Another small range day moves price mostly sideways. After a highly significant breakout, a pullback or consolidation was expected to test support.

Summary: After the breakout from multi year resistance on 20th June, it was expected that price would curve around and back test support about 1,360 to 1,375. That test of support may still be underway.

There are three Elliott wave scenarios in this analysis (published below in this order):

1. The bear market continues: the breakout was false and a high is in place. The short term target is 1,345.

2. The bear market continues: the breakout was false but incomplete. One final high to 1,452 may unfold later this week or next week before a multi year trend change and a new downwards wave to new lows.

3. A bull market is underway: this back test of support is a fourth wave correction. The target for the mid term is 1,565. It is this scenario which currently has the most support from classic technical analysis, but it still has the biggest problem in terms of Elliott wave structure.

Grand SuperCycle analysis is here.

Last monthly charts are here.

Overall, the bearish wave counts still have a higher probability based upon Elliott wave structures. However, it would be best to leave price to invalidate either the bullish or bearish scenario before having confidence in which is correct.

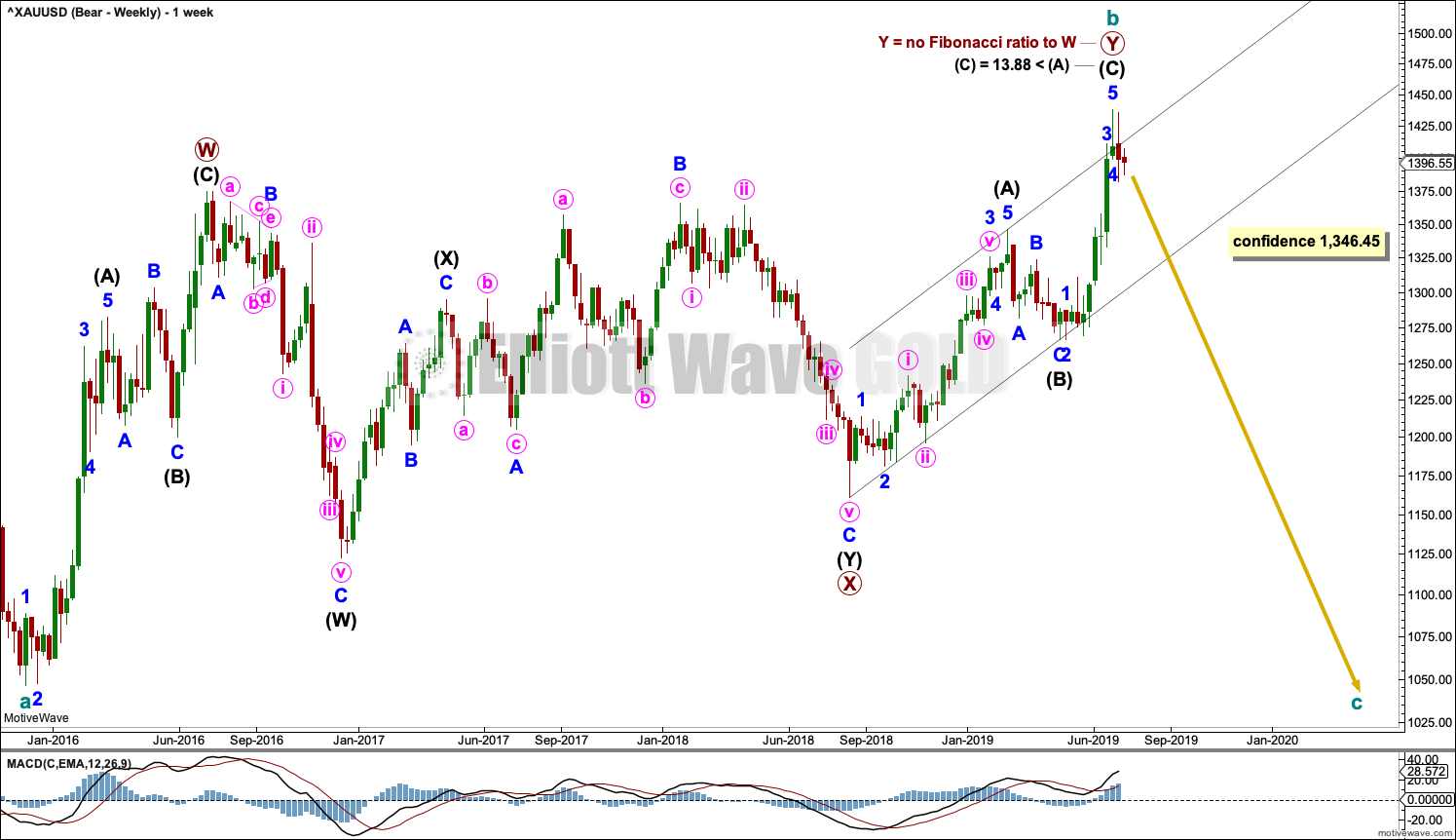

BEARISH ELLIOTT WAVE COUNTS

FIRST WEEKLY CHART

It remains possible that the bear market for Gold may yet continue. It is possible that cycle wave b may be complete at the high. Cycle wave b may be a double zigzag.

Double zigzags are common structures, but within them their X waves are almost always single zigzags that are relatively brief and shallow. However, this wave count sees primary wave X as a complete double combination: zigzag – X – expanded flat.

An X wave may occasionally subdivide as a multiple. In a multiple the maximum number of corrective structures is three: W, Y and Z. To label any one of W, Y or Z as a multiple would violate the Elliott wave rule. Here, the X wave maximum number rule is met.

Primary wave Y may be a complete zigzag. The purpose of a second zigzag in a double zigzag is to deepen the correction when the first zigzag does not move price far enough. This purpose has been achieved.

A new low now by any amount at any time frame below 1,346.45 would invalidate the bullish wave count below and provide some confidence in this wave count.

