Sideways movement continues as both Elliott wave counts expected.

Today a small range day remaining well within resistance and support does not change the Elliott wave counts.

Summary: A sideways consolidation is now expected for a fourth wave to continue for another few sessions. It may be very shallow, with support about 1,277 and resistance about 1,297.

At this stage, a complete corrective structure cannot be seen, and it is expected that minor wave 4 should continue further sideways to have better proportion to minor wave 2.

The final target for this bounce to end is about 1,305 – 1,310.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts is here.

Only two remaining wave counts have a reasonable probability and are published below: a triangle (the preferred wave count) and a double zigzag. The combination wave count is discarded this week based upon a very low probability.

MAIN ELLIOTT WAVE COUNT

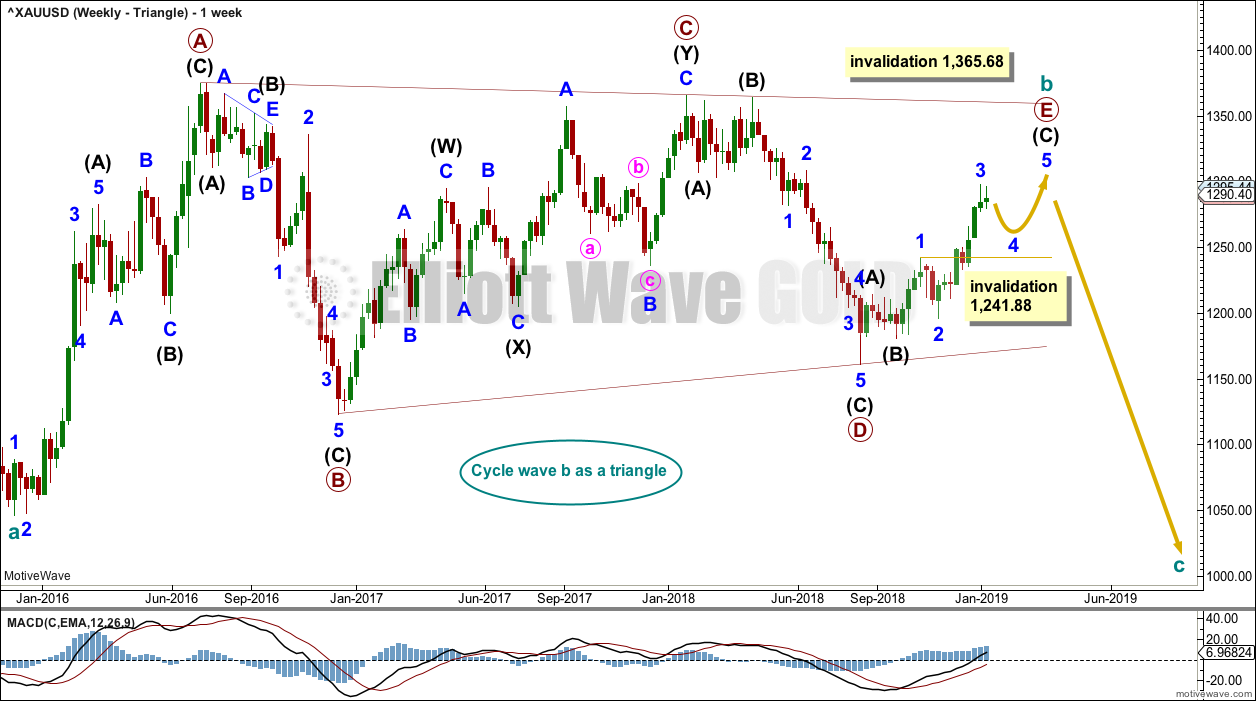

WEEKLY CHART – TRIANGLE

Cycle wave b may be an incomplete regular contracting triangle. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

Within primary wave E, intermediate waves (A) and (B) may be complete. Intermediate wave (C) must subdivide as a five wave structure. Within intermediate wave (C), minor wave 4 may not move into minor wave 1 price territory below 1,241.88.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best. Primary wave E would most likely be a single zigzag. It is also possible that it may subdivide as a triangle to create a rare nine wave triangle.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

When primary wave E is a complete three wave structure, then this wave count would expect a cycle degree trend change. Cycle wave c would most likely make new lows below the end of cycle wave a at 1,046.27 to avoid a truncation.

