by Lara | Aug 20, 2021 | Bitcoin, Public Analysis

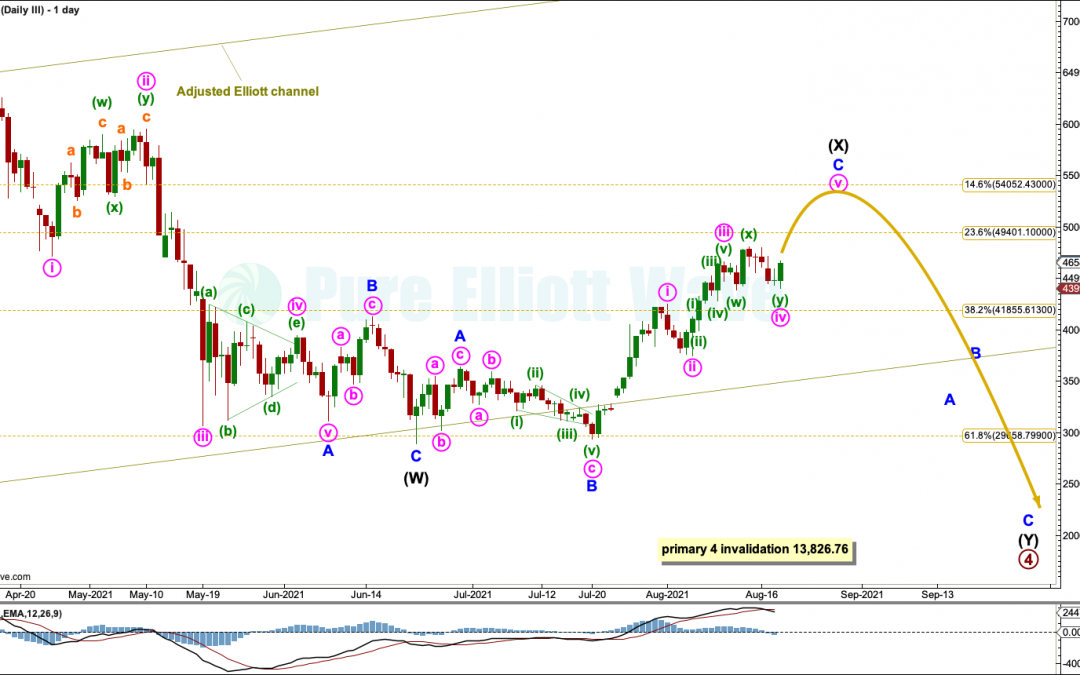

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 19, 2021 Last Bitcoin analysis, on August 11th, expected upwards movement towards a target about 57,669 as most likely. Since August 11th price has mostly moved sideways and a little higher. Summary:...

