Sideways movement over the last couple of weeks still mostly fits the main Elliott wave count for Gold. A short term alternate is still provided.

Summary: With support from volume, GDX has effected a downwards breakout from a very long held consolidation (beginning December 2016). The target is at 16.10.

A mid term low for Gold may still be in place. Confidence may be had with a new high above 1,222.35.

A target for a strong bounce here is about 1,304, which may be reached in several weeks. Along the way up, there may be either a sharp pullback or a sideways time consuming consolidation.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts and several weekly alternates is here, video is here.

Weekly charts are last updated here. Only one weekly chart will be published on a daily basis. All may be reviewed on a once a week basis.

MAIN ELLIOTT WAVE COUNT

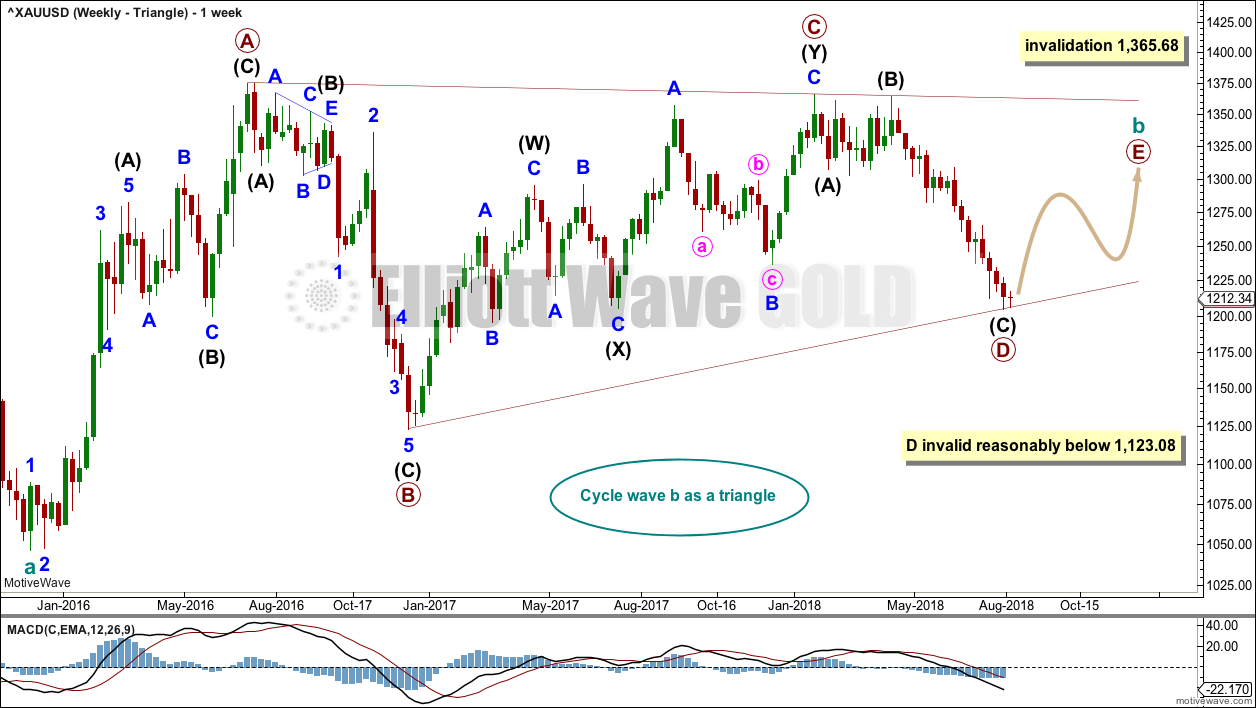

WEEKLY CHART – TRIANGLE

There are four remaining weekly wave counts at this time for cycle wave b: a triangle, flat, combination or double zigzag. All four weekly charts were reviewed in last end of week analysis, and may be again reviewed at the end of this week. At this time, all four weekly charts expect some upwards movement here.

While the direction does not diverge for these four weekly wave counts, only one weekly wave count shall be published on a daily basis, so that the analysis is manageable for me to publish and for members to digest. Note: This does not mean that the remaining three counts may not be correct.

