I had expected more downwards movement towards a short term target at 1,226 which was expected to be over within 24 hours, before the resumption of the upwards trend.

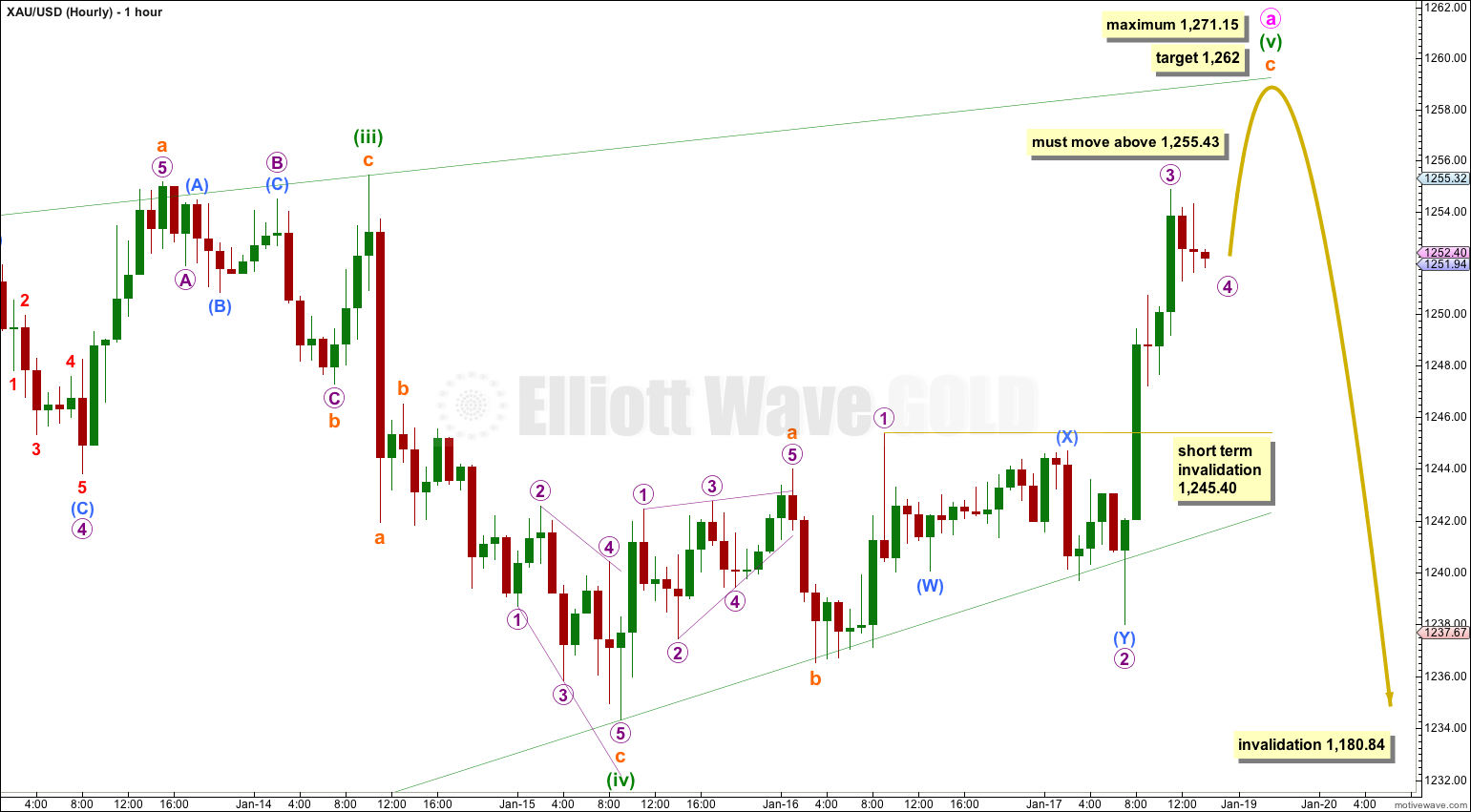

We did not see the downwards movement I had expected. Movement above 1,245.40 invalidated the hourly wave count.

The final upwards wave of this structure is almost over.

Click on the charts below to enlarge.

