Downwards movement was expected to begin the new trading week. An inside day closes red, which mostly fits expectations.

Summary: For the very short term, another pullback to about 1,217 may unfold before upwards movement resumes.

The target for the short term is 1,295.

The final target for this bounce to end is about 1,305 – 1,310.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts is here.

There are four remaining weekly wave counts at this time for cycle wave b: a triangle, a flat, a combination, and a double zigzag.

At this time, the Triangle wave count may again be slightly more likely.

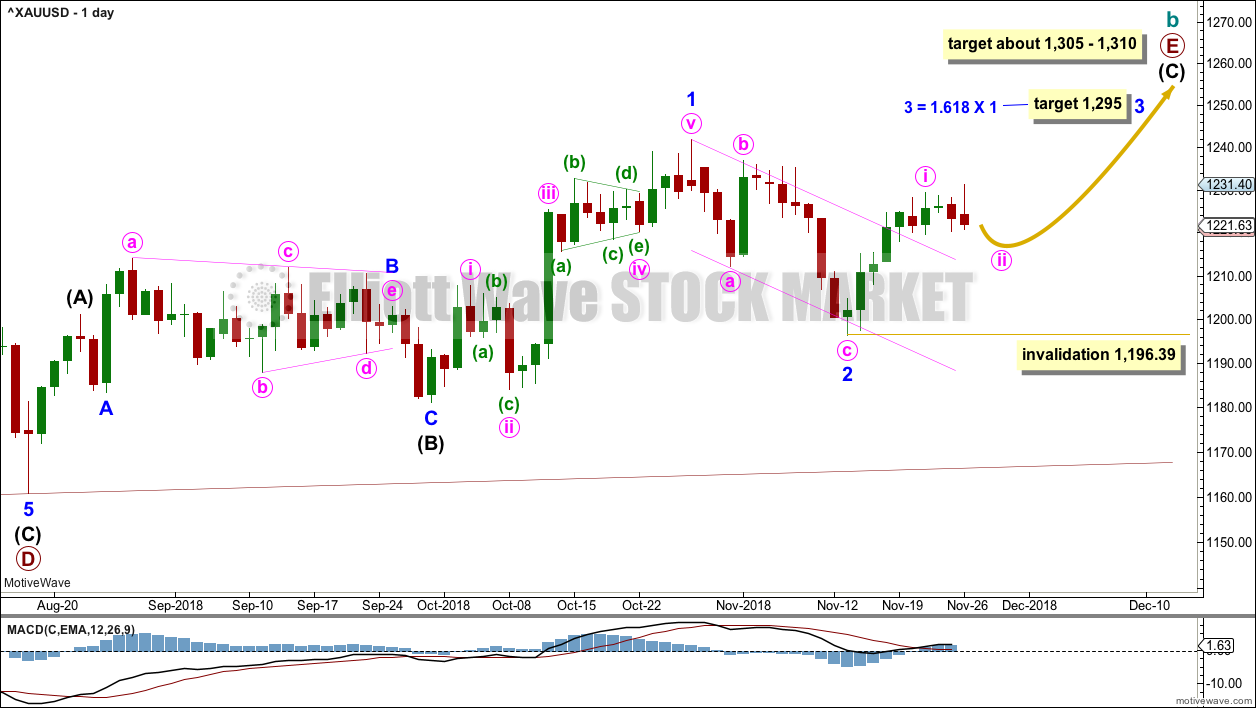

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART – TRIANGLE

Cycle wave b may be an incomplete regular contracting triangle. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

Within primary wave E, intermediate waves (A) and (B) may be complete. Intermediate wave (C) must subdivide as a five wave structure. Within intermediate wave (C), minor wave 2 may not move beyond the start of minor wave 1 below 1,181.06.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best. Primary wave E would most likely be a single zigzag. It is also possible that it may subdivide as a triangle to create a rare nine wave triangle.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

When primary wave E is a complete three wave structure, then this wave count would expect a cycle degree trend change. Cycle wave c would most likely make new lows below the end of cycle wave a at 1,046.27 to avoid a truncation.

DAILY CHART – TRIANGLE

Primary wave E should now be underway for this wave count.

