S&P 500

For the short term, some sideways movement was expected for Friday’s session, which is what has happened.

Summary: The low of December 2018 is expected to very likely remain intact, and this pullback is expected to be followed by a strong third wave up to new all time highs.

Two scenarios remain possible for the short term:

1. Some sideways movement continues before a final wave down to about 2,722 completes the pullback in two or three weeks time. A target calculated from the potential pennant pattern is about 2,690.

2. A pullback ends next week about 2,740 or 2,722.

A new wave count is published this week which considers the possibility that a relatively short lived bear market may have begun. The target is at 2,080. This wave count has a very low probability.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here. Video is here.

ELLIOTT WAVE COUNTS

The first two Elliott wave counts below will be labelled First and Second rather than main and alternate as they may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

The new alternate Elliott wave count has a very low probability.

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

A final target is calculated at cycle degree for the impulse to end.

The structure of cycle wave V is focussed on at the daily chart level below.

Within cycle wave V, primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

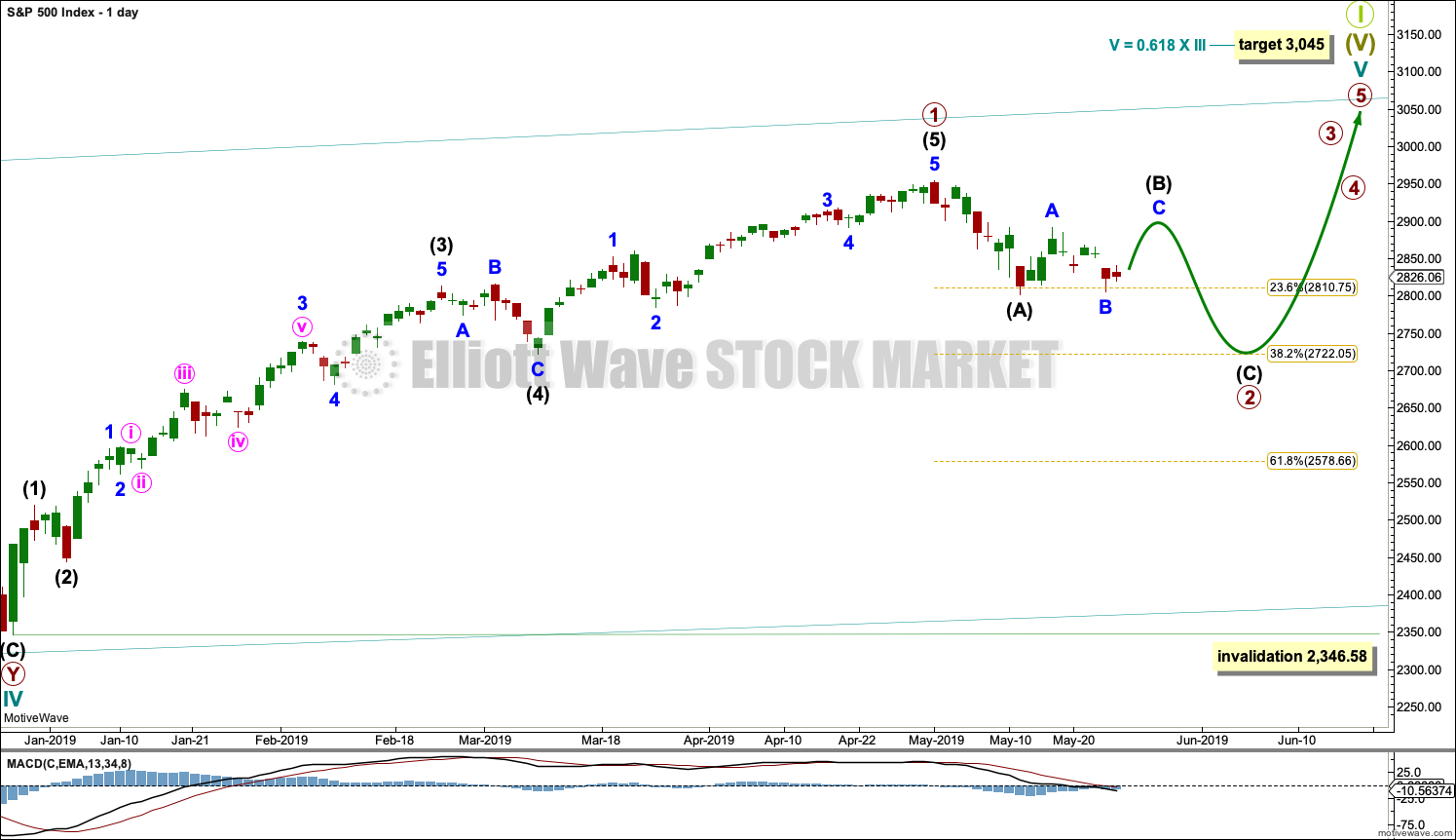

DAILY CHART

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary wave 1 may be complete. Primary wave 2 may now continue sideways and / or lower as a zigzag, which may end within another one to few weeks. It is also possible that primary wave 2 was over at last week’s low although that scenario has reduced in probability.

Primary wave 3 must move above the end of primary wave 1.

When primary wave 3 is over, then primary wave 4 may be a shallow sideways consolidation that may not move into primary wave 1 price territory below 2,954.13.

Thereafter, primary wave 5 should move above the end of primary wave 3 to avoid a truncation.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

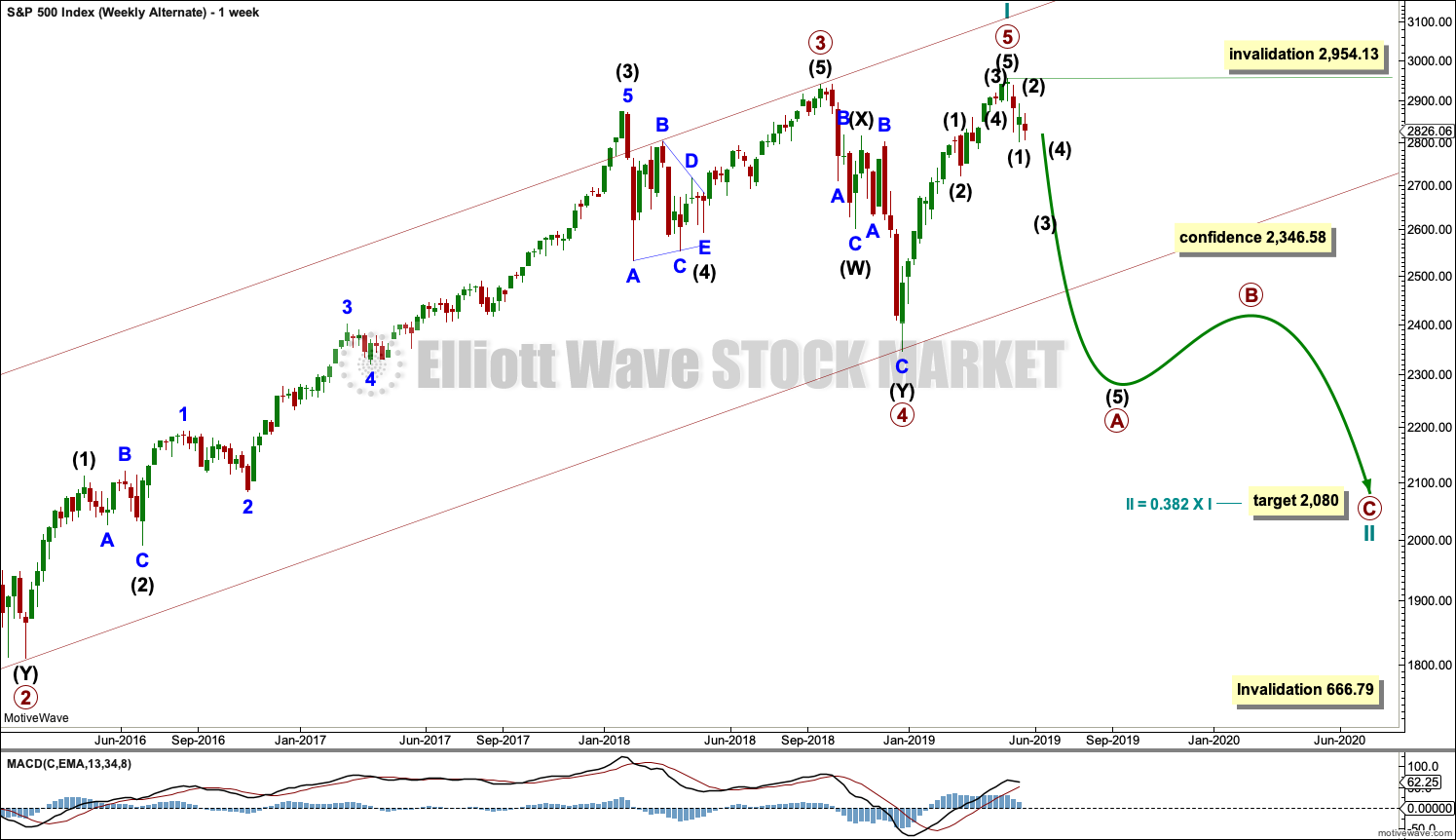

ALTERNATE WAVE COUNT

WEEKLY CHART

It is possible that for the second wave count cycle wave I could be complete. Primary wave 5 may be seen as a complete five wave impulse on the daily chart.

If cycle wave I is complete, then cycle wave II may meet the definition of a bear market with a 20% drop in price at its end.

Within cycle wave I, primary wave 1 was a very long extension and primary wave 3 was shorter than primary wave 1 and primary wave 5 was shorter than primary wave 3. Because primary wave 1 was a long extension cycle wave II may end within the price range of primary wave 2, which was from 2,132 to 1,810. The 0.382 retracement of cycle wave I is within this range.

Cycle wave II may not move beyond the start of cycle wave I below 666.79.

This wave count does not have support at this time from classic technical analysis.

