More upwards movement was expected. The last daily candlestick makes a higher high and a higher low, which fits this expectation.

Summary: There is strength in this upwards movement. The Elliott wave count now expects it to continue to end slightly above 1,346.45 in a few weeks time.

A mid-term target is now at 1,324 where a consolidation within the new upwards trend may develop.

Thereafter, a new large downwards trend may develop.

Grand SuperCycle analysis is here.

Last monthly charts are here. Video is here.

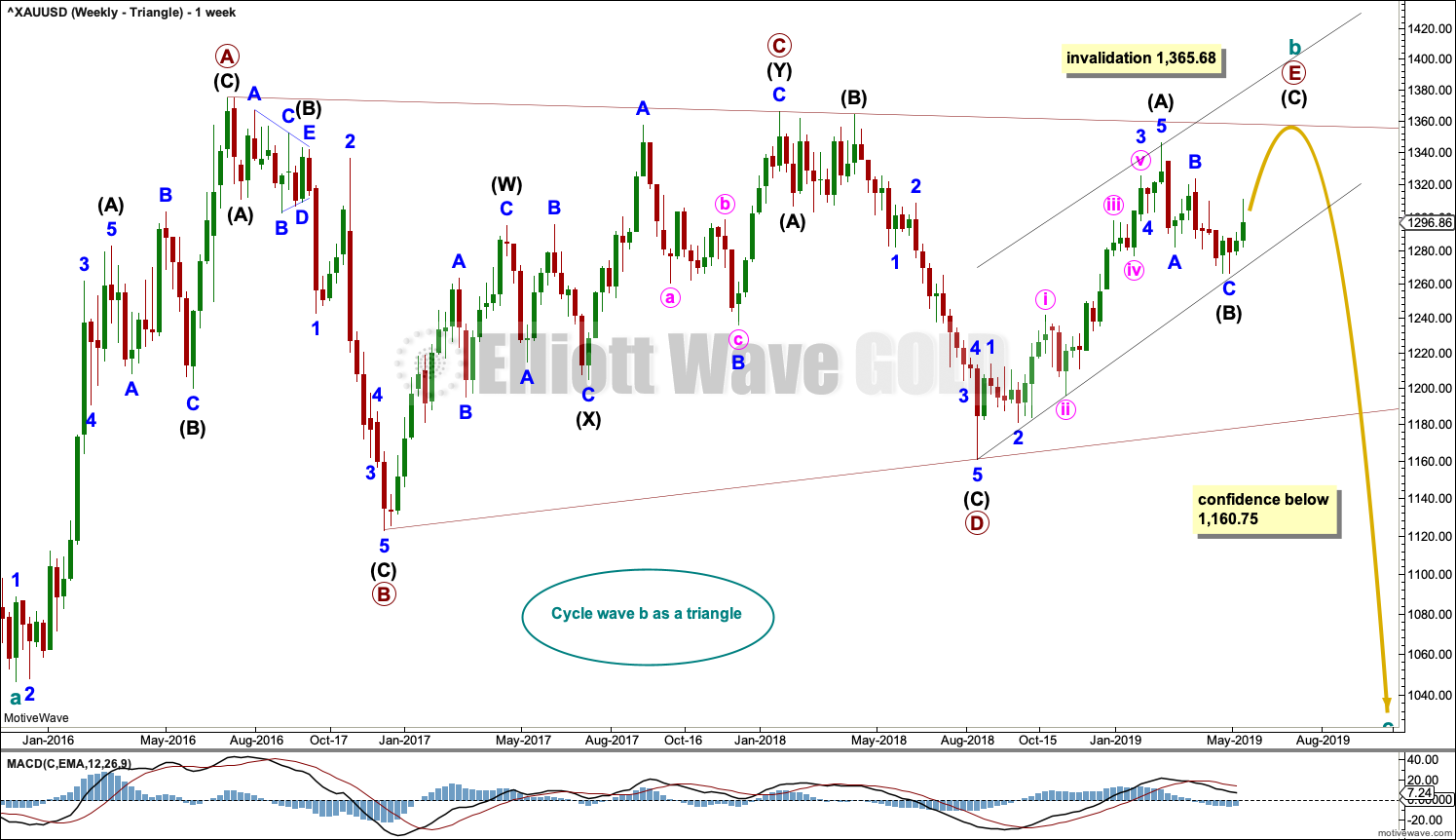

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART – TRIANGLE

The basic Elliott wave structure is five waves up followed by three waves back (in a bull market). At this time, the preferred Elliott wave count sees Gold as still within three waves back, which began at the all time high in September 2011.

Five waves up are labelled 1,2,3,4,5. Three waves back are labelled A,B,C.

This wave count sees Gold as now about two thirds through the three waves back. The three wave structure is labelled cycle waves a, b and c.

