More upwards movement for the short term was expected for both Gold and GDX.

Summary: It is again possible for Gold that a low may be in place, but this needs some confirmation with a new high above 1,216.30. While price remains below 1,216.30, it is possible that current upwards movement is a small bounce within an ongoing downwards trend. If price keeps falling for Gold, expect it to reach below 1,147.

For GDX, a highly significant break below support occurred two weeks ago. The long term target is at 16.02. The small bounce now may be complete. If it continues any higher, then look for resistance at 19.74.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts and several weekly alternates is here, video is here.

Weekly charts were last all reviewed here, with video here.

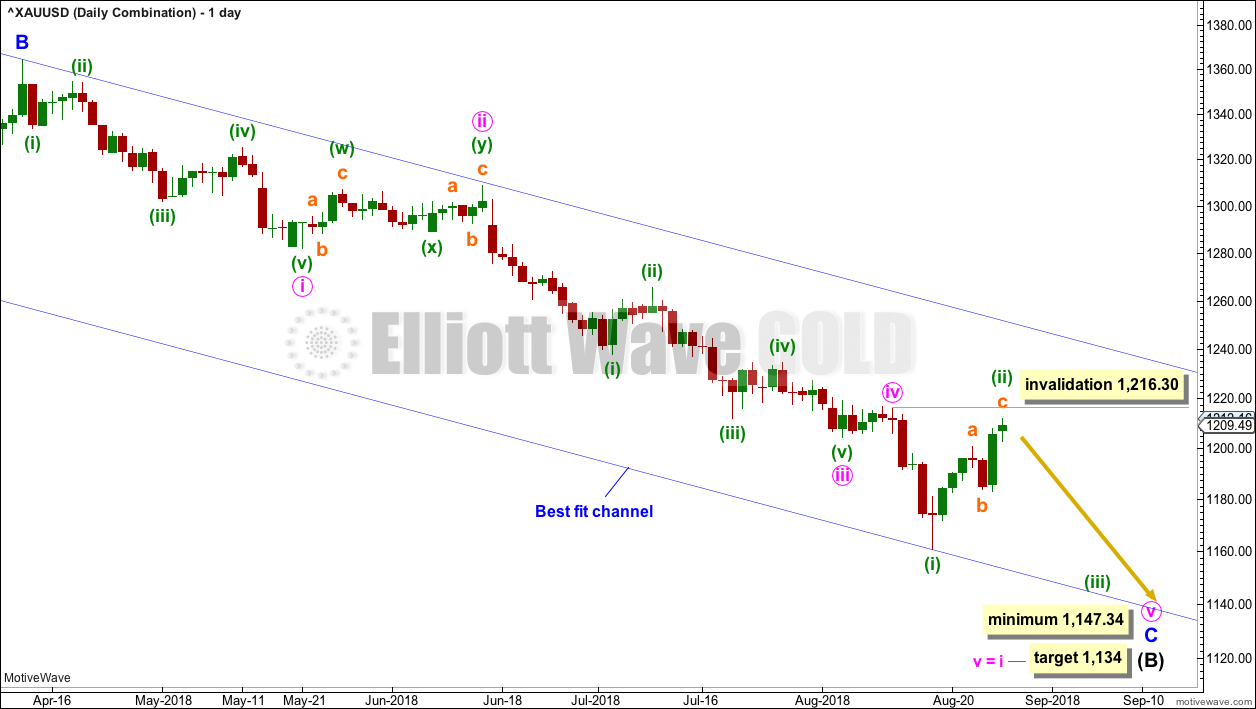

MAIN ELLIOTT WAVE COUNT

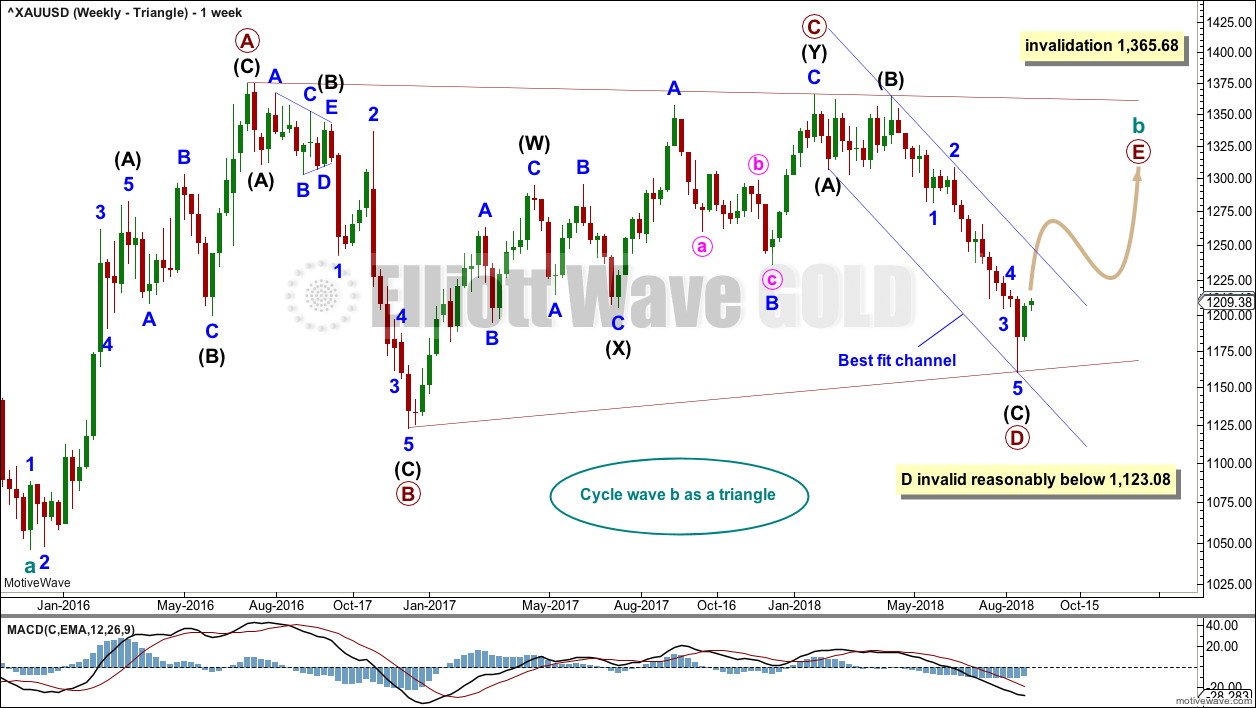

WEEKLY CHART – TRIANGLE

There are four remaining weekly wave counts at this time for cycle wave b: a triangle, flat, combination or double zigzag.

All four weekly wave counts were again considered at the end of last week. Only two shall be followed on a daily basis.

