Downwards movement has continued exactly as the preferred Elliott wave count expected for the week.

Summary: The long term target is now calculated at 473. Confidence in this target may be had with a new low below 1,160.75.

For the short term, expect downwards movement to continue next week. It may exhibit increased momentum and strength.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts is here.

MAIN ELLIOTT WAVE COUNT

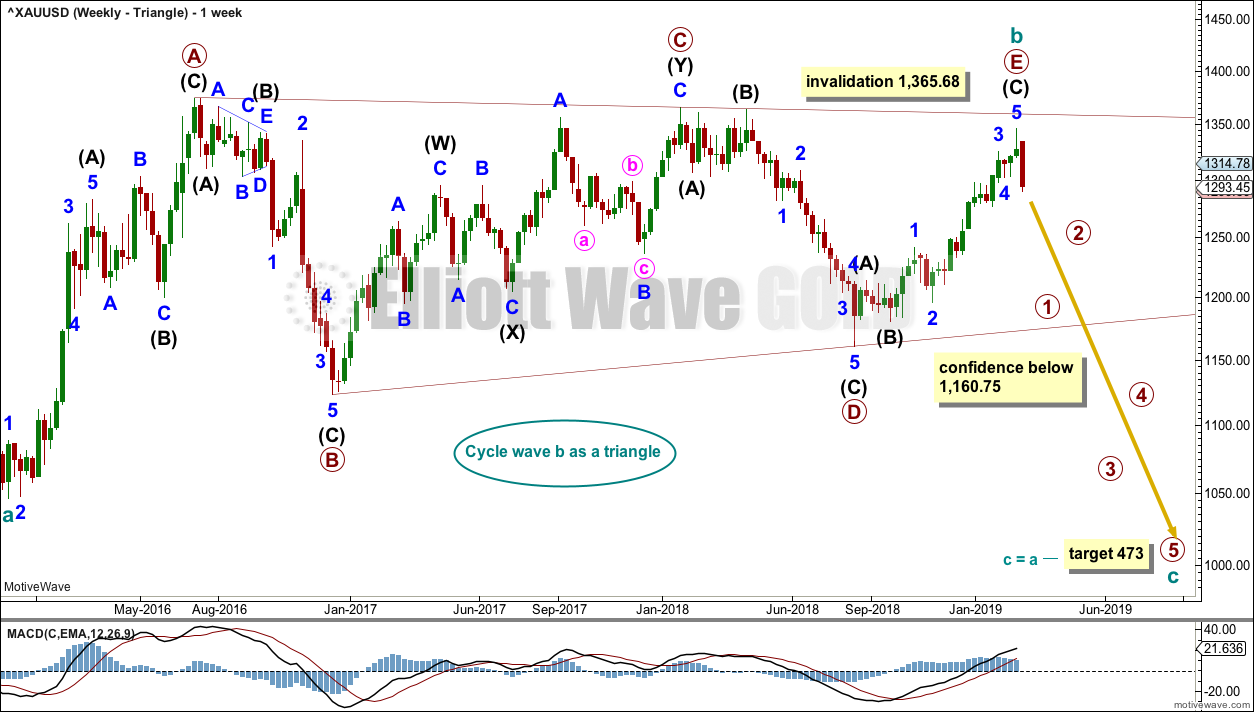

WEEKLY CHART – TRIANGLE

This is the preferred wave count.

Cycle wave b may be a complete regular contracting triangle. If it continues further, then primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

This wave count would expect a cycle degree trend change has just occurred. Cycle wave c would most likely make new lows below the end of cycle wave a at 1,046.27 to avoid a truncation.

Primary wave E should exhibit reasonable weakness as it comes to an end. Triangles often end with declining ATR, weak momentum and weak volume.

If this weekly wave count is correct, then cycle wave c downwards should develop strength, ATR should show some increase, and MACD should exhibit an increase in downwards momentum.

A target is calculated for cycle wave c that expects to exhibit the most common Fibonacci ratio to cycle wave a.