The triangle so far has the best fit and look.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

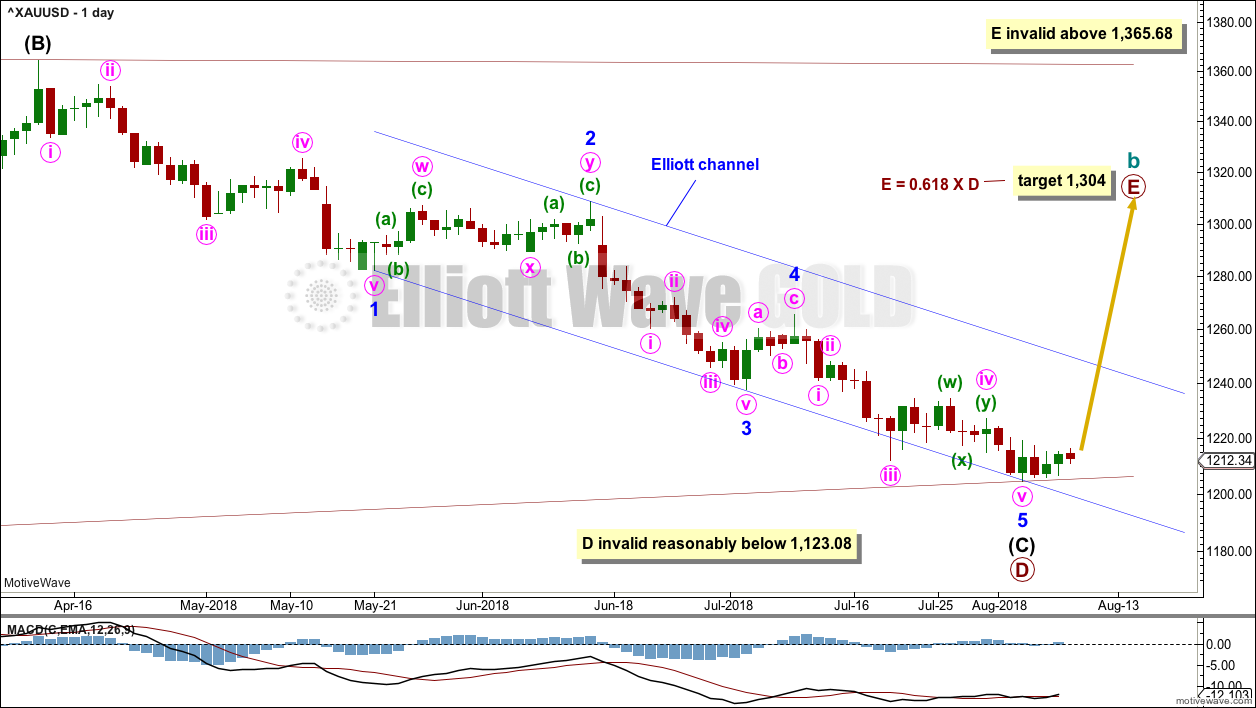

DAILY CHART – TRIANGLE

Primary wave D may again be over. The structure may again be complete at all wave degrees.

Minor wave 5 may have ended almost exactly at the lower edge of the blue Elliott channel.

A target is calculated for primary wave E to end. Primary wave E must subdivide as a zigzag. It may last several weeks.

The main hourly chart today expects that primary wave D is over. An alternate hourly chart looks at the possibility it may still continue to one more low.