It is possible now that primary wave E may end in January or February 2019. Some reasonable weakness should be expected at its end. Triangles often end with declining ATR, weak momentum and weak volume.

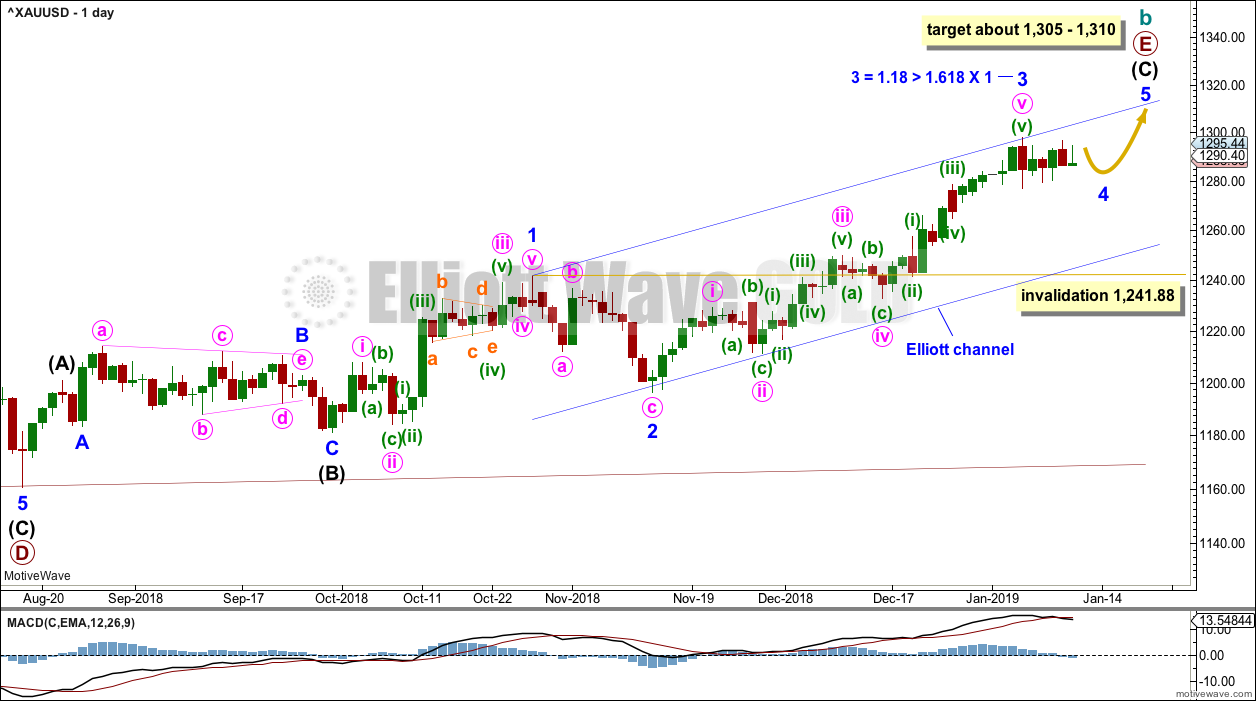

DAILY CHART – TRIANGLE

Primary wave E may now be nearing its final stages for this wave count.

Primary wave E should subdivide as a zigzag. Intermediate waves (A) and (B) may now be complete. Intermediate wave (C) may now be nearing completion.

Minor wave 2 is a deep 0.75 zigzag. Minor wave 4 may be expected to most likely be a shallow sideways flat, triangle or combination.

Minor wave 3 exhibits the most common Fibonacci ratio to minor wave 1.

Minor wave 4 may not move into minor wave 1 price territory below 1,241.88.