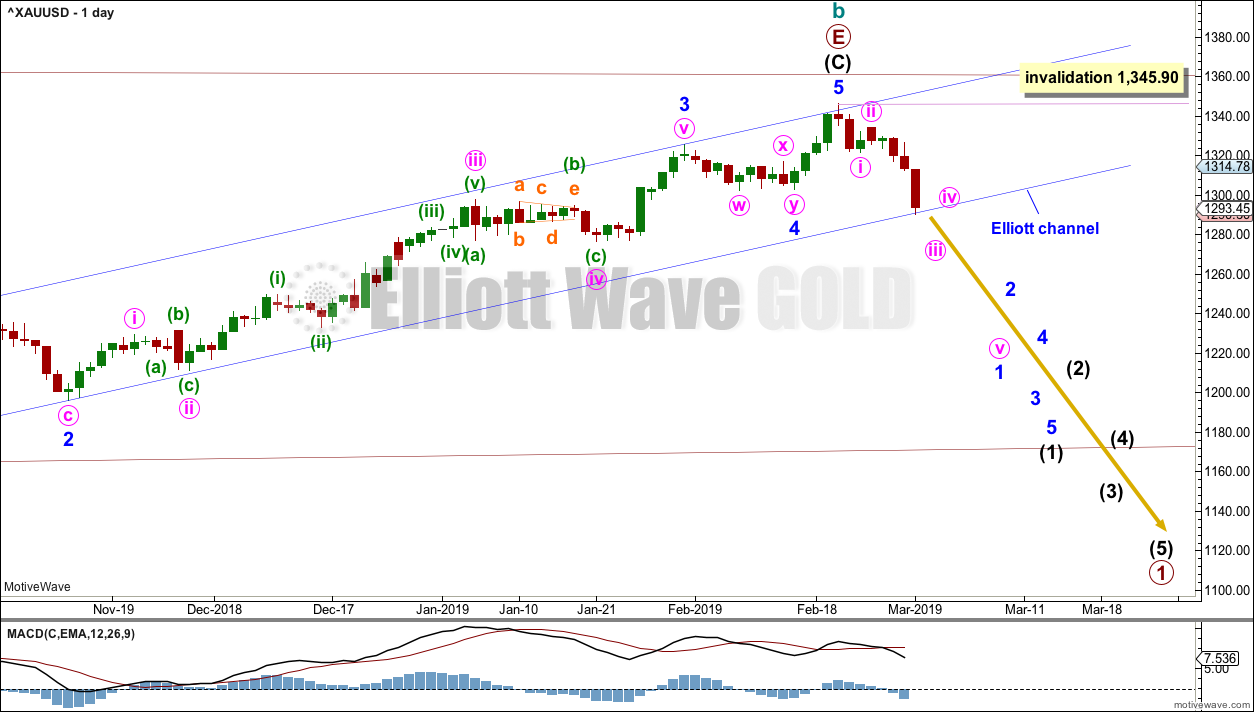

DAILY CHART – TRIANGLE

The remaining two things are now required for confidence in this wave count:

1. A new low below support at 1,300 – this has occurred on Friday but only by the smallest of margins.

2. A breach of the blue Elliott channel.

Classic analysis at the end of this week offers good support to this wave count, so some confidence may be had in it.

Cycle wave c must subdivide as a five wave structure, either an impulse or an ending diagonal. An impulse is much more common and that shall be how it is labelled unless overlapping suggests a diagonal should be considered.

A new trend at cycle degree should begin with a five wave structure on the daily chart, which will be labelled minor wave 1. When minor wave 1 is complete, then minor wave 2 may not move beyond its start above 1,345.90.

A small bounce may develop at the lower edge of the blue channel. If price breaks below the blue channel, then another bounce may test resistance at the lower edge.