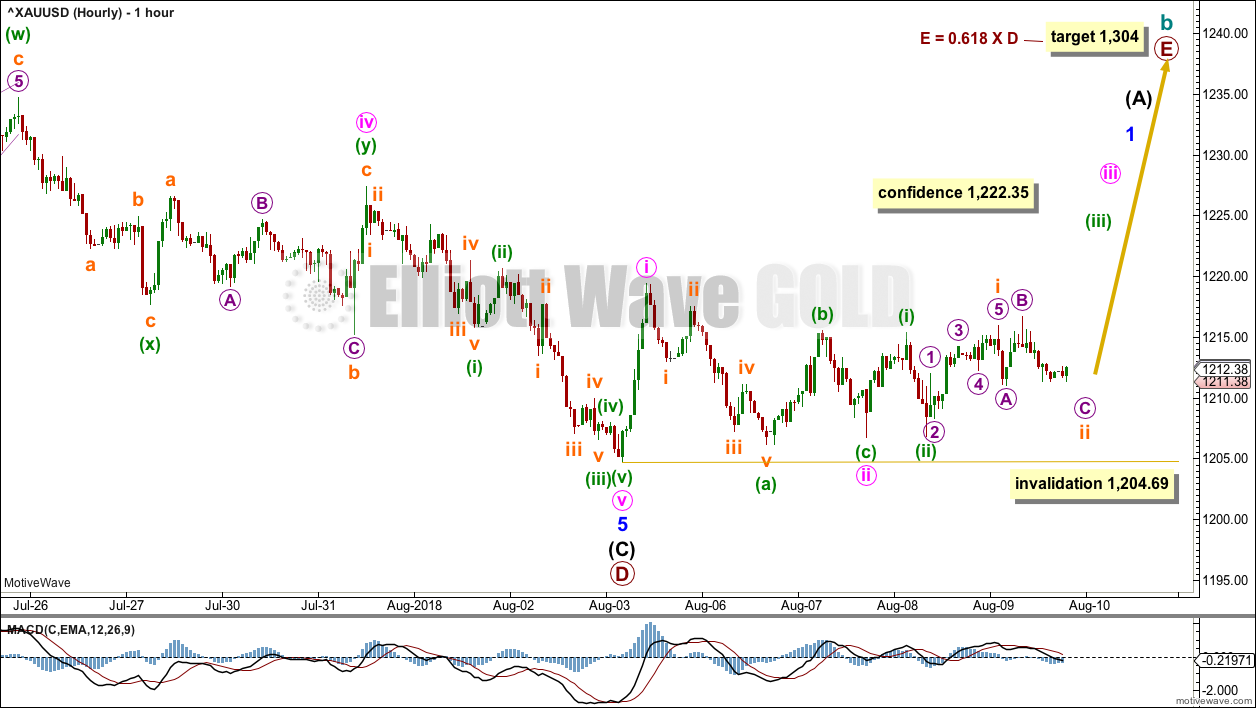

HOURLY CHART

Minute wave iv may have been a double combination. Minute wave v is a complete impulse.

The bounce up during last Friday’s session is very strong and has good support from volume.

Minute wave ii may now be a complete zigzag. But if it is complete, as labelled, then minuette wave (c) is slightly truncated by 0.61.

There may now be three almost complete overlapping first and second waves. This main hourly wave count now expects to see an imminent increase in upwards momentum as the middle of a third wave unfolds.

Minute wave ii may not move beyond the start of minute wave i below 1,204.69.

A new high now above 1,222.35 would invalidate the hourly alternate wave count below and provide some confidence that a low should be in place.

ALTERNATE HOURLY CHART

Minute wave iv may have been over earlier as a single zigzag. Minute wave v may have begun at that point.

Minute wave v may be unfolding as an impulse.

Within the impulse, minuette wave (ii) is seen as a rare double flat correction. In my research on Elliott wave corrective structures to date I have not found any examples of double flats at the daily chart level (or higher) for Gold or the S&P500.

Within the first flat correction labelled subminuette wave w, micro wave B is 2.82 times the length of micro wave A. While there is no Elliott wave rule stating any limit for B waves within flats, it is very rare for them to be any longer than 2 times the length of their A waves. This further must reduce the probability of this wave count.

There is excellent alternation in structure between minuette waves (ii) and (iv).

For this alternate wave count, the labelling within the triangle for minuette wave (iv) has been changed today. The triangle may be incomplete.

If this wave count unfolds as expected, then a surprisingly short fifth wave down may be expected when the triangle is complete. To exhibit surprisingly short fifth waves out of its fourth wave triangles is a common pattern for Gold.

Minuette wave (iv) may not move into minuette wave (i) price territory above 1,222.35.