A target for primary wave E is the strong zone of resistance about 1,305 to 1,310. Primary wave E is most likely to subdivide as a zigzag (although it may also subdivide as a triangle to create a rare nine wave triangle). It may last a total Fibonacci 21 or 34 weeks. So far it has lasted 20 weeks. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

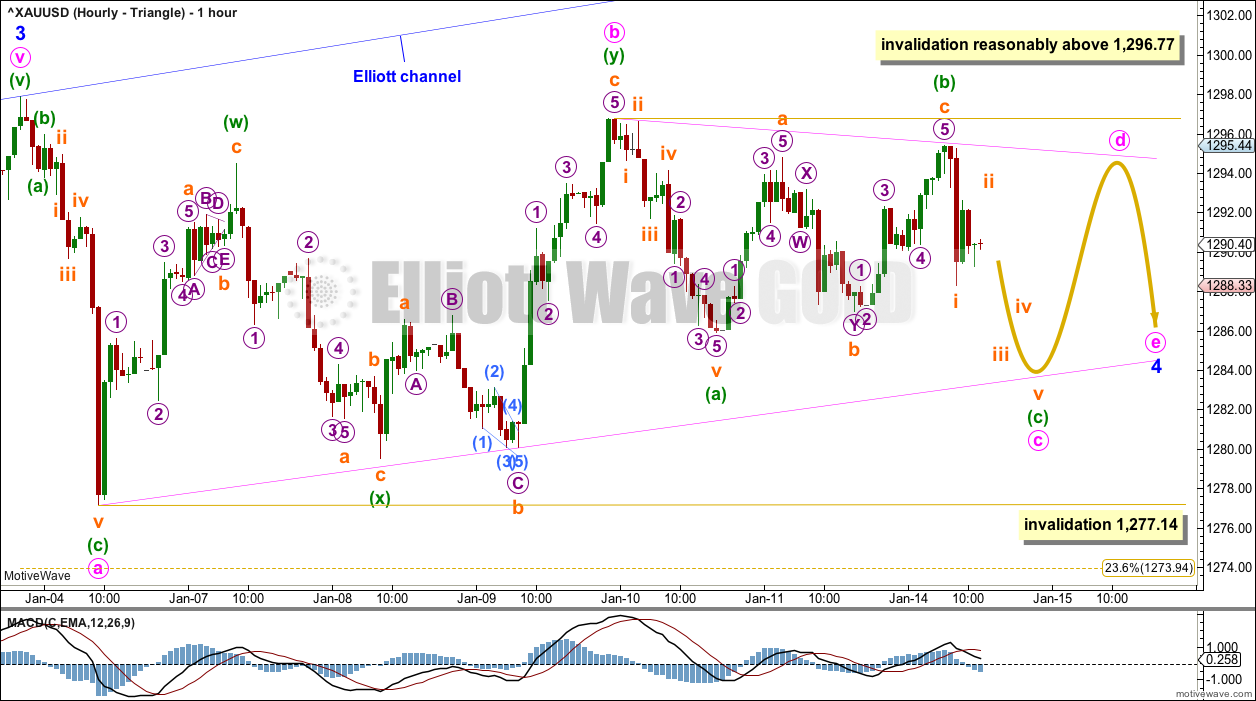

HOURLY CHART

It will be essential over the next couple of weeks to be flexible because there are several possible structures for minor wave 4, so the labelling within it will change as it unfolds; alternate wave counts may be required. The focus should not be on identifying each small swing within minor wave 4. The focus should be on identifying when its structure may be complete and then the trend may resume.

This first hourly chart considers a triangle for minor wave 4. The triangle may be either a regular contracting triangle, which is the most common type, or a regular barrier triangle. My research shows that barrier triangles are more often running than regular.

Minute wave c may not move beyond the end of minute wave a below 1,277.14.

For a contracting triangle, minute wave d may not move beyond the end of minute wave b above 1,296.77.

For a barrier triangle, minute wave d may end about the same level as minute wave b, and in practice may move very slightly above minute wave b at 1,296.77. A triangle would remain valid as long as the b-d trend line remains essentially flat.

The final sub-wave of minute wave e may not move beyond the end of minute wave c.

A triangle may take another few sessions to complete.

If a triangle is invalidated with a new high reasonably above 1,296.77 or a new low below 1,277.14, then the alternate hourly wave count below may be used.