The triangle for cycle wave b may still be incomplete. The final sub-wave of primary wave E may be an incomplete zigzag. Within the zigzag of primary wave E, intermediate wave (C) would be very likely to make at least a slight new high above the end of intermediate wave (A) to avoid a truncation.

Primary wave E may either undershoot or overshoot the A-C trend line. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

Within the five sub-waves of an Elliott triangle, one sub-wave usually subdivides as a more complicated double zigzag and the most common sub-wave to do so is wave C.

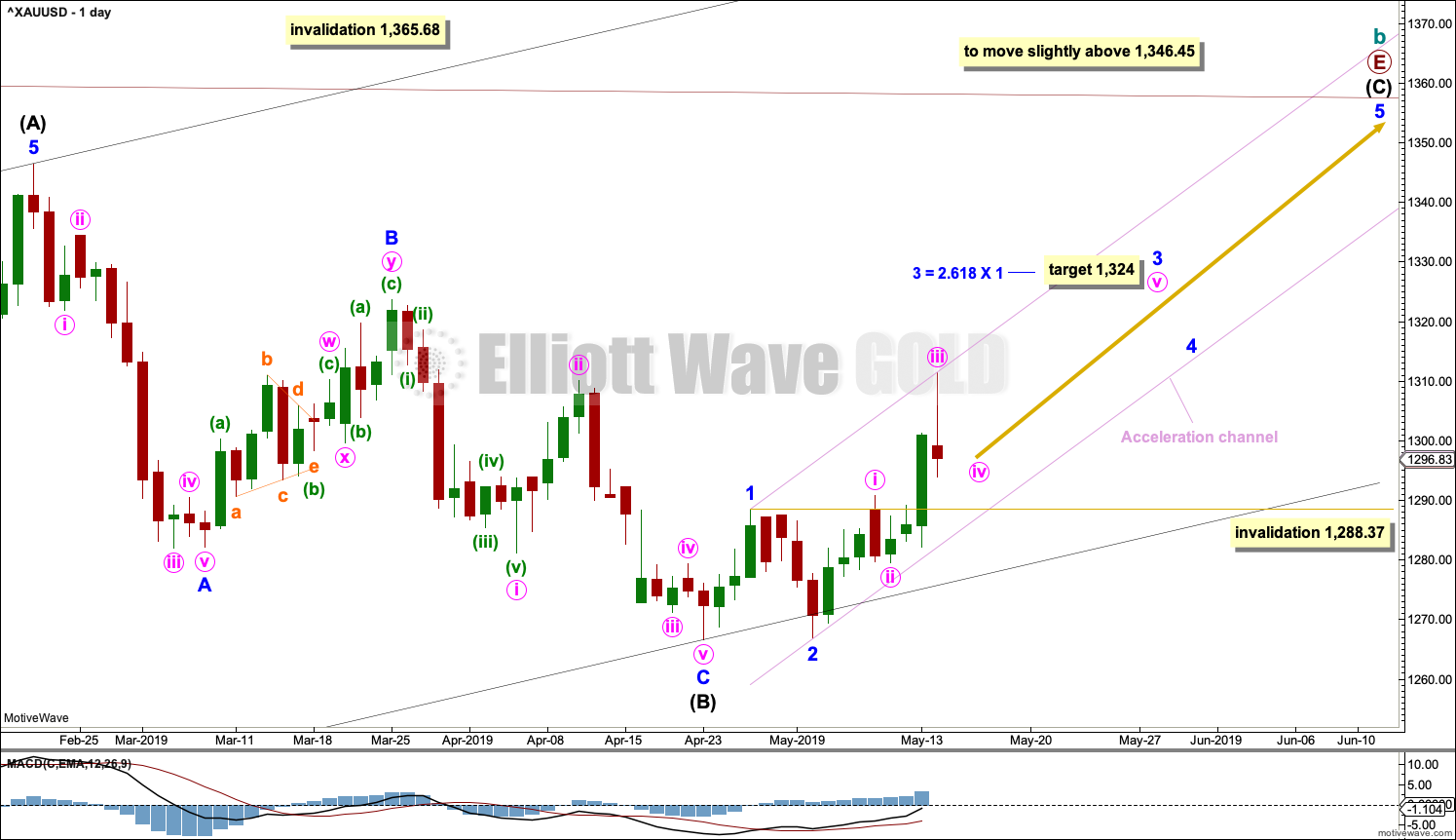

DAILY CHART – TRIANGLE

The final zigzag of primary wave E must subdivide 5-3-5. Intermediate wave (C) must subdivide as a five wave motive structure, most likely an impulse.

Within the impulse of intermediate wave (C), minor waves 1 and 2 may be complete.

Minor wave 3 may only subdivide as an impulse. A target is calculated for it to end. Minor wave 4 may not move into minor wave 1 price territory below 1,288.37.