TECHNICAL ANALYSIS

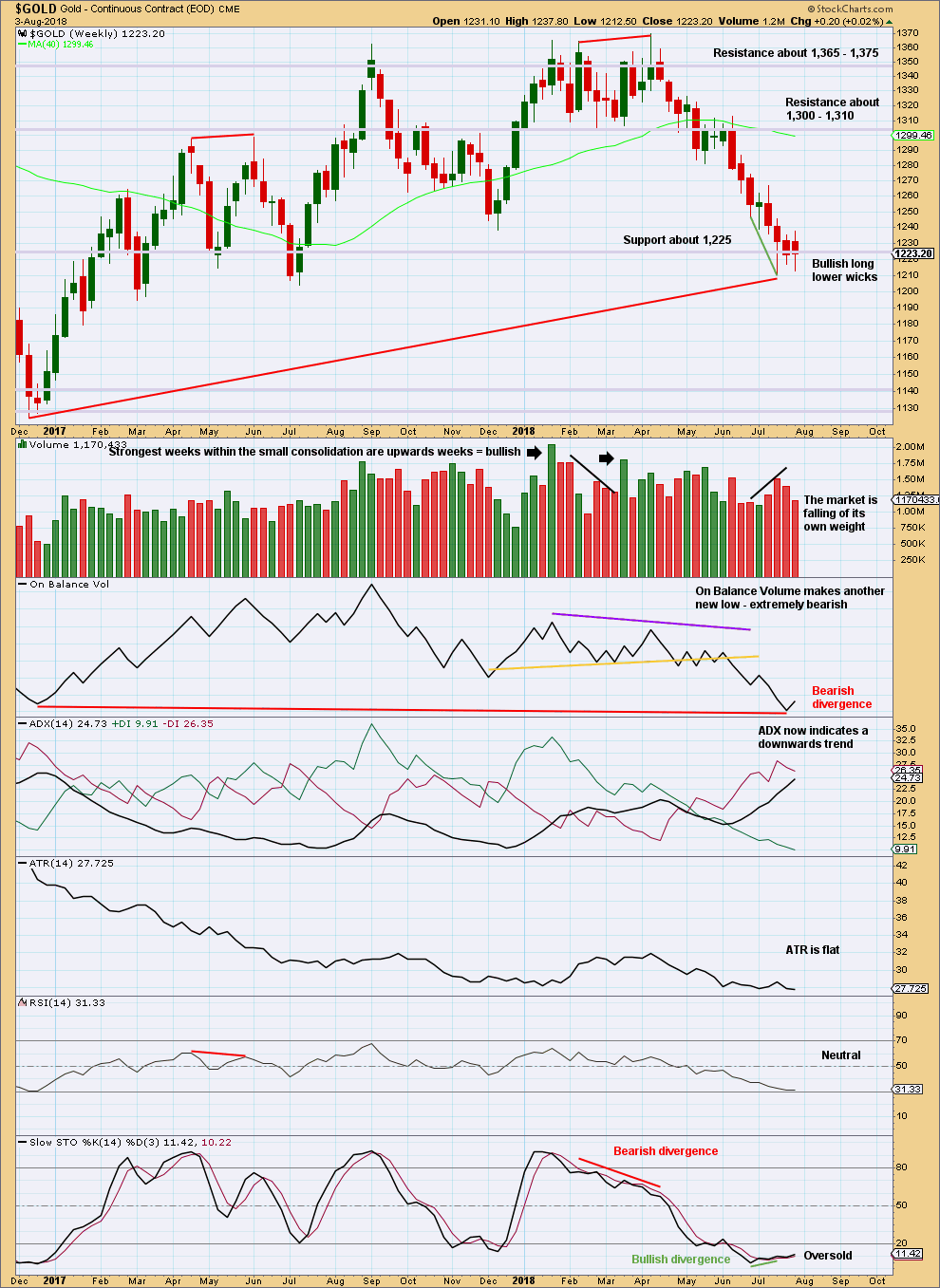

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

At the end of last week, BarChart data has made a new low but StockCharts data has not.

The long term picture for this chart is bearish due to the long term bearish divergence between price and On Balance Volume. The short term is bullish due to long lower candlestick wicks and single short term divergence between price and Stochastics at last lows.