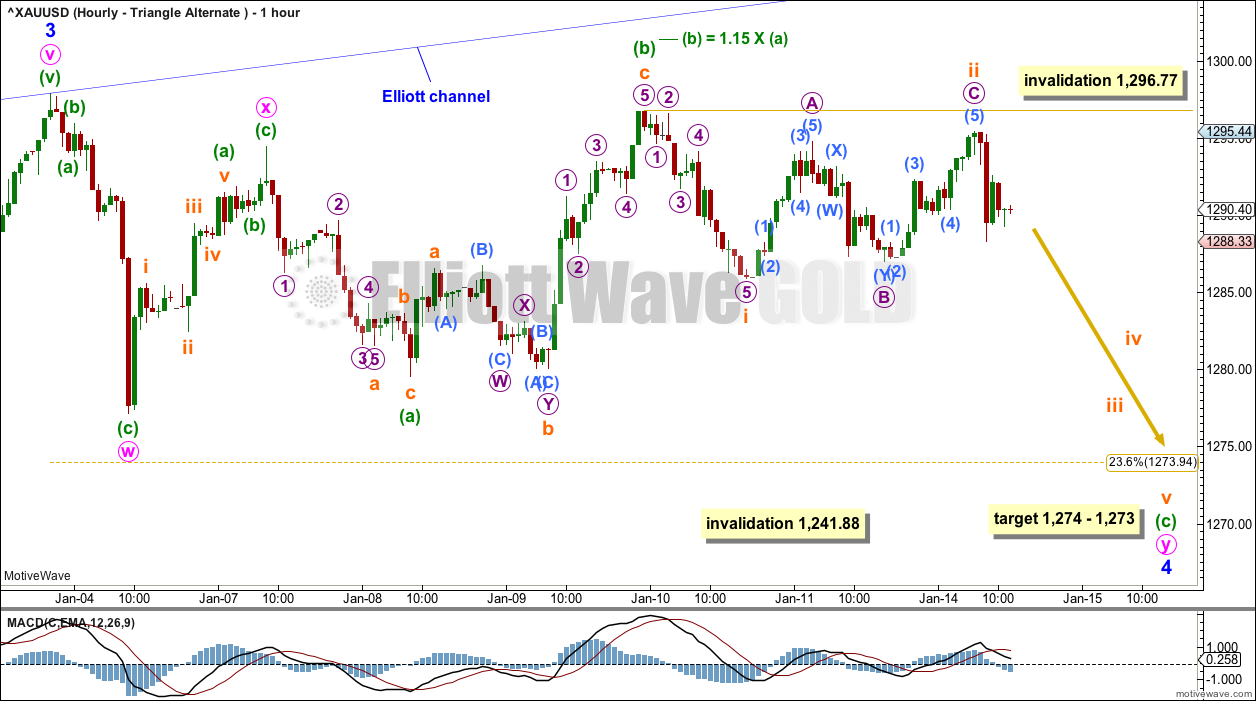

HOURLY CHART ALTERNATE

If a triangle for minor wave 4 is invalidated, then minor wave 4 may be unfolding as a double combination. Double combinations are reasonably common structures. Within double combinations, the most common two structures are one zigzag and one flat correction.

The first structure in a double combination may be a complete zigzag. This is labelled minute wave w.

The double may be joined by a completed three in the opposite direction, a zigzag labeled minute wave x.

The second structure in a double may be unfolding as an expanded flat correction, labelled minute wave y. Within minute wave y, minuette wave (b) is within the most common length of from 1 to 1.38 times the length of minuette wave (a).

A target is calculated using the most common Fibonacci ratio between minuette waves (a) and (c) within an expanded flat. This is close to the 0.382 Fibonacci ratio of minor wave 3, giving a small target zone for minor wave 4 to end.

WEEKLY CHART – DOUBLE ZIGZAG

It is possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about three quarters complete.

Within the triangle of primary wave X, intermediate wave (C) should be complete. Within intermediate wave (D), minor waves A and B may be complete. Minor wave C must subdivide as a five wave structure. Within minor wave C, minute wave iv may not move into minute wave i price territory below 1,241.88.

Intermediate wave (D) would most likely subdivide as a single zigzag.

