A sideways consolidation was expected to begin after the session for the 4th of January closed. The following three sessions thereafter have all moved sideways, which exactly meets expectations.

Elliott wave analysis is used to determine when a corrective structure may be complete.

Summary: A sideways consolidation is now expected for a fourth wave to last about 2 to 4 weeks. It may find support about 1,259 and resistance about 1,300.

At this stage, a complete corrective structure cannot be seen, and it is expected that minor wave 4 should continue further sideways to have better proportion to minor wave 2.

The final target for this bounce to end is about 1,305 – 1,310.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts is here.

Only two remaining wave counts have a reasonable probability and are published below: a triangle (the preferred wave count) and a double zigzag. The combination wave count is discarded this week based upon a very low probability.

MAIN ELLIOTT WAVE COUNT

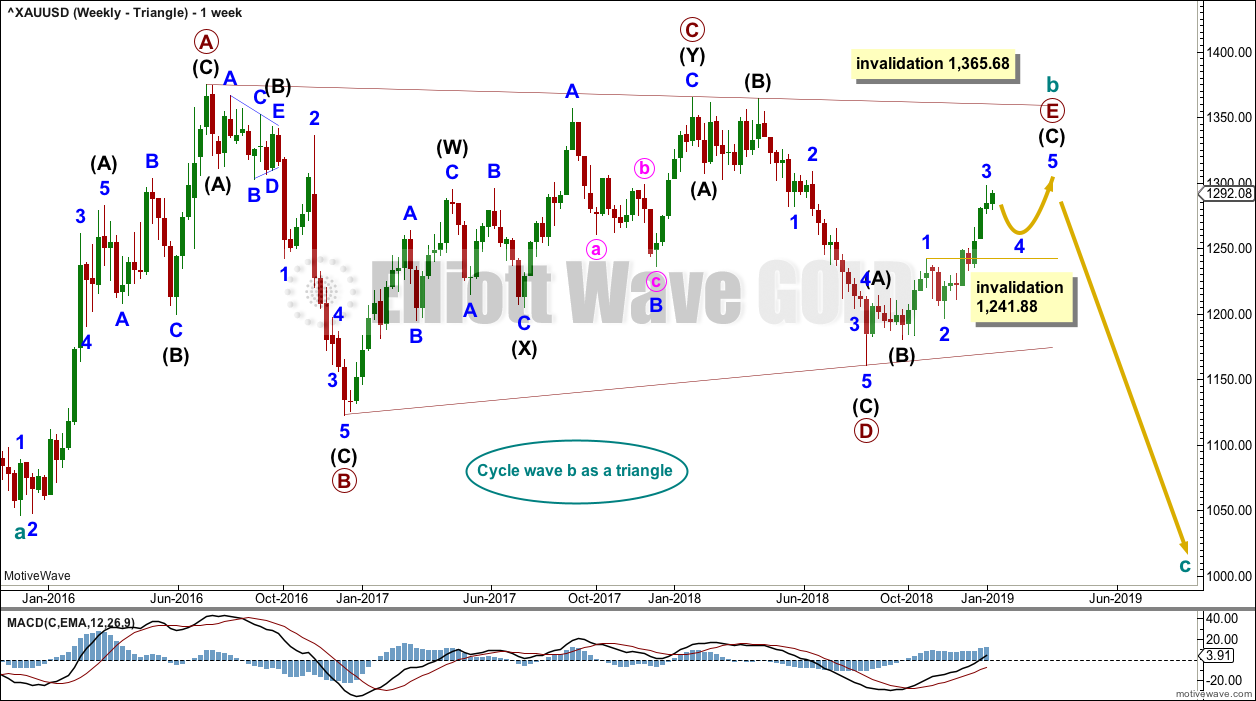

WEEKLY CHART – TRIANGLE

Cycle wave b may be an incomplete regular contracting triangle. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

Within primary wave E, intermediate waves (A) and (B) may be complete. Intermediate wave (C) must subdivide as a five wave structure. Within intermediate wave (C), minor wave 4 may not move into minor wave 1 price territory below 1,241.88.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best. Primary wave E would most likely be a single zigzag. It is also possible that it may subdivide as a triangle to create a rare nine wave triangle.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

When primary wave E is a complete three wave structure, then this wave count would expect a cycle degree trend change. Cycle wave c would most likely make new lows below the end of cycle wave a at 1,046.27 to avoid a truncation.