The triangle so far has the best fit and look.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

A channel is drawn on all charts about the downwards wave of primary wave D. Here, it is labelled a best fit channel. If this channel is breached by upwards movement, that may provide reasonable confidence in this weekly triangle wave count and put serious doubt on the other three weekly wave counts.

This wave count now expects a consolidation for primary wave E to back test resistance at prior support, and then a significant new downwards wave for cycle wave C. For the long term, this is the most bearish wave count.

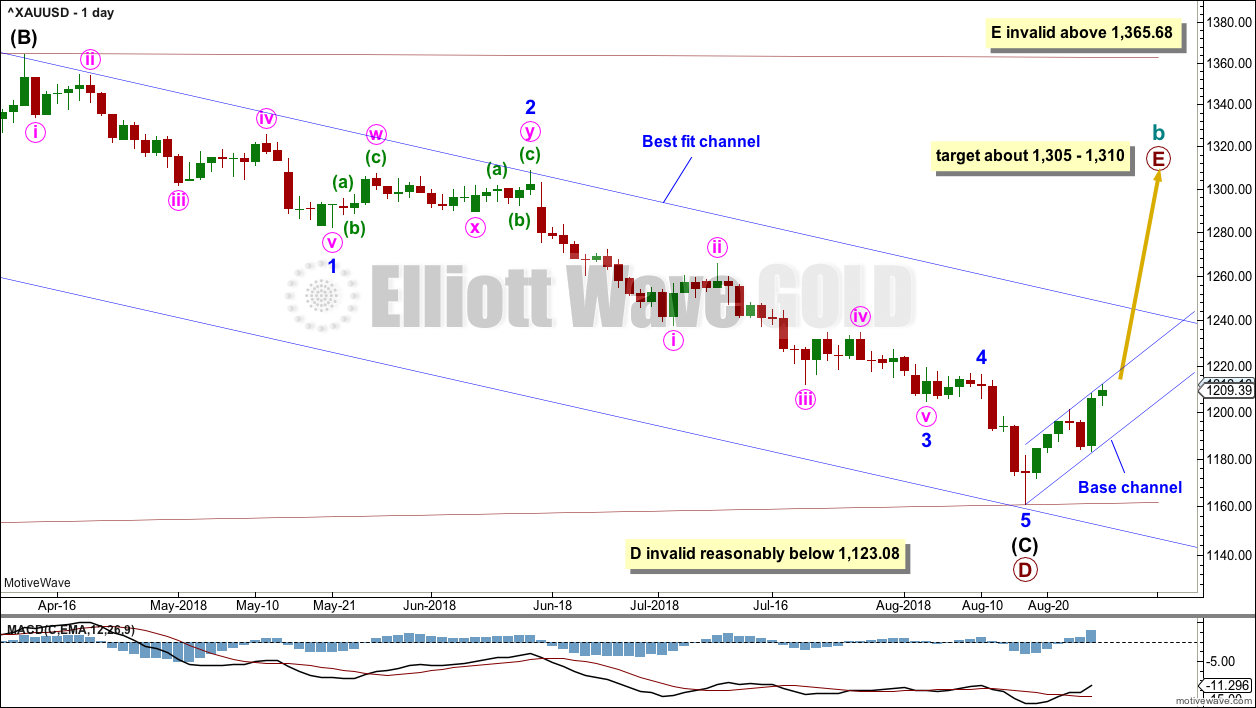

DAILY CHART – TRIANGLE

Primary wave D may again be complete. For Barchart data, there is a Morning Doji Star candlestick reversal pattern at the low.

A new high above 1,216.30 would be required for reasonable confidence that a low is in place. This price point is the start of minor wave 5. A new high above the start of minor wave 5 may not be a second wave correction within minor wave 5, so at that stage minor wave 5 should be over.

