by Lara | Aug 21, 2021 | Membership

Message To All Members Please enable JavaScript to view the comments powered by...

by Lara | Aug 21, 2021 | Gold, Lara's Weekly, S&P500, US Oil

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Video – August 20, 2021 S&P500 first Gold at 16:01 US Oil at...

by Lara | Aug 20, 2021 | Gold, Lara's Weekly, S&P500, US Oil

Lara’s Weekly: Elliott Wave and Technical Analysis of S&P500 and Gold and US Oil | Charts – August 20, 2021 S&P 500 A bounce on Friday remains below the short-term invalidation point but does not fit expectations for the short term picture. The...

by Lara | Aug 20, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Video – August 20,...

by Lara | Aug 20, 2021 | US Oil, US Oil Historical

US OIL: Elliott Wave and Technical Analysis | Video – August 20,...

by Lara | Aug 20, 2021 | Gold

GOLD: Elliott Wave and Technical Analysis | Charts – August 20, 2021 Another small range day to end the week closes as a Gravestone Doji candlestick. This pattern supports the bearish Elliott wave count, slightly. Summary: Both Elliott wave counts remain valid,...

by Lara | Aug 20, 2021 | US Oil, US Oil Historical

US OIL: Elliott Wave and Technical Analysis | Charts – August 20, 2021 Downwards movement this week has invalidated the main daily Elliott wave count for the daily chart. That wave count is now discarded in favour of an alternate Elliott wave count. Summary: The...

by Lara | Aug 20, 2021 | Bitcoin, Cryptocurrencies

BTCUSD: Elliott Wave Analysis and Technical Analysis | Video – August 19, 2021 Please enable JavaScript to view the comments powered by...

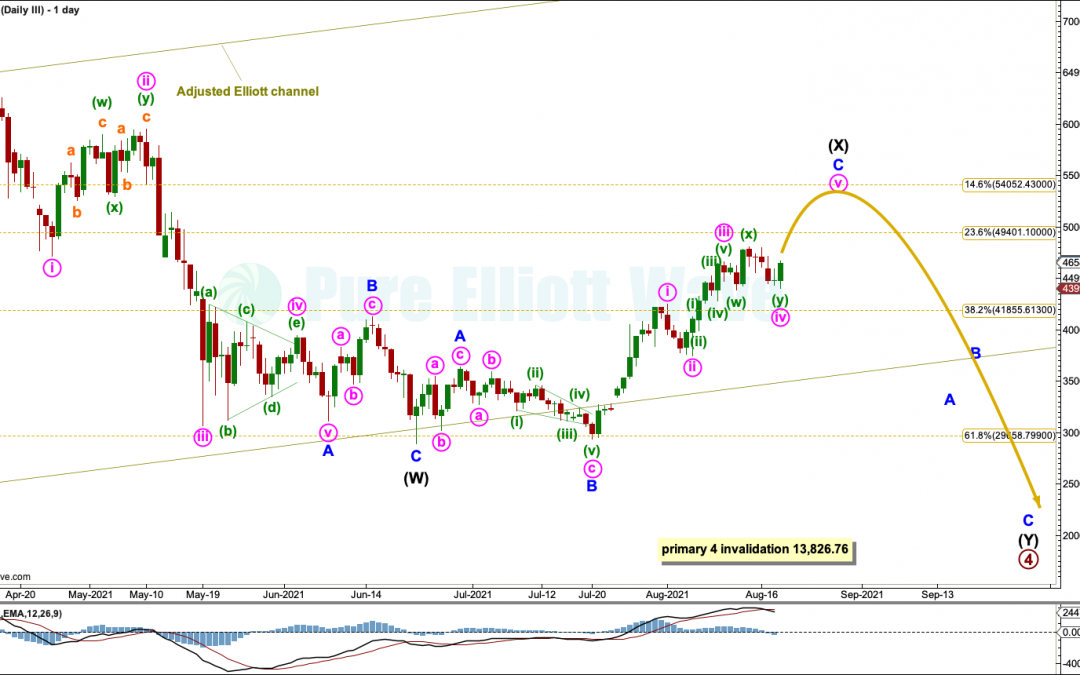

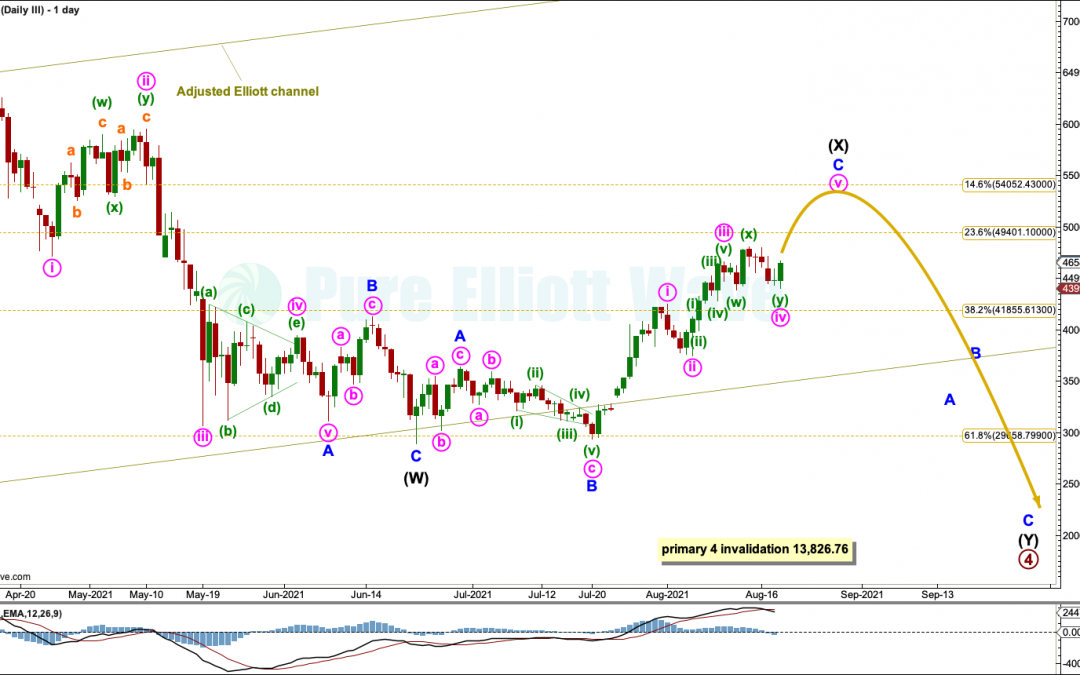

by Lara | Aug 20, 2021 | Bitcoin, Public Analysis

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 19, 2021 Last Bitcoin analysis, on August 11th, expected upwards movement towards a target about 57,669 as most likely. Since August 11th price has mostly moved sideways and a little higher. Summary:...