It is possible now that primary wave E may end in January or February 2019. Some reasonable weakness should be expected at its end. Triangles often end with declining ATR, weak momentum and weak volume.

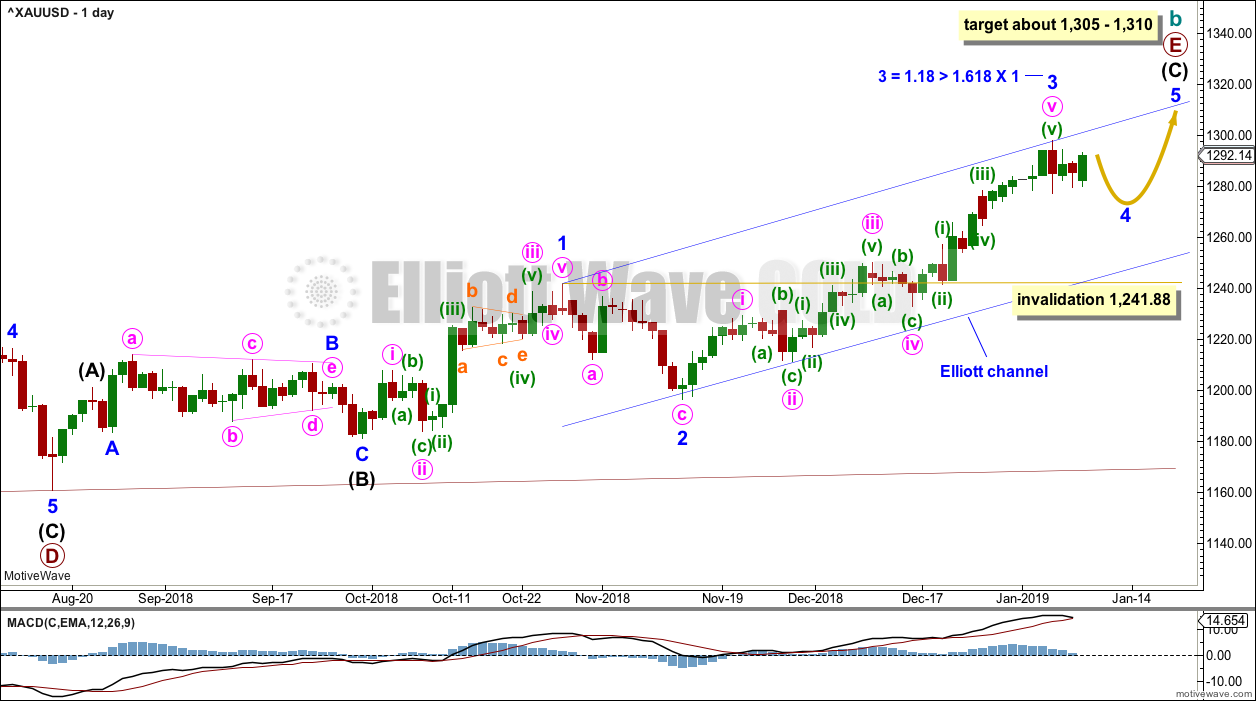

DAILY CHART – TRIANGLE

Primary wave E may now be nearing its final stages for this wave count.

Primary wave E should subdivide as a zigzag. Intermediate waves (A) and (B) may now be complete. Intermediate wave (C) may now be nearing completion.

