S&P 500

Downwards movement for Friday was expected for the short term.

This week saw price move upwards as expected, with a higher high and a higher low.

Summary: This week comes with more upwards movement and new all time highs from the AD line and On Balance Volume (daily chart). Demand is expanding. Supply is contracting. This bull market has underlying strength to support it.

For the short term, a pullback or consolidation may continue for a few days to a target at 2,977. Thereafter, the upwards trend to new all time highs should resume.

Downside risk is at 2,825.51 for the short term.

The next target is 3,120. Classic analysis very strongly supports this main wave count.

A new low below 2,825.51 would indicate a deeper pullback should be underway. Look for strong and final support at the lower edge of the wide channel on weekly and daily charts.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here. There are two further alternate monthly charts here.

ELLIOTT WAVE COUNTS

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

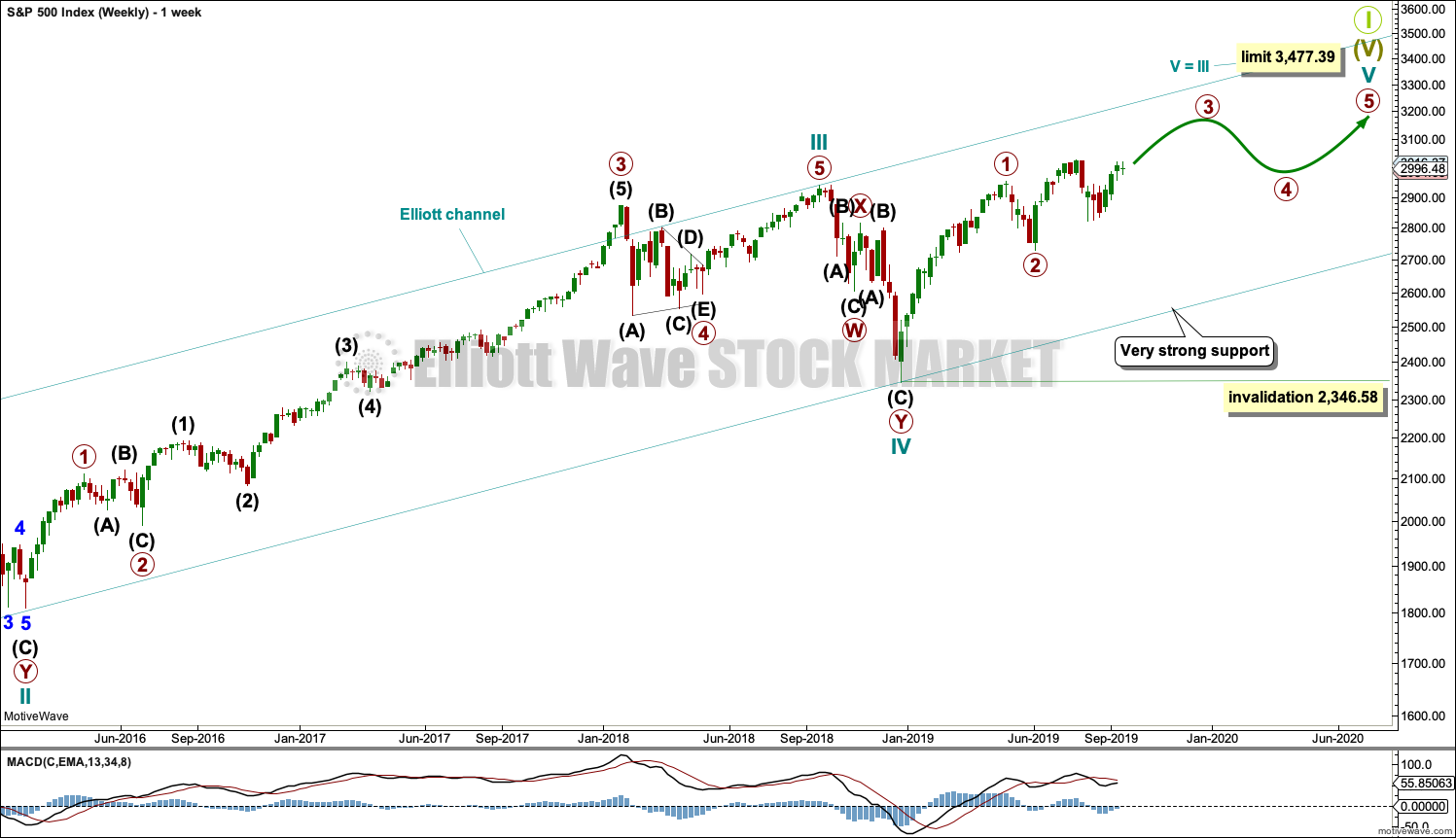

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. This main wave count expects that cycle wave V may be unfolding as an impulse.

The daily charts below will focus on all of cycle wave V.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

MAIN DAILY CHART

Cycle wave V is seen as an impulse for this wave count.

Within cycle wave V, primary waves 1 and 2 may be complete. Primary wave 3 may have begun.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3, intermediate waves (1) and (2) may be complete.

Intermediate wave (3) may have begun. Intermediate wave (3) may only subdivide as an impulse.

Within intermediate wave (3), minor waves 1 and 2 may be complete. Within minor wave 3, minute waves i through to iii may now be complete.

If the degree of labelling within minor wave 3 is moved down one degree, then it may be only minute wave i within minor wave 3 which is nearing an end. Minute wave ii may not move beyond the start of minute wave i below 2,825.51.

All of primary wave 3, intermediate wave (3), minor wave 3 and minute wave iii may only subdivide as impulses.

Intermediate wave (3) must move far enough above the end of intermediate wave (1) to then allow intermediate wave (4) to unfold and remain above intermediate wave (1) price territory.

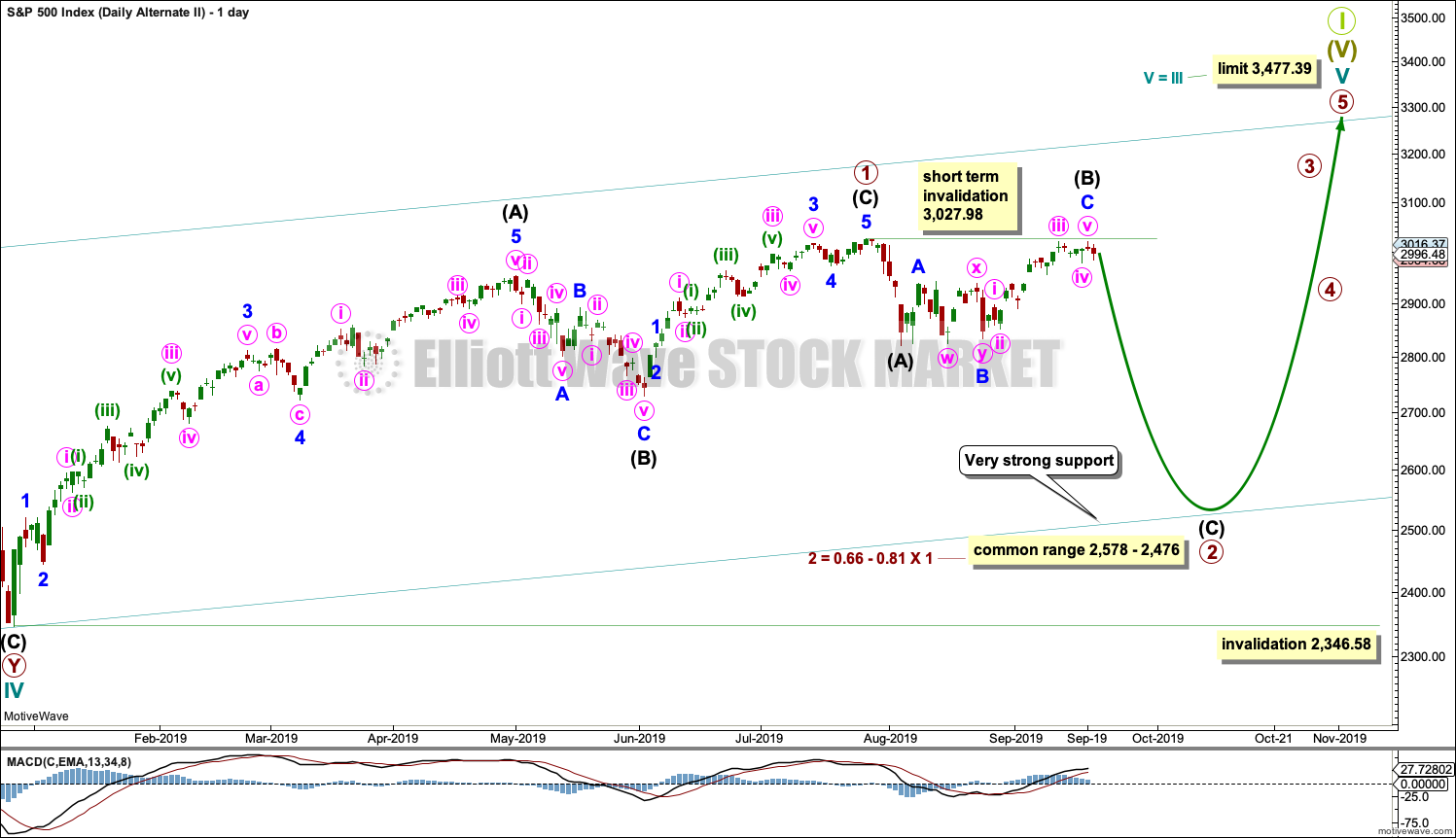

ALTERNATE DAILY CHART

This alternate wave count has been published before. It will be published again as a reminder that alternates do currently exist

This alternate wave count is still judged to have a low probability because it does not currently have support from classic technical analysis.

The main wave count expects cycle wave V to unfold as the more common impulse. This alternate wave count looks at the less likely possibility that cycle wave V may unfold as an ending diagonal.

All sub-waves within ending diagonals must subdivide as zigzags. The second and fourth waves of diagonals are commonly very deep, correcting to between 0.66 and 0.81 the prior wave.

Within the zigzag of primary wave 2, intermediate wave (B) may not move beyond the start of intermediate wave (A) above 3,027.98.

At this stage, a new low below 2,825.51 would be required for any confidence in this wave count.

