S&P 500

Market breadth and volatility are used at the end of this week to indicate the direction for next week. The Elliott wave count continues to have support from rising market breadth in the AD line and declining VIX.

Summary: The first large correction within cycle wave V may have arrived. It may be labelled either intermediate wave (1) or primary wave 1. Classic technical analysis at this stage favours a shallow sideways consolidation; the target would be about 2,550. But it may also be a sharp pullback; the target would be about 2,472. *edit: this was previously incorrectly stated as 2,272

The bigger picture still expects that a low may now be in place. The target is at 3,045 with a limit at 3,477.39.

The biggest picture, Grand Super Cycle analysis, is here.

The monthly chart was last published here.

ELLIOTT WAVE COUNT

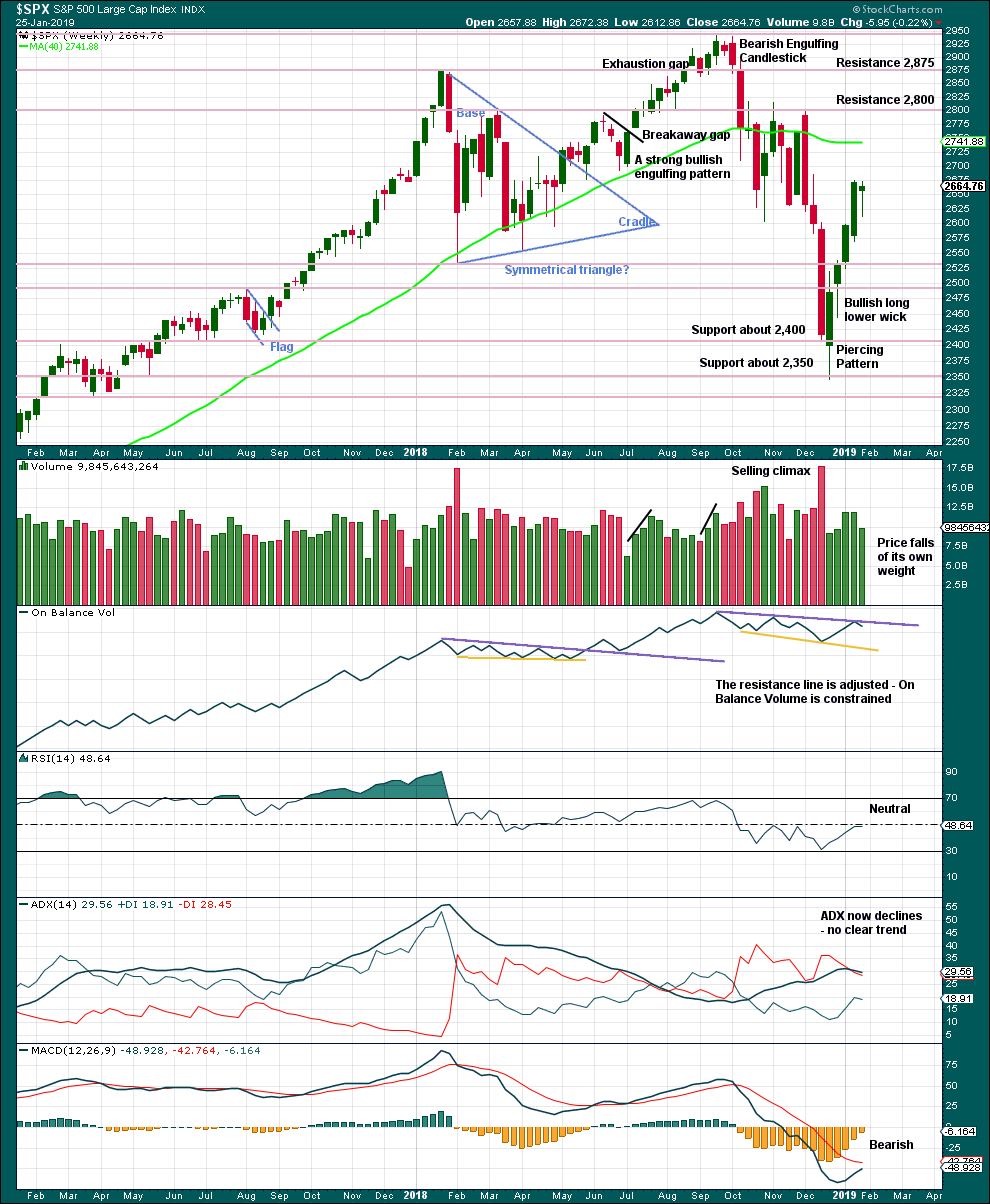

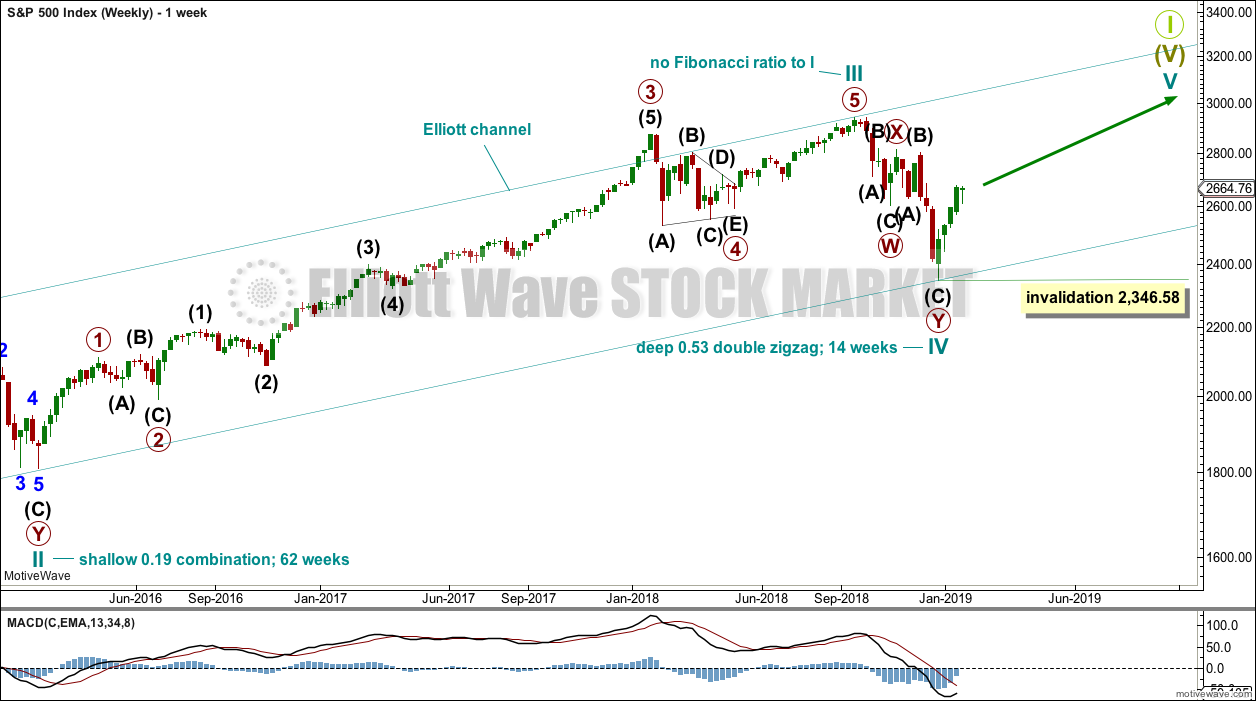

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

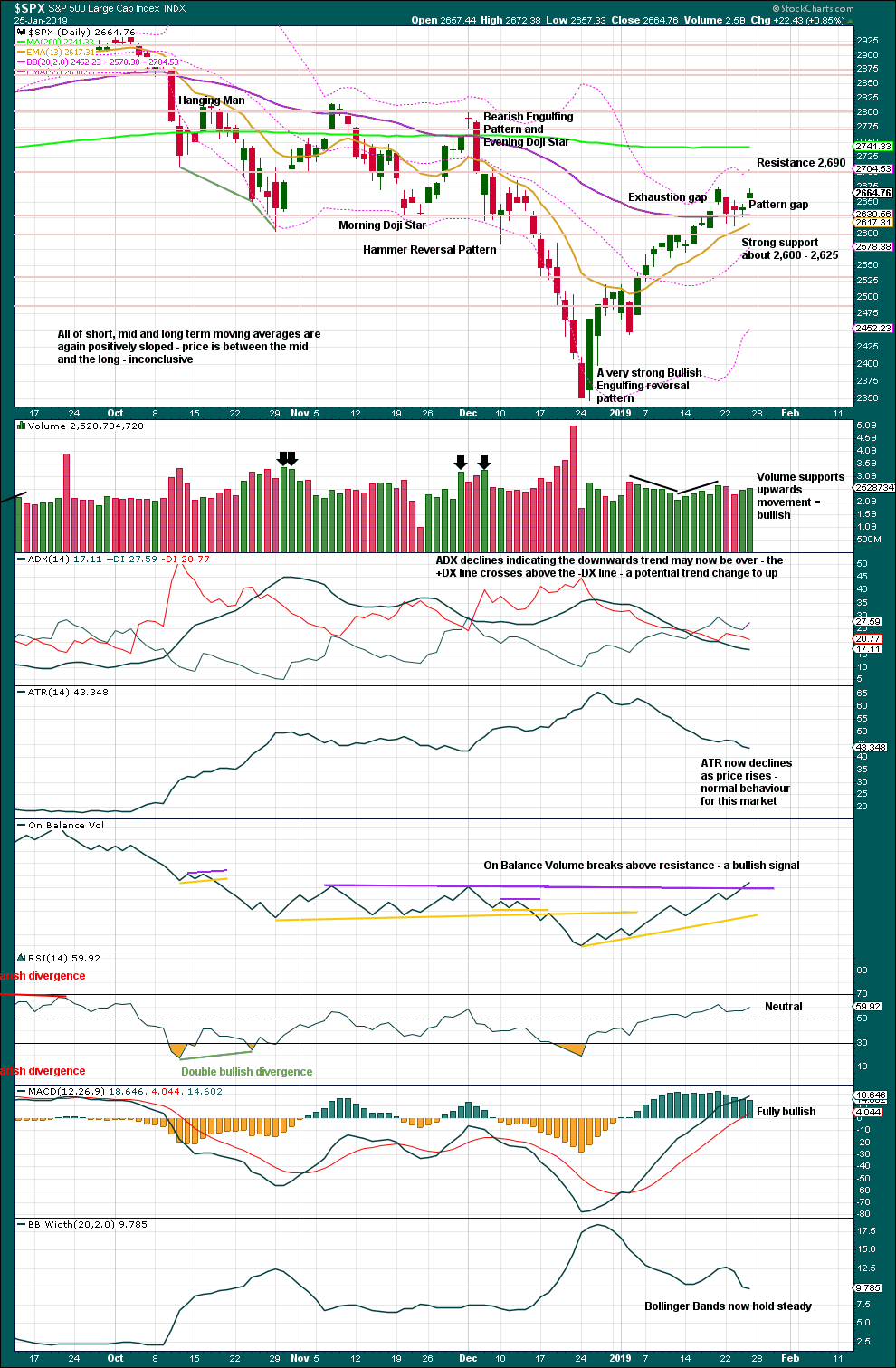

DAILY CHART

The daily chart will focus on the structure of cycle waves IV and V.

Cycle wave IV now looks like a complete double zigzag. This provides perfect alternation with the combination of cycle wave II. Double zigzags are fairly common corrective structures.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Within the five wave structure for cycle wave V, primary wave 1 may be incomplete. Within primary wave 1, intermediate wave (1) may now be complete. The degree of labelling within cycle wave V may need to be adjusted as it unfolds further. At this stage, an adjustment may be to move the degree of labelling within cycle wave V up one degree; it is possible that it could be primary wave 1 now complete.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Intermediate wave (2) now looks like it may unfold as a sideways correction. It may find a low about the 0.382 Fibonacci ratio of intermediate wave (1) at 2,550. It may continue sideways with choppy overlapping movement for another very few weeks.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

From the all time high to the low at the end of December 2018, price moved lower by 20.2% of market value meeting the definition for a bear market.

It should be noted that the large fall in price from May 2011 to October 2011 also met this definition of a bear market, yet it was only a very large pullback within a bull market, which so far has lasted almost 10 years.

This weekly candlestick may complete a Hanging Man, which is a bearish reversal pattern, but the bullish implications of the long lower wick on a Hanging Man requires bearish confirmation. A Hanging Man reversal pattern is essentially a two candlestick pattern.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Over a fairly long period of time this ageing bull market has been characterised by upwards movement on light and declining volume and low ATR. For the short to mid term, little concern may be had if price now rises again on declining volume. Current market conditions have allowed for this during a sustained rise in price.