Primary wave E should subdivide as a zigzag. Intermediate waves (A) and (B) may now be complete. Intermediate wave (C) may have begun.

Minor wave 1 fits perfectly as a five wave impulse. Minor wave 2 may now be complete as a deep zigzag. Minor wave 3 may now exhibit an increase in upwards momentum, and it should have support from volume. The target for minor wave 3 expects it to exhibit a common Fibonacci ratio to minor wave 1.

Minor wave 3 may only subdivide as an impulse. Within minor wave 3, minute wave ii may not move beyond the start of minute wave i below 1,196.39.

A target for primary wave E is the strong zone of resistance about 1,305 to 1,310. Primary wave E is most likely to subdivide as a zigzag (although it may also subdivide as a triangle to create a rare nine wave triangle). It may last a total Fibonacci 21 or 34 weeks. So far it has lasted 13 weeks. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

HOURLY CHART – TRIANGLE

Minor wave 3 may only subdivide as an impulse. Within minor wave 3, minute wave i may be complete.

Minute wave ii is relabelled today as an expanded flat correction. Within the expanded flat, both minuette waves (a) and (b) now subdivide as completed threes. The most common Fibonacci ratio for minuette wave (c) within an expanded flat is used to calculate a target.

Minute wave ii may not move beyond the start of minute wave i below 1,196.39.

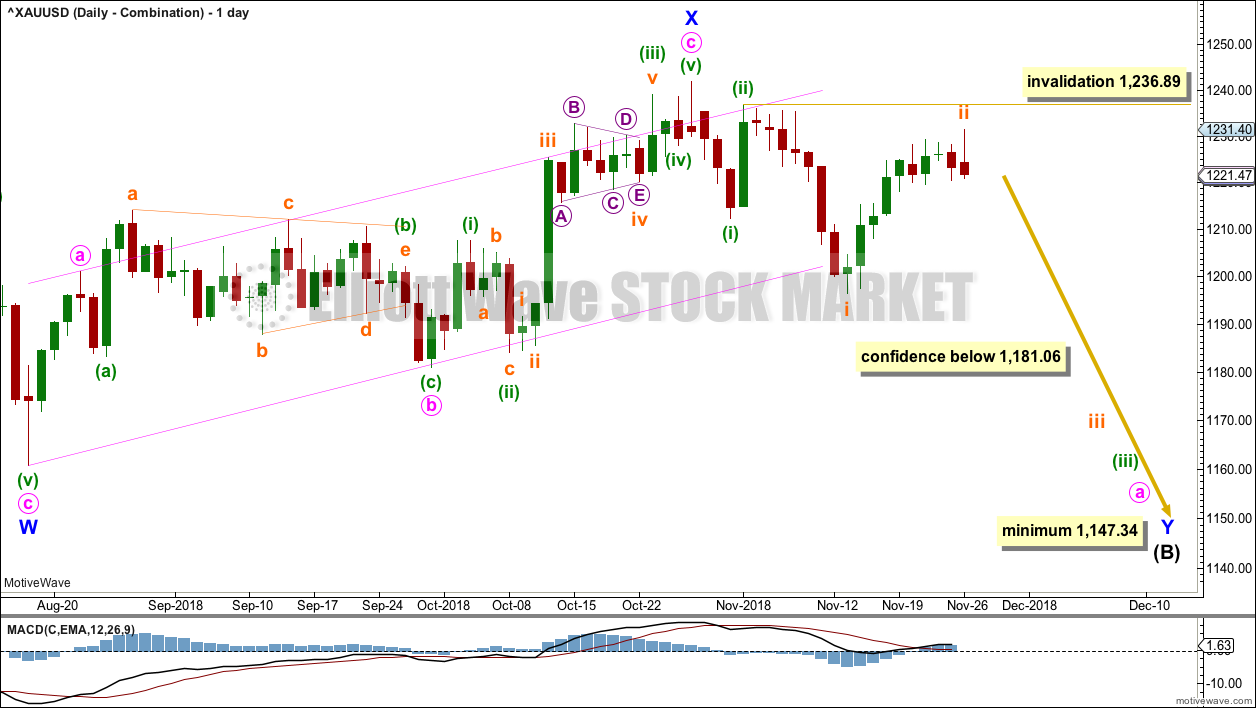

WEEKLY CHART – DOUBLE ZIGZAG

It is possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about three quarters complete.