Minor wave 2 is a deep 0.75 zigzag. Minor wave 4 may be expected to most likely be a shallow sideways flat, triangle or combination.

Minor wave 3 exhibits the most common Fibonacci ratio to minor wave 1.

Minor wave 4 may not move into minor wave 1 price territory below 1,241.88.

A target for primary wave E is the strong zone of resistance about 1,305 to 1,310. Primary wave E is most likely to subdivide as a zigzag (although it may also subdivide as a triangle to create a rare nine wave triangle). It may last a total Fibonacci 21 or 34 weeks. So far it has lasted 20 weeks. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

HOURLY CHART – TRIANGLE

The hourly chart focusses on minor wave 4.

Minor wave 4 would most likely subdivide as a flat, triangle or combination to exhibit alternation with the zigzag of minor wave 2. All of a flat, triangle or combination begin with a three wave structure for minute wave a or w, which is usually a zigzag.

It will be essential over the next few weeks to be flexible because there are several possible structures for minor wave 4, so the labelling within it will change as it unfolds; alternate wave counts may be required. The focus should not be on identifying each small swing within minor wave 4. The focus should be on identifying when its structure may be complete and then the trend may resume.

Today a triangle is considered for minor wave 4. The triangle may be either a regular or running triangle

Minute wave b may move higher to reach above the start of minute wave a at 1,297.90. When minute wave b is complete then minute wave c may move lower. If a triangle is unfolding, then minute wave c may not move beyond the end of minute wave a below 1,277.14. A new low below this point would invalidate the triangle as it is labelled and suggest another Elliott wave structure should be considered.

WEEKLY CHART – DOUBLE ZIGZAG

It is possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about three quarters complete.

Within the triangle of primary wave X, intermediate wave (C) should be complete. Within intermediate wave (D), minor waves A and B may be complete. Minor wave C must subdivide as a five wave structure. Within minor wave C, minute wave iv may not move into minute wave i price territory below 1,241.88.

Intermediate wave (D) would most likely subdivide as a single zigzag.

This wave count may now expect choppy overlapping movement in an ever decreasing range for several more months.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