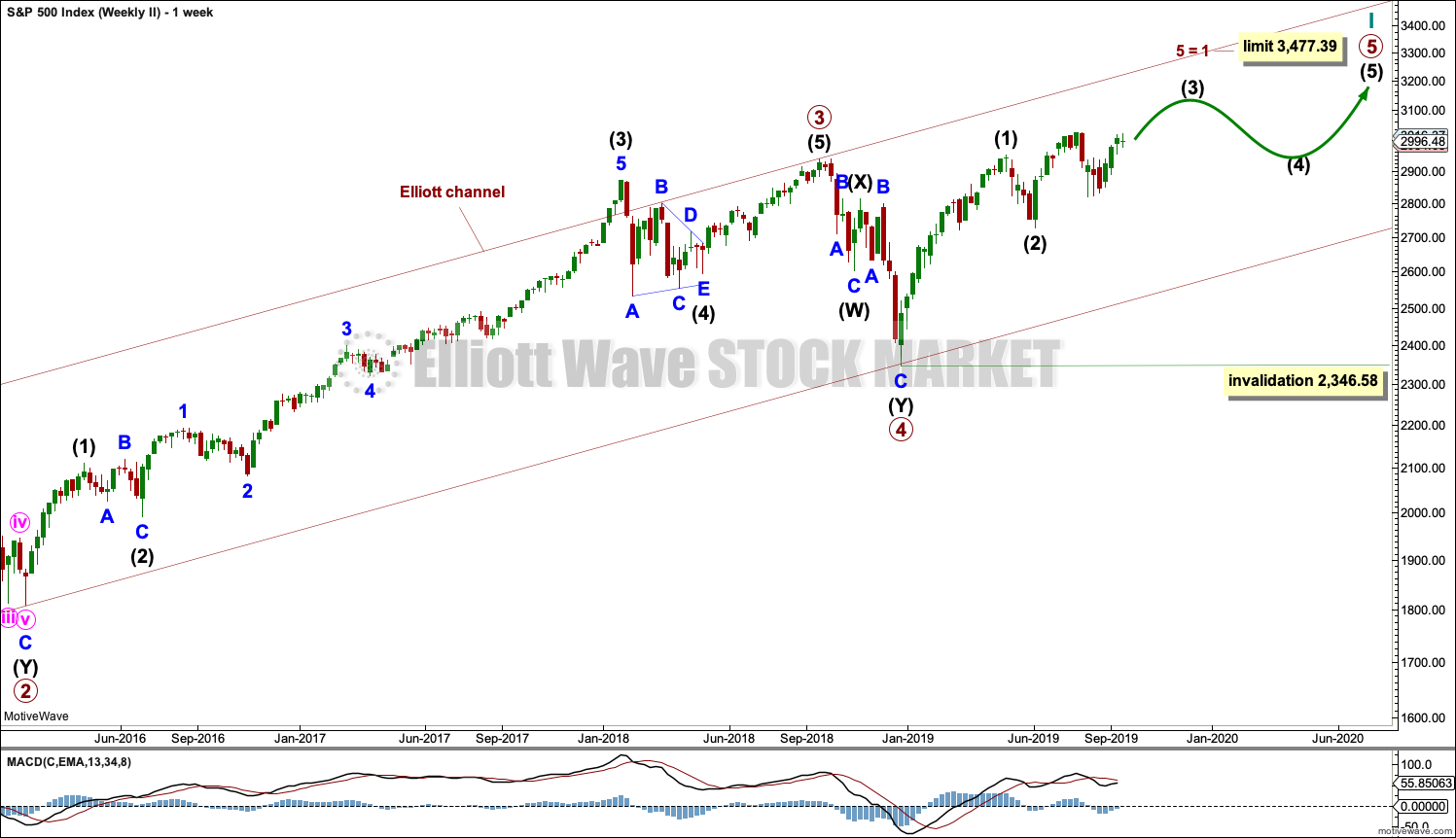

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

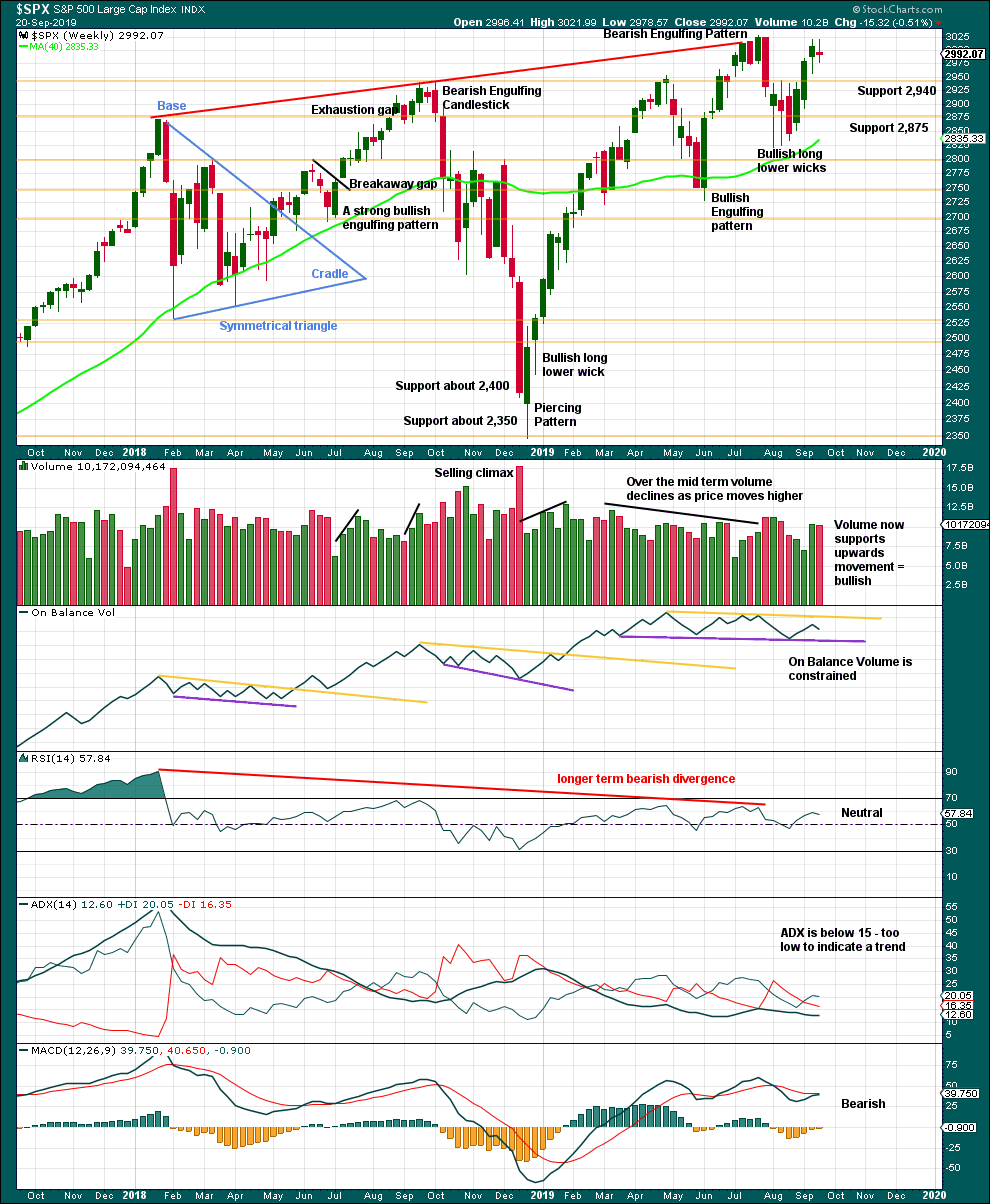

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week is an upwards week with a slightly higher high and a higher low, but the candlestick has closed red and the balance of volume is down. At this stage, this week looks like a small pause within an ongoing upwards trend. There is no candlestick reversal pattern.

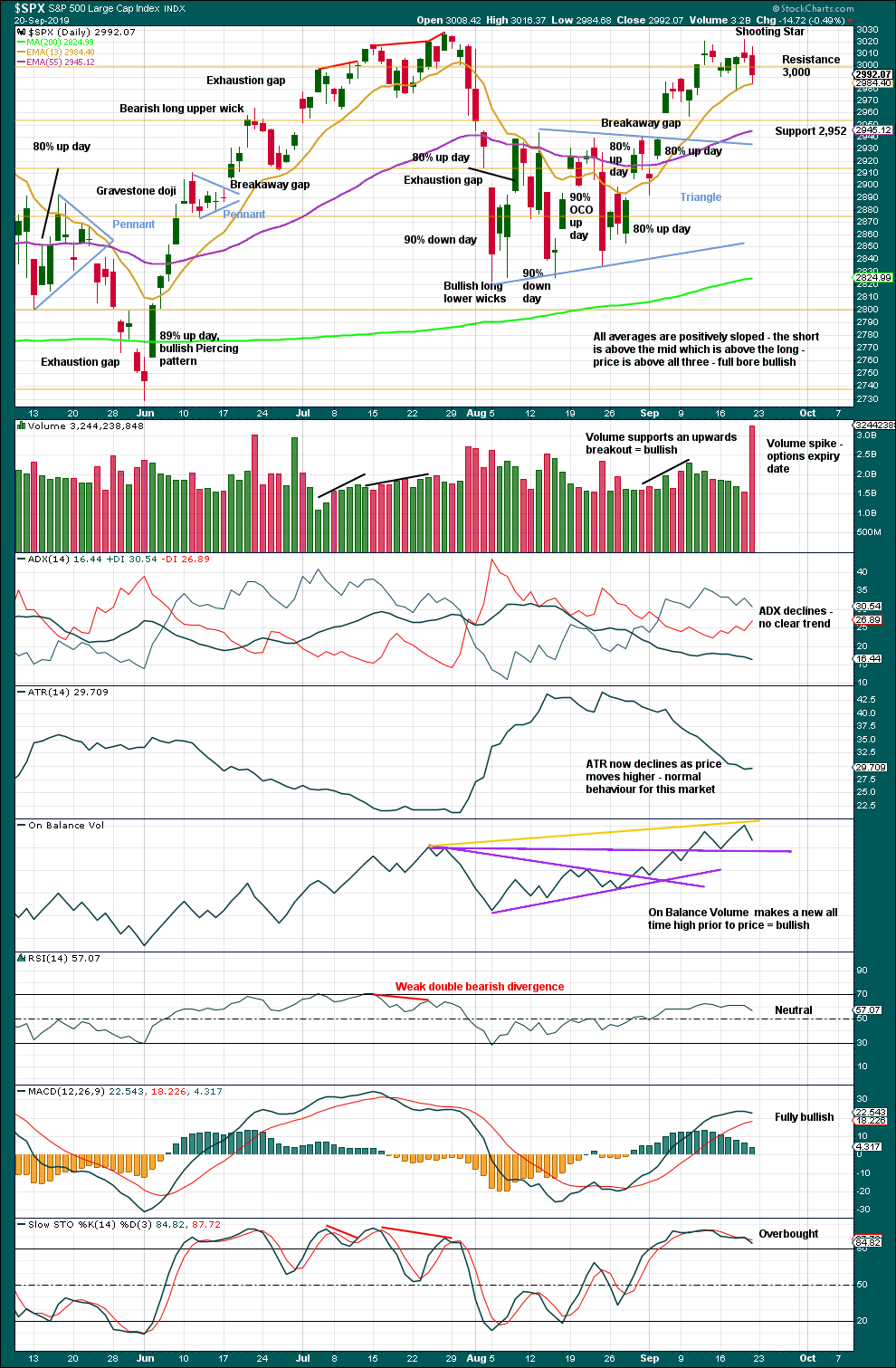

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now a series of higher highs and higher lows since the 5th of August. Strength in 90% up days and back to back 80% up days off lows indicate the lows may be sustainable.

The target from the triangle is at 3,060, which has still not been met and remains valid.

Strong volume suggests more downwards movement immediately ahead. However, with On Balance Volume making a new all time high and having support a little below, downwards movement may be limited. Look for any downwards movement here to possibly be a retest of the breakaway gap, which should offer support at 2,938.84.

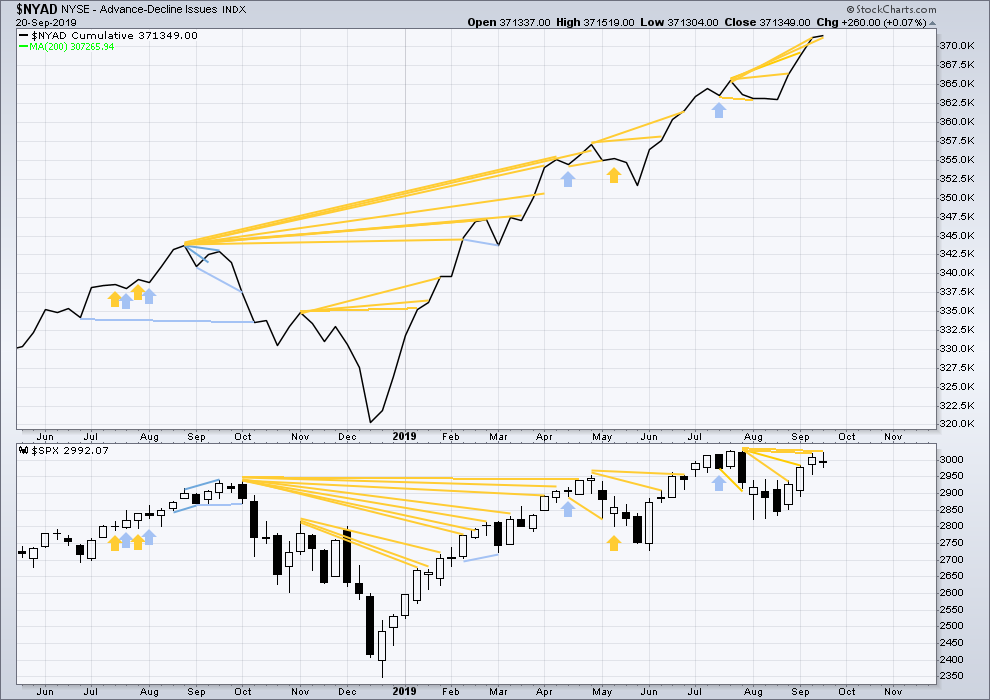

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again this week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is end January 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

The AD line makes another new all time high. This is a very bullish signal and very strongly supports the Elliott wave count.

Small caps have made a new swing high above the prior high of the end of July, but mid and large caps have not yet done so. This upwards movement of the last four weeks appears to be led by small caps. Because small caps are usually the first to exhibit deterioration in the later stages of a bull market, some strength in small caps at this stage indicates a healthy bull market with further to run.

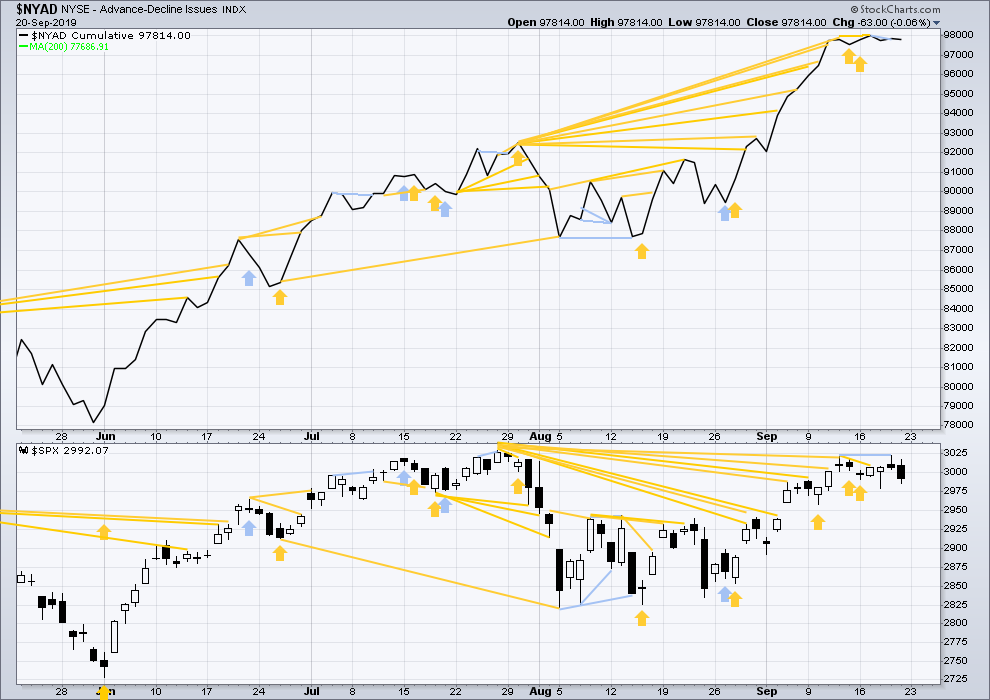

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

On Friday price has moved fairly strongly lower and the AD line has shown a slight decline. There is no new divergence for the short term.