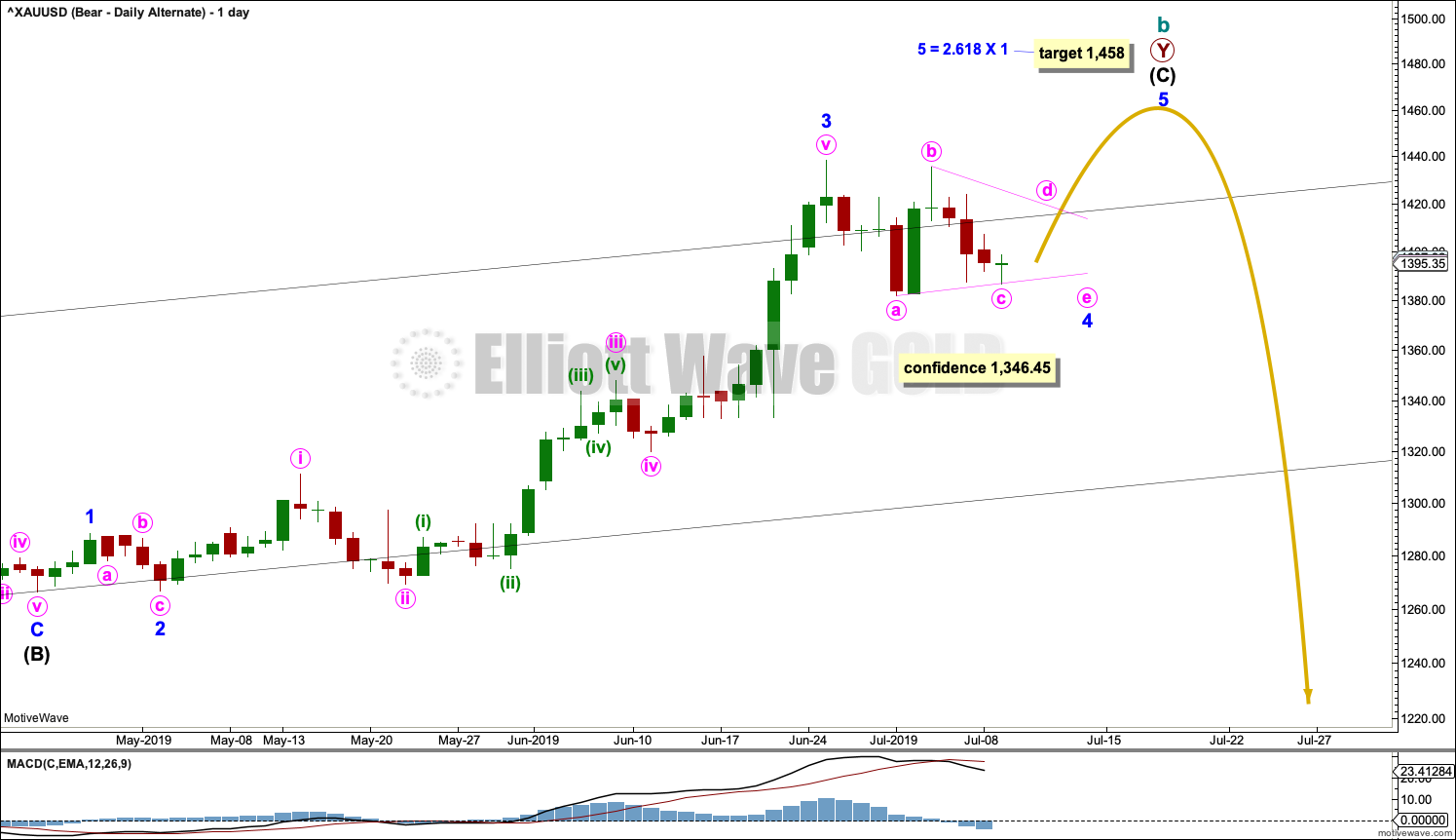

DAILY CHART

This chart focusses on the impulse of intermediate wave (C).

Intermediate wave (C) may be a complete impulse; the structure may now be complete at all time frames. There is a bearish candlestick reversal pattern on StockCharts data.

This wave count now requires a new low below 1,346.45 for confidence.