While price remains below 1,216.30, it will remain possible that primary wave D could continue lower. However, primary wave D for this triangle wave count should end here or very soon, so that the B-D trend line has a reasonable slope ensuring the triangle trend lines converge at a reasonable rate. If primary wave D were to continue much lower, the B-D trend line would have too shallow a slope for a normal looking Elliott wave triangle.

A target for primary wave E is the strong zone of resistance about 1,305 to 1,310. Primary wave E is most likely to subdivide as a zigzag (although it may also subdivide as a triangle to create a rare nine wave triangle), and it should last at least a Fibonacci 13 weeks. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

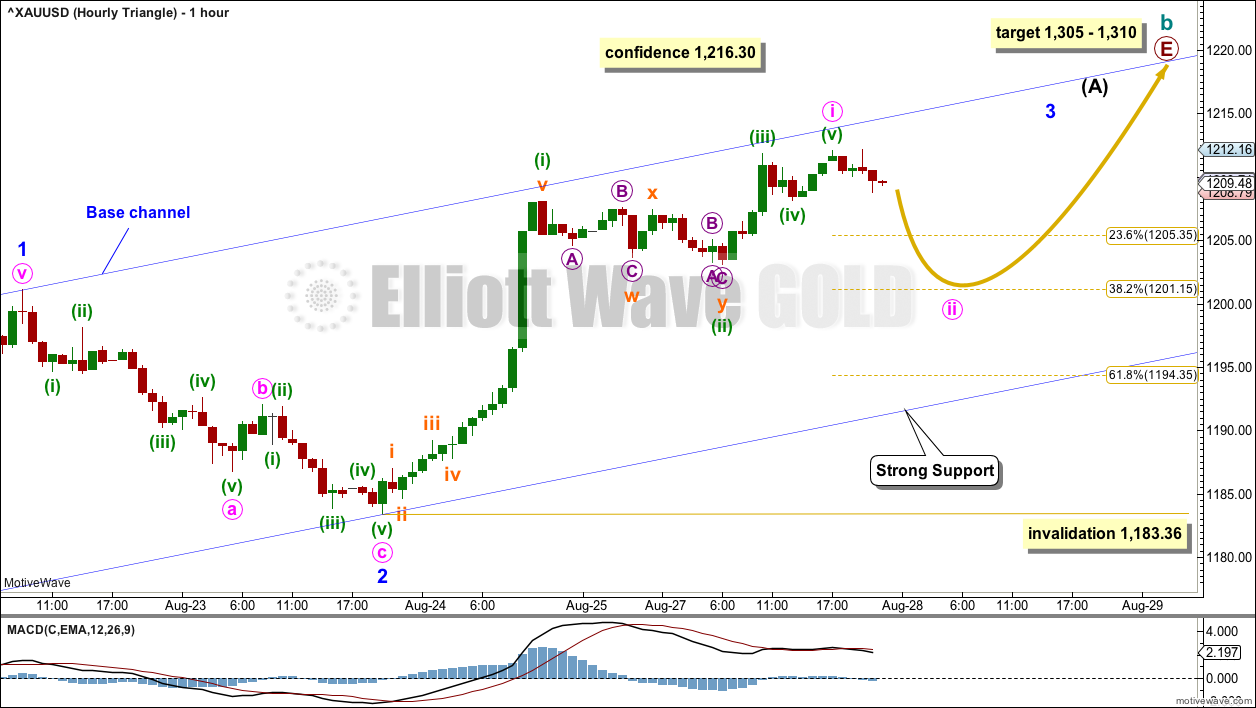

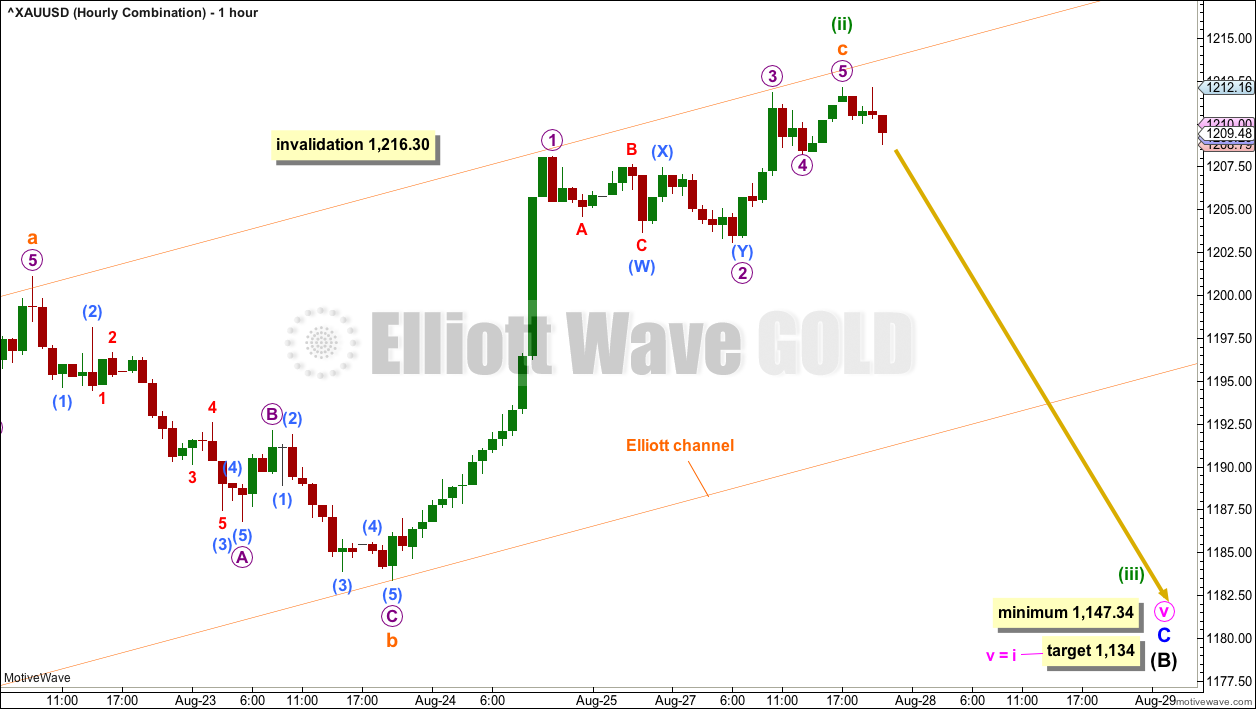

HOURLY CHART

The blue base channel is copied over to this hourly chart from the daily chart. Lower degree second wave corrections along the way up should find support about the lower edge of this channel.

Within a new upwards trend, minor waves 1 and 2 may be complete. Minor wave 2 was relatively shallow at 0.44 the depth of minor wave 1. This is not very common for Gold, but sometimes it does happen.