by Lara | Aug 11, 2021 | Bitcoin, Public Analysis

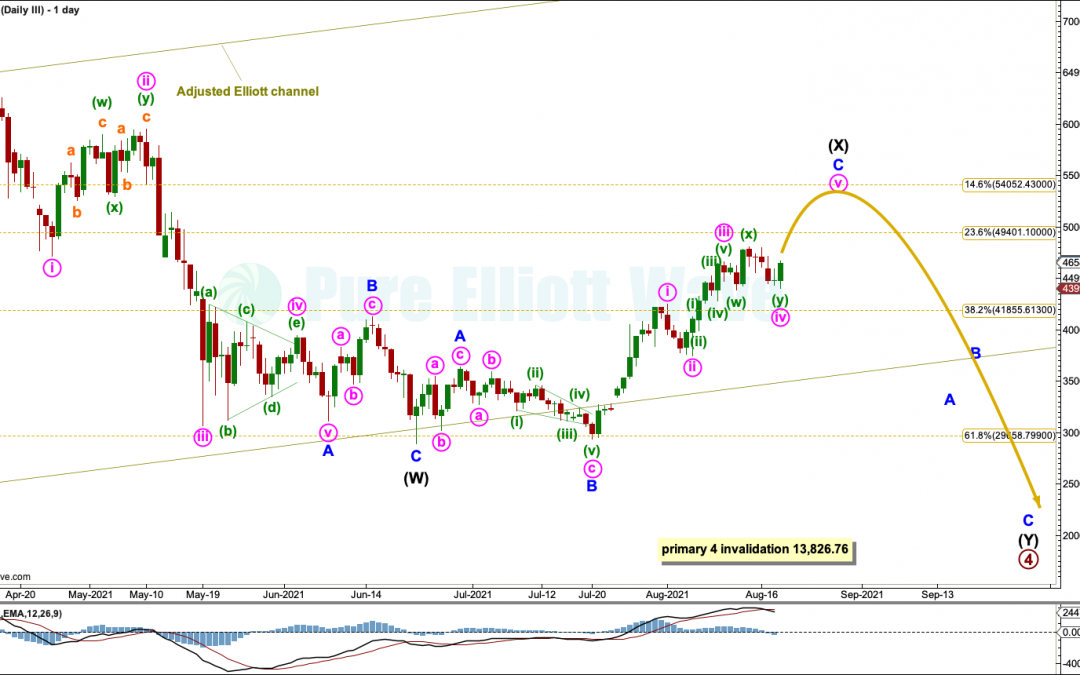

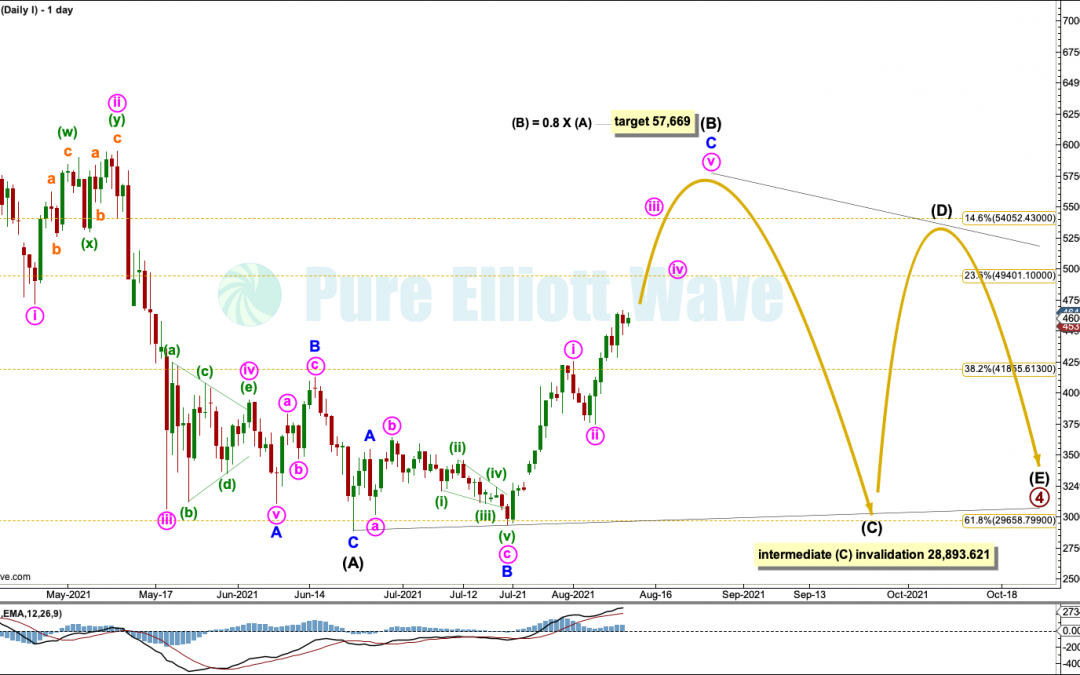

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 11, 2021 Last Bitcoin analysis, on 5th August, expected upwards movement towards a target about 57,669 as most likely. Over the last week this is what has happened. Summary: At this stage, all three...