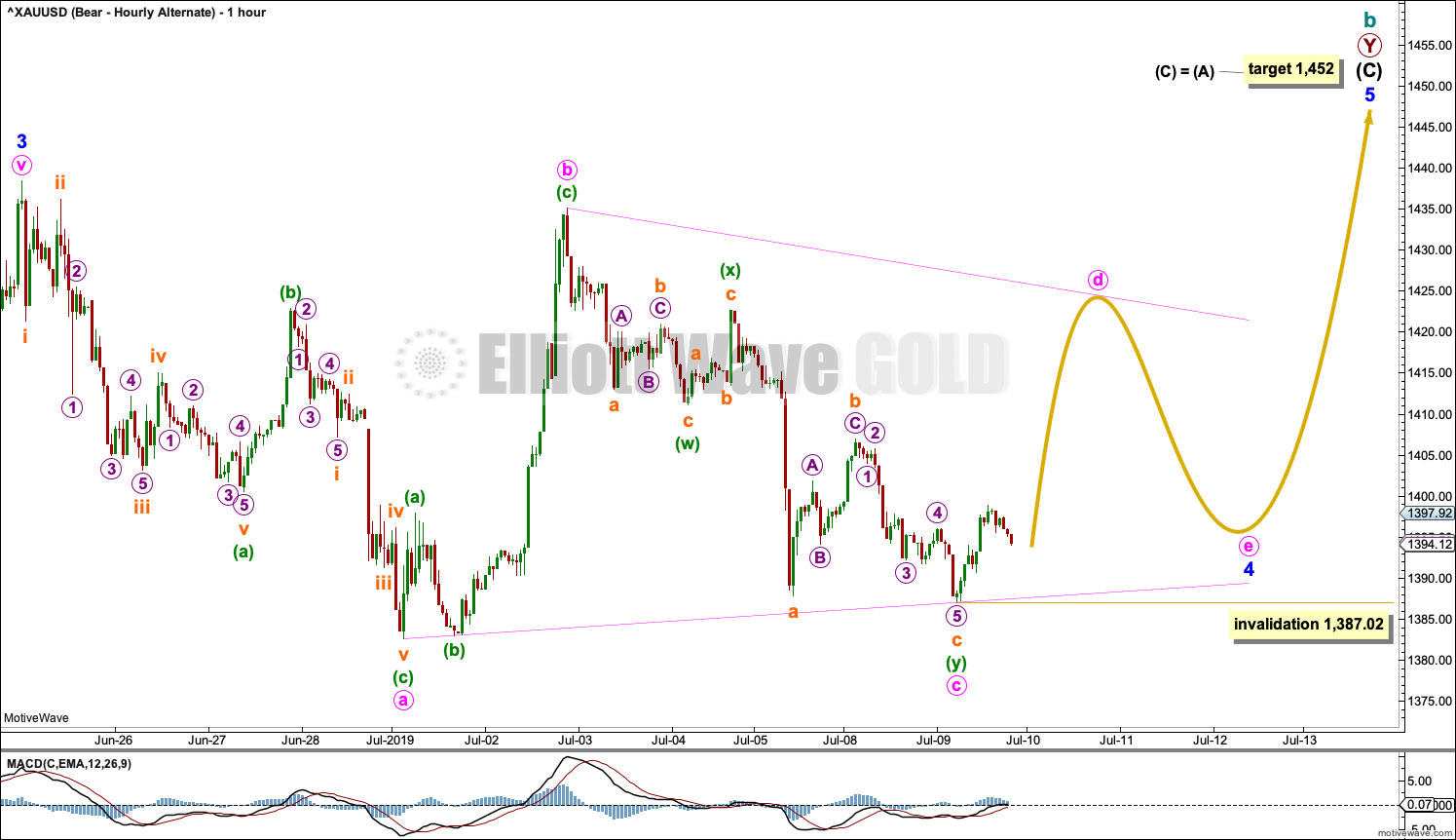

HOURLY CHART

Minor wave 3 may only subdivide as an impulse. A target is calculated for the end of minor wave 3, which expects it to exhibit the most common Fibonacci ratio to minor wave 1.

Within minor wave 3, minute wave i may now be complete. The channel about minute wave i is now breached by upwards movement indicating minute wave i may be complete.

A target for minute wave ii may be the 0.618 Fibonacci ratio of minute wave i.

Minute wave ii may not move beyond the start of minute wave i above 1,435.12.

SECOND DAILY CHART

It is also possible that intermediate wave (C) may be an incomplete impulse and the last several sessions may be a triangle for minor wave 4.

The target for intermediate wave (C) is recalculated for it to reach equality in length with intermediate wave (A).

SECOND HOURLY CHART

Subdivisions of the last few days for this wave count are seen in the same way as the bullish wave count. For both wave counts a triangle may be unfolding sideways. Here, the degree of labelling is one degree lower, at minor degree.

Within the triangle, minute wave d may not move reasonably beyond the end of minute wave b above 1,435.12, and minute wave e may not move beyond the end of minute wave c below 1,387.02.

Elliott wave triangles are always continuation patterns. The direction of entry for this triangle was upwards, so the breakout should be upwards.

As minor wave 4 continues, the triangle may be invalidated. It is also possible that minor wave 4 may be continuing sideways as a double combination. Minor wave 4 may need to be relabelled.

