Last analysis on the 6th of December expected some sideways movement, which is what has happened.

Summary: Use the channel on the main daily chart. Assume more downwards movement while price remains within the channel. When the channel is breached, then assume a multi-month bounce or consolidation may begin that should remain below 7,234.83.

It would be safest to assume that the bear market will continue while Bitcoin remains below 7,234.83. The target is about 1,924, but it may be much lower than this; it is possible this bear market may see the end of Bitcoin.

The data used for this analysis now comes from Yahoo Finance BTC-USD.

Updates to this analysis are in bold.

Last analysis may be found here.

MAIN ELLIOTT WAVE COUNT

MONTHLY

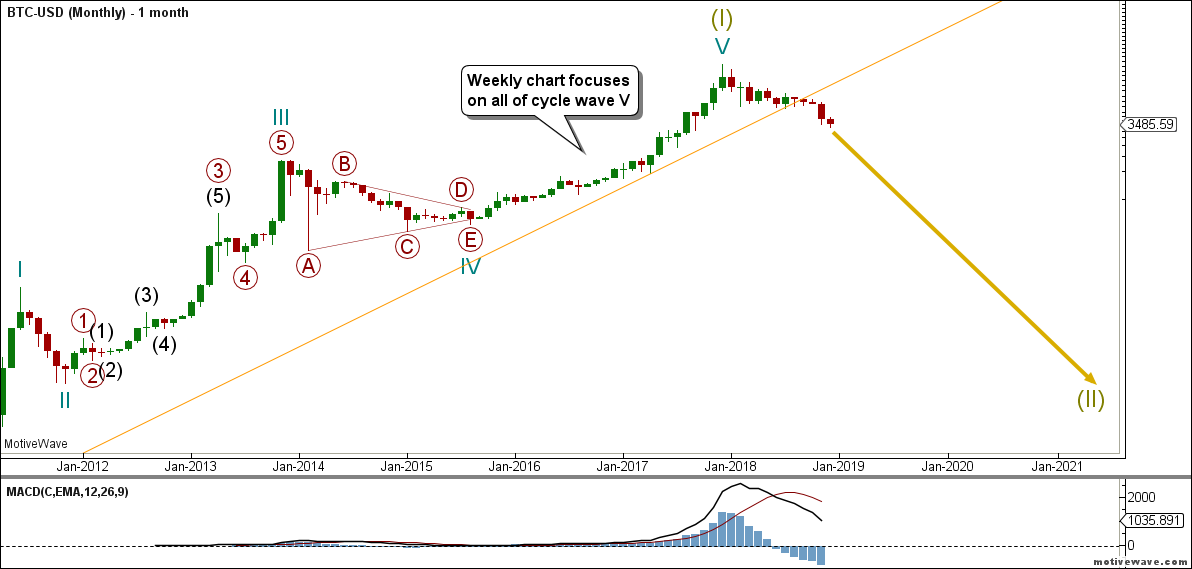

It is possible to see a completed five wave impulse upwards for Bitcoin.

I am unable to find reasonable Fibonacci ratios within this wave count. It appears that Bitcoin may not exhibit Fibonacci ratios very often between its waves, so this makes target calculation impossible. Classic technical analysis was used to identify a high in place on the 23rd of December, 2017.

What is very clear from this chart is that Bitcoin is a classic bubble. This looks like an even larger bubble than the Tulip Mania. The only thing about which I am certain is that this bubble will pop and Bitcoin will collapse.

Confidence that Bitcoin was most likely crashing started since the Forever trend line was breached in June.

WEEKLY

Bitcoin tends to behave like an extreme commodity: price moves upwards for about 2 – 4 weeks in a near vertical movement at the end of its rises. Following this vertical movement the resulting downwards movement is very deep (in percentage terms) and often very quick.

The next rise begins slowly with basing action over weeks or months, and then as the rise nears its end another vertical movement completes it. Also, there are volume spikes just before or at the end, which is another feature typical of commodity like behaviour.

This has happened now several times. The most notable instances are the rise up to the week ending 24th November, 2013, and the week ending 5th June, 2011. The following sharp drops were 94% and 93% respectively.

If this current drop continues like the last two examples, then a reasonable target may be about $1,390.94 or below.

Super Cycle wave (II) would most likely be a zigzag, but it may also be a flat, combination or triangle; a zigzag would subdivide 5-3-5.

It is possible that cycle waves a and b may be complete within the expected zigzag of Super Cycle wave (II). Cycle wave a will fit as a leading contracting diagonal, and cycle wave b fits well as a running contracting triangle.

The target calculated expects cycle wave c to exhibit a Fibonacci ratio to cycle wave a. Bitcoin rarely exhibits Fibonacci ratios, so this target does not have a good probability.

DAILY

Within cycle wave c, primary wave 1 may be incomplete.

Primary wave 2 may not move beyond the start of primary wave 1 above 7,234.83.