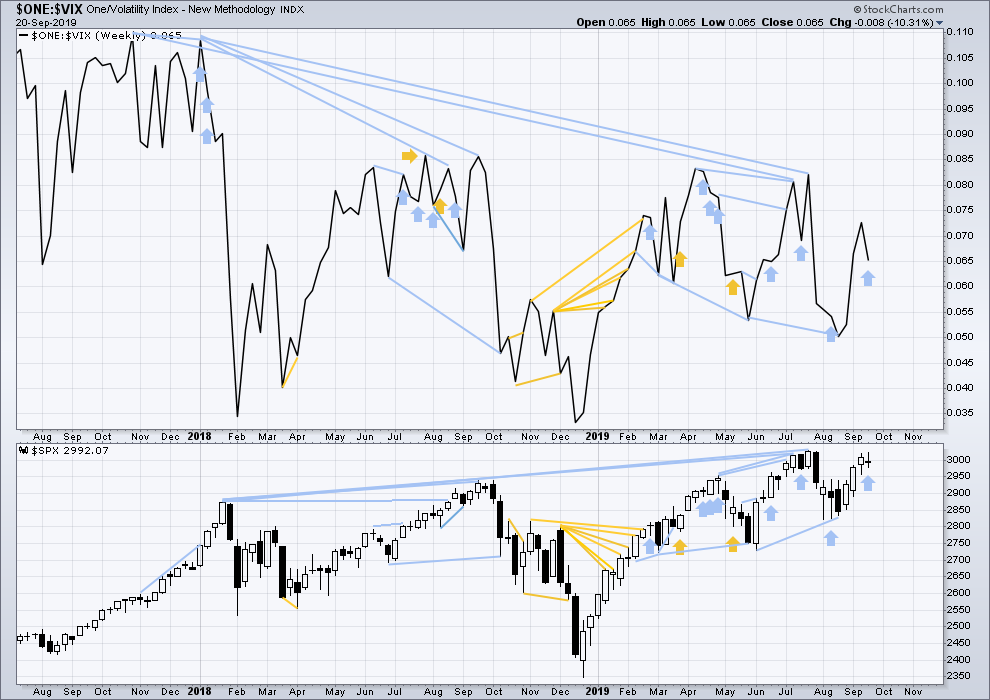

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX (which is the same as the low for VIX) was on 30th October 2017. There is now nearly one year and ten months of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may not be useful in timing a trend change.

This week price has moved slightly higher, but inverted VIX has moved strongly lower. Upwards movement in price this week does not come with a normal corresponding decline in VIX. This divergence is bearish for the short term.

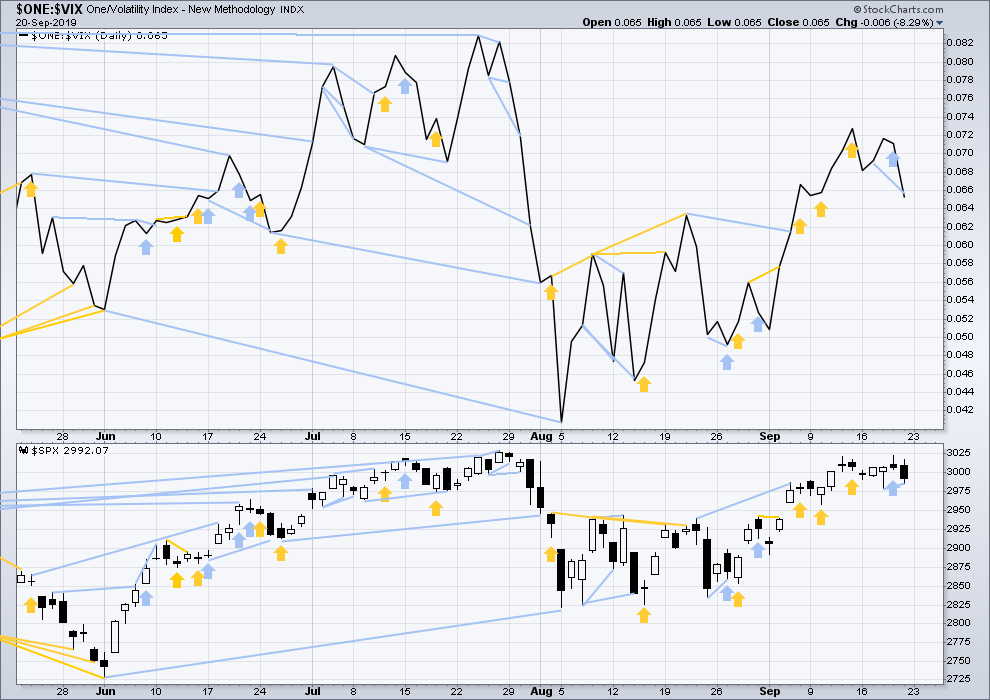

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

On Friday price has moved lower but did not make a new low below the low two sessions prior. Inverted VIX has also moved lower to make a new low below the low two sessions prior. This divergence is bearish for the short term.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

GOLD

Sideways movement continues all week. Price remains range bound.

The Elliott wave counts both expect a breakout in the same direction.

Summary: The bounce may continue up to about 1,529 before the downwards trend resumes.

The bearish Elliott wave count expects a new downwards trend to last one to several years has begun. Confidence in this view may be had if price makes a new low by any amount at any time frame below 1,346.45.

The bullish Elliott wave count expects a primary degree fourth wave is unfolding, forming a large consolidation to end in possibly 6 more sessions. The eventual area of support for the consolidation is expected to be about 1,431.

Grand SuperCycle analysis is here.

Monthly charts were last published here with video here.

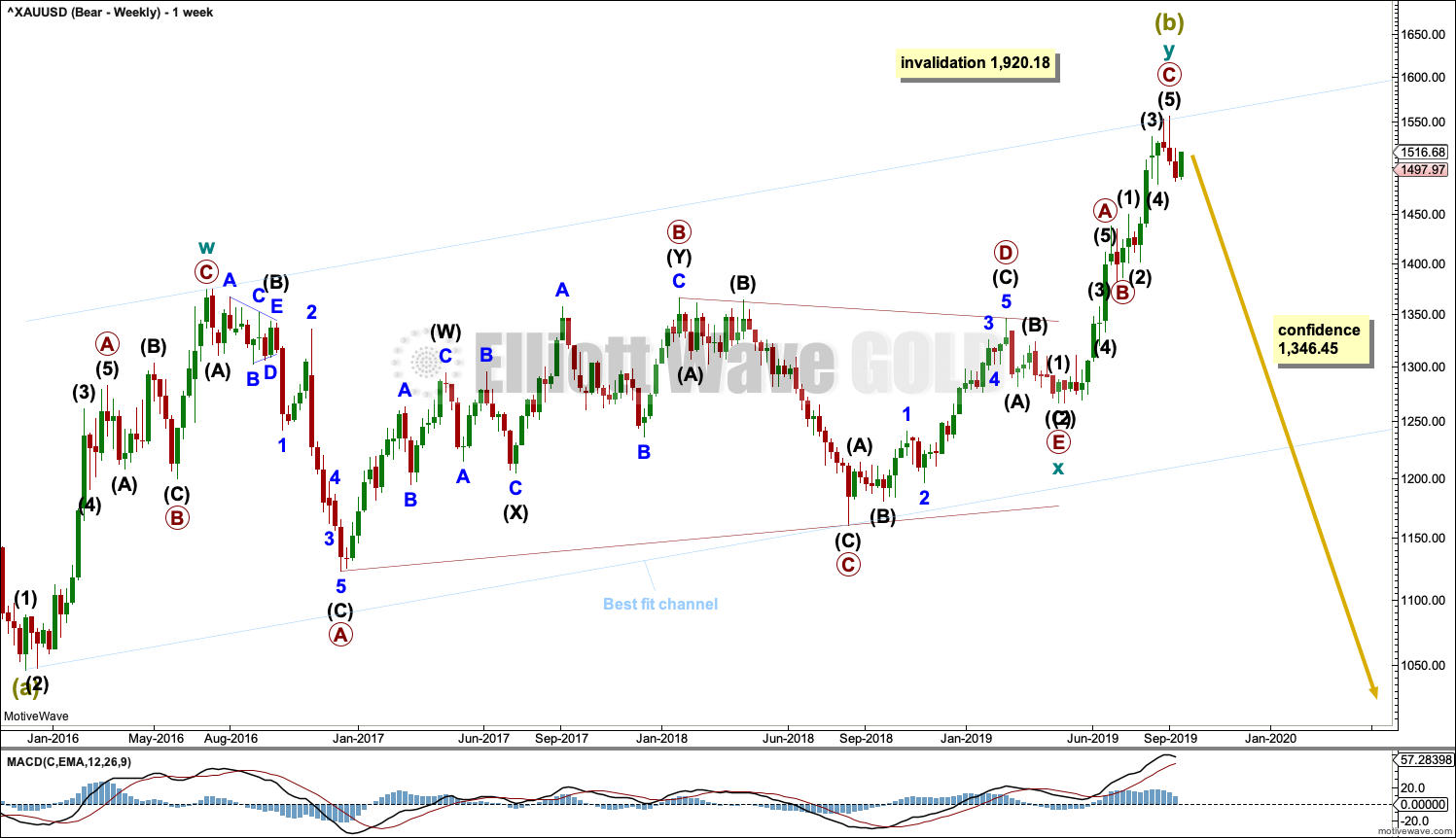

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

It is possible that Super Cycle wave (b) is complete as a double zigzag.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a triangle labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

A new low below 1,346.45 would add strong confidence to this wave count. At that stage, the bullish Elliott wave count would be invalidated.

A wide best fit channel is added in light blue. This channel contains all of Super Cycle wave (b) and may provide resistance and support. Copy this channel over to daily charts.

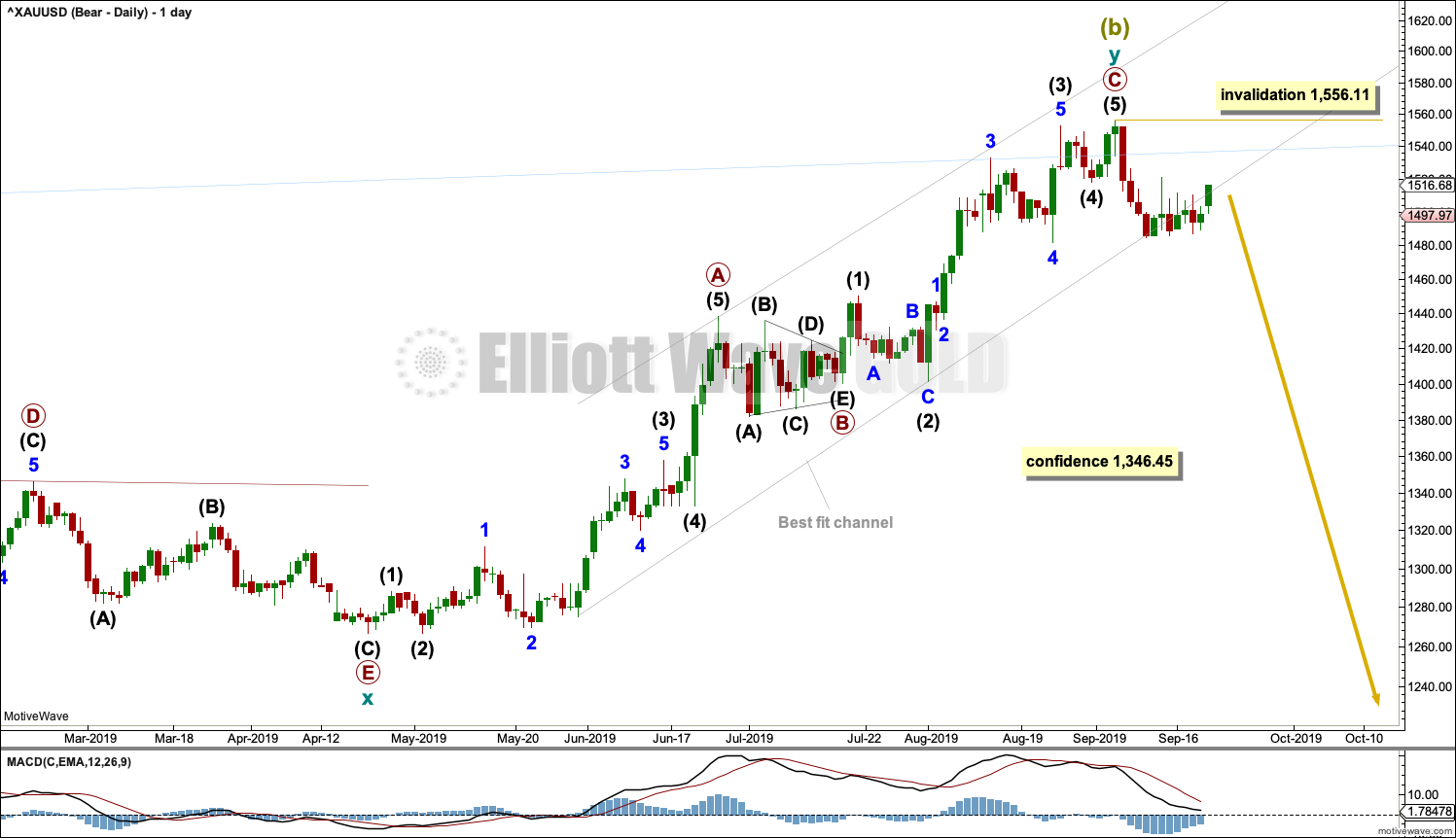

DAILY CHART

Within cycle wave y, the triangle that ended on the 17th of July may have been primary wave B. Primary wave C may have begun there. Primary wave C must subdivide as a five wave structure; it could be a complete impulse.

Within cycle wave y, there is no Fibonacci Ratio between primary waves A and C.

The best fit channel that contained cycle wave y was breached and now price has returned back to within the channel. This channel is not showing were price is finding support.