Within minor wave 3, the upcoming correction for minute wave ii may not move beyond the start of minute wave i below 1,183.36.

Minor wave 3 may only subdivide as an impulse. If minute wave i is complete, then minute wave ii may now begin to correct down to either the 0.382 or 0.618 Fibonacci ratios. If it is deeper, then look for strong support about the lower edge of the base channel.

This hourly wave still requires a new high above 1,216.30 for reasonable confidence.

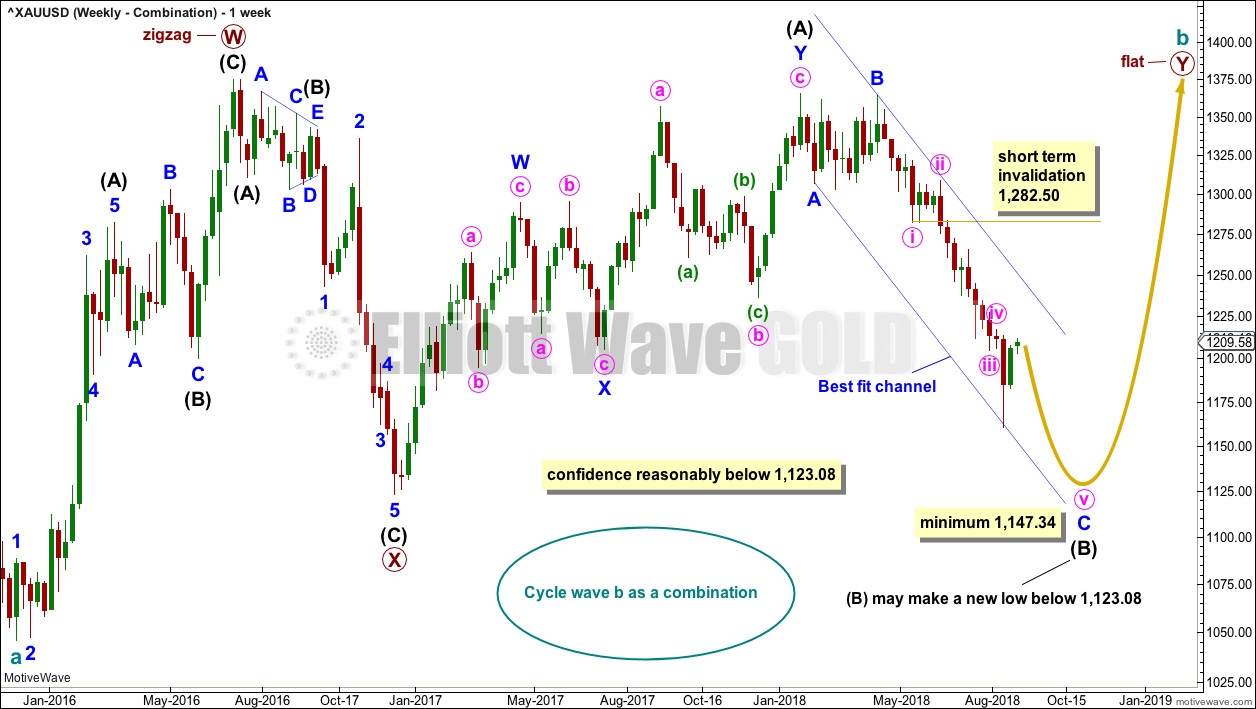

WEEKLY CHART – COMBINATION

It is essential when a triangle is considered to always consider alternates. Too many times over the years I have labelled a triangle as unfolding or even complete, only for it to be invalidated and the structure turning out to be something else.

When a triangle is invalidated, then the most common structure the correction turns out to be is a combination.

If cycle wave b is a combination, then the first structure in a double may be a complete zigzag labelled primary wave W.

The double may be joined by a three in the opposite direction, a zigzag labelled primary wave X.