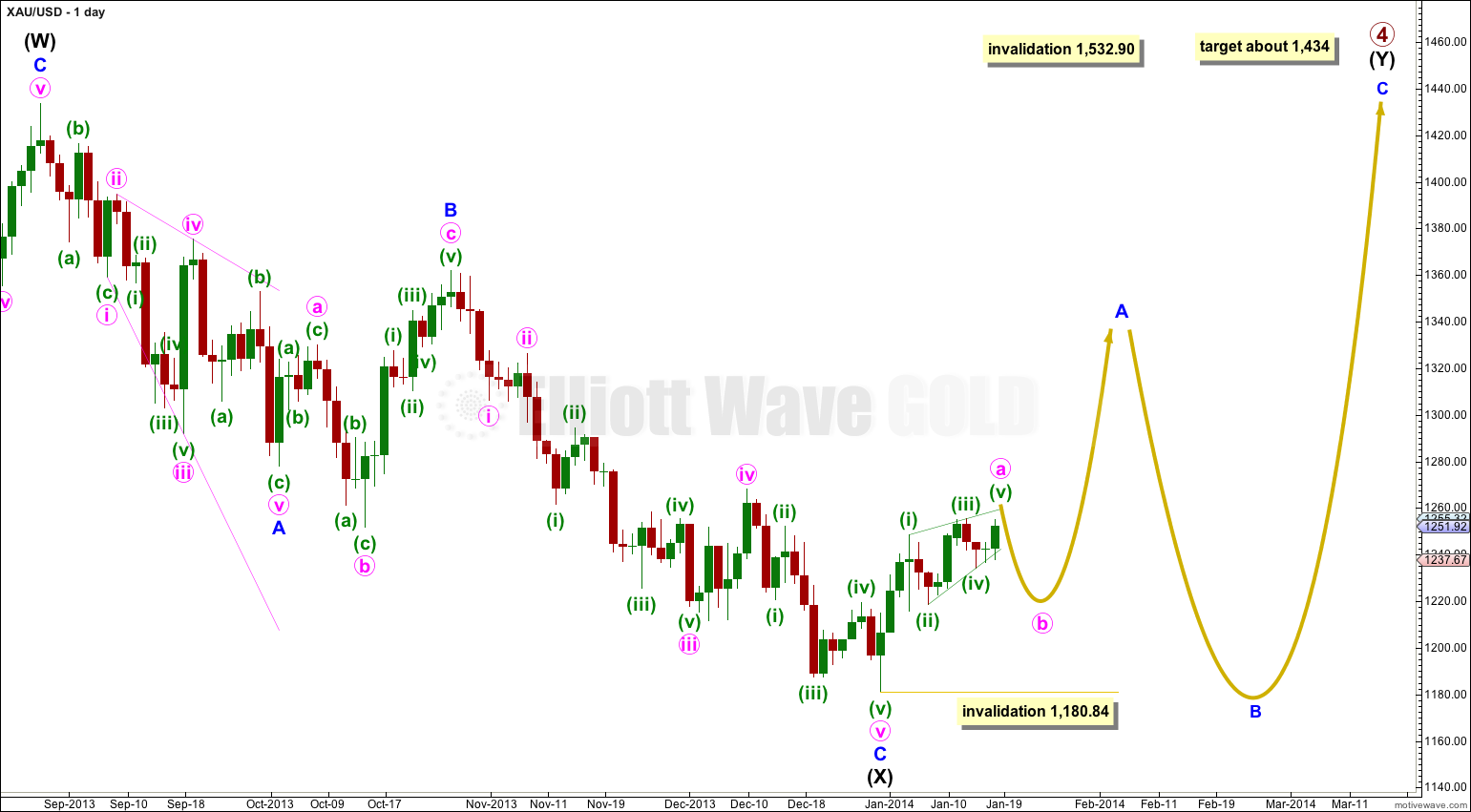

Gold is still within a large fourth wave correction at primary wave degree which is incomplete. To see a full explanation of my reasoning for expecting that primary wave 4 is not over and is continuing see this.

Movement above 1,277.97 would provide confirmation that primary wave 4 is not over. At that stage upwards movement could not be a fourth wave correction within primary wave 5 because it would be in its first wave price territory, and the downwards movement labeled intermediate wave (X) would be confirmed as a completed three wave structure.

Primary wave 2 was a rare running flat correction, and was a deep 68% correction of primary wave 1. In order to show alternation in structure primary wave 4 may be a zigzag, double zigzag, combination, triangle or even an expanded or regular flat. We can rule out a zigzag because the first wave subdivides as a three. This still leaves several structural possibilities.

Primary wave 4 is most likely to be a combination or triangle in order to show structural alternation with the running flat of primary wave 2.