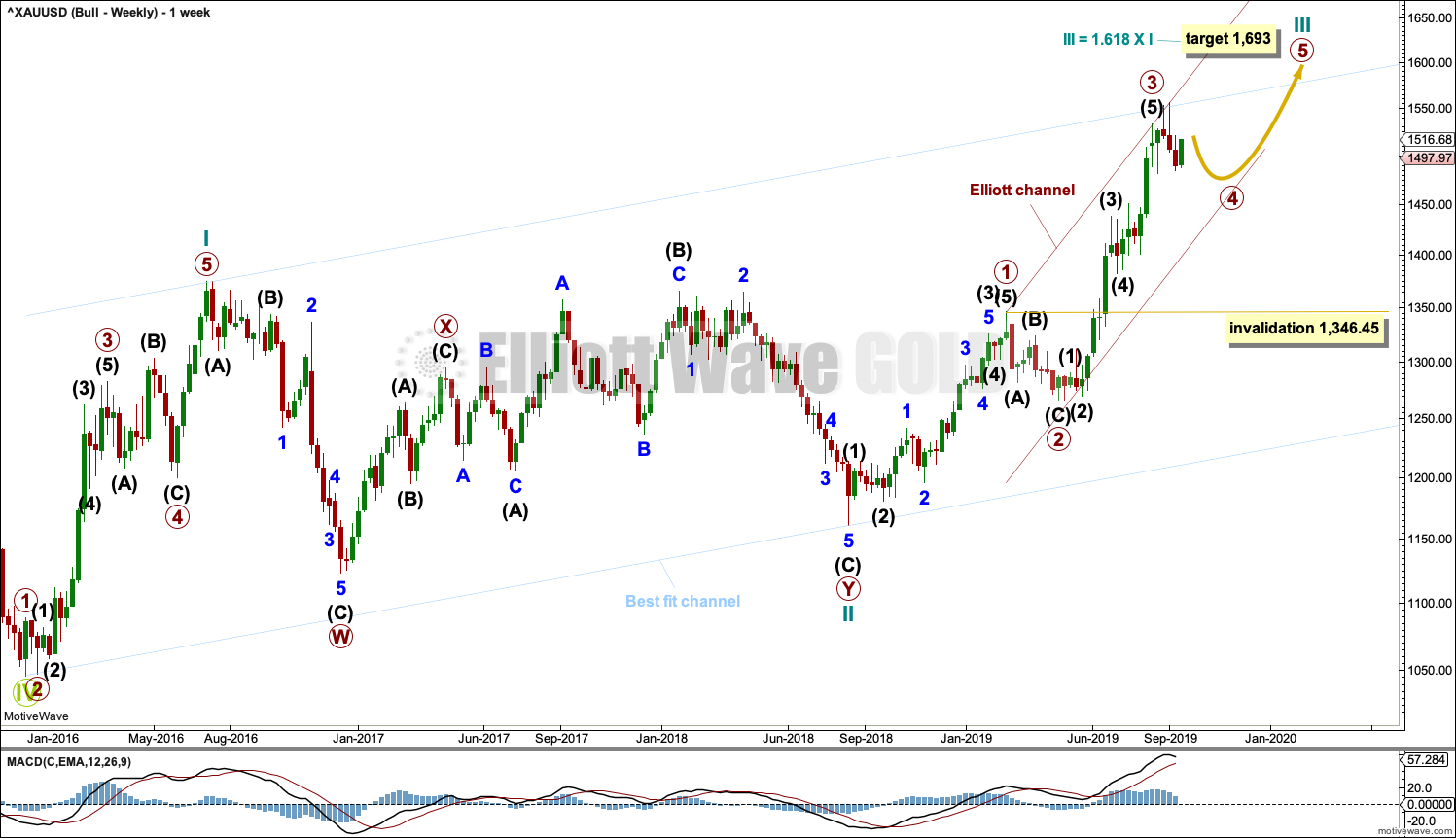

BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold in November 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. This wave count still suffers from this very substantial problem, and for this reason the bearish wave count is still considered because it has a better fit in terms of Elliott wave structure.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. Primary wave 3 has now moved above the end of primary wave 1 meeting a core Elliott wave rule. It has now moved far enough to allow room for primary wave 4 to unfold and remain above primary wave 1 price territory. Primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

Cycle wave III so far for this wave count would have been underway now for 57 weeks. It is beginning to exhibit some support from volume and increasing ATR. This wave count now has some support from classic technical analysis.

The channel drawn about cycle wave III is an Elliott channel. Primary wave 4 may find support about the lower edge.

Add the wide best fit channel to weekly and daily charts.

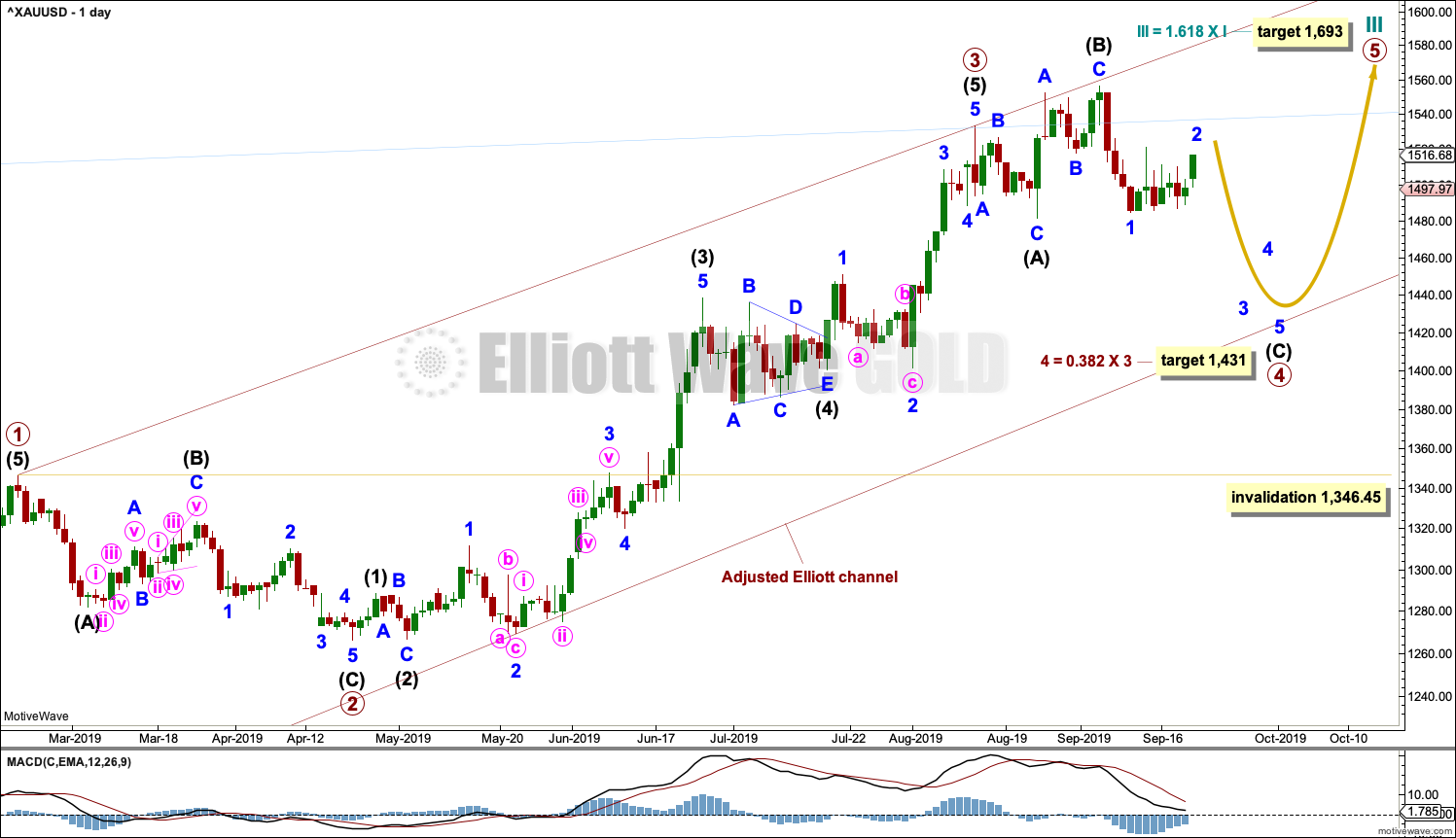

DAILY CHART

Primary wave 4 may be continuing as an expanded flat, which is a common corrective structure. This would see alternation in structure with the zigzag of primary wave 2.

Primary wave 2 lasted 43 sessions. Primary wave 4 may be expected to be more brief; Gold usually exhibits more brief fourth waves than their counterpart second waves. Primary wave 4 may end in a total Fibonacci 21 or 34 sessions. So far it has lasted 28 sessions. Primary wave 4 may now continue for a further 6 sessions to total a Fibonacci 34. Within primary wave 4, it would be extremely likely for intermediate wave (C) to move at least slightly below the end of intermediate wave (A) at 1,481.91 to avoid a truncation and a very rare running flat. It would be most likely that primary wave 4 is incomplete because there is not yet a new low below 1,481.91.

Primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

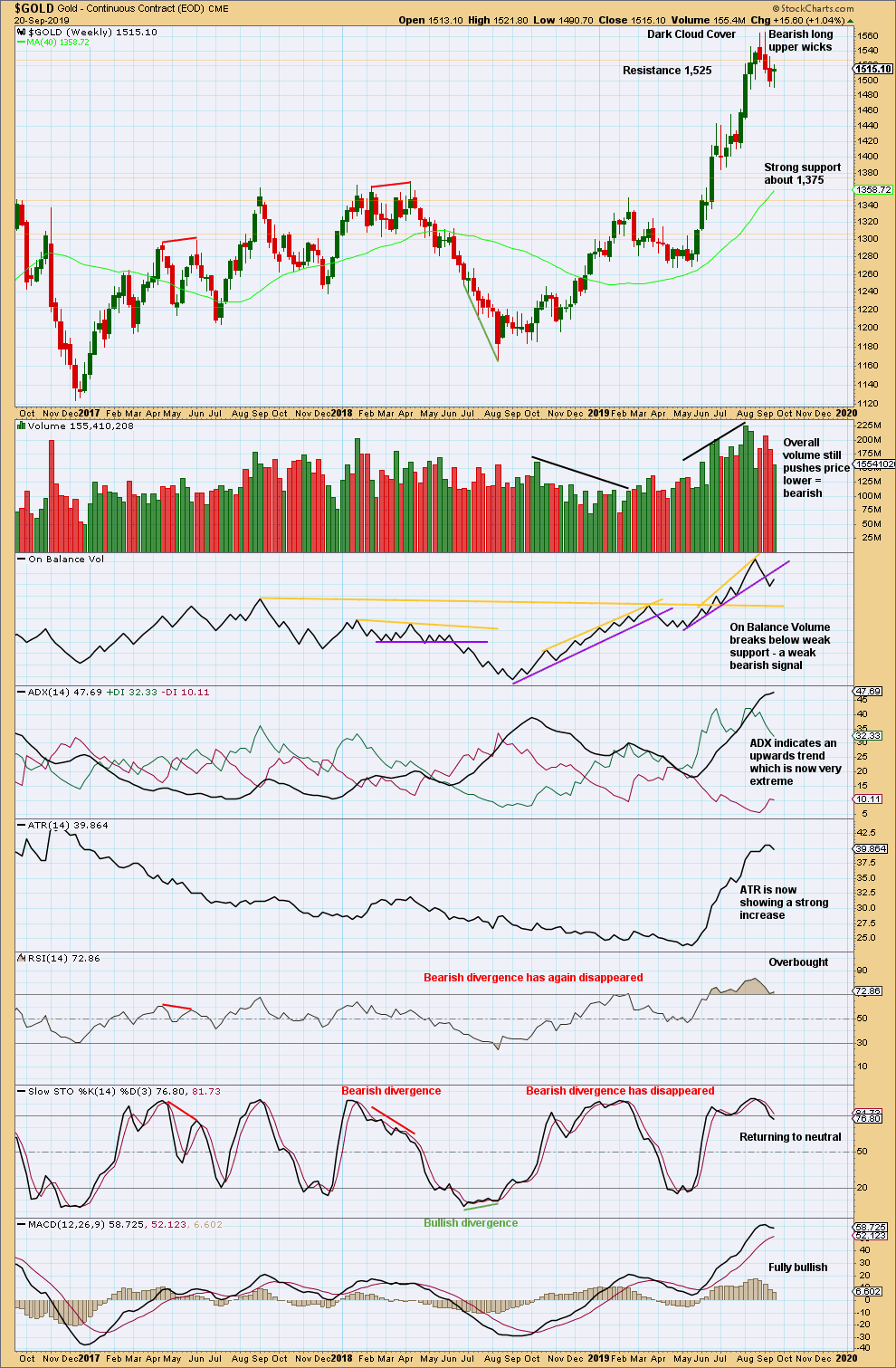

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When trends reach very extreme, candlestick reversal patterns should be given weight. The Dark Cloud Cover bearish reversal pattern is given more bearish weight from the long upper wick.

The risk of a major high and a trend change or a large time consuming consolidation continuing here is very high. These two scenarios effectively follow the main bearish wave count (major trend change) or bullish wave count (a large time consuming consolidation).

A weak bearish signal from On Balance Volume adds confidence to this analysis.

This week completes a downwards week, but the candlestick has closed green and the balance of volume is upwards. Upwards movement within the week may lack support from volume as volume declines for the week; but to judge the short-term volume profile, it would be best to look inside the week at daily volume bars.