Within the triangle of primary wave X, intermediate wave (C) should be complete. Within intermediate wave (D), minor waves A and B may be complete. Minor wave C must subdivide as a five wave structure. Within minor wave C, minute wave ii may not move beyond the start of minute wave i below 1,181.06.

Intermediate wave (D) would most likely subdivide as a single zigzag.

This wave count may now expect choppy overlapping movement in an ever decreasing range for several more months.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

WEEKLY CHART – COMBINATION

If cycle wave b is a combination, then the first structure in a double may be a complete zigzag labelled primary wave W.

The double may be joined by a three in the opposite direction, a zigzag labelled primary wave X.

The second structure in the double may be a flat correction labelled primary wave Y. My research on Gold so far has found that the most common two structures in a double combination are one zigzag and one flat correction. I have found only one instance where a triangle unfolded for wave Y. The most likely structure for wave Y would be a flat correction by a very wide margin, so that is what this wave count shall expect.

Within a flat correction for primary wave Y, the current downwards wave of intermediate wave (B) may be a double zigzag. Intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 1,147.34. Intermediate wave (B) may move beyond the start of intermediate wave (A) as in an expanded flat.

Because the minimum requirement for intermediate wave (B) is not yet met, this wave count requires that intermediate wave (B) continues lower. This is the most immediately bearish of all four weekly wave counts.

When intermediate wave (B) is complete, then intermediate wave (C) would be expected to make at least a slight new high above the end of intermediate wave (A) at 1,365.68 to avoid a truncation. Primary wave Y would be most likely to end about the same level as primary wave W at 1,374.91, so that the whole structure takes up time and moves price sideways, as that is the purpose of double combinations.

While double combinations are very common, triples are extremely rare. I have found no examples of triple combinations for Gold at daily chart time frames or higher back to 1976. When the second structure in a double is complete, then it is extremely likely (almost certain) that the whole correction is over.