TECHNICAL ANALYSIS

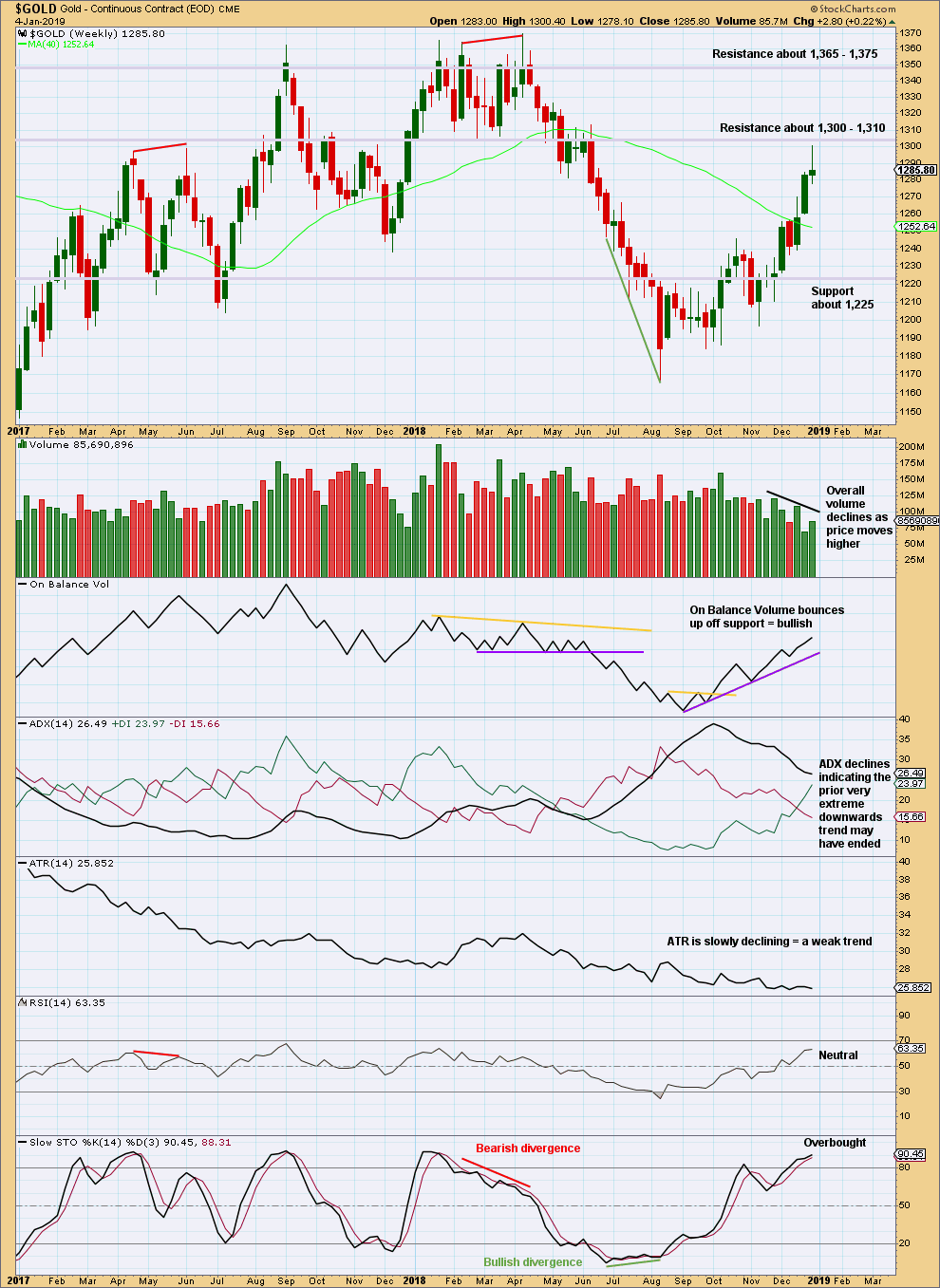

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This upwards movement lacks some strength. Volume is overall not supporting it. The long upper wick on the last weekly candlestick at an area of strong resistance indicates some sideways movement may result here.