This wave count may now expect choppy overlapping movement in an ever decreasing range for several more months.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

TECHNICAL ANALYSIS

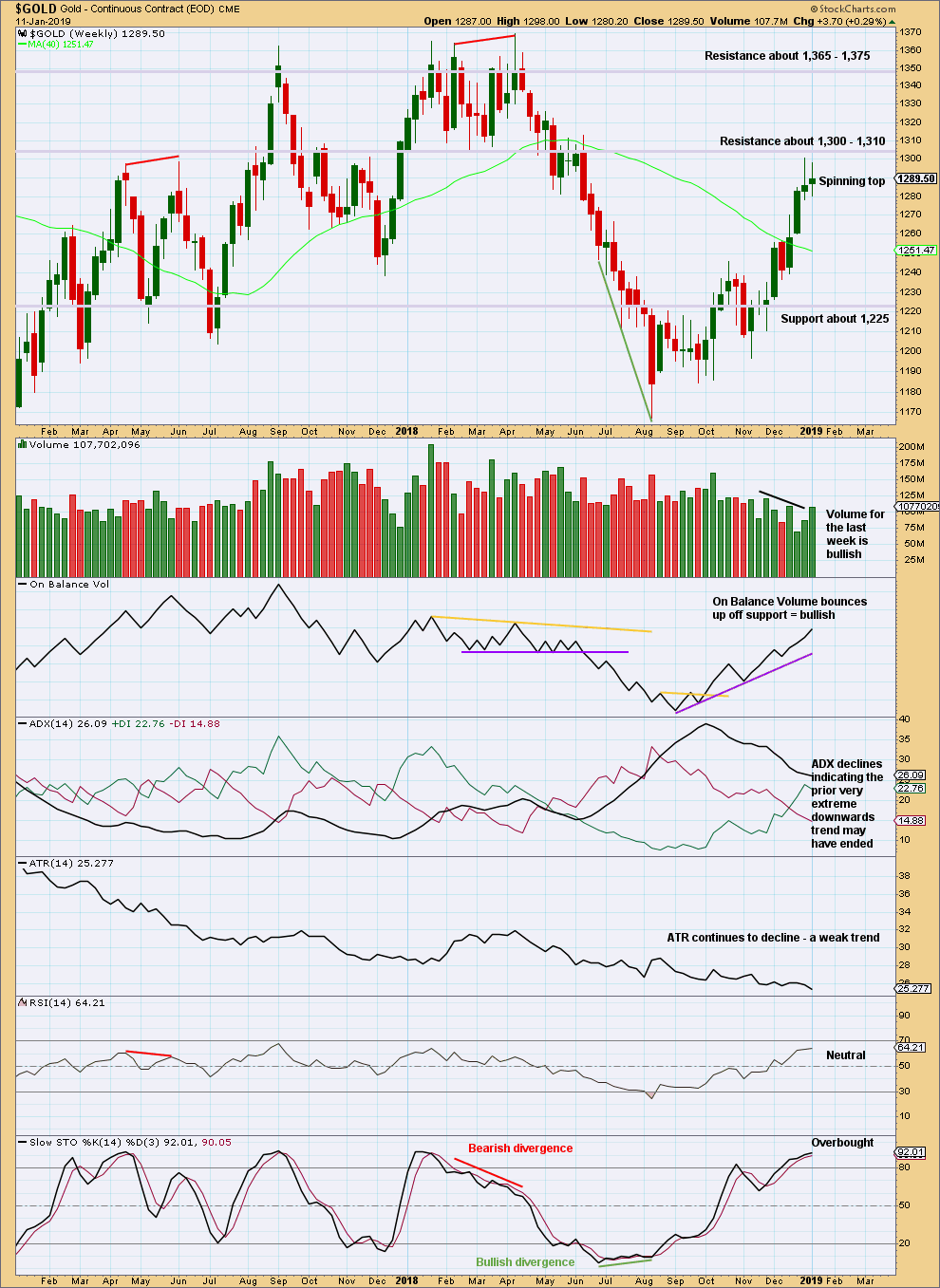

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The spinning top candlestick pattern is not a reversal pattern. This puts the short-term trend from up to neutral.

Volume for the last two weeks supports upwards movement. ADX indicates a potential trend change to upwards, but as yet it does not indicate a new trend at this time frame.

