GOLD: Elliott Wave and Technical Analysis | Charts – January 3, 2020

The main Elliott wave count expected overall upwards movement. Members were warned that upwards movement may exhibit an increase in momentum and volume for a blow off top. This is exactly what has happened to end the week.

Summary: Both wave counts now have the same target at 1,564 to 1,565. About this point a larger consolidation may develop, which may last about two weeks.

Grand SuperCycle analysis is here.

Monthly charts were last updated here.

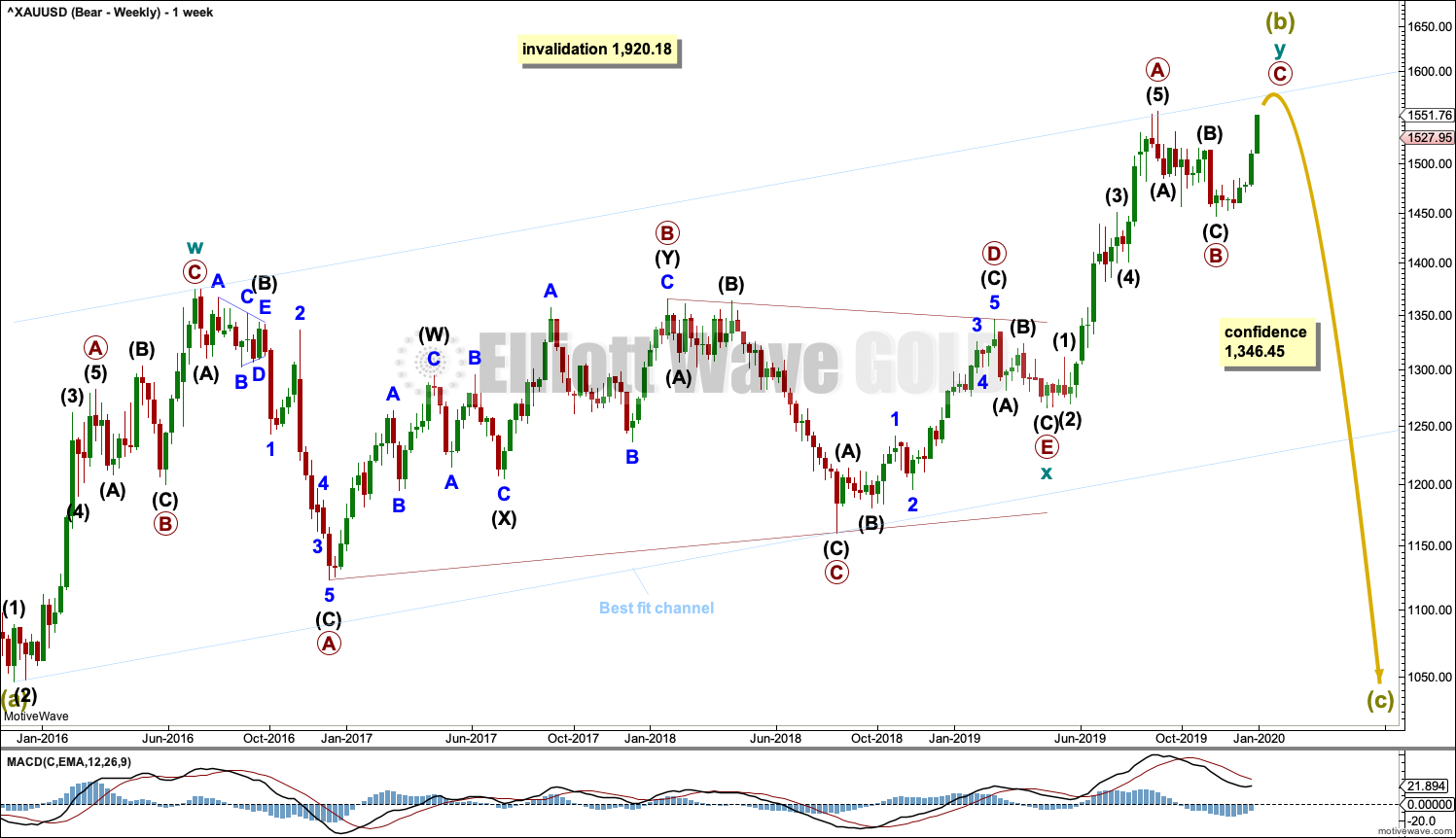

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

Super Cycle wave (b) may still be an incomplete double zigzag, requiring one more high.

The first zigzag in the double is labelled cycle wave w. The double is joined by a three in the opposite direction, a triangle labelled cycle wave x. The second zigzag in the double is labelled cycle wave y.

The purpose of the second zigzag in a double is to deepen the correction. Cycle wave y has achieved this purpose.

After the structure of cycle wave y may be complete, then a new low below 1,346.45 would add strong confidence to this wave count. At that stage, the bullish Elliott wave count would be invalidated. At that stage, targets for Super Cycle wave (c) would be calculated.

A wide best fit channel is added in light blue. This channel contains all of Super Cycle wave (b) and may provide resistance and support. Copy this channel over to daily charts. If the target is wrong, it may not be quite high enough. Upwards movement may end if price comes up to touch the upper edge of the channel.