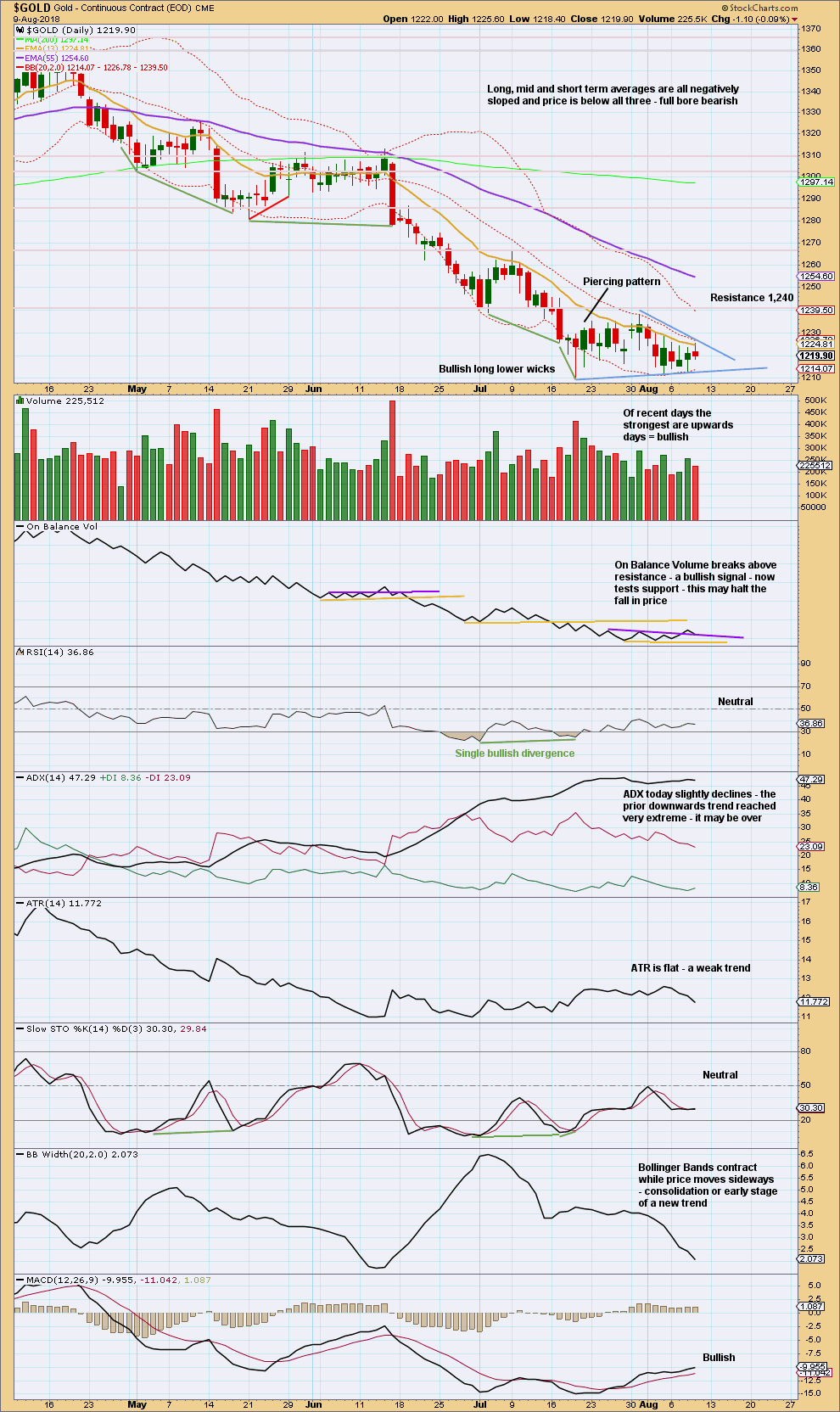

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

It sill looks like a low may be in: the short term volume profile is bullish; there is a bullish candlestick reversal pattern at the last low; and, there was bullish divergence between price and Stochastics and RSI.

The downwards trend is extreme and stretched. It is time to look for a low. That does not mean price may move a little lower before it turns, only that a low should be anticipated here.

On Balance Volume remains bullish.

A pennant pattern may have formed, which has now lasted 15 days. The best performance from pennant and flag patterns is from those lasting no longer than 15 days. If downwards breakout occurs here, then a target would be about 1,157.