by Lara | Aug 5, 2021 | Bitcoin, Public Analysis

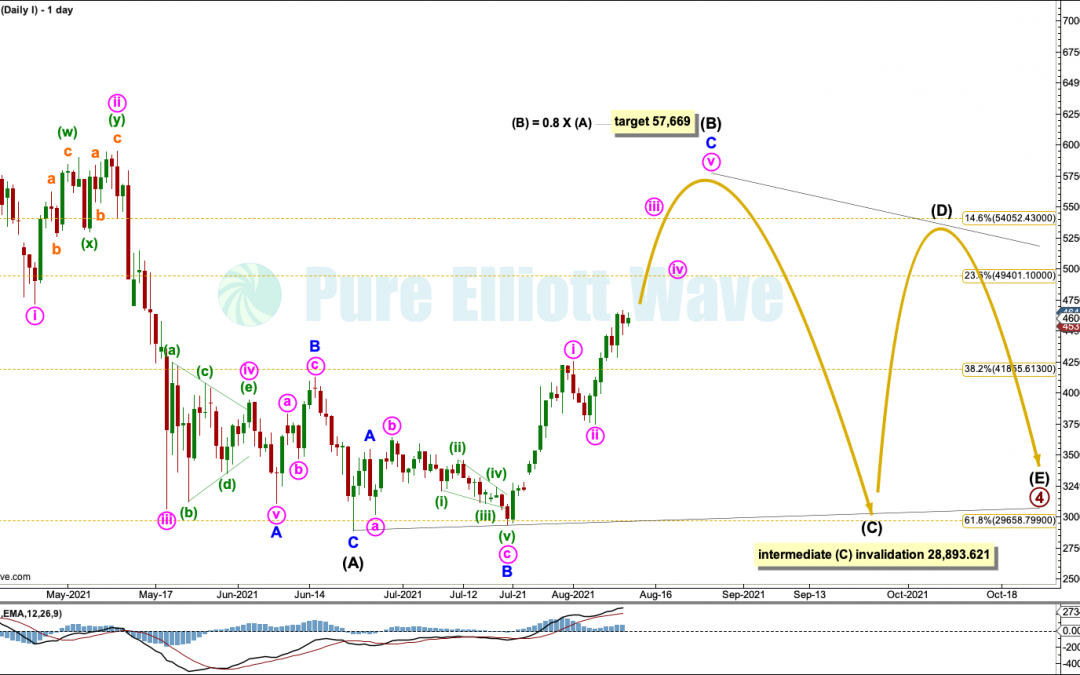

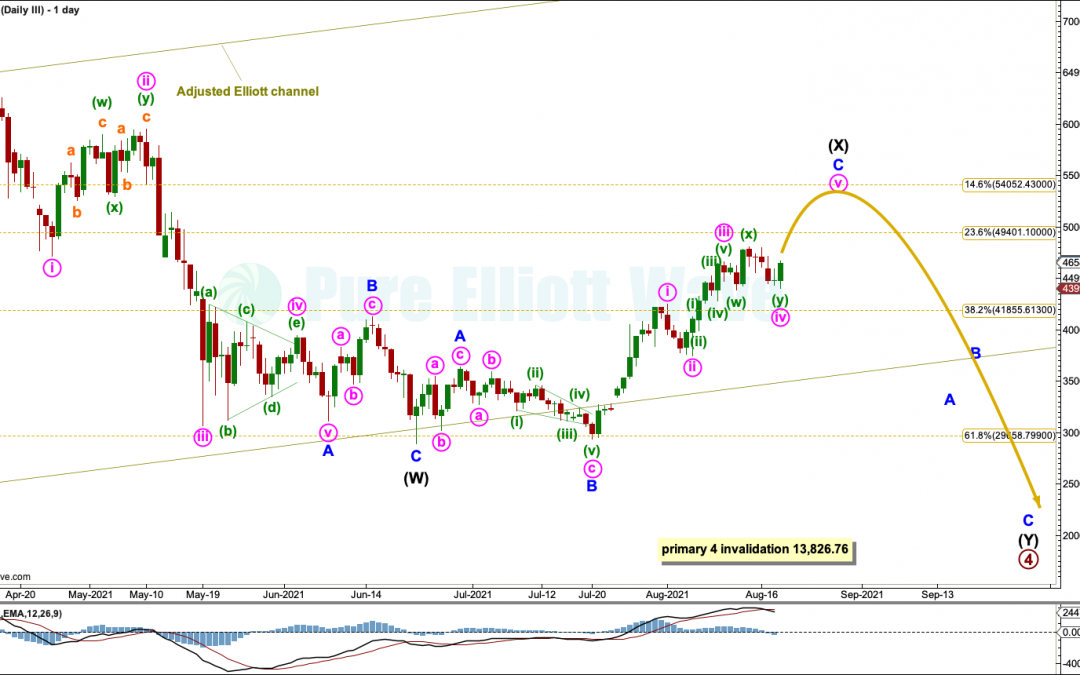

BTCUSD: Elliott Wave and Technical Analysis | Charts – August 5, 2021 Last Bitcoin analysis, on July 29, 2021, expected a consolidation or pullback. This is a mid-term expectation and the consolidation or pullback may last a few more months. Summary: Technical...