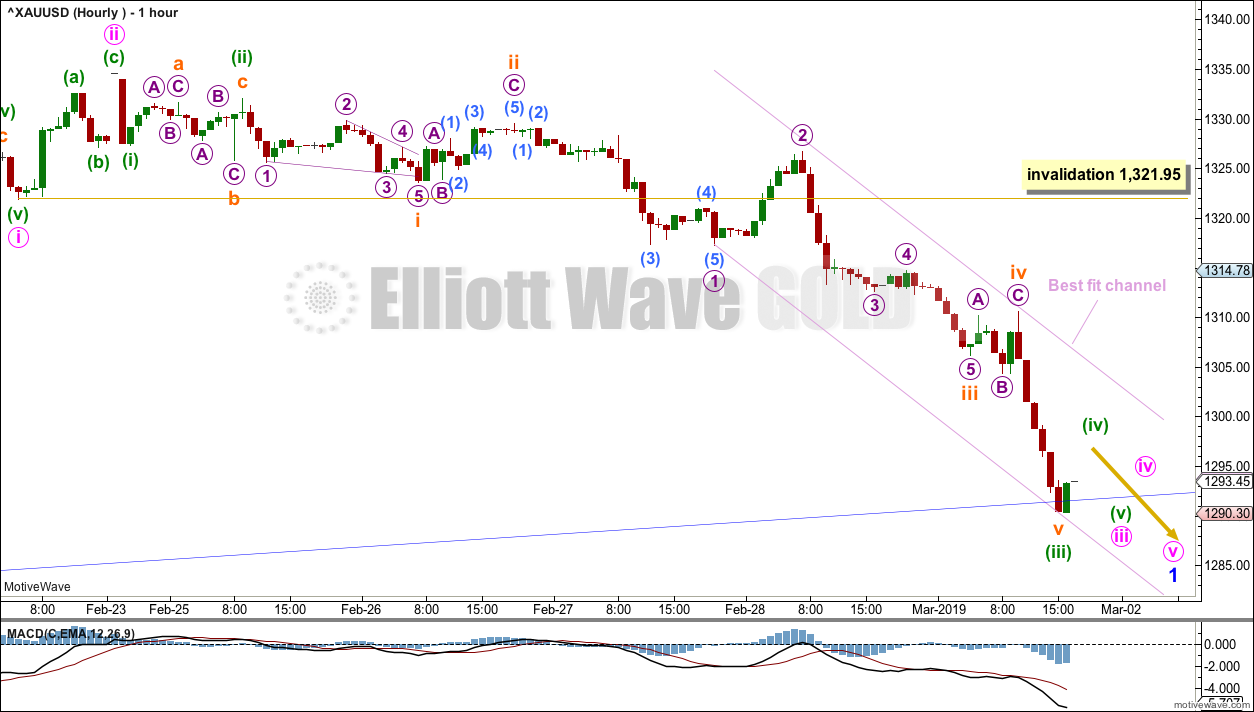

HOURLY CHART

Minute waves i and ii may be complete.

At 1,295 minute wave iii would reach 1.618 the length of minute wave i. Minute wave iii has now passed this target. It may end soon, or it may not exhibit a Fibonacci ratio to minute wave i.

Minute wave iv may not move into minute wave i price territory above 1,321.95.

A narrow best fit channel is drawn about the steepest portion of downwards movement as a short-term guide to where bounces may find resistance. If this channel is breached by upwards movement, that may indicate minute wave iii as over and minute wave iv as underway.

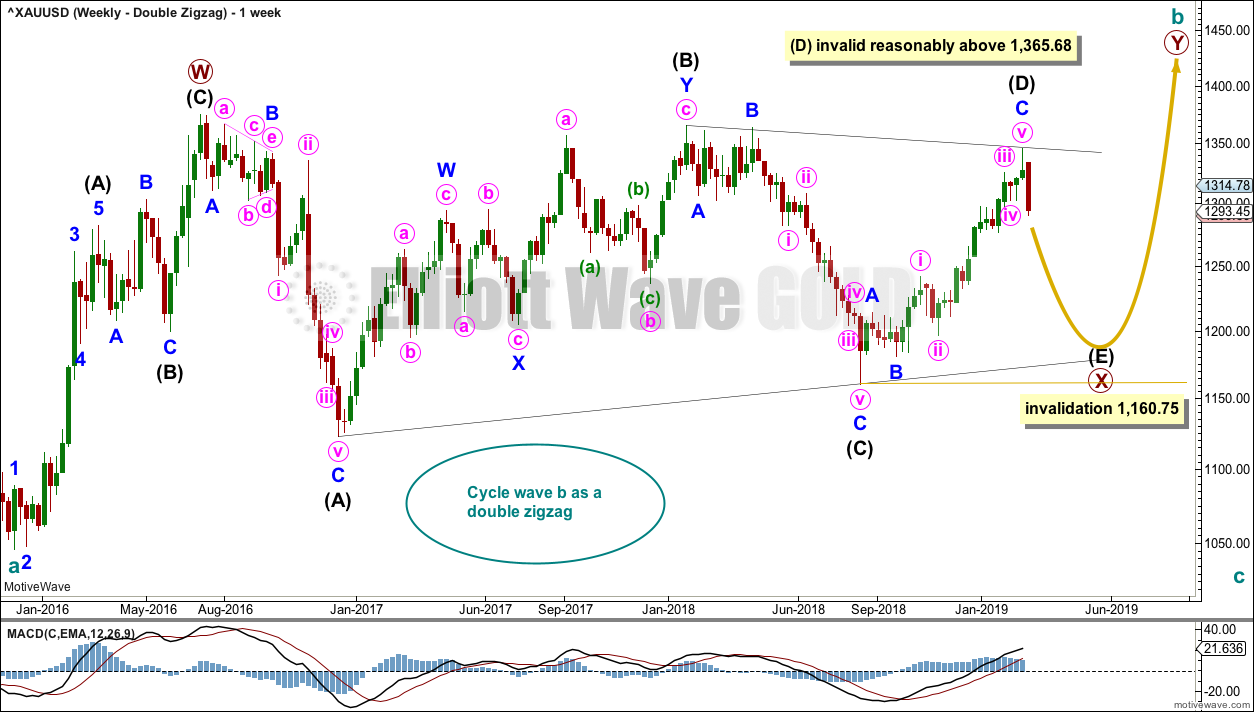

WEEKLY CHART – DOUBLE ZIGZAG

It is possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about four fifths complete.