It is also normal for this market to have lower ATR during bullish phases, and strongly increasing ATR during bearish phases. Currently, declining ATR is normal and not of a concern.

Considering the larger picture from the Elliott wave count, some weakness approaching the end of Grand Super Cycle wave I is to be expected.

From Kirkpatrick and Dhalquist, “Technical Analysis” page 152:

“A 90% downside day occurs when on a particular day, the percentage of downside volume exceeds the total of upside and downside volume by 90% and the percentage of downside points exceeds the total of gained points and lost points by 90%. A 90% upside day occurs when both the upside volume and points gained are 90% of their respective totals”…

and “A major reversal is singled when an NPDD is followed by a 90% upside day or two 80% upside days back-to-back”.

The current situation saw two 80% downside days on December 20th and 21st, then a near 90% downside day with 88.97% downside on December 24th. This very heavy selling pressure on three sessions very close together may be sufficient to exhibit the pressure observed in a 90% downside day.

This has now been followed by two 90% upside days: on December 26th and again on 4th January.

The current situation looks very much like a major low has been found.

Closure of the gap labelled an exhaustion gap indicates a consolidation or pullback may now be expected. A bullish signal from On Balance Volume now suggests any consolidation here may be relatively shallow and may even be short lived.

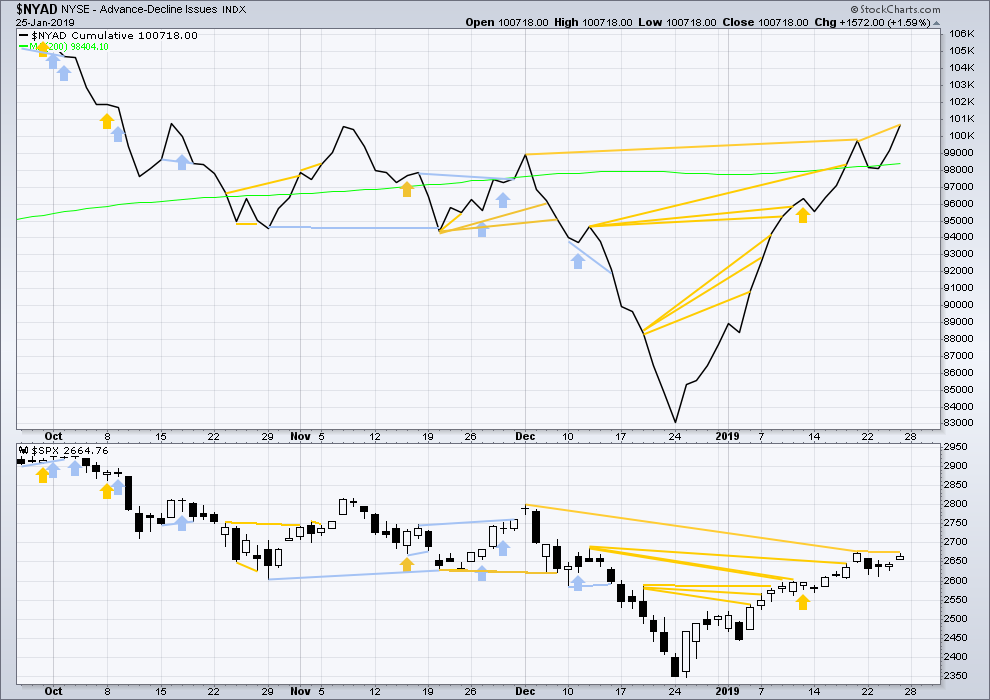

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The AD line has made another new high above the prior swing high of the week beginning 5th of November 2018, but price has not. This divergence is bullish for the mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

There is now a cluster of bullish signals from the AD line. This supports the main Elliott wave count.

The AD line has made a new high above the prior high of the 18th of January, but price has failed by a small margin to make a new high. This divergence is bullish.

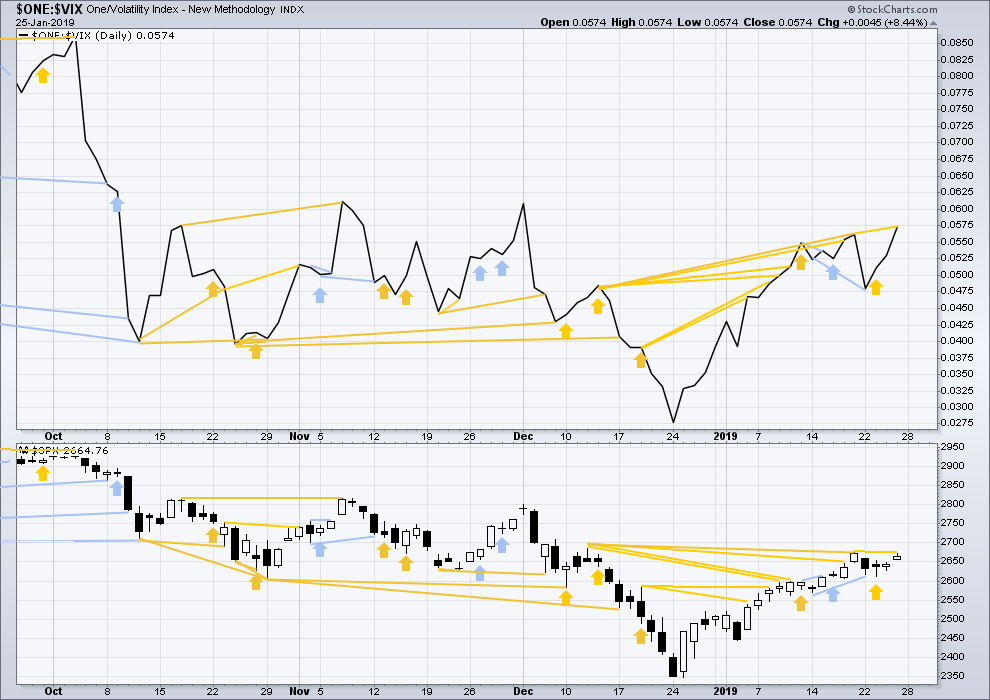

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Inverted VIX has made another new high above the prior swing high of the weeks beginning 26th of November and 3rd of December 2018, but price has not. This divergence is bullish for the mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

There is now a cluster of bullish signals from inverted VIX. This supports the main Elliott wave count.