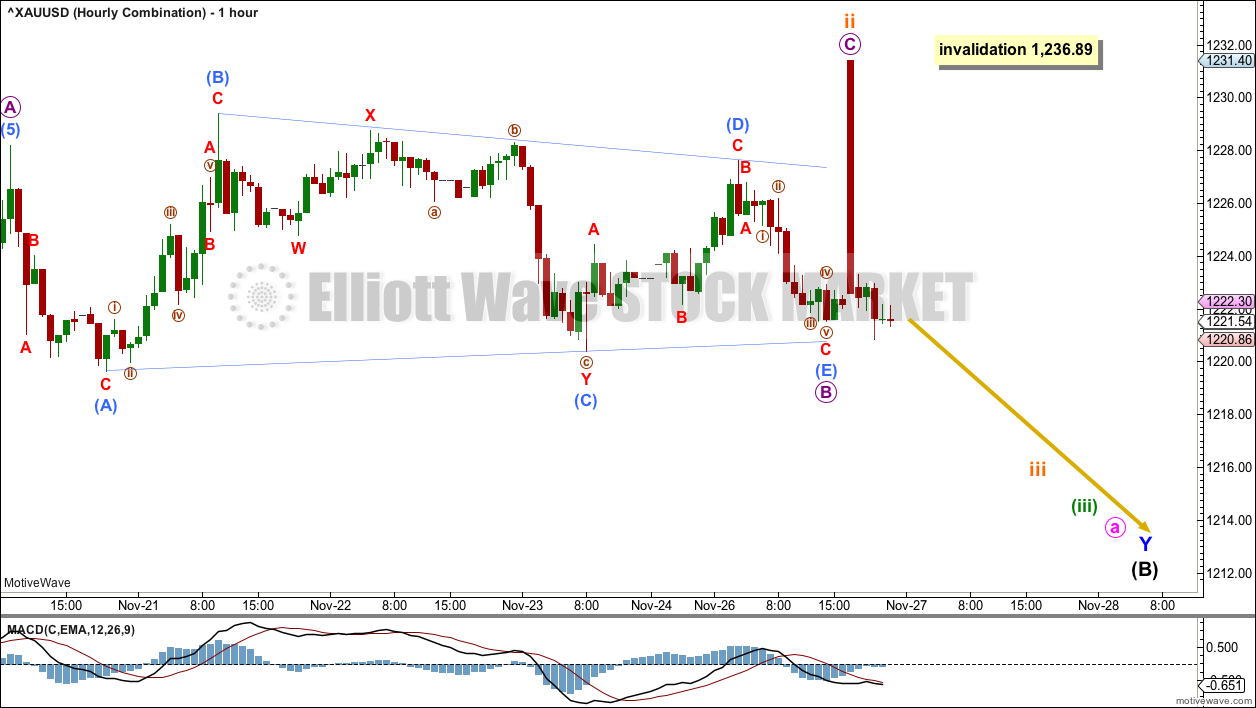

DAILY CHART – COMBINATION

Minor wave X may be complete.

Minor wave Y may be underway for this wave count to continue lower to a minimum at 1,147.34. Minor wave Y may last a few weeks.

A new low below 1,181.06 would provide confidence in this wave count.

Within minor wave Y, minute wave a would be an incomplete five wave impulse. Within minute wave a, minuette waves (i) and (ii) may be complete. Minuette wave (iii) may only subdivide as an impulse.

Within minuette wave (iii), subminuette wave i may be complete. Subminuette wave ii may not move beyond the start of subminuette wave i above 1,236.89.

HOURLY CHART – COMBINATION

Subminuette wave ii may have continued higher today. It still subdivides as a zigzag.

If it continues further, then subminuette wave ii may not move beyond the start of subminuette wave i.

This wave count still expects to see an increase in downwards momentum.

WEEKLY CHART – FLAT

It is possible that cycle wave b may be a flat correction. Within a flat correction, primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. Primary wave B may make a new low below the start of primary wave A at 1,046.27 as in an expanded flat correction.

Only a new low reasonably below 1,123.08 would provide reasonable confidence in this wave count.

Intermediate wave (C) must subdivide as a five wave structure; it may be unfolding as an impulse. Within intermediate wave (C), minor waves 1 through to 4 may be complete. Within minor wave 5, no second wave correction may move beyond its start above 1,241.88.

The blue channel is drawn using Elliott’s second technique. Minor wave 5 may end at support about the lower edge of this channel.

Minor wave 2 was a double zigzag lasting nine weeks. Minor wave 4 exhibits little alternation as a single zigzag and reasonable proportion lasting ten weeks.

The start of this weekly candlestick is now overshooting the blue Elliott channel drawn about intermediate wave (C). If intermediate wave (C) is continuing lower, then this channel should not be breached by upwards movement. This wave count no longer looks right.