TECHNICAL ANALYSIS

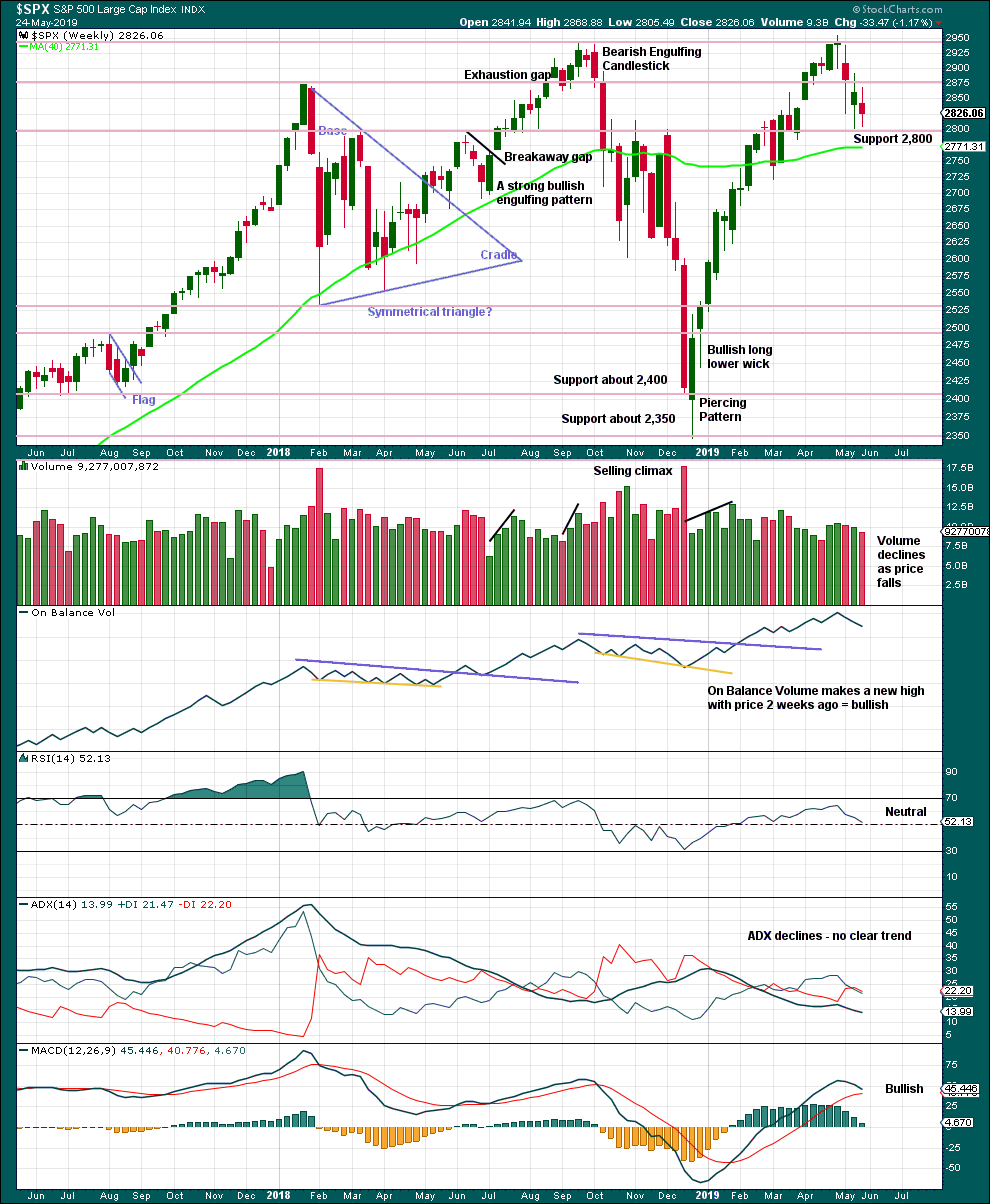

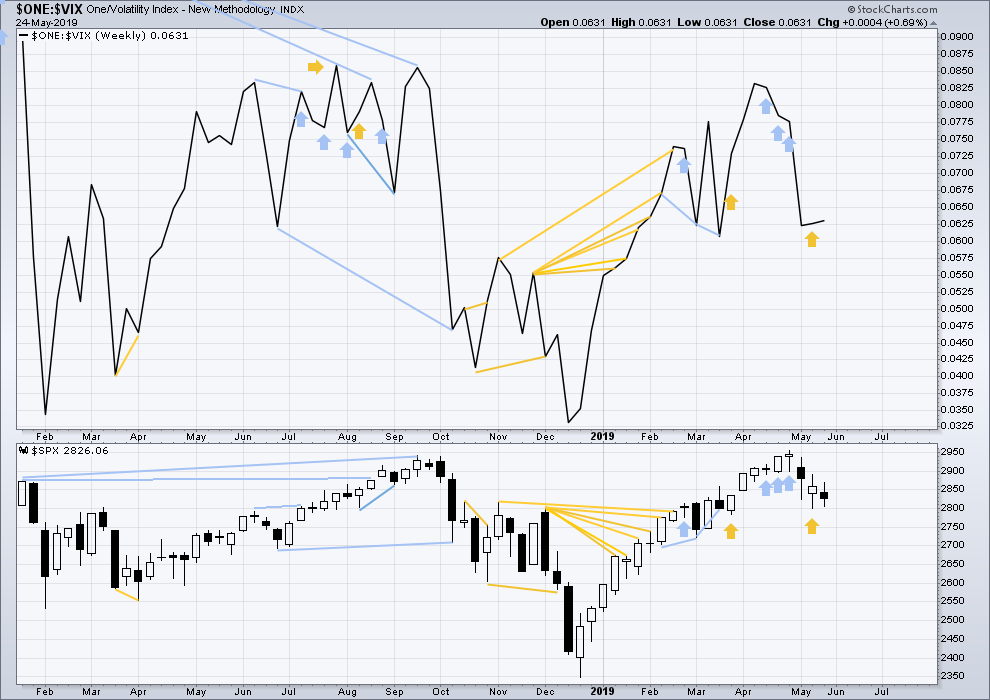

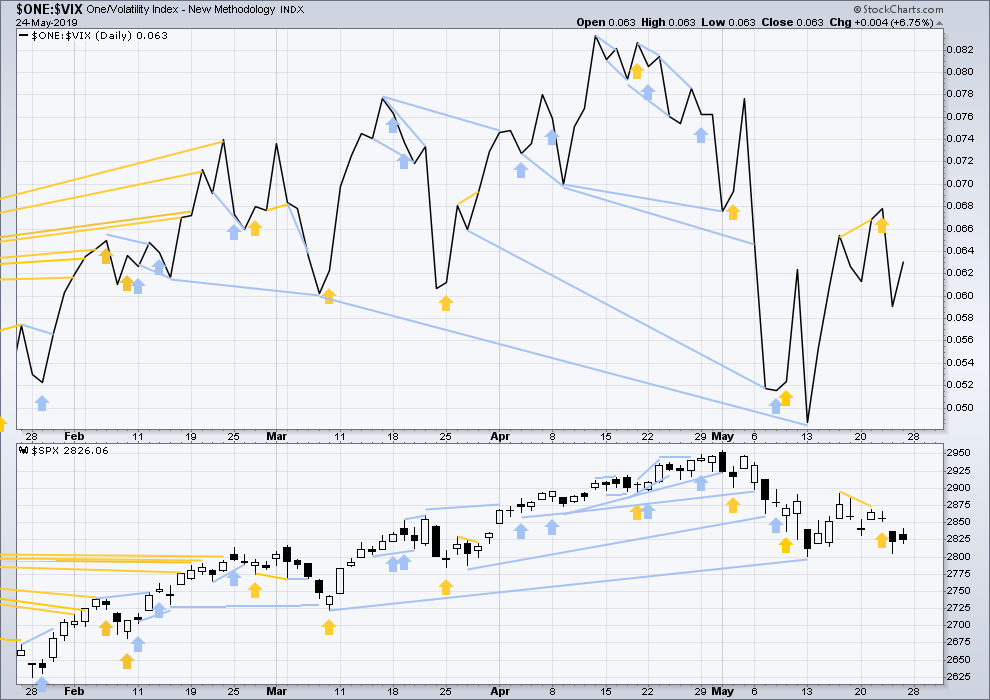

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is an upwards trend from the low in December 2018, a series of higher highs and higher lows with a new all time high on the 30th of April 2019. While the last swing low at 2,785.02 on the 25th of March remains intact, then this view should remain dominant.

The trend is your friend.

This week closes red, but price has moved sideways. The balance of volume was downwards and volume is not pushing price lower. Overall, this is neutral.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A 90% downwards day at or immediately prior a low followed immediately afterwards by a 90% upwards day is a strong indication of a low in place. The indication is weaker in this case, but the movement is also weaker. The 80% upwards day of the 14th of May shows an almost 180 degree shift in sentiment after the 90% downwards day immediately prior. This is a pattern seen at minor lows. However, upwards movement following the low has not developed strong demand needed to produce a sustained rally. There is now less support for the view that a mid-term low is in place.

The dominant trend is up. Pullbacks in an upwards trend should be used as opportunities to join the trend.

Watch On Balance Volume carefully again next week. A breakout would provide a weak signal that may add a little confidence to the next move from price.

A small pennant pattern may be complete and followed by a downwards breakout, which has support from volume. The target is about 2,690.