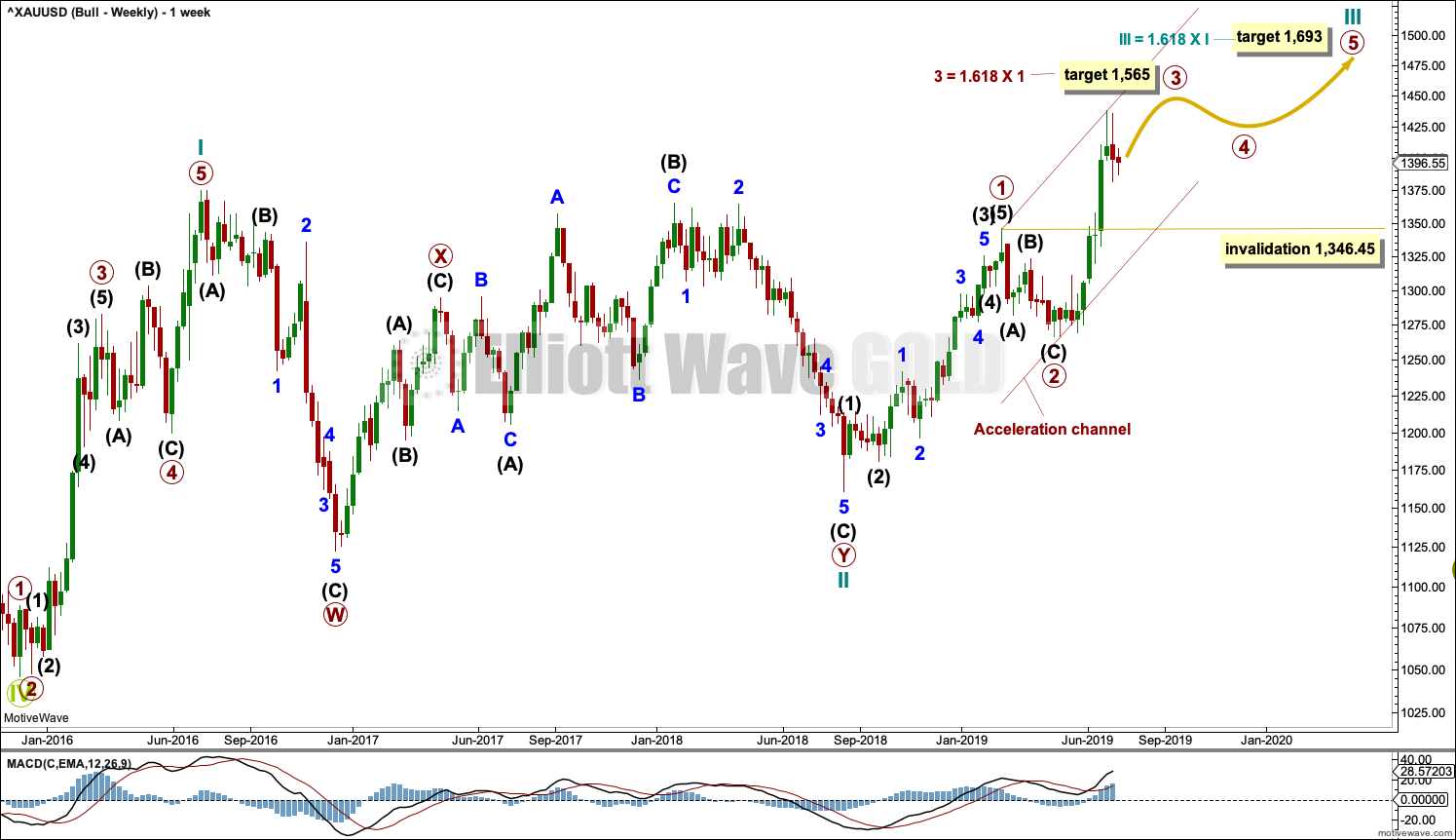

BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold in November 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. This wave count still suffers from this very substantial problem, and for this reason two bearish wave counts are still considered above as they have a better fit in terms of Elliott wave structure.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. If it continues lower as a double zigzag, then primary wave 2 may not move beyond the start of primary wave 1 below 1,160.75.

Cycle wave III so far for this wave count would have been underway now for 45 weeks. It may be beginning to exhibit some support from volume and increasing ATR. If this increase continues, then this wave count would have some support from technical analysis.

Draw an acceleration channel about primary waves 1 and 2: draw the first trend line from the end of primary wave 1 to the last high, then place a parallel copy on the end of primary wave 2. Keep redrawing the channel as price continues higher. When primary wave 3 is complete, then this channel would be drawn using Elliott’s first technique about the impulse. The lower edge may provide support.

Primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

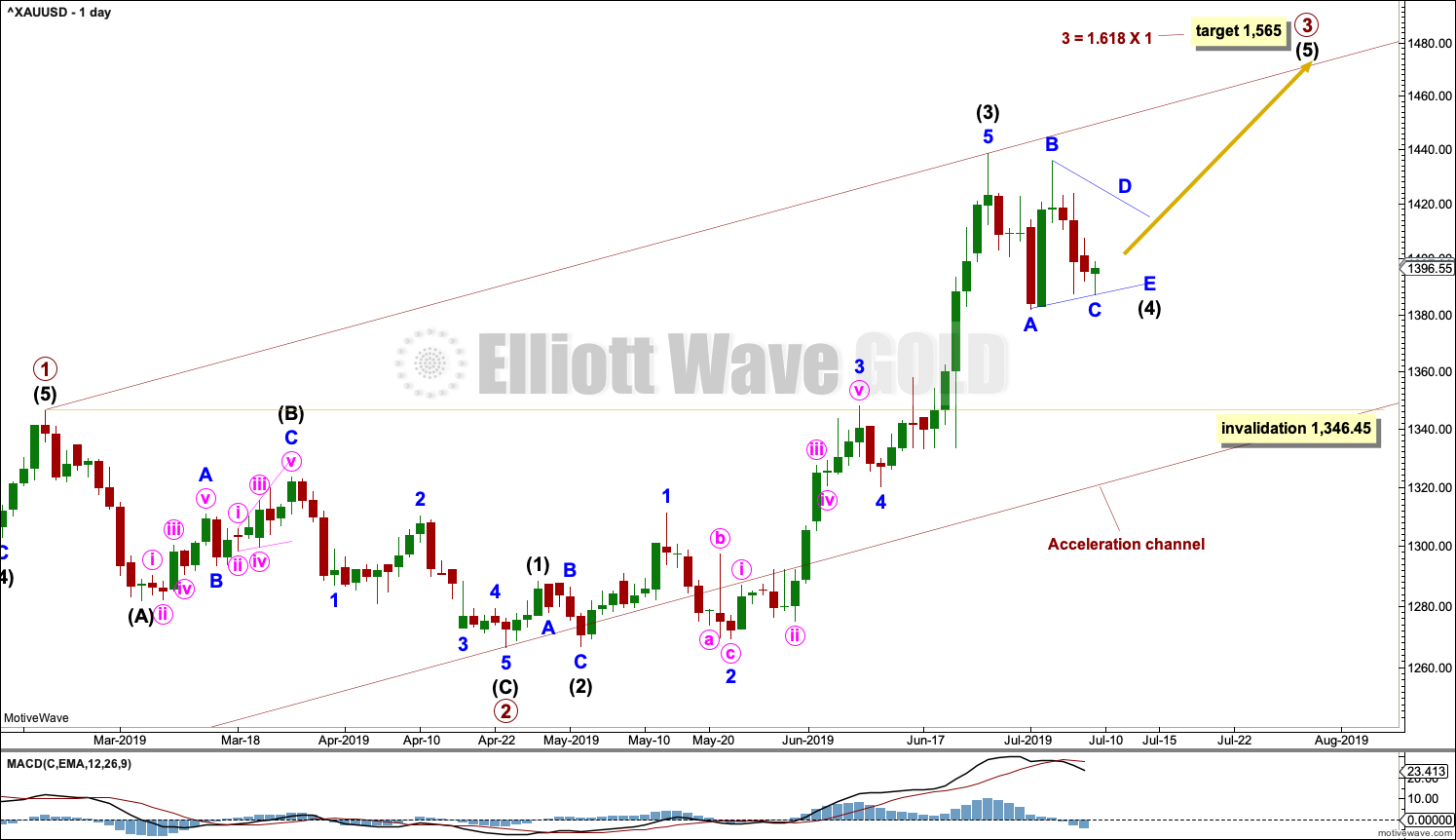

DAILY CHART

This daily chart focusses on the impulse of primary wave 3.