The second structure in the double may be a flat correction labelled primary wave Y. My research on Gold so far has found that the most common two structures in a double combination are one zigzag and one flat correction. I have found only one instance where a triangle unfolded for wave Y. The most likely structure for wave Y would be a flat correction by a very wide margin, so that is what this wave count shall expect.

Within a flat correction for primary wave Y, the current downwards wave of intermediate wave (B) may be a single or multiple zigzag; for now it shall be labelled as a single. Intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 1,147.34. Intermediate wave (B) may move beyond the start of intermediate wave (A) as in an expanded flat.

Because the minimum requirement for intermediate wave (B) is not yet met, this wave count requires that minute wave v of minor wave C of intermediate wave (B) continues lower. This is the most immediately bearish of all four weekly wave counts.

When intermediate wave (B) is complete, then intermediate wave (C) would be expected to make at least a slight new high above the end of intermediate wave (A) at 1,365.68 to avoid a truncation. Primary wave Y would be most likely to end about the same level as primary wave W at 1,374.91, so that the whole structure takes up time and moves price sideways, as that is the purpose of double combinations.

While double combinations are very common, triples are extremely rare. I have found no examples of triple combinations for Gold at daily chart time frames or higher back to 1976. When the second structure in a double is complete, then it is extremely likely (almost certain) that the whole correction is over.

DAILY CHART – COMBINATION

Minor wave C of intermediate wave (B) may be an incomplete five wave impulse. Within the impulse, minute waves i, ii, iii and iv may all be complete and minute wave v may now be unfolding.

Within minute wave v, the current bounce may be minuette wave (ii), which may not move beyond the start of minuette wave (i) above 1,216.30.

HOURLY CHART

Upwards movement may be a continuation of minuette wave (ii).

The orange Elliott channel here is drawn in exactly the same way as the blue base channel on the triangle wave count. A breach of this channel by downwards movement would be a reasonable indication that this wave count may be correct.

The target remains the same.

TECHNICAL ANALYSIS

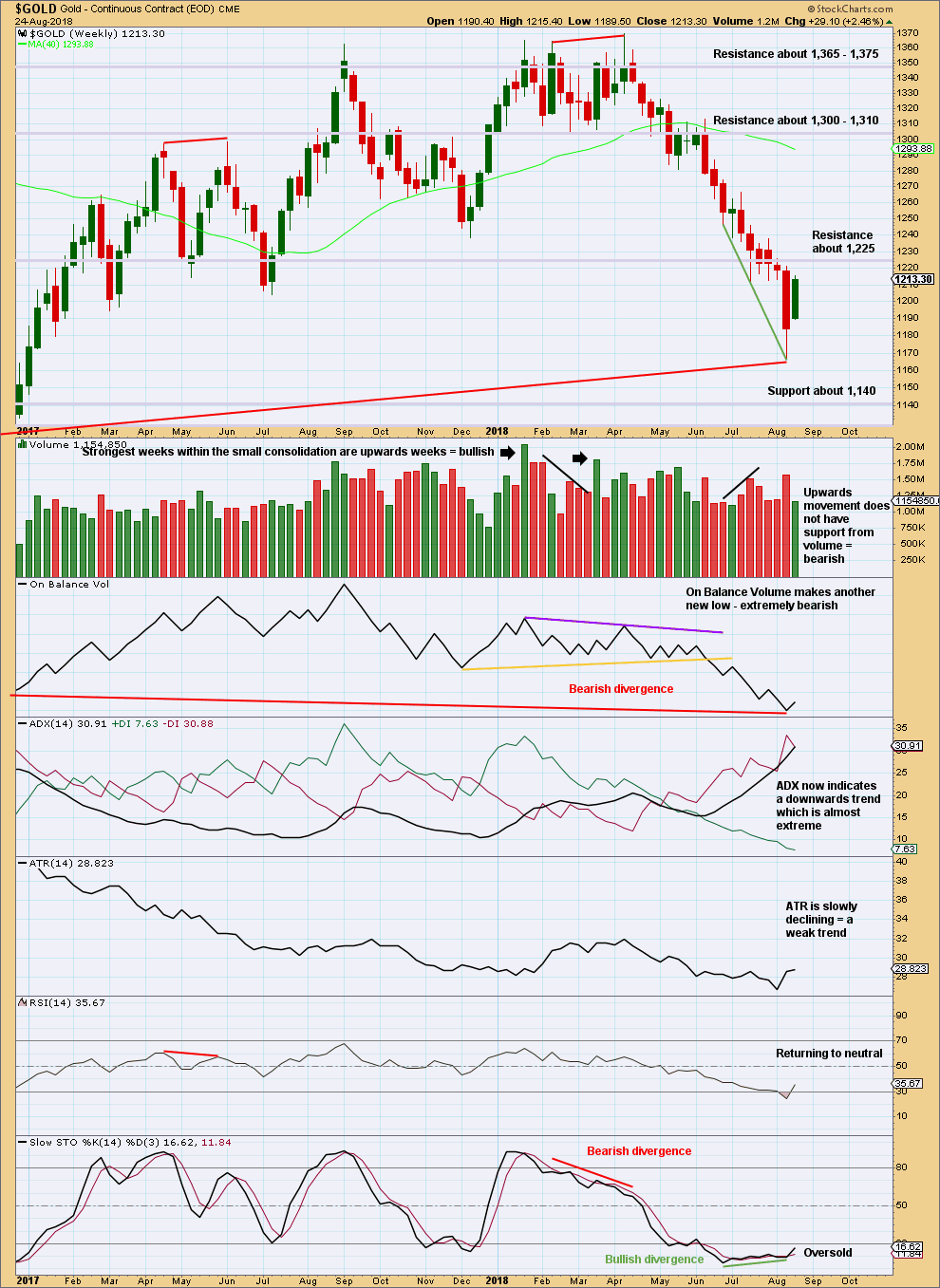

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is lower than its prior point at the end of November 2015. This divergence is extremely bearish but does not rule out a consolidation unfolding here; the divergence does strongly support the Triangle wave count, which expects a consolidation or bounce up to test resistance now and then a continuation of a major bear market.