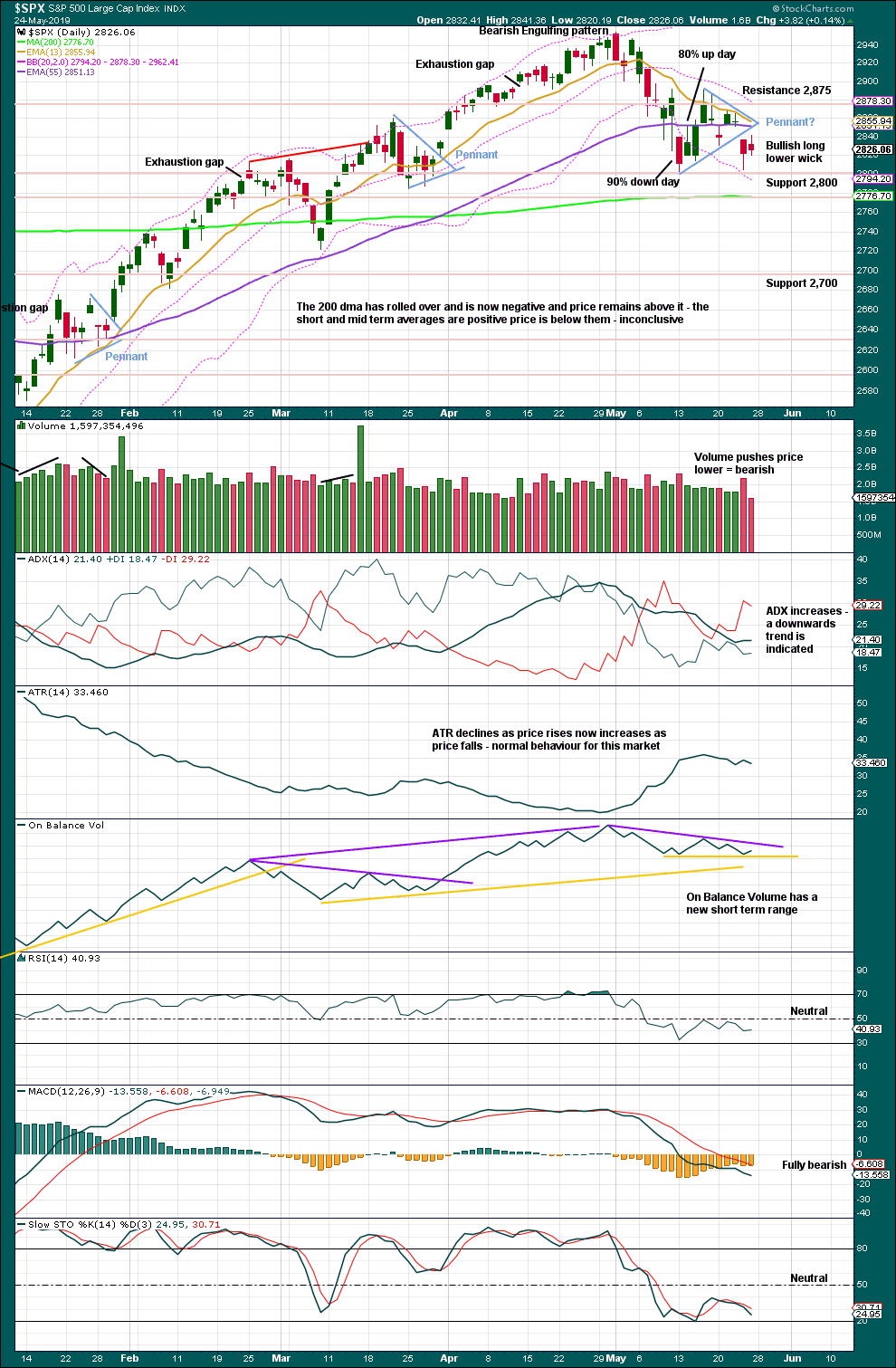

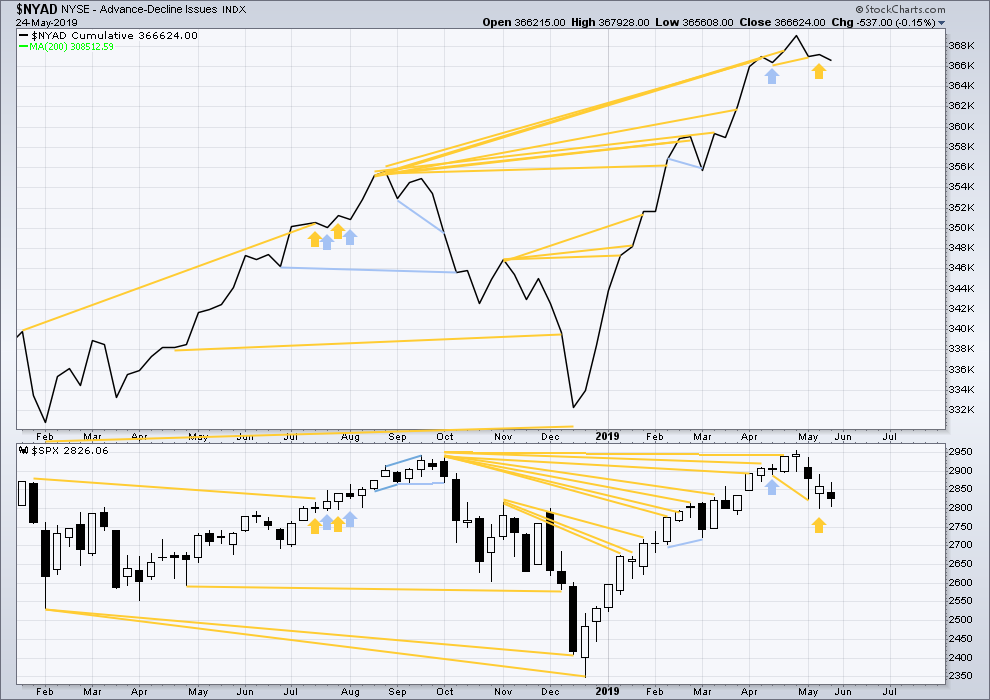

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making a new all time high on the 3rd of May, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is the beginning of September 2019.

This week price has moved sideways and the candlestick has closed red. A decline in breath this week supports downwards movement within the week. There is no short-term divergence.

This week all of small, mid and large caps moved sideways.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Mid-term bullish divergence remains and supports the view here that a low may be in place.

On Friday both price and the AD line have moved higher. There is no new short-term divergence.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Three weeks in a row of weekly bearish divergence has now been followed by two reasonable downwards weeks. It may be resolved here, or it may yet be an indication of further downwards movement in price.

This week price has completed an inside week. Inverted VIX has moved slightly higher. There is no short-term divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

On Friday price and inverted VIX both moved slightly higher. There is no short-term divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91 – a new all time high has been made on the 29th of April 2019.

Nasdaq: 8,133.30 – a new high has been made on 24th of April 2019.

GOLD

Price remains range bound at the end of the week after moving mostly sideways. All Elliott wave counts remain valid.

Summary: Resistance is about 1,310 and support is about 1,265.

A downwards breakout next week may still be more likely. The target would then be at 1,219 (which may not be low enough).

However, the target would be at 1,346 if there is an upwards breakout with support from volume.

Grand SuperCycle analysis is here.

Last monthly charts are here. Video is here.

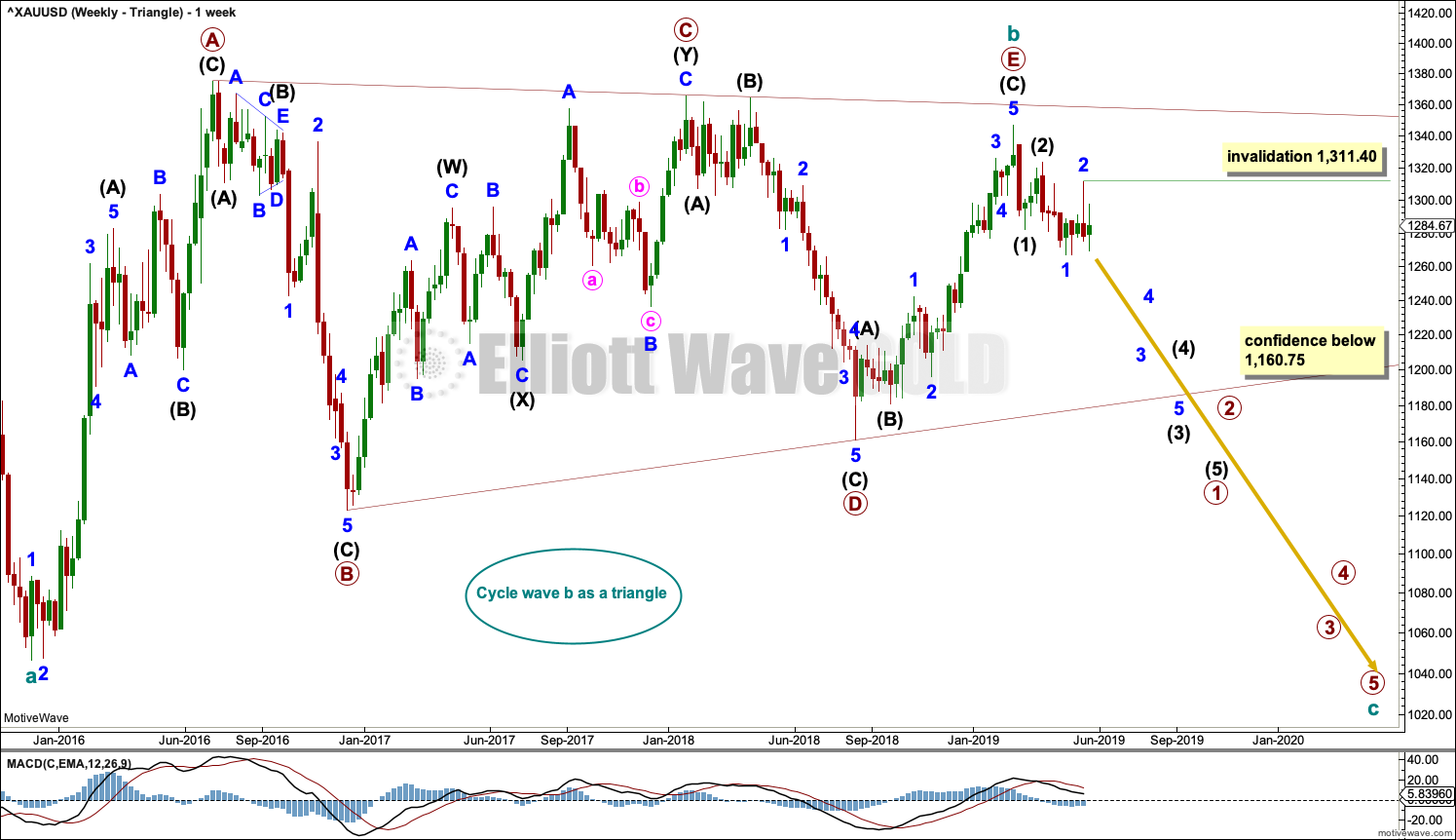

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART – TRIANGLE

The basic Elliott wave structure is five waves up followed by three waves back (in a bull market). At this time, the preferred Elliott wave count sees Gold as still within three waves back, which began at the all time high in September 2011.

Five waves up are labelled 1,2,3,4,5. Three waves back are labelled A,B,C.

This wave count sees Gold as now about two thirds through the three waves back. The three wave structure is labelled cycle waves a, b and c.

It remains possible that the triangle of cycle wave b is complete and cycle wave c downwards has begun.

Within the final wave of the triangle, primary wave E may be a complete zigzag.

Cycle wave c must subdivide as a five wave structure at primary degree, with primary waves 1, 2, 3, 4 and 5. So far primary wave 1 for this wave count would be incomplete.

Primary wave 1 must subdivide as a five wave structure at intermediate degree. So far intermediate waves (1) and (2) may be complete.

Intermediate wave (3) may only subdivide as a five wave impulse at minor degree. So far minor waves 1 and 2 may be complete.

Minor wave 3 may only subdivide as a five wave impulse at minute degree. Within minor wave 3, minute wave ii may not move beyond the start of minute wave i above 1,311.40.

DAILY CHART – TRIANGLE

A target is calculated for minor wave 3 to end based upon the most common Fibonacci ratio to minor wave 1.

A base channel is drawn about intermediate waves (1) and (2). The first trend line of a base channel is drawn from the start of the first wave to the end of the second wave, then a parallel copy is placed upon the end of the first wave. Lower degree second wave corrections in a bear market usually find resistance at the upper edge of the base channel. In this instance, minor wave 2 did not find resistance at the upper edge of the base channel; the channel is breached, which does not invalidate the wave count but does reduce the probability. For this reason the alternate below is considered.

However, base channels do not always work. Gold usually begins new trends slowly with deep and time consuming second wave corrections. Sometimes these deep second wave corrections may breach base channels. The trend usually accelerates through the middle of the third wave and may exhibit explosive movement at the end of third waves.

This wave count requires a new low below 1,266.76 now for confidence.

This wave count now expects to see a strong increase in downwards momentum.