Draw an acceleration channel about upwards movement. Draw the first trend line from the end of minor wave 1 to the last high, then place a parallel copy on the end of minor wave 2. Keep redrawing the channel as price continues higher. The lower edge may show where more time consuming consolidations or deeper pullbacks find support on the way up.

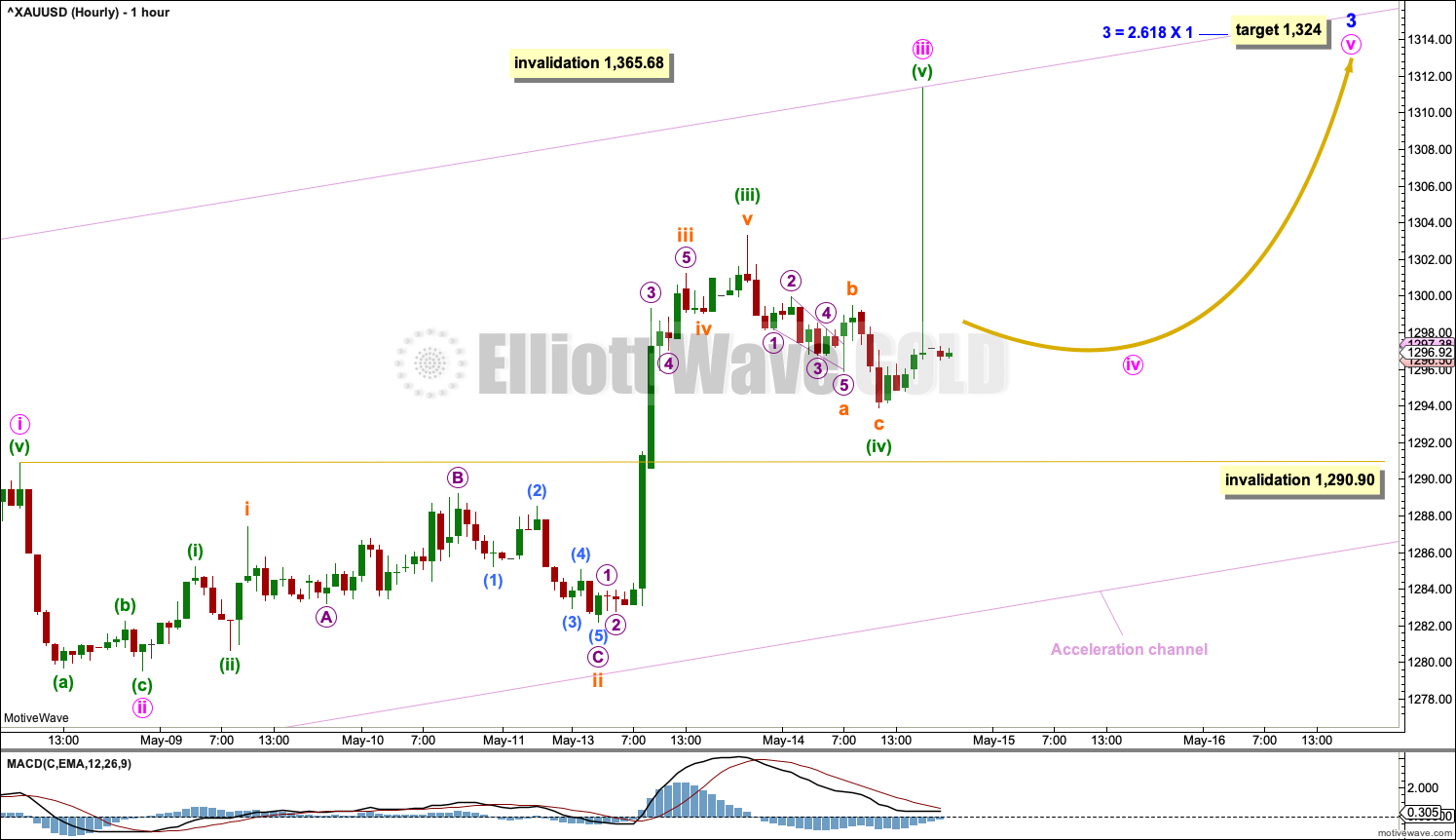

HOURLY CHART

Minor wave 3 may only subdivide as a five wave impulse. Within the impulse, minute waves i through to iii may now be complete.

Minute wave iv may not move into minute wave i price territory below 1,290.90.

It is still possible that minute wave v to end minor wave 3 may end with a blow off top.

WEEKLY CHART – DOUBLE ZIGZAG

This wave count is identical to the first weekly chart up to the low labelled cycle wave a. Thereafter, a different Elliott wave corrective structure is considered for cycle wave b.

It is possible that cycle wave b may be an incomplete double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle may be incomplete.