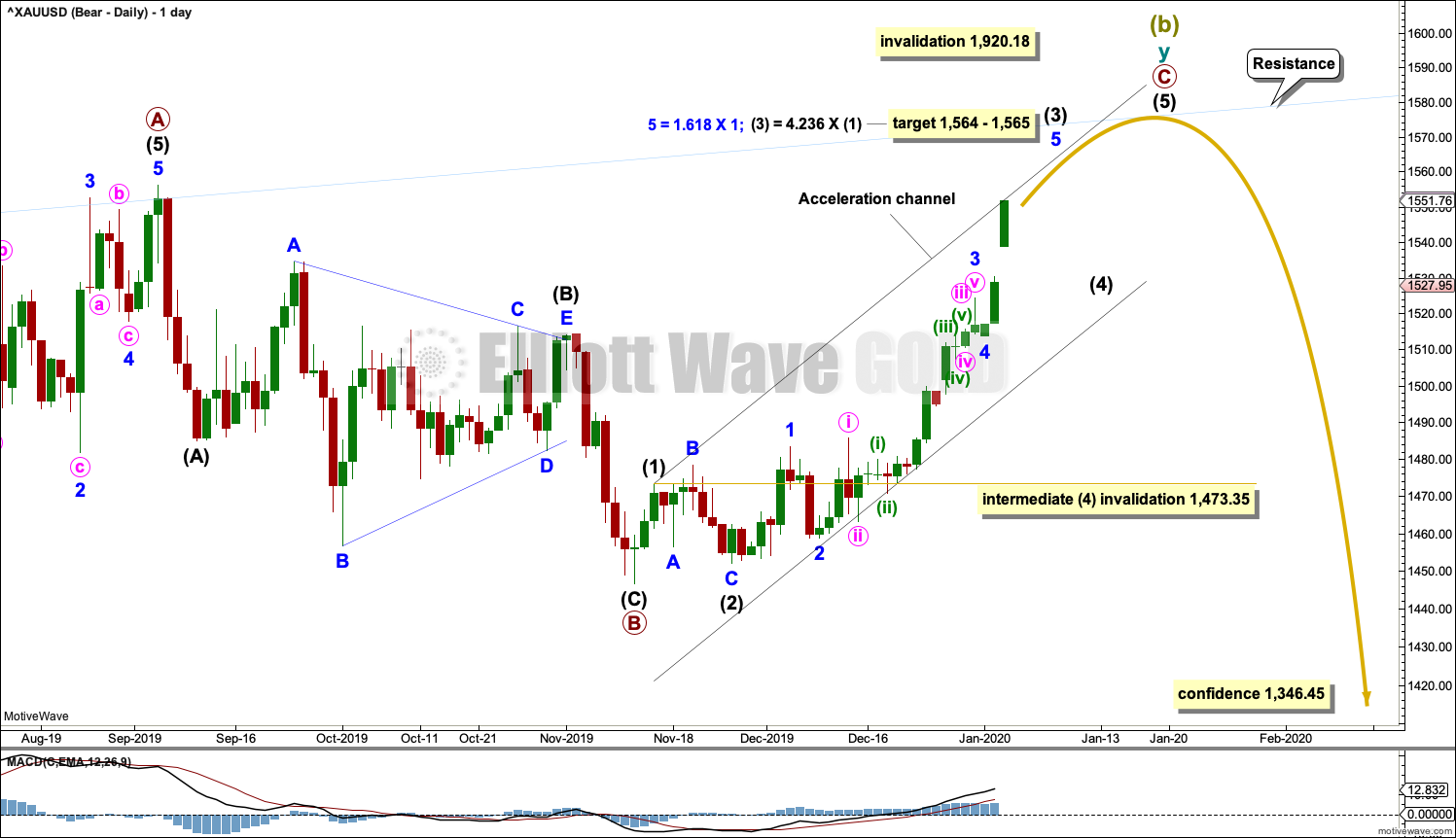

DAILY CHART

It is possible that the double zigzag for Super Cycle wave (b) may be incomplete and may yet require one more high.

Within cycle wave y, primary wave A may have been over at the last high.

Primary wave B may be complete as a single zigzag. Within the zigzag, intermediate wave (C) is just 3.56 short of equality in length with intermediate wave (A). Intermediate wave (B) is a running contracting triangle.

Primary wave C would be expected to find strong resistance and end at the upper edge of the blue best fit channel copied over from the weekly chart.

Primary wave C must subdivide as a five wave structure. Within primary wave C, so far intermediate waves (1) and (2) may be complete. Intermediate wave (3) may only subdivide as an impulse. The middle of the impulse may be complete.

Draw an acceleration channel about primary wave C: draw the first trend line from the end of intermediate wave (1) to the last high, then place a parallel copy to contain all of primary wave C. Keep redrawing the channel as price continues higher. When intermediate wave (4) arrives, then it may find support about the lower edge of this channel.

Gold has a tendency to form blow off tops in bull markets. Blow off tops usually form as fifth waves ending third wave impulses one degree higher. Minor wave 5 has now formed a blow off top for intermediate wave (3), which may be nearing completion.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 1,473.35.

A target is recalculated for intermediate wave (3) to end based upon two wave degrees.

The target for primary wave C is now removed. A target may again be calculated at intermediate degree when intermediate wave (4) may be complete.