Primary wave 3 may only subdivide as an impulse. Primary wave 3 has now moved above the end of primary wave 1, meeting a core Elliott wave rule.

When it arrives, primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

Intermediate wave (5) may exhibit further strength. The target for primary wave 3 is calculated using the most common Fibonacci ratio to primary wave 1.

The structure of primary wave 3 as an incomplete impulse for this wave count is seen in exactly the same way as the incomplete impulse for intermediate wave (C) in the second bearish daily chart. Today both wave counts view a fourth wave triangle unfolding sideways. This bullish wave count sees the triangle as intermediate wave (4).

Look out now for the possibility of another blow off top as intermediate wave (5) to end primary wave 3 comes to an end.

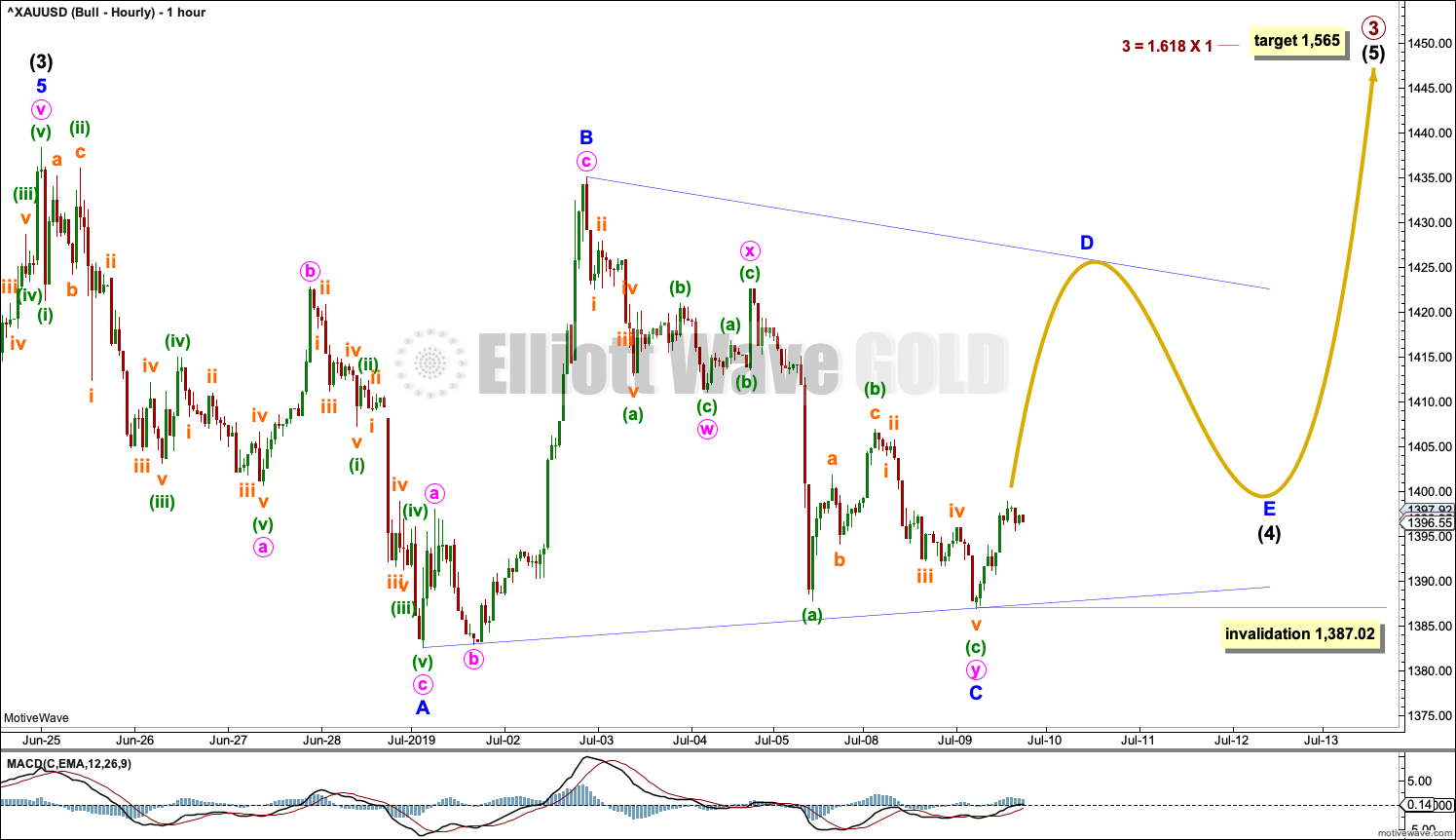

HOURLY CHART

Intermediate wave (4) be continuing sideways as a regular contracting or barrier triangle. Within the triangle, minor wave D may not move reasonably beyond the end of minor wave B above 1,435.12, and minor wave E may not move beyond the end of minor wave C below 1,387.02.

When the triangle is complete, then price may be expected to break out upwards.

It is also possible that the triangle may be invalidated. Intermediate wave (4) may be unfolding as a double combination.