Within multiples, X waves are almost always zigzags and rarely triangles. Within the possible triangle of primary wave X, it is intermediate wave (B) that is a multiple; this is acceptable, but note this is not the most common triangle sub-wave to subdivide as a multiple. These two points reduce the probability of this wave count in terms of Elliott wave.

Intermediate wave (D) of a contracting triangle may not move beyond the end of intermediate wave (B) above 1,365.68.

Intermediate wave (D) of a barrier triangle may end about the same level as intermediate wave (B); as long as the (B)-(D) trend line remains essentially flat the triangle will remain valid. This is the only Elliott wave rule that is not black and white. In practice, intermediate wave (D) may end slightly above intermediate wave (B) at 1,365.68 and this wave count would remain valid.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

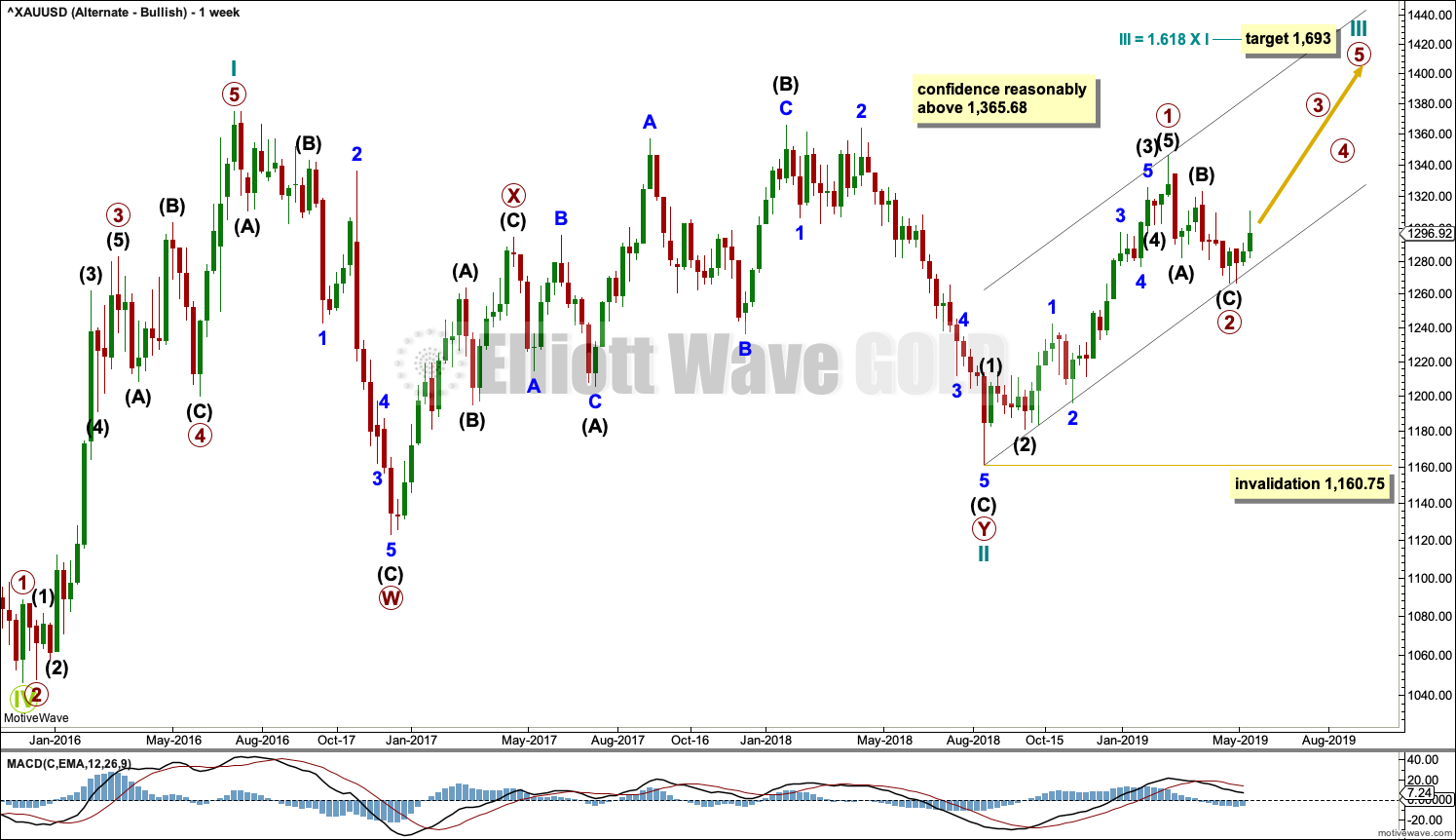

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the three waves back now complete at the last major low for Gold in November 2019.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. The probability of this wave count is low due to this problem.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. If it continues lower as a double zigzag, then primary wave 2 may not move beyond the start of primary wave 1 below 1,160.75.