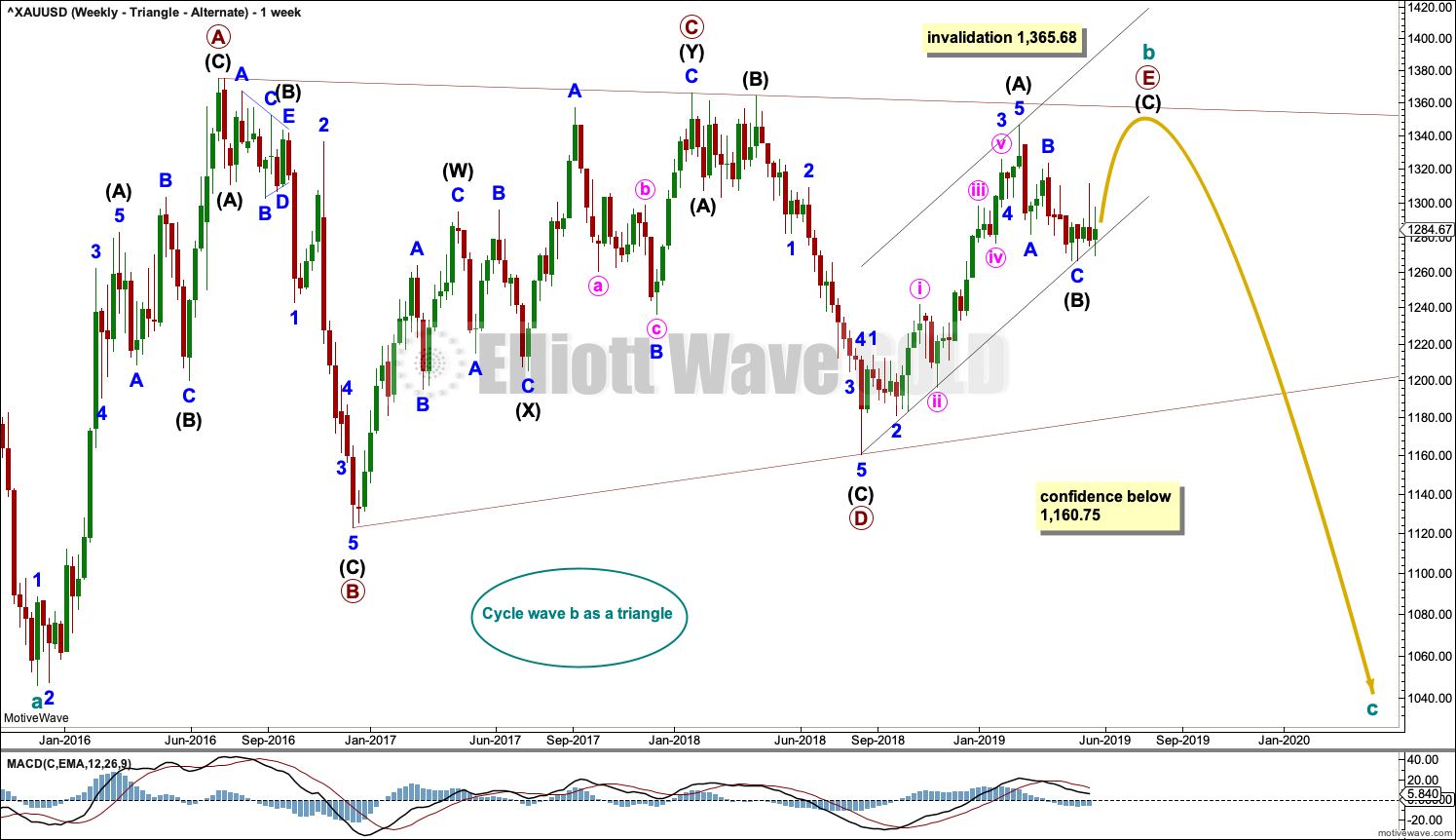

WEEKLY CHART – TRIANGLE – ALTERNATE

The triangle for cycle wave b may still be incomplete. The final sub-wave of primary wave E may be an incomplete zigzag. Within the zigzag of primary wave E, intermediate wave (C) would be very likely to make at least a slight new high above the end of intermediate wave (A) to avoid a truncation.

Primary wave E may either undershoot or overshoot the A-C trend line. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

Within the five sub-waves of an Elliott triangle, one sub-wave usually subdivides as a more complicated double zigzag and the most common sub-wave to do so is wave C.

DAILY CHART – TRIANGLE – ALTERNATE

The final zigzag of primary wave E must subdivide 5-3-5. Intermediate wave (C) must subdivide as a five wave motive structure, most likely an impulse.

Within the impulse of intermediate wave (C), minor waves 1 and 2 may be complete.

Minor wave 3 may only subdivide as an impulse. A target is calculated for it to end.

Draw an acceleration channel about upwards movement. Draw the first trend line from the end of minor wave 1 to the last high, then place a parallel copy on the end of minor wave 2. Keep redrawing the channel as price continues higher.

Within minor wave 3, minute waves i and ii may be complete. Minute wave ii has strongly breached the lower edge of the acceleration channel. This does not have a normal look and reduces the probability of this wave count now. If it continues lower, then minute wave ii may not move beyond the start of minute wave i below 1,266.76.

This wave count now expects to see a strong increase in upwards momentum as a third wave at two degrees unfolds.

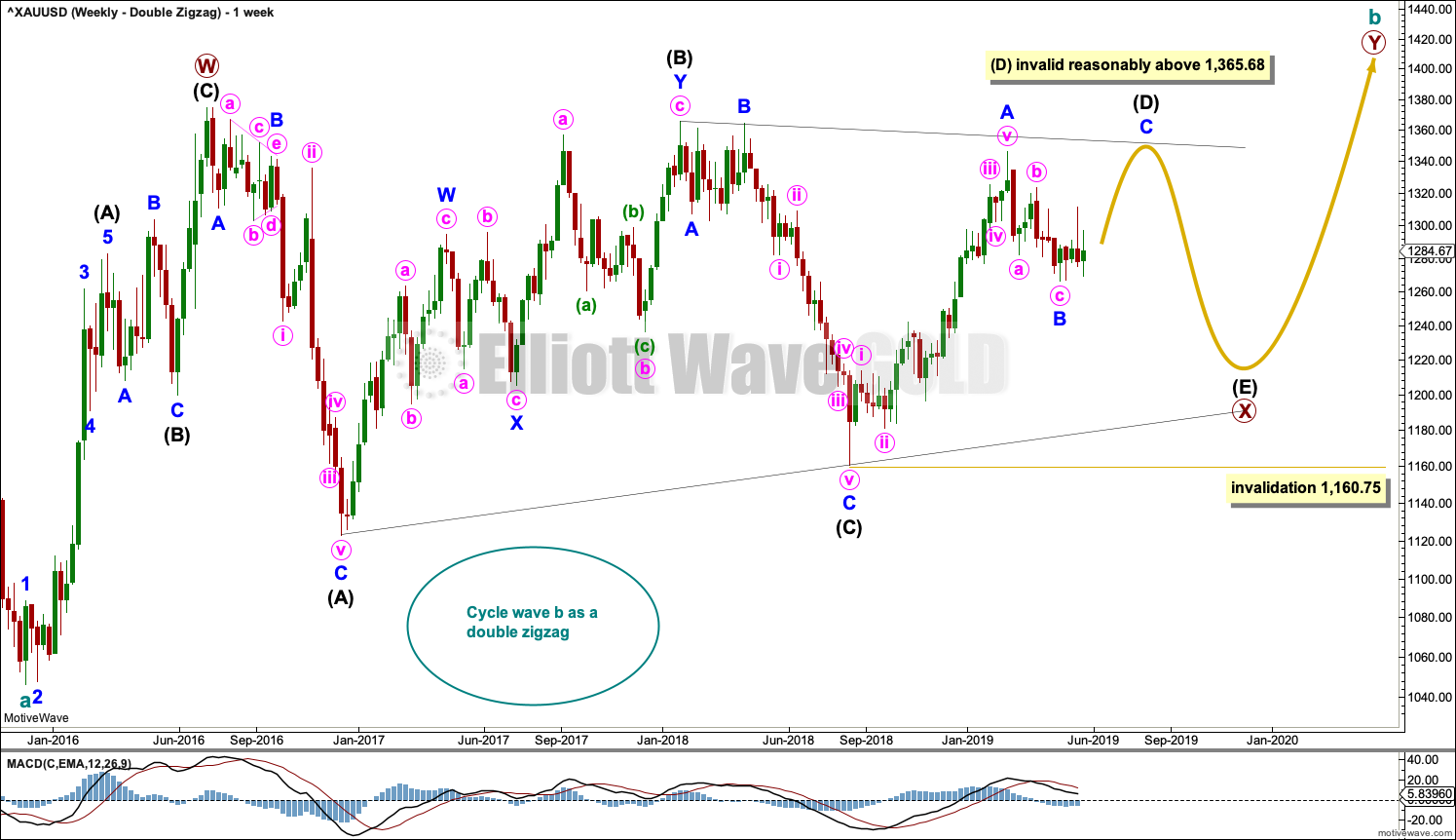

WEEKLY CHART – DOUBLE ZIGZAG

This wave count is identical to the first weekly chart up to the low labelled cycle wave a. Thereafter, a different Elliott wave corrective structure is considered for cycle wave b.

It is possible that cycle wave b may be an incomplete double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle may be incomplete.

Within multiples, X waves are almost always zigzags and rarely triangles. Within the possible triangle of primary wave X, it is intermediate wave (B) that is a multiple; this is acceptable, but note this is not the most common triangle sub-wave to subdivide as a multiple. These two points reduce the probability of this wave count in terms of Elliott wave.

Intermediate wave (D) of a contracting triangle may not move beyond the end of intermediate wave (B) above 1,365.68.

Intermediate wave (D) of a barrier triangle may end about the same level as intermediate wave (B); as long as the (B)-(D) trend line remains essentially flat the triangle will remain valid. This is the only Elliott wave rule that is not black and white. In practice, intermediate wave (D) may end slightly above intermediate wave (B) at 1,365.68 and this wave count would remain valid.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

It is also possible for this wave count that intermediate wave (D) was over at the last high and that intermediate wave (E) downwards may continue, in the same way as the main wave count above.

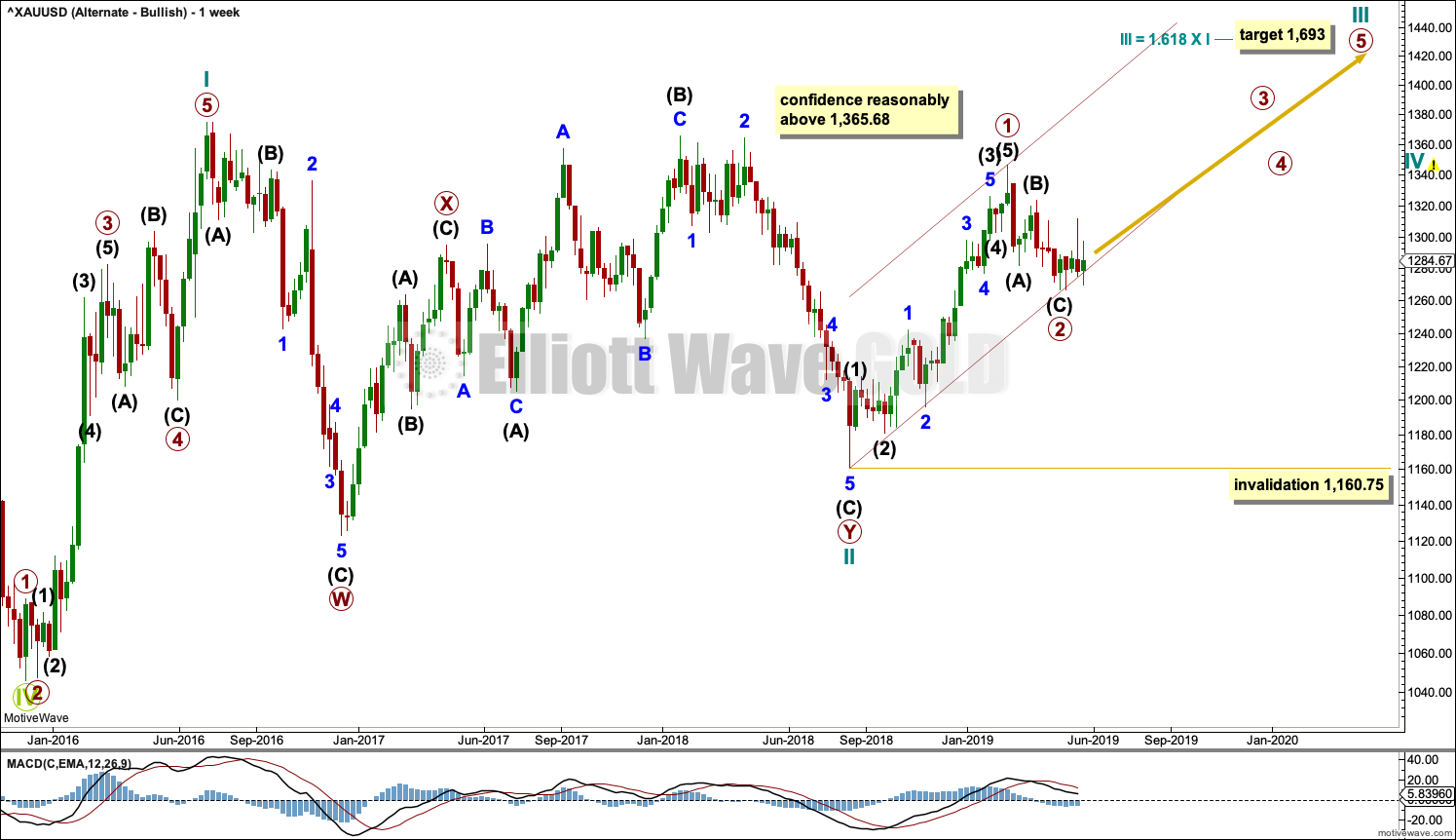

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the three waves back now complete at the last major low for Gold in November 2019.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. The probability of this wave count is low due to this problem.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. If it continues lower as a double zigzag, then primary wave 2 may not move beyond the start of primary wave 1 below 1,160.75.