TECHNICAL ANALYSIS

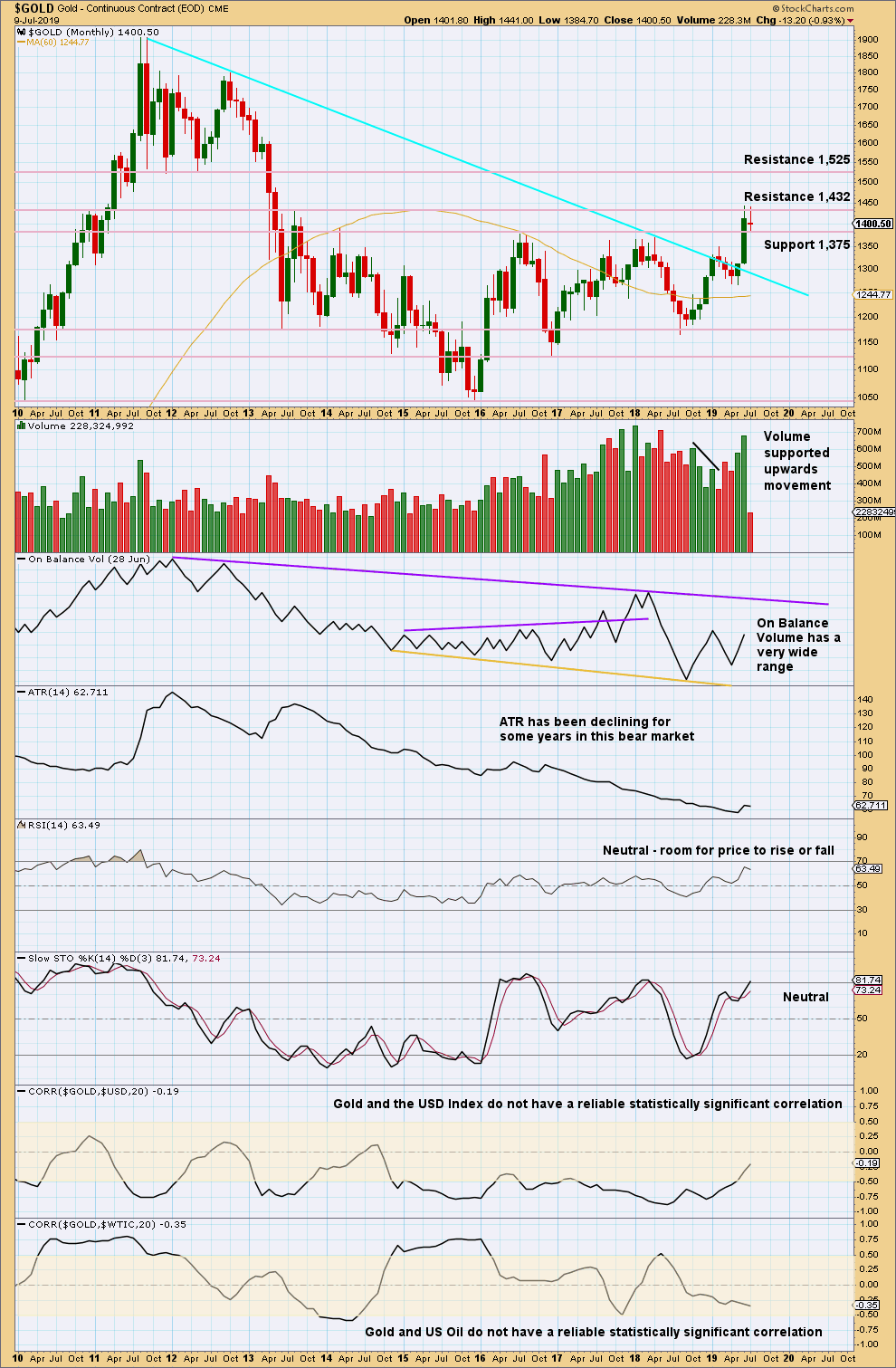

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold has effected an upwards breakout above multi-year resistance and above the cyan bear market trend line. Look for next resistance identified on the chart.