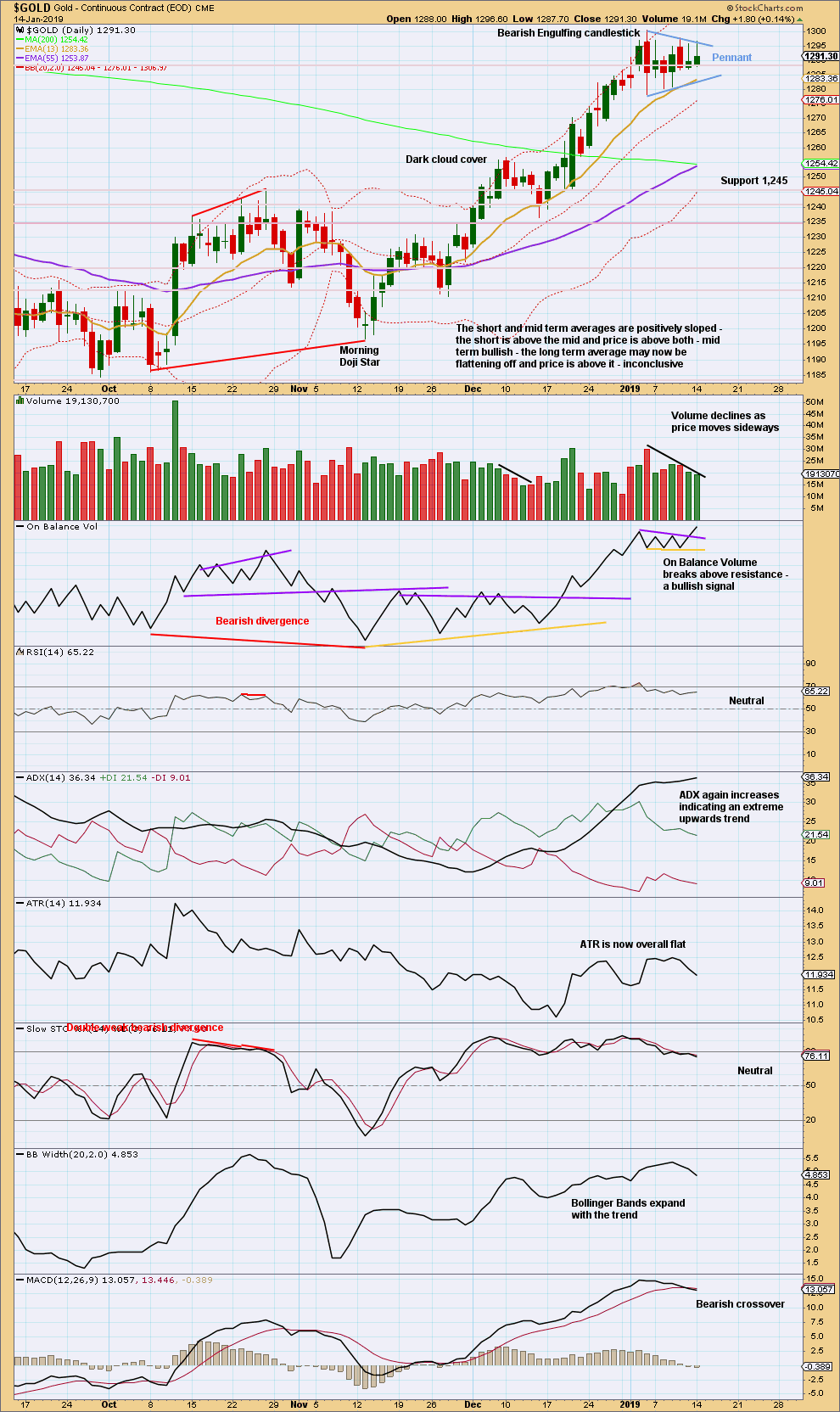

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The Bearish Engulfing reversal pattern has support from volume. After ADX reached extreme, this now signals an end to the upwards trend and either a reversal or a sideways consolidation.

Although ADX again indicates today that an upwards trend may be in place, more weight will be given to the candlestick reversal pattern because ADX remains extreme.

A small pennant pattern may be forming. These are reliable continuation patterns. The target using the flag pole beginning at 1,236.50 on the 14th of December 2018 would be about 1,360. This is substantially higher than the Elliott wave count suggests; this target may be too optimistic.