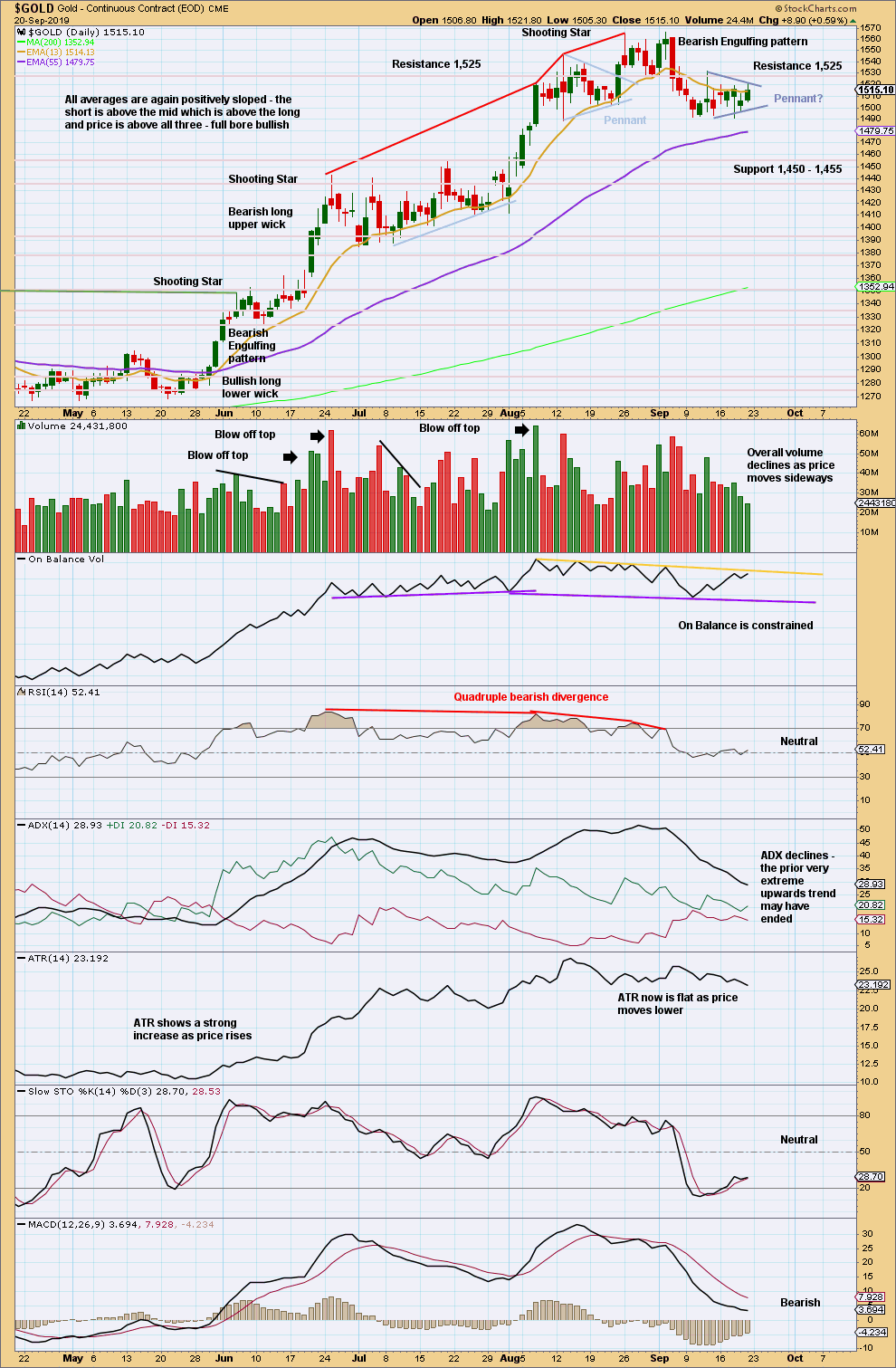

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The Bearish Engulfing pattern is very strong. It fully engulfs the real bodies of the prior seven daily candlesticks. Coming after an upwards trend reached very extreme and indicators reached overbought then exhibited multiple bearish divergence with price, the probability here of either a major trend change to a new downwards trend, or a major consolidation to last weeks or months, is very high indeed.

The last swing low is at 1,488.90. A new low below this point would confirm a trend change.

A small pennant may be forming. This would be a continuation pattern, so a downwards breakout would be expected. A target calculated from the flag pole would be about 1,415.

The short-term volume profile is bearish; upwards movement lacks support from volume.

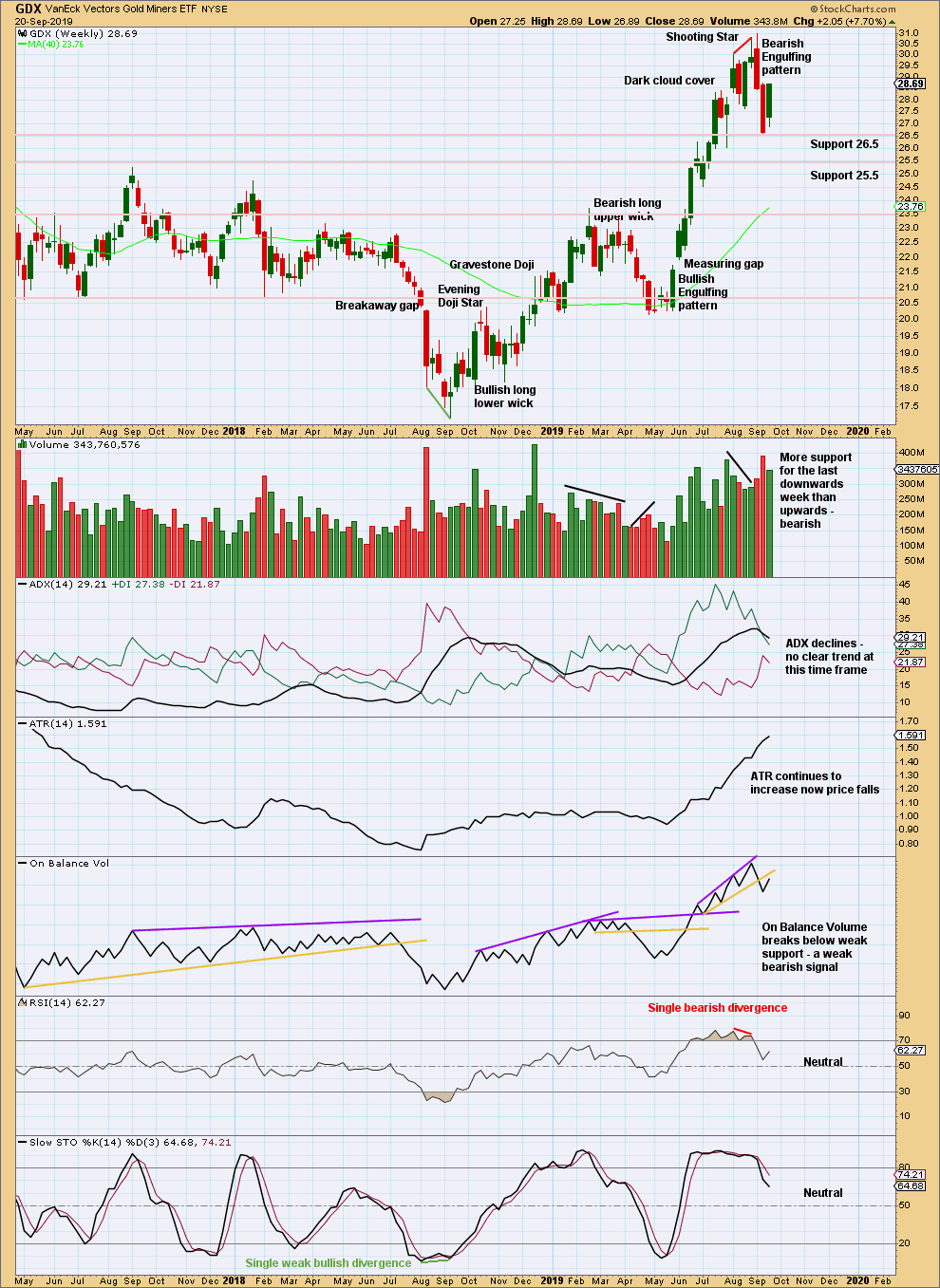

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A bounce up from support has unfolded this week. Look inside the week to judge the short-term volume profile.

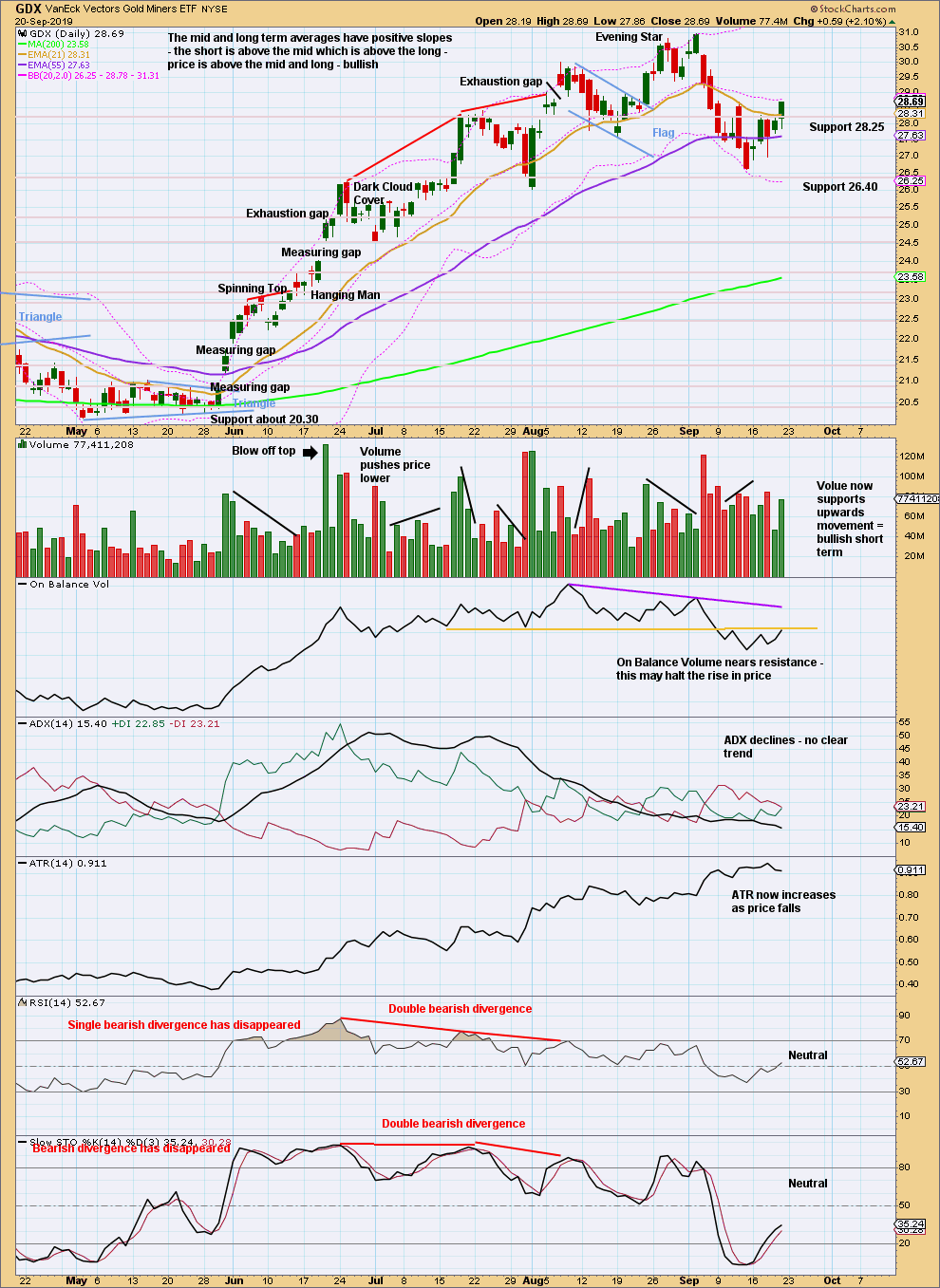

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Some support from volume and a shaven head for the last session suggest more upwards movement next week. It may be limited though by On Balance Volume at resistance.

US OIL

Downwards movement was expected for the week, but a new high above 58.75 indicated a deeper bounce. At that stage, the target was at 74.75.

Summary: A consolidation is expected to most likely continue sideways for a few more weeks. Resistance is about 66.59 and support is about 50.53. The breakout is expected to most likely be downwards.

The bullish alternate wave count would have confidence above 76.90. At that stage, a target for a third wave to end would be at 89.80.