Cycle wave III so far for this wave count would have been underway now for 40 weeks. It should be beginning to exhibit some support from volume, increase in upwards momentum and increasing ATR. However, ATR continues to decline and is very low, and momentum is weak in comparison to cycle wave I. This wave count lacks support from classic technical analysis.

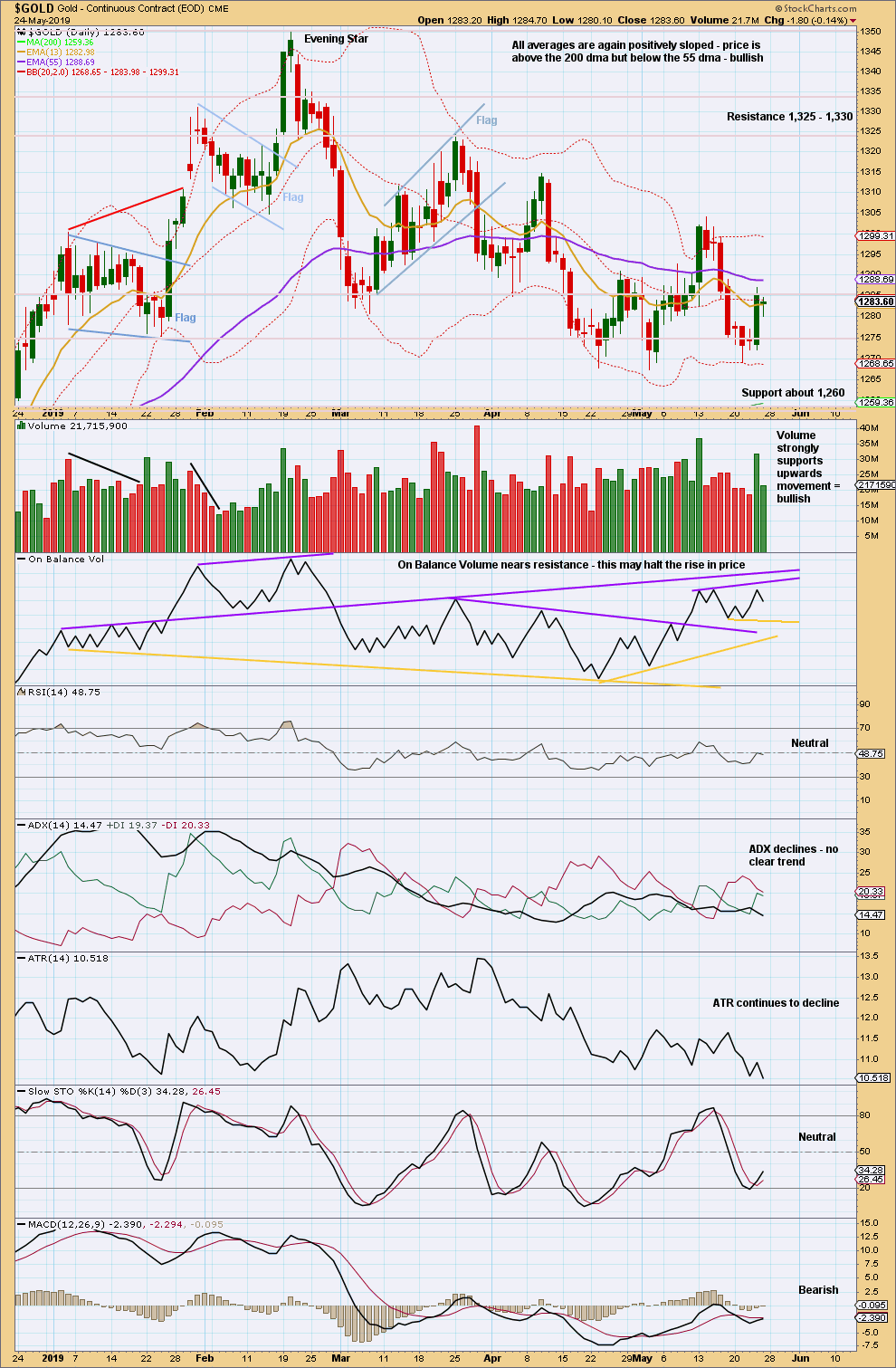

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week price moved lower with a lower low and a lower high, but the balance of volume was upwards and the candlestick has closed green. Upwards movement within the week overall does not have support from volume, but for a clearer look at the short-term volume profile daily volume bars should be considered in this instance.

While the high of the week beginning 13th of May remains intact, a downwards trend may be in place. There has been now a series of two lower swing lows and three lower swing highs from the high at 1,349.80 on the week beginning 19th February.

A continued decline in ATR supports the weekly double zigzag Elliott wave count.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

From August 2018 Gold moved higher with a series of higher highs and higher lows. This series remained intact until the 1st of March 2019 when a lower low was made. At that stage, it was possible that Gold had seen a trend change.

There is now a new series of three lower swing highs and three lower swing lows. The last high of the 14th of May remains intact. A trend change to downwards remains possible.

The very short-term volume profile is bullish.

For the short term, price is range bound with resistance about 1,305 and support about 1,265. A breakout is required for confidence in the next direction.