Inverted VIX has made a new high above the prior high of the 18th of January, but price has failed by a small margin to make a new high. This divergence is bullish for the short term.

DOW THEORY

Dow Theory confirms a bear market. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

GOLD

An upwards breakout from a flag pattern was expected. The first Elliott wave target at 1,300 has been met. But the Elliott wave structure is incomplete, so the second target will now be used.

Summary: For the short term, a little sideways movement may begin next week. Thereafter, a short final upwards wave may unfold.

The next target at 1,314 may be used. If price gets up to this next target and keeps on rising, or if it gets there and the Elliott wave structure is again incomplete, then the next target is at 1,338.

Thereafter, a huge trend change is expected: a new wave down to last years would be expected to make new lows below 1,046.27.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts is here.

Only two remaining wave counts have a reasonable probability and are published below: a triangle (the preferred wave count) and a double zigzag.

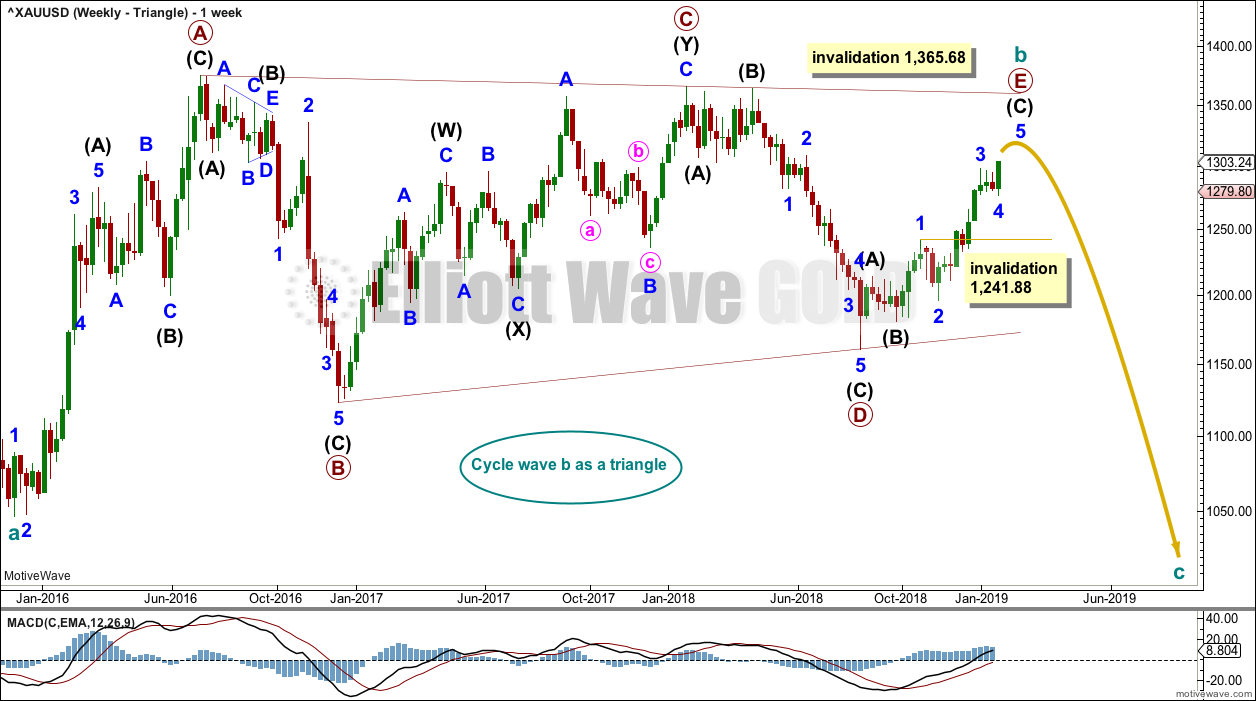

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART – TRIANGLE

Cycle wave b may be an almost complete regular contracting triangle. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

Within primary wave E, intermediate waves (A) and (B) may be complete. Intermediate wave (C) must subdivide as a five wave structure. Within intermediate wave (C), minor wave 4 may not move into minor wave 1 price territory below 1,241.88.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best. Primary wave E looks like it is unfolding as a single zigzag.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

When primary wave E is a complete three wave structure, then this wave count would expect a cycle degree trend change. Cycle wave c would most likely make new lows below the end of cycle wave a at 1,046.27 to avoid a truncation.

It is possible now that primary wave E may end next week. Some reasonable weakness should be expected at its end. Triangles often end with declining ATR, weak momentum and weak volume.

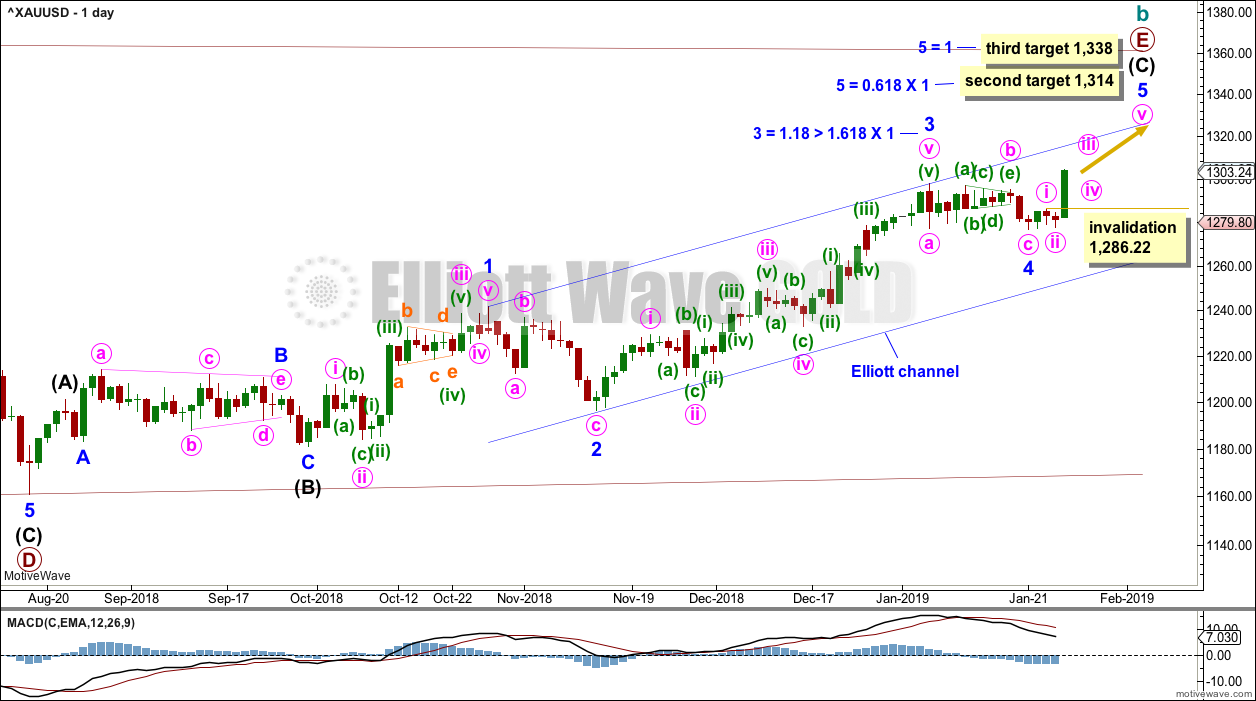

DAILY CHART – TRIANGLE

Primary wave E may now be almost complete for this wave count.

Primary wave E should subdivide as a zigzag. Intermediate waves (A) and (B) may now be complete. Intermediate wave (C) may now be almost complete.

Minor wave 2 is a deep 0.75 zigzag. Minor wave 4 may now be a complete a zigzag. Alternation is a guideline, not a rule, and is not always seen. Zigzags are the most common corrective structure. There is still alternation in depth: minor wave 2 was deep and minor wave 4 was very shallow.