Cycle wave III so far for this wave count would have been underway now for 39 weeks. It should be beginning to exhibit some support from volume, increase in upwards momentum and increasing ATR. However, ATR continues to decline and is very low, and momentum is weak in comparison to cycle wave I. This wave count lacks support from classic technical analysis.

TECHNICAL ANALYSIS

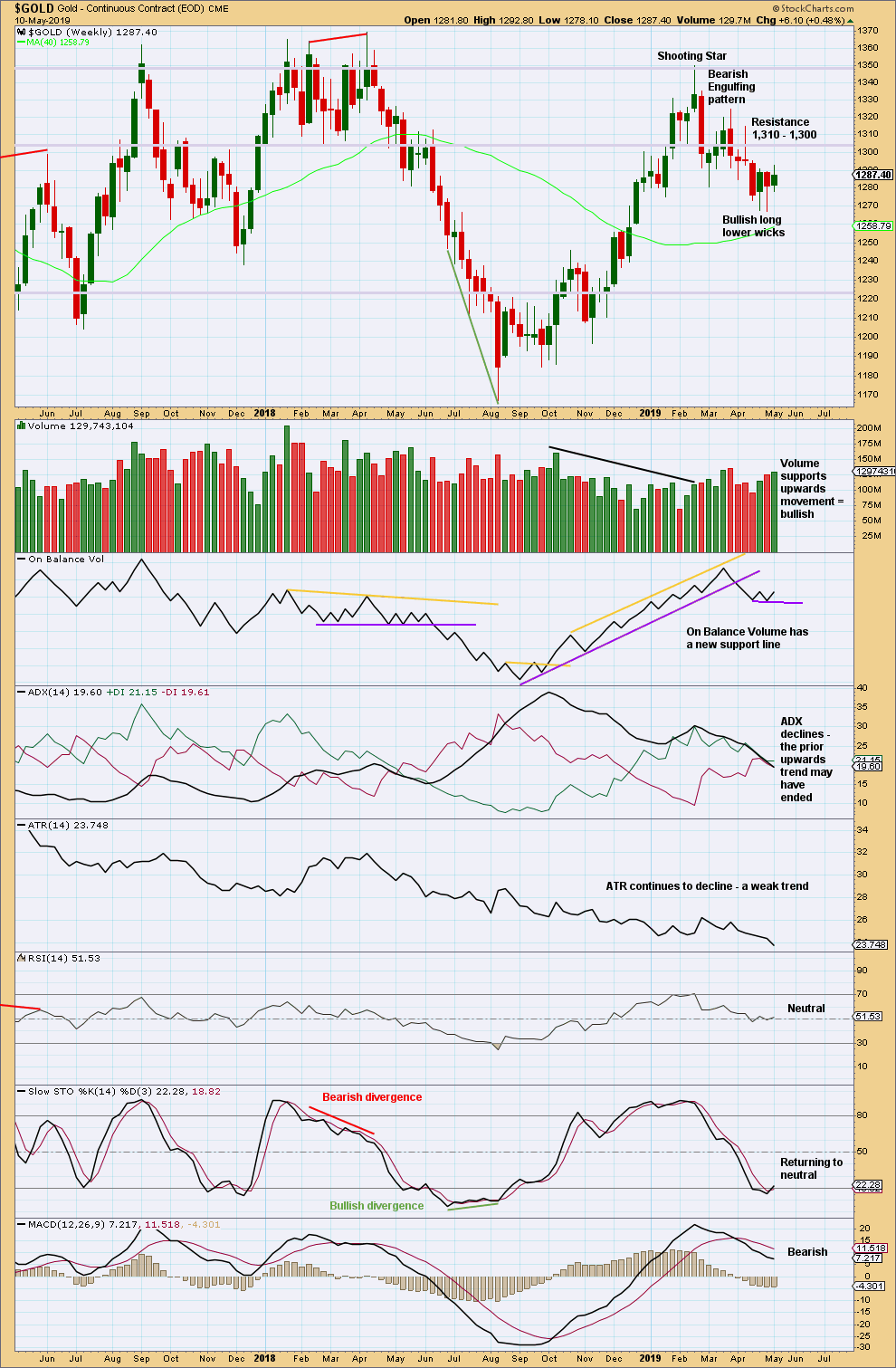

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small range week has some support from volume, but the small range and lack of any bullish candlestick pattern does not make a convincing bounce. This may be a smaller counter trend movement that may continue a little higher before it is done. However, the strong upwards day for Monday’s session now puts that view in doubt. Price is back at now weak resistance about 1,300 to 1,310.

