by Lara | Aug 20, 2021 | Bitcoin, Cryptocurrencies

BTCUSD: Elliott Wave Analysis and Technical Analysis | Video – August 19, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Aug 20, 2021 | Bitcoin, Public Analysis

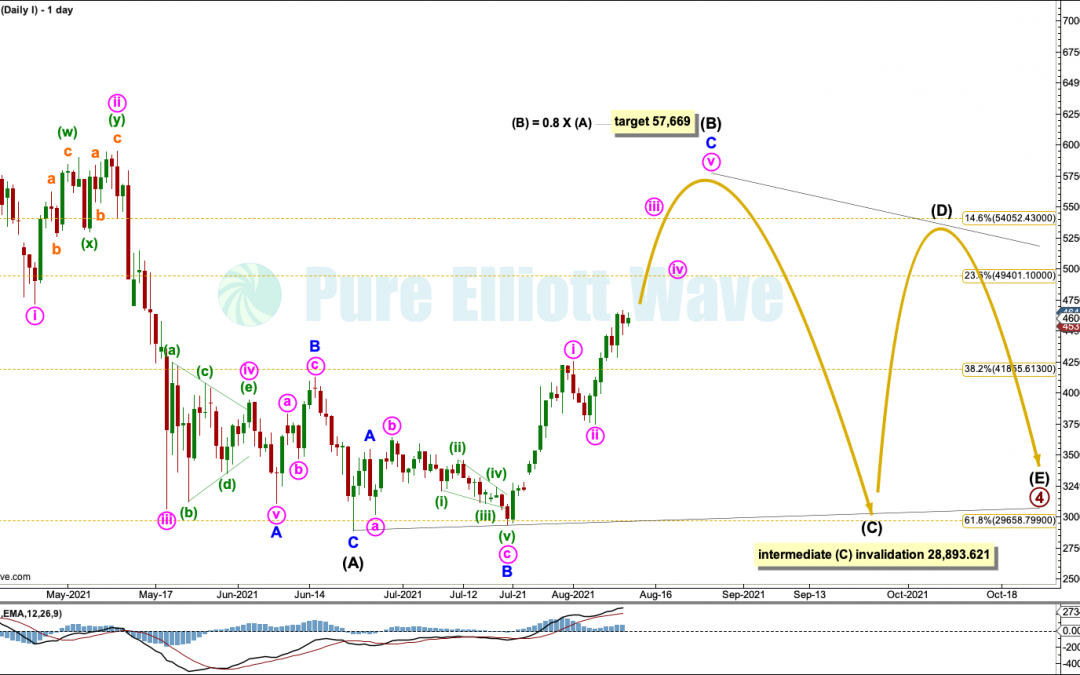

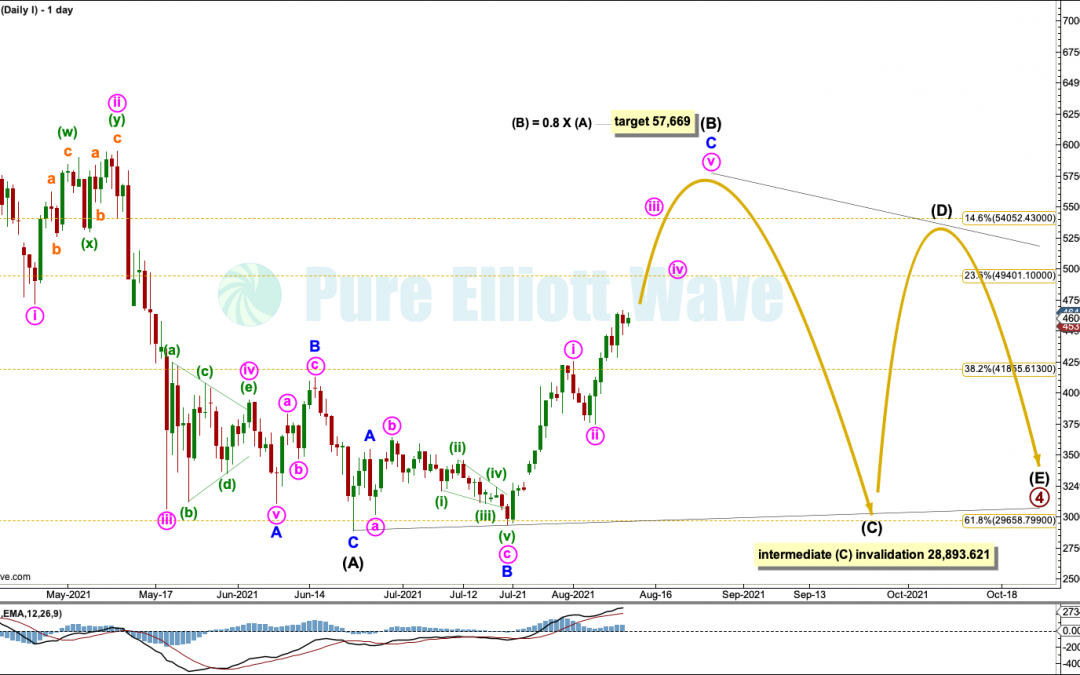

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 19, 2021 Last Bitcoin analysis, on August 11th, expected upwards movement towards a target about 57,669 as most likely. Since August 11th price has mostly moved sideways and a little higher. Summary:...

by Lara | Aug 18, 2021 | Cryptocurrencies

BinanceCoin: Elliott Wave Analysis and Technical Analysis | Video – August 18, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Aug 18, 2021 | Cryptocurrencies

TRON: Elliott Wave Analysis and Technical Analysis | Video – August 16, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Aug 12, 2021 | Cryptocurrencies

Ethereum and Miota: Elliott Wave Analysis and Technical Analysis | Video – August 12, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Aug 11, 2021 | Bitcoin, Public Analysis