Minor wave 3 exhibits the most common Fibonacci ratio to minor wave 1.

Within minor wave 5, minute wave iv may not move into minute wave i price territory below 1,286.22.

Two targets now remain for minor wave 5 to end. If price reaches the next target and the structure is incomplete or price just keeps on rising through it, then the third target may be used.

All targets would expect primary wave E to fall short of the maroon A-C trend line. This is the most common look for E waves of Elliott wave triangles.

WEEKLY CHART – DOUBLE ZIGZAG

It is possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about three quarters complete.

Within the triangle of primary wave X, intermediate wave (C) should be complete. Within intermediate wave (D), minor waves A and B may be complete. Minor wave C must subdivide as a five wave structure. Within minor wave C, minute wave iv should now be over. Within minute wave v, no second wave correction may move beyond its start below 1,276.84.

Intermediate wave (D) would most likely subdivide as a single zigzag. Intermediate wave (D) should end at the upper (B)-(D) trend line for this wave count, so that the triangle adheres neatly to this trend line. That price point is about 1,354.

This wave count may now expect choppy overlapping movement in an ever decreasing range for a few more months.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

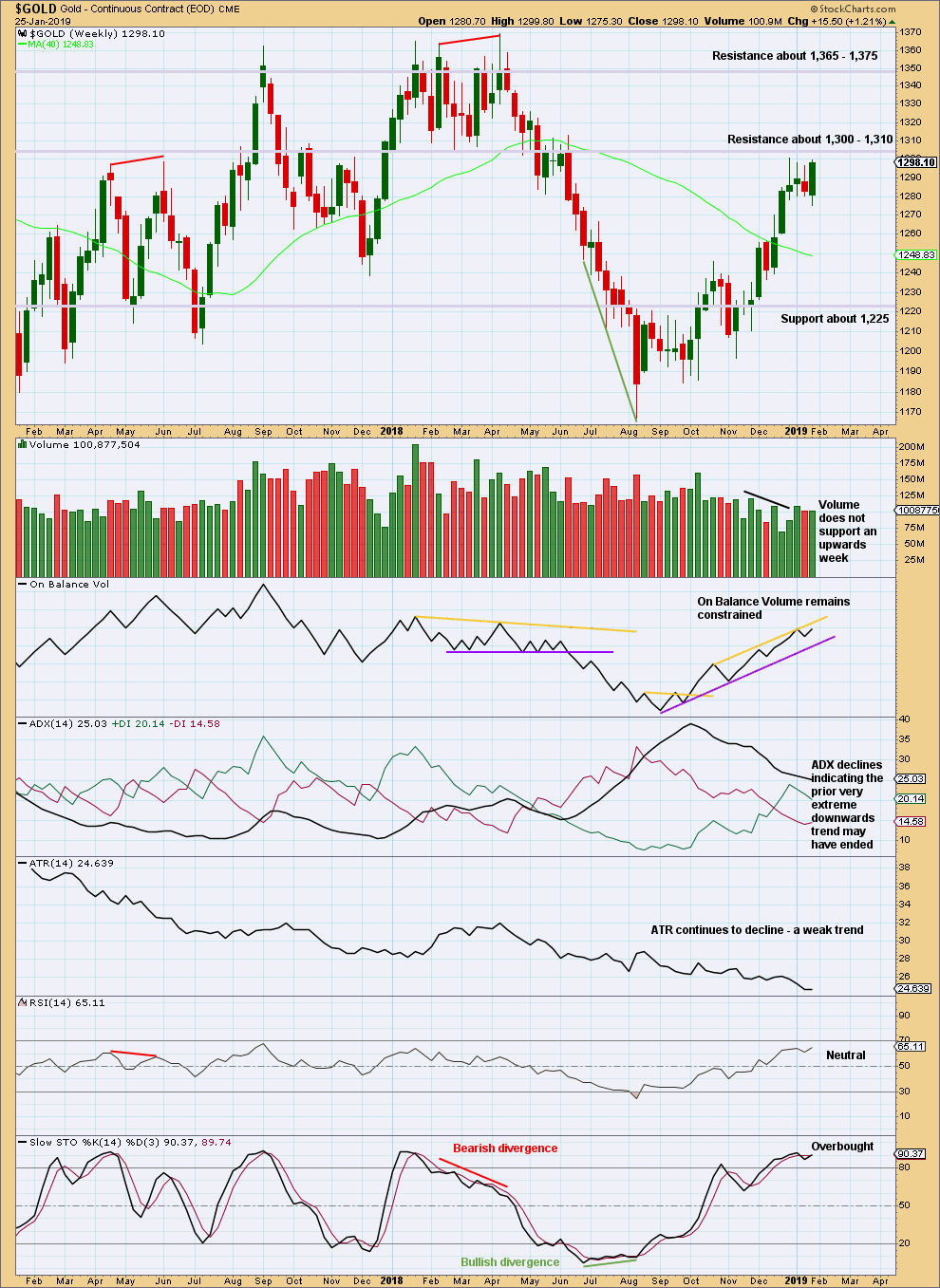

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

ADX indicates a potential trend change to upwards, but as yet it does not indicate a new trend at this time frame.

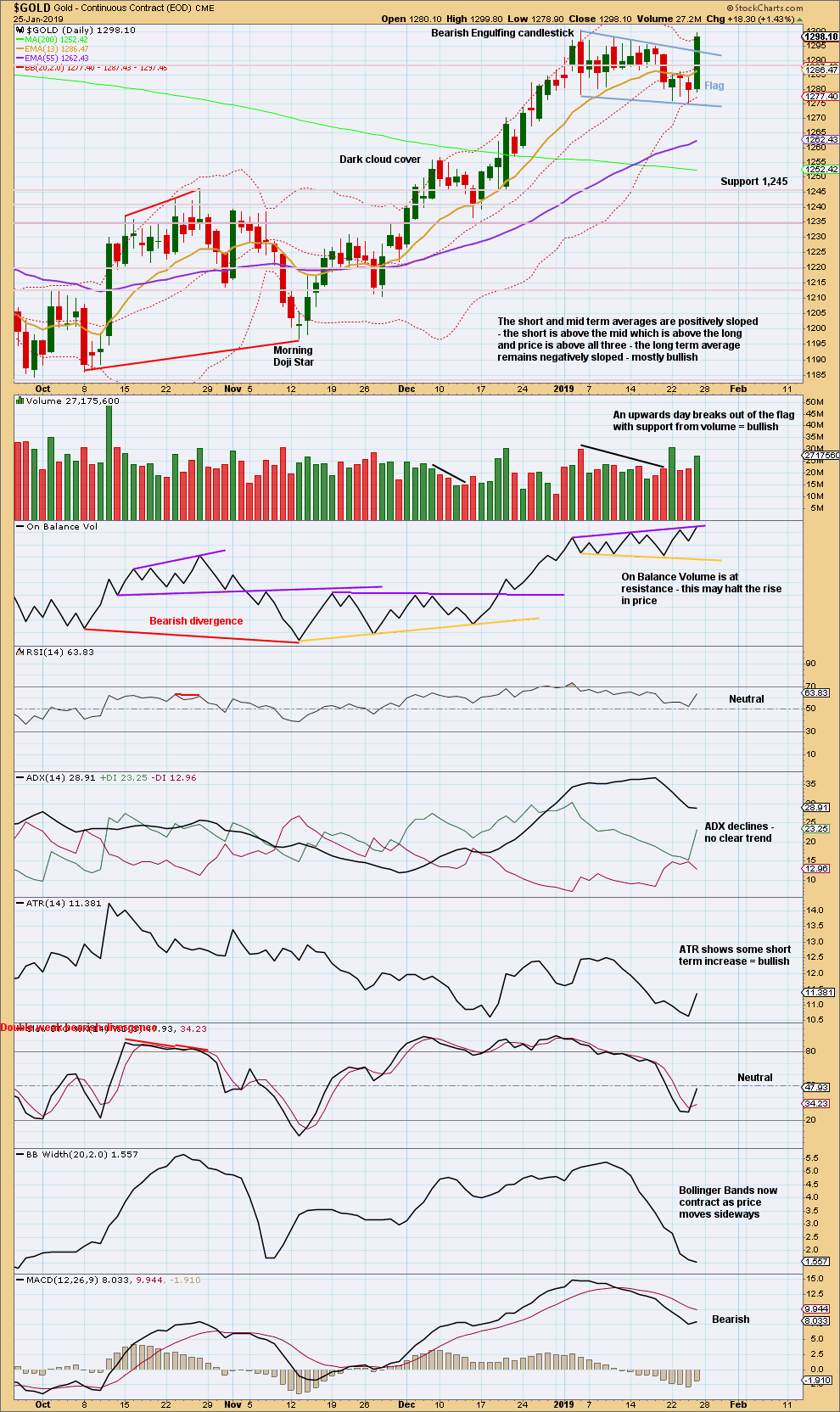

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Friday completes a strong bullish candlestick. The close above the upper flag trend line with support from volume is a classic upwards breakout.

Using the flag pole length, a target at 1,359 is calculated. This target looks rather optimistic.