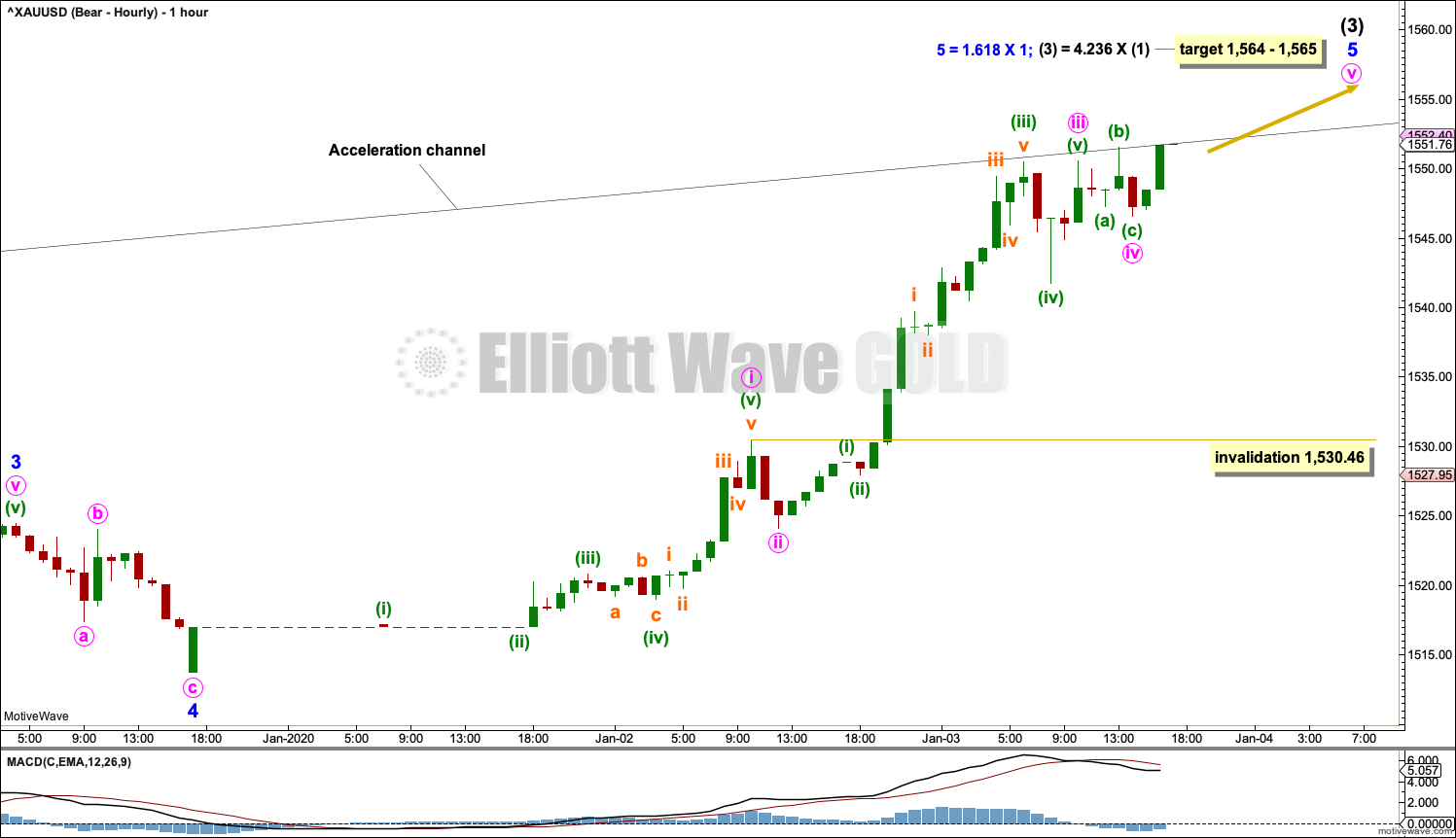

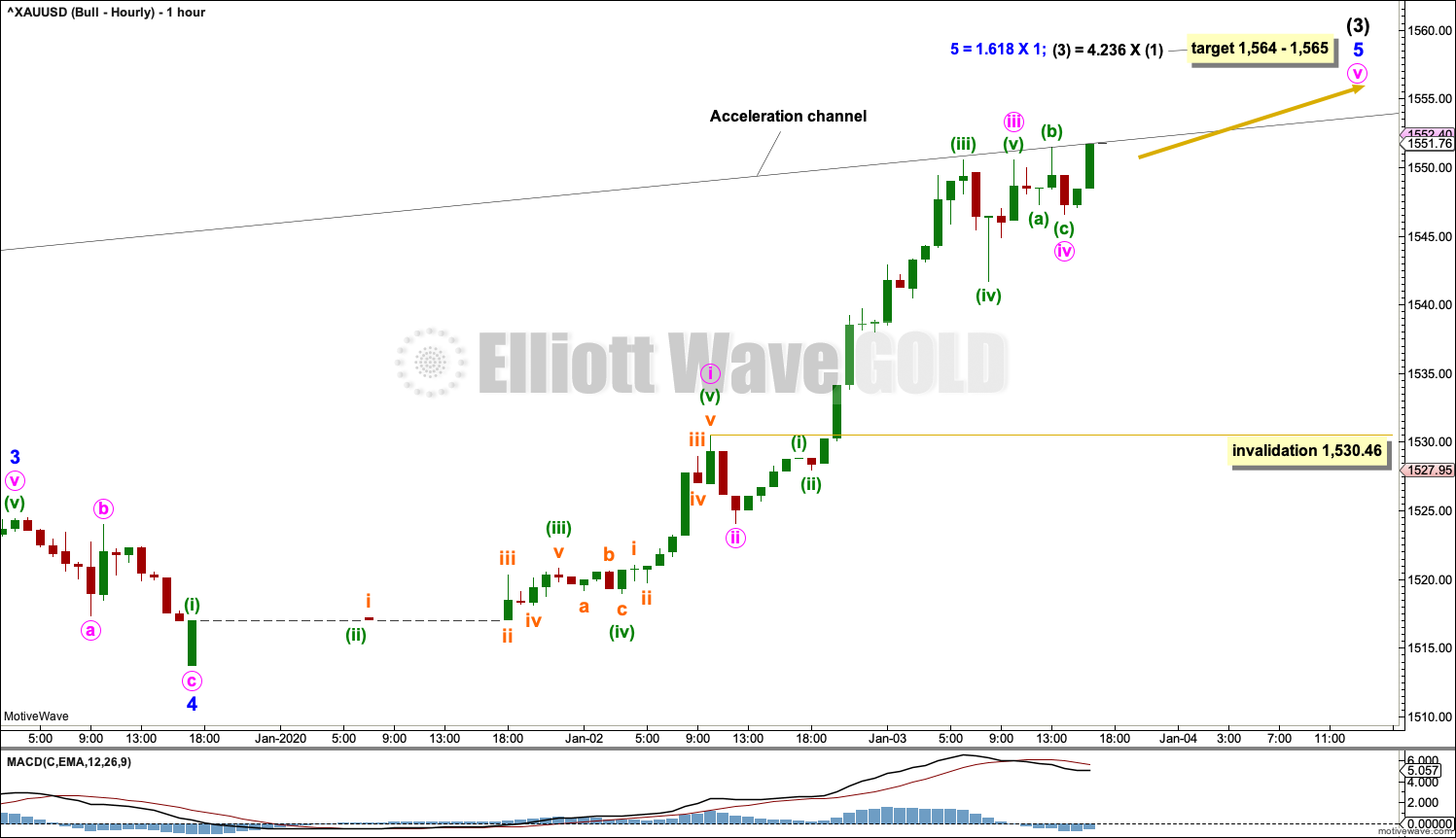

HOURLY CHART

Minor wave 5 is forming a blow off top. These are usually followed by some consolidation and then more upwards movement to a final high. Blow off tops are rarely at the final high.

Within minor wave 5, minute waves i, ii, iii and iv may all now be complete. If minute wave iv continues any further, then it may not move into minute wave i price territory below 1,530.46.