When Gold has a strong trend, ADX may remain very extreme for long periods of time and RSI can move more deeply into oversold. However, most recent lows since November 2015 were all found when RSI just reached oversold, so some caution here in looking out for a possible consolidation or trend change would be reasonable.

A reasonable upwards week last week looks like either a small consolidation within an ongoing downwards trend or the start of a new upwards trend. The lack of support from volume suggests a consolidation.

If price does continue lower, then look for next support about 1,140.

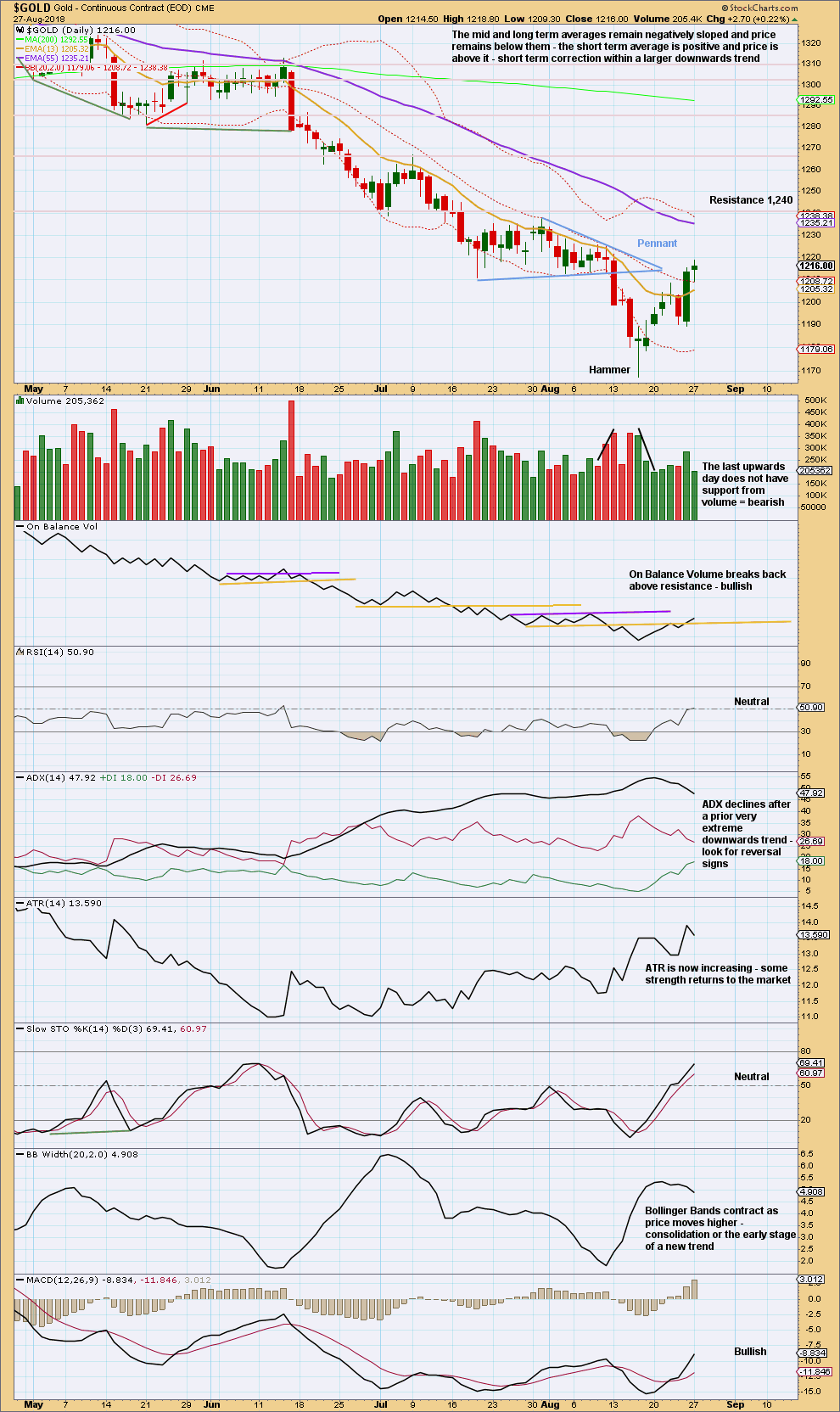

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support below is now about 1,140.

When a trend is very extreme, it is time to look out for candlestick reversal patterns and a possible trend reversal to the opposite direction, or a reasonable sideways move to relieve extreme conditions. Here, there is a Hammer reversal pattern at the low (it is almost a Dragonfly doji, but there is a little too great an upper shadow for that pattern). This is a warning that a low may now be in place.