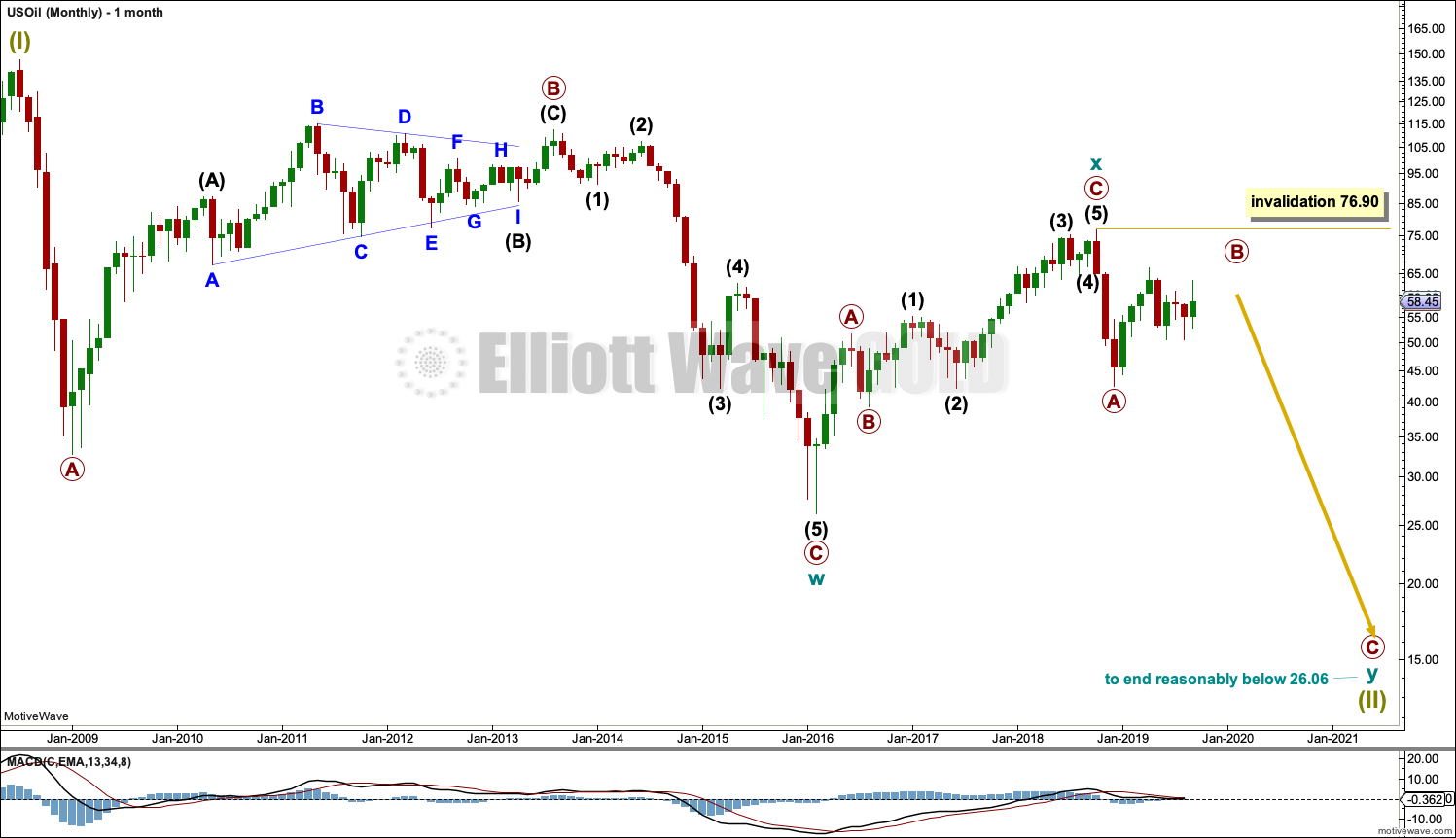

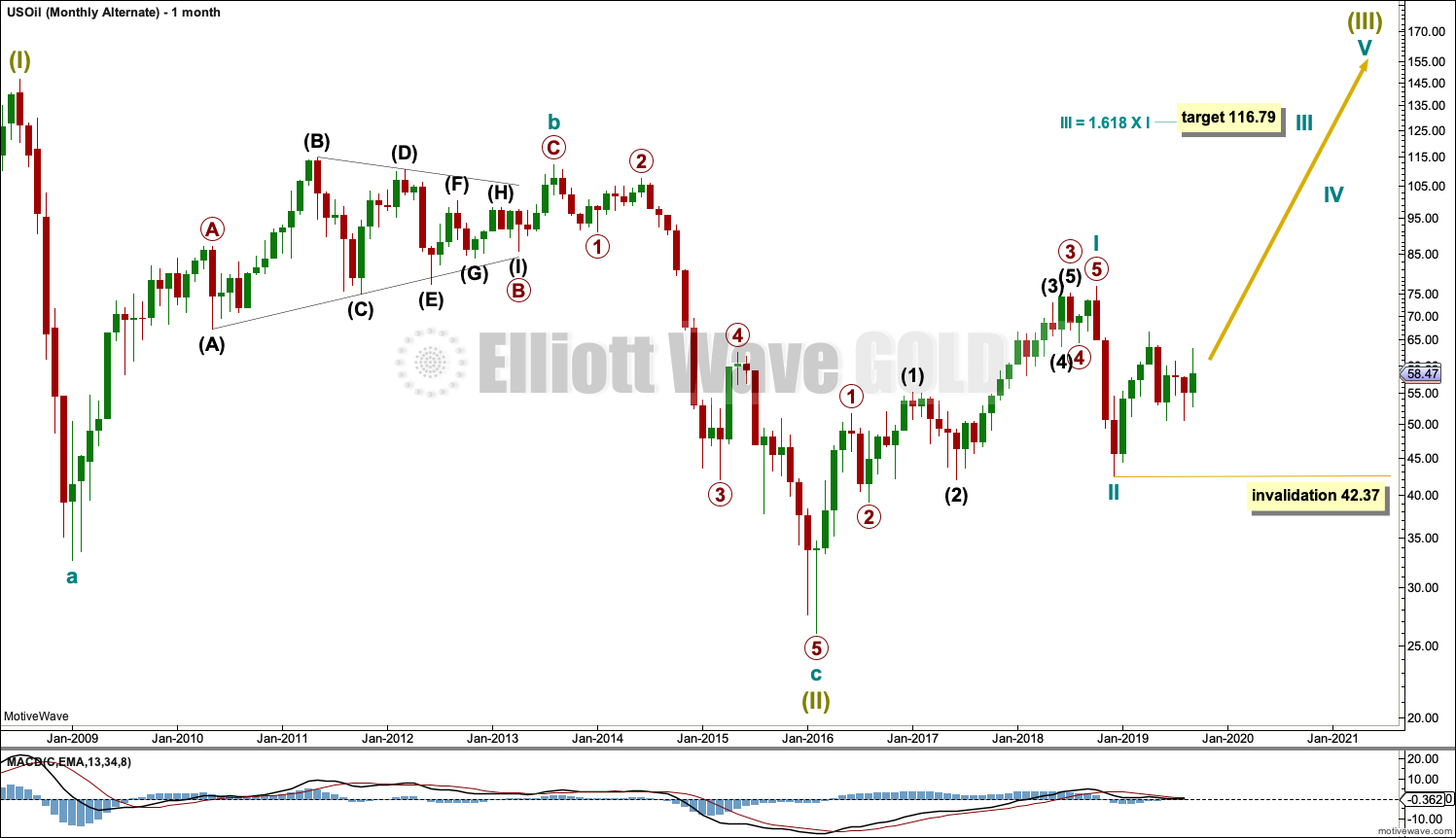

MAIN ELLIOTT WAVE COUNT – BEARISH

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil is still within a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil continues.

This Elliott wave corrective structure is a double zigzag, which is a fairly common structure. The correction is labelled Super Cycle wave (II).

The first zigzag in the double is complete and labelled cycle wave y. The double is joined by a three in the opposite direction labelled cycle wave x, which subdivides as a zigzag. The second zigzag in the double may now have begun, labelled cycle wave w.

The purpose of a second zigzag in a double zigzag is to deepen the correction when the first zigzag does not move price deep enough. To achieve this purpose cycle wave y may be expected to move reasonably below the end of cycle wave w at 26.06. The target is this week removed as primary wave B continues. When primary wave B may again be complete then the start of primary wave C may be known and a target may again be calculated.

Cycle wave y is expected to subdivide as a zigzag, which subdivides 5-3-5.

Cycle wave w lasted 7.6 years and cycle wave x lasted 2.7 years. Cycle wave y may be expected to last possibly about a Fibonacci 5 or 8 years.

Primary wave B may not move beyond the start of primary wave A above 76.90.

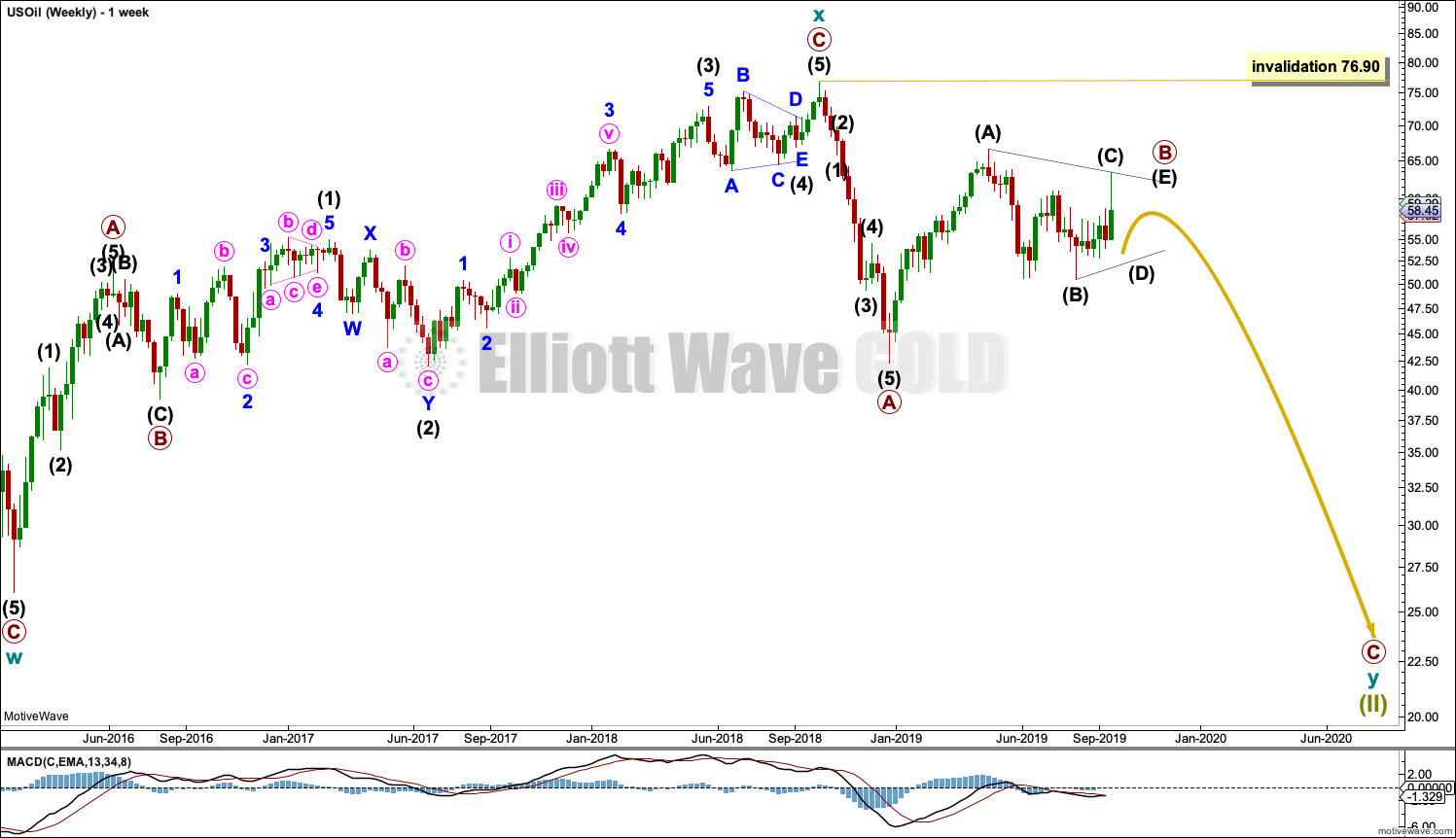

WEEKLY CHART

This weekly chart shows all of cycle waves x and y so far.

Cycle wave y is expected to subdivide as a zigzag. A zigzag subdivides 5-3-5. Primary wave A must subdivide as a five wave structure if this wave count is correct.

Primary wave A may be a complete five wave impulse at the last low.

Primary wave B may now be continuing further as a triangle or combination. Both ideas are outlined in daily charts below, and a triangle is labelled on the weekly chart.

When primary wave B may be complete, then a downwards breakout would be expected for primary wave C.

Primary wave B may not move beyond the start of primary wave A above 76.90.

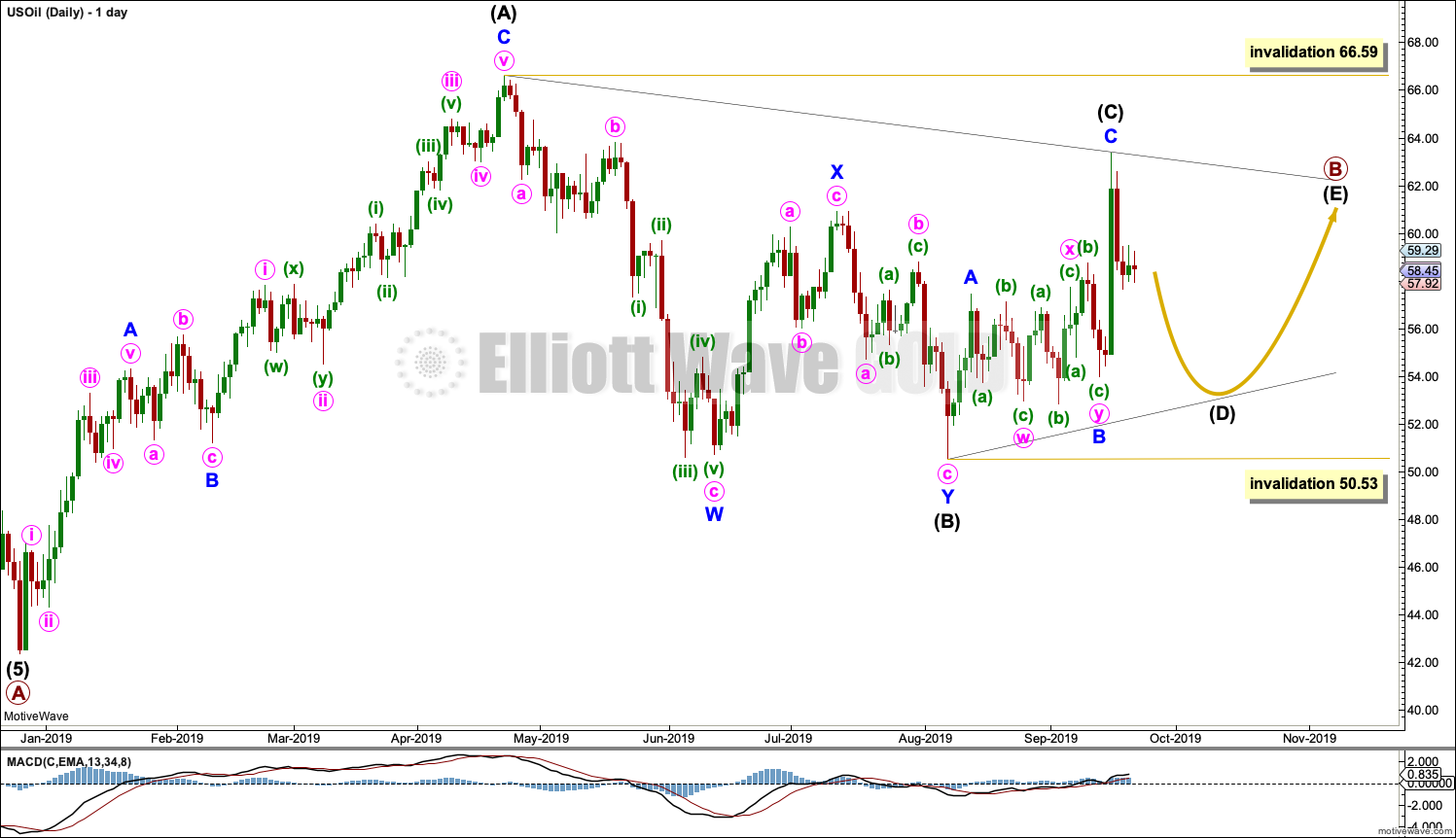

DAILY CHART

Note that monthly and weekly charts are on a semi-log scale, but this daily chart is on an arithmetic scale. This makes a slight difference to trend channels.