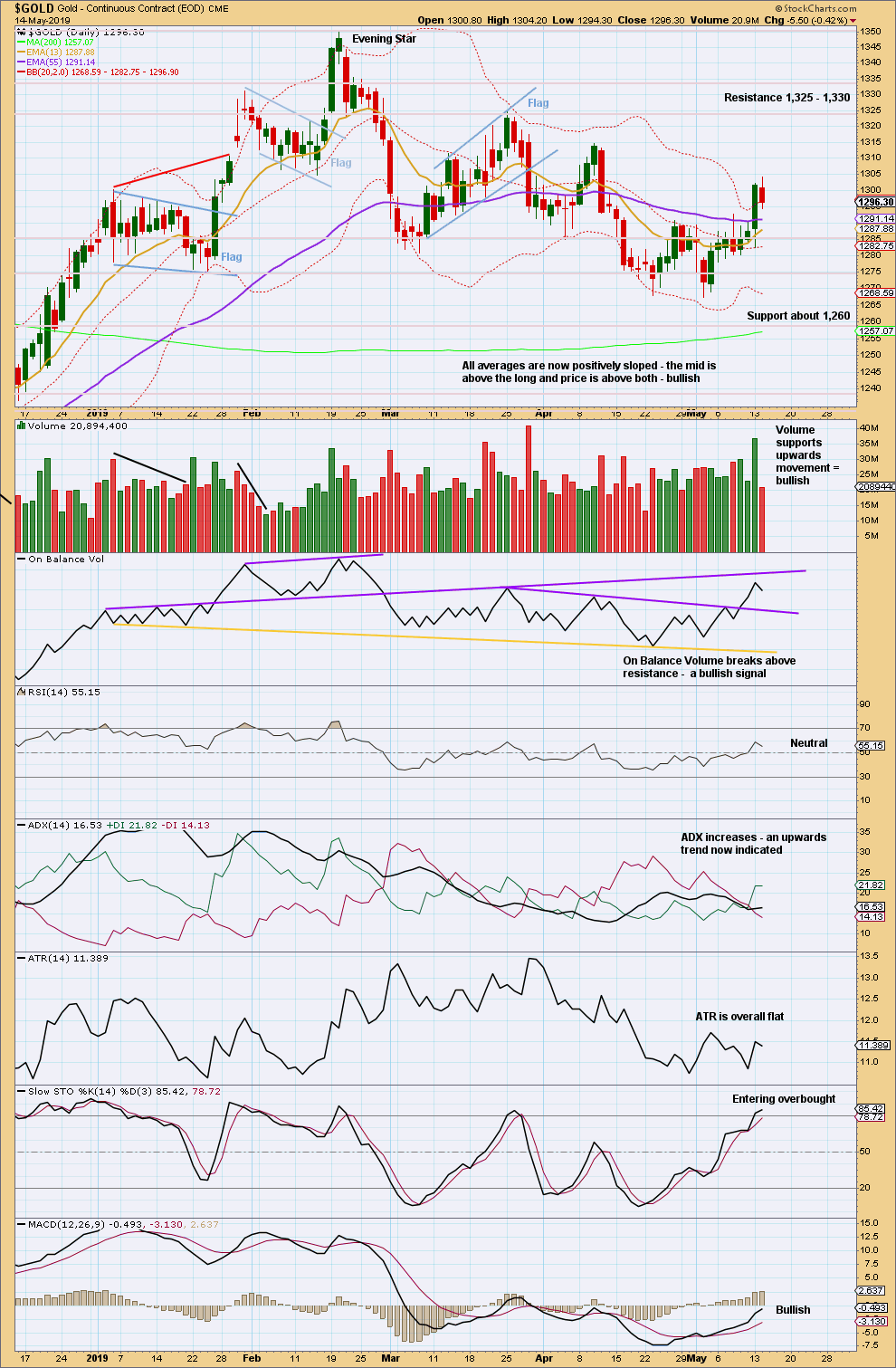

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

From August 2018 Gold moved higher with a series of higher highs and higher lows. This series remained intact until the 1st of March 2019 when a lower low was made. At that stage, it was possible that Gold had seen a trend change.

There is now a new series of three lower swing highs and three lower swing lows. While the last high of the 10th of April remains intact, a new trend change would remain possible.

ADX now indicates an upwards trend, which has support now from volume. Stochastics is nearing overbought, but it may remain so for a reasonable period of time when this market trends.

Price is now at weak resistance about 1,300 to 1,310. Next reasonable resistance above is about 1,330 to 1,325.