Unfortunately, Bitcoin rarely exhibits Fibonacci ratios in its actionary waves. Therefore, it is impossible to calculate a target. A best fit trend channel is drawn on the chart. An upwards breach of the channel would indicate that primary wave 1 should be over and then primary wave 2 should be underway.

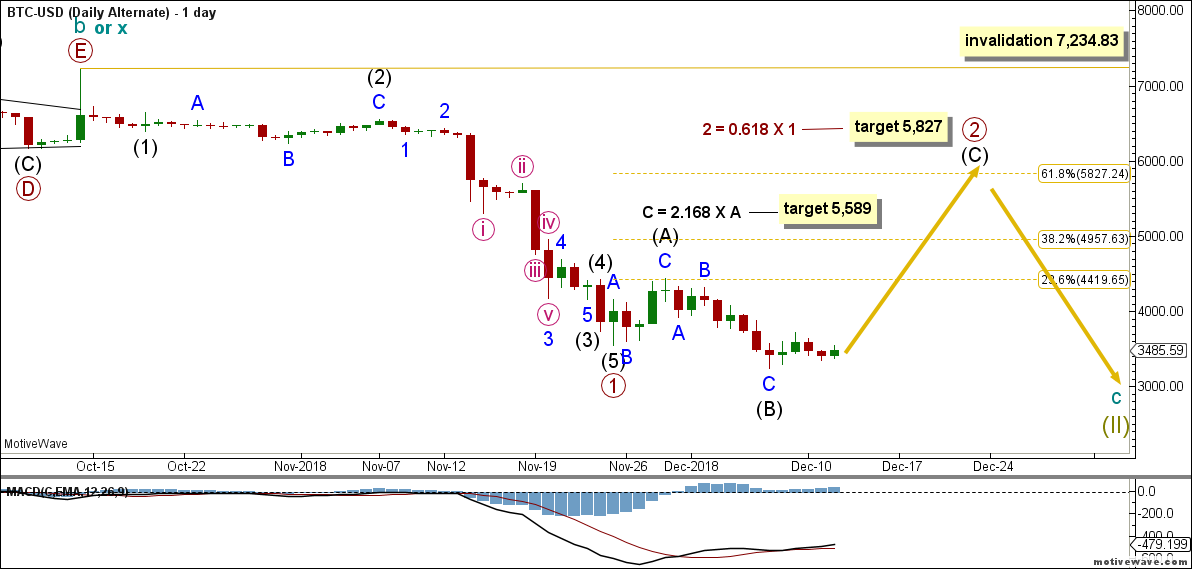

DAILY ALTERNATIVE

Primary wave 2 may be subdividing as an expanded flat. Two targets are calculated at two different wave degrees.

Primary wave 1 lasted 41 sessions. Primary wave 2 may last about two to three months to have reasonable proportion to primary wave 1.

Primary wave 2 may not move beyond the start of primary wave 1 above 7,234.83.

SECOND ALTERNATE ELLIOTT WAVE COUNT

DAILY

By moving the degree of labelling within cycle wave c up one degree, it is possible that the crash for Bitcoin could be over.

This alternate wave count has changed since the last published analysis. It now sees Super Cycle II over at the last low.

This wave count has a very low probability. It does not follow normal behaviour for Bitcoin.

Normal behaviour for an early second wave correction is for Bitcoin to retrace deeper than 90% of the first wave. This wave count expects that Super Cycle wave (II) was only 84%. While this is very deep, it is not as deep as is normal for Bitcoin.

A candlestick reversal pattern at the low of Super Cycle wave (II) would be fairly likely at the weekly chart level which is not the case at this time.

TECHNICAL ANALYSIS

The following can be noted when looking back at Bitcoin’s behaviour during its previous strong falls in price:

The 94% fall in price from June to November 2011 was characterised by:

– Three clearly separate instances of RSI reaching oversold on the daily chart, separated by bounces.

– ADX did not remain very extreme for very long at all on the daily chart.

– On Balance Volume exhibited weak single bullish divergence at the low.

The 93% fall in price from November 2013 to February 2014 was characterised by:

– RSI reached oversold and remained deeply oversold for three weeks; at the low there was only single weak bullish divergence with price.

– ADX remained very extreme for the last seven sessions to the low.

– At the low, On Balance Volume did not exhibit bullish divergence with price; it remained bearish and then exhibited further bearishness after the low as it continued to decline as price began to rise.

For the current fall in price, the current Elliott wave count expects the fall to be larger in terms of duration than the previous two noted here, and at least equivalent in terms of price movement in that a fall of over 90% is expected now.

So far at the lowest low from the all time high Bitcoin has only retraced 0.84. While this is deep, its corrections are usually deeper than this.

For the short term, expect more downwards movement as likely. This is supported by volume. Downwards days have greater support from volume in recent movement.

Published @ 04:56 a.m. EST.