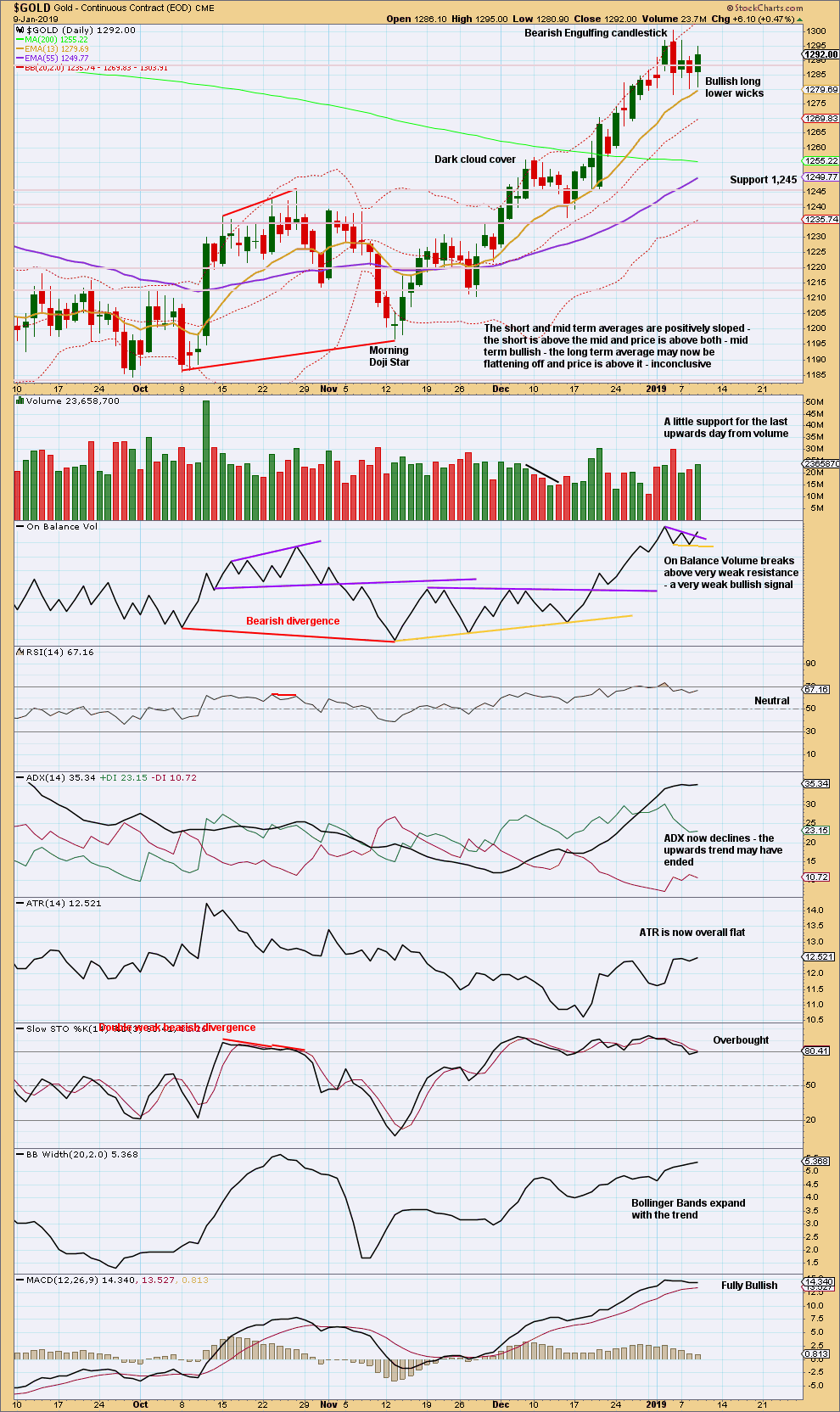

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The Bearish Engulfing reversal pattern has support from volume. After ADX reached extreme, this now signals an end to the upwards trend and either a reversal or a sideways consolidation.

ADX now indicates the extreme upwards trend may have ended.

If On Balance Volume moves lower tomorrow, then the recent purple resistance line may need to be redrawn. The signal is very weak because the line has very low technical significance.