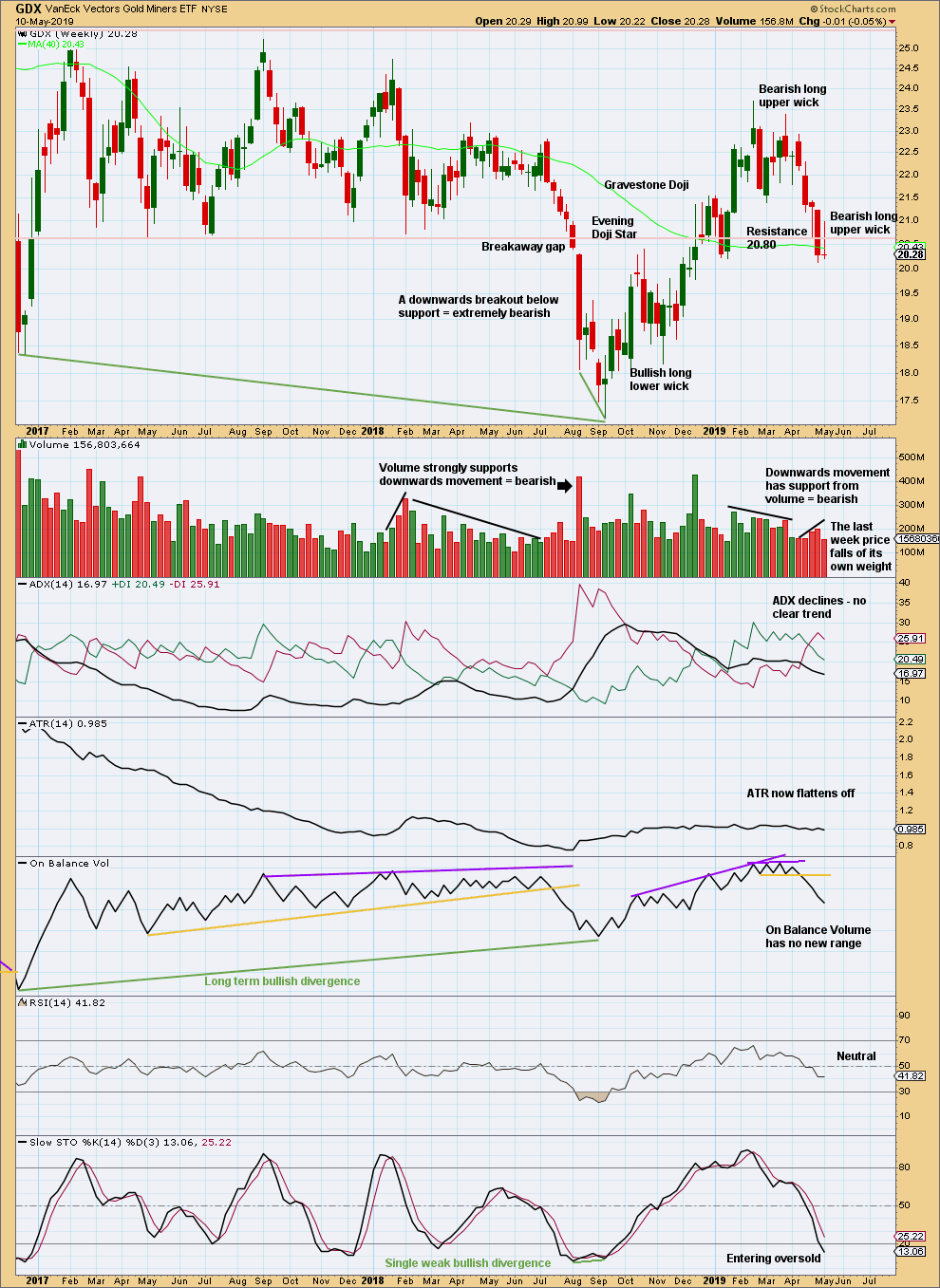

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now a series of two lower highs and lower lows at the weekly chart level. GDX may have seen a trend change to downwards, but ADX does not yet agree. The bearish signal from On Balance Volume supports this view.

Price has closed below 20.80. Expect downwards movement to continue.