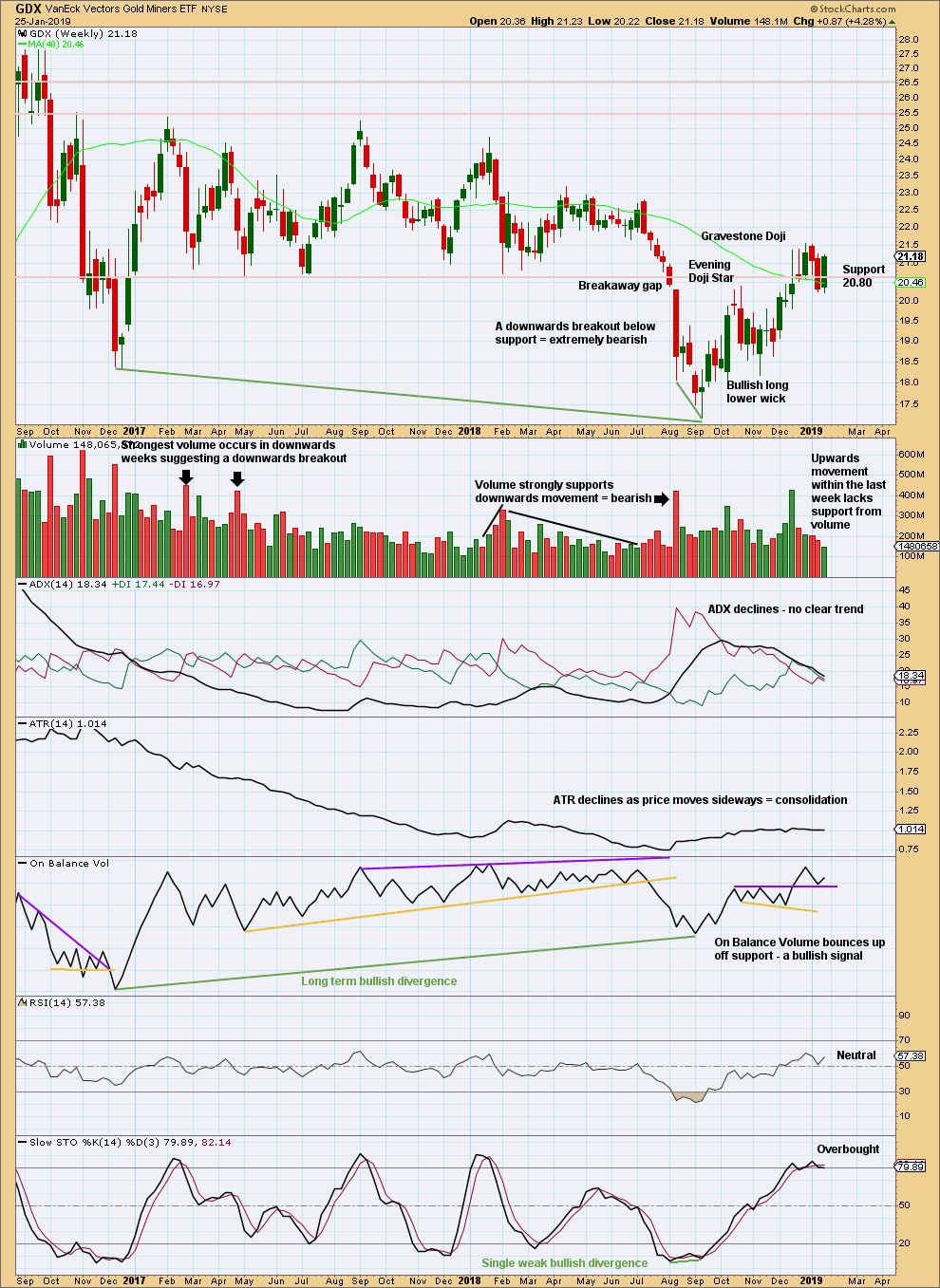

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A close back above 20.80 switches the short-term outlook from bearish to neutral or bullish. The short-term daily chart may be more indicative here.

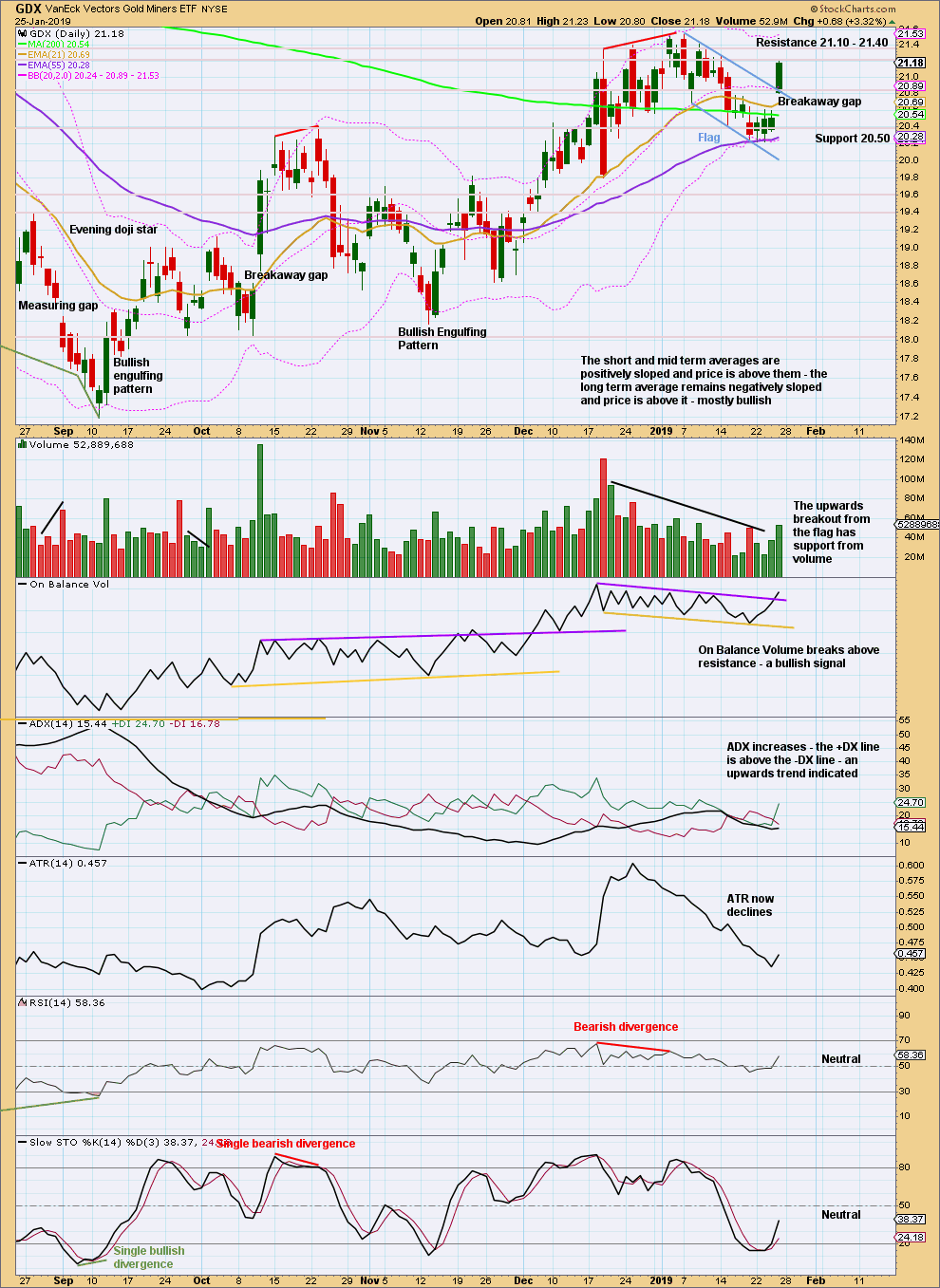

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The flag pattern remains valid for GDX. It lasted 14 sessions and now looks complete with an upwards breakout on Friday.

Flags are continuation patterns. The target would be about 22.60.