by Lara | May 18, 2021 | Bitcoin, Cryptocurrencies

Bitcoin, Ripple, Monero and Dash: Elliott Wave and Technical Analysis | Video – May 18, 2021 Please enable JavaScript to view the comments powered by...

by Lara | Apr 15, 2021 | Bitcoin

Bitcoin: Elliott Wave and Technical Analysis | Video – April 15, 2021 Technical analysis charts and a brief comment will be published in comments below. Please enable JavaScript to view the comments powered by...

by Lara | Jan 29, 2021 | Bitcoin, Public Analysis

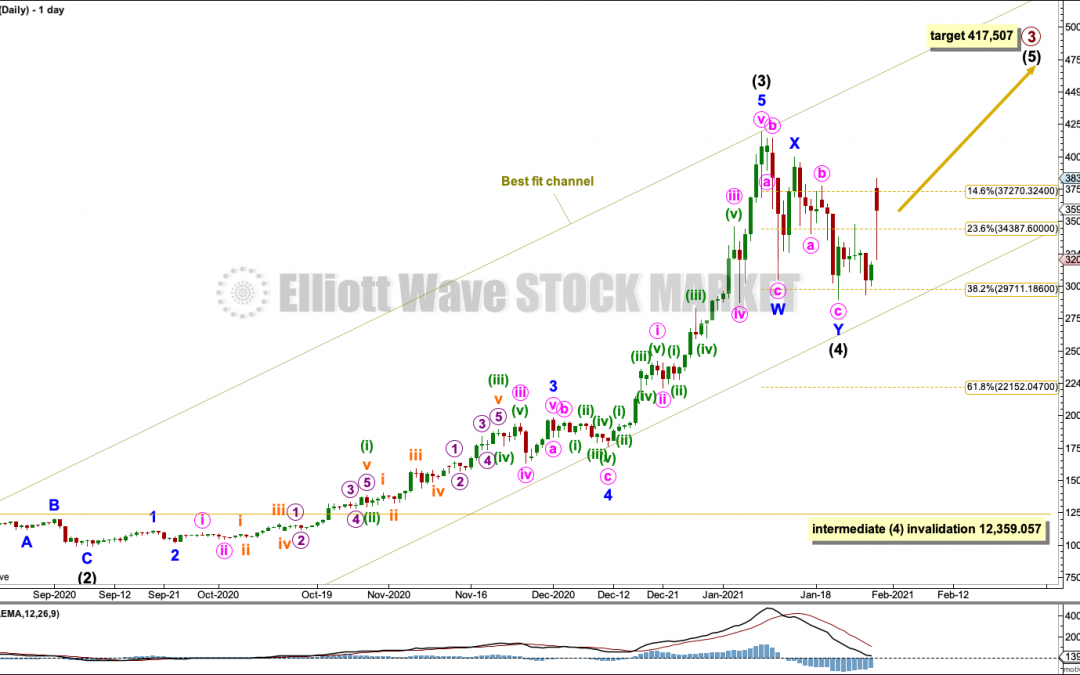

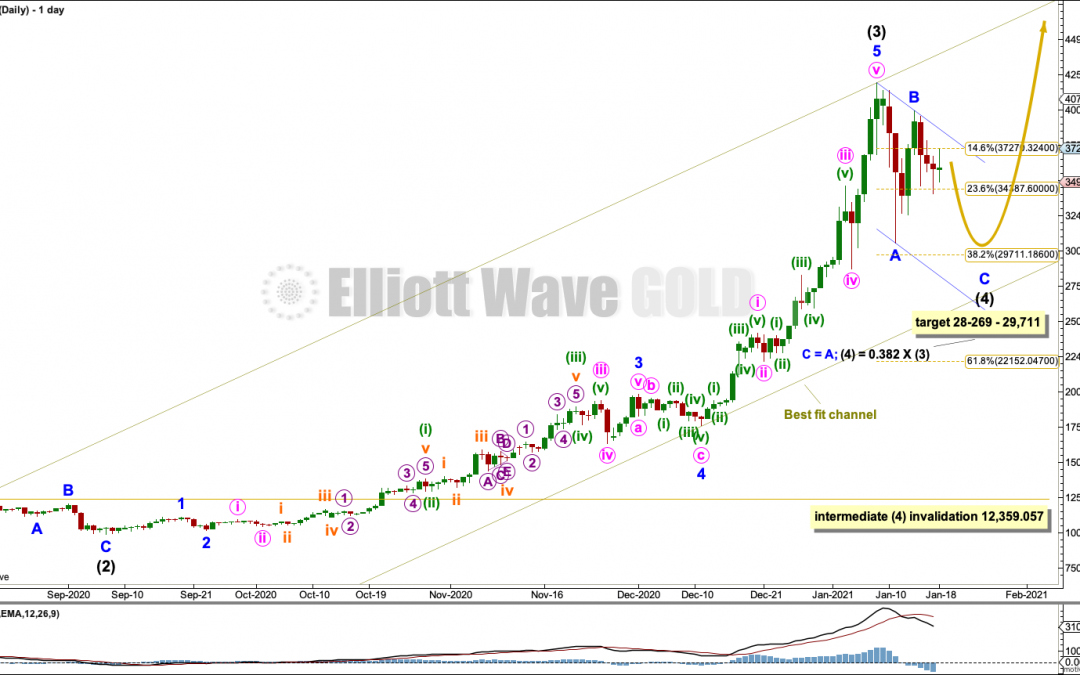

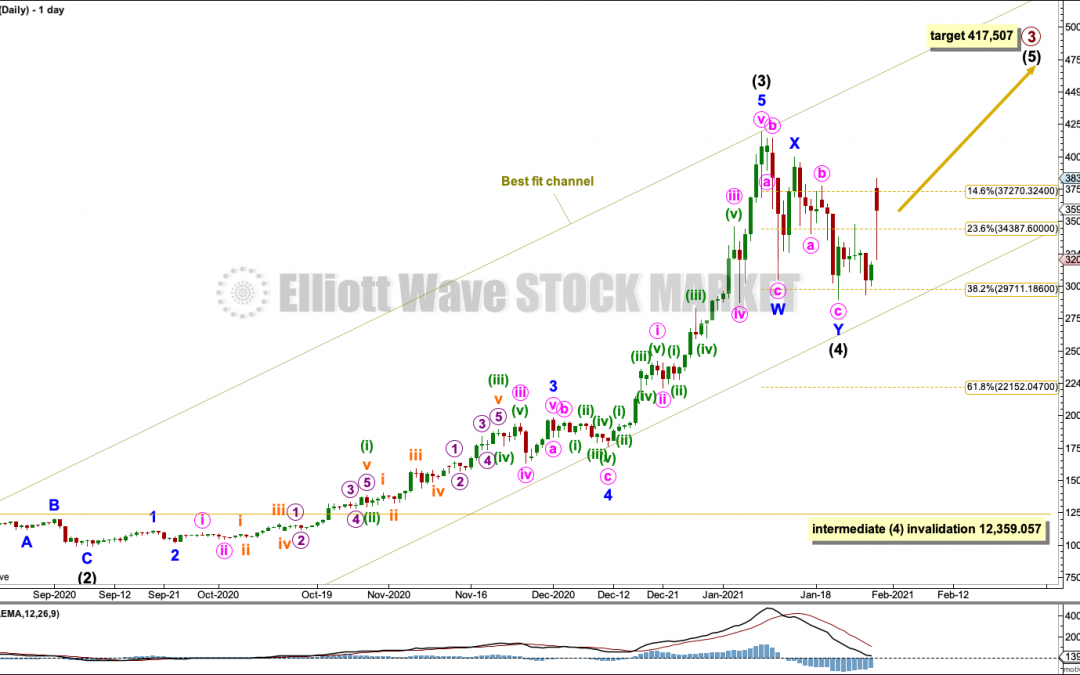

BTCUSD: Elliott Wave and Technical Analysis | Charts – January 29, 2021 Last Bitcoin analysis, on 18th January, expected a pullback to continue and end within a target zone from 29,711 to 28,269. The pullback did continue and reached 28,953.37, right in the...