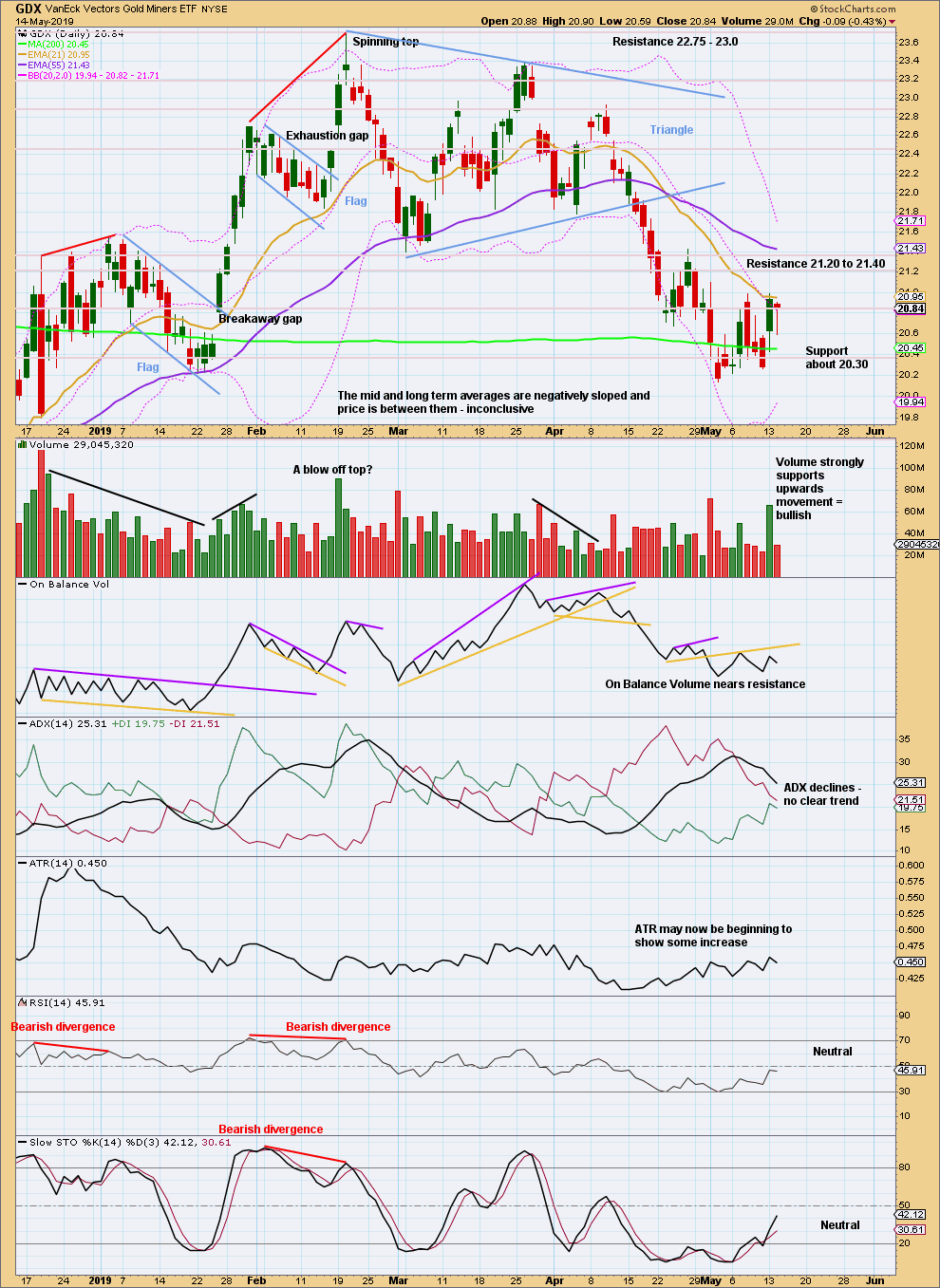

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A target calculated from the triangle width is now at 19.58.

The last swing high of the 26th of April at 21.43 may remain intact. A new high above this point would indicate the downwards trend may be over. The short-term volume profile now suggests this may happen shortly.

Published @ 08:35 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated:

Some sideways movement fits for minute wave iv. It may be a triangle. This may also morph into a combination or flat. Either way, it needs to continue sideways for a little longer.

When it’s done the breakout is expected to be upwards.

Thank you.

I saw that you are looking at Bitcoin … Any initial thoughts ?

I’m pretty surprised gold didn’t get up to the phantom spike on last nights hourly chart. It usually follows the phantom spike before the US market opens the next day. It didn’t even get close

Is the acceleration channel drawn based on a really bad tick for Minute wave III on the daily and hourly charts? If so how does this change the count and targets?

Please see the explanation in the FAQ of where this data is from.

Barchart data sometimes has these weird spikes. We don’t know why, I think it may be a large order placed and maybe not executed… possibly.

Either way, they usually don’t go away and so form part of the wave count.

Because Gold is a truly global market and no data feed uses every single point on the globe, there will be differences in data from one provider to another. This is going to be inevitable in a global market.

As long as I use the same data feed day to day for my wave count then it should be valid.

I know everybody that the spikes look weird. They’re annoying. They shouldn’t be there, particularly as I’m paying for this data. But they’re there and I can’t decide to ignore them, they have to be part of the count.

It works out in the end.

Where can i get this data Lara, Is it Barcharts.com?

It’s ok Lara, I have found it on your site. Thank you.

Where you got such data for gold? I haven’t such spikes on my gold chart

This is answered in the FAQ. The data is from BarChart.

The first time you make a comment it waits in moderation. Now that you have a comment approved your future comments will be published immediately, automatically.