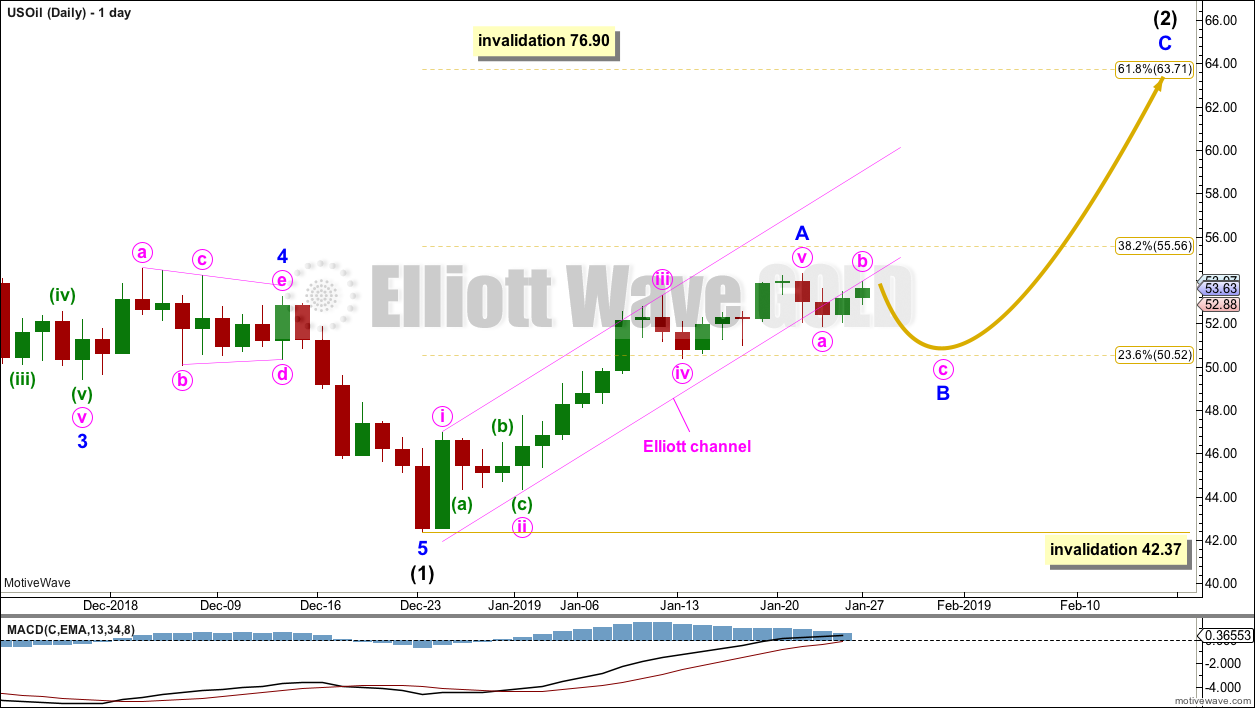

US OIL

About a target at 55.02 to 55.56 a pullback or sideways consolidation was expected this week. Price moved slightly higher to 54.32, falling 0.70 short of the target, and then has moved mostly sideways for the week.

Summary: The final target for the bounce to end is about 63.71.

Some more sideways movement may unfold for the short term before the bounce continues.

The larger picture still sees Oil in a new downwards trend to end reasonably below 26.06.

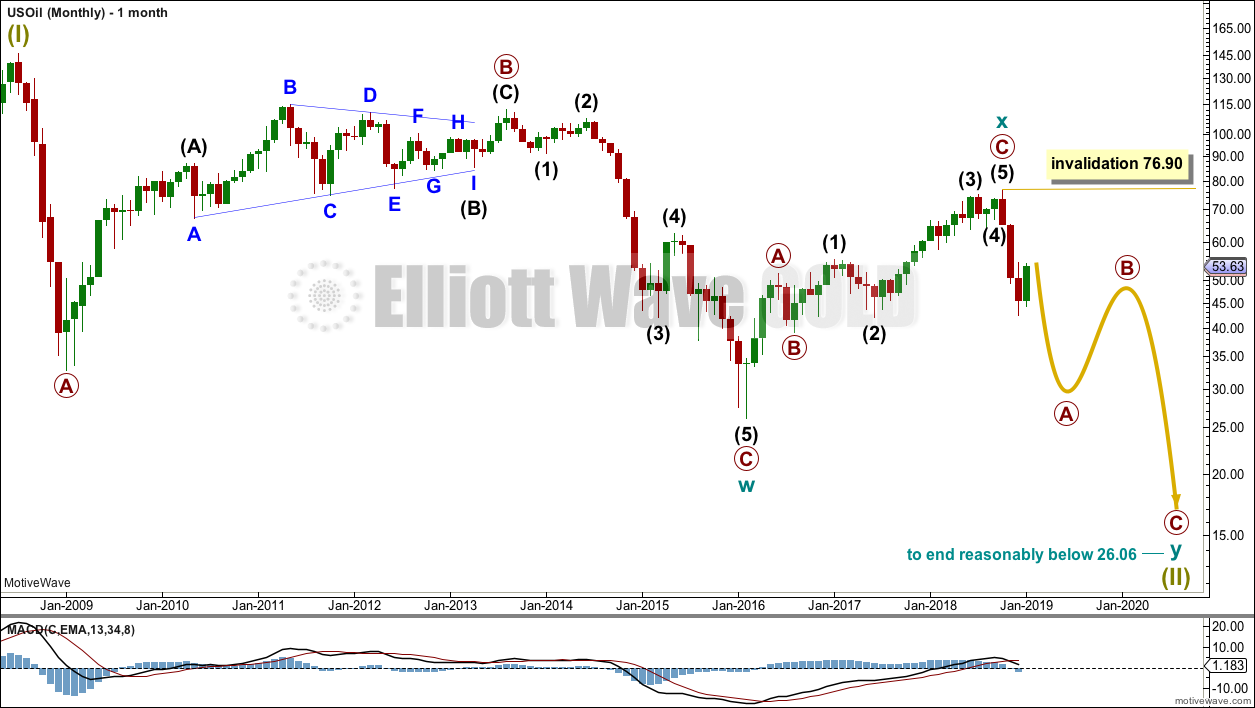

MAIN ELLIOTT WAVE COUNT

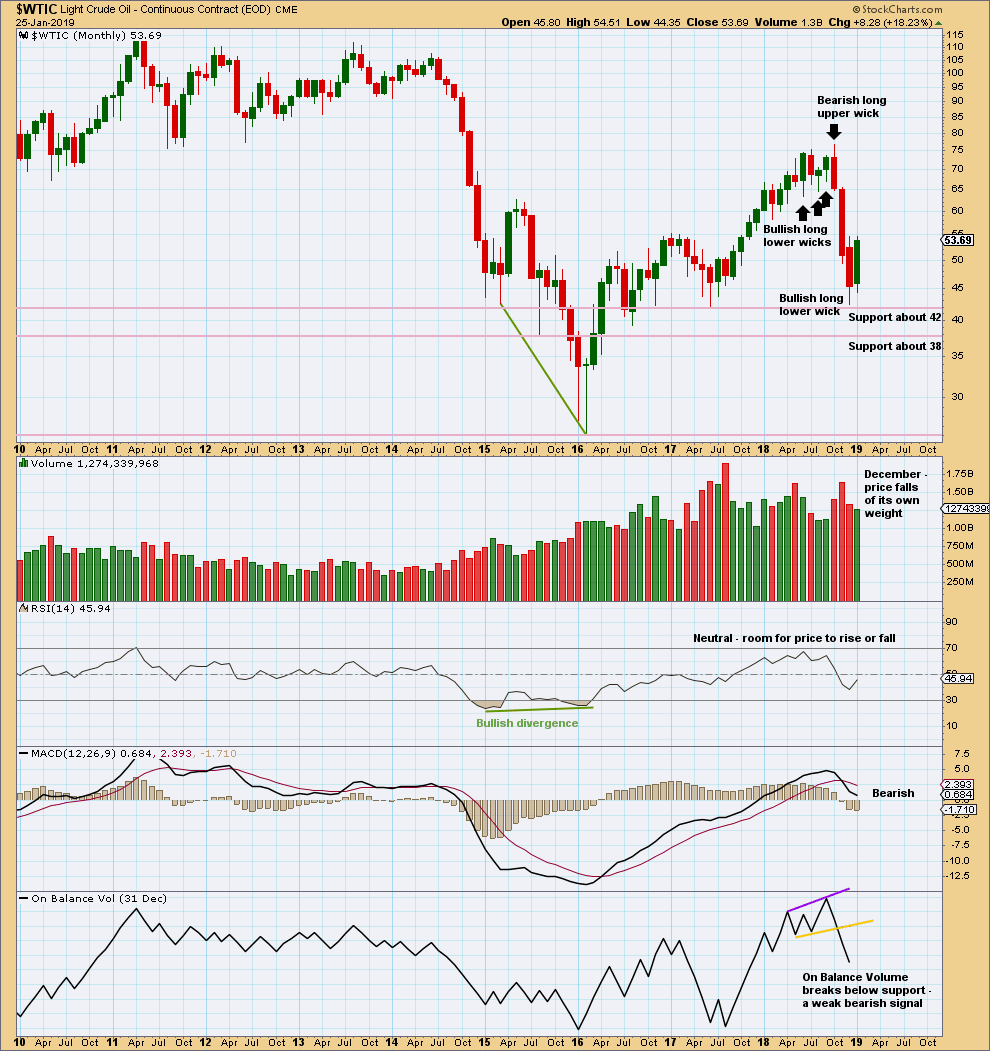

MONTHLY CHART

Classic technical analysis favours a bearish wave count for Oil at this time.

The large fall in price from the high in June 2008 to February 2016 is seen as a complete three wave structure. This large zigzag may have been only the first zigzag in a deeper double zigzag.

The first zigzag down is labelled cycle wave w. The double is joined by a now complete three in the opposite direction, a zigzag labelled cycle wave x.