TECHNICAL ANALYSIS

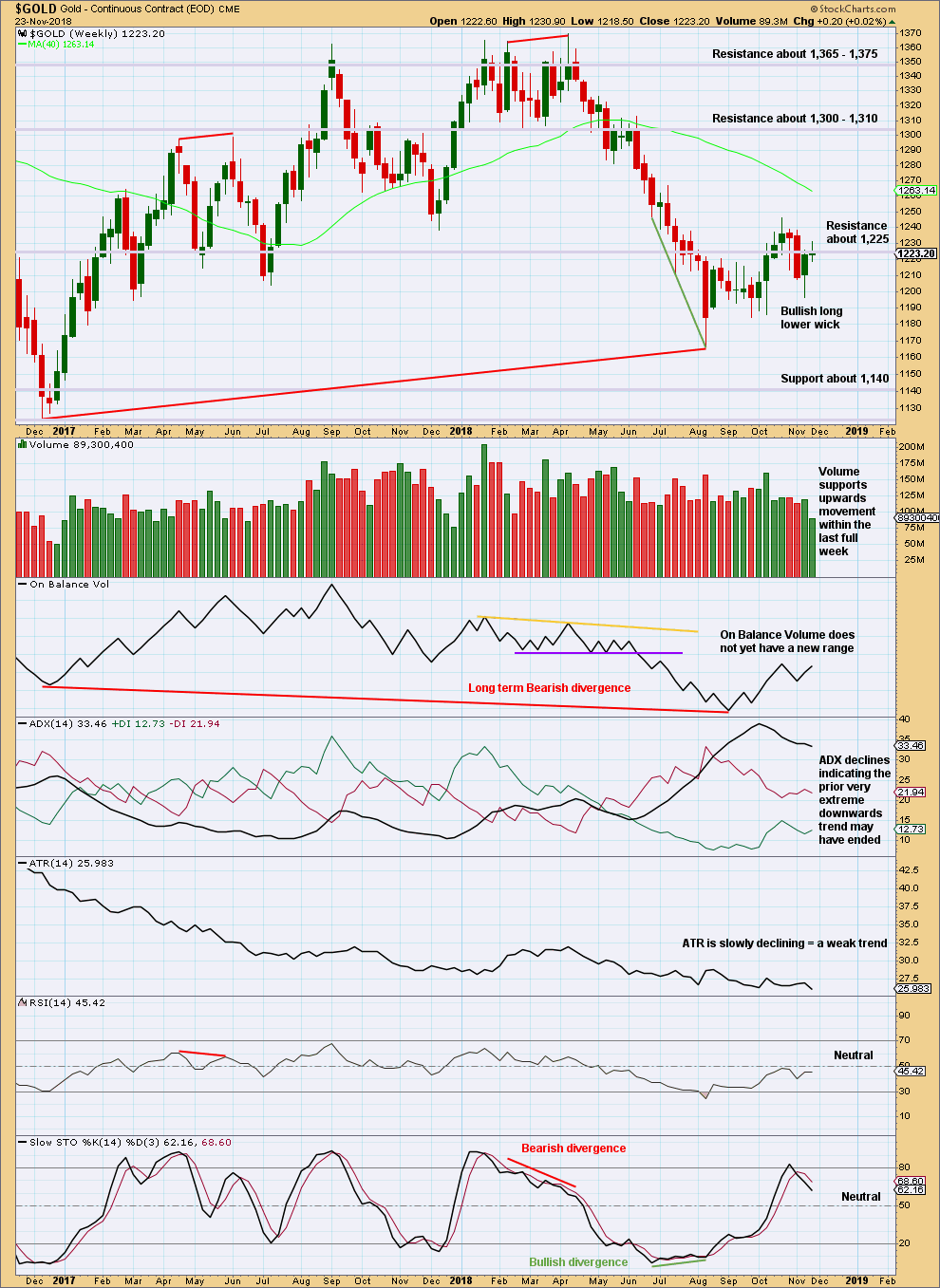

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume has made a lower low than its prior low at the end of November 2015. This divergence is extremely bearish but does not rule out a consolidation unfolding here; the divergence does strongly support the Triangle wave count, which expects a consolidation or bounce up to test resistance now and then a continuation of a major bear market. It could also support the flat wave count that allows for a new low below 1,046.27 in coming months.

Last week a small green doji does not change this analysis, and is to be expected for a short and quiet trading week in which the US had a day and a half of holiday.