Within multiples, X waves are almost always zigzags and rarely triangles. Within the possible triangle of primary wave X, it is intermediate wave (B) that is a multiple; this is acceptable, but note this is not the most common triangle sub-wave to subdivide as a multiple. These two points reduce the probability of this wave count.

Intermediate wave (D) may be complete. The (B)-(D) trend line is almost perfectly adhered to with the smallest overshoot within intermediate wave (C). This is acceptable.

Intermediate wave (E) should continue to exhibit weakness: ATR should continue to show a steady decline, and MACD may begin to hover about zero.

Intermediate wave (E) may not move beyond the end of intermediate wave (C) below 1,160.75.

This wave count may now expect downwards movement for several weeks.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

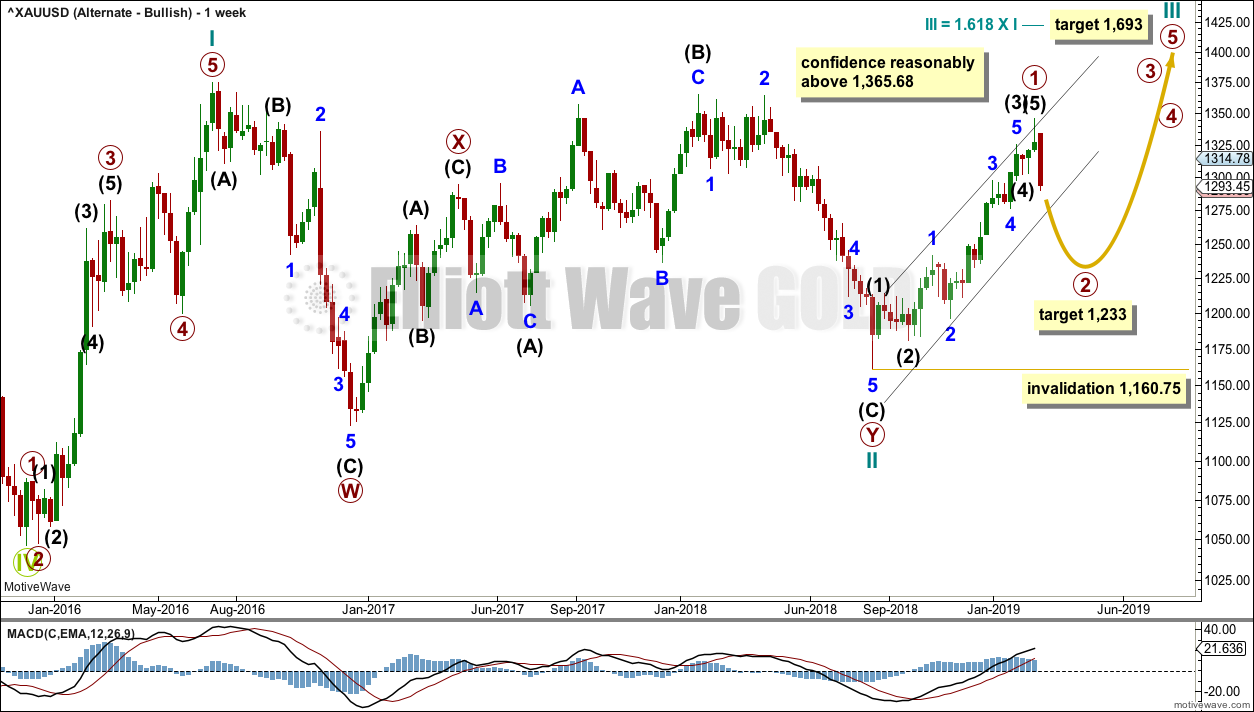

WEEKLY CHART – ALTERNATE BULLISH

Because the preferred wave count is at a critical juncture in expecting a cycle degree trend change, it is time to consider an alternate which expects the continuation of the an upwards trend.

It is possible that the low in December 2015 was the end of a bear market and that Gold has been in a basing action for the past three years. Downwards movement to that low will subdivide as a double zigzag, a corrective structure.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. The probability of this wave count is low due to this problem.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary wave 1 may now be complete. The target for primary wave 2 is the 0.618 Fibonacci ratio of primary wave 1. Primary wave 2 may not move beyond the start of primary wave 1 below 1,160.75.

A black channel is drawn about primary wave 1. Primary wave 2 may breach the lower edge of this channel.