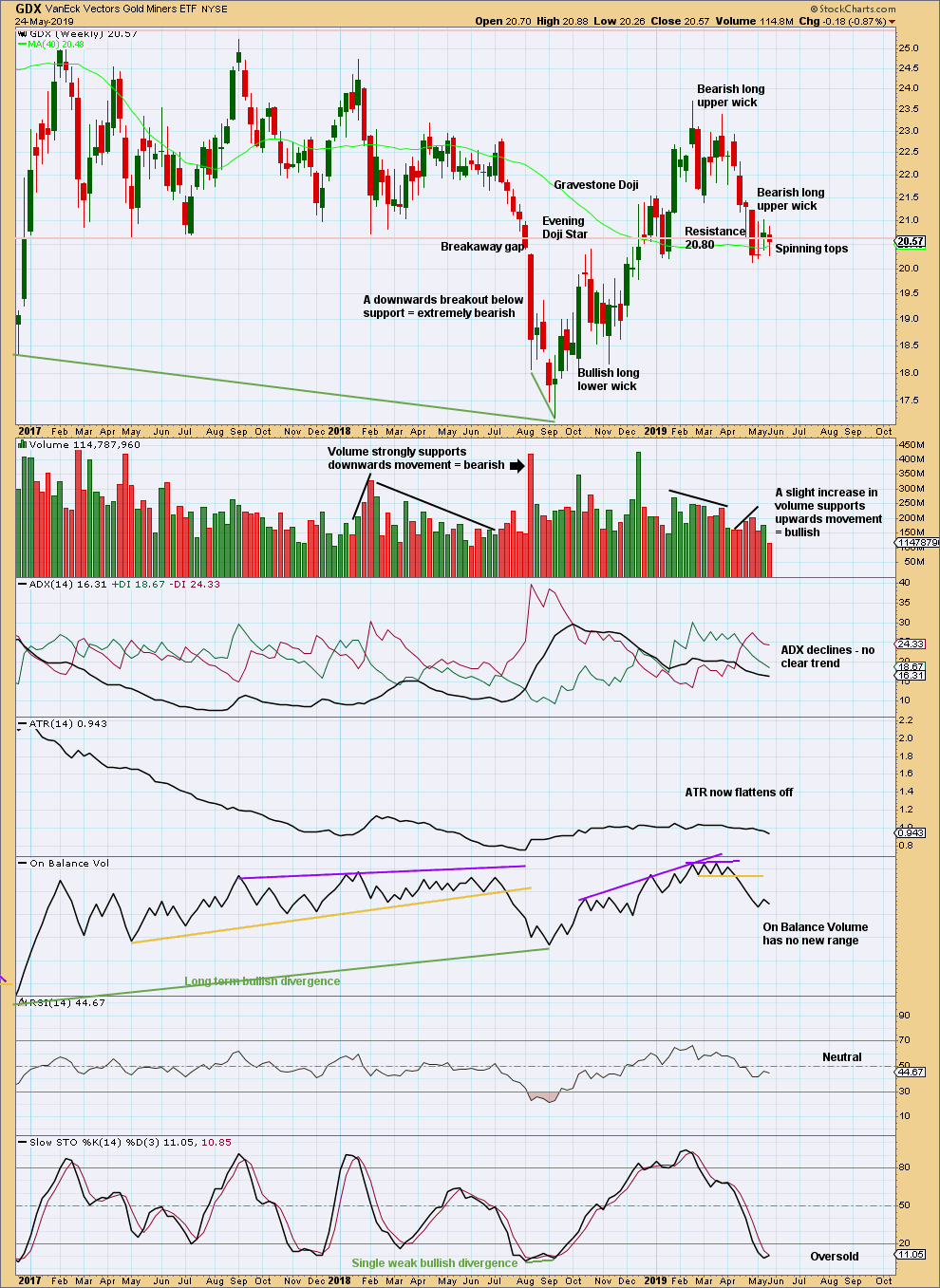

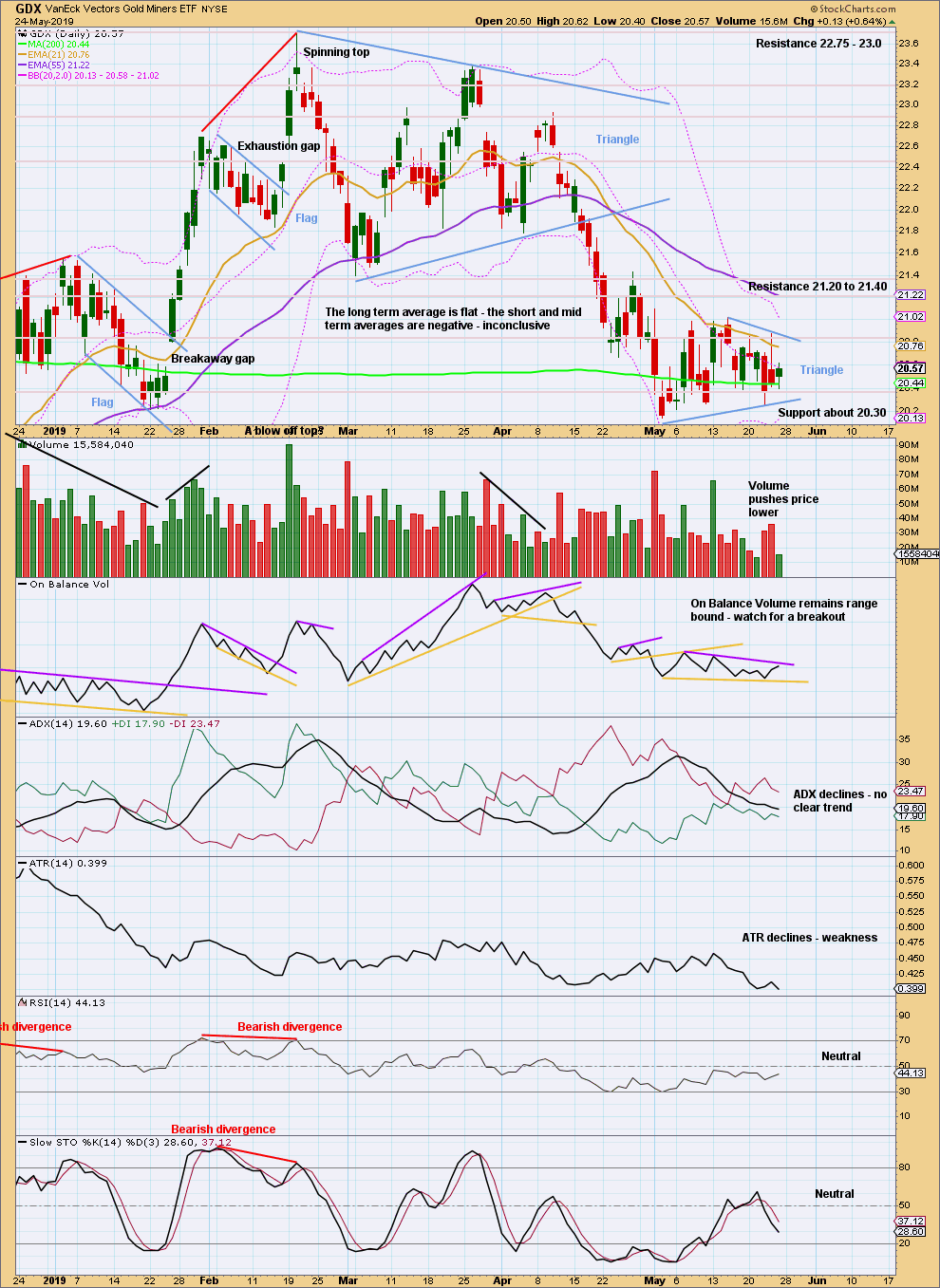

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now a series of two lower highs and lower lows at the weekly chart level. GDX may have seen a trend change to downwards, but ADX does not yet agree. The bearish signal from On Balance Volume supports this view.

Price has again closed below 20.80. The spinning top candlestick pattern for the last two completed weeks is neutral.

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small triangle may be unfolding. Triangles may be either reversal or continuation patterns. A breakout from the triangle trend lines is required to indicate the next trend direction. An upwards breakout requires support from volume for confidence and a downwards breakout does not.

On Balance Volume may breakout prior to price giving an early signal. Watch it carefully.

US OIL

Downwards movement was expected this week for US Oil, which is exactly what has happened.

Summary: A bounce may begin next week to about 61.33. The next wave down may begin thereafter, which may show a further increase in momentum.

The final target is now calculated at 10.72.

Further confidence that a high is in place may be had if price makes a new low below 58.20.

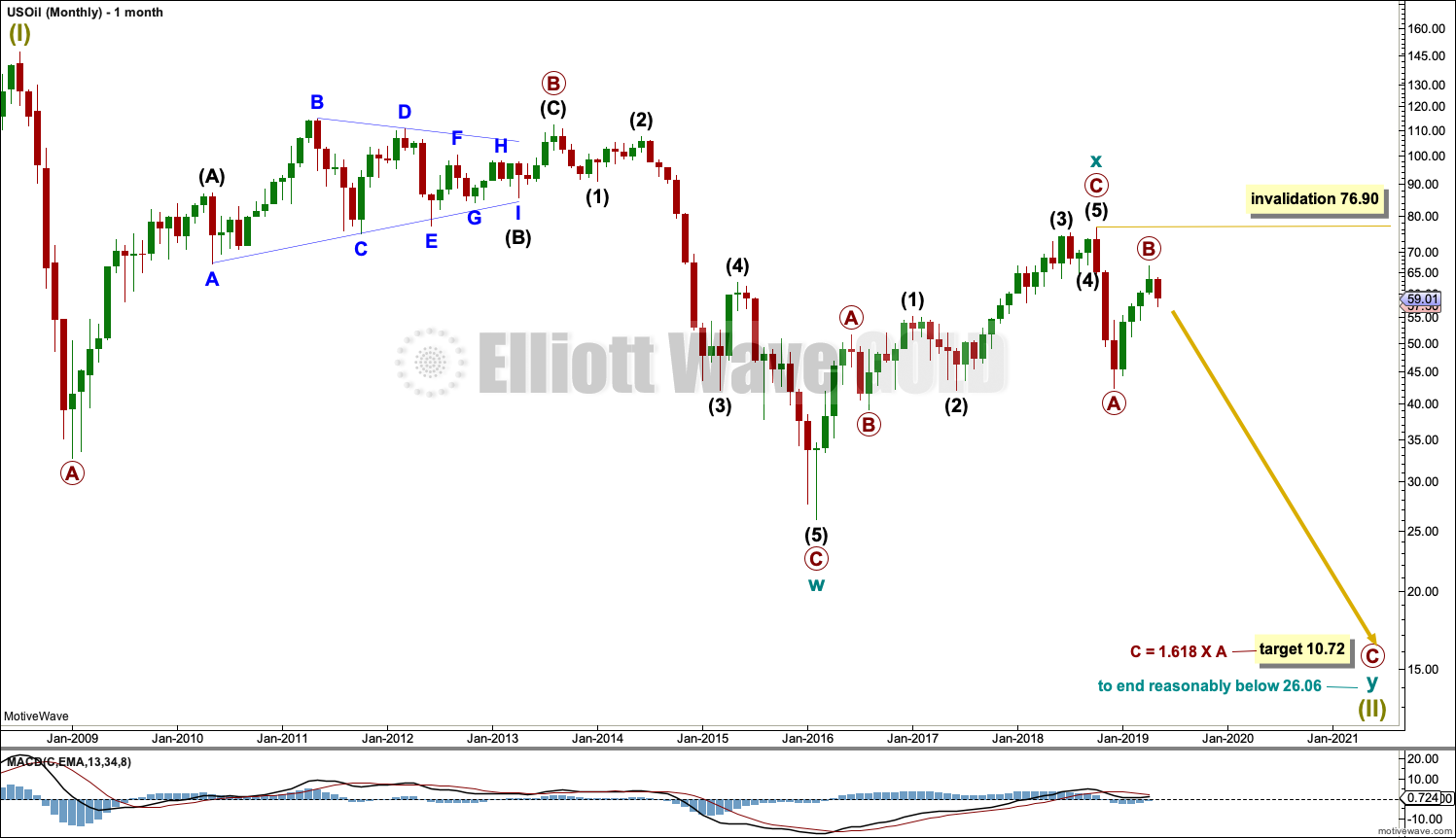

MAIN ELLIOTT WAVE COUNT

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil is still within a three steps back pattern, which began in July 2008. The Elliott wave count expects that the bear market for US Oil continues.

This Elliott wave corrective structure is a double zigzag, which is a fairly common structure. The correction is labelled Super Cycle wave (II).

The first zigzag in the double is complete and labelled cycle wave y. The double is joined by a three in the opposite direction labelled cycle wave x, which subdivides as a zigzag. The second zigzag in the double may now have begun, labelled cycle wave w.

The purpose of a second zigzag in a double zigzag is to deepen the correction when the first zigzag does not move price deep enough. To achieve this purpose cycle wave y may be expected to move reasonably below the end of cycle wave w at 26.06. The target calculated would see this expectation met.

Cycle wave y is expected to subdivide as a zigzag, which subdivides 5-3-5.

Cycle wave w lasted 7.6 years and cycle wave x lasted 2.7 years. Cycle wave y may be expected to last possibly about a Fibonacci 5 or 8 years.

If it continues higher, then primary wave B may not move beyond the start of primary wave A above 76.90.

WEEKLY CHART

This weekly chart is focussed on the start of cycle wave y.

Cycle wave y is expected to subdivide as a zigzag. A zigzag subdivides 5-3-5. Primary wave A must subdivide as a five wave structure if this wave count is correct.

Primary wave A may be a complete five wave impulse at the last low.

Primary wave B may now be a complete single zigzag at the last high.

Primary wave C may have just begun. Primary wave C must subdivide as a five wave structure.

Primary wave A lasted 12 weeks, just one short of a Fibonacci 13.

Primary wave C may be longer in time as well as price. If cycle wave y lasts a Fibonacci 5 years, then primary wave C within it may take as long as 233 weeks.

Within primary wave C, no second wave correction may move beyond its start above 66.59.

Draw a channel about the zigzag of primary wave y using Elliott’s technique for a correction. Draw the first trend line from the start of primary wave A to the end of primary wave B, then place a parallel copy on the end of primary wave A. The upper edge of this channel may show where bounces along the way down find resistance. The lower edge of the channel may provide support.

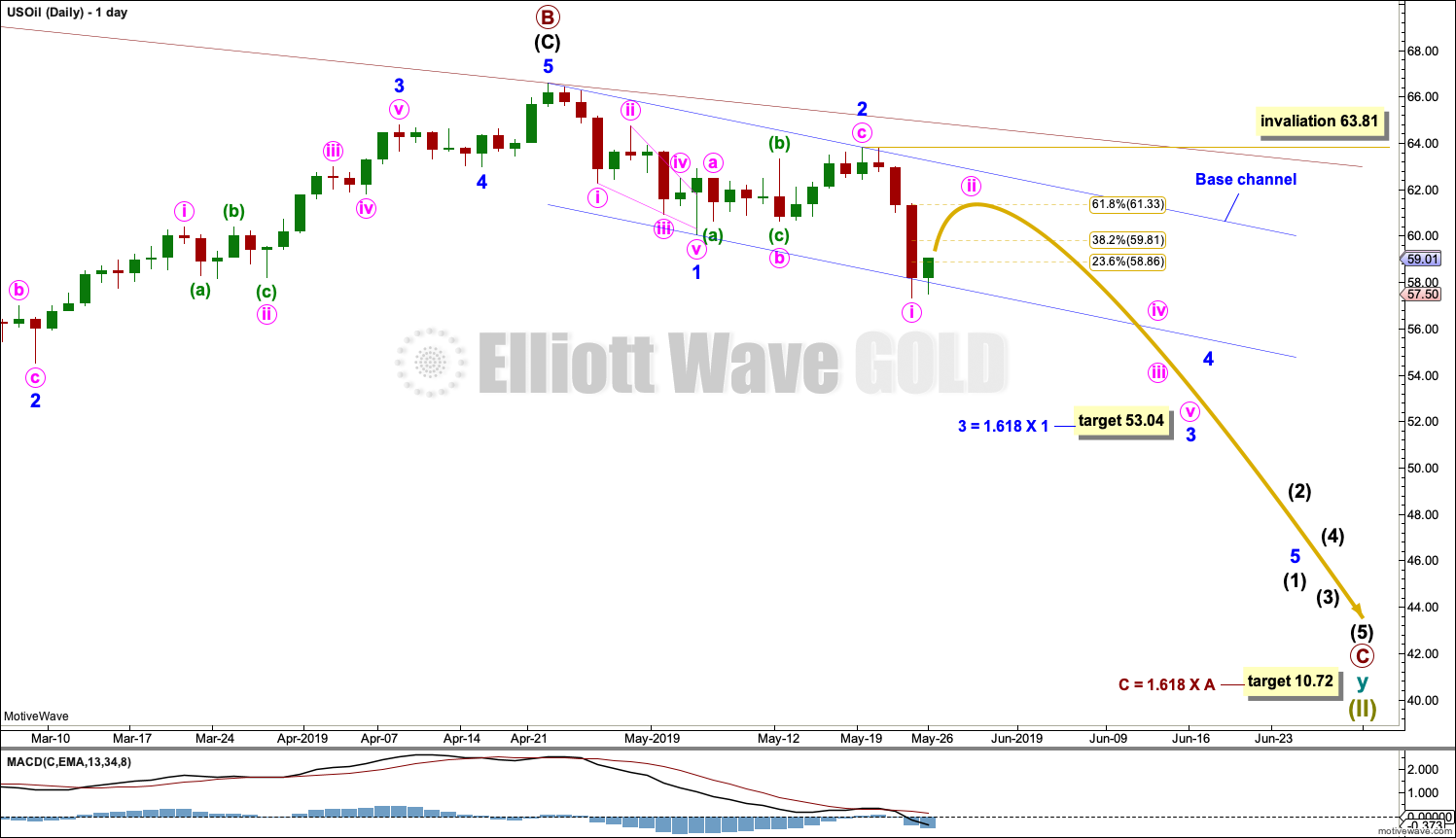

DAILY CHART

Note that monthly and weekly charts are on a semi-log scale, but this daily chart is on an arithmetic scale. This makes a slight difference to trend channels.