The downwards wave labeled intermediate wave (X) is 99% the length of the upwards wave labeled intermediate wave (W). Primary wave 4 is unlikely to be a flat correction because if it were it would be a regular flat. These have similar behaviour and a similar look to running flats, and so there would be little structural alternation between primary waves 2 and 4.

Primary wave 4 is most likely to be a combination rather than a double zigzag because of the depth of intermediate wave (X). Double combinations take up time and move price sideways, and their X waves can be very deep. Double zigzags are different because their purpose is to deepen a correction when the first zigzag does not move price deep enough, so their X waves are not normally very deep. Thus intermediate wave (Y) is most likely to be a flat correction, and less likely a triangle and least likely a zigzag. It is most likely to end about the same level as intermediate wave (W) at 1,434 so that the whole structure moves sideways. It may last about 43 to 89 days, depending upon what structure it takes.

If intermediate wave (Y) is a flat correction then within it minor wave B must retrace a minimum of 90% the length of minor wave A, and it may make a new low below 1,180.84.

If intermediate wave (Y) is a flat correction then within it minor wave A must subdivide as a three wave structure. At this stage it looks like minor wave A may be unfolding as a zigzag because minute wave a within it looks like it is unfolding as a leading diagonal which is a five wave structure.

Primary wave 4 may not move into primary wave 1 price territory. This wave count is invalidated with movement above 1,532.90.

Minuette wave (iv) was already over at 1,234.32. Within a diagonal the fourth wave can only subdivide as a single zigzag. This one does at that point, but within it its C wave is atypical. This is the piece of movement I found so difficult to analyse.

Within minuette wave (iv) subminuette wave a subdivides as an impulse, subminuette wave b as a brief zigzag, and subminuette wave c as an ending diagonal. Within subminuette wave c all the subdivisions fit perfectly; they are all zigzags as they must be within an ending diagonal. The problem is in the length of its waves. Micro wave 4 is longer than micro wave 2, but micro wave 3 is shorter than micro wave 1 and micro wave 5 is the shortest. This diagonal is neither contracting nor expanding. Over the years I have seen this happen on a very few occasions, but it is very rare and atypical. Of all the Elliott wave structures diagonals are the only ones which are not clearly defined by Frost and Prechter and it is my experience with them that they require a little flexibility. The only thing I can state for certain with diagonals is the subdivisions must be correct.

Within the leading diagonal of minute wave a minuette wave (v) would most likely subdivide as a zigzag, but it may also subdivide as an impulse. In this instance because the third wave of this diagonal subdivides as a zigzag it is extremely likely that the fifth wave will as well.

Within leading diagonals the fifth wave may not be truncated. Minuette wave (v) must make a new high above 1,255.43.

Within this leading contacting diagonal minuette wave (iii) is shorter than minuette wave (i). A core Elliott wave rule is a third wave may never be the shortest. Minuette wave (v) may not move above 1,271.15 where it would reach equality in length with minuette wave (iii).

At 1,262 subminuette wave c would reach 2.618 the length of subminuette wave a. I would expect subminuette wave c to end most likely at the upper 1-3 trend line of this diagonal, and less likely it could overshoot this trend line. Within subminuette wave c micro wave 4 may not move into micro wave 1 price territory. This wave count is invalidated in the short term (before a new high above 1,255.43) with movement below 1,245.40.

I would expect minuette wave (v) to be over during Monday. Thereafter, I expect a trend change and a few days of downwards movement for minute wave b.

Minute wave b may not move beyond the start of minute wave a. This wave count is invalidated with movement below 1,180.84.

Although yesterday’s alternate wave count remains technically valid it looks wrong. I will not publish it. I expect it should be invalidated within a few more hours of trading.