Elliott wave triangles are always continuation patterns. When primary wave B is complete, then a downwards breakout would be expected for primary wave C.

This chart considers a triangle for primary wave B. The triangle may be a regular contracting or regular barrier triangle.

Within a contracting triangle: intermediate wave (C) may not move beyond the end of intermediate wave (A) above 66.59; intermediate wave (D) may not move beyond the end of intermediate wave (B) below 50.53; intermediate wave (E) may not move beyond the end of intermediate wave (C), and would most likely fall short of the (A)-(C) trend line.

Within a barrier triangle: intermediate wave (C) may not move beyond the end of intermediate wave (A) above 66.59; intermediate wave (D) should end about the same level as intermediate wave (B) at 50.53 so that the (B)-(D) trend line is flat (in practice, this means that intermediate wave (D) may move slightly below intermediate wave (B) at 50.53; this invalidation point is not absolute for a barrier triangle); and, finally, intermediate wave (E) may not move beyond the end of intermediate wave (C), and would most likely fall short of the (A)-(C) trend line.

Within both a barrier and contracting triangle, the sub-wave of intermediate wave (C) could be over at this week’s high.

Within the zigzag, I have finally been able to see a satisfactory solution for minor wave B as a double flat correction. This labelling avoids all rare structures (such as running flats), meets all Elliott wave rules, and has a fairly normal and mostly sideways look of a double flat. Within the double flat, minute wave w is a regular flat and minute wave y is an expanded flat, exhibiting alternation.

All triangle sub-waves must subdivide as corrective structures. Four of the five sub-waves must subdivide as zigzags or zigzag multiples, with only one sub-wave allowed to subdivide as a multiple. So far intermediate wave (B) fits best as a double zigzag. All remaining waves of intermediate waves (C), (D) and (E) should now subdivide as single zigzags.

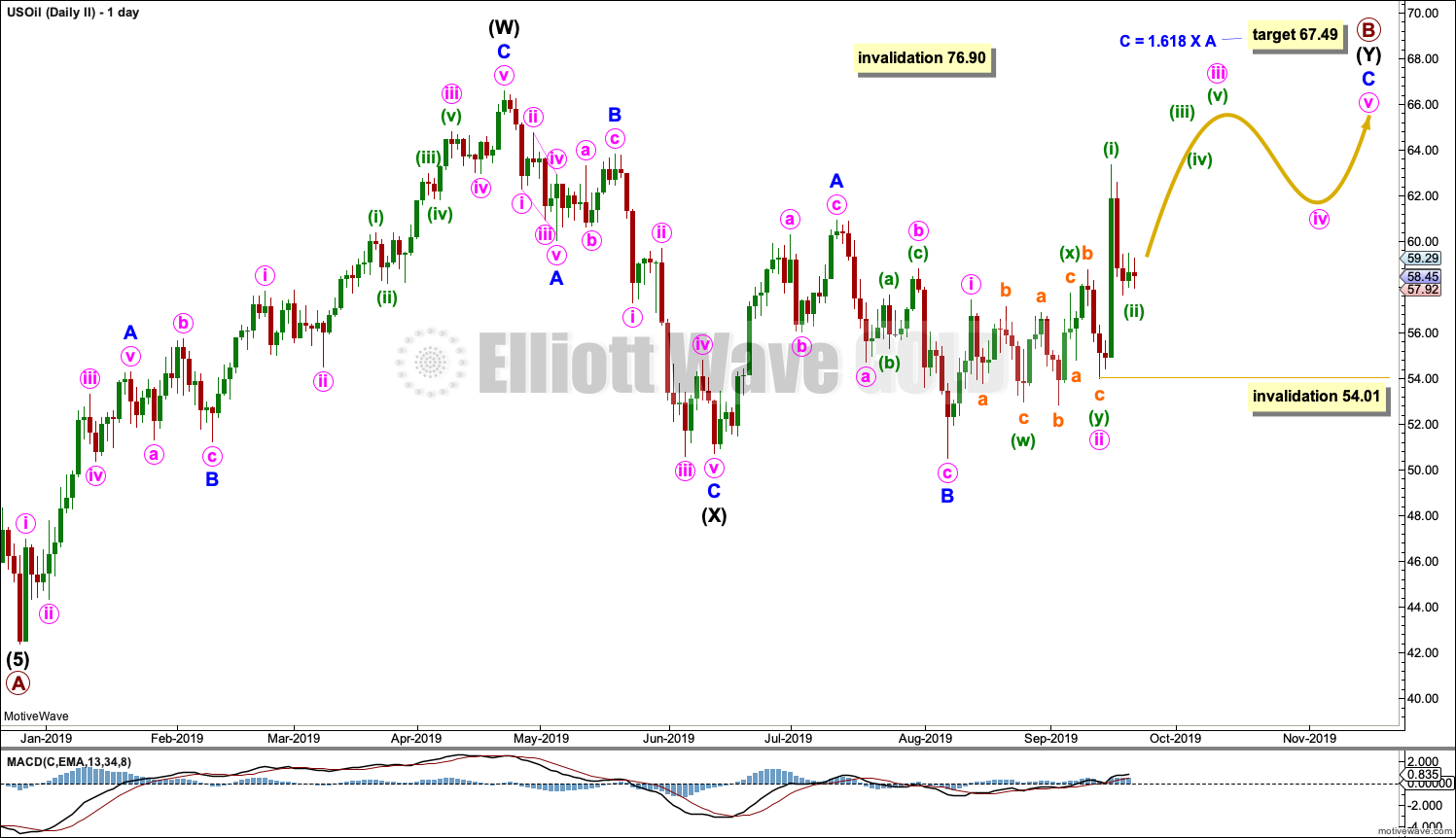

DAILY CHART II

When an Elliott wave triangle is considered, it is essential that alternates are also considered. Too many times an Elliott wave triangle may look to be completing only for the structure to be invalidated; the correction turns out to be something else, and the something else is almost always a combination.

Primary wave B may be a double combination: zigzag – X – flat. Intermediate wave (W) fits as a zigzag. Intermediate wave (Y) fits as a regular flat correction.

Within intermediate wave (Y), minor waves A and B both subdivide as threes. Minor wave B is a 1.02 length of minor wave A. For minor wave C to have room to complete its structure, the target calculated is for it to reach 1.618 the length of minor wave A.

The purpose of double combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends about the same level as the first. The target for intermediate wave (Y) would see this purpose achieved.

ALTERNATE ELLIOTT WAVE COUNT

MONTHLY CHART

It is possible that the bear market is over for Oil and a new bull market has begun.

For a bullish wave count for Oil, the upwards wave from the major low at 26.06 in February 2016 must be seen as a complete five wave impulse. This is labelled cycle wave I.

Cycle wave II may be a complete zigzag at 0.679 the depth of cycle wave I.

A target is calculated for cycle wave III to reach a common Fibonacci ratio to cycle wave I.

Within cycle wave III, no second wave correction may move beyond the start of its first wave below 42.37.

WEEKLY CHART

This weekly chart shows detail of cycle wave I as a five wave impulse.

Cycle wave II does look best as a three. This is the only part of this wave count that has a better look than the main wave count, which sees this downwards wave as a five.

The upwards wave of primary wave 1 within cycle wave III must be seen as a five wave structure for a bullish wave count to work. This movement at lower time frames does not subdivide well at all as a five; this reduces the probability of this wave count.

Cycle wave III may only subdivide as an impulse. Within cycle wave III, so far primary wave 1 may be complete. Primary wave 2 may be moving lower as a double zigzag. Primary wave 2 may not move beyond the start of primary wave 1 below 42.37.

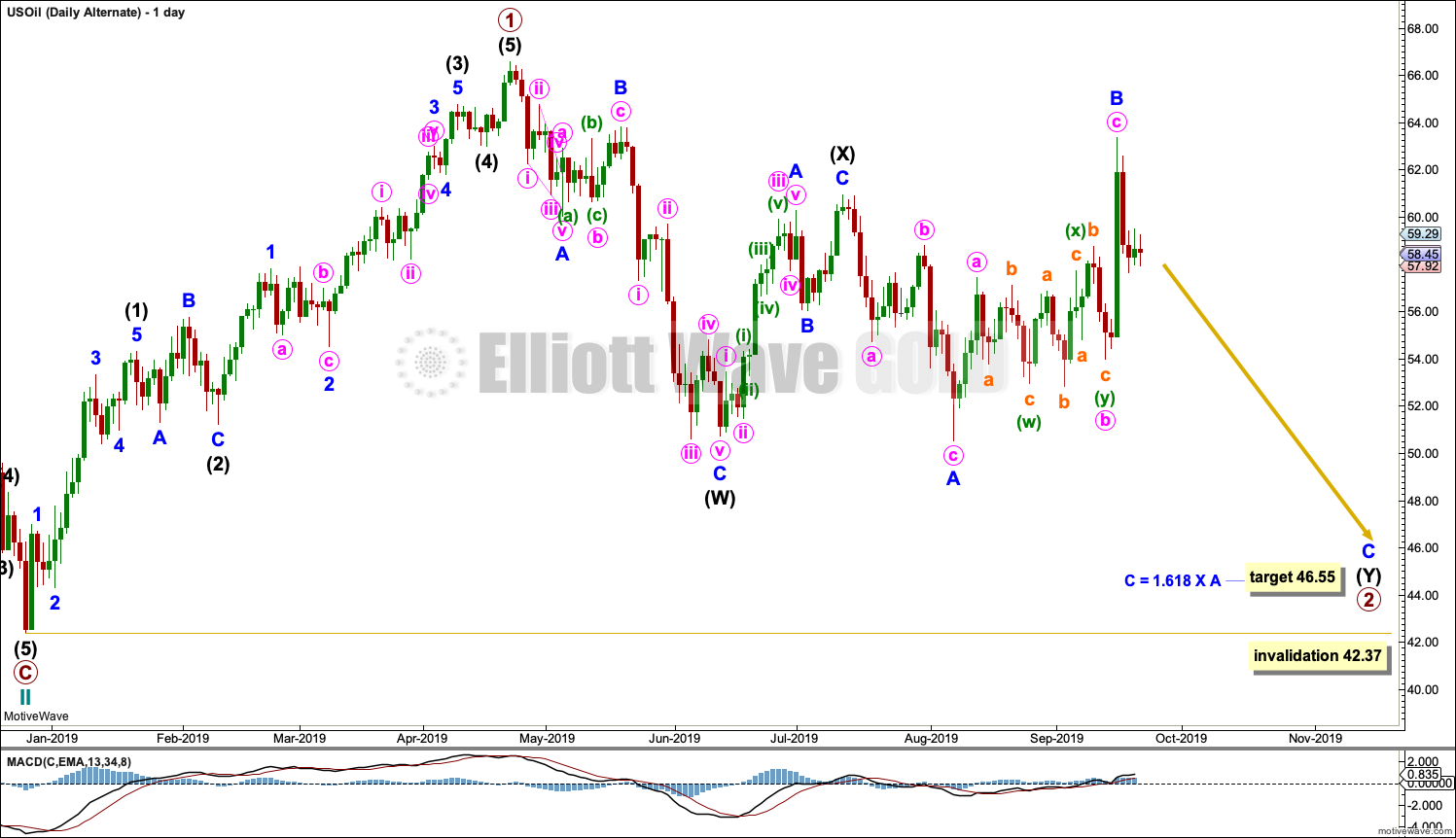

DAILY CHART

Primary wave 2 may be continuing lower as a double combination.

The first structure in the double would be complete, a zigzag labelled intermediate wave (W). Within intermediate wave (W), minor wave C ends with a slight truncation for minute wave v. This is acceptable.

The double may be now joined by a complete three in the opposite direction, a zigzag labelled intermediate wave (X).

Intermediate wave (Y) may now be completing as an expanded flat correction. Within intermediate wave (Y), minor waves A and B both subdivide as threes, and minor wave B is a 1.24 length of minor wave A (this is within the most common range for B waves of flats from 1 to 1.38).