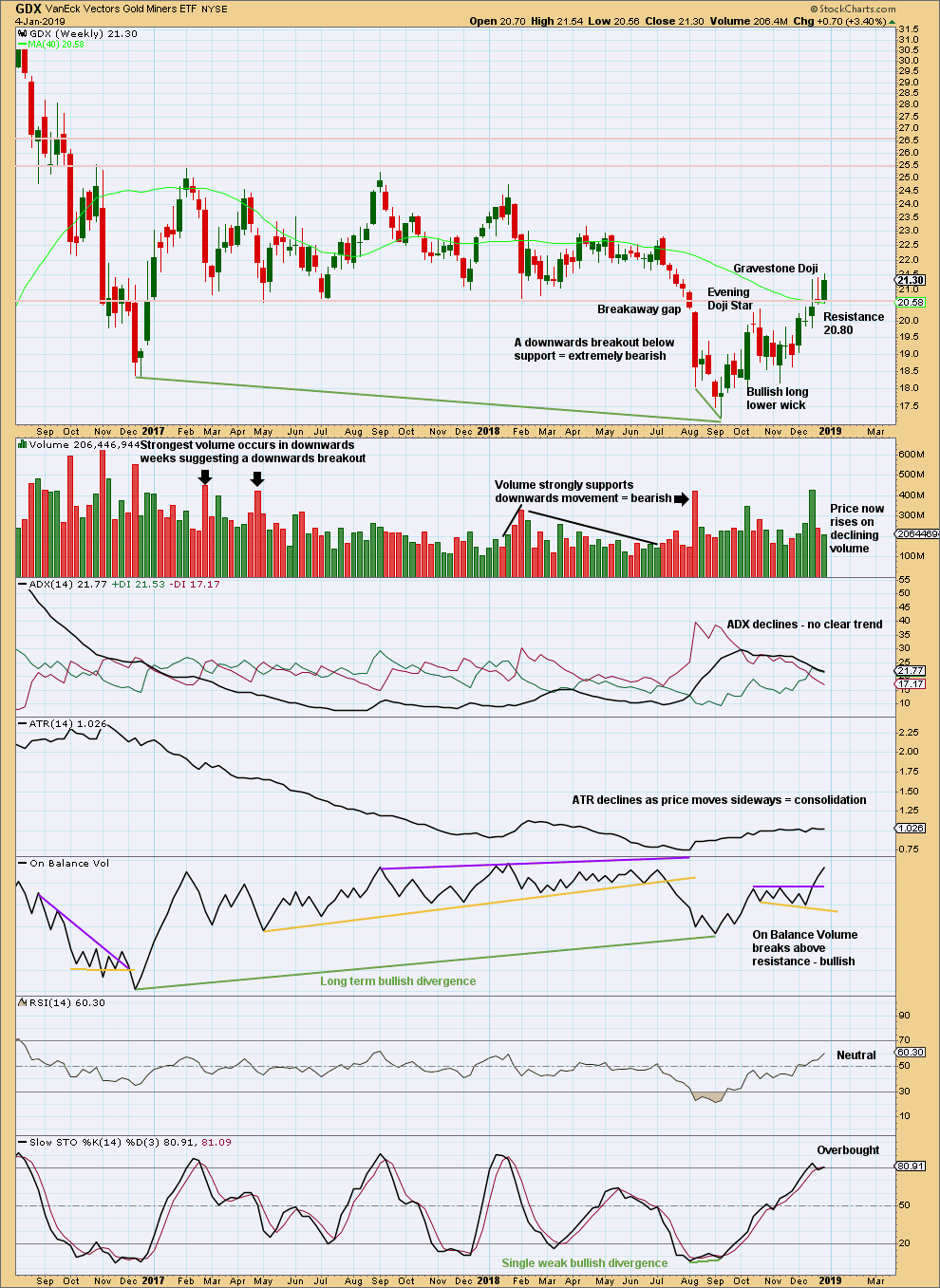

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The Gravestone Doji for last week’s candlestick has failed to signal a high. Price has moved a little higher, but the Gravestone Doji may still be a warning of a final high coming very soon.