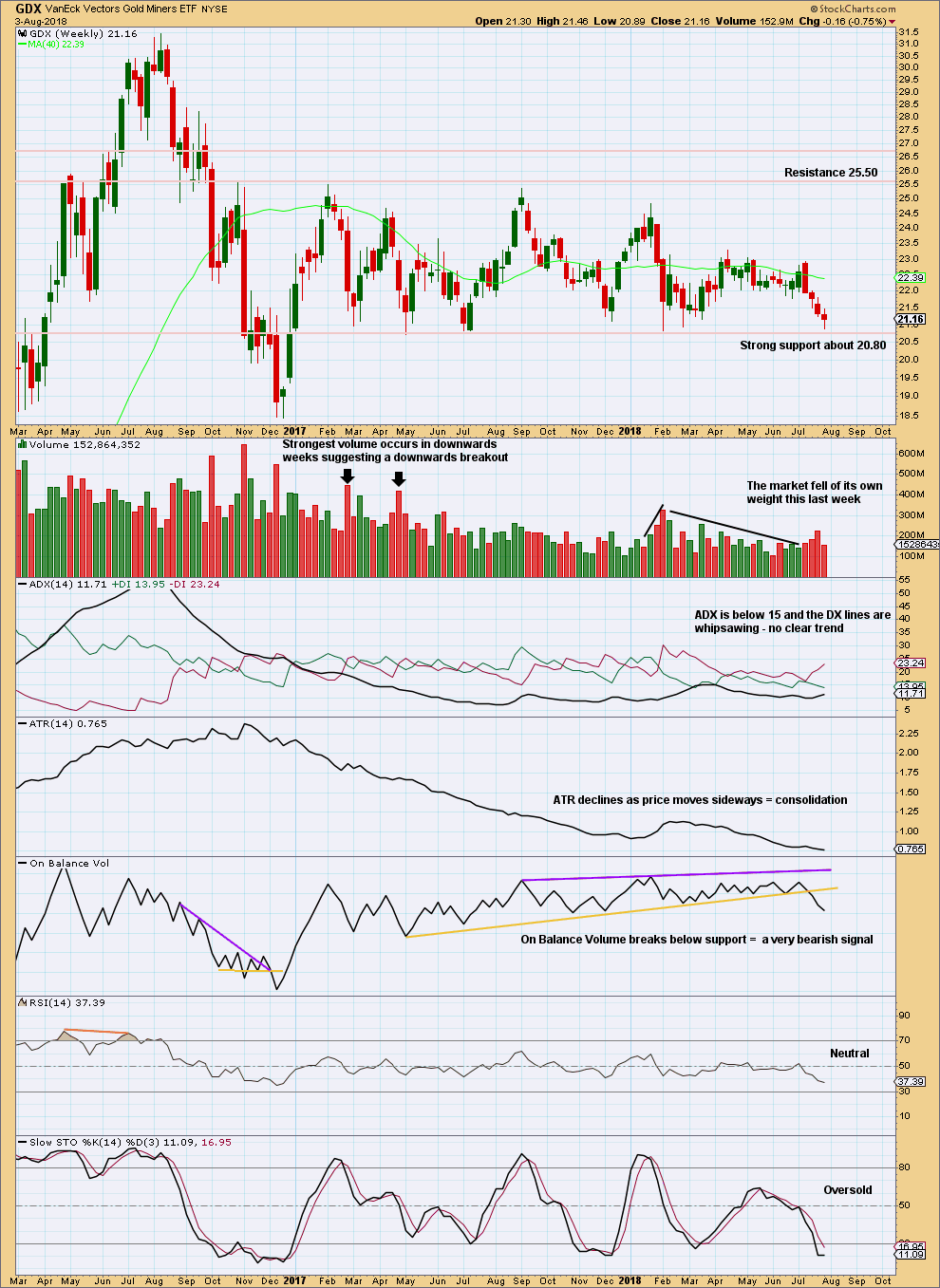

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has been range bounce since January 2017. This is a very long sideways consolidation. The longer it continues, the more sustained the eventual breakout will be. Volume suggests the breakout may more likely be downwards.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

Price is now almost at support about 20.80. Stochastics is now oversold. Normally, it would be reasonable to expect that downwards movement may end here and an upwards swing may develop. But the very bearish signal from On Balance Volume suggests a downwards breakout may be about to happen.

A downwards breakout would require a close below support. If it has support from volume, it would be very bearish; but that is not necessary for a downwards breakout, because the market may fall of its own weight.