Cycle wave III so far for this wave count would have been underway now for 27 weeks. It should be beginning to exhibit some support from volume, increase in upwards momentum and increasing ATR. However, volume continues to decline, ATR continues to decline and is very low, and momentum is weak in comparison to cycle wave I. This wave count lacks support from classic technical analysis.

TECHNICAL ANALYSIS

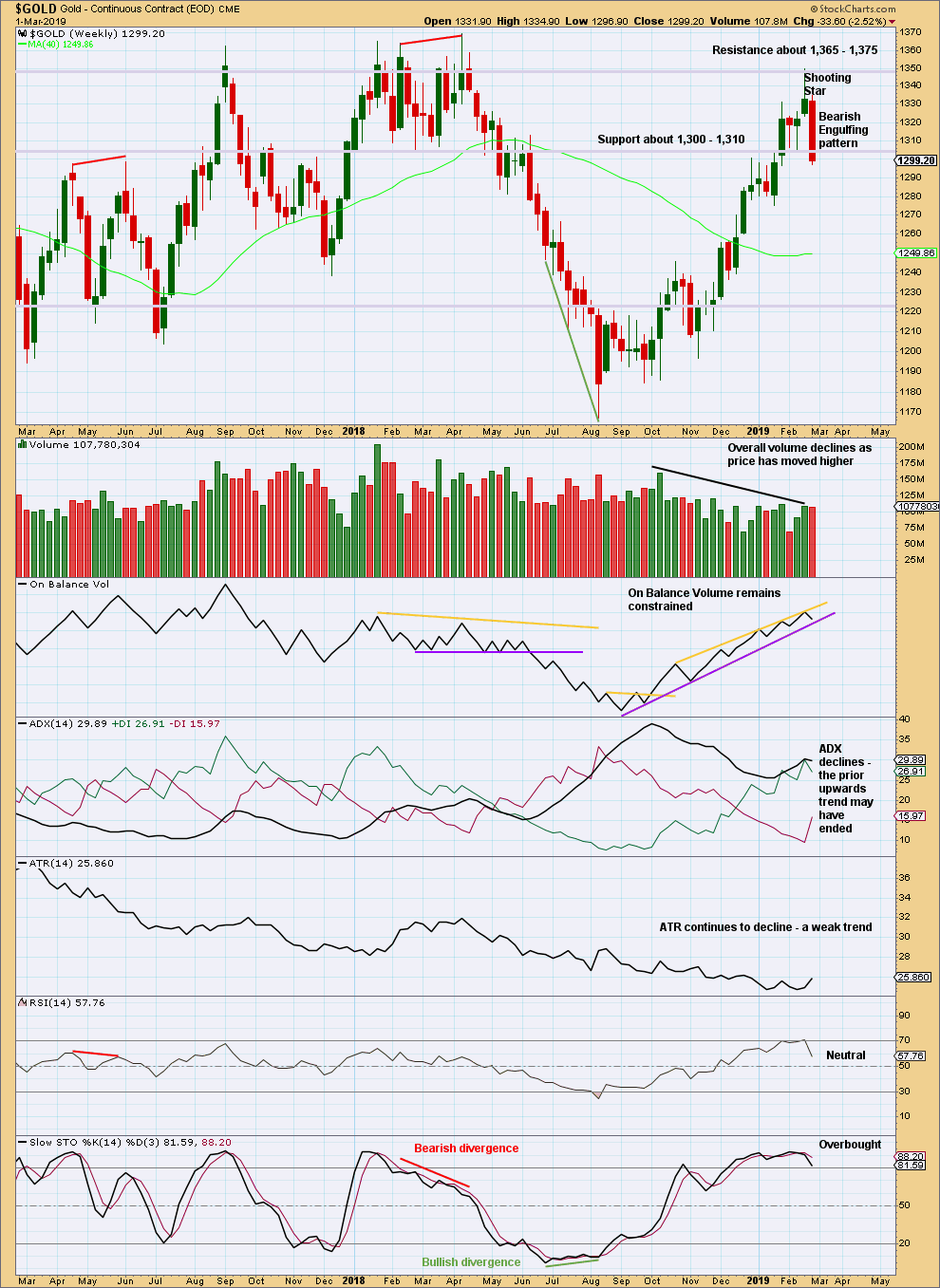

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are now two bearish candlestick reversal patterns on the weekly chart: a Shooting Star and a Bearish Engulfing pattern. This supports the view that a high is in place.