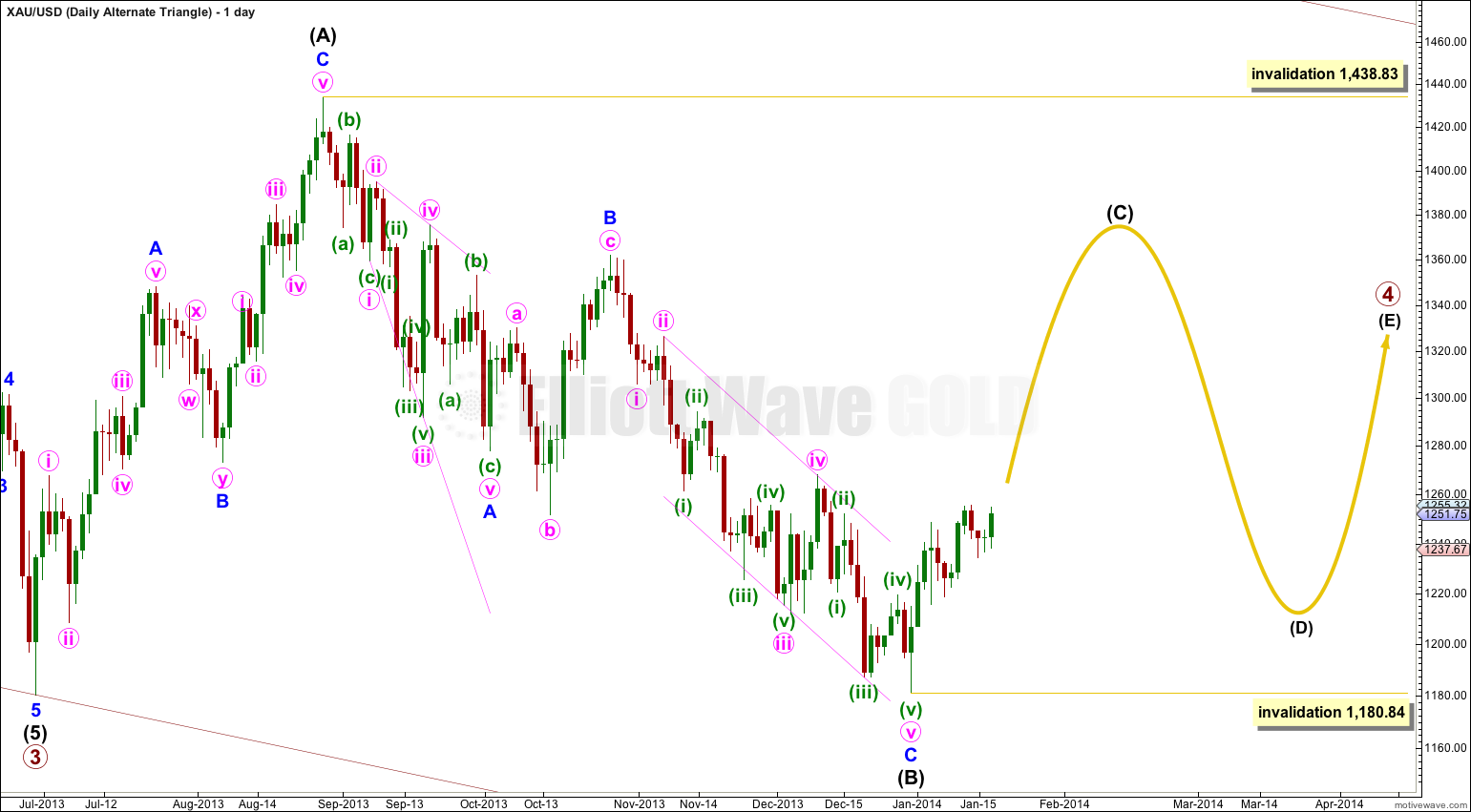

Alternate Daily Wave Count – Triangle.

It is also possible that primary wave 4 may continue as a regular contracting (or barrier) triangle.

The expected direction of this next upwards wave is the same, but for this alternate intermediate wave (C) of the triangle may not move beyond the end of intermediate wave (A). The triangle is invalidated with movement above 1,438.83.

Intermediate wave (C) must unfold as either a single or double zigzag. Within it no second wave correction, nor wave B of the zigzag, may move beyond the start of the first wave or A wave. This wave count is invalidated with movement below 1,180.84.

The final intermediate wave (E) upwards may not move above the end of intermediate wave (C) for both a contracting and barrier triangle. E waves most commonly end short of the A-C trend line.

All five subwaves of a triangle must divide into corrective structures. If this next upwards movement subdivides as a zigzag which does not make a new high above 1,438.83 then this alternate would be correct.

Triangles take up time and move price sideways. If primary wave 4 unfolds as a triangle then I would expect it to last months rather than weeks.

Hi Lara-

I know leading diagonals usually have deep 2nd wave corrections when they are the first wave of an impulse. Does this apply when they are an ‘a’ wave as well for the ‘b’ wave retracement?

Lara, I appreciate seeing your analysis 30 minutes or so before market close, that gives a subscriber time to make portfolio adjustments in preparation for the next day’s gold action.

“Big players” often move the gold market after NYSE close so having your analysis anticipating gold direction is very helpful.

okay, that’s good. I’m on a road trip (searching for waves in the ocean) this week so gold will be published earlier than usual.