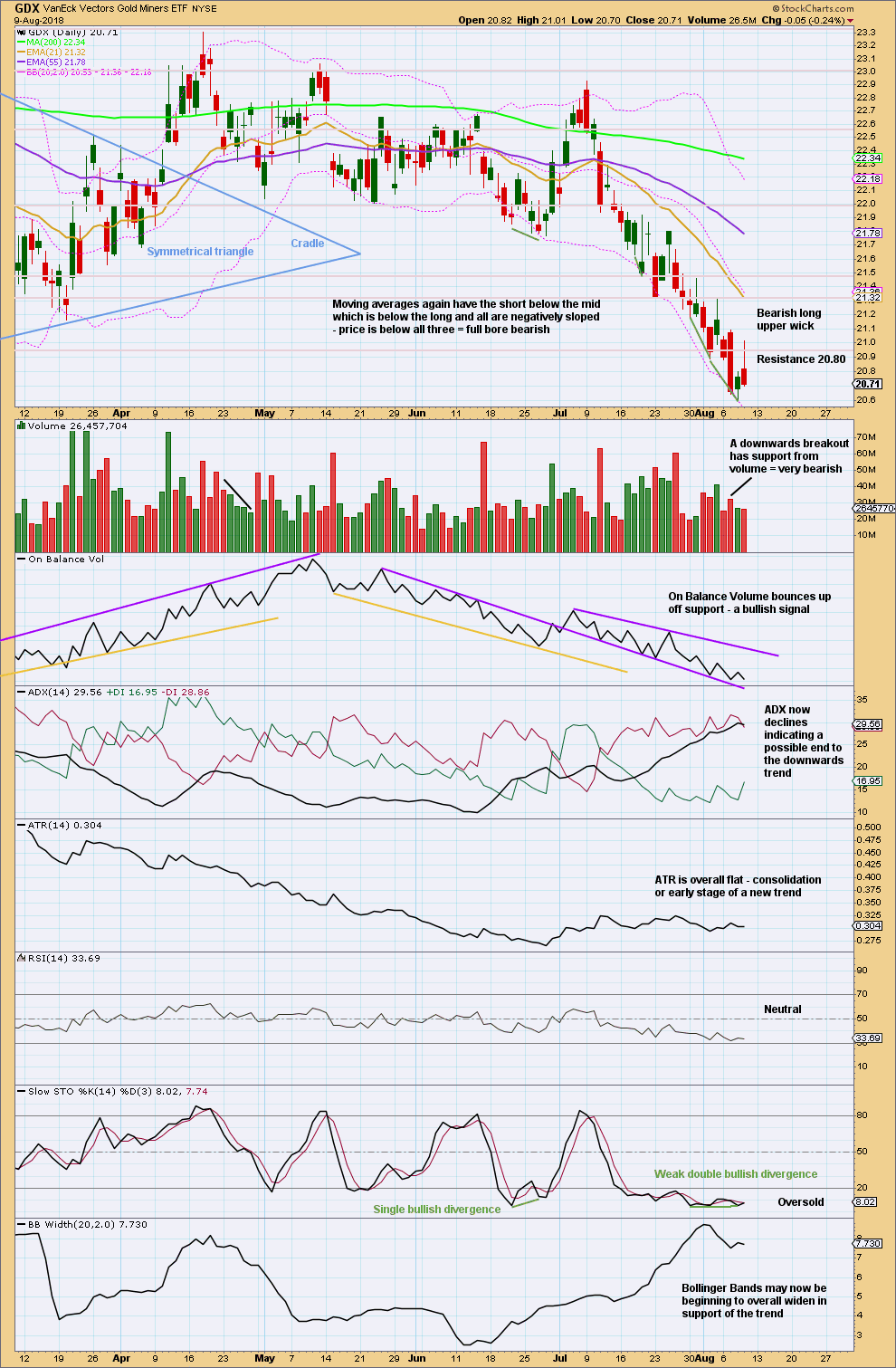

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has now closed below support on a strong downwards day with support from volume. The low yesterday is the lowest low for GDX since December 2016, so this downwards day is extremely significant for GDX.

GDX is in a downwards trend. This trend is now nearing extreme. The trend may be interrupted by a consolidation which may find resistance about prior support at 20.80.

Please remember to protect your trading accounts by careful risk management. Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

A possible target for this downwards trend to end may be now calculated using the measured rule, giving a target about 16.10.