For the short term, Monday shows weakness with a small range and light volume. Upwards movement is slowing. This may be a completed bounce within an ongoing downwards trend.

The signal from On Balance Volume is weak only because the breached trend line has been previously weakened by another breach.

The last seven sessions have relieved extreme oversold conditions. There is again room for price to fall. A low in place should be seriously considered for the mid term only if the combination Elliott wave count is invalidated with a new high above 1,216.30.

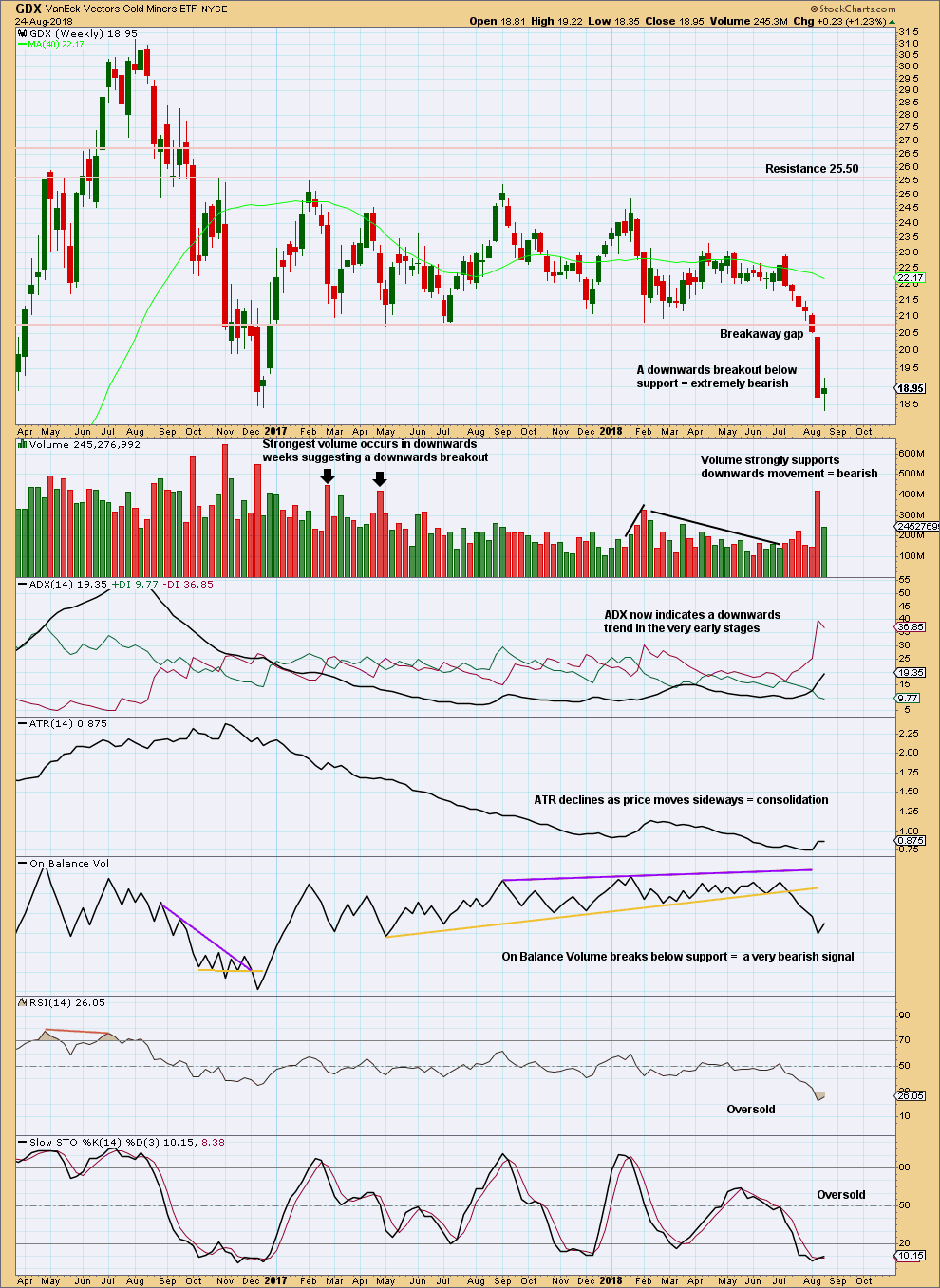

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX is now moving lower exactly as expected.

After a breakout, a technical principle is the longer that price consolidates sideways the longer the resulting trend may be expected to be. Also, the longer that price meanders sideways the more energy may be released after a breakout. This is what is happening now for GDX.

The target for this downwards trend to end is calculated using the measured rule. The widest part of the consolidation is added to the breakout point at 20.80 giving a target at 16.02. That is not yet met.

At the weekly chart level, there is a clear downwards breakout with a breakaway gap. As breakaway gaps should not be closed, they may be used to set stops that may be set just above a downwards breakaway gap.

Upwards movement for this last week may be the start of a bounce to back test resistance.