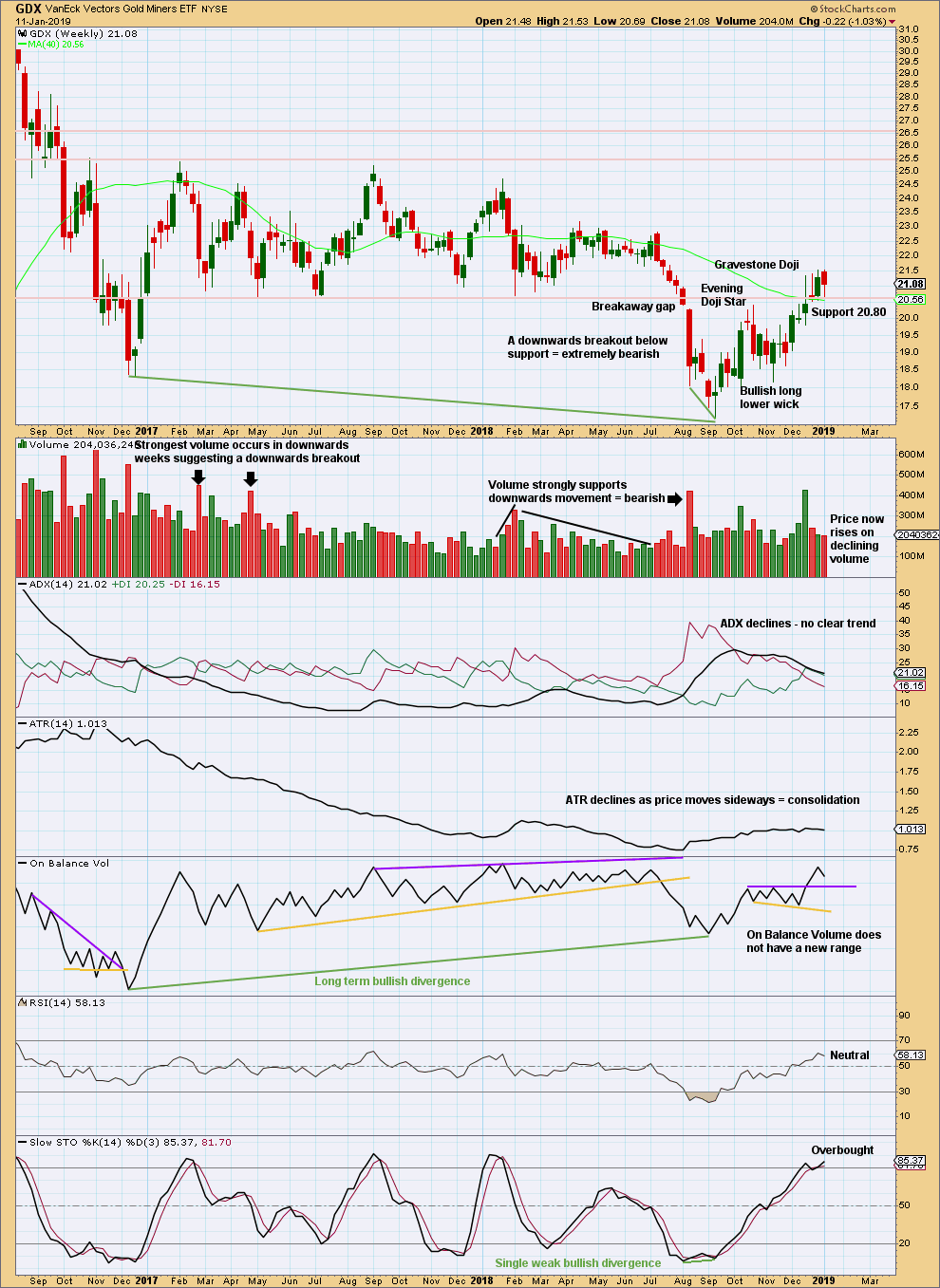

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX is now firmly back within a prior consolidation zone. Strong support may be expected again about 20.80.