Primary wave C must subdivide as a five wave structure, most likely an impulse. Within the impulse, minor waves 1 and now 2 may be complete. A target is calculated for minor wave 3 that expects a common Fibonacci ratio to minor wave 1. If the target is wrong, it may not be low enough.

Within minor wave 3, minute wave i may be complete and minute wave ii may move higher early next week. The 0.382 and 0.618 Fibonacci ratios are reasonable targets for minute wave ii, with the 0.618 Fibonacci ratio favoured.

A base channel is drawn about minor waves 1 and 3. A base channel in a bear market usually shows where bounces for lower degree second wave corrections find resistance.

When minute wave ii is complete, then a third wave down at two degrees may exhibit an increase in downwards momentum. This may happen as early as the end of next week, or possibly the week after.

TECHNICAL ANALYSIS

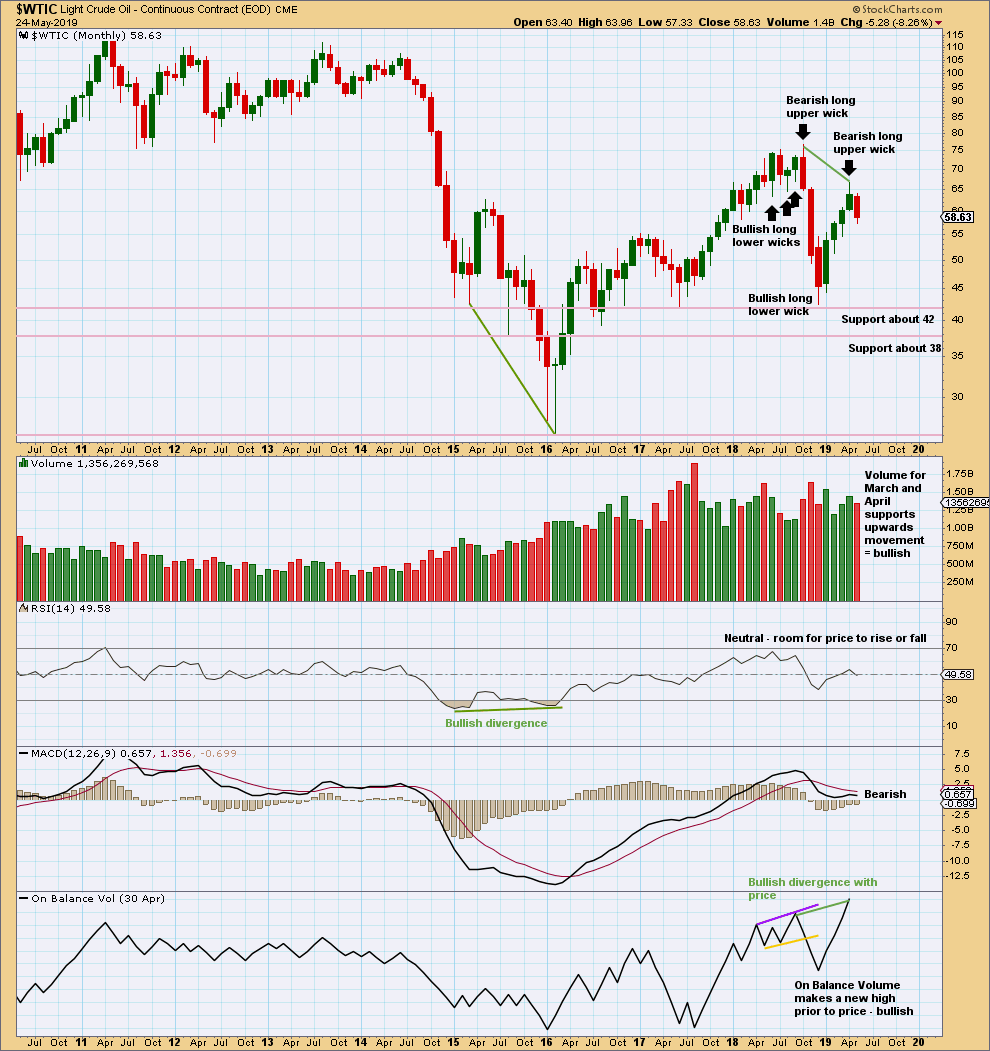

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume and On Balance Volume are bullish. This suggests the bounce may not be over, and this does not support the Elliott wave count.

The long upper wick on April’s monthly candlestick is bearish. This bearish signal is weaker than the bullish volume profile.

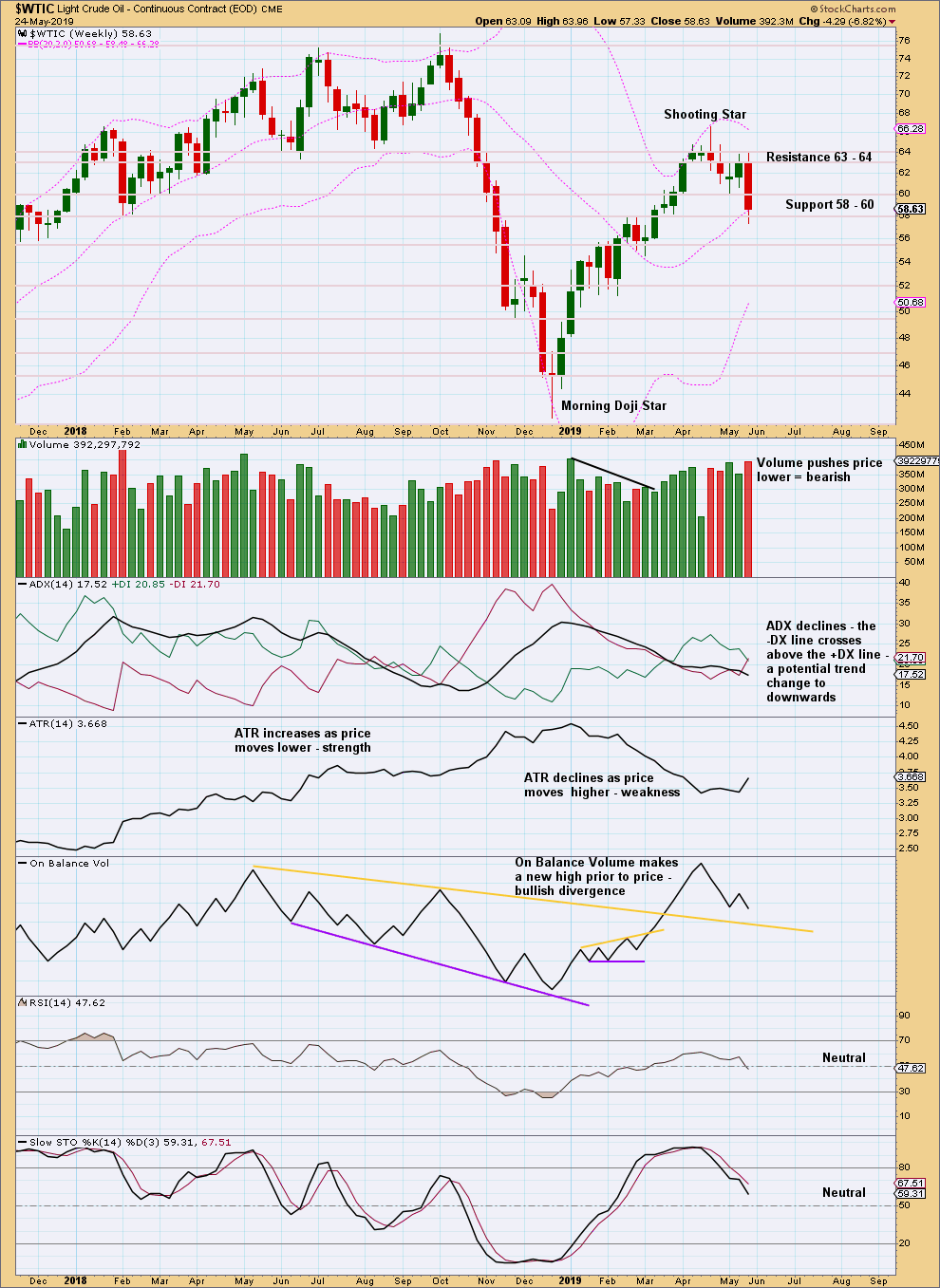

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A Shooting Star candlestick pattern is a bearish reversal pattern when it comes at the end of an upwards movement.

Strong support for downwards movement this week from volume is very bearish.