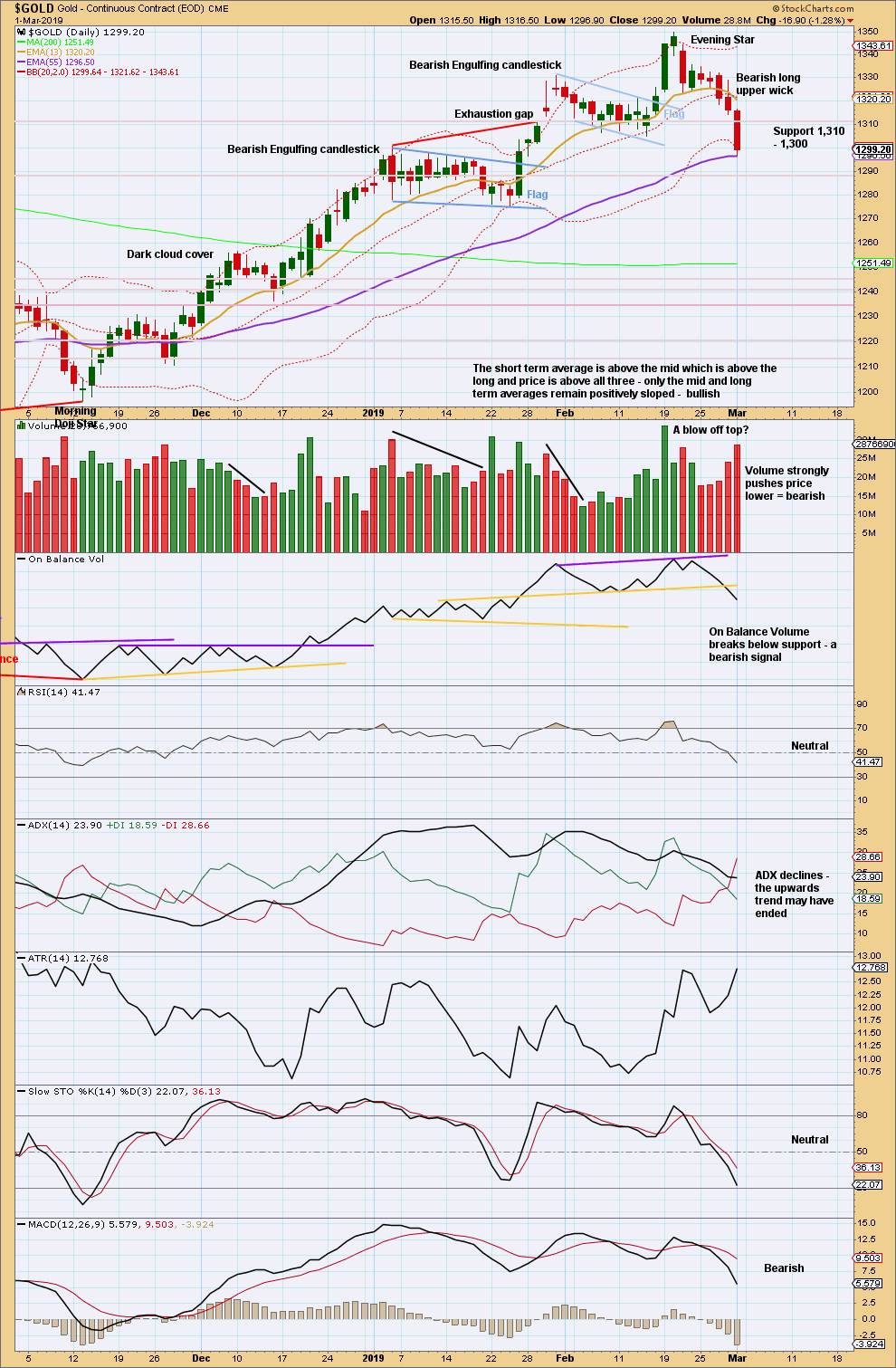

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The Evening Star reversal pattern indicates a trend change here to either down or sideways.

Price has closed below support at 1,300 but only just.

On Balance Volume has broken below support. This is a strong signal to offer support to the Elliott wave analysis.

After very strong volume on Friday, look for a small sideways movement about here before downwards movement resumes.