A target is calculated for minor wave C to exhibit the most common Fibonacci Ratio to minor wave A within an expanded flat.

Primary wave 2 may not move beyond the start of primary wave 1 below 42.37.

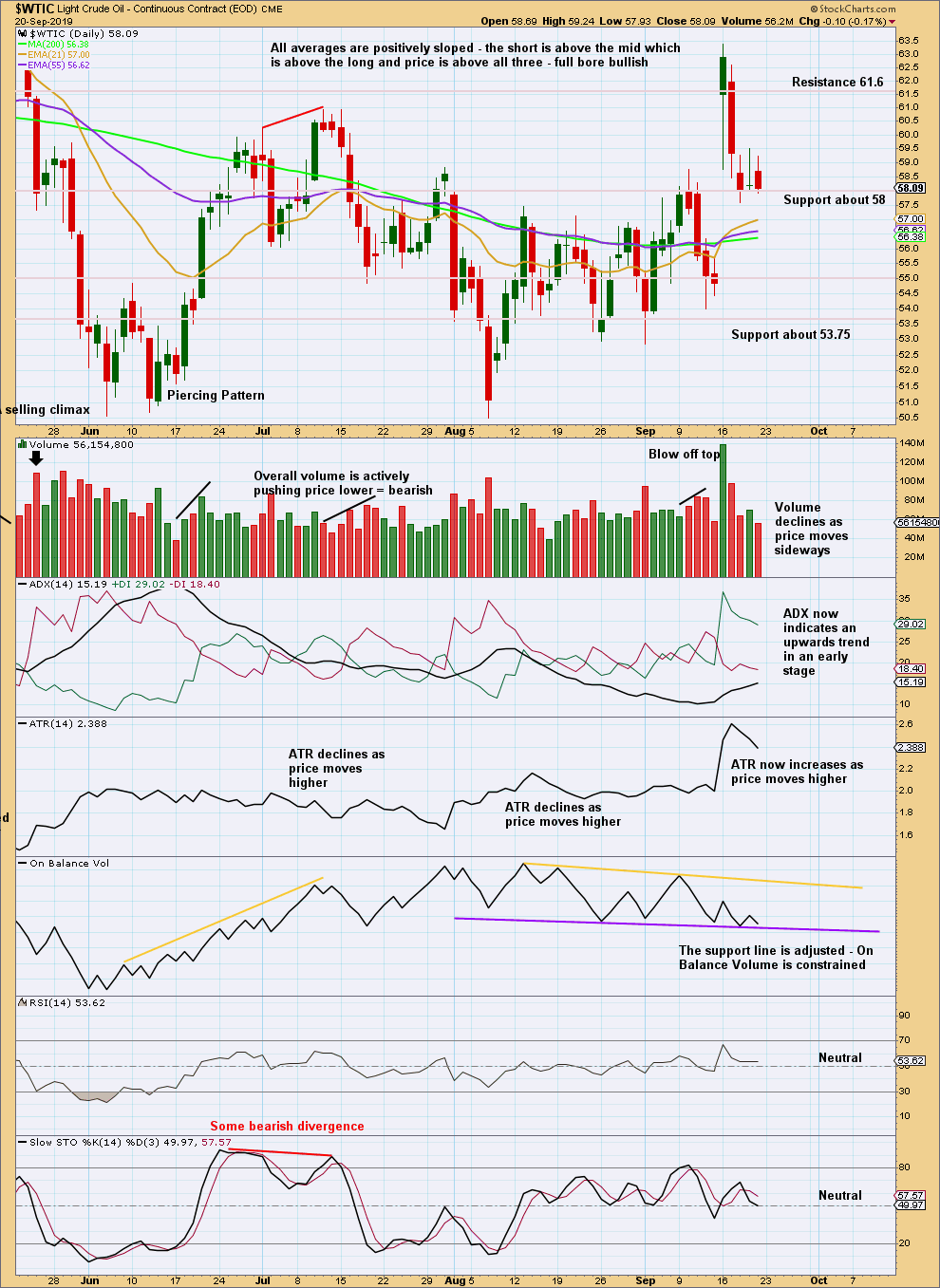

TECHNICAL ANALYSIS

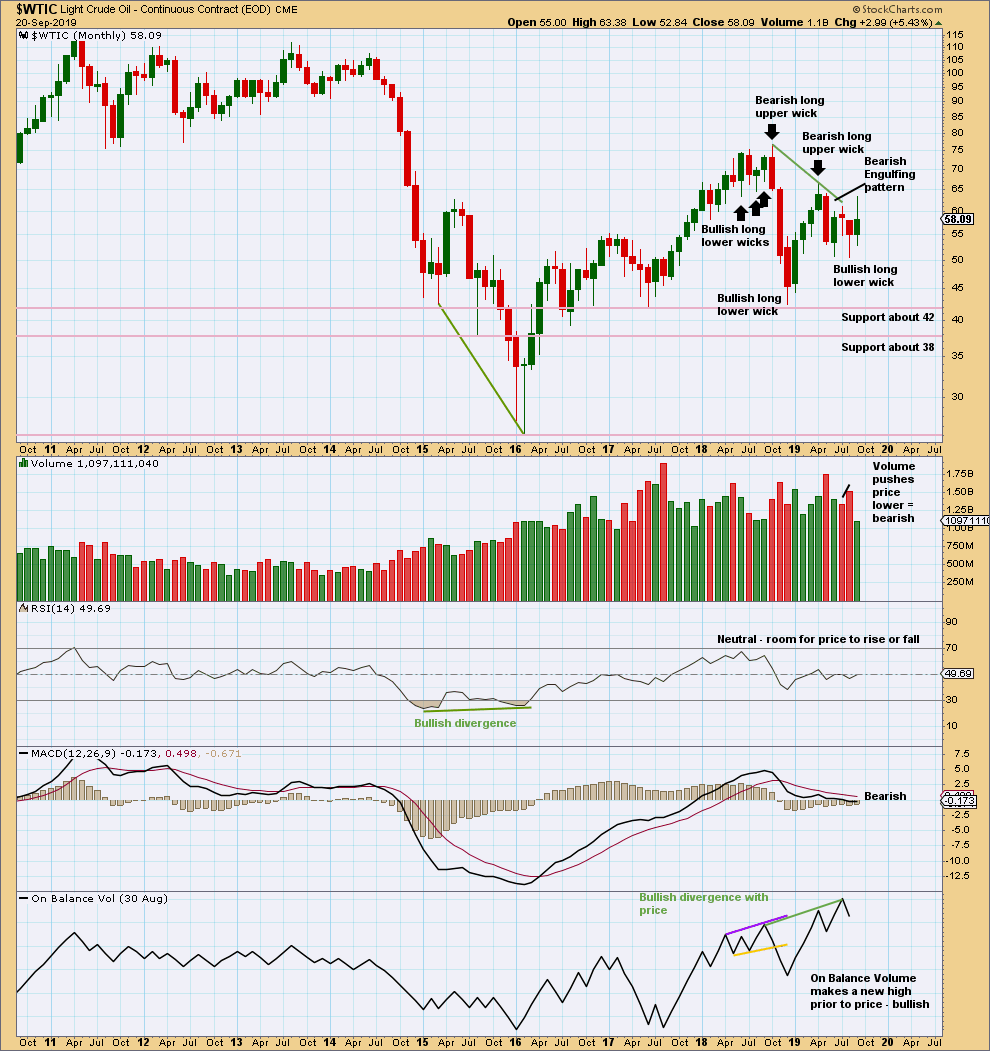

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

August has closed with a long lower wick, which is bullish, but price has moved lower with push from volume, which is bearish.

Overall, August is judged to be more bearish than bullish.

There is now double bullish divergence between price and On Balance Volume. This supports the alternate Elliott wave count.

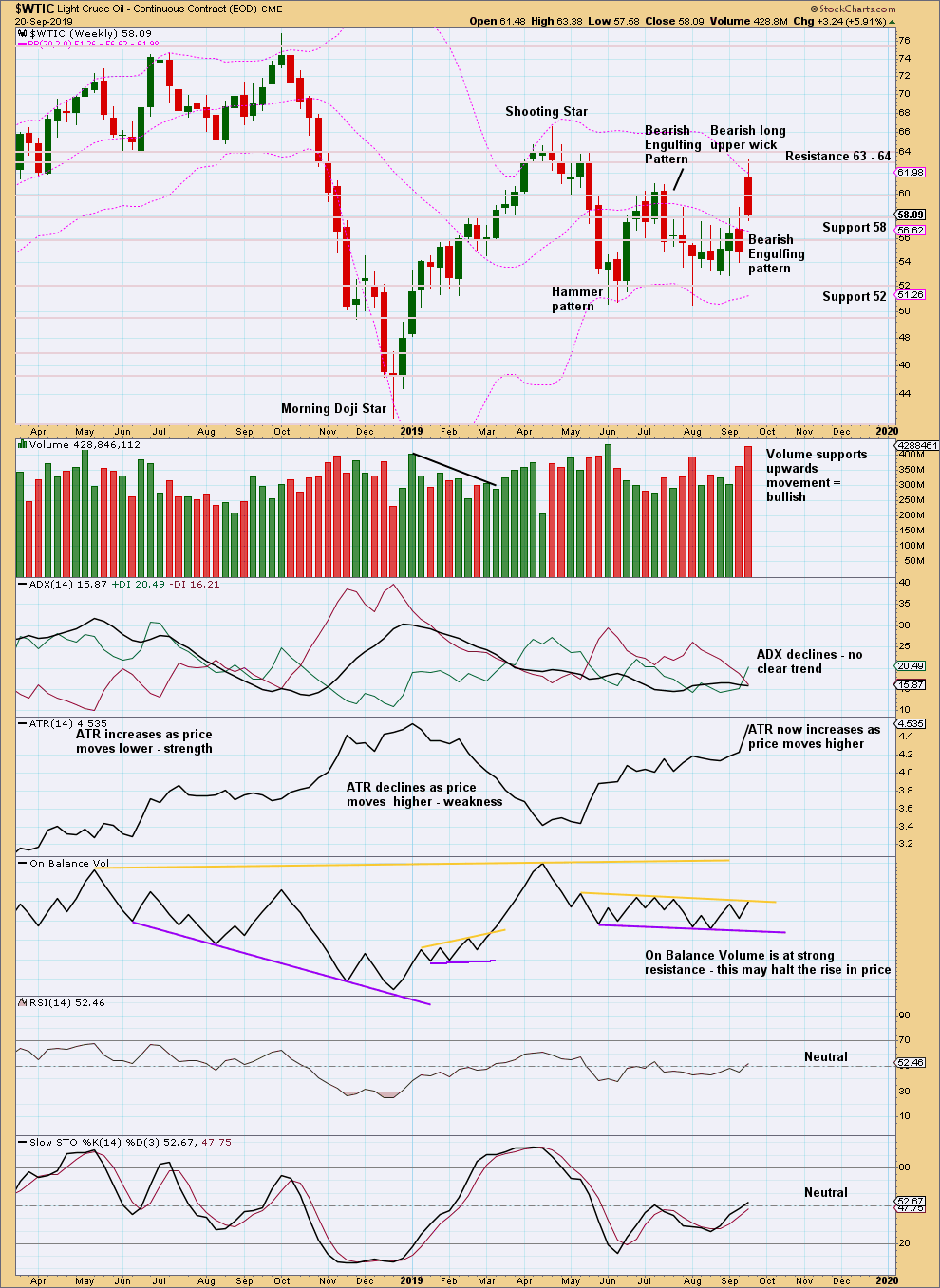

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week price broke out of a small range upwards. Next resistance is shown at 63 – 64.

Upwards movement has support from volume. The breakout is attended by a breakaway gap. But this week’s candlestick closes strongly red with a long upper wick; this looks concerning for bulls.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The breakout above resistance, which was about 58 (and is now support), has strong support from volume, giving confidence. However, it has immediately been followed by a very strong bearish daily candlestick.

An upwards trend may be developing. Downwards movement to end the week may be a typical back test of support, but it does look stronger than is normal.

On Balance Volume may offer the next strong signal if it breaks out of its consolidation.

—

Always practice good risk management as the most important aspect of trading. Always trade with stops and invest only 1-5% of equity on any one trade. Failure to manage risk is the most common mistake new traders make.

Lara – any quick targets to watch for Bitcoin? Just curious about what you think of the meltdown?

Still the 0.618 Fibonacci Ratio at 7,240 in the first instance

but it could be a fair bit deeper than that

thank you!

On this Sept 20th S&P 500 video, regarding Weekly II, at about 11:52 min., you mention a long view possibility of the bull Cycle I coming to an end in ‘another year or so.’ That long view possibility would pertain similarly to the First Wave Count, Weekly bull Super Cycle (V) wave count, as well?

For the S&P500, that view of the bull market continuing for another year or so (two?) applies equally to both weekly charts. Both see a fifth wave (cycle V or primary 5) completing, it looks to me like the structure needs many more months to complete it. It needs this third wave to complete, then two more large fourth waves counterparts to the big second waves that have already unfolded.

For the first weekly chart, when the structure of cycle V is complete then an absolutely huge once in a multi generations bear market would be expected to unfold.

For the second weekly chart, when the structure of primary 5 is complete, then a relatively brief and shallow bear market would be expected for cycle II to unfold. It may be only about 20% of market value and it may be over within a year. Thereafter a stronger bull market would be expected to develop.

The difference is best seen on monthly charts. I encourage you to click through to those in the links given at the start of the S&P analysis.

Hey to all the members of this forum. Lets try to make it clear about which narket we are posting. It make it easier for all readers if we start with something like “Regarding the SPX……..” or “In OIL ……… ” Thanks in advance.

Thanks Rodney. Also for me to answer questions. I don’t like guessing.

from the late 2018 low (IV)what percentage do you put odds of a large diagonal (10% 20%) to finish the final 5?

Less than 20%