While GDX and Gold are often positively correlated, this correlation is unreliable. Gold may still have a multi week shallow bounce and GDX may still move overall lower with smaller bounces along the way. The two wave counts, and indeed technical analysis for these two markets, cannot be reliably linked while the correlation is unreliable.

Published @ 08:28 p.m. EST.

Gold will go lower for 5th waves, target 1196-1197

Hi Lara et al,

Thank you for the June and Aug analysis on the US Dollar.

Ques:

1. If USD is getting close to (A) or (1), do you see it going to about 97.0 or slightly higher, before pulling back. Looks to me that after today, it needs one more swing down, then up to end this move?

2. In a W-X-Y consolidation is there a hard/fast rule that Y must exceed W before the correction completes, or, can Y fall short and still be valid? [Unfortunately, 10th edition does not go into these specifics. ]

3. Going by the content on your sites, you have much to do. Dare I ask when you may eventually make a teaching book available on elliott wave?

Thank you again…

Hi Melanie, good to see you post!

For your #2? My answer is No, Y does not need to end past W, but it can.

When the WXY is a Double ZZ, then Y should typically end past W as the purpose of a DZZ is to deepen the correction.

When the WXY is a Combination such as ZZ-x-Flat or ZZ-x-Triangle, this is a sideways move to correct more in “time” rather than depth. In these scenarios, the 2nd structure (Y) would NOT need to end past W. Hope this helps.

For your #1? Using Lara’s Bearish count, Intermediate 5 will = Intermediate 1 @ 96.84. Todays high was 96.45. If we assume Minor wave 3 is near complete today, a little sideways move, then one final move up toward 96.84 may finish Primary wave A

Hi Dreamer,

So kind of you to take the time to send me your usual intelligent answers. Your explanation of WXY is concise. My measurements and sentiments agree with yours on dollar target.

Now all we need is to get Lara to place her ‘gems’ in a teaching book for easy reference.

Yes I am still here and would like to post more frequently. I have all I can do to run back/forth from computer to an ill husband. This is the stuff that makes one strong and much more philosophical about life.

Again, I am grateful for your almost daily comments along with Papudi, Ari and others. I do miss Alan. He had much to contribute including his intellect.

Have a good weekend….

Hi Melanie,

Firstly, what Dreamer said. Spot on. So I don’t need to answer those questions.

I have for my USD index analysis a length of intermediate (1) at 1.98 and the start of intermediate (5) at 94.16. So intermediate (5) would = (1) at 96.14. Which has been slightly exceeded by Friday’s high.

So the next target would be for intermediate (5) to = 1.618 X intermediate (1) = 97.36.

And yes, along the way up I’d be looking for minor 4 correction to unfold.

Re a book on EW:

I’m writing one. But I’ve hit a hurdle.

Rather than simply base it on the rules in Frost and Prechter and my experience, I’ve decided to base it upon actual research.

So I’ve completed a thorough wave count on Gold back to the 1970’s. Then I’ve complied tables of data for each type of correction, to see how common each type is, and common wave lengths and common total correction depth to the prior wave.

Now I’m doing the same for the S&P.

I want to do this for two commodities, two indices and two currencies. That will cover the three major asset classes for which EW works (can’t do individual equities, not enough volume) and then I’d have good solid data I think to base my book on.

It’s proving to be very time consuming, and difficult. My goal is to have all the research done and data compiled by the end of my Spring here in NZ.

Then put it into the book, the rest of which is already written.

Then I have to ask Cesar oh so nicely if he can format it for publication for me.

a quick update of my USD Index count for the daily chart:

main hourly chart updated:

zooming in on movement since the last low

minute ii may have moved a little lower today, now there is no truncation.

the problem now is minuette (c) looks like a three on the hourly chart, it should be a five. but golds waves can fairly often do that, because within impulses the fourth wave is often much quicker than the second wave, giving the impulse a curved look at higher time frames. so this is acceptable.

alternate updated

the triangle is looking very good

this remains viable, but remember it has serious problems as outlined in the analysis above

it is still possible a low is not quite in, that there may be one final short thrust lower

For those into cycles and symmetry.

https://spockg.com/2018/08/08/gold-preparing-for-a-major-move-higher/

The dollar is getting stronger while gold is weakening!

Gold holding up pretty good so far, considering the $ is making new highs

Gold is green while dollars is up almost .6%. Gold shows great relative strength. I like what I see!