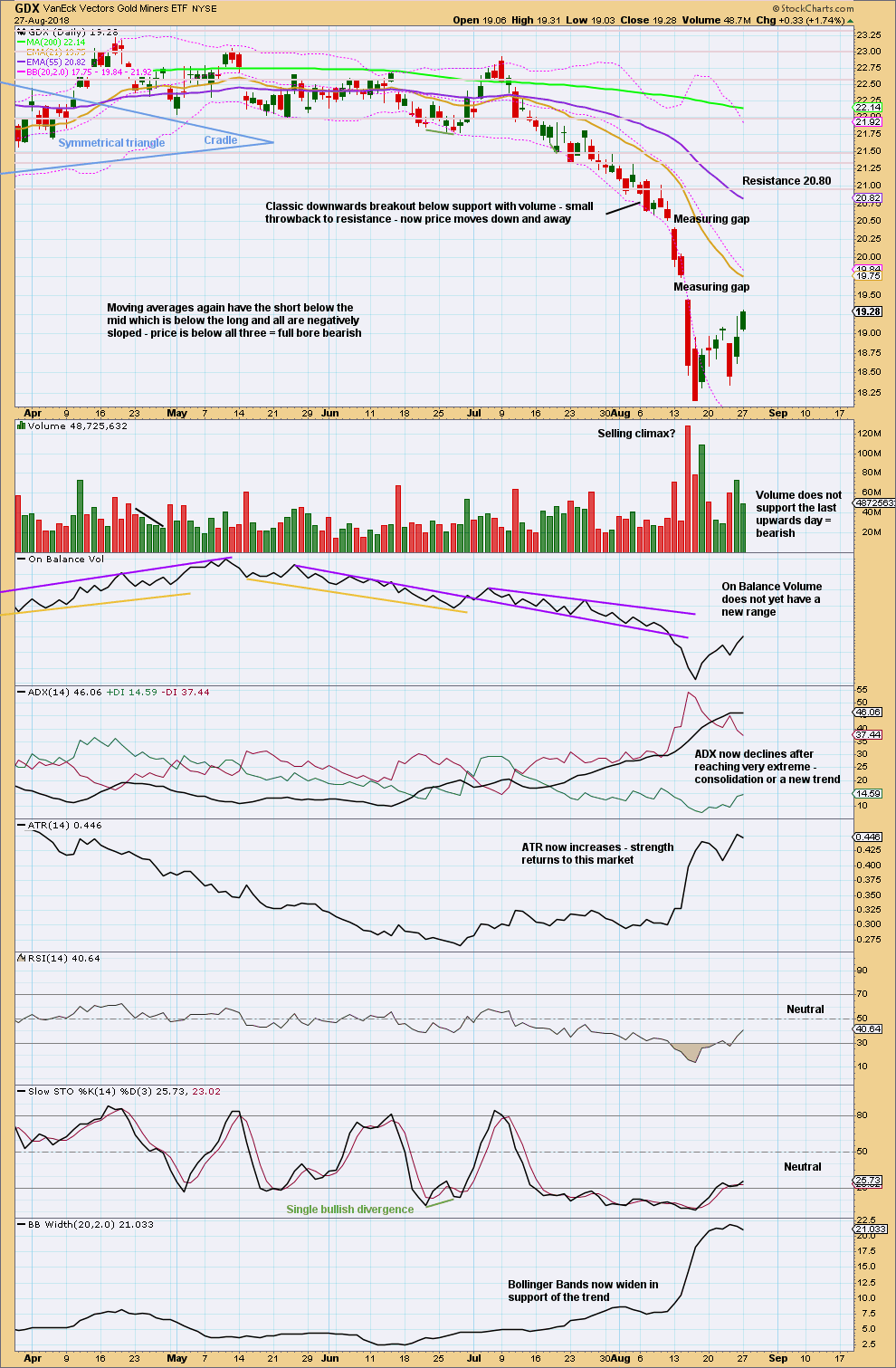

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has now closed below support on a strong downwards day with support from volume. New lows are the lowest for GDX since December 2016. This is extremely significant for GDX.

GDX is in a downwards trend. Bounces and consolidations may be used as opportunities to join the trend. The bounce again today looks like it is weakening, so it may be over.

The last measuring gap may provide resistance. A closure of this gap with a new high above 19.74 would be significant; at that stage, it would not be a measuring gap but an exhaustion gap. Assume it is a measuring gap, until proven otherwise.

Looking back over the last 3 1/2 years at GDX, at the daily chart level, I see it can reach extreme levels and remain there while price continues to move a reasonable distance. Only when it has reached very extreme and then exhibits strong divergence may an end to a strong trend be indicated. I would advise members trading GDX at this time to take some time to look over price action of the last few years, with ADX and RSI especially, and study carefully what happened towards at the end of strong trends.

Please remember to protect your trading accounts by careful risk management. Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

A possible target for this downwards trend to end may be now calculated using the measured rule, giving a target about 16.02.

Published @ 10:52 p.m. EST.

Apologies today for not being here prior to the close.

I’m working on your Gold analysis now, to be published shortly.

GDX failed right at the 1st gap and today will likely form a bearish engulfing candle. More downside likely.

Could be simply a deep second wave…

I hope more people are shorting GDX 😀

Me too! I managed to point out the day it broke support, and then the day it quickly backtested resistance as a near perfect entry point.

I surely do hope that analysis was used by members to profit.

Holding 20 strike puts for more downside… 😎

Good luck! I was being sarcastic. I wouldn’t short GDX until it beaks the recent low.