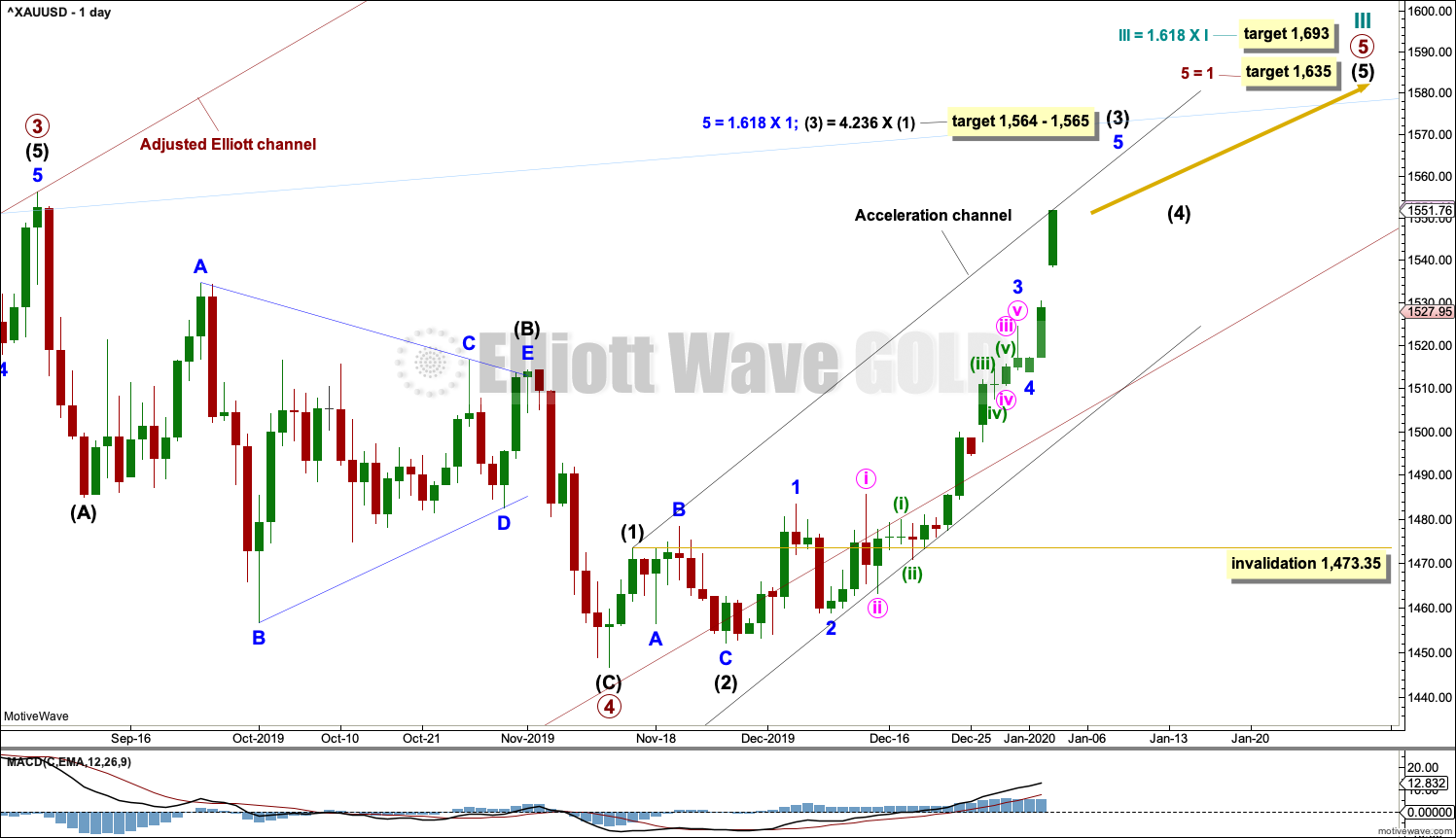

BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold in November 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. This wave count still suffers from this very substantial problem, which is one reason why the bearish wave count is preferred because it has a better fit in terms of Elliott wave structure.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. Primary wave 3 has now moved above the end of primary wave 1 meeting a core Elliott wave rule. It has now moved far enough to allow room for primary wave 4 to unfold and remain above primary wave 1 price territory. Primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

Cycle wave III so far for this wave count would have been underway now for 71 weeks. It exhibits some support from volume and increasing ATR. This wave count has some support from classic technical analysis.

The channel drawn about cycle wave III is an adjusted Elliott channel. The lower edge is pulled lower.

Add the wide best fit channel to weekly and daily charts.

DAILY CHART

Primary wave 4 may be complete as a single zigzag. Primary wave 4 may have lasted 49 sessions, just six more than primary wave 2, which lasted 43 sessions. The proportion remains very good for this part of the wave count.

A target for cycle wave III is calculated also now at primary degree. If price reaches the first target and keeps rising, then the second higher target may be used.

Primary wave 5 may only subdivide as a five wave structure, most likely an impulse. Within primary wave 5, intermediate wave (3) may only subdivide as an impulse.

Within the impulse of intermediate wave (3), minute wave iv may not move into minute wave i price territory below 1,485.71.

At this stage, this bullish Elliott wave count is essentially the same as the main bearish Elliott wave count in that both expect more upwards movement to new highs. The structure unfolding is the same, the degree of labelling is the same, and for the short term hourly charts are the same. The next target is now also the same.

HOURLY CHART

Hourly charts for the main bearish and this bullish wave count are the same.

