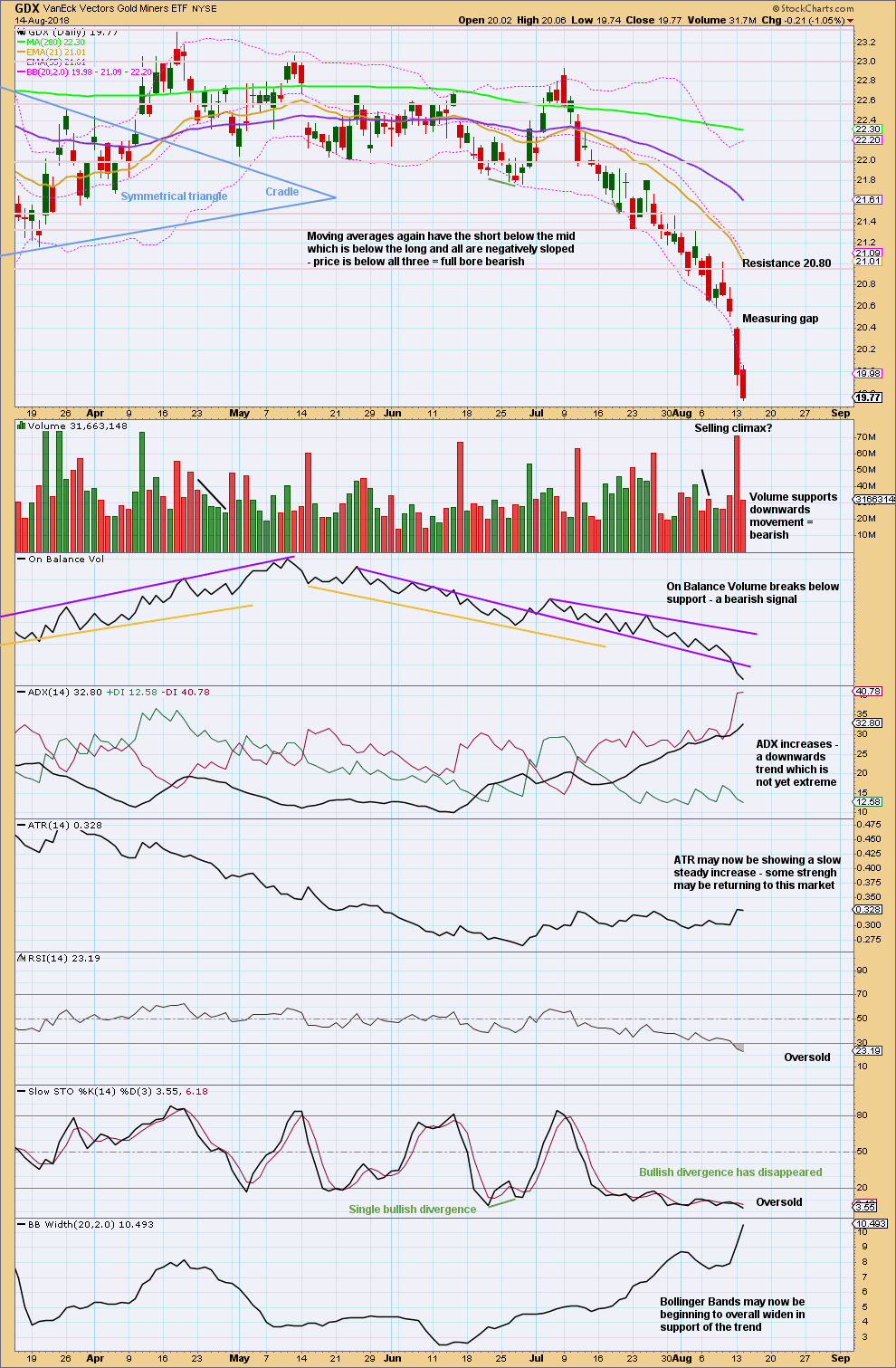

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has now closed below support on a strong downwards day with support from volume. New lows are the lowest for GDX since December 2016. This is extremely significant for GDX.

GDX is in a downwards trend. The short term picture now looks bearish.

A short to mid term target using the measuring gap is about 19.12.

Please remember to protect your trading accounts by careful risk management. Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

A possible target for this downwards trend to end may be now calculated using the measured rule, giving a target about 16.10.

While GDX and Gold are often positively correlated, this correlation is unreliable. Gold may still have a multi week shallow bounce and GDX may still move overall lower with smaller bounces along the way. The two wave counts, and indeed technical analysis for these two markets, cannot be reliably linked while the correlation is unreliable.

Published @ 11:30 p.m. EST.

updated hourly chart:

minute iii is only 0.59 longer than minute wave i, they’re almost even in length and both are extended.

only one or two waves within an impulse may be extended, not all three. so minute v may not be extended, it should be shorter than 24 so the target looks about right.

Hi Lara and Dreamer,

To continue the discussion on WXY if it is a sideways Combination. Dreamer writes “2nd structure (Y) would Not need to end past W”. Please see attached simple drawing of WXY Combo corrections.

Ques: Is it OK for Y to fall short of W in a sideways Combo correction, instead of having to meet Y?

Thanks for your help….and yes [very interesting Rambus article].

The purpose of second structures in double combinations (and third in extremely rare triples) is to take up time and move price sideways.

So firstly, have that in mind when considering combinations.

My research on Gold shows at the daily chart time frame and higher combinations aren’t very common. I see plenty on the hourly chart though.

The several I’ve found on the daily chart have Y ending about the same level as W. Occasionally Y can fall reasonably short. Sometimes Y can end a bit beyond W.

There is no rule, and I don’t think I can write a new one, to tell where W ends in relation to Y. The guideline is that the whole structure should be a sideways consolidation. Rather than a bounce or pullback.

I am considering that if when my research is complete I have not found a triple combination, that maybe just maybe a rule should exclude triple combinations.

I have found triple zigzags, but no triple combinations yet.

Thanks for your clarification…Lara…

Minor 5 is now 20+ away. It appears this the final 5th wave with increase in momentum.

Crash = Miners 😱

Miners price is approaching the 2016 lows. A bounce should be due around here

This is a couple days old, but very relevant. USD ⬆️ Other currencies ⬇️ Big picture bearish for gold

https://rambus1.com/2018/08/12/weekend-report-163/

Trump doesn’t like strong dollar, and he’ll find a way to stop this madness… Lol

Trumps trade war is contributing to a strong dollar.

Armstrong thinks there is a shortage of dollars around the world….

https://www.armstrongeconomics.com/markets-by-sector/foreign-exchange/usd/the-shortage-of-us-dollars/

There is no shortage of dollar. US has 21 trillion debt. Where does he think these dollars resides? All over the world. The world is loaded with dollar.

Further to my comment this is interesting post:

“The world entered a credit-expansion binge in 1971. The US, as the world’s central banker (liberated from the restriction of redeeming dollars for gold) entered upon a long credit expansion that fed dollars to the world in exchange for the world’s products. The world responded to the incoming flow of dollars to its central banks, with a corresponding credit expansion which fostered a credit-based prosperity around the world.

The graph elaborated on the basis of Bloomberg data is telling us that the world reached the point where a general liquidation had to set in, in August 2014.”

http://www.plata.com.mx/enUS/More/304?idioma=2

Come on, we believe in TA analysis, let’s ditch the news. I was saying something about Trump for fun. We are small guys and we don’t have inside news…

King dollars never never get some rest, it keeps going up while suppressing gold! 😬