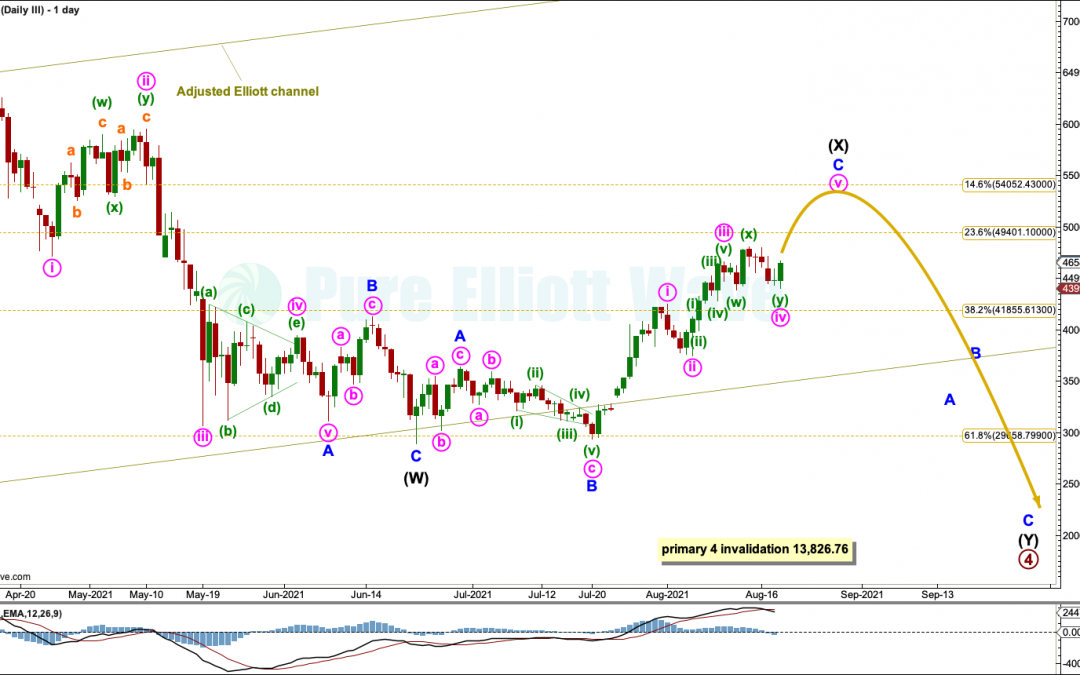

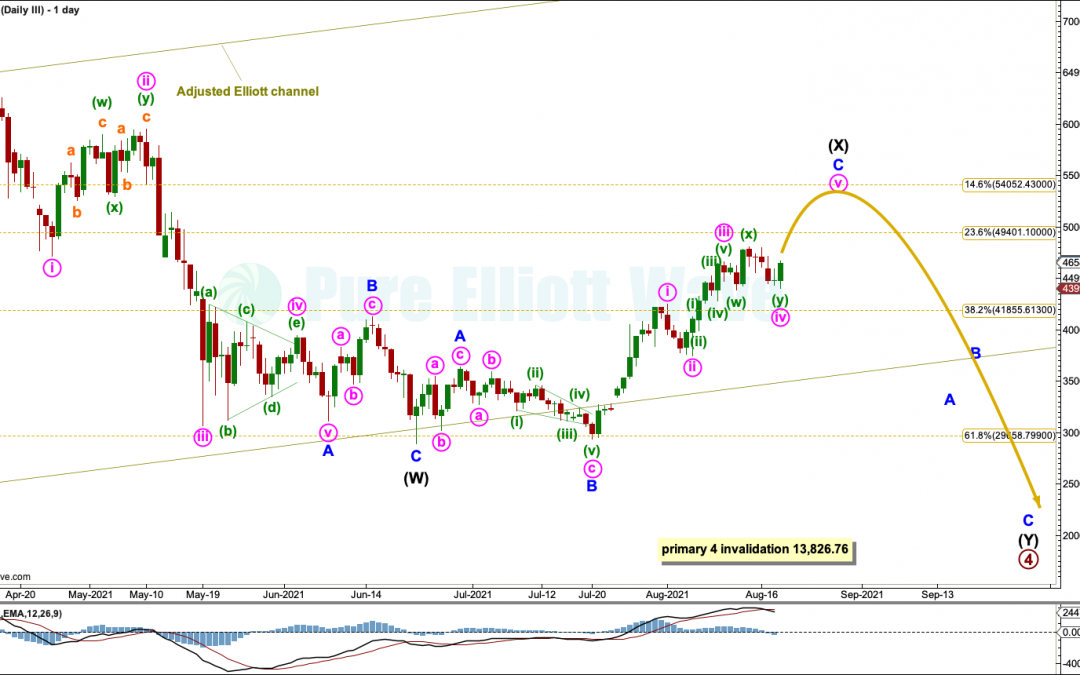

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 11, 2021 Last Bitcoin analysis, on 5th August, expected upwards movement towards a target about 57,669 as most likely. Over the last week this is what has happened. Summary: At this stage, all three...

by Lara | Aug 5, 2021 | Bitcoin, Cryptocurrencies

Bitcoin: Elliott Wave Analysis and Technical Analysis | Video – August 5, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Aug 5, 2021 | Bitcoin, Public Analysis

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 5, 2021 Last Bitcoin analysis, on July 29, 2021, expected a consolidation or pullback. This is a mid-term expectation and the consolidation or pullback may last a few more months. Summary: Technical...

by Lara | Aug 3, 2021 | Bitcoin, Cryptocurrencies

DASH and LiteCoin: Elliott Wave Analysis and Technical Analysis | Video – August 3, 2021 Please enable JavaScript to view the comments powered by...