TECHNICAL ANALYSIS

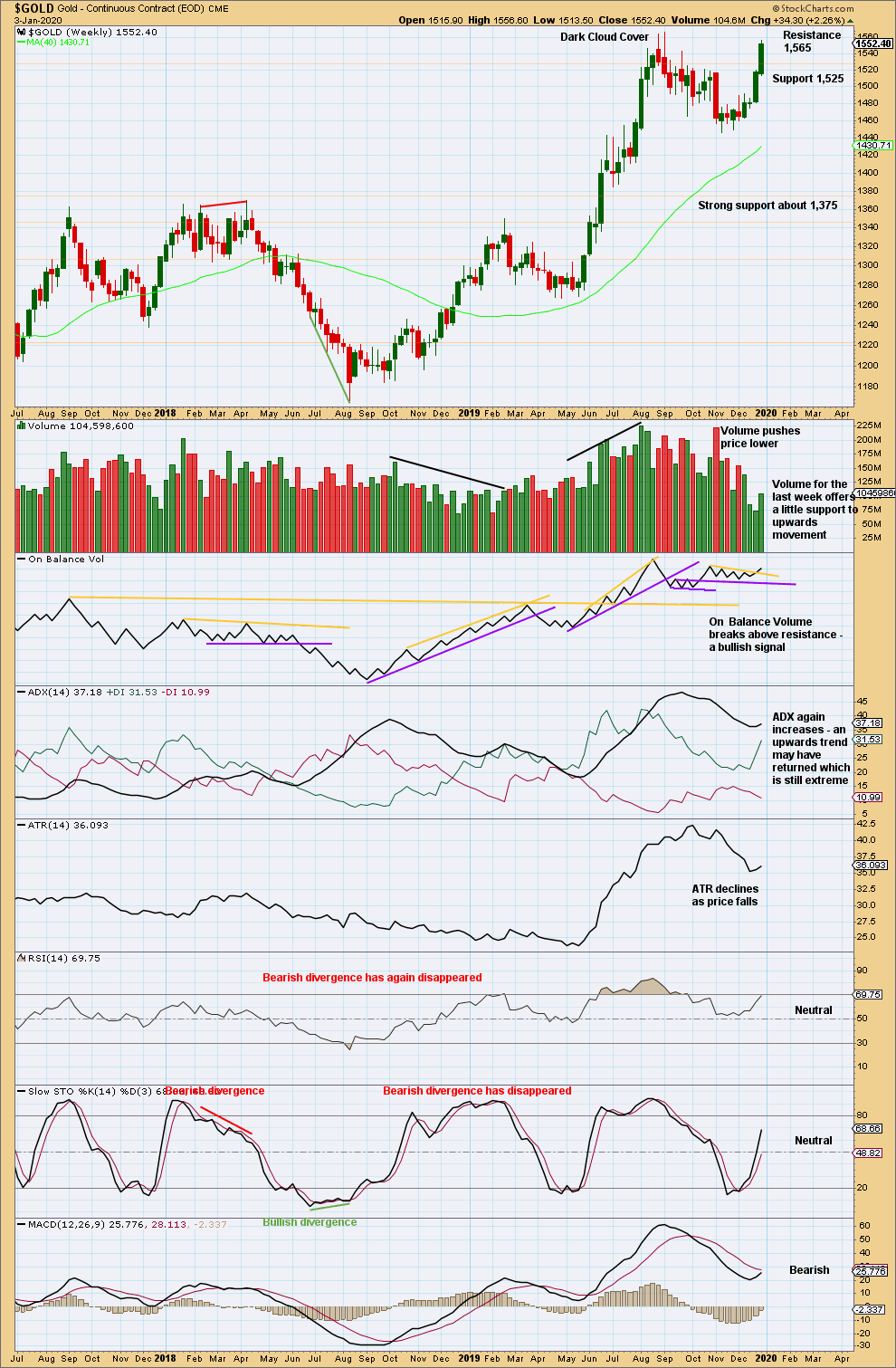

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Upwards movement continues. A bullish signal from On Balance Volume and some support this week from volume suggest upwards movement may continue futher to resistance above at 1,565.