by Lara | Jan 18, 2021 | Bitcoin, Public Analysis

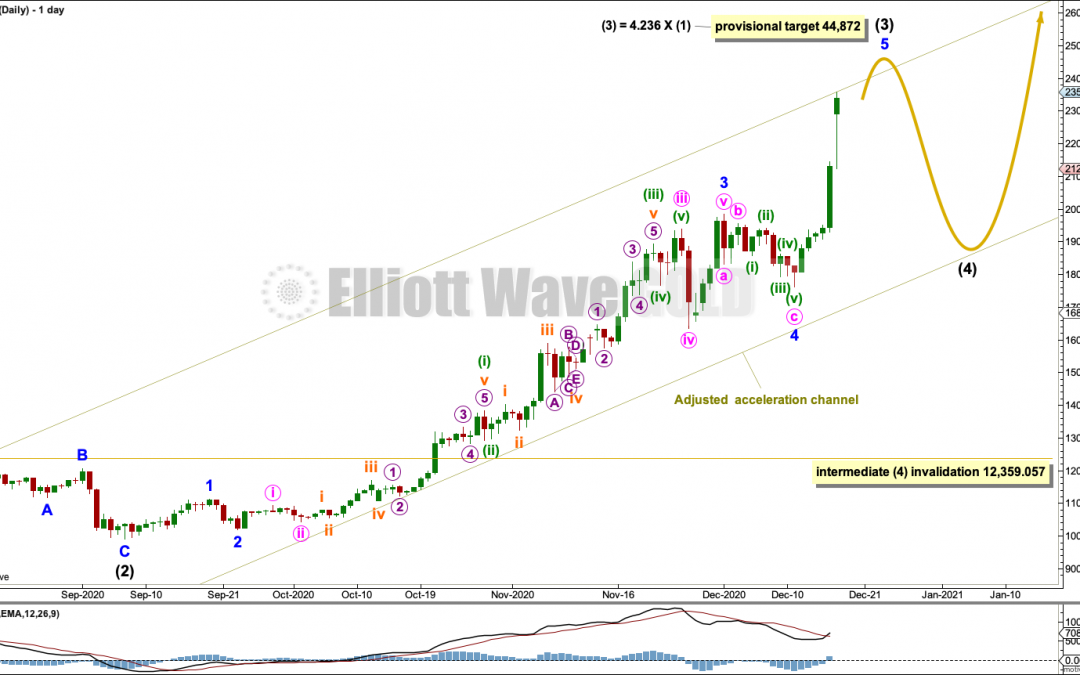

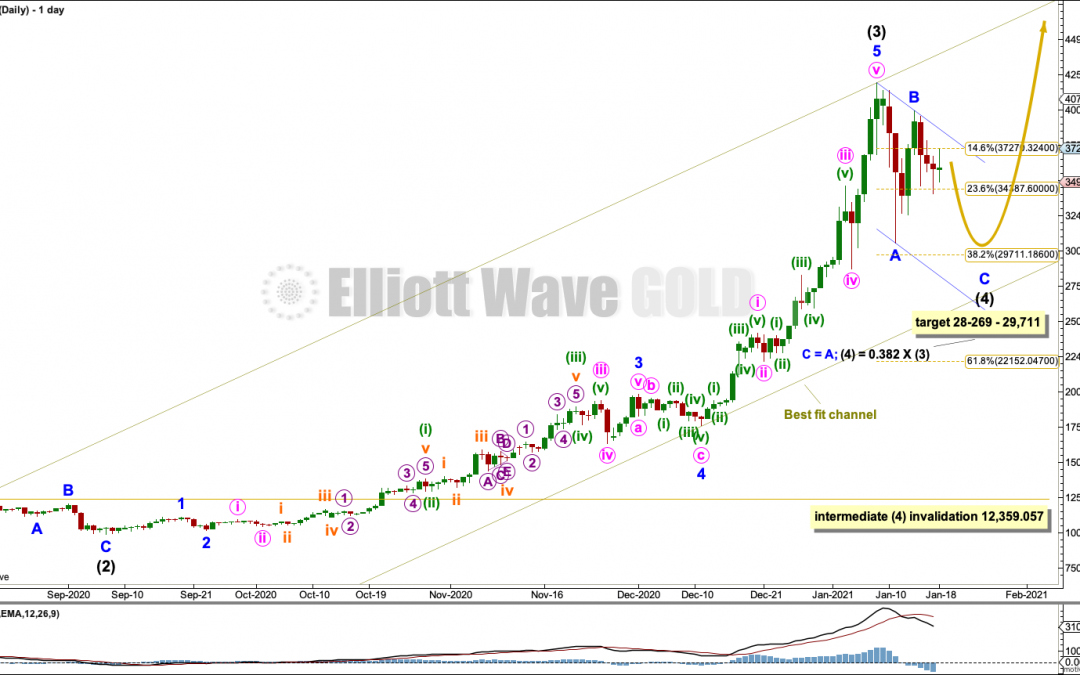

BTCUSD: Elliott Wave and Technical Analysis | Charts – January 18, 2021 The main Elliott wave count in last analysis, on December 17, 2020, expected more upwards movement to a provisional target at 44,872. Bitcoin reached 41,964.96 on January 8, 2021, which was...

by Lara | Jan 18, 2021 | Bitcoin, Public Analysis

BTCUSD: Identifying Bitcoin Highs and Lows | Charts – January 18, 2021 This article