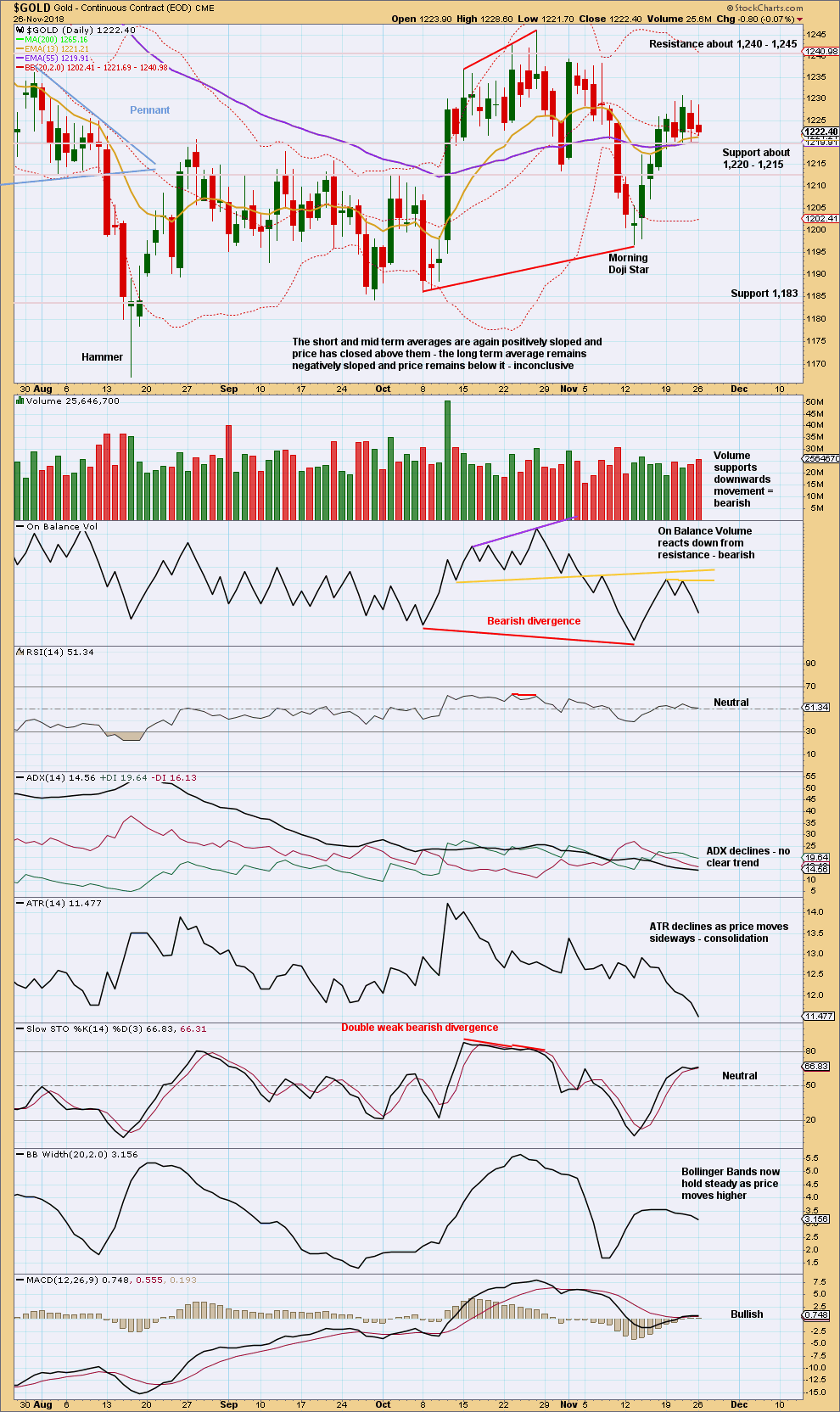

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold may be within a larger consolidation with resistance about 1,240 – 1,245 and support about 1,195 – 1,183. Price is swinging from resistance to support and back again, with Stochastics reaching overbought when price reached resistance and oversold when price reached support.

Currently, price is bouncing up off support which was found about 1,195. Look for overall upwards movement to continue towards 1,240 – 1,245 and only stop when Stochastics reaches overbought. Do not expect price to move in a straight line.

For the short term, there is interim support here about 1,220 which is holding, but an increasingly bearish short-term volume profile suggests it may be broken.

A close above resistance at 1,245 would be an upwards breakout. For confidence it would require support from volume.