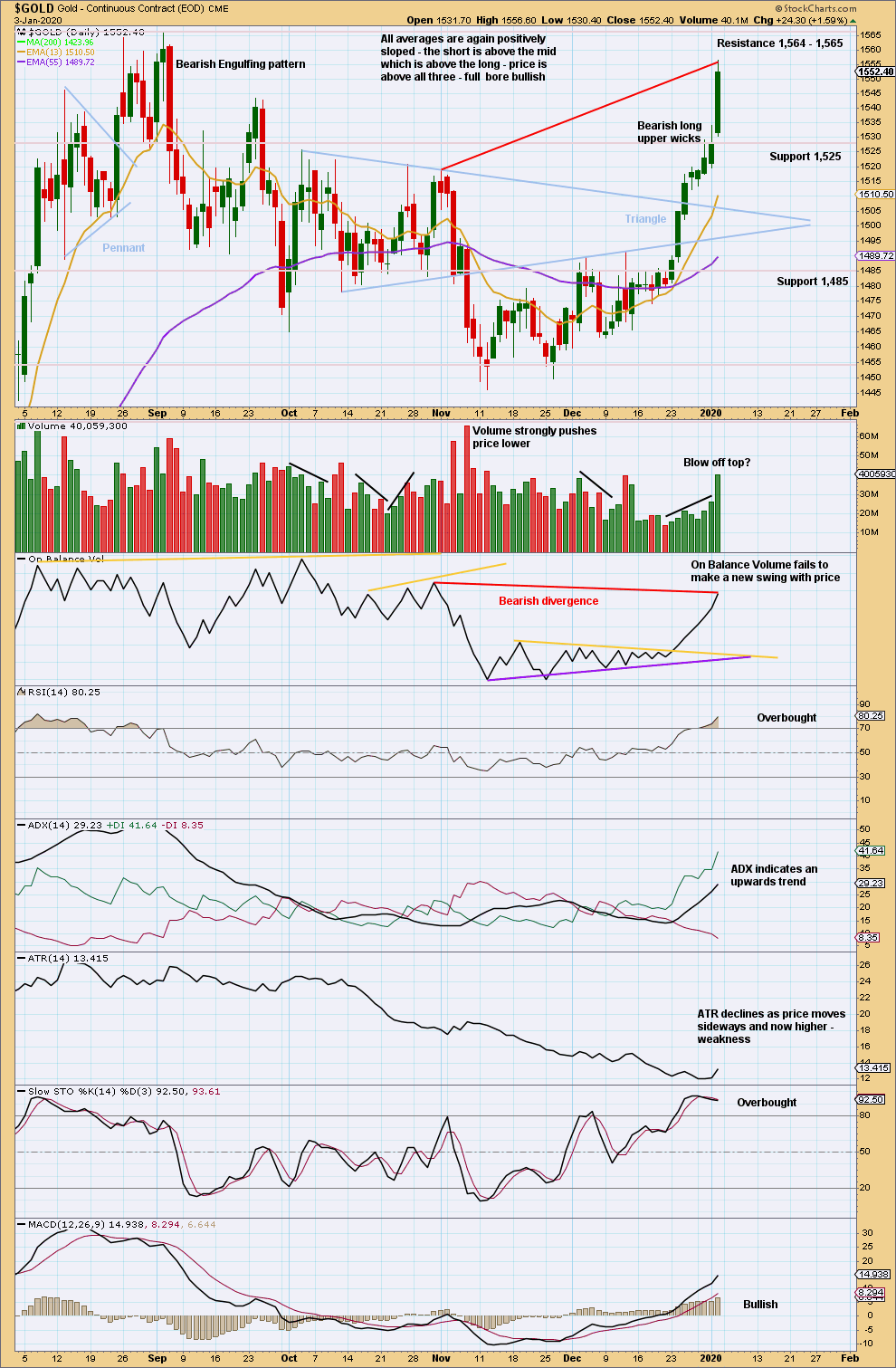

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Upwards movement may now continue higher to next resistance, which is strong about 1,564 – 1,565. As this agrees with Fibonacci ratios in the Elliott wave target, this zone has a high probability of providing resistance.