analyses technical indicators at highs and lows for Bitcoin. TECHNICAL ANALYSIS WEEKLY Click chart to enlarge. The following characteristics can be noted at the end of prior major...

by Lara | Dec 17, 2020 | Bitcoin, Public Analysis

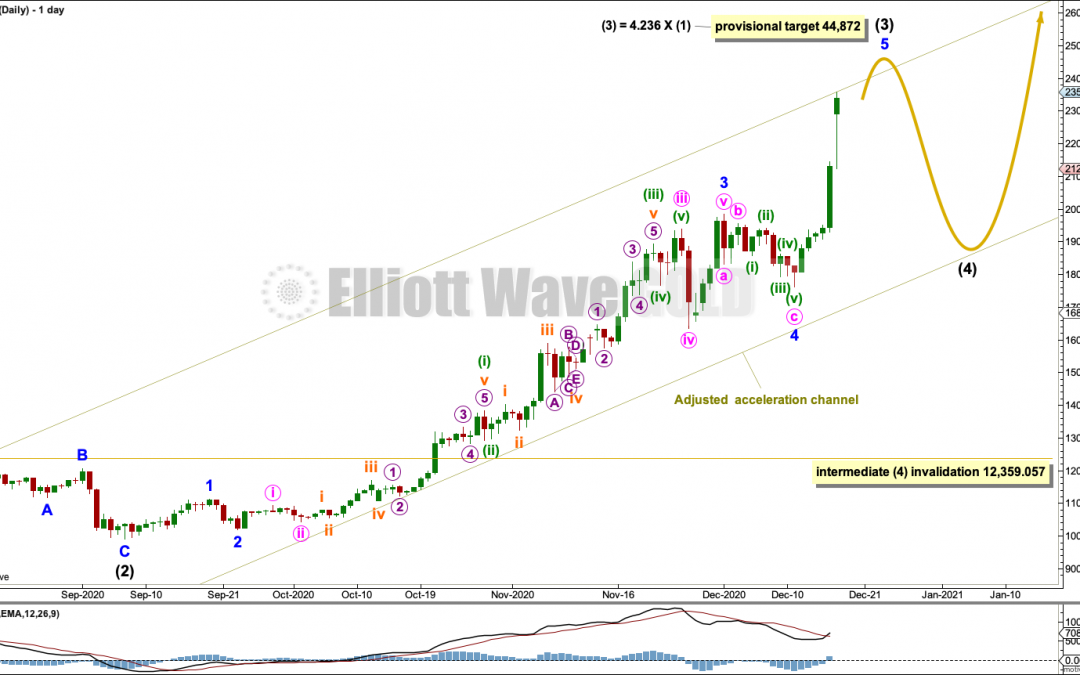

BTCUSD: Elliott Wave and Technical Analysis | Charts – December 17, 2020 The main Elliott wave count in last analysis, on 12th November, expected more upwards movement and a further increase in strength. This is exactly what is happening. Today’s analysis...