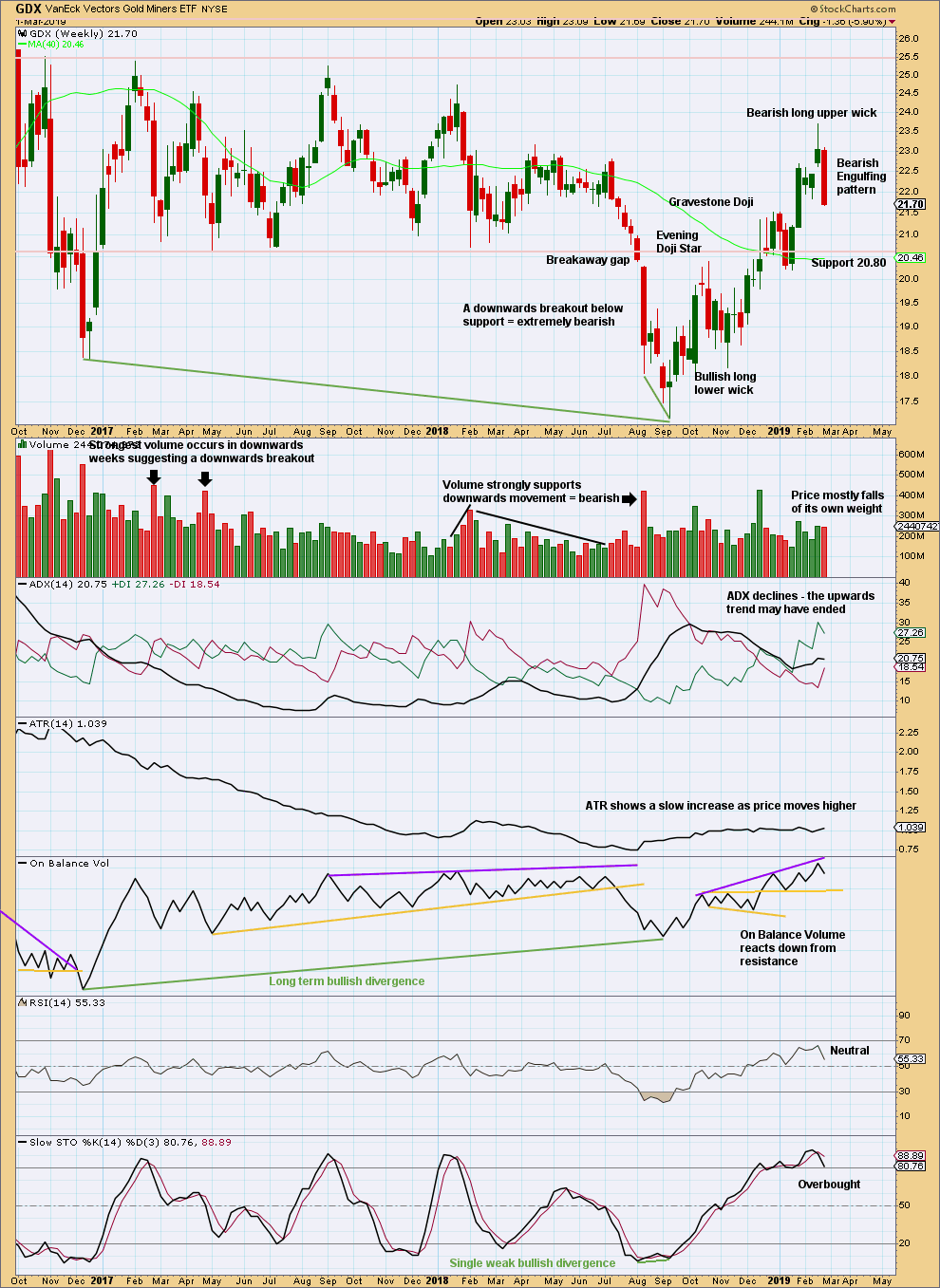

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The Bearish Engulfing pattern at the weekly chart level should be given weight in this analysis this week. It signals an end to the upwards trend and a new downwards or sideways trend.