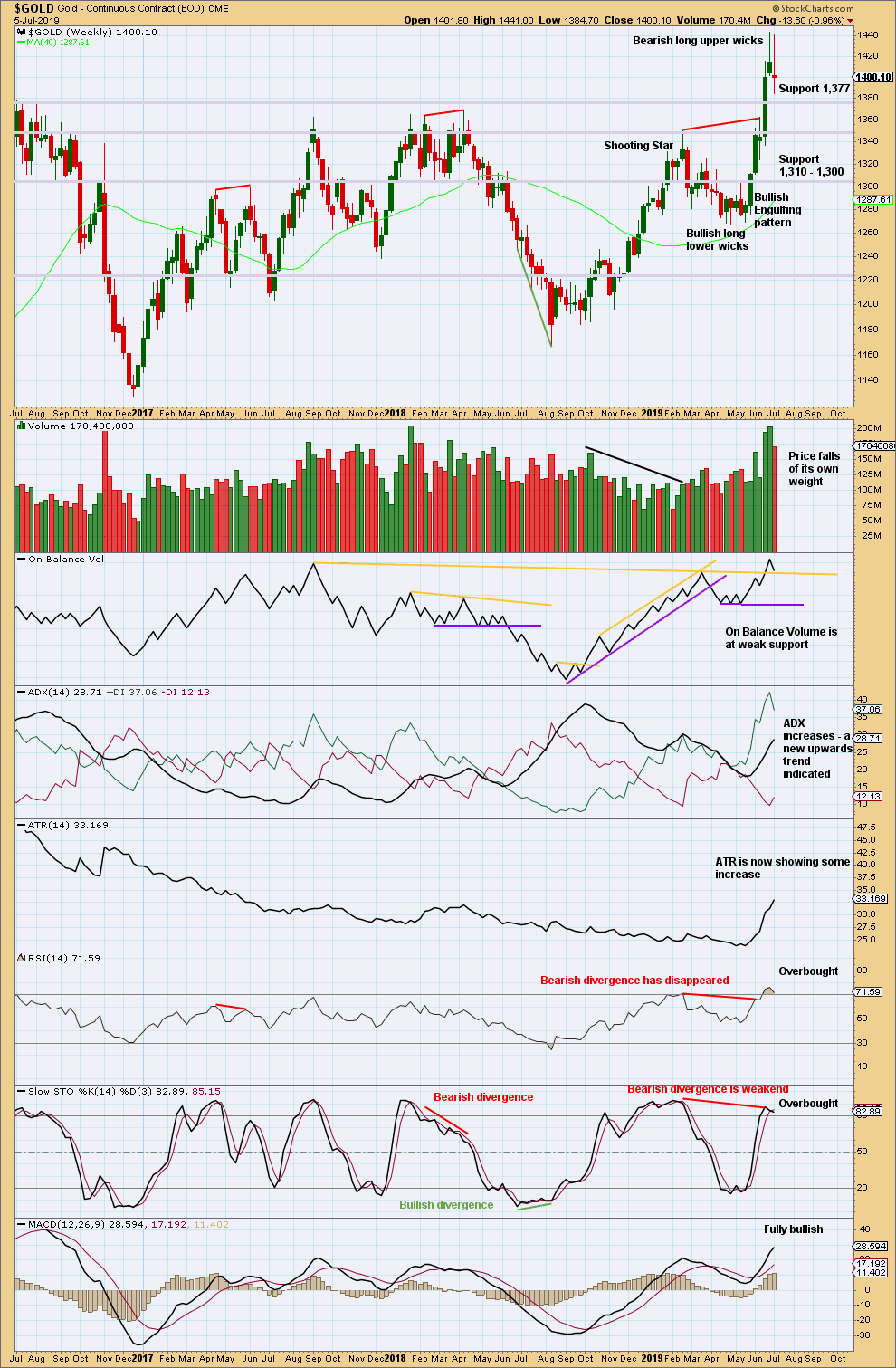

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold has broken out of a multi-year consolidation, which saw resistance about 1,375. The breakout has support from volume, so confidence may be had in it.

Price now has some strength with rising ATR. Conditions remain overbought. The pullback so far has not relieved extreme conditions and has lasted only one week. It may continue a little longer.

Look now for strong support about 1,375.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

It is common to see price curve down and back test support at prior resistance after a breakout. After strong downwards movement on Friday, it now looks like the back test may continue. The back test still looks incomplete.

Overall, this chart is bullish and supports the bullish Elliott wave count.