The purpose of a second zigzag in a double is to deepen the correction when the first zigzag does not move price deep enough. Cycle wave y would be expected to move reasonably below the end of cycle wave w to deepen the correction. Were cycle wave y to reach equality with cycle wave w that takes Oil into negative price territory, which is not possible. Cycle wave y would reach 0.618 the length of cycle wave w at $2.33.

A better target calculation would be using the Fibonacci ratios between primary waves A and C within cycle wave y. This cannot be done until both primary waves A and B are complete.

Within cycle wave y, no second wave correction nor B wave may move beyond its start above 76.90.

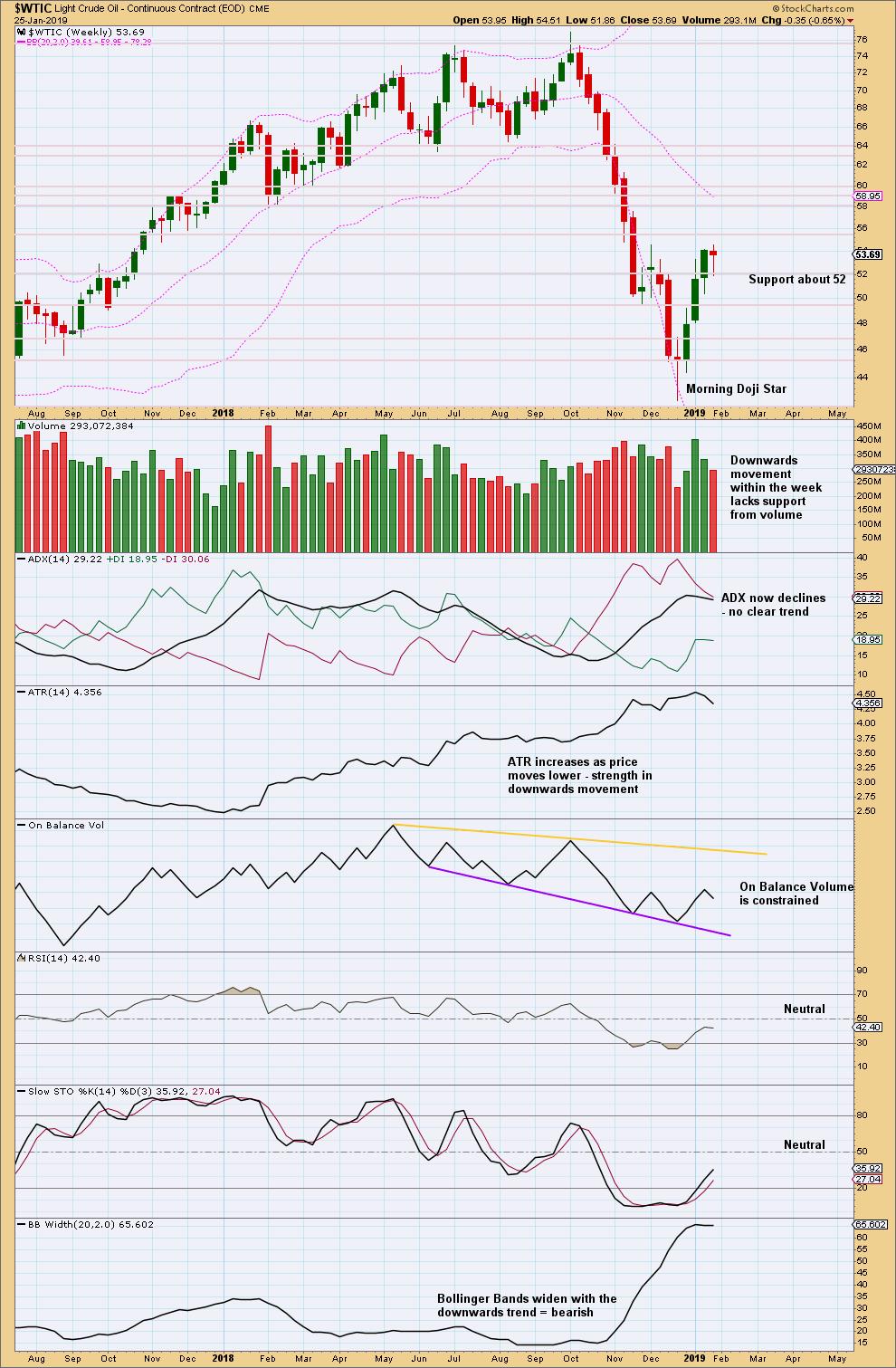

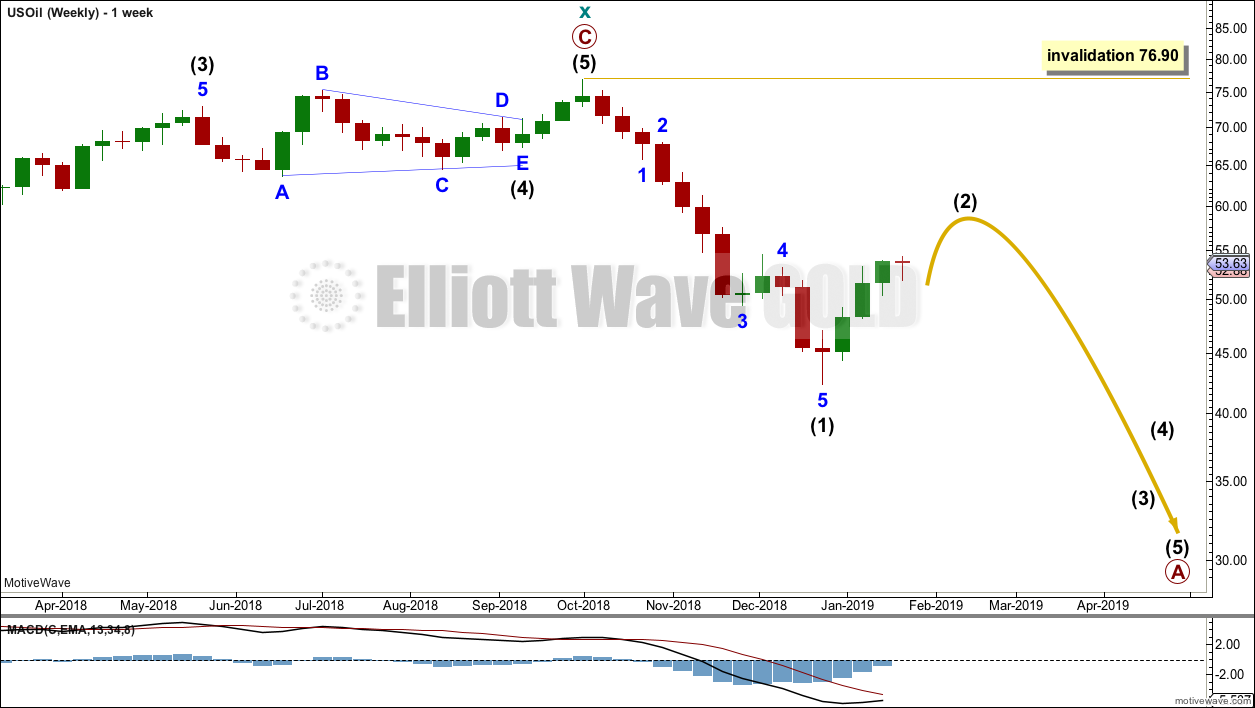

WEEKLY CHART

This weekly chart is focussed on the start of cycle wave y.

Cycle wave y is expected to subdivide as a zigzag. A zigzag subdivides 5-3-5. Primary wave A must subdivide as a five wave structure if this wave count is correct.

Within primary wave A, intermediate wave (1) may now be complete. Intermediate wave (2) may unfold over a few weeks as a sideways choppy consolidation, or a deep sharp bounce. At this stage, it looks more likely to be a deep bounce.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 76.90.