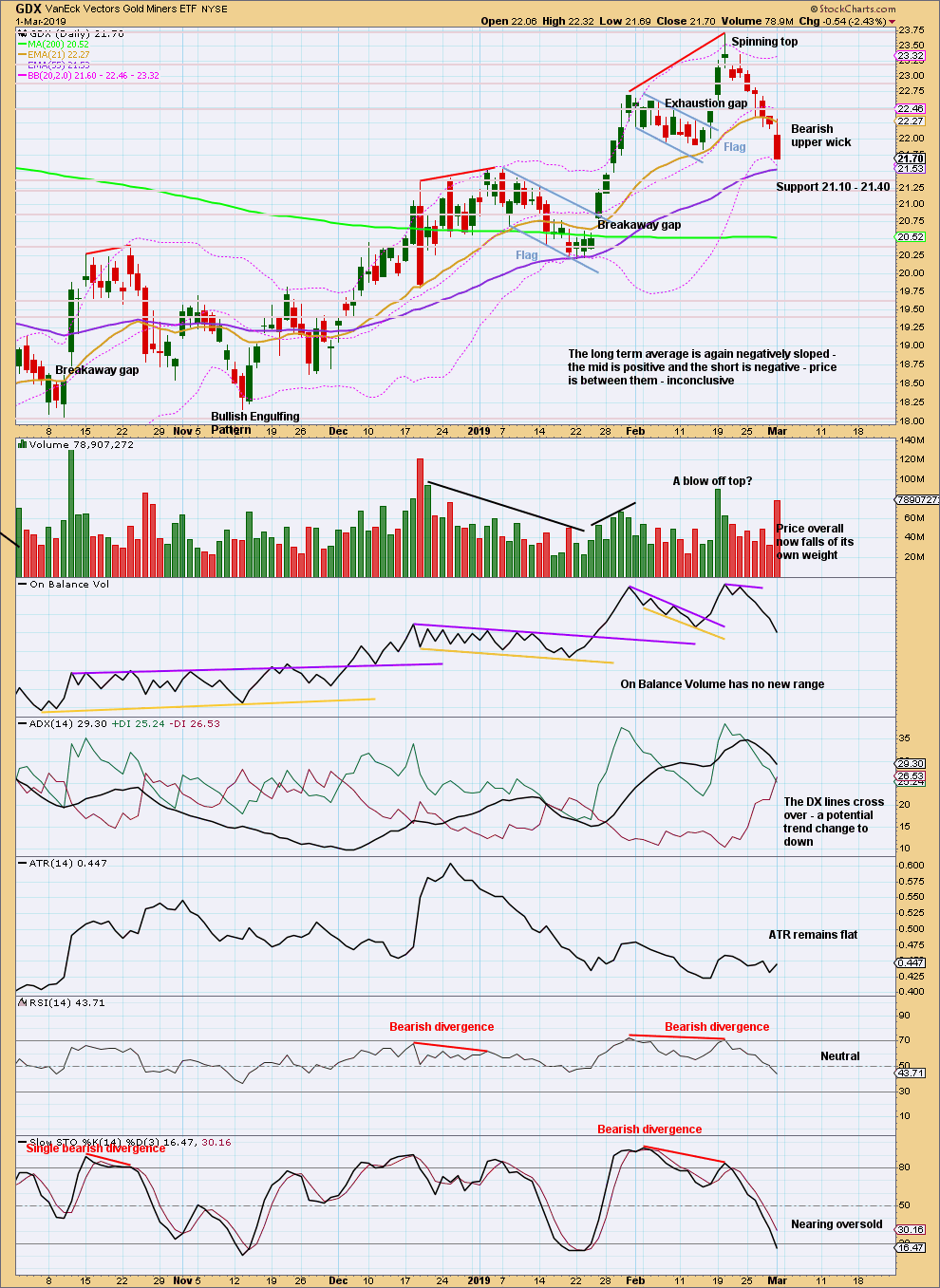

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A long upper wick and a close almost at the low for Friday’s session indicate more downwards movement may begin next week.

Look for next support about 21.40 to 21.10.

Published @ 08:48 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Hourly chart updated:

Now that the blue channel is breached, price may find resistance about that area. I don’t think it will be perfect because minuette (iv) moved back above then below the trend line.

Lara- There is no one out there in gold market will trust the 473 target as a reasonable forecast!!! (emotional belief)

Yes key trigger is gold below 1160 which is only 10% lower from current price.

Choice to make: Liquidate every thing in gold or stay aboard till 1160 is breached and incur additional loses.

My memory serves me that in 1976 I liquidated gold at low (240) and then watched gold make new high from outside. Market would not let any one in.

GSR has been staying in the trading range which is bearish for gold. Even though miners moved higher GSR did not break or confirmed the bullishness of PM sector.

In alt count WXY probably can be label differently, because triangles can only appear in B and 4th waves. Ie, X waves are NOT included. So W is A, and Y is C wave.”

Just the ???

I know. 473 is really low, and I am aware that when that number becomes public I may receive some… ridicule.

But it is what it is. That’s the simple math.

There’s another choice. To go short. Some trading accounts allow you to do it. I can via CFD’s on my CMC account. There are others.

X waves can be any corrective structure, including triangles…

I’d sell my house to all in gold if it drops below $1000 lol

473… wow! I guess we should wait until the confidence point of 1,160.75 is broken, then it would be nice to see the monthly and Grand Supercycle charts updated. Really interested to see where 473 would come in on the Grand Supercycle channel? Kinda looks like that would be below the long term channel you have drawn.

If this is true than Lara should include this report in Historical section as a major turning week for gold.???

Yes. But it should have monthly charts for that section, so I’ll update them later this week, probably end of week to be included in Lara’s Weekly for them as well and so I do a video with them.

That’s a good point. I think it’s time to update the monthly charts and take a look.

Fourth waves aren’t always contained in channels though, so a potential channel breach isn’t a reason to discard the idea.

Thanks. Plus it is a major milestone in EW count triangle wave completion of dreadful wave b.

Hopefully cycle wave c will be quick and swift to below 1045.