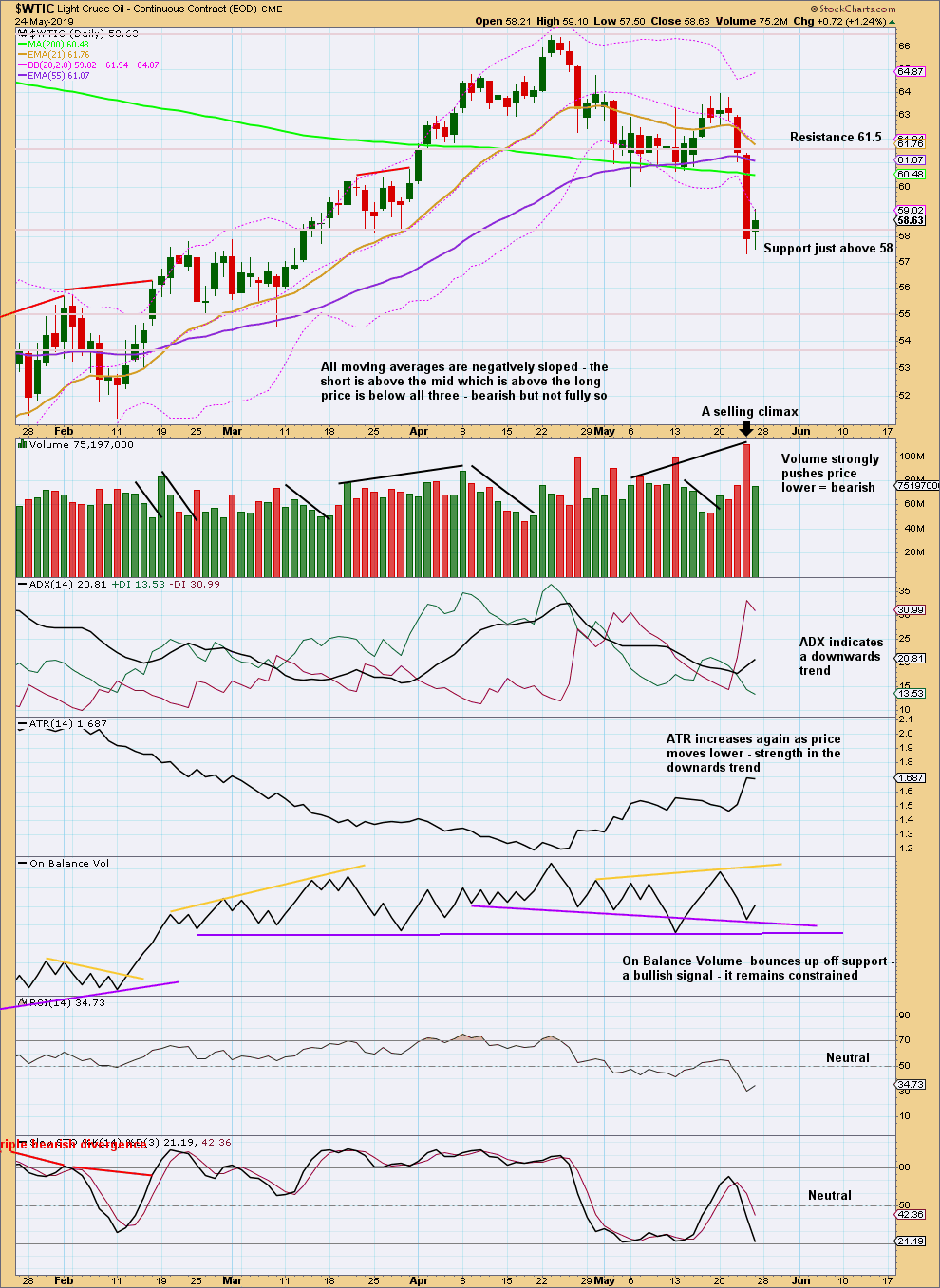

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the 24th of December 2018 there has been a series of higher highs and higher lows, the basic definition of an upwards trend. A lower low below the low of the 28th of March 2019 at 58.20 was made this week on the 23rd of May at 57.33, indicating the bounce may be over.

After the selling climax on the 23rd of May, now look for a bounce or consolidation to relive extreme conditions. A selling climax does not mean that a major low should be in place though; it may be followed by some consolidation before a downwards trend resumes.

—

Always practice good risk management as the most important aspect of trading. Always trade with stops and invest only 1-5% of equity on any one trade. Failure to manage risk is the most common mistake new traders make.

Gold has been very resilient at the 1270 level. If there is a move above the recent 1303 high, and importantly 1310-1311, then I think the 1346 level gets tested. If there is a breakout there, then watch out on the upside.

Also of note, silver nearly hit Lara’s downside target for the alternate weekly bull wave count, and has now turned up…albeit not aggressively yet.

I’m re-thinking my medium-term outlook of price weakness in gold/silver. Gold should be turning down strong, right now at 1289 for near-term downside to play out.

Full disclosure, I went long gold/silver at 1275/14.40 and will bail at 1270/14.25.

I too am looking to see what this next move up in gold does to the EW count. I am so very glad I exited my long DUST (3X bearish gold) positions at $22.30 because it is now down to $19.48.

I am keenly interested in what Lara’s analysis and commentary will say this weekend.

This is one bad ass corrective wave. Ndx is down 650 points since the recent peak!

Even with all these negative headlines, the AD line is really strong , acting much better than price.

I continue to be long and strong…

Hi Lara,

This is a question for the USD Index analysis, dated 15th November, 2018, posted under Public Analysis

The quarterly bearish EW analysis chart starts with Grand Supercycle 0 (limegreen). It goes down to a Grand Supercycle W-X and potential Y (limegreen). I do not see a Grand Supercycle I before the W-X-Y correction. Would there not be an impulse before a correction? I am sure I am missing something here, but what is it ?? Could you kindly help me understand this, please ?

Thanks,

David

I do not see it either, simply because the data I have does not go back that far.

This downwards movement from the high in the quarter beginning January 1985 is one of either two scenarios: the start of a five down, or a three down. It can only be one of those two, because EW structures are either a five or a three.

With the overlapping within it so far it suggests a three.

And further, the bounce up from the low in the month beginning 1st March 2008 to the last high in month beginning 1st January 2017 is a completed three and cannot be counted easily as a five. Because to see it as a five would have to see the first wave ending at 89.62 in the month of March 2009. Downwards movement has now overlapped into what would be that first wave price territory, eliminating any count that sees a five up developing because a fourth wave may not overlap first wave price territory.

So with a three completed upwards, which cannot any longer be counted as an incomplete five, it suggests the larger trend remains down. Hence a double zigzag.

Does that make sense?

I hope to find the time this week to update the DXY analysis. If I do, I’ll do a little video outlining how this works.

Hi Lara,

Thank you for the response. Let me try the question with a screenshot. Kindly bear with me. I am trying to get a better understanding of EW analysis from your valuable archive and I do not understand this specific move.

I am using grandsupercycle here. Per my understanding, after a 0, there would be a 5-wave impulse, labelled wave I. In a bear market the direction would be down and in a bull market it would be up. In the screenshot, after the grandsupercycle 0 (circled in red), I see a corrective structure of same degree of grandsupercycle. I do not understand a corrective structure following immediately after a 0. I thought you could have a corrective structure only after a I or III or IV, but not immediately after a 0. Or am I missing something here?

Thank you kindly.

Dave.

I am assuming at the high of 0 that ended a five wave impulse.

From there, three steps back began.

There is no 0 in Elliott wave, that label comes from Motive wave as the start of a movement.

The 0 is up there because I do not have labels for price movement that came before it.

I have made an assumption that the price movement which I have not labelled was a five, because downwards movement following it has so much overlapping it does not look like the start of a new five down, it looks like a huge three down.

Hi Lara,

Thanks for the AD line clarification…

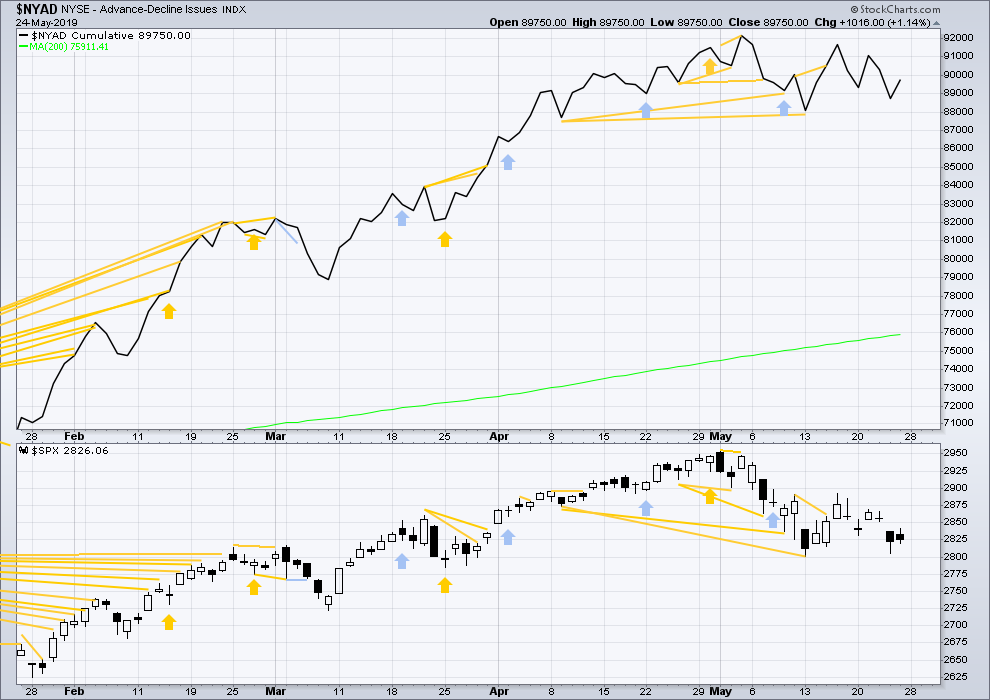

The 1946 and 1976 price action were mild bear markets… In 2018, did the S&P 500 hit a bear market? Well it was very close and the AD line did not predict that. But it had a 3-4 week divergence.

I went back to stockcharts.com and analyzed all the peaks of the AD line since 1980… I don’t have the data before then.

The AD line predicted the 1983, 1987, 1990 and 1994 corrections even though some of them were not bear markets.

However, in the period of 1998 to 2003, the AD line relationship to the S&P 500 price was not acting as expected…. The AD line hit a high in 1998 and hit a low in late 2000 at the beginning of the bear market which was weird… But I remember that period very well because there were huge imbalances in the markets, huge speculations and bubbles. In late 2000, cyclical and value companies were starting to go up while the growth and non-sense companies were coming down.

From 2003 and on, the AD line did a very good job in predicting a downturn.

More interesting observations: the AD line from 2003 to 2007 was a lot stronger than the one from 1995 to 1998… This is very strange because the 1995-2000 S&P 500 rally was a lot stronger than the 2003 – 2008 rally. It is also strange that the AD line from the biggest bull in history (1981 to 2000) was much weaker than the AD line from 2009 to today…. Very strange…

Opinions?

My bottom line now is that from 2003 and on, the AD line is working very well but I am afraid of a scenario like the 1998-2003 where it was pretty messed up. My opinion is that it is still the best indicator to identify a top in the markets.

Mathieu

PS: in the chart, the AD line is at the bottom and it is a weekly chart.

“However, in the period of 1998 to 2003, the AD line relationship to the S&P 500 price was not acting as expected…. The AD line hit a high in 1998 and hit a low in late 2000 at the beginning of the bear market which was weird… But I remember that period very well because there were huge imbalances in the markets, huge speculations and bubbles. In late 2000, cyclical and value companies were starting to go up while the growth and non-sense companies were coming down.”

The bear market from March 2000 to October 2002 (the Dotcom crash) was preceded by 21 months of bearish divergence between price and the AD line. This is not normal, it is excessive. But it did strongly predict a bear market.

In November 2003 the AD line made a new ATH while price had been recovering from its low in October 2002. This bullish divergence was a strong signal that the bear market was over and price was likely to go on to new all time highs also, which it did in July 2007 but only just. And we all know now what happened in October 2007; the start of the crash that led into the GFC.

Then in October 2007 at the last high in price just before the crash started, there was 4 months bearish divergence between price and the AD line. So that prior very strong bullish divergence should at that time have been considered to have been resolved, and the new signal of bearish divergence given consideration.

I do not think we need to be afraid of the situation which happened in 1998 to 2003, because it was simply classic bearish divergence. The only difference there was it was greatly extended in time prior to the bear market actually beginning.

Lowry’s data shows that has happened twice before.

1. Just before the Great Depression at the stock market high in 1929 there was 24 months of bearish divergence between price and the AD line.

2. The price peak in January 1973 was preceded by 21 months of bearish divergence between price and the AD line.

There is a statistical positive correlation of 0.6022 (correlation co-efficient) between the number of months of bearish divergence and the depth in % draw down of the following bear market.

Thanks Lara, I appreciate it.

Yes, Lara, thank you for that explanation. Good question – Good answer.