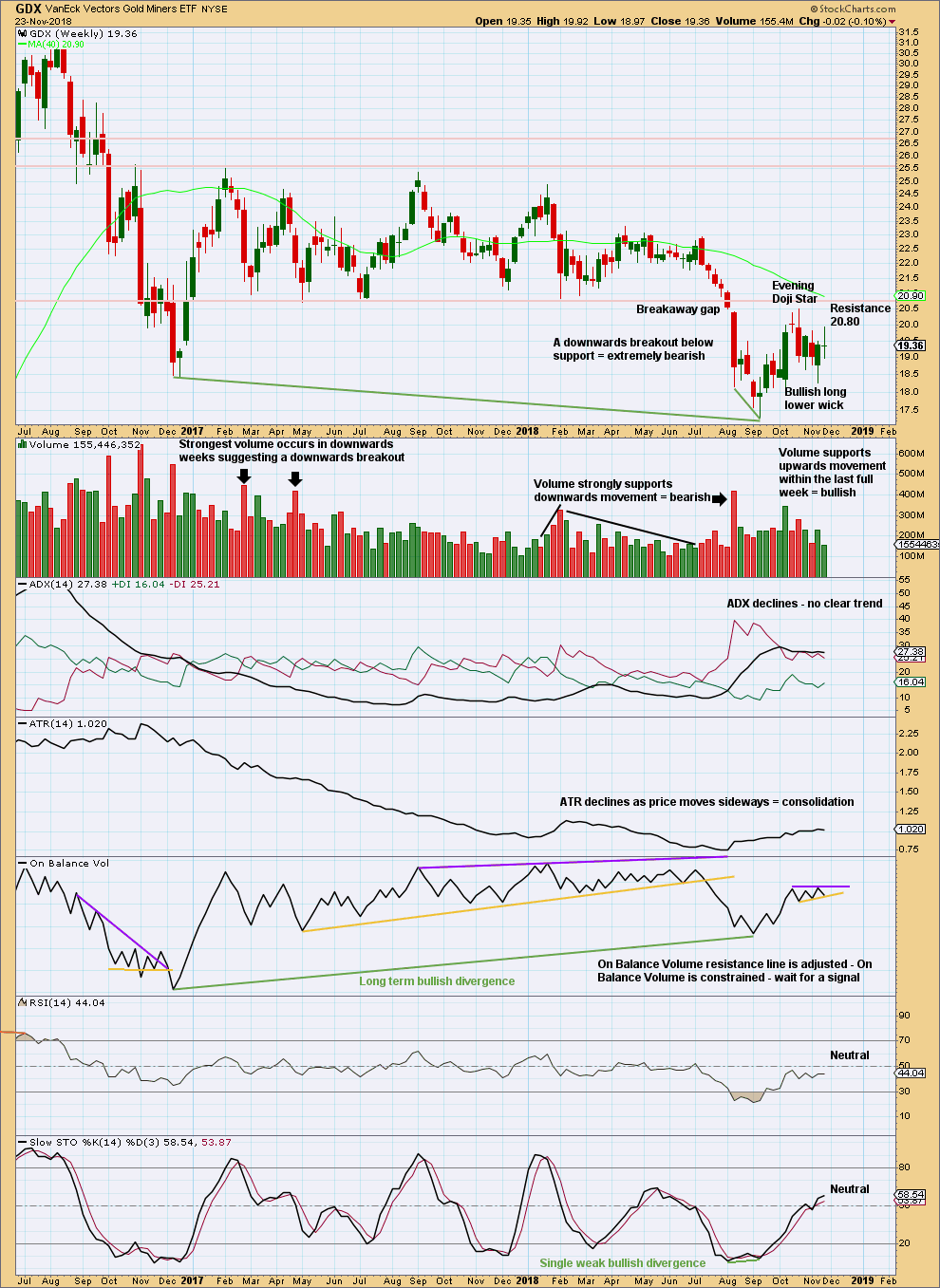

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX had a large consolidation that lasted from January 2017 to August 2018. A downwards breakout below support at 20.80 in early August 2018 is highly significant. The breakout had support from volume, which adds confidence.

The target is at 16.02.