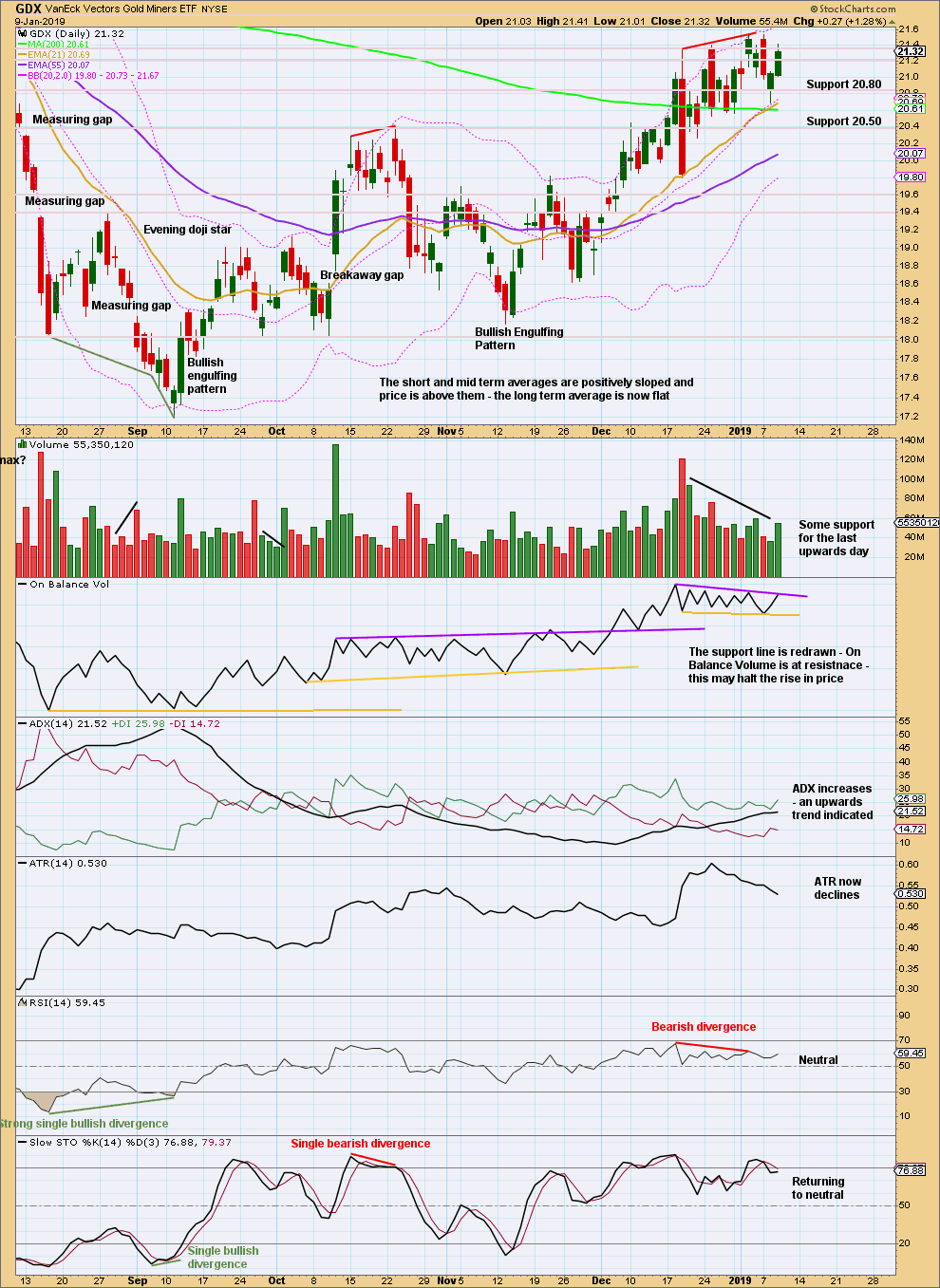

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last two Bearish Engulfing patterns have not come at a high. Price continues higher. There is some weakness with declining volume and ATR.

Now another Bearish Engulfing pattern completes. It comes with a bearish signal from On Balance Volume, so this may be more likely to result in a trend change.

For the very short term, although volume suggests more upwards movement here, resistance on On Balance Volume may be strong enough to counter this and halt a rise in price.

Published @ 9:29 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Good morning everybody. Here is your updated hourly chart today.

Minor wave 4 so far looks like it may be unfolding as a regular contracting triangle.

I’ve changed the labelling within minute b to see this as a double zigzag. This has a better fit.

If that is correct then all remaining sub-waves must subdivide as single zigzags.

Minute c may not move beyond the end of minute a below 1,277.14.

Minute d may not move reasonably above minute b at 1,296.77.

If price remains within this range and continues sideways, then a triangle may be the correct wave count for minor wave 4.

If price breaks out of this range then I will relabel minor wave 4. It may then most likely be a combination.