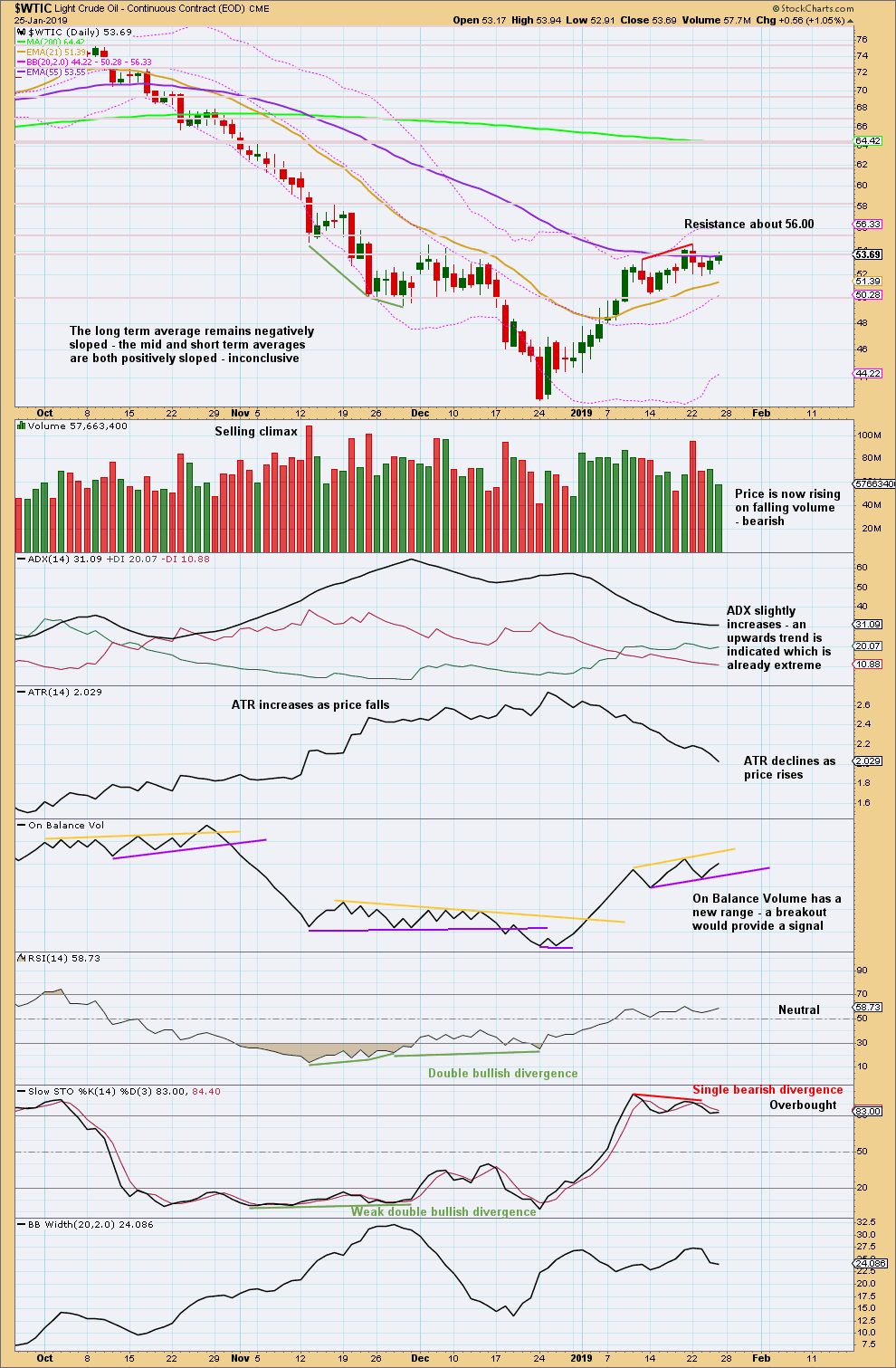

DAILY CHART

Intermediate wave (2) would most likely subdivide as a zigzag and at this stage that is how it will be labelled. However, it may also subdivide as a flat or combination. It is impossible at this stage to know which structure it will unfold as. The labelling within it may change as it unfolds.

If intermediate wave (2) is unfolding as a zigzag, then within it minor wave A must subdivide as a five wave structure. Minor wave A may now be a complete impulse.

A channel is drawn about minor wave A. This channel is this week breached by downwards movement and that may be taken as an indication that minor wave A may be complete and minor wave B may have begun.

Minor wave B may not move beyond the start of minor wave A below 42.37.

Minor wave B may be a complicated sideways correction that does not look complete at this stage. It may be expected to continue sideways or lower next week.

Intermediate wave (2) may be very deep.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 76.90.

TECHNICAL ANALYSIS

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Lower volume and a slightly bullish long lower wick for December add a little support to the Elliott wave count.

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week saw a higher high and a higher low, but the balance of volume was downwards. Within the week, price fell of its own weight.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

For the short term, a lack of volume suggests upwards movement may be limited here.

—

Always practice good risk management as the most important aspect of trading. Always trade with stops and invest only 1-5% of equity on any one trade. Failure to manage risk is the most common mistake new traders make.

For US Oil:

I’m now waiting for this session for Friday to close to get volume data. If today shows strength I’ll label minor B as over.

But if there is any weakness in this session it may be minute b within minor B, and minor B may be continuing as an expanded flat. Those are fairly common structures.

My main count for Gold right now expects an imminent reversal.

But the trend remains the same, until proven otherwise.

What I’m looking for now to have confidence in the main wave count for Gold (the triangle on the weekly chart) is one or more of the following:

1. A candlestick reversal pattern on the daily chart.

2. A breach of the blue channel on the daily chart by downwards movement.

3. A new low by any amount at any time frame below 1,276.84.

While none of these things are seen, please assume the trend for Gold remains up. Use the next target at 1,338.

If we get signs of a reversal before the target is met, then the target would obviously be discarded.

Hi Lara,

Weve passed the 1314 target for gold this morning. How does the shape look at this point? Are we changing the target to 1338?

Cheers,

Jiten

Right now as I watch Gold, I’m looking at resistance just ahead at the blue trend channel.

That would see Gold reach a high about 1,320. Which is neither of my targets.

Draw the channel carefully on the daily chart as I’ve shown. Look out for a potential sharp reversal shortly when price meets it.

Price is now well above the blue line. This could be an overshoot for a fifth wave?

The bottom line though right now is that Gold is in an upwards trend. The trend is your friend. Assume the trend remains the same, until proven otherwise.

Still, a warning about these kinds of price shocks. They are usually sharply reversed, either mostly or in their entirety. If trading this one to the upside today please protect profits with a stop and be prepared to take profits if you see a sharp reversal.

Updated daily chart today for the S&P500:

Some developing underlying strength now suggests that a large pullback has not yet begun. It looks like a small pennant pattern (an Elliott wave equivalent is a triangle) may be unfolding.

I’m also moving the degree of labelling within cycle wave V up one degree.

A possible target for primary wave 1 to now end is about 2,809

This is still my current main wave count for the S&P everybody. The target is very slightly adjusted to 2,804.

Hi Laura, Any thoughts on GDX if it moves higher than 22.30 to 22.50 in this current uptrend. Would this change your outlook on a drop back towards 16?

A close back into that strong zone of support and resistance, above 20.80, has already changed my expectations for GDX. While it remains above 20.80 assume it may now continue higher.

If the target at 22.60 is met and price keeps on rising, then the next expectation may be for it to continue up to about 24.70 where there is strong resistance.

Laura, Thanks for your reply. So the next pullback will probably not drop down to the 15-16 level as you previously had posted correct?

If price can again close below 20.80 then another drop down to the 15 – 16 area may again be possible.

While price remains above 20.80 expect the upwards trend to continue.

Hi Lara,

Hope you are doing well…. I have a different minor wave count…. I have an extended minor 3 that ended one week ago and we are probably doing a triangle for minor wave 4… The AD line is very strong… I have minor wave 5 going to 2750-2800 where there is very strong resistance… What do you think?

Thanks very much for your hard work as always.

Mathieu

I have an alternate idea which looks at it this way. And it does look today like sideways movement may be a completing triangle for the S&P.

Here it is on an hourly chart.

I don’t like publishing hourly charts for Lara’s Weekly members, because I want Lara’s Weekly members to be focussing on the bigger picture, staying with the trend. But anyway, here it is.

If price makes a new high above 2,675.47 on an upwards day with support from volume, that would be a classic upwards breakout. If that happens, then use the target 2,809. However, also be aware that target may be too optimistic.

Thanks Lara…

Lara

Looks like S&P closed above 2675 but didn’t get support from volume or on balance volume

Comments?

Rich

Updated chart above in comments Rich.

I’ve changed the degree of labelling and added a new target.

Hi Lara, could Oil’s low today be the conclusion of Minor Wave B, or is too shallow/too early?

Jiten

It’s possible. But in my experience more patience is required for B waves. They really are the worst.

Minor B may be unfolding as a flat, labelled here. If that’s the case, then within it minute b needs to retrace a minimum 0.9 X minute wave a at 54.02.

If upwards movement in the next few days can’t reach 54.02 and price just continues sideways, then minor wave B could be a triangle.

It may also be a combination.

And that right there is the problem with B waves. There are more than 23 possible corrective structures they can take. And at this stage it’s not possible with any confidence to tell which one it is, or even if it’s over.

I don’t think it’s over yet though. That would be very quick.

I’ll keep an eye on Oil daily. If price makes a new high above the high of minor A and does so with support from volume, then I’d consider minor B could be over and minor C on up to the final target could be underway.

Essentially, an upwards breakout is needed for any confidence this small consolidation is over.

Cool, thanks Lara. Ill keep an eye on volume on any upward movements.

Lara

Can you clarify a point you made in your S&P summary? You said the 2nd wave correction could be a sideways movement or a deeper pullback to 2272. That would be below the start of the first wave so can we assume you meant 2372 for this imminent pullback?

Thanks

Rich

I’m really sorry Rich. I’ve made a mistake. A deeper second wave correction may end about 2,472. Not 2,272