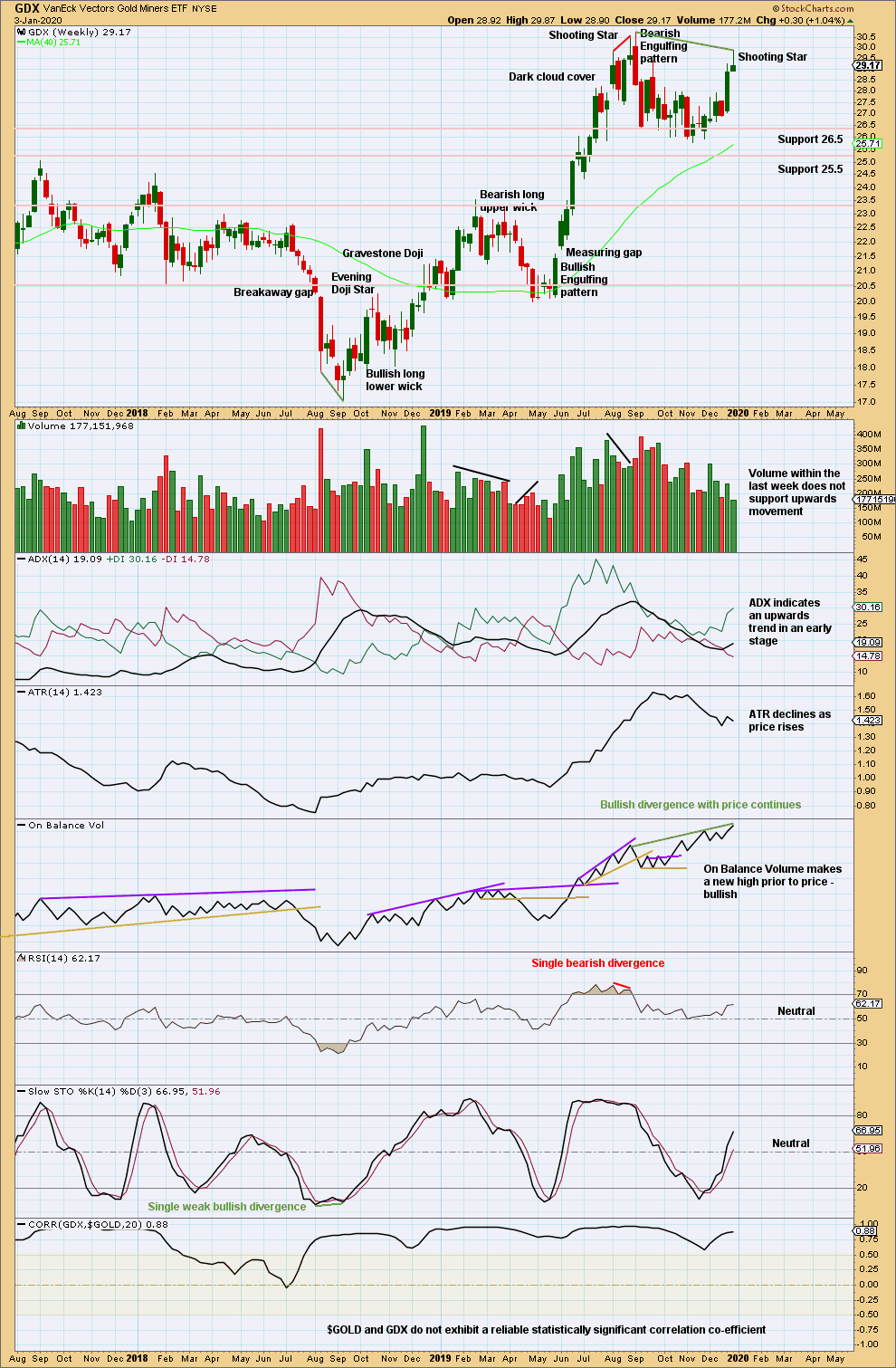

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A shooting star with declining volume this week suggests a consolidation may develop here for GDX.

Friday saw price move very strongly higher for Gold but overall lower for GDX. This is a perfect illustration of the lack of positive correlation between these two markets and why it is dangerous to assume that they must move in the same direction. The correlation co-efficient is added to the bottom of this chart to illustrate the data shows that any correlation that these two markets may have is unreliable.