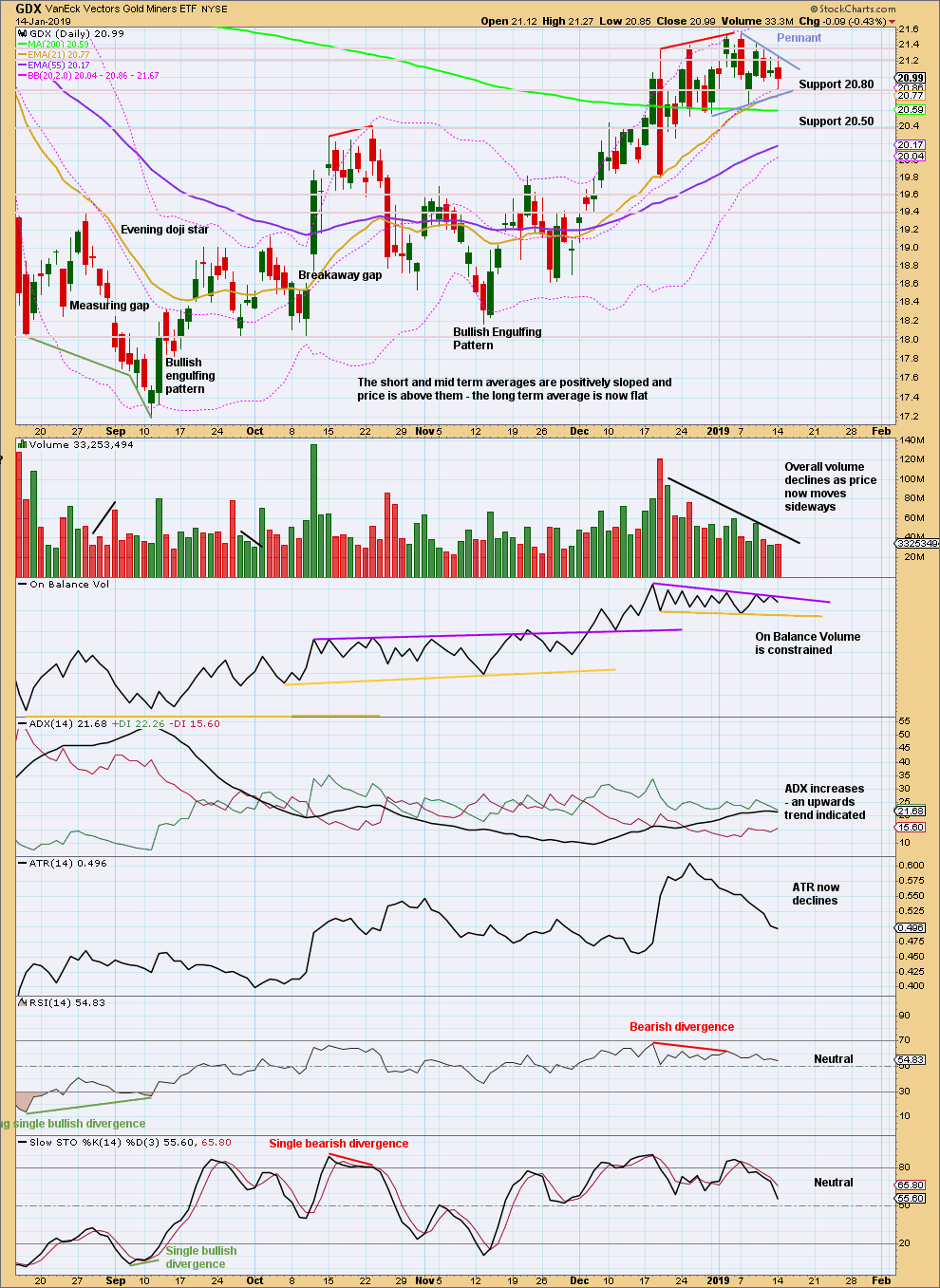

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small pennant pattern may be unfolding. The target using the flag pole beginning at 19.80 on the 19th of December 2018 is about 22.90.

Published @ 12:10 a.m. EST on January 15, 2019.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Good morning everybody 🙂

Sideways movement continues. For the very short term, I’m considering an ending diagonal for minuette wave (c) to end minute wave c.

The triangle for minor 4 still looks incomplete. I’d still expect at least another two sessions, and maybe up to four sessions.

Gold often exhibits surprisingly short and brief fifth waves out of it’s fourth wave triangles. And so if price remains within these invalidation points on the chart to complete the triangle, then breaks out upwards, we will need to look out for this tendency.

By all means, agile traders may like to trade the breakout. But my warning there is to be attentive and take profits quickly. And as always, manage risk.