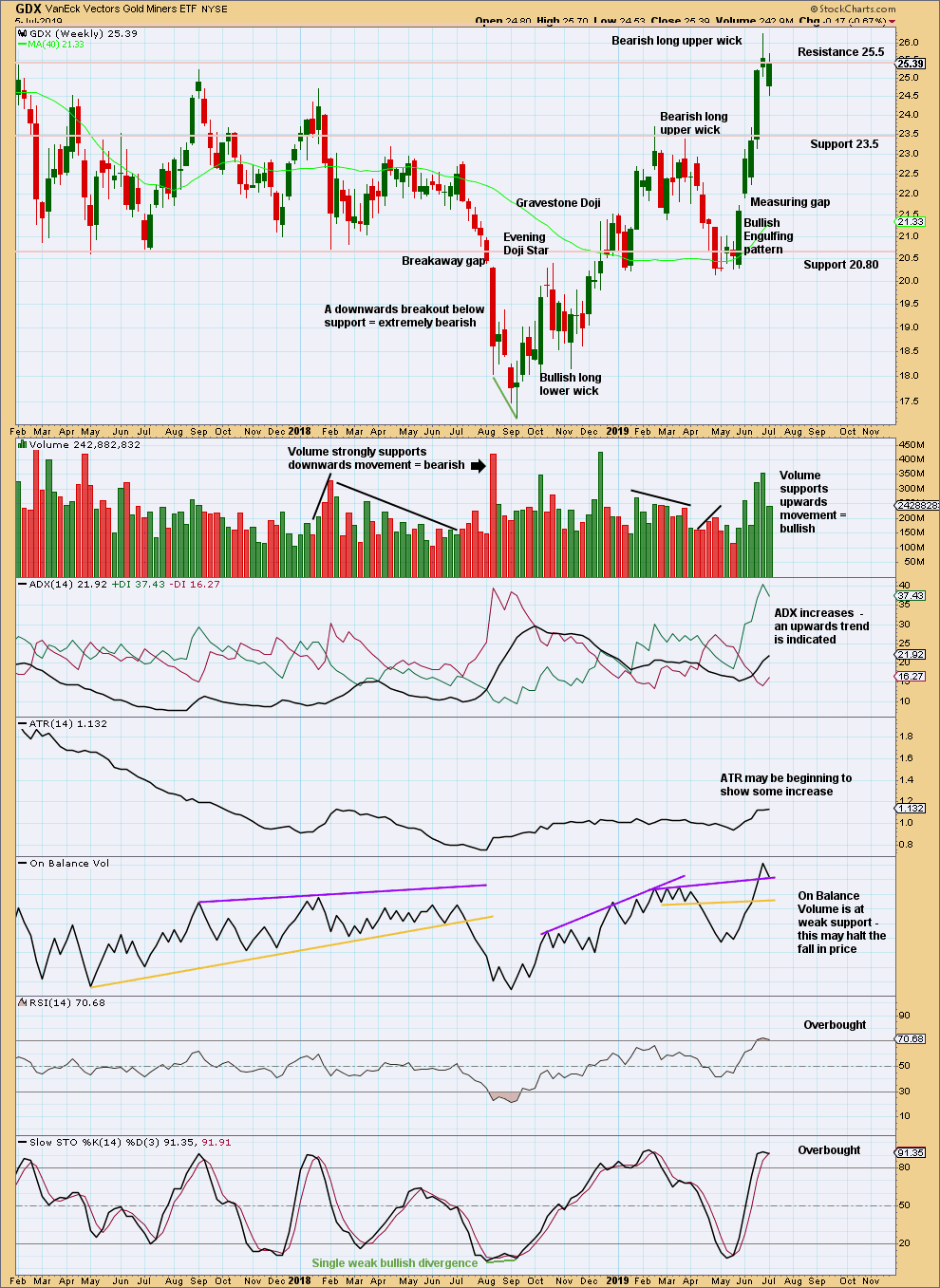

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The upwards trend continues, but conditions are now overbought. This can continue for a while during a strong trend. At this stage, there are no signs of a reversal.

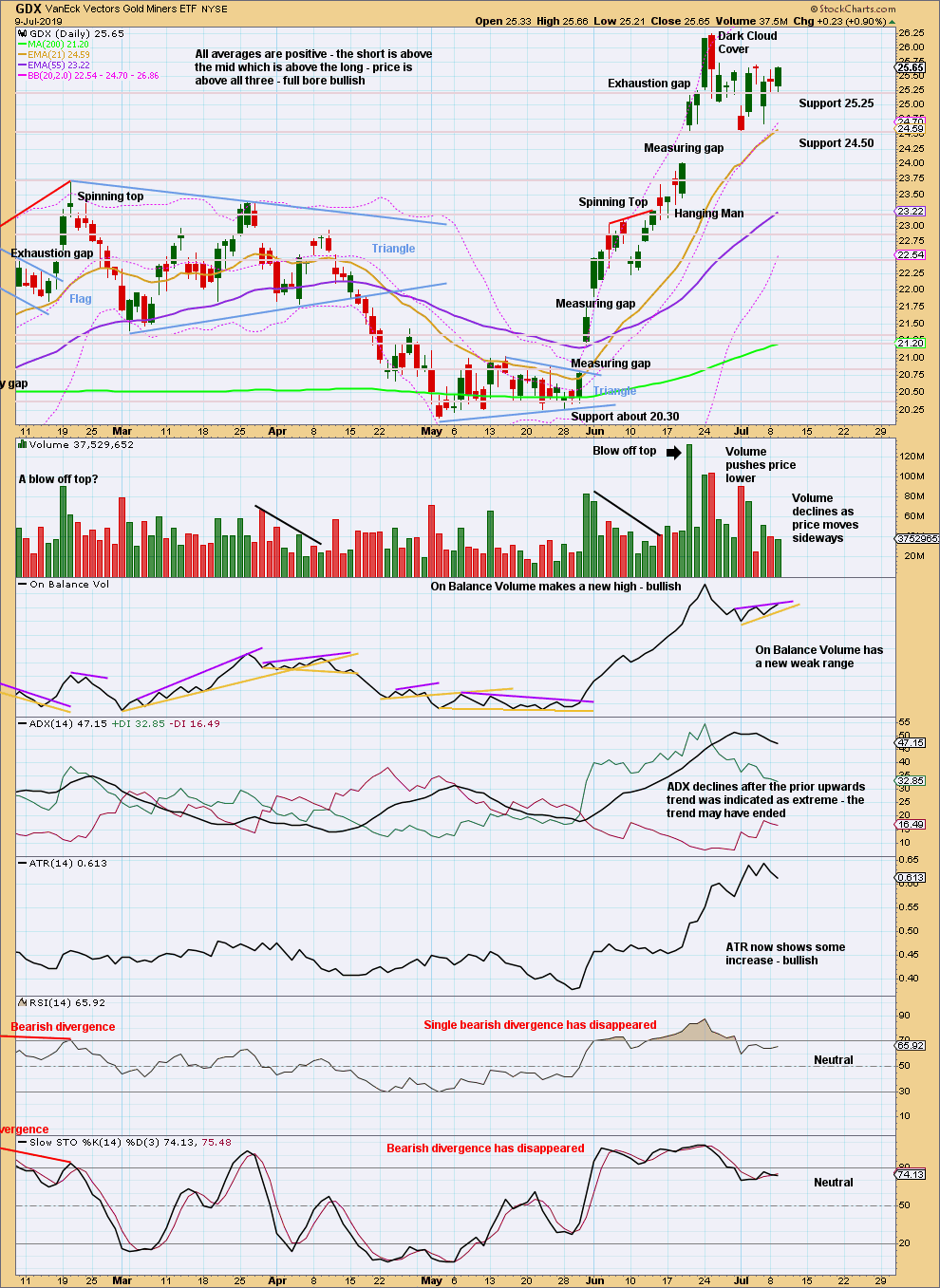

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The measuring gap remains open as long as price remains above 24.03. Closure of this gap would be a significant bearish signal.

A sideways consolidation is continuing; it may be a pause within the ongoing upwards trend. The last gap remains open. The consolidation does not fit as either a flag nor a pennant pattern.

Published @ 09:53 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Bull hourly chart updated:

So far the triangle looks good. But we all know by now how tricky triangles can be. They can look perfect, even look complete, and then the triangle is invalidated and it turns out to be something else.

Beware of triangles. Maybe I should make a t-shirt with that.

Bear hourly chart updated:

So far this too looks okay, but if there had been a major high in place on the 25th of June then I would have expected downwards movement to be more convincing than this.

Alternate / second bear hourly updated:

And so for the bear count I’m now leaning more towards this idea.

Minor 4 may be a triangle, but it may also yet morph into a combination.

this one is a triangle, I can feel it :))