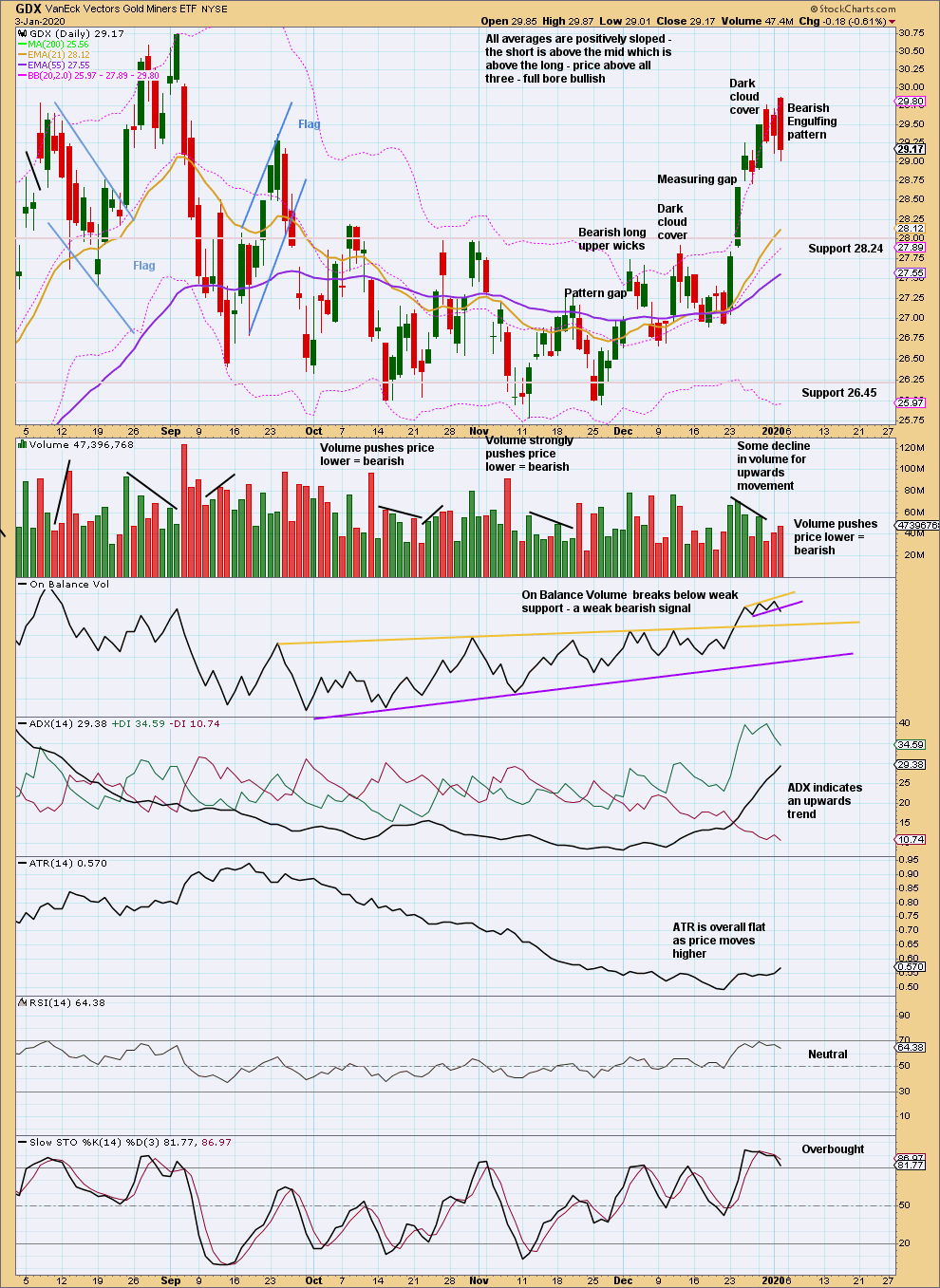

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

For the short term, GDX is more bearish than Gold. It may move lower next week. Look for support about 28.24.

Published @ 07:37 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Here is my attempt at a chart.

That looks good, a completely valid wave count

Is it reasonably possible or low probability in your opinion?

It’s going to be a very low probability since this is a rare EW structure and gold is due for a 2 week correction.

It could be part of the correction.

But it could also be labelled as an expanded flat. It all depends on how the waves subdivide.

Hourly chart updated:

The blow off top looks to now be reversed. The target was inadequate, but it looks like intermediate (3) was over.

Intermediate (4) should begin with a five down at the hourly chart time frame. That is incomplete. I’m labelling it so far minute a, but this may change. Minute b may not move beyond its start.

Is the target for gold changed to 1635 or 1697?

No. The target for intermediate (3) was inadequate. Intermediate (3) looks to be over, now expecting a consolidation or pullback for intermediate (4) to last a couple of weeks or so.

Lara, we used to be able to click on “comments” on a post on the main page and go directly to the comments section of the post. Can we please get that functionality restored? 😊

I’ll pass the request onto Cesar.

Gdx, and gdxj appear to be forming an expanding triangle. Lara could you comment on what is likely happening here. Is this a continuation pattern, or revearsal? Or is it just a consulidation? Any thoughts?

Bearish Engulfing on the daily for GDX is bearish short term and gold has outperformed GDX the last few days. Expect gold to start correcting and GDX will likely continue to correct near term.

Dreamer you are just regurgitating Lara.. Bullish engulfing pattern this morning. This is what happens in an expanding triangle. That is part of my question? Could this actually be a bullish continuation pattern? I’m asking if this is a reasonable alternative view point?

I think GDX goes above it’s 2016 high once the consolidation is over

Expanding triangles are one of the rarest EW structures. I’m not confident I’ve ever actually seen one. So my comment would be the probability is exceptionally low, there is probably a better explanation.

Also, I’m not sure what time frame you’re referring to. A chart would be most helpful.

I’m looking at GDX daily and I’m not seeing a possible expanding triangle at all.

I will send one later, but it is on a weekly time frame not daily.