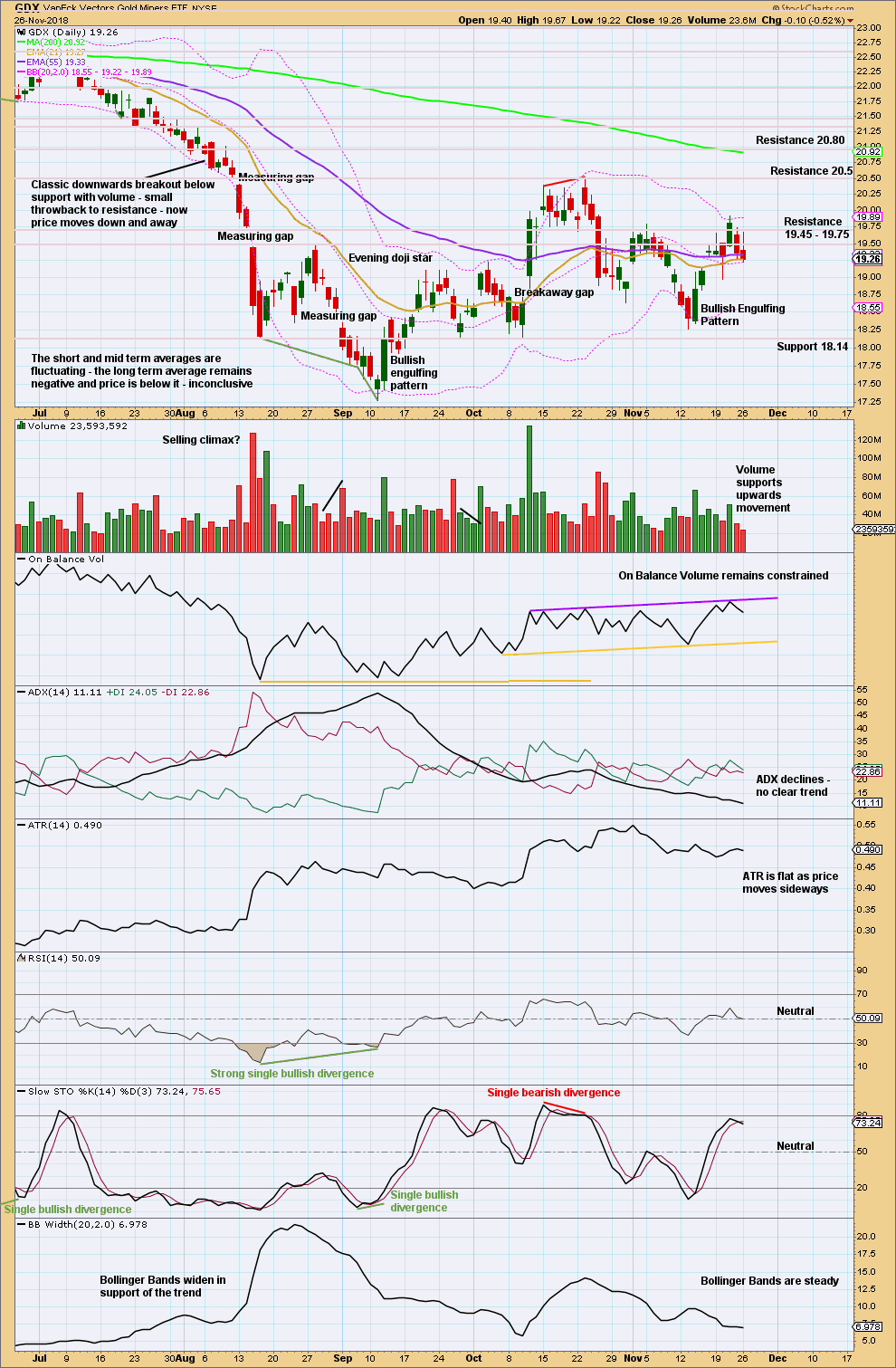

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

At the daily chart level, price is now within a consolidation that is bound by resistance above at 20.50 and support below at 18.14. It is the upwards day of the 11th of October that has strongest volume during this consolidation, suggesting an upwards breakout may be more likely than downwards. This technique does not always work, but it does work more often than it fails.

However, if price does break above 20.50, then it would be extremely likely to find very strong resistance just above at 20.80 and halt there. At a higher time frame that would look like a classic back test of resistance at prior support, identified on the weekly chart. If price does behave like that, it would offer a high probability low risk set up for a short position on GDX that may be held for the long term.

For the very short term, the long upper wick on today’s candlestick suggests a downwards day tomorrow.

Published @ 11:22 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

With the 0.382 Fibonacci ratio passed and price still falling, the 0.618 Fibonacci ratio is the next target for minute ii to end.

At 1,208 minuette (c) = 2.618 X minuette (a). This is very close to 1,209, the 0.618 Fibonacci ratio of minute i.